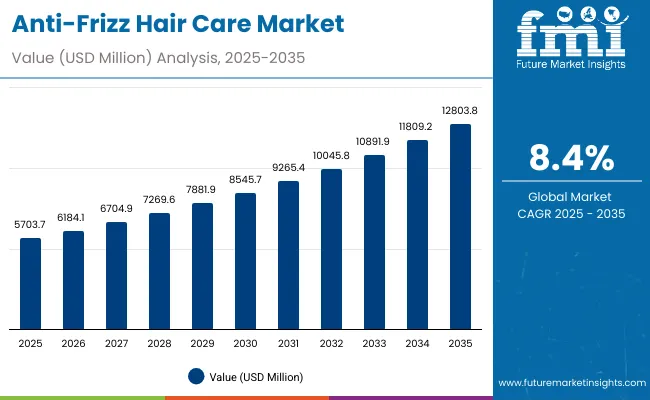

The Anti-Frizz Hair Care Market is expected to record a valuation of USD 5,703.7 million in 2025 and USD 12,803.8 million in 2035, with an increase of USD 7,100.1 million, which equals a growth of nearly 125% over the decade. The overall expansion represents a CAGR of 8.4% and a clear 2X increase in market size.

Anti-Frizz Hair Care Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Frizz Hair Care Market Estimated Value in (2025E) | USD 5,703.7 million |

| Anti-Frizz Hair Care Market Forecast Value in (2035F) | USD 12,803.8 million |

| Forecast CAGR (2025 to 2035) | 8.40% |

During the first five-year period from 2025 to 2030, the market rises from USD 5,703.7 million to USD 8,545.7 million, adding USD 2,842 million, which accounts for almost 40% of the total decade growth. This phase records steady adoption across premium serums, oil-based anti-frizz products, and argan oil-based formulations, driven by rising consumer preference for smooth texture, scalp nourishment, and styling convenience. Serums & oils dominate this period as they cater to more than one-third of global consumer demand, especially in USA and European salons, where high-value treatments continue to gain traction.

The second half from 2030 to 2035 contributes USD 4,258.1 million, equal to around 60% of total growth, as the market jumps from USD 8,545.7 million to 12,803.8 million. This acceleration is powered by widespread adoption of e-commerce platforms, premium hair mask routines, and keratin-infused leave-in creams, combined with rising demand from India, China, and Japan where CAGR ranges from 10%-15%. Consumers in emerging economies increasingly view anti-frizz hair care as part of their daily grooming essentials, and the shift toward natural butter blends for curly and chemically treated hair adds momentum. By the end of the decade, natural formulations and multifunctional products capture larger shares, while e-commerce channels and pharmacies see exponential growth as distribution expands in both developed and emerging markets.

From 2020 to 2024, the Anti-Frizz Hair Care Market expanded from salon-exclusive products into mainstream retail, crossing USD 5,000 million in value by 2024. During this period, the competitive landscape was dominated by legacy brands such as L’Oréal Professional, John Frieda, and Garnier, which together controlled nearly 40% of premium and mass anti-frizz revenues. Competitive differentiation relied heavily on efficacy of frizz control, brand-driven salon endorsements, and pricing tiers spanning luxury to affordable. While hair oils and serums contributed maximum value, shampoos & conditioners secured a broad mass-market base, particularly in supermarkets and hypermarkets across North America and Europe.

By 2025, demand for anti-frizz products surges to USD 5,703.7 million, and the revenue mix begins shifting as natural argan oil formulations and keratin-based solutions grow to a combined share of over 40% of the market. Traditional leaders are being challenged by niche and clean-label entrants offering vegan, silicone-free, and dermatologist-tested formulas, particularly appealing to younger demographics in East Asia and Western markets. E-commerce-focused brands are also scaling rapidly, using digital marketing and subscription models to capture market share from offline retail.

The competitive advantage is no longer confined to salon reputation or retail visibility alone but increasingly lies in ecosystem-based strategies: brand sustainability, social media presence, influencer partnerships, and customized solutions targeting diverse hair types. Companies that can combine performance with personalization and ethical ingredient sourcing are emerging as long-term leaders.

Advances in hair care science have improved the ability of products to target frizz by sealing hair cuticles, maintaining moisture balance, and protecting against humidity. Serums & oils have gained prominence due to their instant smoothing effect, lightweight texture, and suitability across diverse hair types, while argan oil-based products remain the gold standard for premium frizz control. The rise of keratin complexes has contributed to long-lasting straightening and strengthening benefits, especially for chemically treated and frizz-prone hair. Industries such as professional salons, online-exclusive retailers, and drugstore chains are driving demand for anti-frizz solutions that can integrate seamlessly into both luxury treatment regimens and daily care routines.

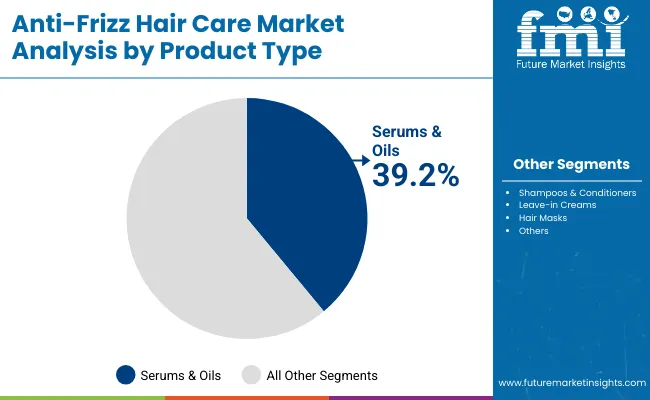

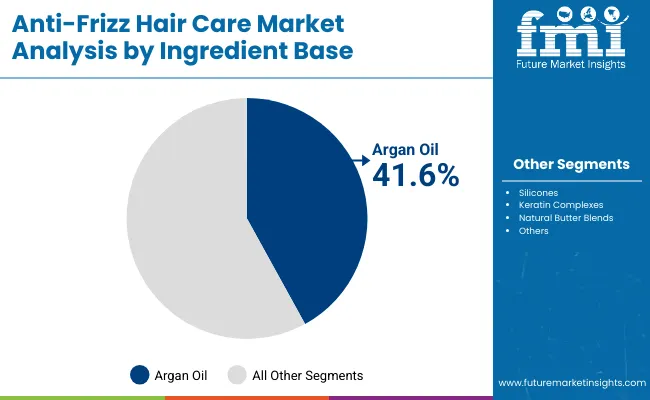

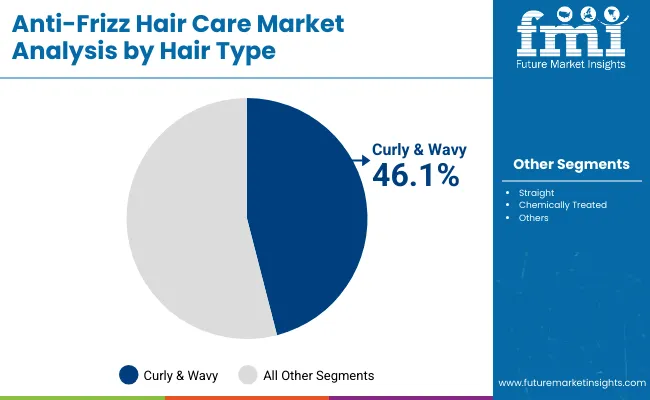

Expansion of natural butter blends, sulfate-free formulations, and vegan-certified hair masks has fueled innovation. Portable packaging formats, clean-label claims, and dermatologist-tested approvals are expected to open new consumer segments. Segment growth is expected to be led by serums & oils under product type, argan oil under ingredient base, and curly & wavy hair under hair type categories. Regionally, Asia-Pacific (led by India and China) and Europe will be central to demand growth due to both volume expansion and premiumization trends.

The market is segmented by product type, ingredient base, hair type, channel, end user, and region. Product types include serums & oils, shampoos & conditioners, leave-in creams, and hair masks, highlighting the premium-to-mass offerings driving adoption. Ingredient base covers silicones, argan oil, keratin complexes, and natural butter blends to cater to both traditional and clean-label demand. Hair type segmentation emphasizes curly & wavy, straight, and chemically treated segments, with curly & wavy projected to dominate.

Distribution channels span salons & professional stores, e-commerce, supermarkets & hypermarkets, and pharmacies, underlining the omnichannel approach to consumer reach. End user segments cover women, men, and unisex, with women accounting for the majority but unisex gradually expanding. Geographically, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with Asia-Pacific leading in growth and North America retaining the largest single-market value through 2030.

| Product Type | Value Share% 2025 |

|---|---|

| Serums & oils | 39.2% |

| Others | 60.8% |

The serums & oils segment is projected to contribute 39.2% of the Anti-Frizz Hair Care Market revenue in 2025, maintaining its lead as the dominant product category. This leadership is driven by ongoing demand for lightweight yet powerful formulations that provide immediate frizz control, shine enhancement, and humidity resistance. Consumers across North America and Europe are increasingly adopting premium oil blends containing argan, jojoba, and coconut oils, while emerging markets in Asia-Pacific are showing accelerated uptake due to rising awareness of hair nourishment benefits.

Growth in this segment is further supported by the development of multi-benefit serums that combine frizz control with heat protection, UV defense, and scalp care. The portability and convenience of oil-based dropper formats and pump dispensers enhance consumer usability both at home and in professional salons. As digital marketing and influencer endorsements amplify consumer interest, serums & oils are expected to retain their position as the backbone of the anti-frizz hair care category, appealing strongly to women and increasingly to men through gender-neutral branding.

| Ingredient Base | Value Share% 2025 |

|---|---|

| Argan oil | 41.6% |

| Others | 58.4% |

The argan oil segment is forecasted to hold 41.6% of the Anti-Frizz Hair Care Market share in 2025, led by its proven ability to provide hydration, smoothness, and long-lasting frizz control. Argan oil is favored for its natural fatty acid and vitamin E composition, which helps restore hair health, making it ideal for curly, wavy, and chemically treated hair types. Premium brands such as Moroccanoil and Kerastase have built their core product lines around argan oil formulations, creating strong consumer loyalty and premium positioning.

The segment’s expansion is supported by widespread penetration in both professional salons and retail chains, where argan oil-based shampoos, conditioners, and hair masks are marketed as luxury yet essential solutions. In China and India, argan oil demand is accelerating as middle-class consumers embrace international beauty standards while seeking natural and safe ingredients. As sustainability in sourcing becomes a consumer priority, brands investing in ethically sourced argan oil will continue to command trust and preference. By the end of the decade, argan oil is expected to remain the benchmark ingredient for anti-frizz performance across global markets.

| Hair Type | Value Share% 2025 |

|---|---|

| Curly & wavy | 46.1% |

| Others | 53.9% |

The curly & wavy hair segment is projected to account for 46.1% of the Anti-Frizz Hair Care Market revenue in 2025, establishing it as the leading hair type category. This dominance is attributed to the inherently higher susceptibility of curly and wavy textures to frizz due to their uneven cuticle structure and increased dryness. Consumers with these hair types actively seek targeted solutions such as leave-in creams, hydrating hair masks, and silicone-free oils that provide long-lasting definition and frizz resistance.

This segment benefits from a growing cultural embrace of natural hair textures, particularly in North America and Europe, where curly hair communities are driving demand for specialized anti-frizz routines. In South Asia and Latin America, where wavy hair is common, daily-use products such as conditioners and serums are gaining popularity. The segment’s growth is reinforced by innovations in butter-based blends, keratin complexes, and sulfate-free formulations, which provide tailored nourishment without weighing hair down. Given the rising preference for texture-specific products and social media-driven styling trends, curly & wavy hair care is expected to continue its dominance in the Anti-Frizz Hair Care Market.

Rising Penetration of Premium Serums & Oils in Urban Markets

The largest product category, serums & oils (39.2% in 2025), is a major growth driver for the Anti-Frizz Hair Care Market. Urban consumers in markets like the USA, UK, and Europe increasingly favor high-performance serums infused with argan oil, keratin complexes, and natural butters. These formulations deliver immediate frizz control, shine, and texture improvement, addressing both styling needs and long-term hair health. The demand is reinforced by the influence of salon professionals and social media influencers, who frequently highlight serum-based routines for curly and chemically treated hair. The premium positioning of serums allows brands to command higher margins, fueling revenue expansion in developed economies while also trickling into emerging Asia-Pacific markets where consumers aspire to international beauty standards.

Expanding Consumer Base for Curly & Wavy Hair Care

The curly & wavy hair segment accounts for 46.1% share in 2025, underscoring its role as a key driver. Frizz issues are most pronounced among curly and wavy textures, leading consumers to seek targeted solutions such as leave-in creams, hydration masks, and silicone-free oils. In North America and Europe, the cultural shift toward embracing natural curls is generating sustained demand for texture-specific products. Meanwhile, in South Asia and Latin America, wavy hair types are common, and everyday anti-frizz solutions are becoming routine purchases. The rising visibility of inclusive beauty campaigns and textured-hair advocacy groups further propels demand for specialized anti-frizz products, positioning curly & wavy hair care as a long-term growth catalyst for the industry.

Rising Consumer Pushback Against Silicones and Synthetic Additives

Although silicones have been widely used in anti-frizz products for their smoothening properties, growing concerns around buildup, scalp irritation, and long-term hair damage are creating resistance in mature markets. Increasing consumer preference for clean-label and silicone-free alternatives poses a challenge for brands heavily reliant on synthetic formulations. This shift requires significant R&D investments into natural substitutes such as botanical oils and butter blends, which often carry higher raw material costs and complex sourcing challenges. For mainstream players, balancing cost efficiency with clean-label compliance is a critical restraint in sustaining competitiveness.

Pricing Sensitivity in Emerging Markets

While markets like India and China are forecast to grow at double-digit CAGRs (14.6% and 13% respectively), adoption of premium anti-frizz hair care remains limited by pricing sensitivity. Consumers in these regions often prioritize affordability over premium attributes, making them reliant on supermarket-grade shampoos and conditioners rather than high-margin serums or salon-exclusive treatments. This restrains revenue growth potential, as companies must adjust portfolios to cater to value-driven mass-market demand while still maintaining profitability. Furthermore, local players offering low-cost herbal or ayurvedic solutions intensify competition, limiting international brands’ ability to scale premium categories quickly.

Surge in Argan Oil-Based Formulations and Ethical Sourcing

Argan oil leads the ingredient base with 41.6% share in 2025, reflecting its premium reputation for hydration and frizz control. However, the trend is evolving beyond functionality consumers now seek products built on ethical and sustainable sourcing practices. Brands emphasizing fair-trade argan oil from Morocco or highlighting traceable supply chains gain competitive advantage, especially in Europe and North America, where sustainability has become a purchase driver. This convergence of performance and ethical branding is reshaping the competitive landscape, pushing companies to integrate transparent sourcing and eco-certifications as part of their value proposition.

Digital-First Growth of E-Commerce and Social Media-Driven Product Discovery

The e-commerce channel is rapidly scaling in both developed and emerging markets, with consumers increasingly discovering and purchasing anti-frizz products via online platforms, influencer campaigns, and subscription-based services. In China, live-streaming platforms such as Douyin (TikTok) are driving impulse purchases of argan oil serums and keratin-based leave-in creams, while in the USA, Instagram and YouTube tutorials are fueling uptake of styling serums and masks. This digital-first trend allows niche and challenger brands to disrupt the dominance of traditional salon-linked giants, accelerating the market’s competitive intensity. Personalized recommendations, subscription packs, and online-exclusive product launches are expected to be central growth levers through 2035.

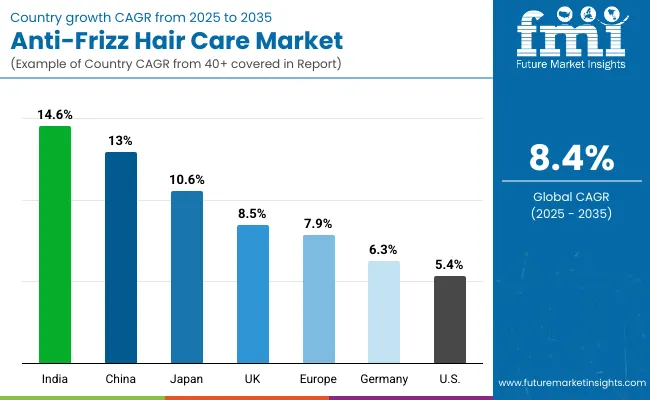

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.0% |

| USA | 5.4% |

| India | 14.6% |

| UK | 8.5% |

| Germany | 6.3% |

| Japan | 10.6% |

| Europe | 7.9% |

The country-level analysis highlights that India (14.6%) and China (13.0%) are set to deliver the fastest growth rates in the Anti-Frizz Hair Care Market between 2025 and 2035. Both markets are benefiting from rising disposable incomes, rapid urbanization, and growing awareness of premium hair care routines among middle-class consumers. In India, demand is further reinforced by the large base of curly and wavy hair types, creating consistent need for serums, oils, and hydrating masks. E-commerce platforms are also playing a significant role in making international and premium products more accessible in both India and China. Increasing experimentation with styling, coupled with a preference for natural and argan oil-based solutions, is accelerating adoption in these high-growth economies.

In contrast, mature markets such as the USA (5.4%), UK (8.5%), and Germany (6.3%) are projected to record steady but comparatively slower growth. In these regions, consumer penetration for anti-frizz products is already high, and the market is shifting toward clean-label, sustainable, and texture-specific formulations rather than pure volume expansion. The UK stands out with stronger growth at 8.5%, driven by a combination of multicultural hair types and a rising preference for natural ingredient bases.

Meanwhile, Japan (10.6%) and the wider European region (7.9%) show resilience, with Japanese consumers gravitating toward technologically advanced, multifunctional products and European consumers increasingly opting for ethical sourcing and vegan claims. Together, these growth dynamics underline how emerging Asian markets will shape the volume trajectory of the Anti-Frizz Hair Care Market, while Western markets will influence premiumization and sustainability trends.

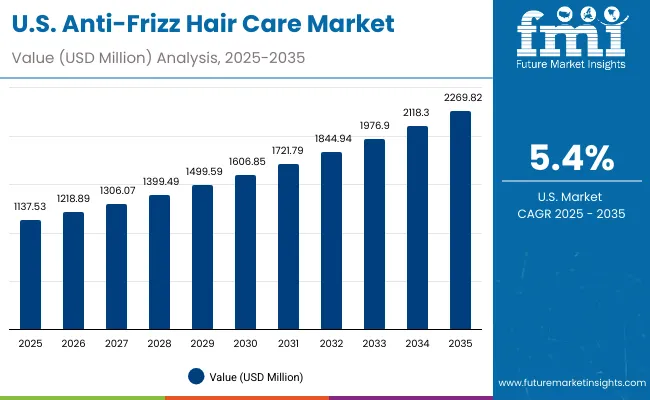

| Year | USA Anti-Frizz Hair Care Market (USD Million) |

|---|---|

| 2025 | 1137.53 |

| 2026 | 1218.89 |

| 2027 | 1306.07 |

| 2028 | 1399.49 |

| 2029 | 1499.59 |

| 2030 | 1606.85 |

| 2031 | 1721.79 |

| 2032 | 1844.94 |

| 2033 | 1976.90 |

| 2034 | 2118.30 |

| 2035 | 2269.82 |

The Anti-Frizz Hair Care Market in the United States is projected to grow at a CAGR of 5.4%, supported by consistent consumer demand for premium serums, leave-in creams, and salon-exclusive treatments. The USA market is shaped by a strong salon culture and rising consumer preference for silicone-free and clean-label anti-frizz products. Digital channels such as Amazon and D2C brand websites are playing an increasing role in capturing sales, particularly among younger demographics. While women remain the primary consumers, unisex and men’s categories are gaining visibility through targeted campaigns.

The Anti-Frizz Hair Care Market in the United Kingdom is expected to grow at a CAGR of 8.5%, driven by increasing penetration of argan oil-based products, hair masks, and natural butter blends. UK consumers are adopting inclusive beauty practices, with curly and textured hair types fueling demand for specialized anti-frizz solutions. The rise of pharmacy chains and online-exclusive product launches is accelerating category growth. Additionally, consumer demand for sustainable packaging and vegan-certified formulations is reshaping brand strategies.

India is witnessing rapid growth in the Anti-Frizz Hair Care Market, forecast to expand at a CAGR of 14.6% through 2035, the highest among major markets. Rising disposable incomes and urbanization are fueling demand for affordable anti-frizz shampoos and conditioners, while aspirational consumers are gravitating toward serums and oils. The growth is not limited to metro cities tier-2 and tier-3 urban centers are also witnessing fast adoption as international brands expand distribution. Educational awareness campaigns and social media influencers are reshaping consumer behavior, especially around premium argan oil and keratin-based products.

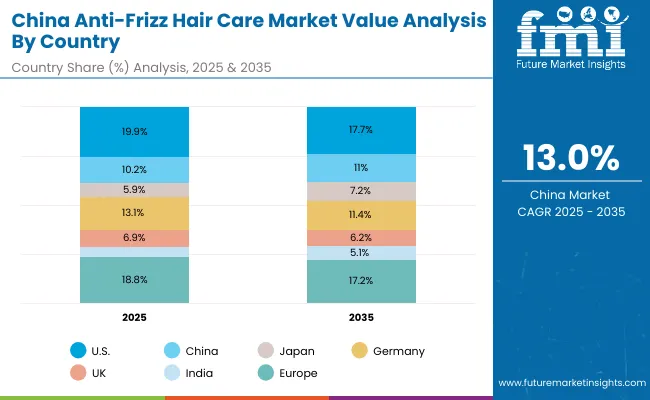

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Europe | 18.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

| Europe | 17.2% |

The Anti-Frizz Hair Care Market in China is expected to grow at a CAGR of 13.0%, among the strongest globally. Growth is powered by e-commerce dominance, where platforms like Tmall and JD.com drive awareness and sales of international and local anti-frizz brands. Urban consumers are adopting argan oil-based serums and keratin-infused creams, with premium positioning aligning with rising disposable incomes. At the same time, local manufacturers are offering affordable, natural-based products, expanding adoption among younger, price-sensitive consumers. Social media and live-streaming sales campaigns are central to driving brand loyalty and impulse purchases.

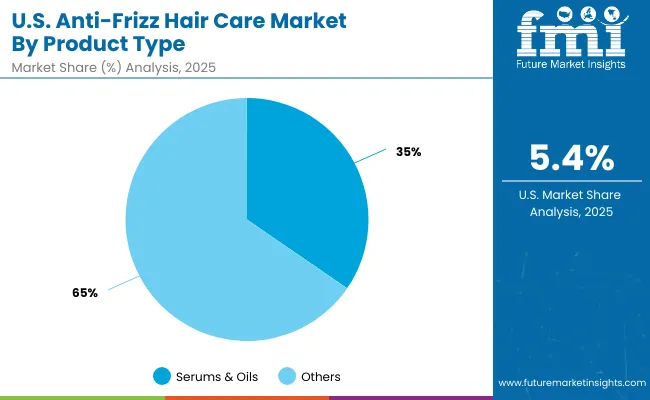

| USA By Product Type | Value Share% 2025 |

|---|---|

| Serums & oils | 34.6% |

| Others | 65.4% |

The Anti-Frizz Hair Care Market in the United States is valued at USD 1,137.53 million in 2025, led by the dominance of serums & oils, which contribute 34.6% of national revenue. This category reflects the premium orientation of USA consumers, who prefer high-efficacy serums that deliver instant frizz control and styling support. While oils dominate salon-led regimens, shampoos, conditioners, and leave-in creams contribute significantly to mass adoption through pharmacies and supermarkets.

The market is shaped by a steady transition toward clean-label, silicone-free, and natural ingredient-based formulations, reflecting heightened consumer awareness of long-term hair health. Growing demand for multi-functional solutions that combine anti-frizz, UV protection, and heat defense is also fueling innovation. E-commerce plays an increasingly critical role, with direct-to-consumer (D2C) platforms enabling premium and niche brands to expand quickly. With multicultural demographics driving texture-specific demand, curly and wavy hair care routines are emerging as the fastest-growing consumer niche.

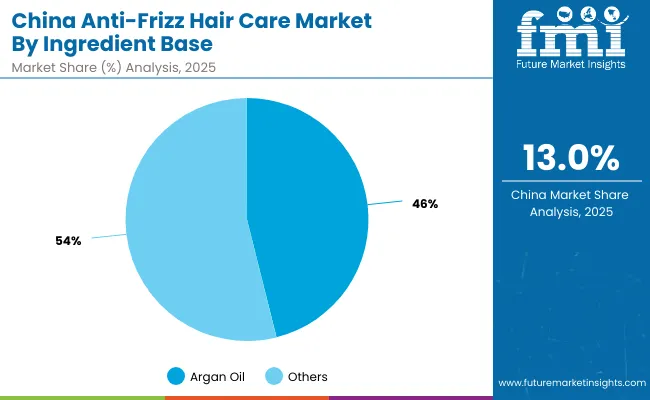

| China By Ingredient Base | Value Share% 2025 |

|---|---|

| Argan oil | 46.1% |

| Others | 53.9% |

The Anti-Frizz Hair Care Market in China is valued at USD 581.4 million in 2025, with argan oil products contributing 46.1%, reflecting the country’s rising preference for premium and natural formulations. This dominance stems from increasing consumer awareness of hair nourishment, hydration, and scalp health benefits associated with argan oil. International brands such as Moroccanoil and Kerastase are leveraging their argan oil portfolios to capture the urban middle class, while local players are developing affordable argan-based alternatives to target non-metro consumers.

China’s rapid e-commerce expansion, particularly on Tmall, JD.com, and Douyin live-streaming platforms, has positioned anti-frizz hair care as a trending lifestyle category. Urban consumers, especially women under 35, are driving demand for serums, keratin-based leave-ins, and hydrating masks. Competitive pricing from domestic brands further accelerates penetration in tier-2 and tier-3 cities, making the Chinese market one of the most dynamic globally. By 2035, China is expected to strengthen its position, with premiumization and digital-first retail continuing to reshape adoption trends.

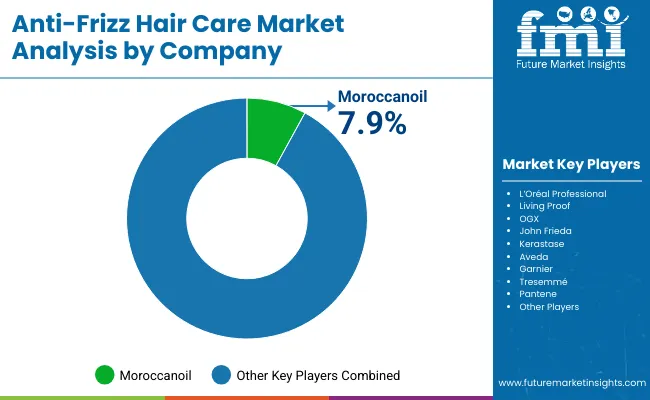

The Anti-Frizz Hair Care Market is moderately consolidated, with a mix of multinational giants, salon-specialist brands, and emerging digital-first players competing across diverse regions. Moroccanoil, with its argan oil-centric positioning, leads the global category with 7.9% share in 2025, owing to its strong salon partnerships, premium brand equity, and targeted marketing campaigns.

Global leaders such as L’Oréal Professional, Kerastase, and Pantene retain significant market presence by leveraging their extensive distribution networks and diverse product lines, spanning mass-market shampoos to premium serums and leave-in creams. These brands are focusing on sustainability initiatives, clean-label claims, and AI-driven personalization to sustain consumer loyalty. Mid-tier players like Living Proof, OGX, and John Frieda specialize in consumer-friendly, scientifically formulated solutions that bridge the gap between salon exclusivity and mass retail.

Their strength lies in portable product lines, silicone-free innovations, and influencer-driven brand strategies, which resonate strongly with younger demographics. Heritage-driven brands such as Aveda and Garnier are capitalizing on natural ingredient bases, vegan claims, and eco-packaging to strengthen their global consumer base. With growing traction in both developed and emerging markets, these companies are redefining competitive advantage beyond performance alone, moving toward sustainability, transparency, and digital engagement ecosystems.

Competitive differentiation in the coming decade will increasingly revolve around digital-first strategies, texture-specific solutions, and ingredient sourcing transparency, rather than product efficacy alone.

Key Developments in Anti-Frizz Hair Care Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Serums & oils, Shampoos & conditioners, Leave-in creams, Hair masks |

| Ingredient Base | Silicones, Argan oil, Keratin complexes, Natural butter blends |

| Hair Type | Curly & wavy, Straight, Chemically treated |

| Channel | Salons & professional stores, E-commerce, Supermarkets & hypermarkets, Pharmacies |

| End User | Women, Men, Unisex |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Moroccanoil, L’Oréal Professional, Living Proof, OGX, John Frieda, Kerastase, Aveda, Garnier, Tresemmé, Pantene |

| Additional Attributes | Dollar sales by product type and ingredient base, adoption trends across curly & wavy hair segments, rising demand for serums & oils, sector-specific growth in salons, pharmacies, and e-commerce, premiumization of argan oil and keratin-based products, software-driven retail personalization, integration of digital channels and influencer-driven campaigns, regional trends influenced by texture diversity and urbanization, and innovations in silicone-free and natural butter blend formulations. |

The Anti-Frizz Hair Care Market is estimated to be valued at USD 5,703.7 million in 2025.

The market size for the Anti-Frizz Hair Care Market is projected to reach USD 12,803.8 million by 2035.

The Anti-Frizz Hair Care Market is expected to grow at a CAGR of 8.4% between 2025 and 2035.

The key product types in the Anti-Frizz Hair Care Market are serums & oils, shampoos & conditioners, leave-in creams, and hair masks.

In terms of hair type, the curly & wavy segment is forecast to command 46.1% share in the Anti-Frizz Hair Care Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Hair Gloss Market – Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA