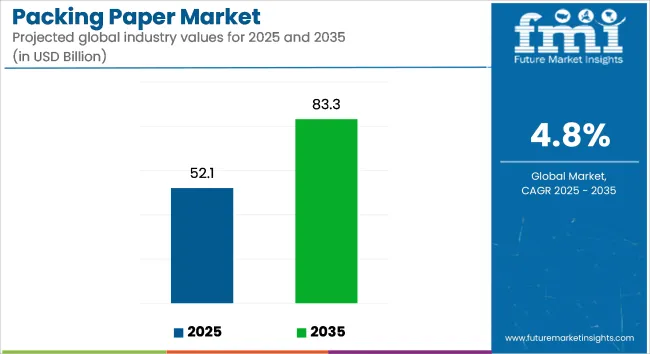

The packing paper market is projected to grow from USD 52.1 billion in 2025 to USD 83.3 billion by 2035, registering a CAGR of 4.8% during the forecast period. Increased reliance on e-commerce and growing demand for recyclable, protective wrapping in food, apparel, and electronics sectors have contributed to the rise in packing paper usage.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 52.1 billion |

| Projected Market Size in 2035 | USD 83.3 billion |

| CAGR (2025 to 2035) | 4.8% |

Cost advantages, improved barrier properties, and lightweight features have supported adoption. Manufacturers have responded to sustainability mandates and brand customization needs by shifting from plastic-based packaging toward kraft and unbleached paper alternatives. Demand from Asia-Pacific and North America is expected to remain dominant, driven by rising exports and fast-moving consumer goods (FMCG) consumption.

In April 2025, Mondi, a global leader in the production of sustainable packaging and paper, has completed the acquisition of the Western Europe assets of Schumacher Packaging, expanding the product range, capacity and innovation available to customers demanding high-performance, sustainable packaging at scale. “This acquisition significantly strengthens our corrugated packaging business, extending our footprint in Western Europe and offering strong vertical integration opportunities.

We are delighted to welcome our new Schumacher Packaging colleagues to Mondi. Together we will expand our e-commerce and FMCG offering, particularly in Western Europe, presenting exciting opportunities to introduce the Group’s unique range of products to a wider array of customers as they increasingly transition towards more sustainable packaging solutions” says - Andrew King, Mondi Group Chief Executive Officer.

Technological innovations in pulp processing and barrier coating have enabled the development of packing papers with superior strength and moisture resistance. Companies are investing in water-based inks, recyclable films, and zero-plastic coating lines to meet customer sustainability expectations.

Enhanced biodegradability and compliance with EU circular packaging goals have accelerated commercial use in foodservice, retail, and direct-to-consumer sectors. Machine learning integration has streamlined material usage and reduced energy inputs. The rise in private-label food and beverage brands has intensified the need for economical and sustainable outer packaging.

Expansion in logistics, pharmaceuticals, and personal care sectors is anticipated to drive long-term demand for flexible, compliant packing papers. Global regulations promoting eco-safe transit packaging are expected to boost innovation in hybrid paper formats.

Investments in AI-driven design, supply chain integration, and region-specific sourcing strategies will remain priorities for market leaders. The industry’s ability to balance regulatory mandates with cost-effective customization is projected to shape competitive advantage. New market entrants and regional players are anticipated to explore cost-effective raw material sourcing and value-added services to gain competitive leverage.

The market is segmented based on material type, paper type, end-use industry, and region. By material type, the market includes virgin fiber paper, recycled paper, bleached paper, unbleached paper, and coated paper. In terms of paper type, the market is categorized into kraft paper, newsprint paper, tissue paper, corrugating medium paper, VCI (volatile corrosion inhibitor) paper, and waxed packing paper.

By end-use industry, the market comprises food & beverage, electronics, automotive parts, industrial equipment, e-commerce & retail, pharmaceuticals, and household goods. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

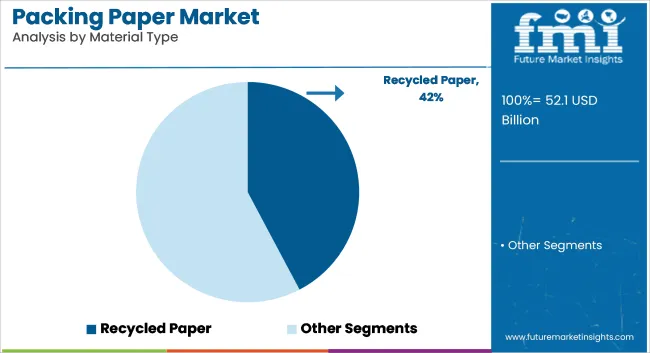

Recycled paper has been projected to dominate the packing paper market with a 42.3% share in 2025, supported by growing demand for environmentally responsible materials. Used widely in protective wraps, inner liners, and crumpled fill, recycled paper has been favored across global supply chains.

Cost benefits over virgin fiber alternatives have enhanced its appeal for high-volume applications. Emissions reduction and waste diversion goals have been aligned with increased recycled paper use. Packaging converters have utilized post-consumer fiber streams to produce standardized roll stock for shipping and wrapping.

Mechanical and chemical pulping processes have been refined to improve fiber quality and sheet strength. Printability and compatibility with water-based inks have been maintained, enabling branding without chemical-laden coatings. Lightweight yet durable formats have reduced freight costs while ensuring package integrity.

Retailers and fulfillment centers have scaled usage of recycled packing paper for cushioning and void fill. Ease of disposal and consumer preference for recyclable materials have enhanced brand value. Regulatory incentives and green procurement policies have also supported procurement from certified recycled sources.

Investments in local recycling infrastructure have ensured regional sourcing and lower lead times. Packaging paper made from recycled fiber has been optimized for e-commerce, electronics, and fragile goods. Developments in multi-ply and reinforced grades have allowed broader industrial adoption. Molded pulp components and interleaf sheets have increasingly replaced foam-based alternatives. Recycled paper’s dominance is expected to grow further as circular economy initiatives intensify globally.

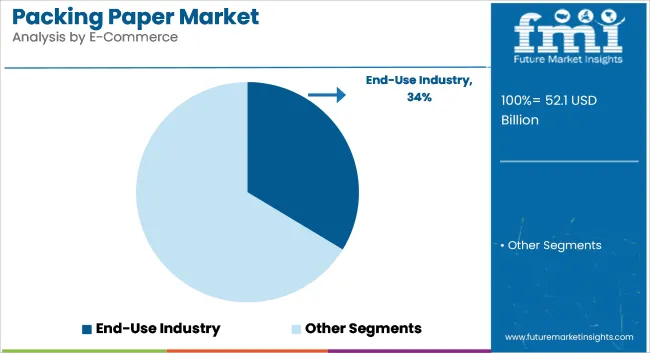

The e-commerce and retail segment has been estimated to contribute 33.7% of the global packing paper demand in 2025, led by growth in direct-to-consumer shipments. Wrapping paper, kraft rolls, and tissue-based fillers have been widely adopted for package protection and branding. Consumer expectation for recyclable and plastic-free packaging has shaped product selection.

Omni channel retailers have prioritized efficient, recyclable packing materials to align with ESG benchmarks. Fulfillment centers have deployed automated paper dispensing systems integrated with recycled roll stock. Protective wraps made from kraft and recycled papers have been used for void fill, surface protection, and product separation. Paper’s clean and tactile feel has enhanced unboxing experiences across lifestyle, fashion, and electronics categories. Recyclability has improved post-consumer recovery rates, helping brands meet EPR and sustainability targets.

Retailers have also customized packing paper with logos, care instructions, or promotional content. Unbleached and naturally textured finishes have aligned with minimalist and eco-conscious branding trends. In-store packaging strategies have mirrored e-commerce practices, ensuring unified brand presentation.

Light-weighting and efficient cube utilization have supported operational efficiency across fulfillment centers. Packaging design for returns and exchanges has included repack-friendly paper wraps and sleeves. Seasonal and campaign-specific rolls have enabled scalable customization without plastic lamination. As e-commerce volumes grow and retail becomes more packaging-intensive, the segment is expected to sustain its lead. Strategic partnerships between retailers and converters are likely to drive further innovation in paper-based protective packaging.

The growth of the packing paper market has been hampered by fierce competition from flexible plastic packaging.

Plastic packaging that can bend provides a major advantage to manufacturers and retailers regarding shipping and warehousing costs. This can reduce the overall weight of packaging, thereby enabling manufacturers and retailers to create more space.

With retort pouches, consumers can enjoy convenient features such as convenient single-serve portions, easy-to-open, and easy-peel formats. In addition, food tastes better in retort pouches than in traditional tin cans.

The overall packaging cost of flexible packaging is 40% less than rigid packaging. This results in a 50% reduction in landfill waste and a 62% reduction in greenhouse gas (GHG) emissions. Consequently, many product packaging manufacturers and package converters are opting for flexible packaging materials because of their ease of use, portability, cost savings, and health benefits.

Increasingly, modern shoppers are considering convenience and portability as top priorities, so packaging design has shifted toward flexible, easy-to-handle packaging. The gusseted flexible pouch is now the packaging of choice for snacks that were once packaged in jars and tins. In addition to food producers and nutraceutical packagers, flexible pouches are also well-suited to gels and liquids.

A company has already closed its wood yard and pulp mill in Port Hudson, LA. This was due to concerns around the environment, which included depleting forests, which certainly was not required. This has been one of the factors limiting the development of the paper packaging market.

Market Opportunities in the Packaging Paper Market are associated with the replacement of plastic packaging for food applications in developing countries.

Globally, India and China have the fastest-growing economies. Developmentally, developing countries still use a great deal of plastic packaging compared to the developed nations of the west. Since plastic is cost-effective and convenient for consumers, it is the perfect material for packaging.

Companies are slowly moving towards providing paper and carton packaging solutions in light of increasing environmental concerns and stringent government policies. A great deal of effort has been put into innovation in order to develop cost-efficient products with similar utility and added benefits to the consumer.

Researchers at the Fraunhofer-Gesellschaft have developed a paper packaging coating that incorporates bioactive materials as part of the BioActiveMaterials project. Not only does this coating reduce plastic use, but the coating of plant-based proteins and waxes also increases the shelf life of the food.

After use, the packaging can be placed in the waste paper recycling bin for disposal. In the BioActiveMaterials project, researchers use paper as the base material for producing typical and functional packaging materials: resealable bags or wrapping paper. The paper is provided with a special coating using standard processes.

Paper packaging gains momentum with a ban on lightweight plastic bags" Comparatively to other materials such as metals and plastics, paper packaging materials can be reused and recycled. As a result, paper packaging is among the most environmentally friendly and economical packaging options.

As consumers become more aware of plastic's harmful effects on the environment, the global paper packaging market is experiencing a rising demand for flexible paper packaging. The ban on lightweight plastic bags in some countries during the forecast period is expected to drive demand for paper packaging. Corrugated boxes and cartons are expected to experience continuous growth in demand in the coming years.

Due to the growing demand for packaging in key end-use industries such as food & beverage, electrical & electronics, and e-commerce, there is expected to be significant growth in the demand for corrugated boxes and cartons during the forecast period.

The cost-effectiveness and optimum protection characteristics of corrugated boxes and cartons are key factors driving the global paper packaging market. There is widespread use of paper packaging as a secondary and tertiary packaging solution for products in a variety of industries.

As online shopping becomes increasingly popular in developed and developing countries like Germany, the USA, India, and China, paper packaging demand is expected to grow significantly over the next four to five years.

Moreover, with the rise in online shopping platforms, other flexible paper packaging solutions, such as corrugated boxes, folding cartons, and other paper-based packaging products that offer optimal protection during shipping and handling, will also gain a strong foothold in the global paper packaging market.

Packaging made from paper can be recycled easily and does not pose a threat to the environment. With the global push for recycling in the paper packaging industry, recycling businesses across the globe will have enormous opportunities. In addition, recycled paper packaging offers distinct cost advantages for the production of corrugated boxes, cartons, and other paper packaging solutions.

Declining hardwood pulp and lumber production markets in the USA have led to decreased demand for boxboard, hardwood pulp derivatives, and other goods made of hardwood pulp.

The paper packaging materials market in North America and Europe has experienced significant growth due to increased paper packaging use. North America and Europe accounted for over half the global demand for paper packaging materials.

Because of the growth in the overall packing industry in the region, the Asia Pacific market will continue to show the fastest growth for paper packaging in the coming years.

A significant market share of the packing paper market is expected to be gained by the roW during the forecast period due to the emerging packaging industry in these regions and increased per capita spending by consumers. Further growth in demand and consumption for consumer goods will drive the need for more paper packaging market throughout the world.

In addition to China, Japan, South Korea, and the Rest of East Asia, the paper packaging market in East Asia provides a country-level analysis. Among the paper packaging markets in East Asia, East Asia holds the largest share in terms of value. Paper packaging in East Asia is expected to grow at a CAGR of 4.2% during the forecast period.

The North American and European market is steady, as they are considering switching to 100% paper to avoid deforestation. Africa could still boast of dense forests. The paper packaging thing hasn’t reached its full potential yet.

India and China have the fastest-growing economies. Developmentally, developing countries still use a great deal of plastic packaging compared to the developed nations of the west. Since plastic is cost-effective and convenient for consumers, it is the perfect material for packaging.

Companies are slowly moving towards providing paper and carton packaging solutions in light of increasing environmental concerns and stringent government policies. A great deal of effort has been put into innovation in order to develop cost-efficient products with similar utility and added benefits to the consumer.

Georgia Pacific announced recently that it is leaving its paper business and will shut down all its paper machines permanently. Another company has already closed its wood yard and pulp mill in Port Hudson, LA.

This was due to concerns around the environment, which includes depleting forests.

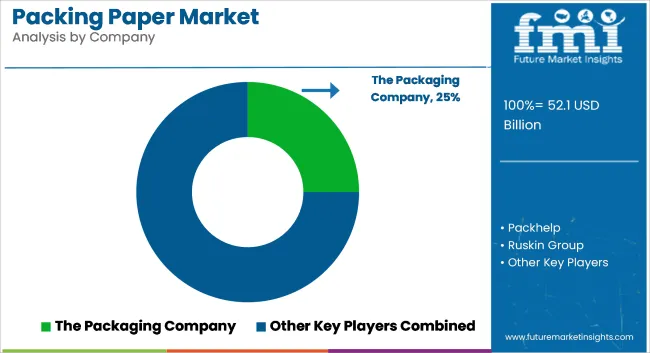

A number of notable players are operating in the global cardiac reconstruction devices market, including The Packaging Company, Packhelp, Ruskin Group, Purple Co, Moraya Packaging, Pratt Industries, Inc., Mondi Group plc, WestRock Company, Oji Holdings Corporation, DS Smith Packaging Limited, Tat Seng Packaging Group.

Recent Developments in the Packing Paper Market

The packing paper market is projected to have a CAGR of 4.8% during the forecast period.

The Europe is the leading region, with an anticipated CAGR of 4.9% through 2035.

The cosmetic segment leads the market with the projected CAGR of 33.7% through 2035.

The packing paper market is predicted to grow to USD 83.3 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Packing Paper Providers

Meat Packing Paper Market Trends & Industry Growth Forecast 2024-2034

Honeycomb Packing Paper Market Analysis – Growth & Trends 2024-2034

Packing Boxes Market Trends - Growth & Forecast 2025 to 2035

Packing Belt Market Insights - Growth & Forecast 2025 to 2035

Competitive Landscape of Packing Tape Providers

Europe Packing Tape Market Trends & Growth Forecast 2024-2034

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Case Packing Machines Market from 2025 to 2035

Tray Packing Machine Market

Nasal Packing Devices Market Size and Share Forecast Outlook 2025 to 2035

Tablet Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Tablet Packing Machine Industry

Leading Providers & Market Share in Powder Packing Machines

Garment Packing Machine Market Trends & Forecast 2024-2034

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Industry Share Analysis for Compression Packing Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA