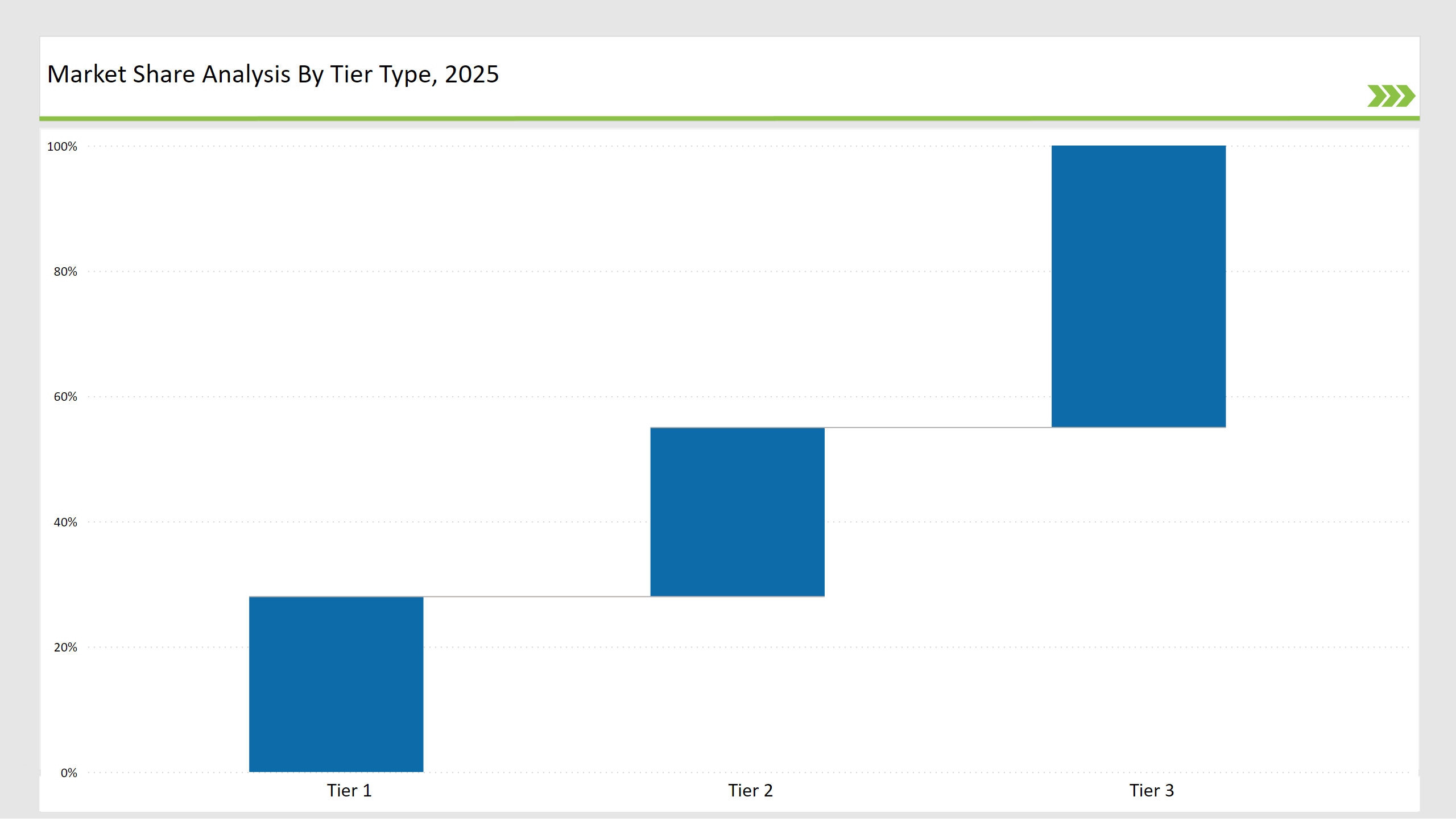

Tier 1, tier 2, and tier 3 players are available in the market, while top manufacturers such as Gerresheimer, SGD Pharma, and Nipro Pharma Packaging hold about 28% of the market share. High quality glass and plastic serum bottles, advanced barrier coatings, and pharmaceutical regulatory compliance are the focal points of top manufacturers. Increasing demand for tamper-proof packaging, precision dosing, and sustainability have been the growth drivers of the market.

Tier 2 is Bormioli Pharma, West Pharmaceutical Services, and AptarGroup. These three have a combined market share of around 27%. Bormioli Pharma, West Pharmaceutical Services, and AptarGroup make low-priced, high-quality, and highly customizable serum bottles for pharmaceutical, biotechnology, and healthcare-related applications.

Tier 3 players comprise the remaining 45% market share, with regional and niche manufacturers.These companies specialize in customized, tamper-proof designs, catering to specific client needs such as biodegradable materials, precision molding, and RFID-enabled packaging.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Gerresheimer, SGD Pharma, Nipro Pharma Packaging) | 13% |

| Rest of Top 5 (Bormioli Pharma, West Pharmaceutical Services) | 9% |

| Next 5 of Top 10 (AptarGroup, Corning Inc., Schott AG, Piramal Glass, Stoelzle Glass) | 6% |

| Market Concentration | Criteria | Current Market |

|---|---|---|

| High | Over 60% by leading players | No |

| Medium | 30-60% by top players | No |

| Low | Below 30% market share | Yes |

Companies in the Serum Bottles Market cater to:

Suppliers offer a variety of serum bottle solutions:

Sustainability drives innovation as companies focus on biodegradable materials, improved barrier coatings, and lightweight serum bottles.

Manufacturers will focus on precision-molded serum bottles, AI-driven quality control, and smart packaging to preserve market leadership. Companies will have recourse to use automated production lines, serialization to provide traceability, and innovation in sustainable material to enhance product security, regulatory compliance, and environmental friendliness. Strategic partners will be those with biotechnology companies, pharmaceutical brands, and research laboratories expanding markets

Recommendations for Technology Suppliers

Technology suppliers should focus on:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Gerresheimer, SGD Pharma, Nipro Pharma Packaging |

| Tier 2 | Bormioli Pharma, West Pharmaceutical Services, AptarGroup |

| Tier 3 | Corning Inc., Schott AG, Piramal Glass, Stoelzle Glass |

| Manufacturer | Latest Developments |

|---|---|

| Gerresheimer | In January 2024, introduced high-barrier, tamper-proof serum bottles. |

| SGD Pharma | Launched AI-driven recyclable glass serum bottle solutions in March 2024 |

| Nipro Pharma Packaging | Introduced precision-molded, medical-grade serum bottles in April 2024. |

| Bormioli Pharma | Increased sustainable packaging for pharmaceutical serum bottles in May 2024. |

| West Pharmaceutical Services | Enhanced RFID-enabled, traceable serum packaging in June 2024. |

| AptarGroup | Invested in smart dosing and secure closure technology in July 2024. |

Leading companies in the Serum Bottles Market leverage:

Serum Bottles Market trends towards biodegradable materials, IoT-enabled tracking, and AI-driven quality control. Companies invest in automated manufacturing, predictive analytics, and green innovations to drive security, compliance, and shelf life of products. The sector emphasizes green technology development, emphasizing light serum bottles, tamper-proof closures, and next-generation barrier coatings.

Among the leading manufacturers, there are Gerresheimer, SGD Pharma, Nipro Pharma Packaging, Bormioli Pharma, and West Pharmaceutical Services.

The top 3 players collectively account for 13% of the global market.

The market concentration is low, with leading players controlling approximately 28% of the industry.

AI-driven automation, smart tracking, and increasing demand for precision-molded serum bottles

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Lactate Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Serum Separating Tubes Market

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Facial Serum Market Forecast and Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Crimp Neck Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Free Eye Serum Market Analysis – Growth & Demand 2024-2034

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA