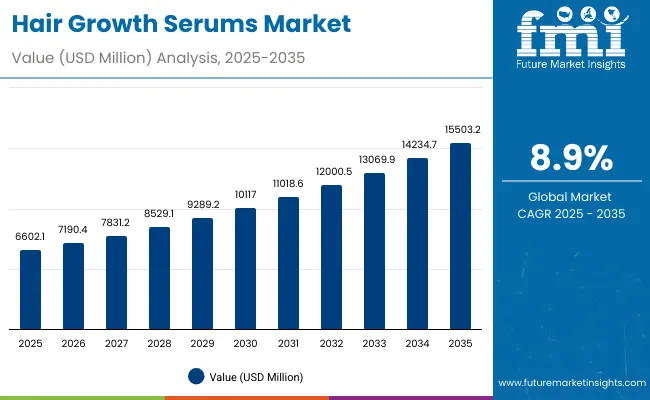

A valuation of USD 6,602.1 Million has been projected for the Hair Growth Serums Market in 2025, which is anticipated to advance to USD 15,503.2 Million by 2035. This reflects an expansion of nearly 2.3 times over the decade, translating into a CAGR of 8.9% during the assessment period. The strong trajectory is expected to be sustained by higher treatment adoption, widening product availability, and growing emphasis on preventative hair health solutions.

Hair Growth Serums Market Key Takeaways

| Metric | Value |

|---|---|

| Hair Growth Serums Market Estimated Value in (2025E) | USD 6,602.1 Million |

| Hair Growth Serums Market Forecast Value in (2035F) | USD 15,503.2 Million |

| Forecast CAGR (2025 to 2035) | 8.90% |

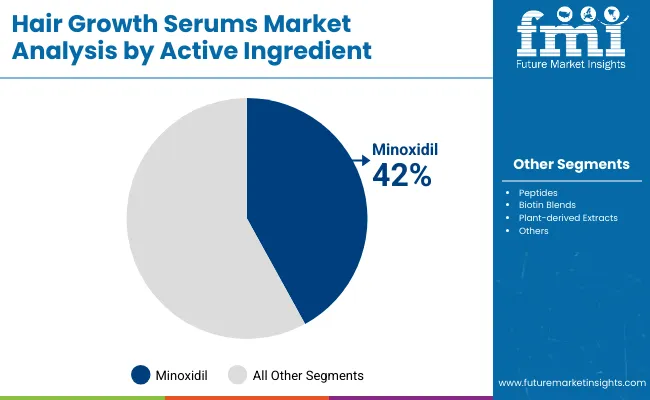

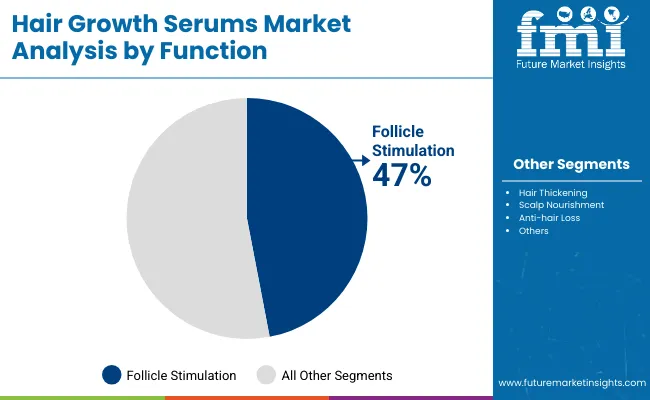

During the first half of the forecast period, from 2025 to 2030, the market is expected to increase from USD 6,602.1 Million to USD 10,117.0 Million. This gain of USD 3,514.9 Million accounts for a significant share of total decade growth. The pace will be supported by steady penetration of clinically validated active ingredients, particularly Minoxidil, which is projected to dominate with a 42.0% share in 2025. Functional categories led by follicle stimulation, representing 47.0% of value in 2025, are also expected to underpin sustained adoption.

The second phase between 2030 and 2035 is anticipated to accelerate further, adding USD 5,386.2 Million as the market moves from USD 10,117.0 Million to USD 15,503.2 Million. Nearly 60% of the decade’s absolute growth is concentrated in this period, underscoring rapid uptake across Asia and digital-first retail formats. Rising consumer confidence in long-term efficacy, along with heightened investment in professional-grade formulations, is expected to reinforce both value creation and category maturity.

The market is projected to more than double in value between 2025 and 2035, highlighting an enduring consumer preference for clinically proven ingredients and innovation-led formulations. Minoxidil is expected to retain dominance, while follicle-stimulation functions will lead performance positioning. Asia, particularly China and India, is forecast to emerge as the fastest-growing region, supported by double-digit CAGR levels. A fragmented competitive landscape is anticipated, with top brands holding single-digit shares, thereby offering significant room for challenger brands and digital-first entrants to expand.

Growth in the Hair Growth Serums Market is being driven by heightened awareness of hair health, rising prevalence of hair thinning, and increasing adoption of preventative care routines. Demand is being reinforced by clinically validated actives such as Minoxidil, which continue to establish credibility through proven efficacy. Expanding e-commerce access has been enabling broader consumer reach, while pharmacies and professional clinics are contributing to trust-based adoption.

Consumer preference has been shifting toward early intervention and long-term scalp care, ensuring repeat usage and higher lifetime value. Advancements in formulation science, including peptide-based blends and plant-derived actives, are expected to enhance appeal among wellness-oriented buyers. Strong growth has been projected across Asia, where double-digit CAGR rates are anticipated due to lifestyle changes, rising incomes, and greater willingness to invest in personal care. A fragmented competitive field has been allowing new entrants and digital-first brands to capture incremental share.

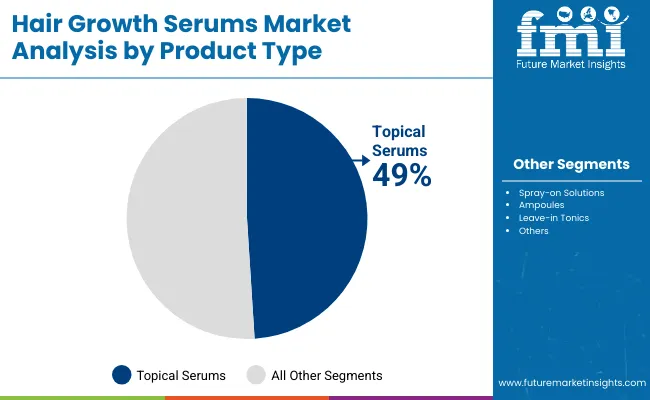

The Hair Growth Serums Market has been segmented across active ingredients, functional benefits, and product types, reflecting the structural factors shaping adoption trends. Active ingredients highlight the scientific backbone of formulations, ranging from clinically proven compounds such as Minoxidil to emerging blends of peptides and botanicals. Functions emphasize the outcomes most sought after by consumers, including follicle stimulation, scalp nourishment, and anti-hair-loss benefits. Product types demonstrate the formats through which these solutions are delivered, with topical serums, sprays, ampoules, and leave-in tonics catering to varied preferences. Each segment has been contributing to distinct consumer behavior patterns, and their relative performance is expected to define the long-term trajectory of the market.

| Active Ingredient | Market Value Share, 2025 |

|---|---|

| Minoxidil | 42% |

| Others | 58.0% |

Minoxidil has been positioned as the cornerstone of the Hair Growth Serums Market, contributing 42.0% of revenue in 2025. Its dominance has been reinforced by long-standing clinical validation and consistent consumer trust in efficacy. Broader availability across regulated retail and digital channels has supported sustained adoption. While alternative blends such as peptides, biotin, and plant-derived extracts have been gaining traction, these have been complementing rather than displacing Minoxidil.

Over the forecast period, continuous product innovations and enhanced treatment adherence programs are expected to preserve Minoxidil’s strong market standing. Expansion of supportive evidence and inclusion in multi-functional formulations are anticipated to extend its relevance. Consequently, Minoxidil is expected to remain the anchor active in the competitive landscape of hair growth solutions.

| Function | Market Value Share, 2025 |

|---|---|

| Follicle stimulation | 47% |

| Others | 53.0% |

Follicle stimulation has been identified as the primary functional focus, commanding 47.0% share in 2025. This leadership has been enabled by strong consumer preference for visible outcomes tied to growth initiation and density improvement. Scientific communication has emphasized the role of follicle activity in reversing early signs of thinning, thereby encouraging proactive usage.

Increasing reliance on targeted solutions that directly address root-level concerns has positioned follicle stimulation as a long-term growth catalyst. While scalp nourishment and anti-hair-loss features are contributing, they remain secondary to the performance-driven appeal of follicle activation. As clinical studies and product trials reinforce efficacy claims, the function of follicle stimulation is expected to expand further, shaping consumer loyalty and driving sustained market momentum.

| Product Type | Market Value Share, 2025 |

|---|---|

| Topical serums | 49% |

| Others | 51.0% |

Topical serums have been projected to hold 49.0% share in 2025, reflecting their position as the most accessible and widely adopted format in the Hair Growth Serums Market. Ease of application, strong compliance rates, and direct-to-scalp delivery mechanisms have supported their dominance. These serums have been increasingly integrated into daily care routines, making them suitable for long-term treatment adherence.

In contrast, alternatives such as sprays, ampoules, and leave-in solutions have been appealing to niche users but have not displaced the consistent demand for serums. As personalization and subscription models expand online, topical serums are expected to retain leadership, supported by strong retail presence and innovation in multi-active formulations. Their role as the foundational product format is anticipated to remain intact over the forecast horizon.

Expanding innovation pipelines and diversified consumer habits have been reshaping the Hair Growth Serums Market, yet barriers linked to efficacy skepticism and compliance hurdles continue to challenge long-term adoption. Opportunities and risks are being shaped simultaneously by shifting clinical evidence and digital retail ecosystems.

Integration of Clinical Validation with Consumer Accessibility

Market acceleration has been supported by the alignment of clinical-grade formulations with mass-market accessibility. Robust clinical data has been integrated into consumer messaging, enabling credibility across diverse demographics. Pharmaceutical-grade actives such as Minoxidil have been positioned not only as treatment solutions but also as lifestyle maintenance tools. This repositioning has allowed adherence to improve while expanding consumer willingness to engage in subscription-based regimens. Partnerships with telehealth platforms have been amplifying this effect, as prescriptions and follow-ups have been streamlined into digital journeys. The blending of rigorous efficacy standards with accessible formats has been reinforcing trust, thereby shaping durable consumer retention in the coming decade.

Adherence Fatigue and Treatment Discontinuation

Sustained compliance has been hindered by treatment fatigue, as long application cycles and delayed visible results have been associated with high discontinuation rates. Even clinically effective regimens have been affected by inconsistent user commitment, limiting the overall lifetime value of consumers. Digital adherence tools and mobile app integrations have been piloted, yet their adoption has not fully offset consumer impatience with extended treatment horizons. As convenience and instant gratification dominate personal care habits, adherence fatigue remains a central bottleneck. Unless resolved through innovation in delivery mechanisms or accelerated efficacy, this restraint is expected to temper growth potential despite a robust demand base.

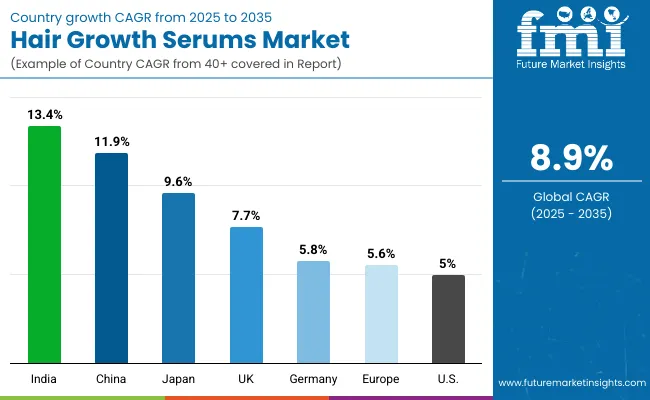

| Countries | CAGR |

|---|---|

| China | 11.9% |

| USA | 5.0% |

| India | 13.4% |

| UK | 7.7% |

| Germany | 5.8% |

| Japan | 9.6% |

Adoption of hair growth serums has been unfolding unevenly across leading economies, with structural factors such as demographic shifts, healthcare accessibility, and evolving beauty standards shaping country-specific trajectories. Asia has been positioned as the strongest growth hub, with India projected at a 13.4% CAGR and China closely following at 11.9%. These outlooks have been reinforced by rising disposable incomes, rapid urbanization, and a cultural shift toward preventative self-care. Increasing male grooming adoption and the broadening of female consumer categories have also been amplifying market depth in both countries. Japan is expected to record a 9.6% CAGR, supported by an aging population investing in advanced scalp and follicle-care solutions.

In contrast, Europe reflects steady but moderate expansion, with the UK projected at 7.7% and Germany at 5.8%. Growth has been sustained by high awareness levels and robust distribution networks, although saturation in certain consumer groups has limited acceleration. The USA is anticipated to expand at a more modest 5.0% CAGR, reflecting maturity in early-adopter categories and slower onboarding of new users. Despite this, digital-first retail strategies and personalized regimens are expected to maintain growth momentum. Overall, emerging Asia is forecast to shape the global market’s most dynamic demand curve.

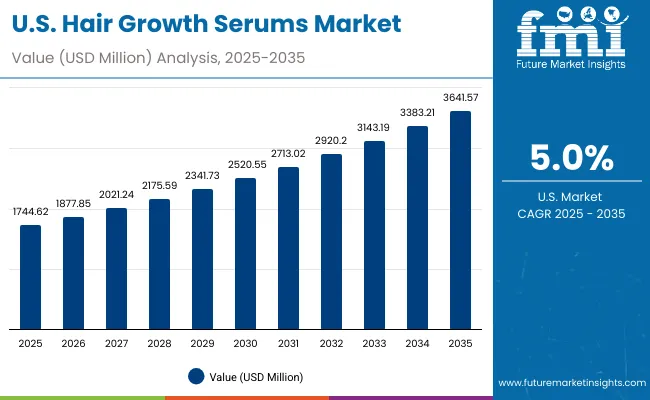

| Year | USA Hair Growth Serums Market (USD Million) |

|---|---|

| 2025 | 1744.62 |

| 2026 | 1877.85 |

| 2027 | 2021.24 |

| 2028 | 2175.59 |

| 2029 | 2341.73 |

| 2030 | 2520.55 |

| 2031 | 2713.02 |

| 2032 | 2920.20 |

| 2033 | 3143.19 |

| 2034 | 3383.21 |

| 2035 | 3641.57 |

The Hair Growth Serums Market in the United States is projected to grow at a CAGR of 7.7%, advancing from USD 1,744.62 Million in 2025 to USD 3,641.57 Million by 2035. Expansion is expected to be enabled by stronger consumer adoption of preventative hair health solutions and increasing penetration of clinically validated actives. Pharmacies and drugstores are projected to retain a significant role, while e-commerce growth is anticipated to accelerate through subscription services and integration with tele-dermatology platforms.

Innovation in topical formulations and wider acceptance of Minoxidil as a trusted active are expected to sustain demand momentum. At the same time, premium positioning of peptide- and plant-based blends is forecast to broaden appeal among wellness-focused segments. Competitive intensity is projected to increase as direct-to-consumer models reshape distribution and adherence tools improve long-term engagement.

The Hair Growth Serums Market in the UK is projected to expand at a CAGR of 7.7% between 2025 and 2035. Growth is expected to be supported by rising awareness of early-stage hair thinning among younger demographics and increased investment in specialized scalp-care solutions. Pharmacies are forecast to remain vital as trusted retail touchpoints, while digital channels are expected to accelerate adoption through subscription-based delivery models. Minoxidil-led offerings are anticipated to hold a strong share, but wellness-focused blends featuring natural and peptide-based actives are likely to broaden the appeal among holistic health consumers.

The Hair Growth Serums Market in India is anticipated to record the highest growth among key countries, expanding at a CAGR of 13.4% from 2025 to 2035. Market acceleration is expected to be fueled by a young consumer base, rapid urbanization, and increased prioritization of grooming routines. E-commerce penetration is forecast to deliver significant growth, enabling access to both premium and mass-market formulations. Clinically proven actives such as Minoxidil are anticipated to drive baseline demand, while herbal and plant-derived blends are projected to resonate strongly with local preferences for natural remedies.

The Hair Growth Serums Market in China is projected to grow at a CAGR of 11.9% between 2025 and 2035. Rapid adoption is expected to be enabled by rising disposable incomes, a strong focus on appearance, and increasing acceptance of medical-grade actives. Pharmacies are forecast to remain influential in establishing trust, while cross-border e-commerce platforms are projected to strengthen access to international brands. Minoxidil is anticipated to dominate share, while fast innovation cycles in peptide- and herbal-based blends are expected to diversify choices for consumers seeking differentiated solutions.

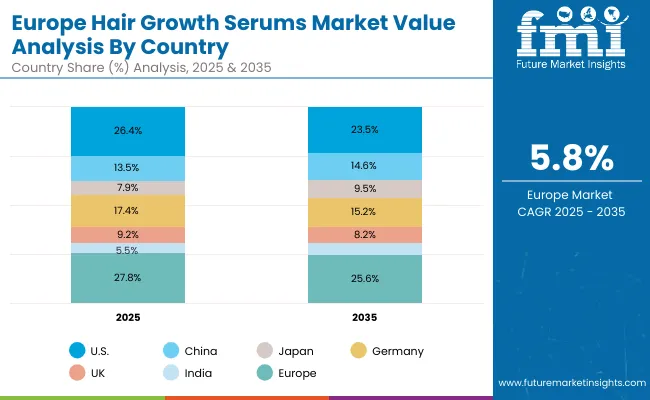

| Countries | 2025 |

|---|---|

| USA | 26.4% |

| China | 13.5% |

| Japan | 7.9% |

| Germany | 17.4% |

| UK | 9.2% |

| India | 5.5% |

| Countries | 2035 |

|---|---|

| USA | 23.5% |

| China | 14.6% |

| Japan | 9.5% |

| Germany | 15.2% |

| UK | 8.2% |

| India | 6.7% |

The Hair Growth Serums Market in Germany is forecast to expand at a CAGR of 5.8% during 2025-2035. Growth is anticipated to remain steady, supported by strong consumer awareness and widespread availability of premium brands across pharmacies. A mature market profile suggests incremental growth will be driven by product innovation, particularly in formulations combining Minoxidil with advanced peptides or botanical blends. Online platforms are expected to strengthen consumer engagement, while offline channels will maintain credibility in clinical and dermatology-driven adoption.

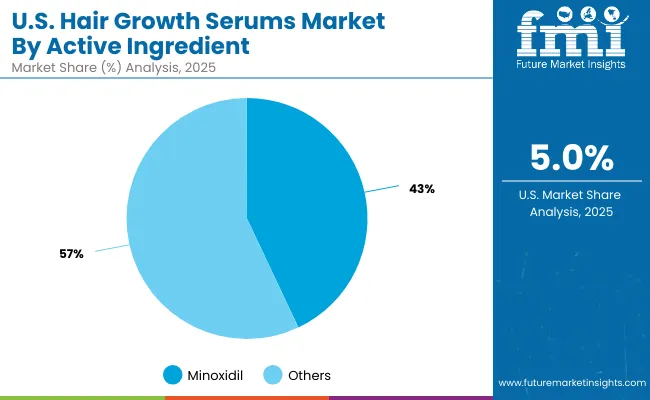

| USA By Active Ingredient | Market Value Share, 2025 |

|---|---|

| Minoxidil | 43% |

| Others | 57.0% |

The Hair Growth Serums Market in the USA is projected at USD 1,744.62 Million in 2025. Minoxidil contributes 43.0% (USD 750.19 Million), while other ingredients account for 57.0% (USD 994.43 Million), underscoring a slight dominance of diversified blends over a single active compound. This balance reflects the expanding consumer demand for wellness-driven, multi-functional formulations that combine efficacy with natural positioning.

Although Minoxidil remains a clinically validated gold standard, the appeal of biotin-based, peptide-enhanced, and plant-derived alternatives is being amplified by lifestyle preferences and growing trust in holistic health solutions. Increased research focus on next-generation actives is expected to accelerate this trend, with consumer adoption being shaped by evidence-driven marketing. As personalization advances, complementary actives are anticipated to move toward parity with Minoxidil, creating a diversified market portfolio.

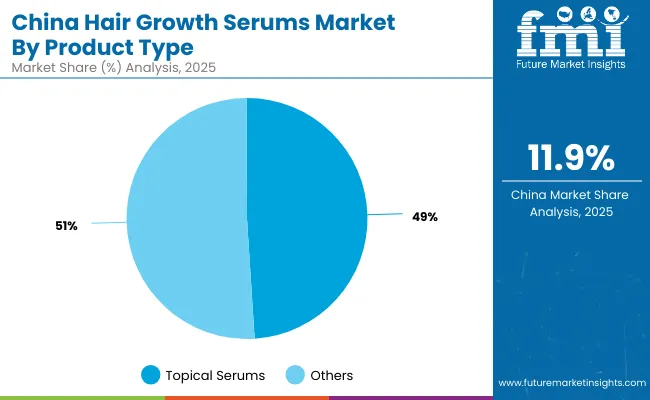

| China By product type | Market Value Share, 2025 |

|---|---|

| Topical serums | 49% |

| Others | 51.0% |

The Hair Growth Serums Market in China is projected at USD 891.70 Million in 2025. Topical serums contribute 49.0% (USD 436.93 Million), while other product formats hold a slightly higher share at 51.0% (USD 454.76 Million). This near-parity highlights the evolving diversity of consumer preferences, where traditional serum formats are being complemented by sprays, ampoules, and leave-in tonics. Trust in topical serums remains strong due to direct-to-scalp application and proven adherence, yet growing experimentation with alternative delivery systems is reshaping product adoption.

Expansion of cross-border e-commerce has been amplifying access to innovative global formulations, further boosting the role of emerging product types. As personalization and convenience become central to consumer choices, the balance between serums and alternative formats is expected to remain competitive, driving continued innovation in formulation and application technologies.

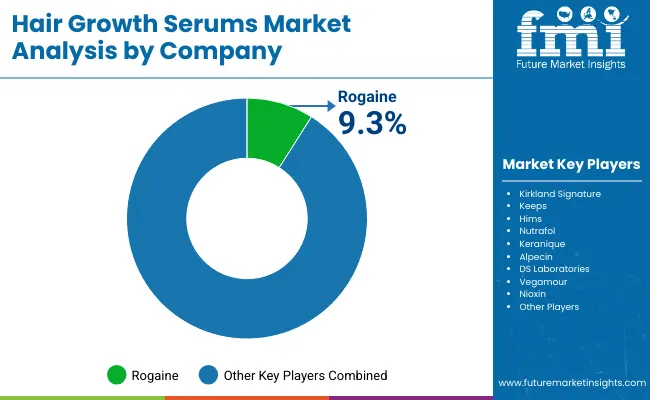

The Hair Growth Serums Market is moderately fragmented, with a mix of global leaders, specialized wellness brands, and emerging digital-first challengers competing across varied consumer segments. Rogaine has been identified as the dominant global player, holding a 9.3% value share in 2025, while all other competitors collectively account for 90.7%. Its leadership has been sustained through clinical credibility, strong brand recall, and extensive pharmacy distribution.

Established players such as Kirkland Signature, Keeps, Hims, Nutrafol, Keranique, and Alpecin have been expanding their reach, leveraging both direct-to-consumer models and e-commerce subscription platforms. These companies have been emphasizing innovation in multi-active formulations, consumer education, and long-term adherence tools, positioning themselves strongly among younger demographics and women consumers.

Niche specialists such as DS Laboratories, Vegamour, and Nioxin have been differentiating through plant-based formulations, scalp-focused wellness routines, and professional salon partnerships. Their strengths lie in premium positioning, clean-label narratives, and targeted marketing strategies that resonate with health-conscious consumers.

Competitive differentiation is expected to shift further toward ecosystem strength, with subscription-driven regimens, digital adherence tools, and tele-dermatology integrations reinforcing loyalty. As clinical validation and personalization become critical, competitive advantage will be shaped less by ingredient exclusivity and more by consumer engagement, data-driven outcomes, and credibility of evidence-based results.

Key Developments in Hair Growth Serums Market

| Item | Value |

|---|---|

| Quantitative Units | USD 6,602.1 Million (2025) → USD 15,503.2 Million (2035) |

| Active Ingredient | Minoxidil, Peptides, Biotin blends, Plant-derived extracts (ginseng, saw palmetto) |

| Function | Follicle stimulation, Hair thickening, Scalp nourishment, Anti-hair loss |

| Product Type | Topical serums, Spray-on solutions, Ampoules, Leave-in tonics |

| Distribution Channel | Pharmacies & drugstores, E-commerce, Salons & clinics, Mass retail |

| End User | Men, Women, Aging consumers |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rogaine, Kirkland Signature, Keeps, Hims, Nutrafol, Keranique, Alpecin, DS Laboratories, Vegamour, Nioxin |

| Additional Attributes | Dollar sales by active ingredient and function, adoption of clinically validated formulations, growing e-commerce subscriptions, rising demand for plant-based and peptide-enhanced blends, digital adherence tools, subscription-driven regimens, expansion in Asia with high CAGR, and integration of tele-dermatology platforms with product adoption. |

The global Hair Growth Serums Market is estimated to be valued at USD 6,602.1 Million in 2025.

The market size for the Hair Growth Serums Market is projected to reach USD 15,503.2 Million by 2035.

The Hair Growth Serums Market is expected to grow at a CAGR of 8.9% between 2025 and 2035.

The key product types in the Hair Growth Serums Market are topical serums, spray-on solutions, ampoules, and leave-in tonics.

In terms of function, the follicle stimulation segment is expected to command 47.0% share of the Hair Growth Serums Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Hair Gloss Market – Trends, Growth & Forecast 2025 to 2035

Hair Styling Products Market Analysis - Trends, Growth & Forecast 2025 to 2035

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA