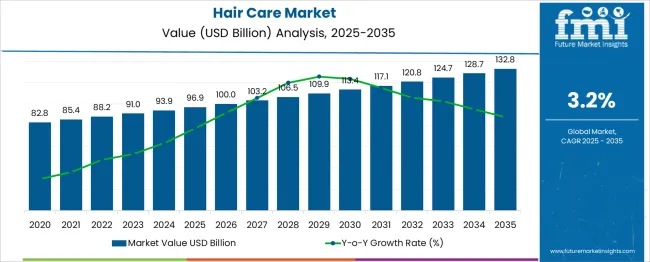

The Hair Care Market is estimated to be valued at USD 96.9 billion in 2025 and is projected to reach USD 132.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Hair Care Market Estimated Value in (2025 E) | USD 96.9 billion |

| Hair Care Market Forecast Value in (2035 F) | USD 132.8 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The hair care market is showing consistent expansion, fueled by growing consumer focus on scalp health and natural formulations. Increasing awareness about the benefits of organic ingredients has driven demand for products that promise gentle care without harmful chemicals.

Consumers have become more selective, seeking shampoos and conditioners that offer both cleansing and nourishing properties tailored to their hair needs. The rise of social media and beauty influencers has further amplified trends around organic and clean beauty products.

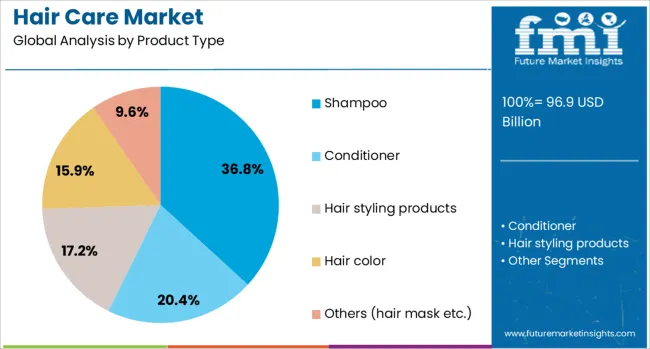

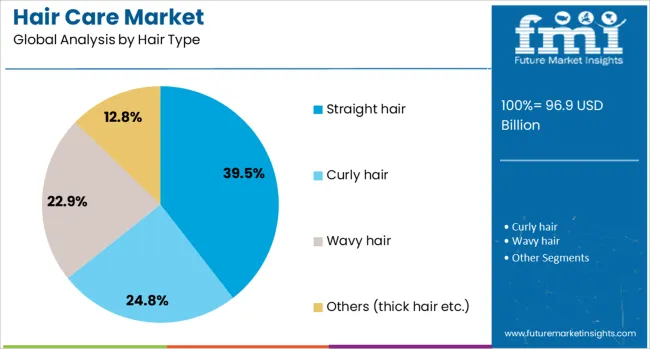

Additionally, advancements in product formulation have led to the introduction of shampoos that cater specifically to different hair types, supporting healthier hair and scalp. The preference for straight hair care solutions reflects broader demographic trends and styling preferences. Market growth is expected to continue as consumers pursue effective and natural hair care regimens. Key segment drivers include Shampoo as the leading product type, Organic as the preferred ingredient, and Straight Hair as the dominant hair type.

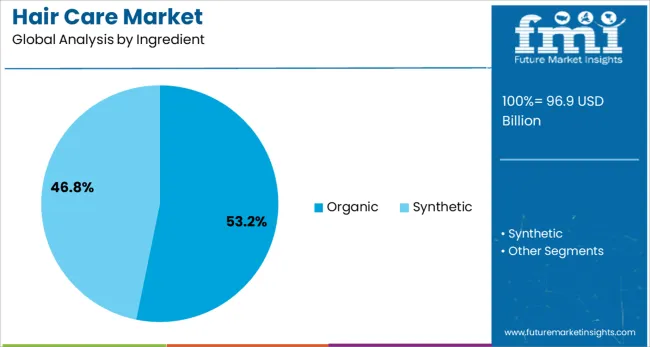

The hair care market is segmented by product type, ingredient, hair type, consumer group, price, end use, and distribution channel and geographic regions. By product type of the hair care market is divided into Shampoo, Conditioner, Hair styling products, Hair color, and Others (hair mask etc.). In terms of ingredient of the hair care market is classified into Organic and Synthetic.

Based on hair type of the hair care market is segmented into Straight hair, Curly hair, Wavy hair, and Others (thick hair etc.). By consumer group of the hair care market is segmented into Women, Men, and Kids. By price of the hair care market is segmented into Medium, Low, and High.

By end use of the hair care market is segmented into Individual and Commercial. By distribution channel of the hair care market is segmented into Offline and Online. Regionally, the hair care industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Shampoo segment is projected to hold 36.8% of the hair care market revenue in 2025, maintaining its position as the largest product category. Shampoos remain essential in daily hair care routines due to their cleansing ability and formulation versatility. Growth in this segment has been supported by innovations that incorporate natural and organic extracts, appealing to consumers who prioritize scalp health and product safety.

The segment benefits from wide accessibility through retail and online channels, making shampoos the first choice for hair care consumers. Furthermore, increasing concerns about hair damage and pollution have led to demand for shampoos with protective and restorative properties.

As consumer preferences evolve toward products that combine efficacy with natural ingredients, the Shampoo segment is expected to sustain its market leadership.

The Organic ingredient segment is anticipated to capture 53.2% of the hair care market revenue in 2025, establishing itself as the leading ingredient category. The shift toward organic hair care products is driven by heightened consumer consciousness about product safety and environmental impact. Organic ingredients are perceived as safer and less likely to cause scalp irritation or allergic reactions.

The segment growth is further supported by the trend toward sustainable sourcing and clean beauty standards promoted by health and wellness movements. Hair care formulations enriched with botanical extracts, essential oils, and natural antioxidants have gained widespread acceptance.

This has encouraged brands to reformulate traditional products and develop dedicated organic lines. As consumers continue to seek transparency and natural efficacy, the Organic segment is expected to drive significant market growth.

The Straight Hair segment is projected to account for 39.5% of the hair care market revenue in 2025, making it the dominant hair type category. This segment’s growth is linked to the prevalence of straight hair across large geographic regions and its unique care requirements. Products designed for straight hair focus on maintaining smoothness, shine, and volume without weighing the hair down.

Consumers with straight hair have shown preference for lightweight formulas that provide moisture balance and reduce oiliness. The segment has benefited from the introduction of specialized shampoos and conditioners that address scalp sensitivity and environmental damage.

As hair care regimens become more personalized, the demand for products targeting straight hair characteristics is expected to continue rising. The segment’s prominence reflects both demographic trends and consumer preferences for tailored hair care solutions.

Global hair care is moving toward performance-first and personalized formats. Wake-up routines now feature proprietary serums, scalp tonics, and fragrance microcapsules. Consumer research shows that 48 % of new product launches in 2024 highlighted claims such as oil control, pH balance, or anti-breakage. Growth is strongest in Asia‑Pacific and Latin America, reflecting higher demand for hair wellness and region-specific botanicals. Brands are integrating smart packaging with micropumps and usage counters to engage repeat use. Online channel penetration now exceeds 55 % of sales in premium personal care categories. Ingredient transparency, refill-friendly formats, and sensory customization are shaping the modern hair care landscape.

Hair care developers are prioritizing targeted treatment formats over generic washes. Formulations for anti-frizz, volume boost, and scalp clarity now make up 52 % of premium shampoo and mask launches. Solid shampoo bars and concentrated refill pods rose by 28 % in urban retail outlets, cutting shipping weight by 34 % and enabling subscription-based sampling. Retailers have introduced scent personalization at the point of sale, driving trial rates 17 % higher than standard launches. Brands bundle tracking QR codes that link user rinse data to re-order platforms, lifting loyalty penetration by 21 %. Kefir-extract, biotin-peptide blends, and oligopeptide boosters account for 43 % of bio-boosted line extensions, aligning with functional hair nutrition trends.

Advanced actives like peptides, ceramides, and botanical extracts add 14–18 % to formulation costs due to limited supply scale. Solid bar formats require moisture validation—under high humidity, failure in 12 % of batches has been reported, shortening shelf-life certificates by 3–4 months. Safe limits for novel actives vary by region; regulatory approval for new amino-acid boosters adds 6–8 weeks to product launch. Smaller brands struggle with multi-format validation, and packaging of refill pods adds 9 % to unit cost. Product complexity also increases manufacturing lead times—validation of multiple SKU variants extends production planning by up to two weeks, slowing responsiveness to trend shifts.

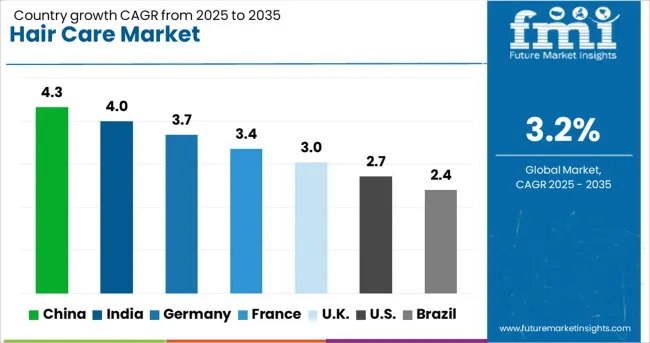

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

Global hair care market demand is forecast to expand at a 3.2% CAGR between 2025 and 2035. Among the top five analyzed, China posts 4.3%, marking a +34% growth premium over the global average, led by domestic brands scaling herbal-based solutions. India follows at 4.0% (+25%), driven by increasing product uptake in urban and semi-urban segments. France shows 3.4%, slightly ahead at +6%, reflecting steady demand for salon-centric formulations. The United Kingdom aligns marginally below global growth at 3.0% (–6%) while the United States reports 2.7%, or –16%, with maturing consumer trends and slower product diversification. Country-level differences reflect variations in population age profiles, natural product preference, and salon penetration. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China’s hair care market is projected to grow at 4.3% CAGR. Consumer interest is increasing in scalp-focused solutions and plant-derived serums. Douyin and JD Health are leading e-commerce platforms where live-stream selling has become influential. Domestic brands are offering sulfate-free and pH-balanced formulations to address hair fall and pollution damage. In second-tier cities, men are adopting leave-in treatments and scalp tonics. International niche brands are expanding access through pharmacy chains and cross-border portals.

India’s market is forecast to expand at 4.0% CAGR from 2025 to 2035. Herbal oils, scalp-active treatments, and hybrid conditioners are driving demand in rural and Tier 2 areas. Neem, fenugreek, and amla remain the preferred base ingredients in lower-priced segments. Urban trials of single-use pods and powder-to-liquid formats remain niche. Online-only labels are scaling through pharmacy tie-ups and social commerce. Sub-100 ml packs dominate due to cost efficiency and high reorder frequency in D2C channels.

France’s hair care segment is expected to grow at 3.4% CAGR. Products with targeted claims addressing breakage and sensitivity are gaining traction. Brands are reformulating rinse-free treatments with camellia oil, oat extract, and amino-acid complexes. All-purpose lines are losing shelf space in favor of hypoallergenic and organic-labeled alternatives. Kits for hair density are increasingly bundled with scalp applicators and trial boosters. Biome-friendly pH and fragrance-free claims are used to reposition existing treatments.

The UK market is forecast at 3.0% CAGR. Post-color repair, split-end prevention, and scalp relief are key focus areas. Products are being reformulated with lower water content to meet compact packaging requirements. Hybrid treatments such as conditioning balms and dry oil sprays are preferred for in-home use. Boutique stores and apothecaries are offering curl repair and postpartum regrowth lines. Omega oils and caffeine blends are central to ingredient development.

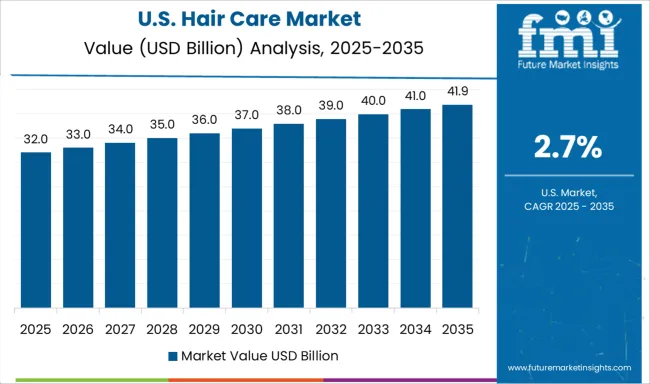

The USA hair care market is projected to grow at 2.7% CAGR. AI-led customization tools are popular among younger buyers. Subscription models are expanding for leave-in products and exfoliating scalp care. Peptide-enriched and silicone-free formulations are gaining attention, often marketed alongside skincare. DTC brands are experimenting with multi-format packaging including balms, bars, and cross-functional gels. Hair and facial care kits are positioned for Gen Z and Millennial audiences through digital channels.

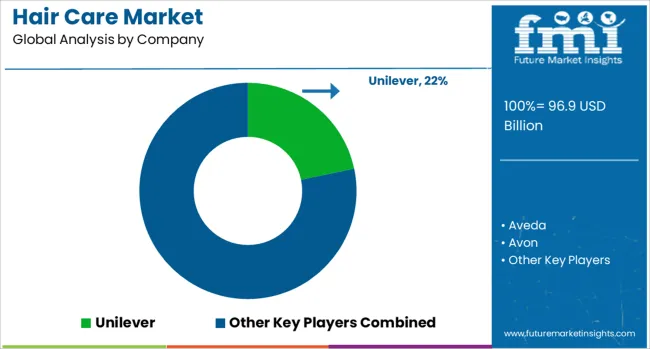

The market is highly competitive, with Unilever dominating at a significant market share through its extensive portfolio of mass-market and professional brands. Key industry leaders, including L'Oréal, Procter & Gamble, and Henkel, compete with innovative formulations, salon-quality products, and sustainable packaging solutions. Premium segment players such as Estée Lauder, Aveda, and LVMH cater to luxury consumers with botanical and organic ingredients, while specialist brands like Redken and Paul Mitchell maintain strong salon distribution channels. Emerging competitors are gaining traction through digital-first strategies and personalized hair solutions. The market is being transformed by several key trends: growing demand for clean beauty and natural ingredients, the rise of customized hair care regimens, and increasing popularity of professional-at-home treatment systems.

L’Oréal signed an agreement on June 30, 2025 to acquire Color Wow, a fast-growing premium haircare brand based in the USA and UK The move strengthens L’Oréal’s presence in high-performance salon-grade products, especially targeting frizz control and styling in the curly hair segment

| Item | Value |

|---|---|

| Quantitative Units | USD 96.9 Billion |

| Product Type | Shampoo, Conditioner, Hair styling products, Hair color, and Others (hair mask etc.) |

| Ingredient | Organic and Synthetic |

| Hair Type | Straight hair, Curly hair, Wavy hair, and Others (thick hair etc.) |

| Consumer Group | Women, Men, and Kids |

| Price | Medium, Low, and High |

| End Use | Individual and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever, Aveda, Avon, Coty, Estée Lauder, Henkel, Johnson & Johnson, KAO Group, Loreal, LVMH, Paul Mitchell, Procter & Gamble, Redken, Revlon, and Shiseido |

| Additional Attributes | Dollar sales by product category and distribution channel, growing demand in scalp health and damage-repair formulations, stable consumption across cleansing and styling segments, innovations in microbiome-friendly ingredients and personalized regimens enhance product differentiation and repeat purchase rates |

The global hair care market is estimated to be valued at USD 96.9 billion in 2025.

The market size for the hair care market is projected to reach USD 132.8 billion by 2035.

The hair care market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in hair care market are shampoo, conditioner, hair styling products, _hair mousse, _hair spray, _hair serums, _hair oil, _others (hair gel etc.), hair color and others (hair mask etc.).

In terms of ingredient, organic segment to command 53.2% share in the hair care market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Packaging Market Growth and Trends 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Rice Water Haircare Sector

Anti-Frizz Hair Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Customized Hair Care Market Trends – Growth & Forecast 2024-2034

Anti-Static Hair Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Professional Hair Care Market Insights & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA