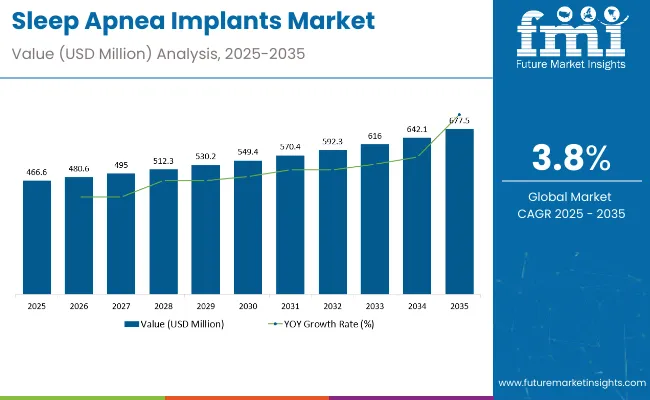

The sleep apnea implants market generated USD 451.6 million in 2024 and is expected to generate USD 466.6 million in 2025. The market is expected to reach USD 677.5 million by 2035, with a growth of 3.8% CAGR during the forecast period.

The market size of this growth is tremendous as cases of Obstructive sleep apnea increase, as well as the consciousness surrounding the issue of sleep disorders and the progressions of implantable neurostimulation technologies. In the past, CPAP therapy had always remained the standard treatment of choice for managing the disease, whereas treatment saw that numerous people were complaining that the treatment method was not comfortable, and due to that fact, patients tend to have low adherence rates.

Hence, implantable options like hypoglossal nerve stimulators, phrenic nerve stimulators, and palatal implants have become significantly popular as promising, long-term solutions. Increased geriatric populations, coupled with lifestyle factors of obesity and stress-related disorders, have further augmented the incidence of sleep apnea, thus building up a massive demand for new, minimally invasive treatment alternatives.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 451.6 million |

| Estimated Size, 2025 | USD 466.6 million |

| Projected Size, 2035 | USD 677.5 million |

| CAGR (2025 to 2035) | 3.8% |

As per the research done in the medical sector, almost 936 million people in the world suffer from sleep apnea. In that vast number, the undiagnosed or untreated portion forms a considerable market opportunity. Further, growing awareness about sleep disorders as major health issues has motivated government bodies, healthcare professionals, and insurance firms to seek easier treatment accessibility.

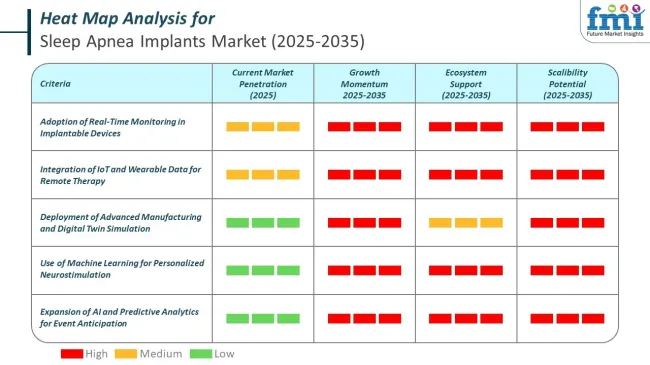

The industry is transforming due to technological advancements in neurostimulation devices, AI-assisted therapy customization, and miniaturized implantable devices. Companies are developing next-generation implants with wireless connectivity, personalized therapy settings, and real-time patient monitoring to ensure optimal treatment outcomes.

Mass scale expansion has been supported by new device approvals in which regulatory bodies such as FDA and EMA have been actively engaged. Clearly, increasing investments in clinical trials, research collaborations, and strategic partnerships between MedTech firms and healthcare providers have added further momentum to the innovation process in the area.

In addition, increasing remote patient monitoring and telemedicine utilization allow patients to undergo improved follow-up care after surgery, which provides physicians with an opportunity to optimize implant settings related to the individual needs of patients. Key factors deterring market growth include high prices of sleep apnea implants, limited reimbursement policies, and fewer insurance coverages.

On-going efforts in insurance coverage and reduced procedural costs should drive the penetration of this market. Going forward, the market will likely grow rapidly because of an increased patient preference for implantable treatment, clinical indication expansion, and the inclusion of AI-driven diagnostics and therapeutic device interventions.

Sleep apnea implants market is becoming central to respiratory care frameworks in the US and EU. With the condition often underdiagnosed, the National Council on Aging estimates that 39 million people have sleep apnea in the U.S. alone. Device-based interventions are preferred in moderate-to-severe cases where CPAP adherence is poor. In 2025, clinical uptake of sleep apnea implants is being influenced by new implantable neurostimulation systems that allow AI-powered feedback loops to auto-adjust stimulation based on sensor inputs during sleep cycles.

Sleep apnea implants industry now benefits from precision engineering through Industry 4.0 tools like 3D printing, digital twins, and embedded quality control. These technologies enable manufacturers to produce miniaturized, high-tolerance components suited for craniofacial and neural pathways, which boosts product demand and sales.

Machine learning applications in the sleep apnea implants market are moving beyond basic automation. Companies are embedding intelligent models into both implant devices and external monitoring tools to deliver patient-specific, self-calibrating therapy. These models process real-time data on respiratory effort, airflow, and muscle tone to anticipate apnea events and adjust stimulation preemptively.

The following table represents the compound annual growth rate of the global sleep apnea implants market for H1 2024 and H1 2025. That would be because of the major industry trends and shifts in revenue. H1 comprises January to June, while H2 comprises July to December within the same periods. Expansion in the business space should be seen in the former half, that is, decade 2024 to 2034, at 3.9% CAGR, and at somewhat lower growth in the later half of the same decade. Its rate of growth through this decade is 4.3%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.9% |

| H2 (2024 to 2034) | 4.3% |

| H1 (2025 to 2035) | 3.8% |

| H2 (2025 to 2035) | 4.4% |

For the next quarter, from H1 2025 to H2 2035, there is a slowdown in CAGR at 3.8 % in the H1 and staying relatively lower for the H2 at 4.4 % In H1, the industry saw a cut of 10 BPS whilst in H2, the industry saw a fall of 9 BPS.

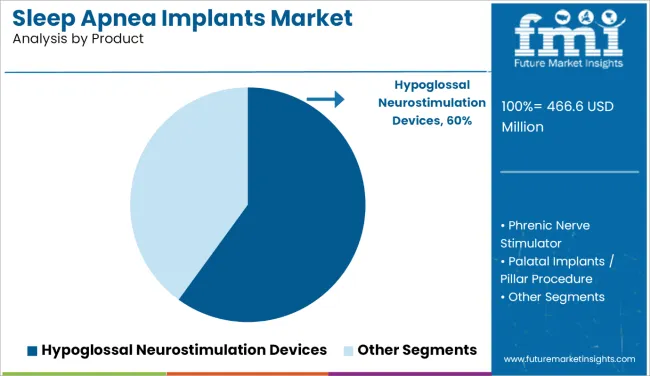

The sleep apnea implants market is segmented by product type, indication, end user, and region. By product type, the key segments include phrenic nerve stimulator, hypoglossal neurostimulation devices, bone screw implant system, and palatal implants / pillar procedure, which encompass innovative implantable technologies designed to restore upper airway patency or stimulate respiratory functions.

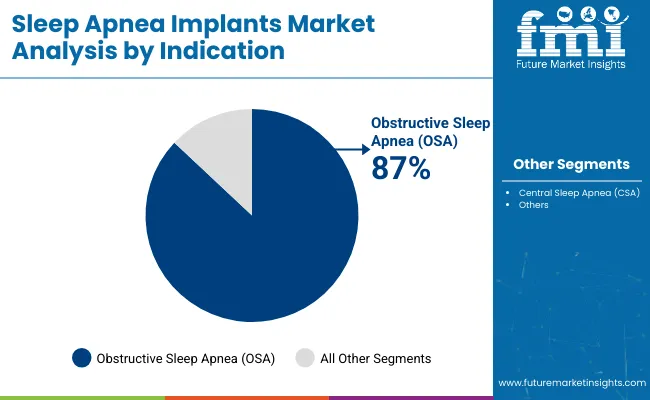

By indication, the market is divided into central sleep apnea and obstructive sleep apnea (OSA) the two primary conditions driving implant adoption based on different physiological etiologies. In terms of end user, segments include ambulatory surgical centers, office based clinics, and hospitals, reflecting diverse procedural settings from specialized outpatient clinics to advanced hospital-based interventions.

Regionally, the market is categorized into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa, representing global growth patterns influenced by healthcare access, reimbursement policies, and technology adoption.

The sleep apnea implants market is projected to expand at a CAGR of 5.4%, with the hypoglossal neurostimulation devices segment emerging as the most lucrative. This dominance is attributed to its growing adoption for treating obstructive sleep apnea (OSA), which constitutes the majority of sleep apnea diagnoses globally. The higher patient compliance, minimally invasive nature, and superior clinical efficacy in repositioning the tongue base to maintain airway patency make this segment commercially attractive.

Other segments such as the Phrenic Nerve Stimulator, which primarily targets Central Sleep Apnea, are gaining traction but address a smaller patient pool. The Bone Screw Implant System and Palatal Implants / Pillar Procedure segments offer lower complexity solutions but face limitations in applicability to moderate-to-severe OSA cases and demonstrate slower uptake due to evolving clinical consensus. As reimbursement pathways for hypoglossal stimulation improve and long-term clinical outcomes gain favor, this segment is likely to lead in revenue generation and innovation focus through 2035.

| Product Segment | CAGR (2025 to 2035) |

|---|---|

| Hypoglossal Neurostimulation Devices | 5.4% |

The obstructive sleep apnea (OSA) segment is expected to be the most lucrative indication driving the sleep apnea implants market, expanding at a CAGR of 4.2%. OSA accounts for over 85% of all sleep apnea diagnoses, and its strong correlation with rising obesity, aging populations, and increasing diagnostic rates in both developed and emerging economies supports sustained demand for implant-based therapies.

This growth is propelled by the effectiveness of implants such as hypoglossal nerve stimulators, which are specifically designed for moderate to severe OSA cases. In contrast, the central sleep apnea (CSA) segment, while showing clinical need, represents a narrower patient subset typically associated with neurological or cardiac comorbidities and is projected to grow at a slower pace due to limited implant eligibility. However, phrenic nerve stimulators continue to show promise in specialized cardiac centers and select patient populations.

| Indication Segment | CAGR (2025 to 2035) |

|---|---|

| Obstructive Sleep Apnea (OSA) | 4.2% |

Hospitals are expected to be the most lucrative end user segment in the sleep apnea implants market, strongly outperforming others in both volume and revenue contribution, with expected CAGR of 4.5%. This segment is capturing nearly 58% of the total market share during the forecast window.

The dominance of hospitals stems from their integrated infrastructure, higher throughput of surgical cases, access to advanced imaging and monitoring equipment, and availability of trained ENT and neurology specialists.

These attributes position hospitals as the primary centers for implantable procedures like hypoglossal neurostimulation and phrenic nerve stimulation, which require surgical precision, post-op monitoring, and patient follow-up. Meanwhile, Ambulatory Surgical Centers (ASCs) are witnessing moderate growth due to their cost-efficiency and faster patient turnover, especially in developed markets. Office Based Clinics, though gaining interest for less invasive procedures, currently lack the surgical capabilities required for most implant-based interventions, leading to lower market penetration.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Hospitals | 4.5% |

The global prevalence of sleep apnea has continually increased, though a large population remains undiagnosed. According to previous studies, the prevalence of sleep apnea occurs in about 25% men and 10% women and is expected to increase with escalating obesity rates of OSA. Poor diet habits, sedentary lifestyle, and stress disorders contribute to severe sleep disturbances.

Besides this, an increase in knowledge regarding more dangerous health threats of sleep apnea such as hypertension, heart diseases, diabetes, and declining cognitive status increased patients', care providers', and even payers' attention and quest for finding effective solutions in its treatments.

The public health campaigns, advocacy groups for the patients, and research institutes in the medical sector have played a crucial role in emphasizing early diagnosis and advanced forms of treatment solutions. As awareness levels increase, demand for implantable sleep apnea treatments grows exponentially, pressurizing manufacturers to accelerate innovation and expand accessibility.

Technological advancements in neurostimulation and implantable medical devices have fueled the growth of the sleep apnea implants market. Traditional CPAP therapy, though effective, had poor patient compliance due to the unsightly mask, hoses, and noise, which directed researchers toward developing next-generation, minimally invasive implantable devices offering a more natural and comfortable treatment experience. The hypoglossal nerve stimulators with AI-driven stimulation algorithms, adaptive therapy settings, and wireless connectivity have significantly improved patient outcomes.

The phrenic nerve stimulators for CSA and palatal implants for mild OSA cases have also expanded the scope of the market. The use of miniature implants, recharging battery systems, and monitoring capabilities via patient remote management helps improve post-treatment patient handling and enhances therapy adherence.

Because medical technology evolves, the key focus by such companies lies on the introduction of machine learning combined with real-time data analytics directly into the devices, where patient-specific treatment depends on an individual's unique necessities. The trend is therefore forecasted to facilitate the increasing implementation of sleep apnea implants on patients, henceforth in such patients who used to not take well traditional remedies.

The most promising opportunities in the sleep apnea implants market would be seen as acceptance of implantable neurostimulation technology rises, investment in AI-driven management of sleep disorders increases, and demand for alternative treatments to CPAP therapy like hypoglossal neurostimulation implants and phrenic nerve stimulators. With increasing patients' preference toward minimally invasive, long-term solutions, this opens a scope for manufacturers as well as health care providers to capitalize on consumer awareness that is on the rise, reimbursement policies that are developing, and new technologies.

The last few years have witnessed the rise of artificial intelligence and big data analytics in changing the face of sleep disorder diagnosis and treatment. Today, through wearable sleep monitoring devices, AI-assisted diagnosis platforms, and smart neurostimulation therapy, health care providers can give treatment tailored to the individual needs of each patient as reflected in real-time patient data.

Companies that are investing in AI-driven adaptive therapy settings, in areas of predictive analytics, and remote patient monitoring will have an edge over others in the market. Even further, through the integration of wireless connectivity, cloud-based patient management, and the enhancements in post-operative care and treatment compliance, sleep apnea implants will become more appealing to both the patient and the physician.

One of the main reasons sleep apnea implants are not fully embraced is because they are costly and not widely covered by health insurance plans. The cost of putting in a sleep apnea implantable device is on average between USD 20,000 and USD 40,000, an amount that excludes many from access in low and middle-income economies. Unlike CPAP machines, which are relatively inexpensive and often covered by insurance, surgical implants require pre-approval, strict eligibility criteria, and long reimbursement approval processes.

Most insurance firms consider hypoglossal nerve stimulation and similar implants as not necessary, so there is only limited coverage for the procedure. In countries like Germany and Denmark with universal coverage, lack of uniform reimbursement rules resulted in variability in access.

Companies are, however, trying to collaborate with health insurers, government agencies, and reimbursement organizations to increase access and bring inexpensive payment models into place to handle the issue. Companies are also looking at affordable financing options, medical grants, and subsidy programs to facilitate higher adoption.

Tier 1 companies are the industry leaders with 92.6% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries. The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Inspire Medical Systems, Respicardia, Inc. and Medtronic Plc

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 21.9% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Pillar Palatal LLC / The Snoring Center, Siesta Medical, Inc. and LivaNova/ImThera.

Compared to Tiers 1 and 2, Tier 3 companies offer outsourced testing services, but with smaller revenue and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

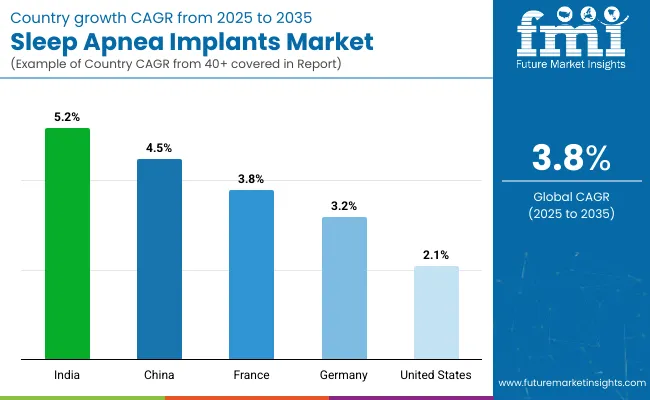

The market analysis for sleep apnea implants in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 98.4%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.1% |

| Germany | 3.2% |

| France | 3.8% |

| China | 4.5% |

| India | 5.2% |

Advanced healthcare infrastructure, established medical research institutions, and government-backed insurance programs make Germany an important player in the Sleep Apnea Implants Market. This country has the highest diagnosis rates for sleep disorders in Europe because of widespread awareness campaigns and proactive screening initiatives. The universal healthcare system in Germany makes sure that the patients are entitled to high technology treatments such as sleep apnea implants and with reimbursement policies making these solutions cheaper.

Since there are high-end medical device manufacturers, research institutions, and facilities, with the continuous improvement of this implantable neurostimulation technology, the treatment of sleep apnea is also expected to rise with age in Germany because the old population has a higher vulnerability to OSA.

Collaboration between universities and biotech firms is currently creating next-generation neurostimulation implants with greater efficiency and durability. Additionally, government funding for medical technology startups encourages innovation, pushing Germany to the forefront of the global market.

United States retains the top-most position in sleep apnea implants market from the rest due to its brisk adoption of breakthrough medical technologies and high diagnosis levels, along with a well-fabricated regulation framework that nurtures breakthrough therapeutics. Estimates show that close to 30 million Americans have OSA conditions, and its treatment solutions increase exponentially.

The country has experienced notable developments in hypoglossal nerve stimulation, AI-powered therapy modulation, and remote patient monitoring devices - all of which are driving growth in demand. The companies leading the charge are Inspire Medical Systems and Medtronic as they invest a lot in research and clinical trials to develop next-generation implantable devices for greater efficiency, comfort, and long-term effectiveness.

Other is the growing coverage of insurance for sleep apnea implants. As there are sound clinical evidence driving these, such treatments have reached a much broader population. Also, integrating AI-powered algorithms into sleep therapy in combination with advances in telemedicine has transformed the management of patients post-implantation for better compliance and outcomes.

India is an emerging market for sleep apnea implants due to a rising prevalence of sleep disorders, increasing urbanization, and rising obesity rates. While CPAP therapy is still the most utilized treatment, many cannot tolerate extra devices and fail to comply.

The Indian private health-care industry is witnessing a very high growth rate with large hospitals that are investing in the latest technologies in medical science, including sleep disorder management solutions. Additionally, the rapidly growing Indian medical tourism industry also throws open new doors for the company to introduce low-cost implant solutions in the Indian market.

However, affordability remains a challenge since the procedure is costly to implant and is thus not widely adopted. In response, the key players are developing domestic manufacturing sites with strategic arrangements with the health providers across India to help upgrade access and lower cost. Increased awareness through campaigns and future changes in reimbursement policies are expected to ensure that India will become a substantial contributor to the Sleep Apnea Implants Market in the near future.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Geographical expansion into the emerging markets, particularly United States and Asia Pacific countries, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

| Report Attributes | Details |

|---|---|

|

Current Total Market Size (2025) |

USD 466.6 million |

|

Projected Market Size (2035) |

USD 677.5 million |

|

CAGR (2025 to 2035) |

3.8% |

|

Base Year for Estimation |

2024 |

|

Historical Period |

2020 to 2024 |

|

Projections Period |

2025 to 2035 |

|

Report Parameter |

Revenue in USD million/Volume in Units |

|

By Product |

Phrenic Nerve Stimulator, Hypoglossal Neurostimulation Devices, Bone Screw Implant System, Palatal Implants / Pillar Procedure. |

|

By Indication |

Central Sleep Apnea, Obstructive Sleep Apnea (OSA) |

|

By End User |

Ambulatory Surgical Centers, Office Based Clinics, Hospitals |

|

Regions Covered |

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

|

Countries Covered |

United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

|

Key Players |

Inspire Medical Systems, Respicardia, Inc., Medtronic Plc, Pillar Palatal LLC / The Snoring Center, Siesta Medical, Inc., LivaNova/ImThera, Nyxoah SA, LinguaFlex LLC, Others. |

|

Additional Attributes |

Rising prevalence of obstructive sleep apnea, Advancements in implantable neurostimulation technologies, Increasing awareness of sleep disorders |

|

Customization and Pricing |

Available upon request |

In terms of product, the industry is divided into phrenic nerve stimulator, hypoglossal neurostimulation devices, bone screw implant system and palatal implants / pillar procedure.

In terms of indication, the industry is segregated into central sleep apnea and obstructive sleep apnea (OSA).

In terms of end user, the industry is divided into ambulatory surgical centers, office based clinics, hospitals.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global sleep apnea implants industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global sleep apnea implants industry stood at USD 451.6 million in 2024.

Hypoglossal neurostimulation devices register 60% share.

The global sleep apnea implants industry is anticipated to reach USD 677.5 million by 2035 end.

China is expected to show a CAGR of 4.5% in the assessment period.

The key players operating in the global sleep apnea implants industry are Inspire Medical Systems, Respicardia, Inc., Medtronic Plc, Pillar Palatal LLC / The Snoring Center, Siesta Medical, Inc., LivaNova/ImThera, Nyxoah SA, LinguaFlex LLC and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Indication, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Indication, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Europe Market Attractiveness by Indication, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Indication, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Indication, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Indication, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Indication, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Product, 2023 to 2033

Figure 158: MEA Market Attractiveness by Indication, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Sleep Apnea Implants Industry

Sleep Apnea Diagnostic Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sleep Apnea Devices Market Overview - Trends & Growth Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

China Sleep Apnea Diagnostic Systems Market Outlook – Size, Share & Growth 2025-2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

France Sleep Apnea Diagnostic Systems Market Insights – Size, Share & Demand 2025-2035

Germany Sleep Apnea Diagnostic Systems Market Trends – Growth, Innovations & Forecast 2025-2035

United States Sleep Apnea Diagnostic Systems Market Analysis – Trends & Forecast 2025-2035

Sleeping Bag Market Forecast and Outlook 2025 to 2035

Sleep Study Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sleep Movement Disorders Market Size and Share Forecast Outlook 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Sleep Study Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Key Players & Market Share in the Sleeping Bag Industry

Sleep Aid Devices Market Growth – Industry Insights & Forecast 2022-2032

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA