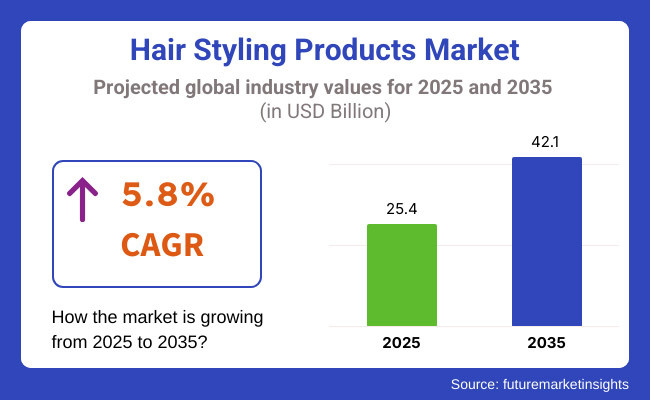

The hair styling products market is set for steady growth between 2025 and 2035, driven by rising consumer interest in hairstyling, increasing demand for natural and organic haircare solutions, and innovations in long-lasting styling formulas. The market is projected to expand from USD 25.4 billion in 2025 to USD 42.1 billion by 2035, reflecting a CAGR of 5.8% over the forecast period.

Factors Similar as the influence of social media, celebrity-championed styling trends, and advancements in heat protection and anti-frizz technologies are contributing to market expansion. Also, sustainable packaging, chemical-free phrasings, and multifunctional styling products are gaining fashion ability, feeding to evolving consumer preferences.

North America remains a crucial market for hair styling products, with a strong demand for salon-quality and clean beauty phrasings.

Consumers in the United States and Canada are decreasingly shifting toward alcohol-free, sulphate-free, and paraben-free styling products. The rise of textured hair care has fuelled demand for coil-enhancing creams, ringlet-control serums, and hydrating baptizing scums, particularly among different hair types.

The region also sees rising manly grooming trends, with hair waxes, pomades, and baptizing gels getting essential in men’s fixing routines. E-commerce platforms and influencer marketing play a significant part in boosting product visibility, while the demand for heat protectants and UV- shielding hair sprays continues to rise as consumers prioritize hair health.

Europe’s hair styling product market is witnessing a strong shift toward natural and organic styling results, driven by strict EU regulations on ornamental constituents.

Consumers in Germany, France, and the UK prefer factory-grounded, atrocity-free styling products that offer long-lasting hold without dangerous chemicals. The trend of minimalist beauty and sustainable phrasings is impacting brands to borrow biodegradable packaging, arid styling products, and eco-friendly aerosol sprays.

Professional hair salons in Europe are also driving market demand, with a focus on keratin-invested styling results that feed to ringlet control and heat damage forestalment. Also, substantiated hair styling products, similar as AI-powered hair analysis tools that recommend custom styling results, are gaining traction.

Asia- Pacific is the swift- growing region, fuelled by rising disposable inflows, increased beauty mindfulness, and the influence of K- beauty and J- beauty trends.

In countries like China, Japan, and South Korea, consumers are concluding for feather light, non-sticky hair styling products that give natural- looking volume and shine. The growing demand for moisture-resistant styling products in tropical climates is also impacting the market.

India is witnessing a swell in demand for Ayurveda and herbal hair styling results, while e-commerce platforms like Alibaba and Lazed are driving the availability of transnational hair styling brands. The DIY hairstyling culture on social media platforms is encouraging inventions in quick- fix styling sprays, volumizing maquillages, and multipurpose hair creams.

Challenge

The presence of synthetic chemicals in numerous styling products raises enterprises over hair damage, crown perceptivity, and environmental impact. Consumers are getting more conservative about constituents like silicones, parabens, and alcohol- grounded sprays, egging nonsupervisory scrutiny in several regions.

Also, aerosol- grounded hair sprays contribute to air pollution, leading to stricter regulations on unpredictable organic composites (VOCs). The assiduity must acclimatize by investing in green chemistry inventions, sustainable packaging, and biodegradable styling phrasings to meet both consumer prospects and nonsupervisory norms.

Opportunity

The demand for natural and multifunctional styling products presents a major growth occasion. Brands fastening on factory-grounded, silicone-free, and nutritional formulas are gaining a competitive edge. Mongrel styling products similar as leave-in conditioners with styling benefits, heat protectant sprays with UV pollutants, and baptizing scums with nutritional canvases are getting largely popular.

The rise of AI-driven haircare technology will also transfigure the market, with brands offering substantiated styling results grounded on hair type, climate, and stoner habits. Also, arid styling products and solid-format styling results( similar to baptizing bars and redolences) are anticipated to reshape the market as sustainability becomes a top precedence.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 62.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 28.50 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 55.20 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 49.30 |

| Country | India |

|---|---|

| Population (millions) | 1,428.6 |

| Estimated Per Capita Spending (USD) | 12.40 |

The USA hair styling products market thrives on invention, decoration brands, and a strong consumer focus on hair health. Demand for natural and organic styling products has surged, with brands like Ouai and Bumble and Bumble leading the market. The rise of curled hair care routines has driven deals of baptizing creams and gels, while dry soaps and texture sprays remain largely popular. E-commerce and salon retail channels contribute significantly to market growth.

China’s market is expanding fleetly as youngish consumers embrace global hair styling trends. transnational brands similar as L'Oréal and Schwarzkopf dominate, while domestic brands like See youthful cater to price-sensitive consumers. The rise of K- beauty and J- beauty influences has boosted demand for featherlight styling sprays and serums. Online shopping platforms similar as Tmall and JD.com regard for a large portion of deals, supported by influencer marketing and social commerce.

The UK market is driven by eco-conscious consumers who prefer sustainable and vegan hair styling products. Brands like Percy & Reed and Divines concentrate on eco-friendly packaging and clean formulas. Hair waxes, pomades, and ocean swab sprays are particularly popular among men, while women favour volume-boosting scums and heat protectants. Apothecaries like thrills and Superdrug, along with online retailers, play a crucial part in distribution.

Germany’s hair baptizing market focuses on high-quality, dermatologically tested products. Consumers prefer non-toxic phrasings, fueling demand for organic styling brands similar as Weleda and Lavera. The men’s fixing member is growing, with an increased preference for baptizing pastes and matte finish products. Retailers like DM and Rossmann, along with e-commerce platforms, drive market availability.

India’s hair styling products market is growing steadily, with a rising middle-class population and adding fixing mindfulness. Original brands like Set Wet and Parachute Advanced dominate the affordable members, while transnational brands feed to decoration consumers. Hair gels and baptizing waxes are popular among men, whereas serums and heat protectants are gaining traction among women. Traditional retail stores remain the primary distribution channel, but online deals are rising due to digital relinquishment.

The market for hair styling products is growing, with customers looking for high-quality, natural, and multi-functional products. The results of a survey of 300 North American, European, and Asian consumers reveal the key drivers in buying and brand selection.

The most sought-after ones are sulphate-free, paraben-free, and silicone-free, as 70% of the clients seek out styling products that are sulphate-free, paraben-free, and silicon-free. The trend is strongest in North America (75%), where the consumer’s value scalp well-being and ingredient transparency, followed by Europe (72%).

Multifunctionality is very high in preference drivers, with 65% of the consumers wanting styling products with added benefits of heat protection, anti-frizz, and moisturizing. Asia has a particularly strong demand for single-step styling sprays and creams (68%) because they are convenient and save time.

Hold and long-lasting action determines product selection, with 58% of the survey participants ending up preferring long-hold hair styling gels, mousses, and sprays that hold hairstyles in place all day. In Europe (62%), humidity-proof and anti-frizz variants are especially popular due to the unseasonal weather conditions.

Sustainability has increased as 63% of consumers said they would choose green packaging and recyclable styling accessories. The trend is also increasing in Europe (68%), as brands employing biodegradable and recyclable packages are fashionable.

The online channel is the biggest channel of purchase, with 71% purchasing hair styling products online, driven by convenience in accessing reviews, more variety of products, and subscription shopping. Social media and influencer marketing in Asia (74%) have significant impacts on purchase decisions on products.

Whereas natural, multi-talent, and green styling products are progressively in vogue, clean ingredients, smart formulation, and green packaging companies are the ones that will define the future of the next hair styling market.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth of heat-protectant sprays, frizz-control serums, and lightweight styling mousses. Increased demand for alcohol-free and silicone-free formulations. Expansion of multi-functional styling products with built-in conditioning and UV protection. |

| Sustainability & Circular Economy | Shift toward biodegradable, plant-based styling gels and creams. Brands introduced aerosol-free styling sprays and refillable packaging to reduce plastic waste. |

| Connectivity & Smart Features | Introduction of AI-driven virtual hair styling apps that recommend products based on hair type and climate. Growth in heat-activated and self-adjusting styling formulas. |

| Market Expansion & Consumer Adoption | Increased demand for salon-quality styling products for at-home use. Growth of gender-neutral and curl-specific styling lines. Expansion of direct-to-consumer (DTC) styling brands offering customized solutions. |

| Regulatory & Compliance Standards | Stricter regulations on harmful chemicals like sulphates, parabens, and phthalates. Increased demand for ECOCERT, cruelty-free, and vegan styling products. |

| Customization & Personalization | Rise of AI-powered hair care platforms recommending tailored styling routines. Brands launched custom scent and hold-level styling products based on consumer preferences. |

| Influencer & Social Media Marketing | Growth in TikTok, YouTube, and Instagram beauty influencers showcasing new styling techniques. Celebrity hairstylists collaborated with brands to launch exclusive styling collections. |

| Consumer Trends & Behavior | Consumers prioritized non-damaging, long-lasting, and multi-functional styling products. Increased demand for heatless styling and hair-strengthening solutions. Growth in clean beauty, sulfate-free, and all-natural styling formulations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered hair analysis tools recommend personalized styling products. Smart styling sprays adapt to humidity and temperature changes. Lab-grown keratin-infused styling solutions enhance hair structure while minimizing damage. |

| Sustainability & Circular Economy | Zero-waste, waterless styling products dominate the market. AI-optimized supply chains ensure sustainable ingredient sourcing. Blockchain-backed tracking ensures transparency in ethical sourcing of hair care ingredients. |

| Connectivity & Smart Features | AI-powered smart dispensers optimize product quantity to prevent overuse. Meta verse-based virtual salons allow consumers to test styling products before purchasing. Smart styling applicators track product absorption and effectiveness in real-time. |

| Market Expansion & Consumer Adoption | Subscription-based, AI-personalized styling product bundles optimize product selection based on seasonal and lifestyle needs. 3D-printed, custom-formulated styling products provide on-demand solutions for different hair textures. AI-driven scalp and hair health analysis enhances product recommendations. |

| Regulatory & Compliance Standards | Governments mandate full transparency in ingredient sourcing and sustainability practices. AI-powered compliance tracking ensures adherence to global safety and environmental regulations. Standardized biodegradability testing for all styling products becomes a market requirement. |

| Customization & Personalization | 3D-printed, on-demand styling solutions allow users to create their own formulas. AI-integrated scalp health monitoring systems adjust styling recommendations based on real-time hair condition. Personalized ingredient blends optimize styling effectiveness without damage. |

| Influencer & Social Media Marketing | AI-generated virtual hair influencers promote the latest styling innovations. AR-powered try-on features let users test hair styling products before purchasing. Metaverse-based styling tutorials provide real-time digital styling consultations. |

| Consumer Trends & Behavior | Biohacking-inspired hair styling integrates AI-driven hydration and protection technology. Consumers embrace multi-functional, AI-personalized styling solutions that adapt to hair health, texture, and environmental conditions. |

The USA hair styling products market is witnessing steady growth, driven by adding demand for long-lasting hold and heat-protection results, rising preference for organic and chemical-free phrasings, and growing influence of celebrity-championed hairstyling brands. Major players include L'Oréal, Revlon, and Ouai.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The UK hair styling products market is expanding due to adding consumer preference for sustainable and atrocity-free hair care, rising demand for flexible-hold and volumizing products, and strong salon and professional hairstyling influence. Leading brands include Toni & Guy, Percy & Reed, and GHD.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

Germany’s hair styling products market is growing, with consumers favoring salon-quality, dermatologist-tested, and high-performance styling results. Crucial players include Wella, Schwarzkopf, and Goldwell.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

India’s hair styling products market is witnessing rapid-fire growth, fueled by adding disposable inflows, rising mindfulness of hairstyling trends, and growing influence of Bollywood and social media influencers. Major brands include Streax, BBlunt, and Set Wet.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

China’s hair styling products market is expanding significantly, driven by adding disposable inflows, growing demand for salon- inspired home hairstyling results, and the influence of K- beauty and J- beauty hair trends. Crucial players include Shiseido, L'Oréal China, and VS Sassoon.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

Consumers are shifting toward natural and organic hair styling products free from sulphates, parabens, and silicones. The demand for factory-grounded constituents, similar as shear adulation, argan oil painting, and aloe vera, is rising as guests prioritize crown health and hair aliment while achieving their asked hairstyles.

Hair styling brands are expanding their product lines to feed to a different range of hair textures and types, promoting gender-neutral and inclusive phrasings. Products acclimatized for curled, coily and textured hair types are gaining traction, with brands introducing hydrating scums, coil-defining creams, and ringlet-control serums.

Online platforms, influencer collaborations, and social media advertising have significantly boosted deals of hair styling products. Consumers calculate on online reviews, videotape tutorials, and virtual consultations to make informed purchases. Subscription-grounded services also contribute to market expansion, offering customized styling accessories.

Consumers demand multifunctional styling results that give long- lasting hold, moisture resistance, and heat protection. Advanced phrasings, similar as heat- actuated sprays, flexible- hold gels, and light volumizing maquillages, are getting decreasingly popular as people seek salon- suchlike results at home.

The hair styling products market is witnessing steady growth driven by adding consumer demand for innovative hairstyling results, including gels, sprays, waxes, scums, and serums. The rise of men's fixing, DIY styling trends, and the influence of social media and celebrity signatures are crucial growth factors. Consumers are shifting towards natural, organic, and chemical-free styling results, with brands fastening on sustainability, heat protection, and long- lasting hold.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| L’Oréal (L’Oréal Paris, Redken, Matrix) | 20-25% |

| Procter & Gamble (Pantene, Herbal Essences) | 15-20% |

| Unilever (TRESemmé, Axe, Dove, VO5) | 12-16% |

| Henkel (Schwarzkopf, got2b, Syoss) | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| L’Oréal | Market leader with a diverse range of styling products, including professional salon brands, focusing on premium and clean beauty formulations. |

| Procter & Gamble | Strengthening its presence with heat-protectant and damage-repair styling products, integrating advanced hair care technology. |

| Unilever | Expanding its mass-market and professional styling ranges with a focus on gender-inclusive and sustainable formulas. |

| Henkel | Innovating with long-lasting, salon-grade styling solutions and expanding into premium and natural hair styling categories. |

Strategic Outlook of Key Companies

L’Oréal (20-25%):

Strengthening its leadership with advanced styling technology, including heat protection, ringlet control, and long- lasting hold. The company is expanding its organic and vegan styling product range to meet the demand for clean beauty.

Procter & Gamble (15-20%)

Enhancing its styling portfolio with defensive and nutritional formulas, particularly fastening on damage- form results. The company is using influencer marketing and digital juggernauts to expand its consumer reach.

Unilever (12-16%)

Expanding gender-neutral and inclusive styling products while integrating natural and factory- grounded constituents. The company is fastening oneco-conscious packaging and phrasings that feed to sustainability- driven consumers.

Henkel (8-12%)

Investing in salon- inspired styling results, with a focus on long- continuing,ultra-hold products and innovative formulas that promote crown health. The brand is targeting youngish cult with trend- driven hairstyling inventions.

Other Key Players (30-40% Combined)

Hair Gels, Hair Sprays, Hair Mousse, Hair Wax, Hair Pomades, Hair Creams, and Others.

Chemical-Based, Organic/Natural, and Hybrid.

Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drug Stores, Online, and Others.

Men, Women, and Unisex.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Hair Styling Products industry is projected to witness a CAGR of 5.8% between 2025 and 2035.

The Hair Styling Products industry stood at USD 24.4 billion in 2024.

The Hair Styling Products industry is anticipated to reach USD 42.1 billion by 2035 end.

Natural and organic hair styling products are set to record the highest CAGR of 6.7%, driven by increasing demand for chemical-free and sustainable hair care solutions.

The key players operating in the Hair Styling Products industry include L'Oréal, Unilever, Procter & Gamble, Henkel, Coty Inc., and Amika.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 18: North America Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 26: Latin America Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 36: Europe Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 38: Europe Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 41: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 45: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 46: Asia Pacific Excluding Japan Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 47: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 48: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 49: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 50: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 51: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 53: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 54: Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 55: Japan Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 56: Japan Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 57: Japan Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 58: Japan Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 59: Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 60: Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 65: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 66: Middle East and Africa Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 67: Middle East and Africa Market Value (US$ Million) Forecast by Gender, 2017 to 2033

Table 68: Middle East and Africa Market Volume (Units) Forecast by Gender, 2017 to 2033

Table 69: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 70: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Gender, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 19: Global Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by End Use, 2023 to 2033

Figure 28: Global Market Attractiveness by Gender, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Gender, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 45: North America Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 49: North America Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by End Use, 2023 to 2033

Figure 58: North America Market Attractiveness by Gender, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Gender, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Gender, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Gender, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 105: Europe Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 118: Europe Market Attractiveness by Gender, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Excluding Japan Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: Asia Pacific Excluding Japan Market Value (US$ Million) by Gender, 2023 to 2033

Figure 124: Asia Pacific Excluding Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 132: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 135: Asia Pacific Excluding Japan Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 136: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 137: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 138: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 139: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 140: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 141: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 142: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 143: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 144: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Excluding Japan Market Attractiveness by End Use, 2023 to 2033

Figure 148: Asia Pacific Excluding Japan Market Attractiveness by Gender, 2023 to 2033

Figure 149: Asia Pacific Excluding Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 151: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: Japan Market Value (US$ Million) by End Use, 2023 to 2033

Figure 153: Japan Market Value (US$ Million) by Gender, 2023 to 2033

Figure 154: Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 162: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: Japan Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 165: Japan Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 166: Japan Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 167: Japan Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 168: Japan Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 169: Japan Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 170: Japan Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 171: Japan Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 172: Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 173: Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 174: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 177: Japan Market Attractiveness by End Use, 2023 to 2033

Figure 178: Japan Market Attractiveness by Gender, 2023 to 2033

Figure 179: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Japan Market Attractiveness by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 183: Middle East and Africa Market Value (US$ Million) by Gender, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 192: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 195: Middle East and Africa Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 196: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 197: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 198: Middle East and Africa Market Value (US$ Million) Analysis by Gender, 2017 to 2033

Figure 199: Middle East and Africa Market Volume (Units) Analysis by Gender, 2017 to 2033

Figure 200: Middle East and Africa Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 201: Middle East and Africa Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 202: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 203: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 204: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 208: Middle East and Africa Market Attractiveness by Gender, 2023 to 2033

Figure 209: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Hair Gloss Market – Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA