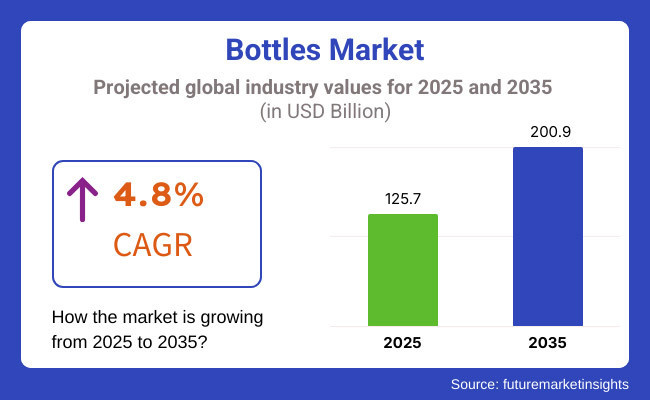

The global bottles market is projected to expand from USD 125.7 billion in 2025 to USD 200.9 billion by 2035, reflecting a CAGR of 4.8% over the period. This growth is being driven by rising consumer demand for bottled beverages, increasing investments in sustainable materials, and evolving packaging technology.

Manufacturers are responding by adopting eco‑friendly solutions, including biodegradable plastics, glass, and aluminium. Smart packaging innovations and refillable bottle programs are being deployed to meet regulatory requirements and appeal to environmentally conscious consumers

Plastic bottle producers have been stepping up investments in recycled materials and bottle-to-bottle recycling initiatives. In December 2024, Coca‑Cola announced new targets to use 35-40% recycled content in its primary packaging-including plastic, glass, and aluminium-by 2035, and to collect 70-75% of all bottles and cans introduced to the market by that year.

These ambitions were described by Bea Perez, Executive VP and Global Chief Communications, Sustainability and Strategic Partnerships Officer, as “a continued commitment to invest in refillable packaging where infrastructure already exists,” underscoring Coca‑Cola’s strategic shift toward circular packaging solutions.

Bottle formats are being redefined by fast-growing refillable and reusable systems. Refillable glass milk bottles and aluminium water bottles have seen rapid adoption in developed markets. Meanwhile, Asia-Pacific, led by China, India, Japan, and South Korea, is emerging as the fastest-growing regional segment. This is being driven by increasing bottled beverage consumption, rising disposable income, and growing e-commerce penetration. Innovation in bottle manufacturing and printing is underway.

Lightweight glass technologies are reducing shipping weight. Digital smart labels and RFID-enabled bottle verification are being adopted for anti-counterfeiting and supply chain transparency. PET bottles are now offered in post-consumer recycled versions and coated with barrier layers to improve shelf life-further supporting the sustainability agenda.

Growth in sector-specific segments is also notable. Demand for premium bottled water, sustainable cosmetic packaging, and tamper-proof pharmaceutical bottles is being driven by rising consumer expectations and health concerns. Evolving food safety regulations are fueling demand for high-barrier glass and aluminum bottles. Meanwhile, the drink can and bottled liquid markets continue to benefit from strong e-commerce growth and convenience trends.

Despite this growth, cost pressures persist. Fluctuating prices of raw materials-like petroleum for plastic, aluminum ingots, and silica for glass-are challenging manufacturers. Infrastructure gaps in recycling remain a hurdle. However, industry-wide progress is being supported by global regulations and corporate sustainability commitments, including those emerging from circular economy frameworks.

The bottle Industry is being shaped by a convergence of sustainability mandates, digital innovation, and consumer demand. Companies that align with eco-conscious practices-through recyclable, refillable, and smart bottle designs-are expected to capture significant value through 2035.

Plastic bottles are expected to continue dominating the packaging market, particularly across the beverage, personal care, household cleaning, and pharmaceutical sectors, with PET (Polyethylene Terephthalate) and HDPE (High-Density Polyethylene) anticipated to collectively account for a significant market share of over 60% by 2025.

These materials are being favored due to their lightweight nature, impact resistance, and strength-particularly in carbonated beverage packaging, where durability is essential. The global rise in demand for ready-to-drink (RTD) beverages, functional drinks, and health-conscious consumer products has led to an increased reliance on PET and HDPE bottle formats.

Advanced plastic bottle designs incorporating ergonomic structures, smart dispensing features, and aesthetic appeal are being widely developed to enhance consumer convenience and shelf differentiation. Additionally, the adoption of biodegradable plastics, recycled PET (rPET), and plant-based polymers is being accelerated by brands attempting to align with global sustainability mandates.

Despite ongoing concerns about plastic waste and regulatory pressures including bans on single-use plastics in several regions investments in circular economy solutions, refillable formats, and closed-loop recycling systems are being intensified to retain plastic bottles as a viable, eco-conscious packaging choice.

Bottles in the 501-1000 ml capacity range are anticipated to account for nearly 35% of total plastic bottle volume sales by 2025, driven by their application in household cleaning, personal care, and food and beverage packaging. These mid-sized bottles are being preferred for their ability to reduce purchase frequency, offer cost savings, and serve larger consumer groups, particularly in family-sized formats. Categories such as shampoos, liquid detergents, cooking oils, and multi-serving beverages are being increasingly packaged in this size segment.

While consumer convenience continues to support the adoption of larger bottles, limitations in storage space and increased logistics costs have posed challenges. However, innovations in lightweight material engineering, collapsible bottle technologies, and concentrated product formulations have been deployed to mitigate such concerns.

Additionally, refill stations and bulk packaging systems are being introduced to complement 501-1000 ml bottles, thereby enhancing their relevance in both retail and e-commerce distribution channels. As a result, this bottle size range is expected to sustain growth momentum through its practicality and compatibility with evolving sustainability and reuse strategies.

Environmental Concerns and Regulatory Restrictions

The key challenge facing the Bottles Market is the growing environmental apprehensions involving plastic wastes and carbon emissions during the production of bottles. Tough restrictions on single-use plastics, recycling laws and goals for reducing carbon footprints are forcing manufacturers to embrace sustainable practices and invest in alternative materials.

The bottle manufacturing industry also faces the challenges of fluctuating raw material prices, supply chain disruptions, and high investments in the development of biodegradable and reusable bottle technologies. Transitioning to sustainable packaging materials also requires education of consumers and entry of infrastructure to recycle on a large scale and to have refillable bottle programs.

Smart Packaging and Circular Economy Solutions

The Bottles Market holds high growth horizons despite challenges. Integrating smart packaging technologies such as RFID tracking, active and passive label, and intelligent coating, which can assist in consumer engagement and offer supply chain visibility, are gaining momentum.

Demand for refillable and reusable bottle solutions including glass milk bottles, aluminum water bottles and bulk refill stations is creating opportunities for circular economy solutions in the packaging space. Emerging technologies like plant-based bioplastics and compostable materials, along with AI-driven sorting systems for bottle recycling, will help to further enhance sustainability and minimize waste.

Moreover, growing premium bottled beverage markets, wider adoption of eco-friendly cosmetic packaging, and increasing interest for minimalist and aesthetic bottle designs are fueling product differentiation and the change in consumer preference.

The United States Bottles Market that is the most in demand, as it is growing at a steady rate being driven by increasing demand for sustainable packaging and vessel consumption along with technological advancements in bottle manufacturing. There is also growing awareness among people about the health hazards associated with the use of plastic bottles and the need for manufacturer change; the USA Food and Drug Administration (FDA) is regulating safety standards of plastic and glass bottles to phase manufacturers to utilize BPA-free and recyclable contents.

Demand for lightweight, durable, and eco-friendly bottles is being driven by the rise of bottled water, functional beverages, and personal care product packaging. Top companies like Coca-Cola, PepsiCo and Nestlé Waters are investing in bio-based plastics and recycled PET (rPET) bottles to achieve their sustainability targets.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

Factors such as rising demand for sustainable packaging solutions, stringent regulations imposed by the government on single-use plastics, and growing consumer awareness regarding glass and aluminum bottles are expected to contribute to the growth of the Bottles Market in the United Kingdom. UK ’s Plastic Packaging Tax is spurring investment in recycled and biodegradable bottle substitutes.

Major players are focusing on aesthetic and eco-friendly packaging, and the premium bottled water and craft beverage sector is aiding market growth. Moreover, the rising adoption rate of personalized and reusable bottles in lifestyle and sports sectors further drive the demand for stainless steel and BPA-free plastic bottles.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The Bottles Market is being propelled by stringent sustainability regulations, an increasing requirement for circular economy solutions, and an increase in the consumption of bottled beverages in the European Union. Manufacturers are encouraged to use recycled plastics, glass and aluminum in bottle production as part of the European Green Deal and Single-Use Plastics Directive.

Germany, France and Italy are pioneers in introducing reusable and returnable bottle systems, especially for beverages and personal care products. The increasing popularity of plant-based bioplastics and compostable bottles is also changing the game with many of the biggest beverage brands currently pledging to use 100% recycled or biodegradable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The Bottles Market in Japan is growing due to some factors such as the increasing demand from the development of innovative packaging, the rising adoption of environment-friendly materials, and increased consumption of ready-to-drink beverages. Initiatives to reduce plastic waste in Japan, including the use of lightweight and recyclable bottle designs, are promoted by through the Japanese Ministry of the Environment.

Suntory and Kirin, two of Japan's beverage giants, are pumping money into PET bottle recycling tech and alternatives to PET, which is a kind of a biodegradable plastic. Moreover, increasing demand for high-end glass and aluminum bottles from the cosmetic packaging segment as a result of the booming beauty and personal care industry is further contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

Government policies promoting the reduction of plastic waste, increasing trends for healthy and environmentally responsible consumer behavior, and growing demand for refillable and eco-friendly bottle options are driving growth of the Bottles Market in South Korea. Plastic reduction regulations from the South Korean Ministry of Environment have led companies to transition to rPET, as well as aluminum and biodegradable alternatives to bottles.

The growth of functional beverages, luxury skincare items and refillable household products is increasing demand for premium, reusable and recyclable bottles. Moreover, the burgeoning e-commerce market in South Korea is driving the adoption of bespoke and lighter bottle packaging for direct-to-consumer brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

As more people tend to live an eco-aware lifestyle, they are inquiring about sustainable packaging which will drive the Bottles Market. Factors such as increasing beverage consumption, pharmaceutical packaging development, and new lightweight and biodegradable bottles drive the market.

Manufacturers are also working towards glass alternatives and smart packaging solutions that improve durability, environmental end-of-life recyclability and branding opportunities. This market comprises frontrunners in packaging such as packaging manufacturers, beverage companies, and sustainable material innovators.

Amcor plc (15-20%)

Amcor is a global leader in PET bottle production, offering lightweight, recyclable, and high-barrier plastic packaging solutions for beverages, healthcare, and food industries.

Berry Global Inc. (12-16%)

Berry Global specializes in custom bottle designs with post-consumer recycled plastics, promoting sustainability and innovation in flexible packaging.

Gerresheimer AG (10-14%)

Gerresheimer focuses on pharmaceutical-grade bottles, producing glass and high-quality plastic packaging for medical and laboratory use.

O-I Glass, Inc. (8-12%)

O-I Glass is a major glass bottle manufacturer, offering premium and eco-friendly packaging for alcoholic beverages, juices, and carbonated drinks.

Alpla Group (6-10%)

Alpla develops biodegradable plastic bottles, refillable solutions, and sustainable bottle designs for food, beverage, and cosmetic industries.

Other Key Players (35-45% Combined)

Several packaging and bottle manufacturers contribute to advancements in sustainable packaging, lightweight materials, and smart bottle technology. These include:

The overall market size for the Bottles Market was USD 125.7 Billion in 2025.

The Bottles Market is expected to reach USD 200.9 Billion in 2035.

Rising demand for sustainable packaging, increasing consumption of bottled beverages, and growth in the pharmaceutical and personal care sectors will drive market growth.

The USA, China, India, Germany, and Brazil are key contributors.

Glass and Plastic bottles are expected to dominate due to their lightweight nature, durability, and cost-effectiveness in packaging solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material, 2023 to 2033

Figure 142: MEA Market Attractiveness by Capacity, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Beer Bottles Providers

MDPE Bottles Market

Glass Bottles Market Forecast and Outlook 2025 to 2035

Smart Bottles Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles And Containers Market Size and Share Forecast Outlook 2025 to 2035

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Paper Bottles Market Growth - Demand & Forecast 2025 to 2035

Competitive Overview of Glass Bottles Market Share

Market Positioning & Share in the Serum Bottles Market

Dosing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Bullet Bottles Market Growth – Demand & Forecast 2025 to 2035

Competitive Overview of Dosing Bottles Providers

Tubes, Bottles and Tottles Market

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beveled Bottles Market Growth – Demand & Forecast 2025 to 2035

Airless Bottles Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA