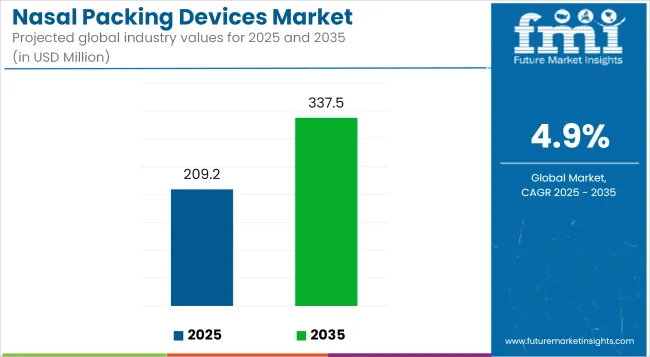

The Nasal Packing Devices Market is anticipated to be valued at USD 209.2 million in 2025 and is expected to reach USD 337.5 million by 2035, registering a CAGR of 4.9%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 209.2 Million |

| Projected Market Size in 2035 | USD 337.5 Million |

| CAGR (2025 to 2035) | 4.9% |

This market is experiencing significant growth, propelled by the increasing prevalence of chronic sinusitis, epistaxis, and the rising number of ENT surgeries. Advancements in bioresorbable materials and patient-friendly designs are enhancing postoperative care, leading to broader adoption in both hospital and outpatient settings. The shift towards minimally invasive procedures and the emphasis on patient comfort are further driving demand. Manufacturers are focusing on developing absorbable, antimicrobial, and drug-eluting nasal packs to reduce complications and improve healing outcomes.

The market is also benefiting from the expansion of healthcare infrastructure in emerging economies, coupled with increased awareness of nasal health. These factors collectively contribute to a positive outlook for the market, with sustained growth anticipated in the coming years.

Prominent players in the Nasal Packing Devices Market include Medtronic, Smith & Nephew, Stryker, Summit Medical, and Lohmann & Rauscher. These companies are at the forefront of innovation, focusing on developing advanced nasal packing solutions that enhance patient comfort and clinical outcomes. Key activities influencing market growth encompass the introduction of bioresorbable materials, antimicrobial coatings, and drug-eluting technologies.

In Oct 2024, Aptar Pharma, announces that it has acquired all device technology assets from the proprietary portfolio of SipNose Nasal Delivery Systems, a company focused on intranasal delivery platforms for local, systemic and central nervous system indications.

“Our nasal systems’ proven capabilities have brought added value to our customers and further convenience for patients worldwide for over 30 years, As the nasal market looks to develop new drugs to address unmet patient needs, this transaction will enhance Aptar’s portfolio of nasal drug delivery systems with a focus on CNS diseases.” Said Alex Theodorakis, President Aptar Pharma Prescription.

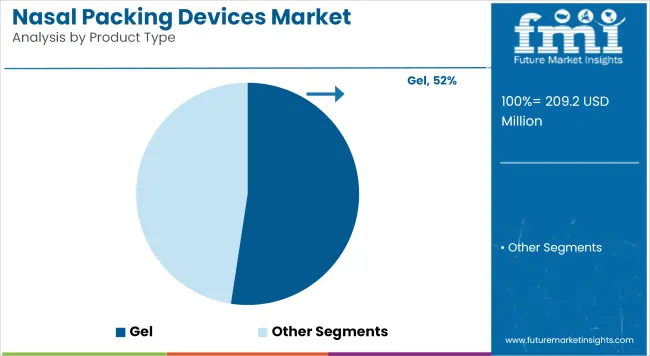

The gel-based product segment has emerged as the market leader, capturing 52.4% revenue share in 2025, owing to its enhanced usability and patient-centric features. This segment has been favored due to its ability to provide superior hemostasis, effective mucosal adhesion, and minimal post-operative trauma.

Unlike traditional packs, gels reduce the risk of tissue damage upon removal and significantly improve patient compliance. The segment’s growth has also been driven by the rising number of ENT procedures, wherein clinicians prefer gel formulations for ease of application and improved outcomes.

Additionally, clinically documented evidence from ENT specialists and surgical practitioners has validated the efficacy of gel nasal packing in managing epistaxis and post-surgical bleeding. Increased R&D investments by medical device manufacturers have resulted in formulations that offer biocompatibility, sustained drug release, and resorbability, further enhancing its appeal. The integration of antimicrobial agents into gel compositions has also contributed to its widespread acceptance, particularly in outpatient and minimally invasive settings.

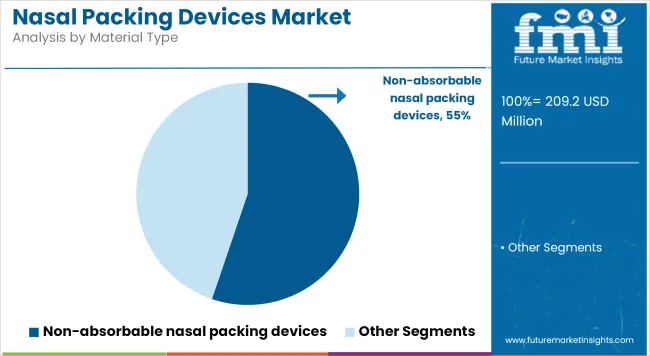

The non-absorbable segment accounts for the largest share of 55.2% in the nasal packing devices market in 2025, largely attributed to its affordability, availability, and reusability in clinical practice. This segment has remained dominant due to strong acceptance in hospital and surgical settings, where precision and post-surgical inspection are critical. Surgeons have continued to prefer non-absorbable packs for their structural integrity, which ensures effective nasal cavity support during the healing phase.

Furthermore, non-absorbable materials, typically composed of polyvinyl alcohol (PVA) and silicone-based compounds, have demonstrated high tolerance and minimal adverse reactions. Their predictable performance in preventing post-operative adhesion and maintaining septal alignment has sustained demand.

In cost-sensitive healthcare systems, especially in developing regions, these devices offer a favorable price-performance ratio, further driving adoption. Although bioresorbable alternatives are growing, the familiarity among ENT professionals, coupled with ease of removal and strong clinical outcomes, has reinforced the position of non-absorbable materials as the preferred choice for many procedural workflows.

Patient Discomfort, Risk of Adhesion, and Limited Reimbursement

Nasal packing devices market is still ongoing challenges related to patient discomfort, especially due to rigid or non-absorbable nasal packs that result in pain, mucosal injury, or synechiae formation upon removal. Moreover, factors like no standardized regimens for post-operative care and the heterogeneity in ENT surgical techniques further exasperate both product choice and clinician uptake.

Lack of coverage by reimbursement programs, especially for new bioresorbable technologies and in-office practices, is a limitation associated with reforming healthcare systems. Other factors leading to the complication rate include infection risk and user compliance with care after packaging.

Bioabsorbable Materials, Minimally Invasive ENT Procedures, and Outpatient Expansion

Combined with these disadvantages, the industry is positioned to expand by means of improvements to bioabsorbablehemostatic nose packing gadgets available with less patient distress, antimicrobial features, and don't require removal. Novel chitosan-based sponges, hyaluronic acid-releasing tampons, and shape-memory foam are among those improving clinical outcomes after surgery (septoplasty, FESS, turbinate reduction).

The growth of day-care ENT procedures, wider application of nasal endoscopes, and broader use of ambulatory surgical centers (ASCs) provide new platforms for growth. Other trends such as the incidence of sinusitis, nasal trauma, and cosmetic rhinoplasties drive procedural volumes globally.

The United States nasal packing devices market is entering in a very rapid growth phase by predominately supported with the growing prevalence of epistaxis (nosebleeds) among the population, rise in ENT procedures and high rate of chronic sinusitis and nasal surgeries.

Growing population base with the need for ENT specialists and better access to these specialists results in an increase in demand for absorbable and non-absorbable nasal packing solutions. Technology is making product lines richer with drug-eluting, biodegradable, hemostatic. In addition, rising patient volume of outpatient ENT procedures is propelling adoption of easy-to-use nasal packing kits in ambulatory facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

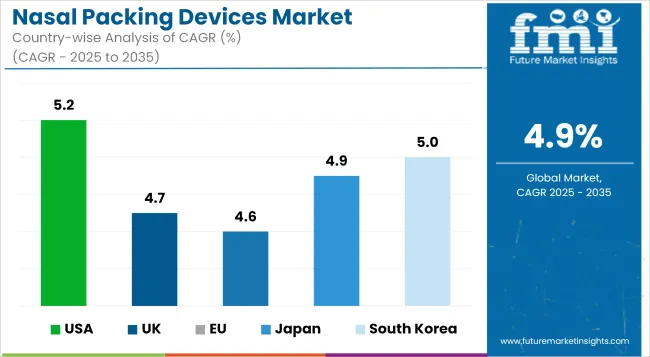

| USA | 5.2% |

The UK nasal packing devices market has moderate growth owing to NHS uptake of minimally invasive ENT procedures and growing application of nasal packing in trauma care and elective nasal surgeries.

Increasing awareness of post- operative care and rising usage of absorbable nasal packs in sinus and septoplasty therapies propel the market growth. Also, clinician preference for devices that are low-irritation and antimicrobial-coated is becoming a factor in hospital purchasing decisions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Germany, France and Netherlands have developed otolaryngology practice in these countries and a rising trend towards growth in the EU Nasal Packing Devices market. Additionally, major application segments are about ENT procedures, supported by chronic rhinitis, deviated septum, and nasal polyps.

Several packing manufacturers are ensuring compliance with stringent regulations under MDR to promote adoption of biocompatible and CE-marked packing materials. Instead of gauze, clinics and hospitals are choosing packing devices that are comfort-based, anti-adhesion and bioabsorbable to reduce the need for follow-ups.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.6% |

The Japan nasal packing devices market is gaining steady momentum due to increasing adoption of ENT surgeries by its elderly people along with rising awareness regarding minimally invasive treatment procedures.

Japanese healthcare units prefer small, high absorption, and painless removal penetrable nasal packs. Domestic companies are seeking antimicrobial or anti-inflammatory coated versions that promote post-surgical recovery and patient comfort.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

In South Korea, the nasal packing devices market is booming, owing to the amalgamation of aesthetic nasal surgeries (like rhinoplasty), a prevalence of allergic rhinitis, and fast-paced healthcare modernization.

Increasing use of advanced, sponge based and biodegradable nasal packing systems in ENT clinics and tertiary care hospitals. Local manufacturing of affordable and innovative nasal packs is also strengthening the domestic supply chain of the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The global nasal packing devices market is anticipated to be driven by growing prevalence of nasal surgeries (septoplasty, FESS), epistaxis (nosebleed), and sinusitis. Nasal packing devices are used to control bleeding, stabilize the nasal cavity, prevent adhesions, and improve healing after surgery.

The factors contributing to this rise in market growth include growing ENT procedures, increasing demand for absorbable and biocompatible materials, innovations in hemostatic agent technology, and expanding outpatient ENT clinics.

The market is segmented into Injectable, Gel, Spray, and Dressings.

The market is segmented into Bio-Resorbable and Non-Absorbable.

The Nasal Packing Devices Market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and the Middle East & Africa.

The overall market size for nasal packing devices market was USD 209.2 million in 2025.

The nasal packing devices market is expected to reach USD 337.5 million in 2035.

Increasing cases of chronic sinusitis and nasal surgeries, rising preference for minimally invasive ENT procedures, and growing use of absorbable nasal packing materials will drive market growth.

The top 5 countries which drives the development of nasal packing devices market are USA, European Union, Japan, South Korea and UK.

Bio-resorbable expected to grow to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nasal Congestion Treatment Devices Market Analysis Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Implant Market Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Packing Paper Market Size, Share & Forecast 2025 to 2035

Packing Boxes Market Trends - Growth & Forecast 2025 to 2035

Packing Belt Market Insights - Growth & Forecast 2025 to 2035

Nasal Polyposis Treatment Market - Drug Innovations & Demand 2025 to 2035

Nasal Antihistamines Market – Growth & Forecast 2025 to 2035

Competitive Landscape of Packing Tape Providers

Competitive Landscape of Packing Paper Providers

Europe Packing Tape Market Trends & Growth Forecast 2024-2034

Nasal vaccines Market

Nasal Sampling Lines Market

Nasal Oxygen Cannula Market

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Intranasal Corticosteroids Market Analysis – Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA