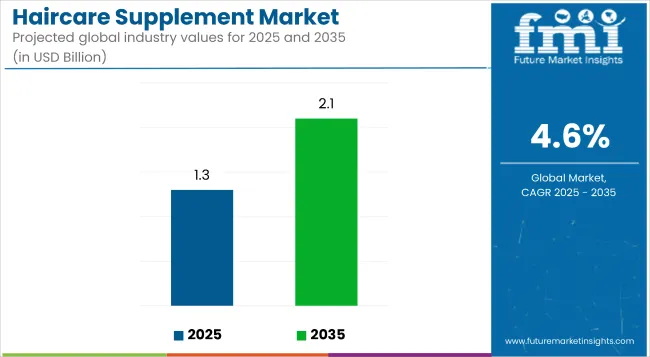

The global haircare supplement market is valued at USD 1.3 billion in 2025 and is slated to reach USD 2.1 billion by 2035, reflecting a CAGR of 4.6%. Growth is expected to be driven by increasing hair and scalp-related issues caused by air pollution and lifestyle factors.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.3 billion |

| Market Value (2035) | USD 2.1 billion |

| CAGR (2025 to 2035) | 4.6% |

Rising consumer awareness of beauty and grooming, combined with the demand for supplements supporting hair regrowth and strength, is also expected to propel the market. Additionally, the growing popularity of influencer marketing is enhancing market penetration and brand visibility.

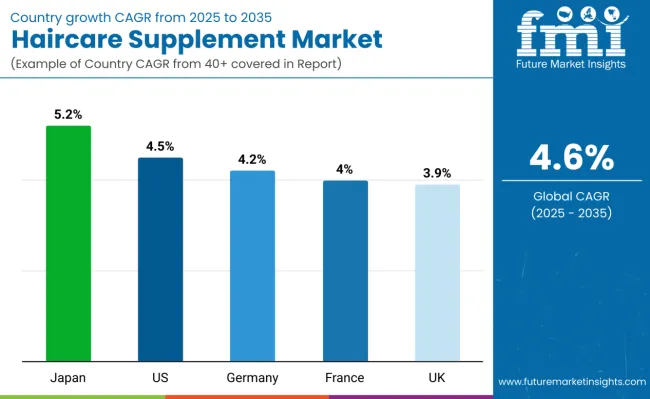

Japan is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by an ageing population demanding collagen-based beauty supplements. The USA is expected to register a CAGR of 4.5%, supported by high consumer spending on wellness products and the popularity of biotin gummies.

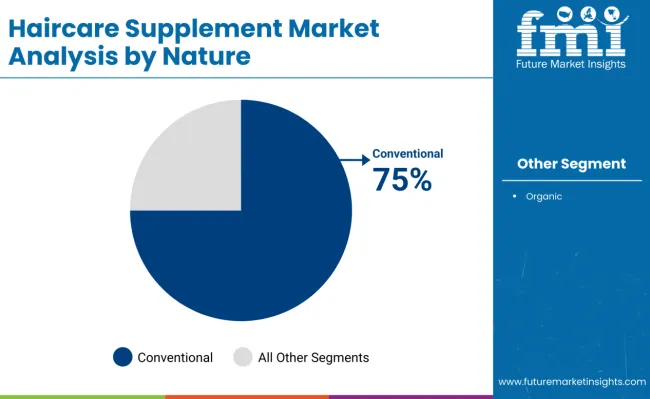

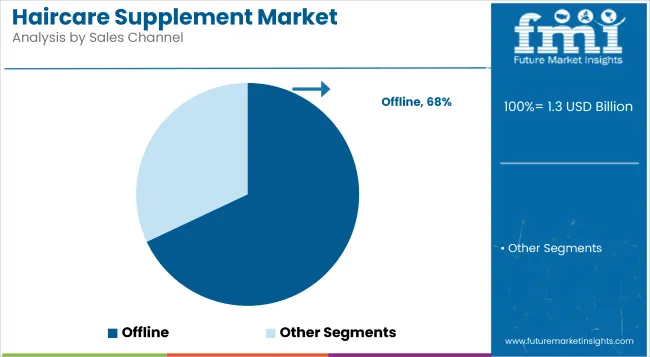

Germany is forecasted to grow at a CAGR of 4.2%, driven by demand for collagen and vitamin-based supplements with clinically validated formulations. In 2025, the conventional segment is projected to lead the nature category with a 75% share, while the offline segment will dominate sales channels with a 68% share.

The market holds a relatively small but steadily growing percentage within its parent markets. In the global nutraceuticals market, haircare supplements contribute less than 1%, reflecting their niche positioning. Within the dietary supplements market, haircare supplements account for around 0.5% to 1%, driven by increasing demand for beauty-from-within products.

In the broader personal care and beauty market, their share remains minimal but is rising as consumers increasingly integrate ingestible beauty supplements alongside topical treatments to achieve holistic hair health and grooming goals.

Per capita spending on haircare supplements varies across regions, influenced by consumer awareness, beauty standards, disposable income, and product availability. In developed markets, higher spending is driven by strong personal care habits, the popularity of wellness products, and easy access to a wide range of supplements. In contrast, developing markets show lower spending but are witnessing rapid growth as awareness and affordability increase.

The global trade of haircare supplements is growing steadily, driven by rising consumer demand for wellness and beauty products. As consumers increasingly seek natural, functional, and convenient solutions for hair health, cross-border trade in these supplements has expanded significantly. Trade flows are supported by e-commerce platforms, global brand expansions, and the popularity of imported nutraceuticals in both developed and emerging markets.

The market segments include type, nature, form, functionality, sales channel, and region. The type segment covers biotin, vitamin A, saw palmetto extract, vitamin D, folic acid, vitamin E, collagen, omega-3 fatty acids, vitamin B complex, and vitamin C. The nature segment includes organic and conventional.

The form segment comprises tablets/pills, capsules, liquid, powder, gummies/chewable, and others such as (sprays, soft gels, effervescent tablets, and hair supplement drops). The functionality segment includes hair re-growth, hair thinning, hair fall, and dandruff.

The sales channel segment covers offline (hypermarkets/supermarkets, specialty stores, convenience stores, departmental stores, drug stores & pharmacies, health & wellness stores) and online (e-commerce, others). The regional segment includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The biotin segment is expected to continue to be the most profitable within the type category, holding a dominant market share of 28% in 2025.

The conventional segment is projected to remain the most lucrative within the nature category, accounting for a dominant market share of approximately 75% in 2025.

The gummies/chewable segment is expected to remain the most lucrative, holding a significant market share of 36% in 2025.

The hair re-growth segment is poised to remain the most lucrative, holding a considerable market share of 42% in 2025.

The offline segment is anticipated to remain the most lucrative, holding a substantial market share of 68% in 2025.

The global market is growing steadily, driven by rising consumer demand for beauty-from-within solutions, increasing prevalence of hair thinning and hair fall issues, and advancements in biotin, collagen, and multivitamin formulations targeting hair regrowth and scalp health.

Japan is projected to lead the market with the highest CAGR of 5.2% from 2025 to 2035, driven by its ageing population and demand for collagen-based beauty supplements. The USA follows with a 4.5% CAGR, supported by premium spending on biotin and collagen products.

Germany is expected to grow at a 4.2% CAGR, driven by collagen supplement adoption and gummies’ popularity. France is projected to expand at 4.0% CAGR, supported by rising beauty consciousness and organic supplement demand. The UK shows stable growth at 3.9% CAGR, driven by clean beauty trends and vegan formulations gaining traction.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA haircare supplement market is anticipated to grow at a CAGR of 4.5% from 2025 to 2035.

Sales of haircare supplements in the UK are projected to grow at a CAGR of 3.9% from 2025 to 2035.

Germany’s haircare supplement revenue is expected to grow at a CAGR of 4.2% from 2025 to 2035.

The haircare supplement revenue in France is expected to grow at a CAGR of 4.0% from 2025 to 2035.

Japan’s haircare supplement revenue is projected to grow at a CAGR of 5.2% from 2025 to 2035.

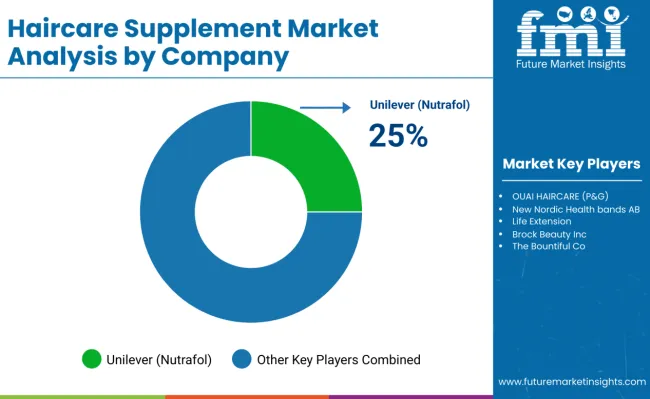

The market is moderately fragmented, with key global players and emerging brands competing through innovation, strategic partnerships, and targeted pricing strategies. Leading companies include OUAI HAIRCARE (P&G), New Nordic Health bands AB, and Nutraceutical Wellness Inc. (Unilever), which hold substantial market shares due to their strong brand recognition, extensive distribution networks, and investment in clinically backed formulations.

For example, OUAI HAIRCARE focuses on premium hair health supplements targeting millennial consumers, while Nutraceutical Wellness Inc., under Unilever, is expanding its product lines to include personalised hair and beauty supplements.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 2.1 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Type | Biotin, Vitamin A, Saw Palmetto Extract, Vitamin D, Folic Acid, Vitamin E, Collagen, Omega-3 Fatty Acids, Vitamin B Complex, Vitamin C |

| By Nature | Organic, Conventional |

| By Form | Tablets/Pills, Capsules, Liquid, Powder, Gummies/Chewable, Others (Sprays, Soft Gels, Effervescent Tablets, and Hair Supplement Drops) |

| By Functionality | Hair Re-growth, Hair Thinning, Hair Fall, Dandruff |

| By Sales Channel | Offline (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Departmental Stores, Drug Stores & Pharmacies, Health & Wellness Stores), Online (E-commerce, Brand Websites, D2C Platforms) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | OUAI HAIRCARE (P&G), New Nordic Health bands AB, Nutraceutical Wellness Inc. (Unilever), Life Extension, Brock Beauty Inc., The Bountiful Co., Source Naturals, Inc., Viva Naturals, Nutra Champs, GNC Holdings, Inc. (Harbin Pharmaceutical Group) |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is valued at USD 1.3 billion in 2025.

The market is projected to reach USD 2.1 billion by 2035.

The market is projected to grow at a CAGR of 4.6% during 2025 to 2035.

Gummies/chewables lead with a 36% market share in 2025.

Offline sales channels hold the largest share with 68% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Andro Supplements Market

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA