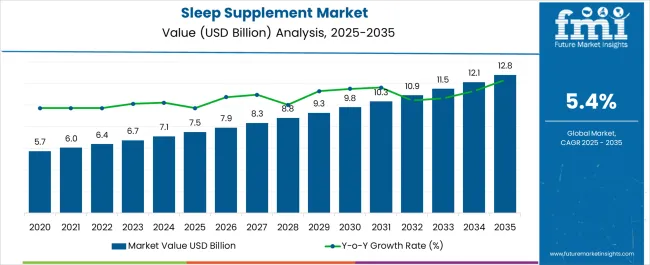

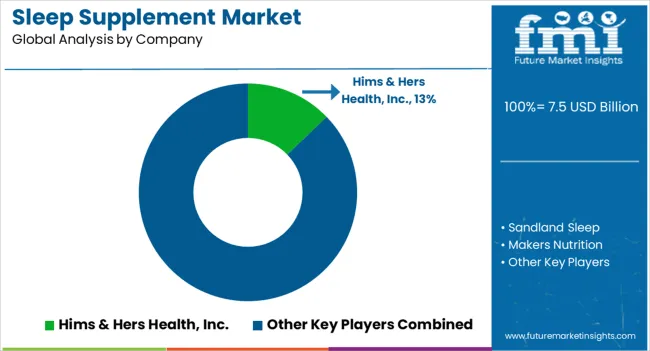

The Sleep Supplement Market is estimated to be valued at USD 7.5 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Sleep Supplement Market Estimated Value in (2025 E) | USD 7.5 billion |

| Sleep Supplement Market Forecast Value in (2035 F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The sleep supplement market is expanding steadily, supported by rising prevalence of sleep disorders, heightened stress levels, and increasing consumer awareness of natural wellness solutions. Market growth is driven by lifestyle changes, urbanization, and growing demand for over-the-counter products that aid relaxation and improve sleep quality.

Consumers are shifting preference toward supplements backed by clinical validation and natural sourcing, aligning with broader health and wellness trends. Regulatory acceptance of certain sleep-promoting ingredients has further legitimized the market, encouraging innovation and broader adoption.

The current scenario highlights strong demand across both developed and emerging economies, with e-commerce platforms expanding product accessibility. Looking forward, continued investments in research, combined with personalized supplement formulations and clean-label positioning, are expected to reinforce market expansion and sustain strong consumer engagement.

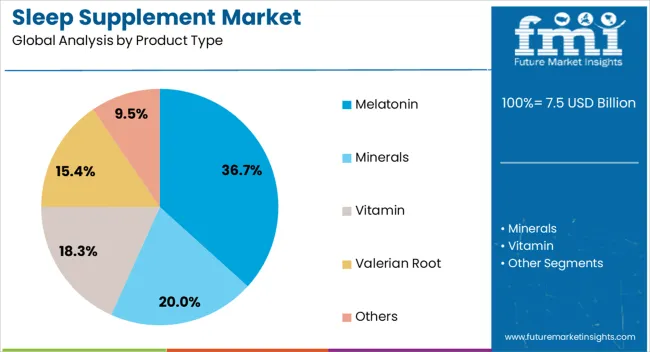

The melatonin segment accounts for approximately 36.7% share in the product type category of the sleep supplement market. Its leadership is supported by strong clinical evidence of effectiveness in regulating circadian rhythm and sleep-wake cycles.

Melatonin supplements have become widely accepted as safe and effective, with rising consumer adoption for jet lag management and insomnia relief. Market penetration has been reinforced by broad availability in diverse dosage formats and affordability compared to prescription sleep aids.

Increasing consumer reliance on non-habit-forming solutions has further strengthened melatonin’s appeal. With continuous product innovation, including sustained-release and combined formulations, this segment is expected to retain a dominant role in shaping market dynamics.

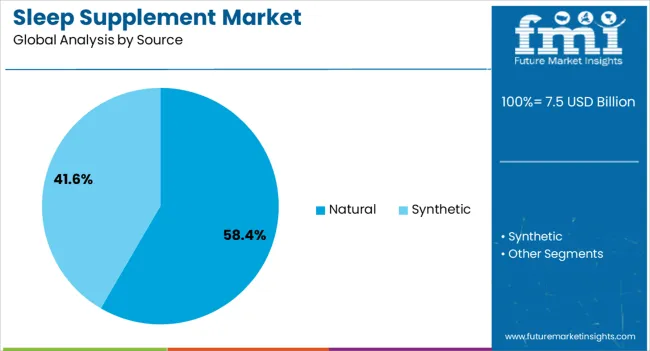

The natural segment dominates the source category with approximately 58.4% share, reflecting consumer preference for herbal and plant-based formulations over synthetic alternatives. Growth in this segment is supported by rising awareness of clean-label products and perceived safety advantages of natural ingredients.

Natural sleep supplements featuring valerian root, chamomile, or passionflower are being widely integrated into dietary routines. The segment benefits from regulatory flexibility in many regions, which has encouraged broader product launches and consumer adoption.

Supported by increasing demand for holistic health solutions and integration into wellness-based lifestyles, the natural segment is expected to remain the leading source in the forecast period.

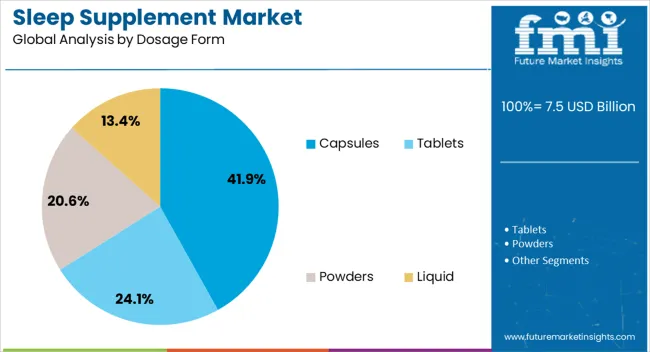

The capsules segment leads the dosage form category, holding approximately 41.9% share of the market. Its prominence is due to ease of consumption, precise dosing, and longer shelf life compared to liquid or gummy alternatives.

Capsules also offer compatibility with a wide range of natural and synthetic ingredients, enabling diverse formulations. Consumer familiarity and convenience in daily supplementation routines have further reinforced demand for this format.

Manufacturers have expanded product portfolios with vegetarian and soft-gel variants, enhancing appeal across demographic segments. With rising preference for portable and consistent dosage formats, the capsules segment is projected to retain its leadership in the market landscape.

The market for sleep supplements expanded at a CAGR of 5.6% during the forecast period. The demand for sleep supplements increased due to the growing concern for health care.

| Historical Market Valuation, 2025 | USD 7.1 billion |

|---|---|

| HCAGR, 2020 to 2025 | 5.6% |

Epidemiologists acknowledge that obtaining enough sleep is important, but many people find it difficult to fall into deep sleep. Numerous physical and psychological factors, such as stress, sadness, and poor lifestyle choices cause insomnia. The underlying medical illnesses and obesity result in sleep apnea or other sleep disorders, contributing to the market’s growth. Sleep deprivation has been linked to an increased risk of obesity, diabetes, high blood pressure, heart disease, stroke, and depression. However, sleeping aid manufacturers focus on all-natural remedies to explore lucrative opportunities in the sleep supplement market.

The growing need for convenience and compliance is a result of consumers’ growing knowledge of the importance of getting a great sleep. The expanding elderly population and the ease of access to a wide array of products are important drivers of market growth.

The market is set to have an attractive growth outlook over the forecast period. Natural sleep aids like melatonin offer fewer negative side effects than many pharmaceutical medicines commonly given for insomnia such as barbiturates, which can lead to regular usage or addiction.

Natural sleep aids are administered to those with mild or recurrent insomnia because they have no negative side effects. However, it is imperative to continue researching the workings, effectiveness, and side effects of several natural sleep aids.

These above-mentioned factors are expected to boost the market for sleep supplements in the future due to the increased demand for natural sleep aids and supplements to treat sleep disorders.

A lack of knowledge of sleep supplement consumption is expected to have side effects impairing sleep quality. Consuming alcohol along with sleep supplements is making sleeping medications more sedating. The combination has the potential to be quite devastating.

Additionally, the consumption of melatonin for good sleep can cause adverse effects. According to a study, consuming an excess of melatonin might cause an upset stomach making it even harder to fall asleep. Extremely high melatonin levels, however, can be overridden by the body, which will interpret them as an error.

Cumulatively, these factors propose a negative effect on the developmental growth of the sleep supplement market.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5% |

| India | 3.8% |

| China | 5.1% |

| Germany | 5.8% |

| United Kingdom | 4.5% |

The United States holds a share of 86.3% of the North American Market. The increase in sleep disorder cases among people in the United States is expected to drive the market over the coming years.

Although sleeping should be restful, 35% of Americans find it difficult to get seven or more hours of sleep every night. The lack of sleep has surged the demand for sleep supplements.

India dominates the South Asia region with a total market share of about 44.6% and is expected to grow at a CAGR of 3.8% through 2035.

A lack of sleep can have several negative health effects, including weight gain, diabetes, heart disease, stroke, and memory loss. Workplace productivity may also be impacted. The wellness market in India has grown as lifestyles become busier and more stressful. Additionally, there is an increasing concern to improve an individual’s quality of sleep.

China holds a share of 27.7% of the East Asia market. The country is projected to grow at a CAGR of 5.1% through 2035.

Researchers estimate that around 300 million Chinese people have sleep issues. Young people are especially susceptible to these problems. Nearly half of the people between the ages of 19 and 25 don't go to bed until after midnight.

Germany holds a share of 23.5% of the European market with a market valuation of USD 455.3 billion. The market is expected to record a CAGR of 5.8% over the forecast period.

| Top Product Type | Melatonin |

|---|---|

| Market Share in 2025 | 35.8% |

The melatonin segment is expected to hold a market share of about 35.8% in 2025.

Melatonin is a hormone that occurs naturally and is essential for the human body's sleep-wake cycle. Essentially, the "N1 Phase" or "light sleep" controls your body's rhythm based on the light surrounding, signaling to the body that darkness is a trigger for night-time behavior.

Therefore, melatonin pills are stated to be an excellent choice for people who have trouble falling asleep or trouble staying asleep.

| Top Dosage Form | Tablets |

|---|---|

| Market Share in 2025 | 41.8% |

The tablets segment accounted for a market share of 41.8% in 2025. As tablet offers a very efficient delivery method, they are highly preferred form of medication for the majority of pharmaceuticals and nutraceuticals. Several meticulously conducted clinical trials over many years have established the dependability and effectiveness of tablets as the dosage form.

| Top Distribution Channel | Retail Pharmacies |

|---|---|

| Market Share in 2025 | 46.5% |

Retail pharmacies are leading the market by distribution channel, holding a share of 46.5% in 2025. Since these sleep supplements are also available on an OTC basis for health benefits, this segment generates significant revenue among the other distribution channels. The segment is set to grow at a CAGR of 5.4% over the forecast period.

In the highly fragmented sleep supplement market, companies are adopting various strategic methods to meet consumer demand, gain a competitive edge, and expand their customer base.

Key developmental strategies employed by industry players include spending on research and development activities to produce supplements from natural sources with reduced or negligible side effects.

Recent Developments in the Sleep Supplement Market

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC, and South Africa |

| Key Market Segments Covered | Product Type, Source, Dosage form, Indication, Distribution Channel, and Region |

| Key Companies Profiled | Hims & Hers Health, Inc.; Sandland Sleep; Makers Nutrition; OLLY; Galventa; Amorpacific; Wilson Lau; Som Sleep; Fuel 4 Ever; Nature Made; Kao; Spectrum Lifesciences Pvt Ltd.; Wholesome MedTech Pvt Ltd.; NUTRASCIENCE LABS; SMPNutra |

| Pricing | Available upon Request |

The global sleep supplement market is estimated to be valued at USD 7.5 billion in 2025.

The market size for the sleep supplement market is projected to reach USD 12.8 billion by 2035.

The sleep supplement market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in sleep supplement market are melatonin, minerals, vitamin, valerian root and others.

In terms of source, natural segment to command 58.4% share in the sleep supplement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Melatonin Sleep Supplements Market Growth – Trends & Forecast 2025 to 2035

Sleeping Bag Market Forecast and Outlook 2025 to 2035

Sleep Study Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sleep Movement Disorders Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Sleep Study Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Sleep Apnea Diagnostic Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sleep Apnea Implants Market Analysis – Size, Share & Forecast 2025-2035

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Sleep Apnea Devices Market Overview - Trends & Growth Forecast 2025 to 2035

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Key Players & Market Share in the Sleep Apnea Implants Industry

Key Players & Market Share in the Sleeping Bag Industry

Sleep Aid Devices Market Growth – Industry Insights & Forecast 2022-2032

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Short sleep syndrome Treatment Market Growth & Demand 2025 to 2035

China Sleep Apnea Diagnostic Systems Market Outlook – Size, Share & Growth 2025-2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA