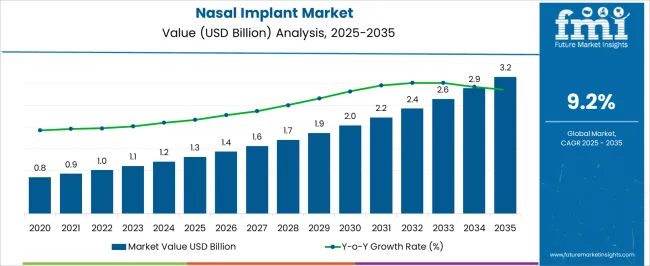

The Nasal Implant Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Nasal Implant Market Estimated Value in (2025 E) | USD 1.3 billion |

| Nasal Implant Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The nasal implant market is experiencing significant growth, driven by rising demand for reconstructive and cosmetic procedures aimed at improving nasal structure and function. Increasing prevalence of nasal deformities caused by trauma, congenital conditions, or medical interventions is contributing to the widespread adoption of implants. Cosmetic enhancement procedures, which continue to gain social acceptance globally, are also boosting market demand.

Advancements in surgical techniques and biomaterials have enhanced the safety, durability, and compatibility of implants, thereby improving patient outcomes and increasing the confidence of surgeons in using advanced implant solutions. Rising healthcare expenditure, particularly in emerging economies, and greater access to specialized surgical care are creating favorable conditions for market expansion.

Additionally, awareness campaigns and increased availability of minimally invasive treatment options are driving patient preference toward nasal implants With technological progress supporting innovation in material design and customization, and with hospitals and specialty clinics strengthening their capabilities in facial reconstruction, the nasal implant market is poised for strong growth in both therapeutic and aesthetic applications worldwide.

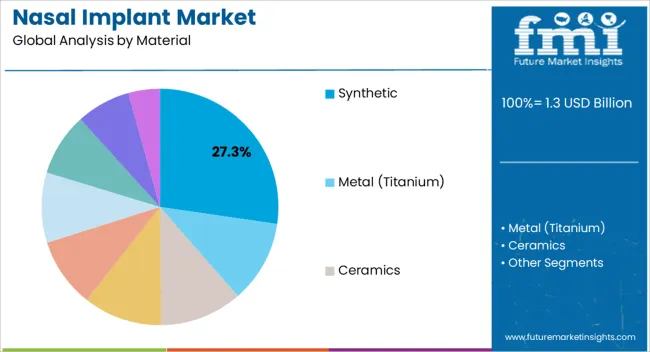

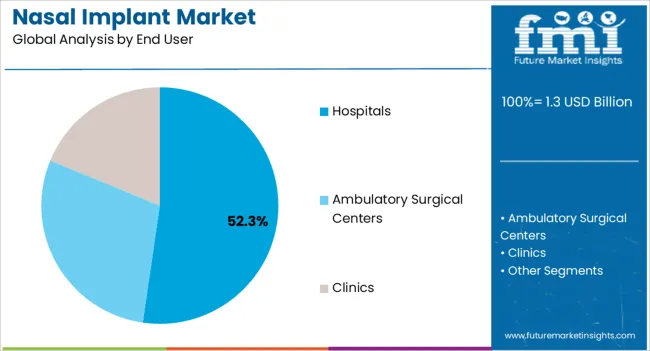

The nasal implant market is segmented by material, end user, and geographic regions. By material, nasal implant market is divided into Synthetic, Metal (Titanium), Ceramics, Polymers (Silicone, Polyethylene, Ptfe, Polyesters And Polyamides), Biological, Autograft, Xenograft, Allograft, and Alloplast. In terms of end user, nasal implant market is classified into Hospitals, Ambulatory Surgical Centers, and Clinics. Regionally, the nasal implant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic material segment is projected to account for 27.3% of the nasal implant market revenue share in 2025, establishing itself as a leading category. Growth of this segment is being supported by advancements in biocompatible polymers and medical-grade silicone, which have enhanced structural stability, minimized risk of rejection, and improved long-term performance. Synthetic implants are increasingly being adopted because they eliminate the need for harvesting autologous tissue, thereby reducing surgical complexity, procedure time, and donor site morbidity.

Their versatility in shaping and customization is enabling surgeons to achieve precise aesthetic and functional outcomes, which is further strengthening patient satisfaction. The scalability of synthetic materials allows manufacturers to ensure consistent quality and supply, making them a reliable choice across healthcare systems globally.

Rising demand for elective cosmetic surgeries, combined with their cost-effectiveness compared to alternatives, is also reinforcing adoption As safety profiles and outcomes continue to improve through material innovation, synthetic implants are expected to retain their leadership position within the nasal implant market.

The hospitals segment is anticipated to hold 52.3% of the nasal implant market revenue share in 2025, making it the leading end-use category. This dominance is being driven by the concentration of advanced surgical infrastructure, skilled specialists, and access to comprehensive patient care within hospital settings. Hospitals are increasingly preferred by patients undergoing both reconstructive and cosmetic nasal procedures due to the availability of multidisciplinary care, postoperative monitoring, and advanced imaging technologies that support precise planning and execution.

The ability of hospitals to handle complex trauma cases, congenital deformities, and revision surgeries further strengthens their position as primary treatment centers. Rising healthcare expenditure and investments in expanding hospital facilities in both developed and emerging markets are accelerating adoption of nasal implants within this segment.

Additionally, hospitals are at the forefront of clinical research and innovation, adopting new biomaterials and minimally invasive techniques faster than smaller healthcare facilities With patient trust in hospitals for safety, quality, and outcomes remaining high, this segment is expected to maintain its leadership in the nasal implant market.

Nasal implant or nose sculpting refers to augmentation of the nasal bridge or covering the concave deformities in the injured or asymmetrical nose. Nasal implants are used in nasal surgery to provide a symmetrical shape and other cosmetic requirements.

The materials for nasal implants may include metal, ceramics, and polymers such as silicone, polyethylene, PTFE, polyesters and polyamides. Implants used for nasal reconstruction may be difficult to choose but are an important component in patient’s care. Due to the central location of nose even small defects in reconstruction can be evident.

The reason behind the rise in the number of nasal reconstruction procedures is directly related to the psychological need of the patient. However, in many cases, there has been significant help for the patients with damaged nose during traumatic injuries.

Drug-remitting nasal implants, which are biodegradable in nature are advanced implants with significant benefits. The nature of the implant of degrading naturally has over shadowed the use of metallic and other synthetic implants. Nevertheless, additional research is expected to develop new natural forms of nasal implants, which in turn is expected to favor the market in near future.

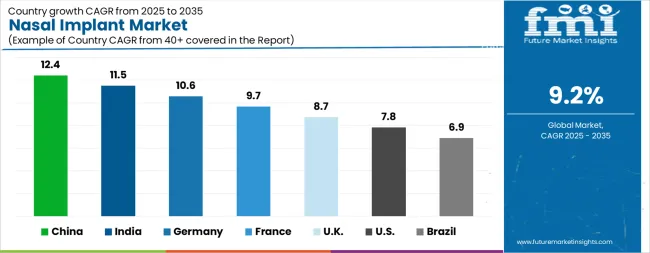

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The Nasal Implant Market is expected to register a CAGR of 9.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.4%, followed by India at 11.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.9%, yet still underscores a broadly positive trajectory for the global Nasal Implant Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.6%. The USA Nasal Implant Market is estimated to be valued at USD 471.4 million in 2025 and is anticipated to reach a valuation of USD 1.0 billion by 2035. Sales are projected to rise at a CAGR of 7.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 70.2 million and USD 36.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Material | Synthetic, Metal (Titanium), Ceramics, Polymers (Silicone, Polyethylene, Ptfe, Polyesters And Polyamides), Biological, Autograft, Xenograft, Allograft, and Alloplast |

| End User | Hospitals, Ambulatory Surgical Centers, and Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

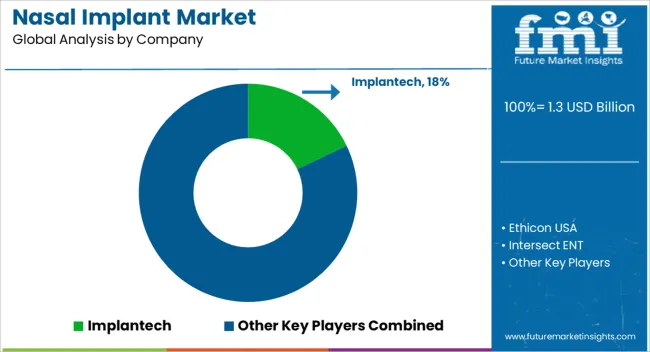

| Key Companies Profiled | Implantech, Ethicon USA, Intersect ENT, Stryker, Zimmer Biomet, Sientra, Matrix Surgical USA, Koken, and Wanhe Plastic Material |

The global nasal implant market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the nasal implant market is projected to reach USD 3.2 billion by 2035.

The nasal implant market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in nasal implant market are synthetic, metal (titanium), ceramics, polymers (silicone, polyethylene, ptfe, polyesters and polyamides), biological, autograft, xenograft, allograft and alloplast.

In terms of end user, hospitals segment to command 52.3% share in the nasal implant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Implantable Tibial Neuromodulation Market Forecast and Outlook 2025 to 2035

Implant-Borne Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Implantable Collamer Lens Market Size and Share Forecast Outlook 2025 to 2035

Implantable Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nasal Congestion Treatment Devices Market Analysis Size and Share Forecast Outlook 2025 to 2035

Implantable Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Implantable Drug Eluting Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Packing Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Polyposis Treatment Market - Drug Innovations & Demand 2025 to 2035

Nasal Antihistamines Market – Growth & Forecast 2025 to 2035

Nasal vaccines Market

Nasal Sampling Lines Market

Nasal Oxygen Cannula Market

Implantable Drug Infusion Pumps Market

Preimplantation Genetic Testing Market Size and Share Forecast Outlook 2025 to 2035

Bio-Implants Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Intranasal Corticosteroids Market Analysis – Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA