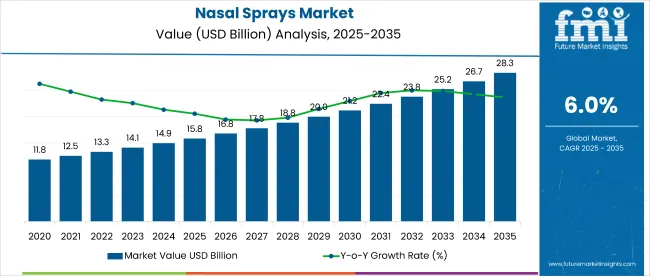

The global nasal sprays market is projected to grow from USD 15.82 billion in 2025 to USD 28.35 billion by 2035, expanding at a CAGR of 6.0%. This growth is driven by increasing prevalence of respiratory diseases, rising awareness about non-invasive drug delivery methods, and expanding applications of nasal sprays in allergy treatment, pain management, and vaccine delivery.

Nasal sprays are widely used for treating conditions such as allergic rhinitis, sinusitis, and nasal congestion. Their advantages include rapid drug absorption, targeted delivery, and improved patient compliance compared to oral medications. Growing incidence of respiratory illnesses, including seasonal allergies and chronic sinus conditions, is driving demand for effective nasal spray therapies.

Recent innovations in the market include the development of advanced formulations and delivery systems. In 2024, pharmaceutical companies introduced nasal sprays with improved bioavailability, longer-lasting effects, and enhanced patient comfort. For example, newer nasal sprays incorporate nanoemulsion technology, which increases drug solubility and absorption efficiency. Additionally, needle-free nasal vaccines have gained traction, offering pain-free immunization options for diseases such as influenza and COVID-19.

Manufacturers are also focusing on multi-dose nasal spray devices with precise dosing mechanisms and improved ergonomics, enhancing ease of use and safety. Companies like Pfizer and AstraZeneca have invested in developing smart nasal spray devices integrated with digital monitoring features, enabling personalized treatment and adherence tracking.

Regionally, North America holds a significant market share due to well-established healthcare infrastructure, high patient awareness, and favorable reimbursement policies. Europe follows closely, with growing adoption of nasal sprays in chronic disease management. The Asia Pacific region is expected to witness rapid growth, supported by rising healthcare expenditure, increasing prevalence of respiratory disorders, and expanding pharmaceutical markets in countries like China and India.

With ongoing technological advancements and increasing patient preference for non-invasive therapies, the nasal sprays market is poised for sustained growth through 2035, driven by innovation and expanding therapeutic applications.

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 15.82 billion |

| Industry Value (2035F) | USD 28.35 billion |

| CAGR (2025 to 2035) | 6.0% |

The nasal sprays market is shaped by region-specific regulatory frameworks that influence approval timelines, device classification, and clinical requirements across major pharmaceutical economies.

Top companies in the nasal spray market are prioritizing compliance with regional and international pharmaceutical standards to maintain quality, safety, and market authorization. Leaders such as GlaxoSmithKline, AstraZeneca, and Johnson & Johnson have adopted rigorous regulatory practices across their nasal spray product lines.

These companies actively conduct extractables and leachables testing for plastic components, a requirement in many regulated markets. Their nasal sprays undergo sterility assurance testing and microbial control to meet product safety expectations.

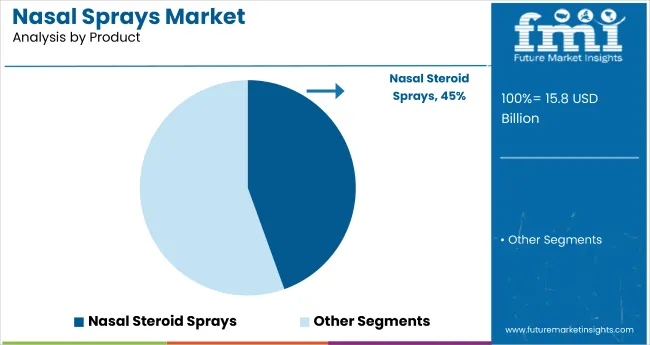

Nasal steroid sprays are projected to dominate the nasal spray market, with an estimated 44.5% market share by 2025. These sprays contain corticosteroids that effectively reduce inflammation within the nasal passages, making them highly effective for managing allergic conditions. Their localized action minimizes systemic side effects common with oral antihistamines, such as drowsiness, which makes them a preferred option for patients with chronic nasal symptoms.

One key advantage of nasal steroid sprays is their rapid onset and prolonged effect, often lasting up to 24 hours, reducing the need for frequent dosing. This enhances patient adherence and convenience, further driving market demand. They are widely used for both short-term relief and long-term management of allergies and nasal inflammation.

The growing prevalence of allergic rhinitis and respiratory disorders globally is significantly contributing to increased usage. Additionally, ongoing innovations in spray delivery systems and formulations are improving efficacy and user experience. The strong safety profile and effectiveness of nasal steroid sprays ensure their continued market leadership and growing acceptance in pharmaceutical and over-the-counter nasal care products through 2025.

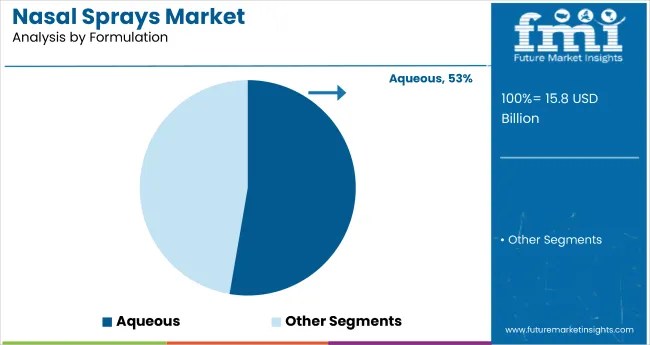

Aqueous nasal spray formulations are expected to capture approximately 52.7% market share by 2025, making them the leading formulation segment. These formulations deliver active ingredients directly to the nasal mucosa while providing gentle hydration, which soothes irritated nasal tissues without causing dryness or discomfort. This makes aqueous sprays highly preferred among sensitive patient groups, including children and the elderly.

Water, as the main solvent, is non-toxic and generally well tolerated. Aqueous nasal sprays offer a safer alternative compared to hydroalcoholic or non-aqueous formulations, which may cause irritation or dryness over prolonged use. Their ease of production and cost-effectiveness have made them widely available in both prescription and over-the-counter nasal products.

Furthermore, aqueous formulations benefit from longer shelf life and reduced formulation degradation risks, boosting their market appeal. The rising demand for comfortable, effective, and affordable nasal spray solutions drives the growth of the aqueous segment, ensuring its dominant position in the nasal spray market through 2025.

A global nasal spray market has been predicted for which specific expected CAGRs are shown in the table below across various half-year periods between 2024 and 2034. Thus, the industry has been projected to increase at 5.8% CAGR in the first half of the decade (2024 to 2034), followed by a decrease in the second half of the same decade with CAGR being at 5.2%.

| Particular | Value CAGR |

|---|---|

| H1 | 5.9% (2024 to 2034) |

| H2 | 6.5% (2024 to 2034) |

| H1 | 6.0% (2025 to 2035) |

| H2 | 6.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.0% in the first half and remain relatively moderate at 3.2% in the second half. In the first half (H1) the market witnessed a increase of 10.0 BPS while in the second half (H2), the market witnessed a increase of 8.7 BPS.

Breathing Issues on the Rise: A Catalyst for Industry Growth

Prevalence of respiratory diseases such as allergic rhinitis and common cold has increased in most regions of the world. Environmental pollution and changes in lifestyle are the main contributory factors. Increasing respiratory problems act as a driver for demand in the market for effective and accessible options for treatment.

In light of this, nasal sprays have emerged as a favorite choice for many consumers because they work quickly, locally, and effectively. The increased exposure to common allergens like pollen, dust, and molds in urban areas increases the numbers affected by these types of sickness that show signs such as congestion, sneezing, and a running nose.

However, nasal sprays-again, largely corticosteroid-based medications-have seen better support by most healthcare professionals based on their efficacy to directly affect the nasal cavity site of action at an inflammation pathway. These give better endurance than decongestants that give symptomatic relief only.

Increasing the rate of allergies calls for nasal sprays in handling these symptoms. Inflamation of paranasal sinuses may become painful and present as facial pains, pressure, and nasal blockage.

Mostly, sinusitis can be treated with a nasal spray holding either saline or corticosteroids because these facilitate the discharge of mucus in the respiratory passages and control the inflammation in them. Increasing respiratory diseases influenced by environmental and lifestyle factors, along with viruses, will remain a significant factor driving growth in the nasal spray market.

Rise in Self Medication is fueling Nasal Sprays Industry Growth

The increasing costs of health care have made access to such services limited. Over-the-counter remedies are often sought by consumers because they frequently suffer from health problems. The trend is highly noticeable for treating mild to moderate respiratory disorders. The quick and focused relief the nasal sprays deliver for these ailments has gained great popularity as a consequence.

With the ability for self-medication, it becomes easy and accessible to control one's health in order to manage the symptoms. The nasal sprays are particularly advisable to the trend because they bring the localized treatment right to the doorstep of the problem, like nasal passages, for immediate relief.

While oral medications may take time to act and affect the entire body, nasal sprays can target selected areas of discomfort that were bothering them, such as allergic nasal congestion or sinusitis, providing them with quick effective relief.

As a result, they will be very appealing to people in order to quickly cope with symptoms without professional help. As consumers continue to seek effective, easy-to-use products that provide fast and targeted relief, the market for nasal sprays will continue to benefit.

Expanding The Use of Nasal Spray for Non-Respiratory Conditions offers an Untapped Opportunity for Market Growth

Traditionally, nasal sprays were prescribed and marketed mainly for conditions like nasal congestion, allergies, and sinusitis. With increased interest in non-invasive drug delivery systems, a greater application scope for nasal sprays in non-respiratory conditions is likely to expand in the coming future, encompassing neurological disorders, pain management, mental health, and chronic diseases, creating growth in this market for firms to capture on the new waves.

Nasal sprays are increasingly being considered as a route of administration for drugs in the treatment of conditions such as migraine headaches, Parkinson's disease, and epilepsy. The nasal cavity provides an open route directly to the brain through the olfactory and trigeminal nerves, thus providing a route around the digestive system and blood-brain barrier, potentially offering quicker relief and effectiveness.

Examples of such products already in the market are nasal sprays for the acute treatment of migraines, including triptan-containing formulations, and further innovation could lead to the development of nasal formulations for other neurological conditions.

Companies may tap into a lucrative market with substantial unmet needs by focusing on these high-demand areas. This new opportunity to invest in research and development will provide a source of competitive advantage to market players to capitalize on nasal sprays development for non-respiratory conditions.

Competition from Alternative Drug Delivery Methods Results Hinder the Market Growth

While nasal sprays are well-suited for localized administration, many other non-invasive options have been developed. Oral medications, transdermal patches, inhalers, sublingual tablets, and injectable treatments are now being used. Such formulations have gained attention for their use, targeted delivery, and perceived fewer drawbacks compared to nasal sprays.

Oral drugs provide the convenience of easy administration without any particular method or discomfort; oral drugs come in pill or liquid form, so it is very appealing to be used for acute or chronic conditions. Although oral drugs are usually slower in their onset than nasal sprays, oral drugs are mostly used for chronic systemic conditions. That's because oral drugs allow medications to penetrate into the rest of the body and have cases other than just the nasal cavity.

Recently, inhalers also gained massive prominence as formidable rivals in nasal sprays competition especially for pulmonary condition treatment cases of asthma, chronic obstructive pulmonary disease and the likes. Inhaler's immediate relief offered at the actual place of absorption where medications act faster into respiratory symptoms have often been valued for their relative superiority over intranasal medication by some patients to take it who suffered from chronically acquired and other similar long-lasting conditions. Competition from alternative drug delivery methods is a significant factor hindering the nasal spray market’s growth.

The nasal sprays market experienced a CAGR of 4.1% from 2020 to 2024. Nasal sprays produced USD 14,952.0 million in 2024 compared to USD 12,252.3 million in 2020, as reported by the industry.

Early Nasal sprays were created for decongestant relief, particularly decongestant sprays or mere saline solutions. Nasal sprays previously contained uncomplicated formulations that typically included ingredients such as phenylephrine or oxymetazoline, which provided relief from nasal congestion temporarily but caused side effects such as rebound congestion upon prolonged use. The majority of the initial formulations throughout the years came forward for symptomatic short-term relief of common cold and allergic rhinitis symptoms.

The market nowadays has transformed shifted towards more effective and specific remedies. The nasal steroid sprays have the most market share with their capacity for decreasing swelling of the nasal pathways. Nasal steroid sprays are utilized for different conditions related to allergies.

In contrast to previous decongestants, nasal steroids provide long-lasting comfort without danger from rebound congestion and are hence regarded as favorable drugs for extended periods of care. Formulation technology have enhanced efficacy and comfort. More recent sprays use improved delivery systems to deliver active ingredients with more accurate application and improved absorption.

Future looking, the nasal spray market is expected to witness further innovation. Scientists are dedicated to perfecting bioavailability, enhancing the delivery mechanism, and taking better action in the nasal passage.

Tier 1 companies have 57.5% of the world market, making them the leaders in the industry. Tier 1 players have a diverse product range and have achieved industry presence.

With financial capabilities, they can develop their research and development and grow in new markets. A well-established brand recall and loyal customers give them a competitive edge. Major players in Tier 1 are Janssen Pharmaceuticals, Inc. (J&J), GlaxoSmithKline, Novartis AG (Sandoz), and others

Tier 2 players lead the industry with a market share of 33.1%. Tier 2 companies have high concentration on a particular Product and a large presence in the industry, but less power than Tier 1 companies. The players are more price competitive and serve niche markets. New Product and services will also be added to the industry by Tier 2 companies. Tier 2 players are Bayer AG, Merck & Co., Inc., Sanofi, Boehringer Ingelheim International GmbH, and so on.

As compared to Tiers 1 and 2, Tier 3 firms have lesser revenue spouts and a smaller influence. Tier 3 companies have lesser work force and a smaller presence globally. Key players among the tier 3 firms include Cipla Ltd., Hikma Pharmaceuticals USA Inc, Endo International plc, Nemera, and others.

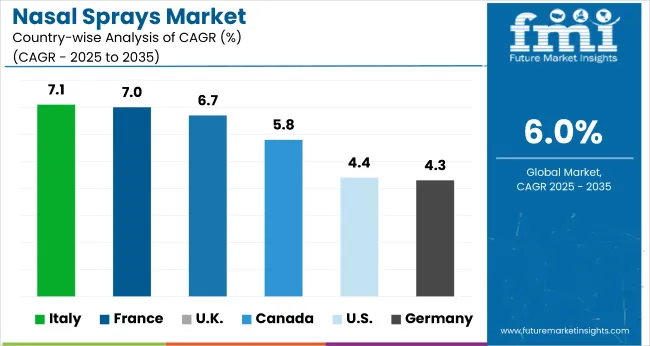

The section below covers the industry analysis for the nasal sprays for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided. The United States is anticipated to remain at the forefront in North America through 2035. India is projected to witness a CAGR of 8.8% from 2025 to 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

| Canada | 5.8% |

| Germany | 4.3% |

| France | 7.0% |

| Italy | 7.1% |

| United Kingdom | 6.7% |

In United States, respiratory conditions from allergic rhinitis to sinusitis afflict millions of Americans. Air pollution and climate change have fueled seasonal allergies. With a swelling in the number of patients dealing with this disease, there has been a rise in demand for efficient therapy.

Nasal sprays are extremely popular because they provide localized relief to nasal congestion, runny nose etc. Thus offering an easy, non-invasive option for the management of symptoms.

There is now a growing trend of consumer self-medication, in which more Americans are choosing over-the-counter products to solve common health problems. This development can be attributed to the increased demand for localized treatment such as nasal sprays, which users can employ easily with the promise of fast relief rather than the systemic side effects orally taken medications implicate.

The availability of nasal spray formulations in OTC and prescription forms makes them easily accessible to a broad range of consumers, further expanding market reach.

The health care infrastructure in Germany is robust and ever ready for service, built around preventive care and effective chronic conditions management like allergies, asthma, or sinusitis. Quality medical products such as nasal sprays have been made easily accessible through the German health care system, which often prescribe them as the first line of treatment for nasal congestion and allergic rhinitis.

The Germans possess a very high level of consumers who are aware of preventive measures in health, and most look for nasal sprays as a part of health regimen to prevent symptoms related to seasonal allergies, sinus problems, or dryness in the nasal passage and are often favored over more invasive drugs.

A high level of onus is constantly shown upon self-care in the country. Along with this, people have a great deal of consumer awareness in Germany, meaning they are seeking nasal sprays for long-term relief along with convenience. The strong above factors combine to drive the growth of the nasal spray market in Germany.

In Japan large proportion of elderly citizens experience chronic respiratory issues. The condition ranges from allergies to dry nasal passages. As people age nasal discomforts become more prevalent. The nasal sprays offer a non-invasive, easy-to-use solution. This has resulted in Japanese elderly people with a preference for nasal sprays for the convenience they bring to such conditions, as the application is local and not systemic, thereby minimizing side effects.

Japanese culture also promotes health prevention as part of everyday living. In such a mindset, it would make people more open to the use of products like nasal sprays that could prevent the aggravation of symptoms toward conditions.

Preventive measures are important during high pollen seasons. In these seasons allergic reactions are common due to which nasal sprays a favored solution for managing allergy-related symptoms. Japan's aging population, preventive health focus, and environmental factors are driving the growth of the nasal spray market in the country.

Companies are focusing on the development of new formulations for different therapeutic indications, including allergy management, pain relief, and opioid overdose treatment. A number of partnerships and collaborations are also observed in the market, especially in the development and commercialization of life-saving treatments, such as naloxone sprays for opioid overdose.

The introduction of new nasal sprays for anaphylaxis treatment creates further pressure in this highly competitive arena, since providers have to aim for a certain market share both within the consumer and healthcare arenas. Innovation in formulations and delivery systems and their corresponding regulatory approvals form the major influencers in shaping this market's competition.

Recent Industry Developments in the Nasal Sprays Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 15.82 billion |

| Projected Market Size (2035) | USD 28.35 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million doses for volume |

| Products Analyzed (Segment 1) | Decongestant Sprays, Nasal Steroid Sprays, Nasal Antihistamine Sprays, Nasal Cromolyn Sodium Sprays, Nasal Anticholinergic Sprays, Nasal Triamcinolone Sprays, Others |

| Formulations Analyzed (Segment 2) | Aqueous, Hydroalcoholic, Non-aqueous Based Solutions, Suspensions, Emulsions, Dry Powder/Microparticles |

| Packaging Formats Analyzed (Segment 3) | Pressurized Canisters, Pump Bottles |

| Dosage Formats Analyzed (Segment 4) | Multi Dose, Bi Dose, Single/Unit Dose |

| Distribution Channels Analyzed (Segment 5) | Institutional Sales (Hospitals, Community Clinics, Specialty Clinics, Public Health Agencies), Retail Sales (Retail Pharmacies, Drug Stores, Mail Order Pharmacy) |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Nasal Sprays Market | Becton Dickinson & Company, GlaxoSmithKline, Novartis AG (Sandoz), AstraZeneca, Pfizer Inc., Bayer AG, Merck & Co., Inc., Sanofi, Boehringer Ingelheim International GmbH, Viatris Inc. (Mylan N.V.), Others |

| Additional Attributes | Market share by formulation (aqueous vs non-aqueous), Application trends for seasonal allergies and chronic rhinitis, Distribution efficiency across institutional vs retail channels, Regional acceptance of steroid-based and antihistamine sprays, Innovation in packaging and unit dose formats |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of product, the industry is segmented into decongestant sprays, nasal steroid sprays, nasal antihistamine sprays, nasal cromolyn sodium sprays, nasal anticholinergic sprays, nasal triamcinolone sprays, and others.

In terms of formulation, the industry is bifurcated into Aqueous, Hydroalcoholic, Non-acqueous based solutions, suspensions, emulsions, and dry powder/microparticles.

In terms of packaging, the industry is segmented into pressurized canisters and pump bottles.

In terms of dosage, the industry is bifurcated into multi dose, bi dose, and single/unit dose.

In terms of distribution channel, the industry is segmented into Institutional Sales (hospitals, community clinics, specialty clinics, and public health agencies) and retail sales (retail pharmacies, drug stores, and mail order pharmacy).

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East, and Africa have been covered in the report.

Nasal sprays market is expected to increase at a CAGR of 6.0% between 2025 and 2035.

The nasal steroid sprays segment is expected to occupy 44.5% market share in 2025.

The market for nasal sprays is expected to reach USD 28.35 billion by 2035.

The United States is forecast to see a CAGR of 4.4% during the assessment period.

The key players in the nasal sprays industry include Becton Dickinson & Company, GlaxoSmithKline, Novartis AG (Sandoz), AstraZeneca, Pfizer Inc., Bayer AG, Merck & Co., Inc., Sanofi, Boehringer Ingelheim International GmbH, Viatris Inc. (Mylan N.V), and Others.

Table 01: Global Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 03: Global Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 04: Global Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 05: Global Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 06: Global Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 07: North America Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 08: North America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 09: North America Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 10: North America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 11: North America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 12: North America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 13: North America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 14: Latin America Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 15: Latin America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 16: Latin America Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 17: Latin America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 18: Latin America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 19: Latin America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 20: Latin America Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 21: Europe Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 22: Europe Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 23: Europe Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 24: Europe Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 25: Europe Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 26: Europe Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 27: Europe Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 28: South Asia Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 29: South Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 30: South Asia Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 31: South Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 32: South Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 33: South Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 34: South Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 35: East Asia Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 36: East Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 37: East Asia Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 38: East Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 39: East Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 40: East Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 41: East Asia Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 42: Oceania Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 43: Oceania Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 44: Oceania Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 45: Oceania Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 46: Oceania Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 47: Oceania Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 48: Oceania Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Table 49: MEA Market Value (US$ million) Analysis 2017 to 2021 and Forecast 2023 to 2033, by Country

Table 50: MEA Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Product

Table 51: MEA Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 52: MEA Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Formulation

Table 53: MEA Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging Material

Table 54: MEA Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Packaging

Table 55: MEA Market Value (US$ million) Analysis and Forecast 2015 to 2033, by Distribution Channel

Figure 01: Global Market Volume (Units), 2015 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Market, Pricing Analysis per unit (US$), in 2023

Figure 04: Market, Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ million) Analysis, 2015 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ million) Analysis, 2022 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Formulation

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Formulation

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Formulation

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Packaging Material

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Packaging Material

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Packaging Material

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Packaging

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Packaging

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Packaging

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by Distribution Channel

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Distribution Channel

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by Distribution Channel

Figure 23: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 24: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 25: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 26: North America Market Value (US$ million) Analysis, 2015 to 2022

Figure 27: North America Market Value (US$ million) Forecast, 2023 to 2033

Figure 28: North America Market Value Share, by Product (2023 E)

Figure 29: North America Market Value Share, by Formulation (2023 E)

Figure 30: North America Market Value Share, by Packaging Material (2023 E)

Figure 31: North America Market Value Share, by Packaging (2023 E)

Figure 32: North America Market Value Share, by Distribution Channel (2023 E)

Figure 33: North America Market Value Share, by Country (2023 E)

Figure 34: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40: The USA Market Value Proportion Analysis, 2022

Figure 41: Global Vs. The USA Growth Comparison

Figure 42: The USA Market Share Analysis (%) by Product, 2022 to 2033

Figure 43: The USA Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 44: The USA Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 45: The USA Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 46: The USA Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 47: Canada Market Value Proportion Analysis, 2022

Figure 48: Global Vs. Canada. Growth Comparison

Figure 49: Canada Market Share Analysis (%) by Product, 2022 to 2033

Figure 50: Canada Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 51: Canada Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 52: Canada Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 53: Canada Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 54: Latin America Market Value (US$ million) Analysis, 2015 to 2022

Figure 55: Latin America Market Value (US$ million) Forecast, 2023 to 2033

Figure 56: Latin America Market Value Share, by Product (2023 E)

Figure 57: Latin America Market Value Share, by Formulation (2023 E)

Figure 58: Latin America Market Value Share, by Packaging Material (2023 E)

Figure 59: Latin America Market Value Share, by Packaging (2023 E)

Figure 60: Latin America Market Value Share, by Distribution Channel (2023 E)

Figure 61: Latin America Market Value Share, by Country (2023 E)

Figure 62: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 63: Latin America Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 64: Latin America Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 65: Latin America Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 66: Latin America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 67: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 68: Mexico Market Value Proportion Analysis, 2022

Figure 69: Global Vs Mexico Growth Comparison

Figure 70: Mexico Market Share Analysis (%) by Product, 2022 to 2033

Figure 71: Mexico Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 72: Mexico Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 73: Mexico Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 74: Mexico Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 75: Brazil Market Value Proportion Analysis, 2022

Figure 76: Global Vs. Brazil. Growth Comparison

Figure 77: Brazil Market Share Analysis (%) by Product, 2022 to 2033

Figure 78: Brazil Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 79: Brazil Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 80: Brazil Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 81: Brazil Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 82: Argentina Market Value Proportion Analysis, 2022

Figure 83: Global Vs Argentina Growth Comparison

Figure 84: Argentina Market Share Analysis (%) by Product, 2022 to 2033

Figure 85: Argentina Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 86: Argentina Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 87: Argentina Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 88: Argentina Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 89: Europe Market Value (US$ million) Analysis, 2015 to 2022

Figure 90: Europe Market Value (US$ million) Forecast, 2023 to 2033

Figure 91: Europe Market Value Share, by Product (2023 E)

Figure 92: Europe Market Value Share, by Formulation (2023 E)

Figure 93: Europe Market Value Share, by Packaging Material (2023 E)

Figure 94: Europe Market Value Share, by Packaging (2023 E)

Figure 95: Europe Market Value Share, by Distribution Channel (2023 E)

Figure 96: Europe Market Value Share, by Country (2023 E)

Figure 97: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 98: Europe Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 99: Europe Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 100: Europe Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 101: Europe Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 102: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 103: The United Kingdom Market Value Proportion Analysis, 2022

Figure 104: Global Vs. The United Kingdom Growth Comparison

Figure 105: The United Kingdom Market Share Analysis (%) by Product, 2022 to 2033

Figure 106: The United Kingdom Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 107: The United Kingdom Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 108: The United Kingdom Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 109: The United Kingdom Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 110: Germany Market Value Proportion Analysis, 2022

Figure 111: Global Vs. Germany Growth Comparison

Figure 112: Germany Market Share Analysis (%) by Product, 2022 to 2033

Figure 113: Germany Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 114: Germany Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 115: Germany Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 116: Germany Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 117: Italy Market Value Proportion Analysis, 2022

Figure 118: Global Vs. Italy Growth Comparison

Figure 119: Italy Market Share Analysis (%) by Product, 2022 to 2033

Figure 120: Italy Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 121: Italy Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 122: Italy Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 123: Italy Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 124: France Market Value Proportion Analysis, 2022

Figure 125: Global Vs France Growth Comparison

Figure 126: France Market Share Analysis (%) by Product, 2022 to 2033

Figure 127: France Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 128: France Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 129: France Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 130: France Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 131: Spain Market Value Proportion Analysis, 2022

Figure 132: Global Vs Spain Growth Comparison

Figure 133: Spain Market Share Analysis (%) by Product, 2022 to 2033

Figure 134: Spain Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 135: Spain Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 136: Spain Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 137: Spain Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 138: Russia Market Value Proportion Analysis, 2022

Figure 139: Global Vs Russia Growth Comparison

Figure 140: Russia Market Share Analysis (%) by Product, 2022 to 2033

Figure 141: Russia Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 142: Russia Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 143: Russia Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 144: Russia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 145: BENELUX Market Value Proportion Analysis, 2022

Figure 146: Global Vs BENELUX Growth Comparison

Figure 147: BENELUX Market Share Analysis (%) by Product, 2022 to 2033

Figure 148: BENELUX Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 149: BENELUX Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 150: BENELUX Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 151: BENELUX Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 152: East Asia Market Value (US$ million) Analysis, 2015 to 2022

Figure 153: East Asia Market Value (US$ million) Forecast, 2023 to 2033

Figure 154: East Asia Market Value Share, by Product (2023 E)

Figure 155: East Asia Market Value Share, by Formulation (2023 E)

Figure 156: East Asia Market Value Share, by Packaging Material (2023 E)

Figure 157: East Asia Market Value Share, by Packaging (2023 E)

Figure 158: East Asia Market Value Share, by Distribution Channel (2023 E)

Figure 159: East Asia Market Value Share, by Country (2023 E)

Figure 160: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 161: East Asia Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 162: East Asia Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 163: East Asia Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 164: East Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 166: China Market Value Proportion Analysis, 2022

Figure 167: Global Vs. China Growth Comparison

Figure 168: China Market Share Analysis (%) by Product, 2022 to 2033

Figure 169: China Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 170: China Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 171: China Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 172: China Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 173: Japan Market Value Proportion Analysis, 2022

Figure 174: Global Vs. Japan Growth Comparison

Figure 175: Japan Market Share Analysis (%) by Product, 2022 to 2033

Figure 176: Japan Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 177: Japan Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 178: Japan Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 179: Japan Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 180: South Korea Market Value Proportion Analysis, 2022

Figure 181: Global Vs South Korea Growth Comparison

Figure 182: South Korea Market Share Analysis (%) by Product, 2022 to 2033

Figure 183: South Korea Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 184: South Korea Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 185: South Korea Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 186: South Korea Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 187: South Asia Market Value (US$ million) Analysis, 2015 to 2022

Figure 188: South Asia Market Value (US$ million) Forecast, 2023 to 2033

Figure 189: South Asia Market Value Share, by Product (2023 E)

Figure 190: South Asia Market Value Share, by Formulation (2023 E)

Figure 191: South Asia Market Value Share, by Packaging Material (2023 E)

Figure 192: South Asia Market Value Share, by Packaging (2023 E)

Figure 193: South Asia Market Value Share, by Distribution Channel (2023 E)

Figure 194: South Asia Market Value Share, by Country (2023 E)

Figure 195: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 196: South Asia Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 197: South Asia Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 198: South Asia Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 199: South Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 200: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 201: India Market Value Proportion Analysis, 2022

Figure 202: Global Vs. India Growth Comparison

Figure 203: India Market Share Analysis (%) by Product, 2022 to 2033

Figure 204: India Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 205: India Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 206: India Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 207: India Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 208: Indonesia Market Value Proportion Analysis, 2022

Figure 209: Global Vs. Indonesia Growth Comparison

Figure 210: Indonesia Market Share Analysis (%) by Product, 2022 to 2033

Figure 211: Indonesia Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 212: Indonesia Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 213: Indonesia Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 214: Indonesia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 215: Malaysia Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Malaysia Growth Comparison

Figure 217: Malaysia Market Share Analysis (%) by Product, 2022 to 2033

Figure 218: Malaysia Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 219: Malaysia Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 220: Malaysia Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 221: Malaysia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 222: Thailand Market Value Proportion Analysis, 2022

Figure 223: Global Vs. Thailand Growth Comparison

Figure 224: Thailand Market Share Analysis (%) by Product, 2022 to 2033

Figure 225: Thailand Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 226: Thailand Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 227: Thailand Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 228: Thailand Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 229: Oceania Market Value (US$ million) Analysis, 2015 to 2022

Figure 230: Oceania Market Value (US$ million) Forecast, 2023 to 2033

Figure 231: Oceania Market Value Share, by Product (2023 E)

Figure 232: Oceania Market Value Share, by Formulation (2023 E)

Figure 233: Oceania Market Value Share, by Packaging Material (2023 E)

Figure 234: Oceania Market Value Share, by Packaging (2023 E)

Figure 235: Oceania Market Value Share, by Distribution Channel (2023 E)

Figure 236: Oceania Market Value Share, by Country (2023 E)

Figure 237: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 238: Oceania Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 239: Oceania Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 240: Oceania Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 241: Oceania Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 242: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 243: Australia Market Value Proportion Analysis, 2022

Figure 244: Global Vs. Australia Growth Comparison

Figure 245: Australia Market Share Analysis (%) by Product, 2022 to 2033

Figure 246: Australia Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 247: Australia Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 248: Australia Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 249: Australia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 250: New Zealand Market Value Proportion Analysis, 2022

Figure 251: Global Vs New Zealand Growth Comparison

Figure 252: New Zealand Market Share Analysis (%) by Product, 2022 to 2033

Figure 253: New Zealand Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 254: New Zealand Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 255: New Zealand Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 256: New Zealand Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 257: Middle East & Africa Market Value (US$ million) Analysis, 2015 to 2022

Figure 258: Middle East & Africa Market Value (US$ million) Forecast, 2023 to 2033

Figure 259: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 260: Middle East & Africa Market Value Share, by Formulation (2023 E)

Figure 261: Middle East & Africa Market Value Share, by Packaging Material (2023 E)

Figure 262: Middle East & Africa Market Value Share, by Packaging (2023 E)

Figure 263: Middle East & Africa Market Value Share, by Distribution Channel (2023 E)

Figure 264: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 265: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 266: Middle East & Africa Market Attractiveness Analysis by Formulation, 2023 to 2033

Figure 267: Middle East & Africa Market Attractiveness Analysis by Packaging Material, 2023 to 2033

Figure 268: Middle East & Africa Market Attractiveness Analysis by Packaging, 2023 to 2033

Figure 269: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 270: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 271: GCC Countries Market Value Proportion Analysis, 2022

Figure 272: Global Vs GCC Countries Growth Comparison

Figure 273: GCC Countries Market Share Analysis (%) by Product, 2022 to 2033

Figure 274: GCC Countries Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 275: GCC Countries Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 276: GCC Countries Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 277: GCC Countries Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 278: Turkey Market Value Proportion Analysis, 2022

Figure 279: Global Vs. Turkey Growth Comparison

Figure 280: Turkey Market Share Analysis (%) by Product, 2022 to 2033

Figure 281: Turkey Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 282: Turkey Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 283: Turkey Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 284: Turkey Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 285: South Africa Market Value Proportion Analysis, 2022

Figure 286: Global Vs. South Africa Growth Comparison

Figure 287: South Africa Market Share Analysis (%) by Product, 2022 to 2033

Figure 288: South Africa Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 289: South Africa Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 290: South Africa Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 291: South Africa Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 292: North Africa Market Value Proportion Analysis, 2022

Figure 293: Global Vs North Africa Growth Comparison

Figure 294: North Africa Market Share Analysis (%) by Product, 2022 to 2033

Figure 295: North Africa Market Share Analysis (%) by Formulation, 2022 to 2033

Figure 296: North Africa Market Share Analysis (%) by Packaging Material, 2022 to 2033

Figure 297: North Africa Market Share Analysis (%) by Packaging, 2022 to 2033

Figure 298: North Africa Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Nasal Implant Market Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nasal Congestion Treatment Devices Market Analysis Size and Share Forecast Outlook 2025 to 2035

Nasal Packing Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Polyposis Treatment Market - Drug Innovations & Demand 2025 to 2035

Nasal Antihistamines Market – Growth & Forecast 2025 to 2035

Nasal vaccines Market

Nasal Sampling Lines Market

Nasal Oxygen Cannula Market

Intranasal Corticosteroids Market Analysis – Growth & Demand Forecast 2025 to 2035

Migraine Nasal Spray Market Outlook – Trends, Growth & Forecast 2025 to 2035

High Flow Nasal Cannula Market – Innovations & Forecast 2024-2034

Pediatric Nasal Cannula Market

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Fragmentable Nasal and Ear Dressing Market Size and Share Forecast Outlook 2025 to 2035

Inhalation And Nasal Spray Generic Drugs Market Size and Share Forecast Outlook 2025 to 2035

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Throat Sprays Market Analysis - Size, Share & Forecast 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA