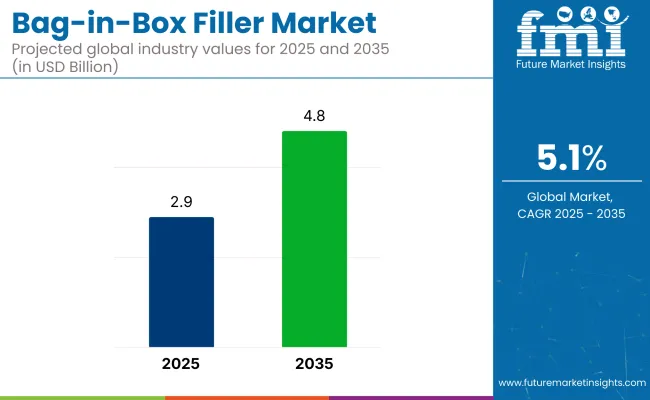

The bag-in-box filler market is projected to grow from USD 2.9 billion in 2025 to USD 4.8 billion by 2035, registering a CAGR of 5.1% during the forecast period. Sales in 2024 reached USD 2.7 billion, reflecting a steady increase in demand across various industries.

This growth has been attributed to the rising need for efficient packaging solutions in sectors such as food and beverage, chemicals, and pharmaceuticals. The increasing adoption of Bag-in-Box Fillers for their cost-effectiveness and extended shelf life has further propelled the market's expansion.

The surge in global trade and the demand for eco-friendly packaging materials have led to a higher utilization of advanced filling technologies worldwide.

In October 2024, SIG announces APR-recognized recycle-ready bag-in-box package for beverages featuring SIG Terra RecShield D laminate. APR Design® for Recyclability Recognition provides third-party validation that a package or packaging component’s design is compatible with the North American recycling system.

This process confirms the SIG Terra RecShield D bag-in-box package has met the highest criteria for recyclability according to the APR Design®. Brent Haynam, Director of Commercial Engineering and Sustainability at SIG, states: “As companies strive for net zero, recyclability is a key lever in their journeys. In North America, we’ve seen the focus here shift beyond retail and into the foodservice arena, which shows the importance of developing better packaging solutions. Not only is it important that our packaging reduces product waste, but it needs to reduce packaging waste as well. Innovating with recycle-ready solutions are foundational steps to this journey.”

Manufacturers have been focusing on developing fillers that are energy-efficient, reduce material waste, and offer enhanced product protection. Innovations include the integration of advanced materials, modular designs, and the use of natural additives to enhance performance. These advancements align with global regulatory requirements, making bag-in-box fillers an attractive option for environmentally conscious industries.

The bag-in-box filler market is poised for significant growth, driven by increasing demand in food and beverage, chemicals, and pharmaceuticals industries. Companies investing in new materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge.

As global supply chains expand and environmental regulations become more stringent, the adoption of bag-in-box fillers is anticipated to rise, offering cost-effective and eco-friendly solutions for packaging. Furthermore, the integration of smart technologies and automation in filling applications is expected to enhance operational efficiency and meet the evolving needs of various industries

The market is segmented based on automation, filling technology, end use, and region. By automation, the market is divided into automatic and semi-automatic systems. In terms of filling technology, the market includes vacuum filling, gravity filling, piston filling, flow meter filling, and peristaltic pump filling. By end use, the market is categorized into food and beverages, pharmaceutical & medical, homecare & personal care, and others. Regionally, the market is analyzed across North America, Latin America, Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

Automatic bag-in-box fillers with 78.2% share are projected to expand at a CAGR of 6.2% from 2025 to 2035, as manufacturers have increasingly adopted fully automated systems to meet the demands of hygienic filling, reduced labor costs, and high-volume processing. These systems have been integrated with inline sterilization, flow control sensors, and CIP/SIP cleaning mechanisms to deliver consistent product quality and regulatory compliance in food-grade and industrial environments.

Touchless operation, programmable logic controls (PLCs), and modular design architectures have enabled automatic fillers to support flexible production runs while minimizing changeover times. These machines have been applied across dairy, juice, wine, liquid detergents, and oils packaging operations, offering high-speed throughput with precise volume accuracy and reduced product wastage.

Automatic lines have also facilitated real-time data monitoring, quality assurance, and maintenance automation, making them suitable for large-scale manufacturers seeking performance traceability and operational visibility. As demand continues to rise for safe, efficient, and scalable liquid packaging solutions, the adoption of automatic bag-in-box fillers is expected to remain dominant across multiple industries.

The food and beverages industry with 83.9% share is expected to grow at a CAGR of 6.7% from 2025 to 2035, as bag-in-box fillers have been increasingly deployed to package liquid foods, sauces, syrups, dairy products, wine, juice, and edible oils. Their utility in aseptic and extended shelf-life packaging has enabled food producers to reduce spoilage, simplify distribution, and cater to institutional buyers and foodservice operations.

Bag-in-box systems have been used to prevent contamination and oxidation through hermetically sealed liners and controlled dispense valves, preserving product freshness even after partial use. Flexible filler configurations have supported variable pack sizes and materials, aligning with diverse end-user requirements.

In beverage plants, automated filling lines have been integrated with cold chain systems to ensure product safety and quality. Reduced transportation costs, extended storage capabilities, and environmental advantages over rigid containers have made bag-in-box packaging the preferred option for both high-acid and low-acid food products. As the demand for economical, space-saving, and hygienic liquid packaging formats increases across food and beverage markets, the dominance of this end-use segment is expected to be sustained by advancements in filler technology and packaging innovation.

High Initial Investment and Maintenance Costs

High expenditure involved in buying and maintaining such automated filling devices pose challenge for the growth of Bag-in-Box Filler Market. Joining thanks to this growing sector but small and medium sized manufacturers spend most of their funds on advanced filling systems so they often have a challenge to compete with their large-scale producers.

Moreover, ongoing maintenance requirements-such as regular servicing, parts replacement, software upgrades, and adherence to rigorous regulatory standards-further inflate operations costs. To overcome this, manufacturers can take initiatives such as moving towards leasing models, modular machine design, energy-efficient technology, predictive maintenance solutions, and cost-effective servicing plans to bring down the overall price tag, making machinery affordable and appealing to a wider range of businesses all over the world.

Stringent Food Safety and Packaging Regulations

Bag-in-Box Filler manufacturers across the globe face a challenge of ensuring compliance to the dynamic food safety and packaging regulations. Given strict requirements from governments and regulatory agencies on hygiene, material, and quality controls, which are designed to prevent contaminated products from entering the marketplace and provide guarantees of consumer safety. Guidelines are frequently changed, and manufacturers are encouraged to invest in new technologies, which entails extensive testing, follow up monitoring, and documentation processes. Not complying may result in recalls, legal actions, damaged reputations, and increased financial liabilities.

As regulatory expectations change, companies must prepare to comply by implementing systems that monitor in real-time, use certified food-grade materials, improved sanitation techniques or automated cleaning and sterilization capabilities.

Growing Demand for Sustainable and Eco-Friendly Packaging

With echoing public awareness about sustainability, packaging solutions are in high demand across sectors. Compared to rigid containers, which dominate the beverage, dairy and liquid food sectors, bag-in-box packaging offers a more sustainable alternative. Films that can break down naturally, recyclable products, light packaging, water-based inks and carbon-neutral production processes give companies a key competitive advantage over competitors in the industry. This will mean another opportunity to gain brand credibility and therefore long-term market growth.

Expansion of Bag-in-Box Applications across Industries

The Bag-in-Box format is extending its reach beyond beverages and liquid food products into non-traditional sectors including household chemicals, lubricants, pharmaceuticals, personal care products, and industrial fluids. Bag-in-Box solutions are gaining industry adoption to deliver extended shelf life packaging with more efficient storage layout to save cost and while preventing contamination.

This transition opens doors for the filler manufacturers to tailor specialized designs that incorporate unique options such as precise dosing, aseptic filling, multilayer barrier films, intelligent packaging integration, etc. The demand for versatile packaging options worldwide will probably be met by manufacturers who invest in research and development, cutting-edge dispensing technology, digital automation, and solutions that cater to a variety of applications.

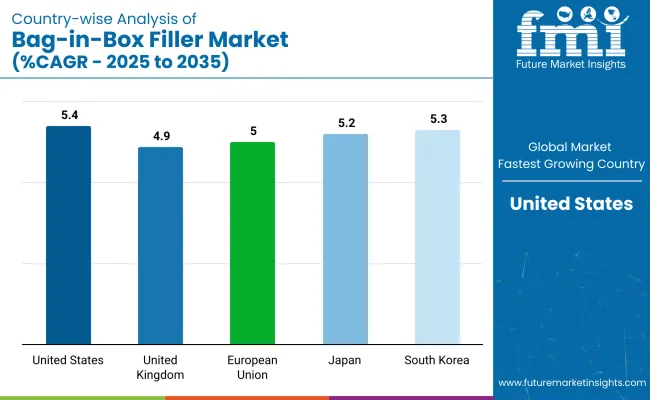

The United States bags the Bag-in-Box Filler market owing to a robust food and beverage industry, rising demand for efficient liquid packing, and expanding preference for sustainable substitutes. Market growth is driven by the present of major manufactures and advancement in filling systems technology.

Additionally, growing demand for high-speed filling machines, automation in packaging, and sustainable solutions, propels the growth of the market. Furthermore, the integration of smart fillers with real-time monitoring and precision filling mechanisms are escalating operational efficiency across beverage, dairy, and liquid food industries. This is further expected to boost the product adoption in USA market.

The market transformation is being aided by growing investments to enhance biodegradable bag-in-box solutions and innovation in flexible packaging. The increased range of luxury drinks packaging, particularly in the wine and dairy sectors, is also driving demand for high-quality bag-in-box fillers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

Bag-in-box filling equipment is popular in the UK due to factors, such as growing demand for sustainable packaging, premium beverage products, and convenient bulk liquid distribution. Demand is also boosted by the growth of e-commerce and direct-to-consumer sales.”

Also, government regulations encouraging the usage of recyclable materials, along with increasing demand for prolonged shelf life packaging, boost the market growth. In addition, the penetration of automated filling systems that are capable of filling with greater precision with diminished wastage, is gaining popularity.

And opportunities have opened up for companies in nitrogen dosing technology to extend the freshness of products and sustain quality in wine, juices, and dairy applications.

As efficient transportation further drives demand for compact and lightweight packaging, innovation across UK’s Bag-in-Box Filler market is being catalyzed. Furthermore, growing adoption of home delivery packaging solutions and ready-to-drink beverages is more positively influencing companies to manufacture versatile and cost-effective filler machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

Europe holds a significant market share in BIB fillers, with Germany, France, and Italy accounting for the largest market within the region due to a well-established wine industry, increasing demand for liquid packaging, and stringent environmental regulations. In addition, investments by the European Union to reduce single-use plastics and support biodegradable and recyclable packaging solutions, promote the market growth. Also, the use of high-speed and aseptic filling machines is growing productivity and lowering spoilage.

Demand for innovative bag-in-box solutions is being spurred further by the growth in bulk liquid packaging for dairy, edible oils, and liquid concentrates. Over the years, increased adoption of advanced bag-in-box fillers in EU is majorly attributed to the expansion of automation in production lines and increased filling accuracy. In addition, the expansion of the pharmaceutical industry, which needs sterile and contamination-free liquid packages, is creating new opportunities for manufacturers in the European market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Gaps in the Japan Bag-in-Box Filler market are being priced with the significance towards effective packaging as well as longer term, space-saving and regenerate both vessels and storage in Japan which in turn increases its preference amongst the consumers. Market growth is also supported by the increasing demand for high-precision filling machines with low risk of contamination. With a continued impetus on technological solutions in the nation, smart sensors integrated solutions to dispense liquid precisely is driving the innovation.

Additionally, stringent government regulations regarding packaging waste and food safety is a significant factor propelling high-efficiency, sterile bag-in-box fillers development among the companies. Increasing adoption is also being fueled by the expanding consumption of premium beverages, sake and ready-to-drink teas. Moreover, automated packaging solutions for bulk liquid handling are gaining traction in the food service and pharmaceutical industries in Japan. Greater automation and robotics in the packaging sector are also driving the creation of more advanced filler machines with enhanced precision and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The bag-in-box fillers market in South Korea is currently gaining pace, owing to its strong manufacturing sector, increasing liquid food exports, and investments in sustainable packaging. Governing authorities along with sustainable packaging initiatives and increasing recyclables adoption are driving the market growth. Further driving competitiveness is the country’s emphasis on improving efficiency via high-speed filling systems, precision metering, and reduced waste.

However, increasing demand for bag-in-box solutions from personal care, cleaning products, and food service culture are also contributing toward the market adoption. Organizations are also making on investment on smart automation and IoT-empowered filling gear as one of the best arrangements are to improve operational abilities and supply equilibrium product consistency. Moreover, the demand for high-efficiency bag-in-box filler technologies is being leveraged by some of the manufacturers, owing to the high preference for premium cosmetics and skincare brands requiring liquid packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The Bag-in-Box Filler market is driven by the increasing consumer inclination towards cost-effective and sustainable packaging solutions for liquid products. Through automation, advanced aseptic filling technology and different materials designed to make composites reusable recyclable and biodegradable, these businesses are working to boost both efficiency and the shelf life of their products. Invisible trend: fully automated filling systems, flexible packaging company, and smart dispensing mechanisms for the food, beverage, and chemicals industry.

The overall market size for Bag-in-Box Filler market was USD 2.9 Billion in 2025.

The Bag-in-Box Filler market expected to reach USD 4.8 Billion in 2035.

Growing usage in beverage and liquid food industries are projected to drive the demand for bag-in-box filler market, along with a rise in adoption of sustainable and efficient packaging solutions and improvement in aseptic filling technology as well as demand for a more extended shelf-life packaging with regards to food and pharmaceutical.

The top 5 countries which drives the development of Bag-in-Box Filler market are USA, UK, Europe Union, Japan and South Korea.

Automatic and semi-automatic fillers growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filler and Extender Cosmetics Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cup Filler Market

Sack Fillers Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Auger Filler Market Growth - Trends & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Paper Filler Market Trends & Industry Growth Forecast 2024-2034

Dermal Fillers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dermal Fillers and Botulinum Toxin Market Outlook - Size, Trends & Forecast 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Sachet Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Competitive Overview of Dermal Fillers Market Share

Welding Filler Metal Market Size and Share Forecast Outlook 2025 to 2035

Plastic Fillers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Aseptic Fillers Market Growth - Trends & Forecast 2025 to 2035

Inorganic filler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA