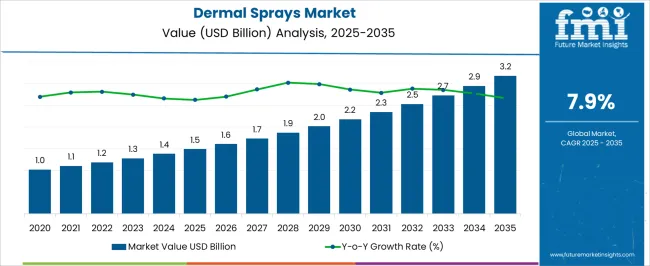

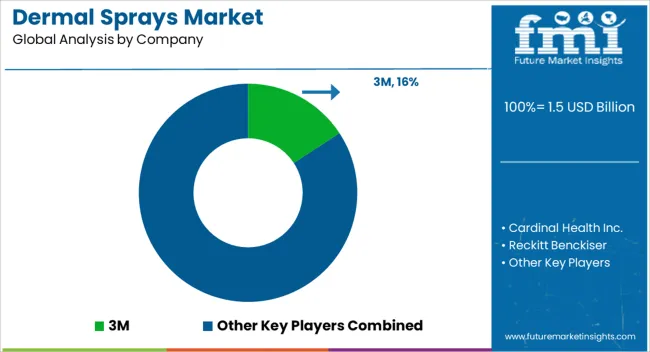

The Dermal Sprays Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

| Metric | Value |

|---|---|

| Dermal Sprays Market Estimated Value in (2025 E) | USD 1.5 billion |

| Dermal Sprays Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The Dermal Sprays market is witnessing steady growth, driven by increasing consumer awareness of skin health and hygiene, coupled with the rising prevalence of skin-related conditions. Adoption is being supported by innovations in formulation technologies that enhance product efficacy, safety, and ease of application. The market is further influenced by the growing demand for quick-absorbing, non-greasy, and portable skincare solutions suitable for both personal and clinical use.

Hospitals, clinics, and pharmacies are increasingly integrating dermal sprays into therapeutic regimens and preventive care programs, which has strengthened market penetration. Regulatory compliance, quality assurance, and clinical validation of formulations are enhancing consumer trust and facilitating adoption across healthcare and retail channels. The rising focus on preventive healthcare, hygiene, and dermatological care is creating a sustained demand pipeline.

As technological advancements in active ingredient delivery, product stability, and packaging continue, the dermal sprays market is expected to expand steadily Increasing investments in dermatology-focused healthcare infrastructure and the popularity of professional skincare treatments are also contributing to long-term growth opportunities.

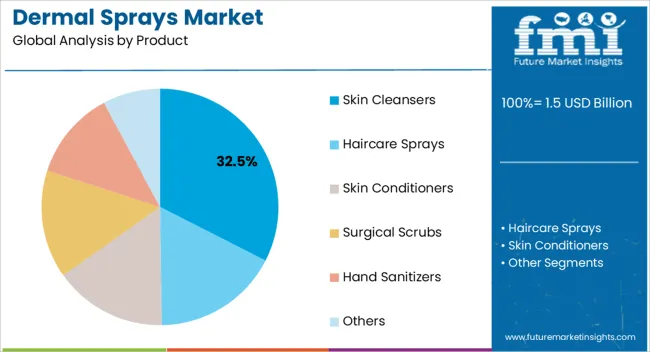

The skin cleansers product segment is projected to hold 32.5% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is driven by the rising adoption of dermal sprays for daily skin cleansing and therapeutic purposes in both personal care and clinical settings. Formulations are increasingly being enhanced with active ingredients that provide antibacterial, moisturizing, and anti-inflammatory benefits, which increases consumer preference.

Ease of use, rapid application, and non-irritating properties further strengthen adoption among diverse user groups. Hospitals, clinics, and dermatology centers prefer skin cleanser sprays due to their hygienic delivery mechanism and compatibility with sensitive skin types. The ability to integrate clinical-grade ingredients with convenience-oriented designs enhances market appeal.

Growing awareness of preventive skincare, combined with the trend of using spray-based hygiene solutions in clinical and personal contexts, is expected to maintain the segment’s leading position Product innovation, coupled with consistent performance and regulatory compliance, is reinforcing its dominance in the dermal sprays market.

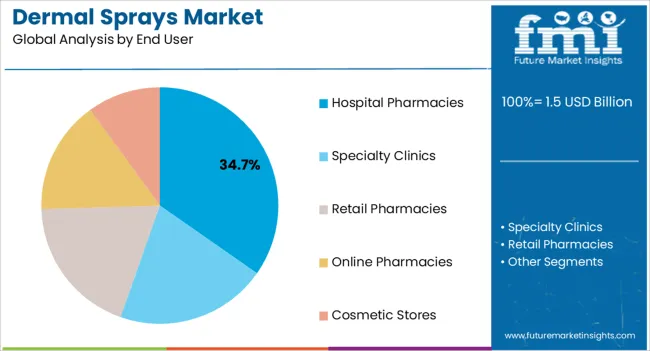

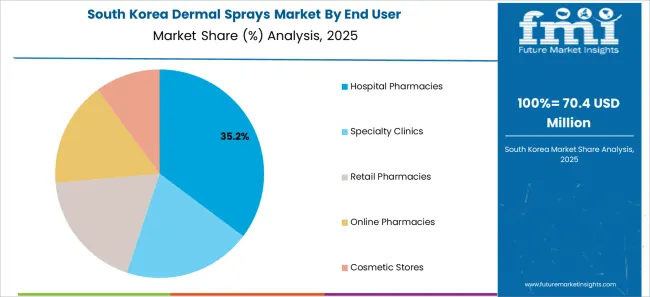

The hospital pharmacies end-user segment is expected to account for 34.7% of the market revenue in 2025, making it the largest end-user category. Its growth is driven by increasing procurement of dermal sprays for therapeutic, hygiene, and wound care purposes in hospital settings. Hospital pharmacies are integrating dermal sprays into patient care protocols for both inpatients and outpatients, improving clinical efficiency and ensuring consistent dosing.

The convenience of spray formulations, combined with safety, sterility, and regulatory compliance, has reinforced their preference over traditional topical alternatives. Adoption is further supported by increasing hospital investments in dermatology and infection control programs, as well as rising awareness among healthcare professionals regarding advanced skin care solutions.

The scalability and standardization offered by hospital pharmacies allow for bulk procurement and consistent supply across multiple departments As hospitals continue to emphasize hygiene, patient safety, and clinical efficacy, the hospital pharmacies segment is expected to remain the primary driver of market growth, with dermal sprays increasingly becoming a standard component of institutional care.

From 2020 to 2025, the global dermal sprays market experienced a CAGR of 13.9%, reaching a market size of USD 1.5 billion in 2025.

From 2020 to 2025, the market for dermal sprays has consistently expanded throughout the years. Market expansion has been spurred by increased customer demand for practical and efficient skincare products as well as improvements in spray technology.

Future Forecast for Dermal Sprays Industry:

Looking ahead, the global dermal sprays industry is expected to rise at a CAGR of 8.3% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 3.2 billion by 2035.

The market for dermal sprays is anticipated to have rapid growth over the forecast period. Market expansion will be fueled by rising consumer interest in skincare and beauty products as well as rising demand for practical and efficient goods. The market for dermal sprays will continue to be significantly fueled by the skincare and beauty sector. Dermal spray demand will be driven by consumers' need for rapid and effective skincare treatments as well as improvements in formulation technology.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 3.2.0 million |

| CAGR % 2025 to End of Forecast (2035) | 8.1% |

The dermal sprays industry in the United States is expected to reach a market size of USD 3.2.0 million by 2035, expanding at a CAGR of 8.1%. In recent years, there has been an increased focus on skincare and beauty regimens. Customers are eager to spend money on goods that enhance their overall appearance as they become more aware of the condition of their skin. Dermal sprays have acquired popularity among people looking for quick and efficient skincare remedies due to their promises of moisturizing, refreshing, or rejuvenating effects.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 170.0 million |

| CAGR % 2025 to End of Forecast (2035) | 7.7% |

The dermal sprays industry in the United Kingdom is expected to reach a market value of USD 170.0 million, expanding at a CAGR of 7.7% during the forecast period. Consumers in the United Kingdom now have greater access to a variety of skincare products, including dermal sprays, as a result of the expansion of e-commerce platforms and online retail channels. Online shopping is a convenient choice for customers because of the range of products available and the availability of customer reviews. Dermal sprays' market expansion in the United Kingdom has been aided by their accessibility through internet merchants.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 197.0 million |

| CAGR % 2025 to End of Forecast (2035) | 9.5% |

The dermal sprays industry in China is anticipated to reach a market size of USD 197.0 million, moving at a CAGR of 9.5% during the forecast period. Chinese consumers are more prepared to spend on skincare and personal care goods as a result of their expanding disposable income. People are seeking higher-quality goods and are ready to spend more on dermal sprays for their skincare regimens as they have more disposable income.

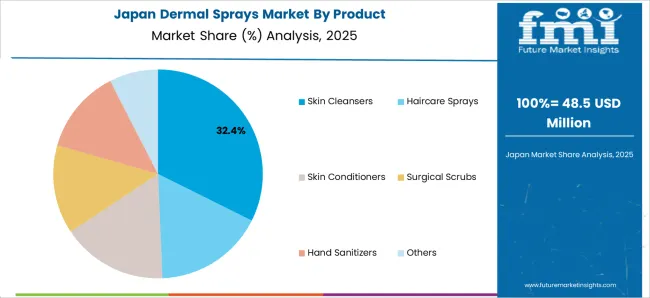

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 109.0 million |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The dermal sprays industry in Japan is estimated to reach a market size of USD 109.0 million by 2035, thriving at a CAGR of 7.2%. Beauty and skincare have a long history in Japan. Japanese consumers place a high value on preserving skin that looks healthy and young. Because skincare practices are so deeply embedded in the culture, there is a significant need for skincare products. Dermal sprays have grown in popularity among Japanese consumers as an essential component of their skincare routine thanks to its moisturizing and refreshing qualities.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 40.0 million |

| CAGR % 2025 to End of Forecast (2035) | 9.2% |

The dermal sprays industry in South Korea is expected to reach a market size of USD 40.0 million, expanding at a CAGR of 9.2% during the forecast period. South Korean skincare companies are renowned for their wide range of products and focus on personalization. Dermal sprays are available in a variety of formulas that address various skincare issues, including hydration, brightening, and calming. South Korean customers looking for individualized solutions have been drawn to the possibility to customize skincare regimens to meet specific demands. The market for dermal sprays has expanded in part because to the large range of products available and the customization possibilities.

Skin Cleansers dominated the dermal sprays industry with a market share of 30.2% in 2025. This segment captures a significant market share in 2025, as they help to remove dirt, oil, and impurities from the skin that can clog pores and lead to breakouts and other skin issues. This, in turn creates a much better surface for dermal sprays to be applied, allowing them to penetrate deeper into the skin and achieve greater results.

The retail pharmacies segment dominated the dermal sprays industry with market share of 37.5% in 2025. These pharmacies serve as a primary distribution channel for dermal sprays due to their widespread reach and easy accessibility. They also provide easy-to-read directions on how to use the product. They offer promotion and marketing campaigns for dermal sprays manufacturers can benefit from increased distribution and sales, resulting in a larger share of the market.

The dermal sprays sector is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Used by the Participants

Product Development

To produce innovative goods that increase efficacy, dependability, and cost-effectiveness, businesses make significant investments in research and development. Product innovation enables companies to stand out from the competition while also meeting the shifting needs of their customers.

Strategic Alliances & Collaborations

Strategic alliances and partnerships with other businesses are regularly formed by major players in an industry to take advantage of each other's advantages and expand their market reach. Through such arrangements, businesses may also obtain access to new technologies and markets.

Expansion into Emerging Markets

In developing nations like China and India, the market for dermal sprays is growing quickly. To boost their presence in these regions, major companies are expanding their distribution networks and building regional manufacturing sites.

Acquisitions and mergers

Key players in the dermal sprays industry routinely employ mergers and acquisitions to strengthen their market positions, broaden their product offerings, and enter new markets.

Key Developments in the Dermal Sprays Market:

The global dermal sprays market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the dermal sprays market is projected to reach USD 3.2 billion by 2035.

The dermal sprays market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in dermal sprays market are skin cleansers, haircare sprays, skin conditioners, surgical scrubs, hand sanitizers and others.

In terms of end user, hospital pharmacies segment to command 34.7% share in the dermal sprays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dermal Fillers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dermal Fillers and Botulinum Toxin Market Outlook - Size, Trends & Forecast 2025 to 2035

Competitive Overview of Dermal Fillers Market Share

Epidermal Nevus Syndrome Market

Transdermal Cosmetic Patches Market Size and Share Forecast Outlook 2025 to 2035

Intradermal Injection Market Size and Share Forecast Outlook 2025 to 2035

Transdermal Ultrasound Surgery Market

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Toxic Epidermal Neurolysis Market – Trends & Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

Non-Hyaluronic Acid Dermal Filler Market Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Throat Sprays Market Analysis - Size, Share & Forecast 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Medical Nitroglycerin Sprays Market - Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA