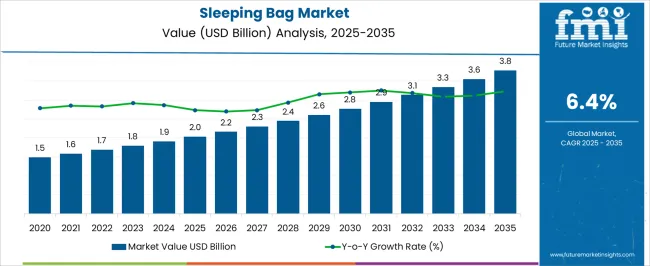

The Sleeping Bag Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The Sleeping Bag market is experiencing steady growth driven by increasing participation in outdoor recreational activities, camping, and adventure sports. The future outlook is influenced by the rising awareness of health and wellness benefits associated with outdoor activities, coupled with the growing demand for comfortable and high-performance sleep solutions. Technological advancements in insulation materials, design ergonomics, and lightweight portable solutions have enhanced user experience, boosting adoption across diverse demographics.

Investment in high-quality manufacturing, along with innovations in weather-resistant and thermally efficient sleeping bags, supports market expansion. Additionally, the growing popularity of eco-friendly and sustainable products is shaping consumer preferences, encouraging manufacturers to develop environmentally conscious offerings.

Urbanization, rising disposable incomes, and the influence of social media in promoting adventure lifestyles are further fueling demand As consumers increasingly prioritize convenience, portability, and specialized performance features, the Sleeping Bag market is poised for continued growth, with opportunities in both recreational and professional outdoor segments.

| Metric | Value |

|---|---|

| Sleeping Bag Market Estimated Value in (2025 E) | USD 2.0 billion |

| Sleeping Bag Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

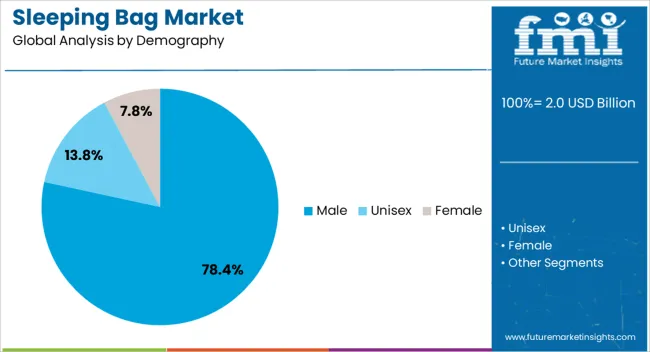

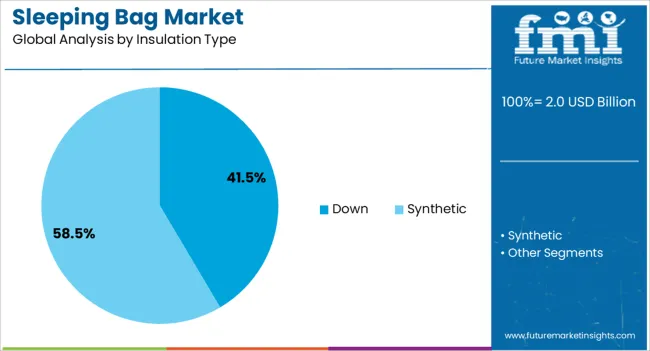

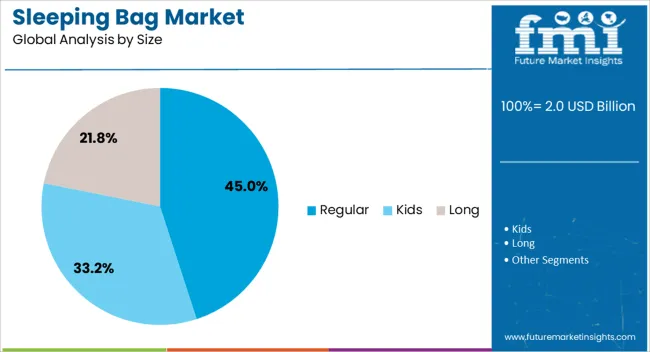

The market is segmented by Demography, Insulation Type, Size, Shape, and Sales Channel and region. By Demography, the market is divided into Male, Unisex, and Female. In terms of Insulation Type, the market is classified into Down and Synthetic. Based on Size, the market is segmented into Regular, Kids, and Long. By Shape, the market is divided into Mummy Shape and Rectangular Shape. By Sales Channel, the market is segmented into Online Sales, Multi Brand Stores, Independent Retailers, Supermarket/Hypermarket, Company Website, 3rd Party Online Sales, and Specialty Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The male demographic segment is projected to hold 78.40% of the Sleeping Bag market revenue share in 2025, establishing it as the leading demographic. This dominance is primarily driven by higher participation of males in outdoor recreational activities, adventure sports, and camping trips.

The segment has benefited from the availability of sleeping bags designed to meet male-specific ergonomic requirements, including tailored insulation, weight distribution, and comfort features. Additionally, the growing interest in solo and group camping experiences among males has reinforced the demand for durable and high-performance sleeping bags.

The expansion of adventure tourism and outdoor lifestyle trends has further supported the adoption of sleeping bags within this demographic Manufacturers are increasingly focusing on customization and technical specifications to address male consumer needs, contributing to sustained growth in this segment.

The down insulation type segment is expected to account for 41.50% of the Sleeping Bag market revenue share in 2025, positioning it as the leading insulation type. The growth of this segment is driven by superior thermal efficiency, lightweight design, and compressibility, which enhance portability and user comfort.

Down insulation offers excellent heat retention, making it highly suitable for cold-weather camping and mountaineering. The adoption of advanced down processing techniques has further improved performance while maintaining eco-friendly standards.

Consumer preference for high-performance sleeping solutions in extreme outdoor conditions continues to reinforce the prominence of this segment The reliability, durability, and comfort associated with down insulation have made it a preferred choice among both recreational and professional users, driving sustained market growth.

The regular size segment is projected to hold 45.00% of the Sleeping Bag market revenue share in 2025, establishing it as the leading size category. This preference is driven by the versatility and suitability of regular-sized sleeping bags for a wide range of users and outdoor scenarios.

The segment benefits from standardized dimensions that cater to average body sizes while providing sufficient comfort and mobility. Regular size sleeping bags are easier to manufacture, transport, and store, enhancing their accessibility and affordability.

Consumer demand for convenience, combined with adaptability to different climates and camping conditions, supports the growth of this segment The widespread availability of regular size sleeping bags across retail and e-commerce platforms further reinforces adoption, making it the dominant size category in the market.

The global demand historically developed at a CAGR of 5.60%. However, sales are slated to advance at a brighter pace, displaying a CAGR of 6.40% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Market Historical CAGR for 2020 to 2025 | 5.60% |

Start-ups are exploring new materials like aerogel insulators, which offer superior thermal conductivity, to enhance customer comfort by reducing camping bag weight and increasing warmth.

New companies aim to enhance outdoor comfort by introducing innovative camping equipment. Consumers often conduct extensive online searches before purchasing camping gear, leading to demand propagating for various shapes, insulation types, weights, and temperature ratings.

The adventure tourism industry is experiencing rapid growth due to increased demand for authentic local experiences, with collaborations with operators and online booking platforms promoting essential gear.

Educational institutions and adventure learning programs are beneficial to the demand for these bags. Camping operators can develop their market through strategic partnerships, promotional strategies, bulk purchasing options, and renting opportunities for camping enterprises and trail associations.

Widespread Demand for Outdoor Recreational Activities

Over the past decade, outdoor recreational activities like camping, hiking, trekking, and adventure sports have risen significantly. This is due to consumer shifts towards active lifestyles and nature-based experiences, leading to a growing demand for camping gear, especially sleeping bags.

To illustrate, the Outdoor Industry Association reported that in 2024, over 50 million Americans participated in camping, a rise of over 7 million from the previous year.

The trend toward outdoor recreation is envisioned to persist, leading to elevated demand for camping gear.

The eCommerce Sector Influences the Sales of Adventure Sleeping Gears

eCommerce is rapidly gaining popularity due to companies' omnichannel presence and brand websites providing convenient access to product information, user reviews, and discounted prices.

One example of the digital trading trend is the launch of rental subscription models by online retailers such as Tentrr, Decathlon, Wildcraft, etc. These models allow consumers to access sleeping bags and tents at affordable prices, making camping more accessible.

Social media marketing campaigns are gaining popularity for companies to boost brand visibility and reach customers. Market leaders can capitalize on the eCommerce boom by partnering with eRetailers and launching online stores. The eCommerce sector is promising as companies innovate and adapt to consumer needs.

Campers Favor Improvements in Temperature Monitoring

Contemporary investments in temperature regulating and heating technologies have developed electronic heating pads and liners with rechargeable batteries. These pads provide on-demand warmth inside sleeping bags without layering clothes, making it easier for people to stay warm and comfortable even in freezing temperatures.

The introduction of waterproof and stretchable quilted electric blankets for sleeping bags is gaining popularity due to their ability to provide extra warmth and comfort.

The development of temperature-monitoring mobile applications, paired with Bluetooth-connected smart sensors integrated into camping bags, has improved user experience by enabling users to adjust temperatures for a good night's sleep effortlessly.

Specialized improvements in camping gear are envisioned to increase the use of 3-season and winter camping bags for sub-zero conditions, offering a more comfortable and convenient way to stay warm and cozy outdoors.

The following part offers an in-depth analysis of segments of the market. The demand for camping bags for males is significant, whereas the need for down insulation of bags is anticipated to increase in 2025.

| Attributes | Details |

|---|---|

| Top Demography | Male |

| Market Share in 2025 | 78.4% |

The demand for sleep bags for men is set to experience a 78.4% market share in 2025 due to the augmented requirement for specialized bags.

Women's camping bags are heavier than unisex or men's bags because they need more insulation for a given length of time and tend to get cold more easily than men's.

Men's sleeping bags come in taller lengths, with the men's regular size fitting men between 6 feet and 6 feet 5 inches tall and the men's long size accommodating men between 6 feet 5 inches and 7 feet tall. Proper fitting is paramount for warmth and comfort.

| Attributes | Details |

|---|---|

| Top Insulation Type | Down |

| Market Share in 2025 | 41.5% |

The demand for down insulation of sleeping bags is significant, with a market share of 41.5% anticipated in 2025. These bags are essential outdoor gear, with down insulation being the most popular choice due to its lightweight, compressible, and excellent warmth-to-weight ratio.

Down insulation in bags provides warmth and safety, making them ideal for cold-weather camping. High-quality sleeping bags with down insulation are portable, making them easy to carry on long hikes or camping trips.

The camping bag industry is anticipated to advance as producers focus on improving these bags with high-quality insulation materials and increased research and development. As the sector advances, more research and development investments are envisioned to enhance camping bag quality.

The sleeping bag industry in the United States and India is hitting the roof due to several factors. The camping bags sector in Australia is anticipated to climb gradually in the upcoming decade.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 4.00% |

| Germany | 2.60% |

| China | 10.60% |

| India | 12.10% |

| Australia | 7.80% |

The United States camping bag industry is foreseen to grow due to the increasing number of professional rock climbers and mountaineers. The market is projected to register a 4% CAGR between 2025 and 2035, urged by an increase in outdoor activities, leading to a rise in demand for high-quality sleeping bags.

The rising import rate of camping bag raw materials is boosting sleeping bag market growth as United States manufacturers continuously seek innovative materials to improve efficiency and comfort.

The United States camping gear industry is divined to experience substantial growth due to the rise in professional rock climbers and mountaineers and the surge in recreational activities.

The market in Germany is anticipated to experience steady growth at a CAGR of 2.6% from 2025 to 2035. Germany is home to various historical locations that often attract visitors who prefer to camp.

Many of these locations have been transformed into heritage camping grounds to further promote tourism and the camping industry in recent years. This development has increased focus on innovation and advanced product improvements. These innovations are predicted to be key themes driving the growth of the camping bag sector in Germany in the forthcoming decade.

The tourism industry in Asia, particularly in China, is witnessing a surge in government support, which is anticipated to boost the need for camping bags. The forecasted CAGR of the demand in China is divined to be 10.6% from 2025 to 2035.

China's sports and fitness industry is rapidly expanding, which has led to many investments in the sector, further complementing the growth of the physical activity industry. The digital commerce sector is thriving in China, creating a favorable environment for product development.

Australia's camping and outdoor equipment industry is predicted to see significant growth between 2025 and 2035, with a projected CAGR of 7.8%. The increase can be attributed to the country's rising popularity as a destination for camping and outdoor activities.

Australia's diverse camping and safari experiences, including beachside camping, bushwalking, and hiking, have significantly increased camping equipment sales.

The growth of the adventure furnishings sector is attributed to the trend towards glamping and outdoor camping. Tourists are willing to pay a premium for a comfortable and enjoyable camping experience, leading to a surge in demand for high-quality camping gear.

The demand in India is foreseen to experience a CAGR of 12.1% from 2025 to 2035.

Indian government’s initiatives promoting adventure tourism boost employment and economic growth in the region. India's camping sector is anticipated to experience a rapid increase in intra-regional visitor arrivals in the coming years, offering numerous leisure and adventure activities for all age groups.

Economic growth, travel restrictions relaxation, increased competition, and aggressive promotion techniques by sector players and regional governments have significantly accelerated the Indian group travel business.

The industry is competitive, with many companies making similar products. These companies try to stand out by creating high-quality products, offering good prices, and developing new ideas.

Some companies try to grow their business by creating new products, getting their approval, and getting patents. Others may buy other companies, partner, or work together to grow their business.

Because people are using the internet more to buy things, it is changing how this industry works. Now, people can purchase camping furniture online and compare prices easily. This means companies have to work harder to ensure they have competitive prices and products.

Recent Developments in the Sleeping Bag Market

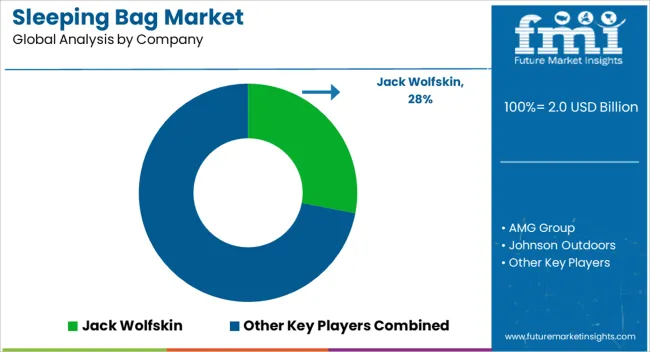

The global sleeping bag market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the sleeping bag market is projected to reach USD 3.8 billion by 2035.

The sleeping bag market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in sleeping bag market are male, unisex and female.

In terms of insulation type, down segment to command 41.5% share in the sleeping bag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in the Sleeping Bag Industry

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Competitive Landscape of Bag-in-Tube Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA