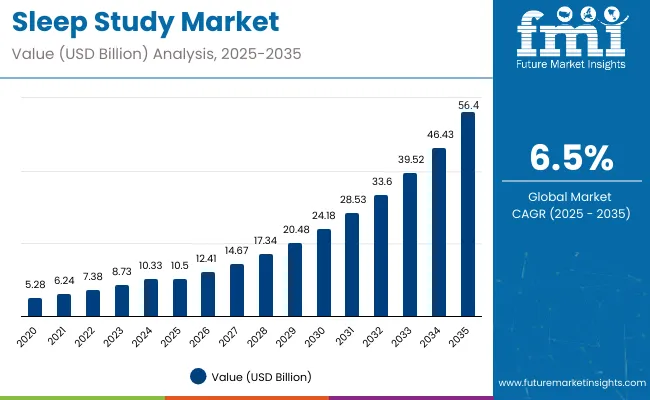

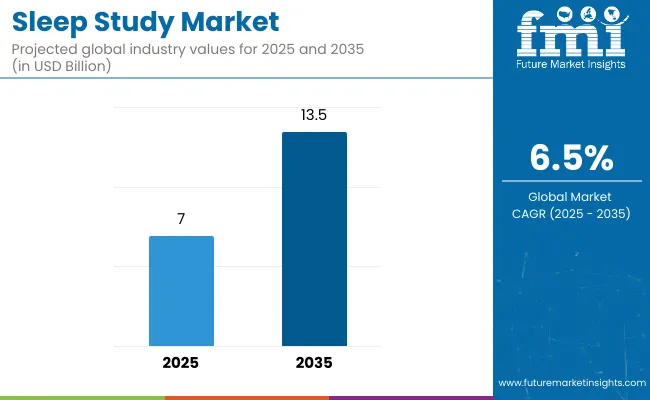

The sleep study market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 13.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 6.5 billion during this period. This reflects a 1.9 times growth at a CAGR of 6.5%. The market evolution will be shaped by increasing prevalence of sleep disorders, rising awareness of sleep health, and technological advancements in diagnostic tools, including polysomnography, wearable devices, and home-based monitoring systems.

By 2030, the market is likely to reach USD 9.6 billion, adding USD 2.6 billion in incremental value during the first half of the decade. The remaining USD 3.9 billion is expected during the second half, supported by expansion in North America, Europe, and Asia-Pacific, alongside growing adoption of hospital and clinic-based sleep diagnostics.

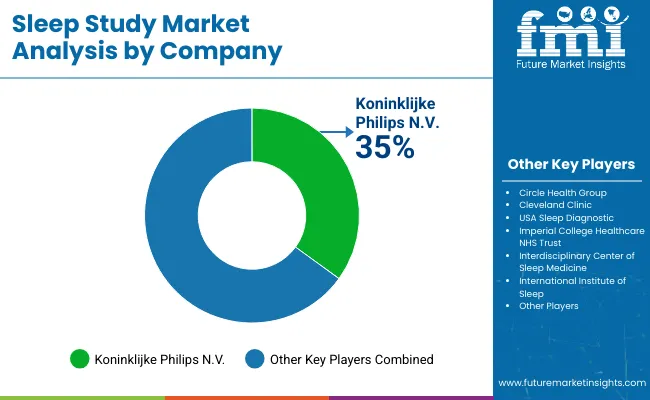

Companies such as Circle Health Group, Cleveland Clinic, Imperial College Healthcare NHS Trust, Interdisciplinary Center of Sleep Medicine, Koninklijke Philips N.V., Korea University Medicine, London Sleep Centre, MedStar Health, and Millennium Sleep Lab are strengthening their positions through technological innovation, strategic partnerships, and expansion of clinical networks. Key focus areas include development of integrated diagnostic platforms, telemedicine-enabled sleep monitoring, and patient-centric care solutions.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 7 billion |

| Projected Value (2035F) | USD 13.5 billion |

| CAGR (2025 to 2035) | 6.5% |

The market holds a significant position across its parent industries, reflecting increasing adoption in healthcare, hospital diagnostics, sleep clinics, and home-based monitoring solutions. Within the healthcare market, sleep studies contribute 6 to 7% share, driven by rising prevalence of sleep disorders and growing awareness of sleep health. In the hospital diagnostics and clinical services market, its share is around 10%, supported by integration with patient care workflows and diagnostic protocols. Within specialized sleep clinics, sleep studies account for roughly 15%, reflecting their role in personalized sleep assessment and management. In the broader home healthcare and remote monitoring segment, sleep studies contribute nearly 12%, highlighting their importance in enabling continuous patient monitoring, early diagnosis, and improved management of chronic sleep disorders.

The market is being driven by increasing prevalence of sleep disorders, technological advancements in diagnostic tools, and growing adoption of in-lab and home-based monitoring solutions. Innovations include wearable sleep tracking devices, polysomnography systems, telemedicine-enabled monitoring platforms, and AI-assisted diagnostic tools. Developments focus on improved accuracy, patient comfort, real-time data analysis, and integration with digital health platforms, particularly in North America, Europe, and Asia-Pacific. Trends indicate a shift toward personalized sleep care, remote patient monitoring, and preventive sleep management solutions, while challenges remain in cost optimization, insurance coverage, and accessibility in emerging markets.

The unique ability of sleep studies to diagnose, monitor, and manage sleep disorders is driving adoption across global healthcare, hospital diagnostics, and home-based care sectors. Their functional benefits, including accurate assessment, personalized analysis, real-time monitoring, and integration with treatment plans, make them indispensable in hospitals, sleep clinics, specialized diagnostic centers, and remote care programs, where patient outcomes, comfort, and long-term sleep health are critical.

Rising prevalence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome is further propelling market growth, supported by technological advancements such as polysomnography systems, wearable sleep trackers, telemedicine-enabled platforms, and AI-assisted diagnostic tools. Innovations in sensors, software analytics, and connected monitoring technologies are enhancing diagnostic accuracy, patient convenience, and continuous monitoring, making sleep study solutions more efficient, reliable, and accessible.

Government initiatives promoting awareness of sleep health, expansion of hospital and clinic infrastructure, and increasing insurance coverage for sleep diagnostics are strengthening the market outlook. As healthcare providers increasingly prioritize preventive care, patient-centric monitoring, and chronic disease management, the sleep study market continues to gain traction. With companies focusing on technological innovation, strategic partnerships, and regional expansion, the market is set to witness steady growth across hospitals, clinics, and home-based diagnostic settings.

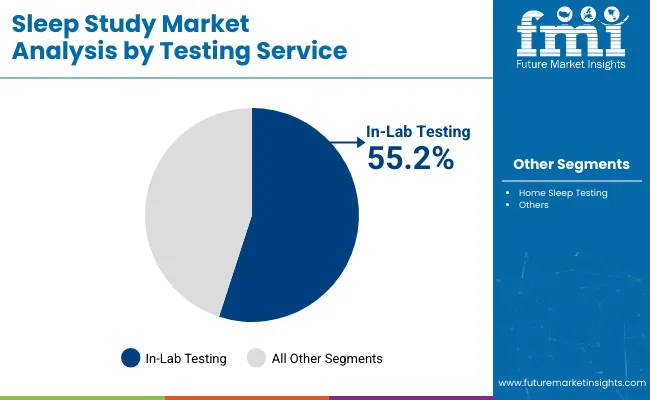

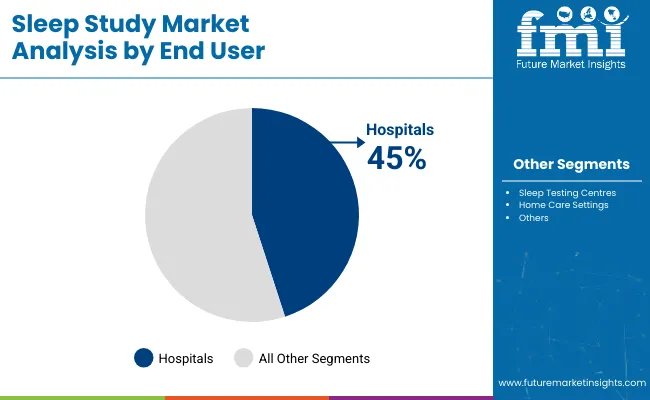

The market is segmented by testing service, indication, end-user, and region. By testing service, the market is categorized into home sleep testing and in-lab testing, which includes polysomnography (PSG) testing, CPAP/BiPAP titration, split night PSG, multiple sleep latency test (MSLT), maintenance of wakefulness test (MWT), and epilepsy monitoring. By indication, the market is divided into obstructive sleep apnea, insomnia, restless leg syndrome, circadian rhythm sleep disorders, narcolepsy, REM sleep disorders, periodic limb movement disorders, and bruxism. By end-user, the market is classified into hospital settings, sleep testing centers, and home care settings. Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The in-lab testing segment dominates the testing service category with 55.2% market share in 2025, driven by the accuracy, reliability, and comprehensive diagnostic capabilities of polysomnography and other clinical tests. Hospitals and specialized sleep clinics widely adopt in-lab testing to monitor complex sleep disorders, guide treatment plans, and evaluate therapy efficacy.

Healthcare providers favor in-lab testing due to its ability to deliver detailed, real-time patient data, integration with clinical workflows, and support for personalized care. Technological advancements in PSG systems, CPAP/BiPAP titration, AI-assisted analysis, and connected monitoring devices are enhancing diagnostic accuracy, patient comfort, and operational efficiency.

With increasing prevalence of sleep disorders and growing hospital and clinic infrastructure worldwide, the in-lab testing segment is expected to remain the backbone of sleep diagnostics. Investments in advanced testing platforms, clinical staff training, and hospital partnerships are driving revenue growth, positioning this segment as the primary contributor to the market.

The hospital segment holds a dominant position with 45% market share in 2025, driven by integration of sleep diagnostic services within inpatient and outpatient care, respiratory therapy, and chronic disease management programs. Hospitals prioritize sleep studies to manage high patient volumes, ensure accurate diagnosis, and develop treatment plans for complex sleep disorders.

Sleep testing centers and home care settings also contribute to market growth but at a smaller scale. Providers are increasingly adopting advanced diagnostic tools, remote monitoring, and telemedicine-enabled platforms to improve patient outcomes and operational efficiency.

Ongoing investments in hospital-based sleep programs, technological upgrades, and specialized staff training are strengthening adoption. Combined with rising awareness of sleep health and increasing prevalence of disorders such as sleep apnea and insomnia, hospitals are expected to remain the dominant end-user segment throughout the forecast period.

In 2025, the global sleep study market is projected at USD 7.0 billion, with North America and Europe together accounting for more than 60% of total market share. Applications include hospitals, sleep testing centers, and home care settings. Vendors are investing in polysomnography systems, wearable sleep trackers, telemedicine-enabled monitoring platforms, and AI-assisted diagnostic tools to enhance diagnosis, patient monitoring, and treatment outcomes. Accuracy, convenience, and operational efficiency continue to support market penetration. Sleep study solutions are increasingly adopted in hospital-based diagnostic programs, specialized sleep clinics, and home care monitoring, further driving market growth.

Rising Prevalence of Sleep Disorders Drives Sleep Study Adoption

The healthcare and diagnostic industries are the largest adopters of sleep study solutions, leveraging their ability to accurately diagnose, monitor, and manage a wide range of sleep disorders. With increasing prevalence of conditions such as obstructive sleep apnea, insomnia, restless leg syndrome, and circadian rhythm disorders, hospitals, specialized sleep clinics, and home-based care providers are witnessing expanded demand. Sleep studies are estimated to account for a significant share of diagnostic and patient monitoring services globally, close to 10-12% within hospital diagnostics and home healthcare segments. The ability of these solutions to improve patient outcomes, enable personalized treatment plans, and support continuous monitoring continues to anchor their adoption. Rising awareness of sleep health, technological advancements in polysomnography systems, wearable sleep trackers, and telemedicine-enabled platforms further strengthen growth prospects.

High Costs and Accessibility Challenges Restrain Market Expansion

Market growth faces constraints due to high device and service costs, limited access in emerging regions, and the need for trained specialists to conduct and interpret sleep studies. Technological complexity, regulatory compliance, and operational requirements can delay adoption in smaller clinics or low-resource healthcare facilities. Price sensitivity, reimbursement limitations, and patient reluctance for in-lab testing also restrict uptake. These restraints are pushing manufacturers and service providers to focus on cost-effective solutions, home-based testing options, modular platforms, and regional partnerships, while ensuring accuracy, patient comfort, and reliable monitoring.

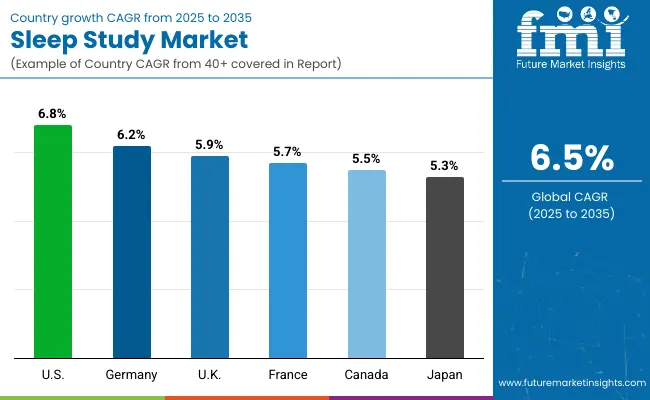

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| Germany | 6.2% |

| UK | 5.9% |

| France | 5.7% |

| Canada | 5.5% |

| Japan | 5.3% |

The sleep study market shows varied growth trajectories across the top six countries. The USA leads with the highest projected CAGR of 6.8% from 2025 to 2035, supported by advanced healthcare infrastructure, high prevalence of sleep disorders, and expanding hospital- and clinic-based sleep diagnostic programs. Germany follows at 6.2%, driven by modernization of sleep care workflows, government-backed awareness campaigns, and growing adoption of home- and hospital-based sleep monitoring technologies.

The UK maintains steady growth at 5.9%, fueled by hospital and sleep clinic adoption of in-lab testing, wearable sleep trackers, and innovations in remote monitoring. France records 5.7% CAGR, benefiting from investments in hospital-based sleep programs and integration of sleep diagnostics into routine healthcare. Canada grows at 5.5%, supported by favorable healthcare policies, rising awareness of sleep health, and increasing adoption of telemedicine-enabled sleep diagnostics. Japan exhibits moderate growth at 5.3%, driven by increasing prevalence of obstructive sleep apnea and insomnia and adoption of AI-assisted and digitally connected monitoring devices.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

The sleep study market in the USA is projected to expand at a CAGR of 6.8% from 2025 to 2035, driven by high adoption of advanced diagnostic tools, hospital- and clinic-based sleep programs, and technological innovations in wearable sleep trackers, polysomnography systems, and AI-assisted monitoring platforms. Healthcare providers increasingly prefer in-lab and home-based testing to enhance diagnostic accuracy, optimize treatment, and improve patient sleep outcomes. Manufacturers are investing in telemedicine solutions, connected monitoring devices, and predictive analytics to meet growing demand.

Key Statistics:

Revenue from sleep study services in Germany is projected to grow at a CAGR of 6.2% from 2025 to 2035, supported by modernization of hospital and clinic workflows, government-backed awareness initiatives, and increasing adoption of home-based sleep monitoring. Hospitals and clinics focus on obstructive sleep apnea, insomnia, and complex sleep disorder diagnostics using in-lab and wearable technologies. Manufacturers emphasize telemedicine-enabled platforms and AI-assisted analytics to improve performance, accuracy, and patient compliance.

Key Statistics:

Sales for sleep study services in the UK are projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by hospitals’ focus on accurate diagnosis, treatment planning, and adoption of advanced in-lab and home-based testing. Integration with hospital workflows and clinical staff training enhances patient outcomes. Increasing awareness about sleep health and government initiatives for preventive care are also contributing to market growth. Technological innovations such as AI-assisted monitoring, wearable devices, and telemedicine platforms are further strengthening adoption across hospitals and clinics.

Key Statistics:

Demand for sleep study services in France is expected to grow at a CAGR of 5.7%, fueled by expansion of hospital-based diagnostic programs, rising patient awareness, and adoption of advanced monitoring solutions. Hospitals prioritize functional sleep diagnostics and long-term treatment monitoring. Increasing collaboration between technology providers and hospitals is driving innovation in connected sleep monitoring and telehealth solutions. Enhanced insurance coverage and government funding support accessibility to advanced sleep care.

Key Statistics:

Revenue from sleep study services in Canada is projected to grow at a CAGR of 5.5%, supported by government healthcare initiatives, rising hospital adoption, and demand for technologically advanced sleep monitoring devices. Hospitals and sleep clinics are the largest consumers. Growing investments in R&D, along with increased patient education on sleep health, are driving market penetration. Expansion of specialized clinics and training programs further accelerates adoption.

Key Statistics:

The sleep study market in Japan is expected to expand at a CAGR of 5.3% from 2025 to 2035, driven by an aging population, hospital-based diagnostic programs, and adoption of AI-enabled and digitally connected sleep monitoring devices. Hospitals prioritize integration with clinical workflows and long-term patient monitoring. Increasing government initiatives for elderly care and preventive health are encouraging wider adoption. Collaborations between tech companies and hospitals are facilitating development of smart sleep diagnostics and telemedicine solutions.

Key Statistics:

The market is moderately consolidated, comprising a mix of multinational medical device manufacturers, specialized sleep diagnostic solution providers, and regional hospital and clinic service providers. Key players include Circle Health Group, Cleveland Clinic, Imperial College Healthcare NHS Trust, Interdisciplinary Center of Sleep Medicine, Koninklijke Philips N.V., Korea University Medicine, London Sleep Centre, MedStar Health, and Millennium Sleep Lab. These companies leverage advanced diagnostic technologies, wearable and in-lab monitoring systems, and AI-assisted platforms to improve patient outcomes, treatment planning, and long-term sleep health.

The market is characterized by dominant adoption of in-lab testing, accounting for 55.2% of the testing service segment share in 2025, while hospitals remain the leading end users with a 45% share. Hospitals, sleep testing centers, and home care providers increasingly rely on high-precision, AI-enabled, and digitally connected sleep diagnostic solutions for workflow optimization, patient monitoring, and chronic sleep disorder management. Companies focus on innovations such as telemedicine-enabled platforms, wearable sleep trackers, polysomnography systems, and AI-assisted analytics to meet evolving patient needs and clinical requirements.

Strategic initiatives such as mergers and acquisitions, partnerships, regional expansions, and R&D in AI, connected monitoring, and wearable technologies are common among market players seeking to strengthen their presence. Vendors emphasize accuracy, patient comfort, interoperability with clinical workflows, and high-performance diagnostic solutions. In summary, the sleep study market is evolving with established and emerging companies striving to enhance diagnostic accuracy, ensure patient satisfaction, and expand their global footprint, shaping the competitive landscape and market growth trajectory.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.0 billion |

| Testing Service | Home Sleep Testing, In-Lab Testing (Polysomnography (PSG) Testing, CPAP/ BiPAP Titration, Split Night Polysomnography, Multiple Sleep Latency Test (MSLT), Maintenance of Wakefulness Test (MWT), and Epilepsy Monitoring |

| Indication | Obstructive Sleep Apnoea, Insomnia, Restless Leg Syndrome, Circadian Rhythm Sleep Disorders, Narcolepsy, Rapid Eye Movement (REM) Sleep Disorders, Periodic Limb Movement Disorders, and Bruxism |

| End-user | Hospital Settings, Sleep Testing Centres, and Home Care Settings |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Circle Health Group, Cleveland Clinic, Imperial College Healthcare NHS Trust, Interdisciplinary Center of Sleep Medicine, Koninklijke Philips N.V., Korea University Medicine, London Sleep Centre, MedStar Health, and Millennium Sleep Lab |

| Additional Attributes | Dollar sales by testing service, indication, and end-user, regional demand trends, competitive landscape, adoption trends in hospitals vs. sleep testing centers and home care, innovations in wearable devices, AI-assisted monitoring, and telemedicine-enabled platforms, scalability and deployment considerations |

The global sleep study market is estimated to be valued at USD 7.0 billion in 2025.

The market size for sleep study is projected to reach USD 13.5 billion by 2035.

The sleep study market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The in-lab testing segment is projected to lead in the sleep study market with 55.2% market share in 2025.

In terms of end user, hospital settings segment is projected to command 45% share in the sleep study market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sleep Study Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sleeping Bag Market Forecast and Outlook 2025 to 2035

Sleep Movement Disorders Market Size and Share Forecast Outlook 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Sleep Apnea Diagnostic Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sleep Apnea Implants Market Analysis – Size, Share & Forecast 2025-2035

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Sleep Apnea Devices Market Overview - Trends & Growth Forecast 2025 to 2035

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Key Players & Market Share in the Sleep Apnea Implants Industry

Key Players & Market Share in the Sleeping Bag Industry

Sleep Aid Devices Market Growth – Industry Insights & Forecast 2022-2032

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Short sleep syndrome Treatment Market Growth & Demand 2025 to 2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

China Sleep Apnea Diagnostic Systems Market Outlook – Size, Share & Growth 2025-2035

France Sleep Apnea Diagnostic Systems Market Insights – Size, Share & Demand 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA