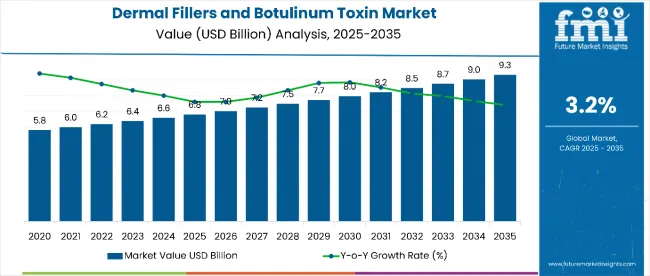

The global dermal fillers and botulinum toxin market is worth USD 6.8 billion in 2025 and is poised to reach USD 9.3 billion by 2035, expanding at a CAGR of 3.2%. This growth is primarily driven by the increasing demand for non-invasive cosmetic procedures, which provide effective solutions for facial rejuvenation with minimal downtime.

The popularity of botulinum toxin treatments and dermal fillers is rising among both younger and aging populations. Consumers are opting for these treatments due to their affordability compared to surgical alternatives and the quicker recovery times they offer, making them more accessible for a wider range of individuals.

Looking ahead, the market for dermal fillers and botulinum toxin is likely to continue expanding, fueled by technological advancements in product formulations and techniques. As new products become safer and more effective, the demand for these minimally invasive procedures will increase, with patients seeking non-surgical options for facial rejuvenation.

Additionally, the growing acceptance of aesthetic treatments in emerging markets, coupled with higher disposable incomes, will contribute significantly to market growth. Social media influence and celebrity endorsements are also playing a role in shaping consumer behavior, further boosting the popularity of these procedures across a variety of demographics.

Government regulations play a key role in ensuring the safety and efficacy of dermal fillers and botulinum toxin products. Regulatory agencies like the USA Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce strict guidelines for these injectables, covering aspects such as formulation, product safety, and practitioner qualifications.

These regulations are essential for maintaining high standards of safety and product quality. As the market for non-invasive cosmetic treatments grows, it is likely that these regulations will continue to evolve, ensuring that new products meet the required safety standards and protecting consumers from potential risks associated with substandard treatments.

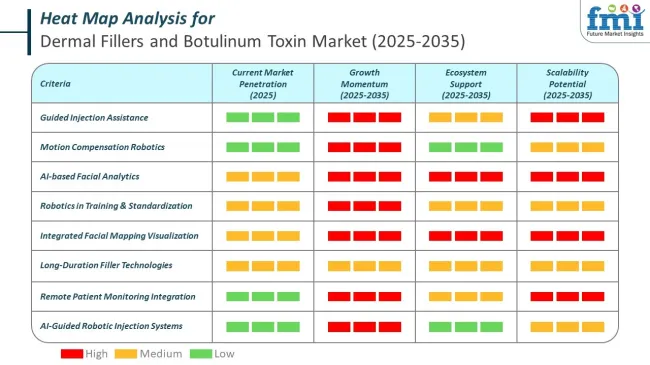

Robotics is gradually emerging as a precision-enhancing tool in the dermal fillers and botulinum toxin market, particularly in clinical training environments and high-volume aesthetic centers. While the field is still in its early deployment stage, robotic systems are being explored for their ability to assist practitioners in delivering consistent and accurate injections.

Market leaders in the dermal fillers and botulinum toxin market are responding to evolving treatment expectations by building clinical data, modernizing delivery formats, and embedding AI across product and service platforms.

Across several semi-annual periods between 2025 and 2035, the above table presents the expected CAGR for the dermal fillers and botulinum toxin market. A growth rate of 3.8% is predicted in the first half (H1) of the decade from 2024 to 2034, followed by a 3.5% rate in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.8% |

| H2 (2024 to 2034) | 3.5% |

| H1 (2025 to 2035) | 3.3% |

| H2 (2025 to 2035) | 3.1% |

By 2025, the CAGR is projected to increase to 3.3% in the first half and then remain low at 3.1% in the second half.

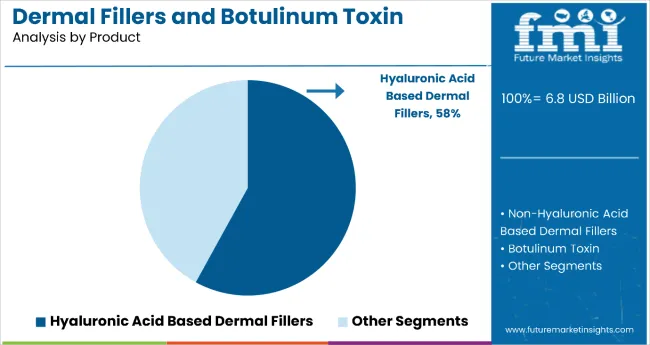

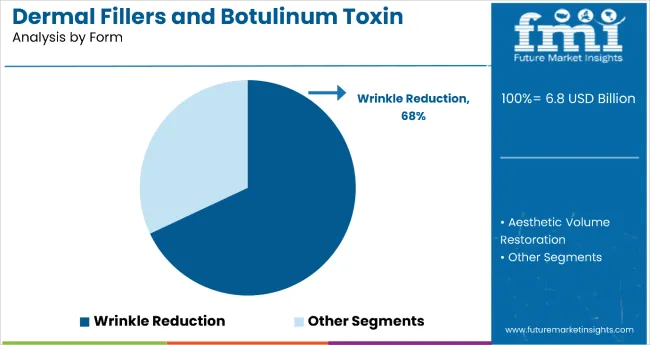

The market is segmented based on product, application, and region. By product, the market is divided into hyaluronic acid based dermal fillers, non-hyaluronic acid based dermal fillers, and botulinum toxin. In terms of application, it is segmented into aesthetic volume restoration and wrinkle reduction. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Hyaluronic acid (HA)-based dermal fillers are highly popular due to their natural composition, safety profile, and effectiveness in a wide range of cosmetic applications. As a substance naturally found in the human body, particularly in the skin and connective tissues, HA is well-tolerated and poses a low risk of allergic reactions, making it a preferred choice for both patients and practitioners.

These fillers are commonly used to reduce the appearance of fine lines and wrinkles, enhance facial volume in areas like the cheeks and lips, and improve skin hydration and texture. Their ability to attract and retain moisture provides a plumping effect that results in a youthful and natural look, which appeals to individuals seeking subtle, non-surgical rejuvenation.

Dermal fillers and botulinum toxin procedures are popular for wrinkle reduction because they offer quick, non-surgical solutions with noticeable and natural-looking results. Botulinum toxin, commonly known by brand names like Botox, works by temporarily relaxing the facial muscles that cause dynamic wrinkles, such as frown lines, crow’s feet, and forehead lines. It is especially effective for expression-related wrinkles and provides a smoother, more youthful appearance with minimal downtime.

On the other hand, dermal fillers are used to restore lost volume and fill in static wrinkles, such as nasolabial folds or marionette lines. They help contour the face, plump areas like cheeks and lips, and improve skin elasticity. Both treatments are minimally invasive, well-tolerated, and can be performed in outpatient settings with rapid recovery.

The rising emphasis on self care activities has a substantial impact on the rapidly expanding industry for dermal fillers and botulinum toxin. In the fast paced world of today, people are increasingly valuing self care as a way to preserve their physical, mental, and emotional health.

As part of this all encompassing approach to self care, many people are resorting to cosmetic procedures like dermal fillers and botulinum toxin injections to improve their looks and self esteem.

People who include dermal fillers and botulinum toxin treatments into their self care regimens are investing in themselves and their long term wellbeing, propelling the dermal fillers and botulinum toxin industry forward and altering beauty standards in the process.

Increasing demand from the cosmetic industry is a key driver of the industry for dermal fillers and botulinum toxin treatments. With changing beauty standards and a growing emphasis on aesthetic upgrades, cosmetic corporations are expanding their investments in research, development, and marketing of products and treatments that meet this demand.

The influences of social media, celebrity endorsements, and the mainstream of cosmetic treatments have all increased demand in the cosmetic sector. As a result, the industry for dermal fillers and botulinum toxin continues to expand rapidly, according to customers changing requirements and tastes throughout the world.

The use of Artificial Intelligence (AI) is transforming the industry for dermal fillers and botulinum toxin treatments, increasing efficiency, accuracy, and patient happiness. AI powered technologies are used at many phases of the cosmetic enhancement process, including initial consultations, treatment planning, and post procedure follow up.

AI powered technologies let healthcare providers give injections with high accuracy, reducing the risk of complications and increasing treatment efficacy. Real time monitoring and feedback systems enabled by AI allow practitioners to make educated decisions throughout operations while assuring safety and efficacy.

Botox and dermal fillers can cause swelling, redness, and bruising as permanent or temporary side effects. The complications associated with these treatments can discourage some individuals from seeking them.

These treatments are often expensive, posing a significant barrier to many people. A further obstacle to accessibility is the limited or non-availability of insurance coverage for such procedures.

The lack of standardization in the manufacturing process and variations in quality between products can lead to inconsistent results. Treatments of this kind are subject to a complex regulatory environment, as different laws and guidelines apply in different regions. Due to these challenges, manufacturers and practitioners may be unable to grow the market.

The popularity of social media can lead to unrealistic expectations and a focus on short-term solutions rather than long-term, sustainable solutions.

Some individuals may be discouraged from seeking these treatments as a result of a negative perception of them. In addition, dermal fillers and botulinum toxin are likely to be challenged by non-invasive treatments, such as surgical procedures.

The Tier 1 industry players consists of market leaders with a significant 39% market share. A significant investment in research and development and extensive product ranges will enable the players to maintain their dominance.

With a strong international presence and a strong reputation for manufacturing quality products and introducing innovative solutions, the business is poised for significant growth in the years ahead.

As market leaders with a diversified geographic reach and extensive manufacturing experience, they serve a broad range of consumers. Tier 1 companies include Allergan plc, Galderma SA, and Merz Pharma GmbH & Co. KGaA.

In Tier 2, mid-size companies with market shares of 26.5% are present in specific regions and have a strong influence on local markets. Innovation and strategic partnerships will allow Tier 2 players to challenge Tier 1 players.

Budgets that are limited in comparison with tier 1 and revenue streams that are moderate will contribute to global expansion. Prominent companies in tier 2 include Anika Therapeutics, Inc., TEOXANE Laboratories, and Medy-Tox Inc.

The Tier 3 companies are primarily small-scale and serve niche markets locally. Due to their significant focus on meeting the needs of local markets, these companies are classified as tier 3 companies.

Niche players will be able to consolidate their market positions drastically by lowering their revenue and limiting their investments. Prominent companies in tier 3 include Daewoong Pharmaceuticals, Suneva Medical, Inc., HUGEL, Inc., Speciality European Pharma, Grex Pharma SaS.

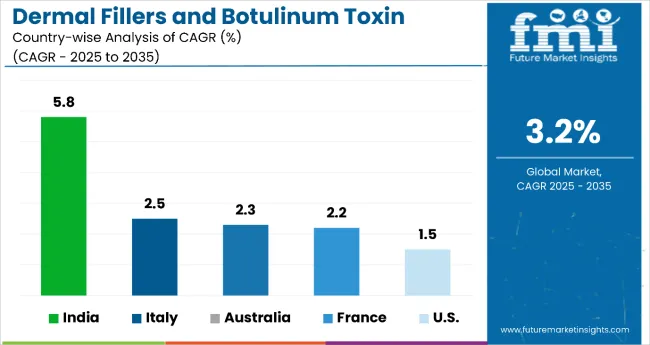

The following table shows the estimated growth rates of the top three markets. Italy and India are set to exhibit high dermal fillers and botulinum toxin industry growth, recording CAGR of 2.5% and 5.8%, through 2035.

The dermal fillers and botulinum toxin market is classified into hyaluronic acid based dermal fillers, non-hyaluronic acid based dermal fillers and botulinum toxin.

The dermal fillers and botulinum toxin market is classified into aesthetic volume restoration and wrinkle reduction.

Analysis of the dermal fillers and botulinum toxin market has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe and Middle East & Africa.

The global market is expected to reach USD 9.3 billion by 2035, growing from USD 6.8 billion in 2025, at a CAGR of 3.2% during the forecast period.

The Botulinum Toxin segment is projected to grow at the fastest pace, registering a CAGR of 8.3%, driven by the increasing demand for minimally invasive aesthetic procedures.

The wrinkle reduction segment holds a 50% market share and is driven by the rising demand for non-invasive procedures to smooth out wrinkles and fine lines.

Key drivers include the increasing demand for non-invasive cosmetic procedures, rising acceptance of aesthetic treatments, affordability compared to surgical options, and shorter recovery times.

Top companies include Allergan plc, Galderma SA, Merz Pharma GmbH & Co. KGaA, Anika Therapeutics, Inc., and Suneva Medical, Inc., offering advanced aesthetic treatment solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Dermal Fillers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Dermal Fillers Market Share

Epidermal Nevus Syndrome Market

Transdermal Cosmetic Patches Market Size and Share Forecast Outlook 2025 to 2035

Intradermal Injection Market Size and Share Forecast Outlook 2025 to 2035

Transdermal Ultrasound Surgery Market

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Toxic Epidermal Neurolysis Market – Trends & Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

Non-Hyaluronic Acid Dermal Filler Market Size and Share Forecast Outlook 2025 to 2035

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Sack Fillers Market Size and Share Forecast Outlook 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Plastic Fillers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Aseptic Fillers Market Growth - Trends & Forecast 2025 to 2035

Volumetric Cup Fillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA