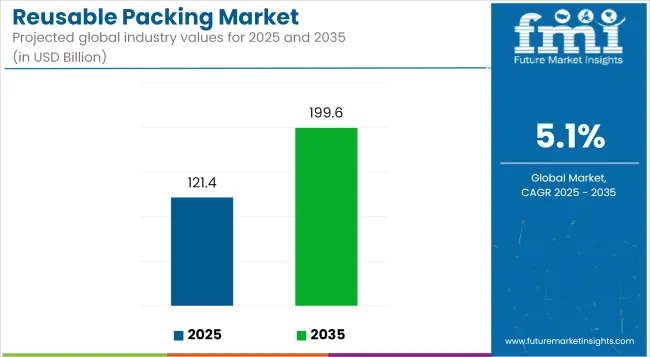

The reusable packing market is projected to grow from USD 121.4 billion in 2025 to USD 199.6 billion by 2035, registering a CAGR of 5.1% during the forecast period. Sales in 2024 reached USD 115.5 billion. The rise in industrial automation, combined with growing e-commerce logistics, has boosted the adoption of reusable transit solutions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 121.4 billion |

| Projected Market Size in 2035 | USD 199.6 billion |

| CAGR (2025 to 2035) | 5.1% |

Lightweight, durable materials and advanced folding mechanisms have been integrated to streamline return cycles. Retailers and FMCG sectors have adopted bulk containers and reusable totes to minimize single-use plastic waste. Standardization of crate dimensions for warehouse robotics has further strengthened product demand.

In November 2024, ORBIS to Showcase Reusable Packaging Products that Play a Pivotal Role in Optimizing Supply Chains at PACK EXPO International 2024. “At ORBIS, we recognize that a better way to a more sustainable supply chain starts with reusable packaging” said Lynn Hediger, vice-president of product management.

“Our integrated portfolio of products and solutions enhance supply chain efficiency and sustainability-driven ROI. We’re excited to showcase our commitment to demonstrating what a more efficient, sustainable and resilient supply chain looks like for our customers and how it can greatly benefit their business while also serving a greater good.”

Strong demand for closed-loop logistics, coupled with legislation limiting single-use packaging, is expected to create sustained growth opportunities for reusable packing providers. Market expansion is projected to continue in cold chain applications, particularly for pharmaceuticals and perishables.

Digital tracking tools and blockchain integration are forecast to become standard in reusable asset management. Long-term contracts with manufacturers, retailers, and 3PLs are being signed to stabilize container rotations and reduce loss rates. Regional governments are expected to offer incentives for circular packaging practices, fueling further adoption.

Sustainability mandates and corporate net-zero roadmaps have played a crucial role in shaping innovation within the reusable packing market. Emphasis has been placed on lightweight polymer compositions that resist degradation during multiple use cycles.

Machine-washable, collapsible crates and pallets have been engineered to reduce both logistics costs and material waste. Integration of smart labels and IoT tags has enhanced product traceability across return loops.

Carbon tracking systems have been embedded to align with ESG reporting metrics. Modular component replacements have been developed to extend lifespan and lower maintenance overheads. Partnerships between packaging firms and retailers have accelerated innovation in rental-based reusable solutions. These product designs have been tailored for high-density shipping and compatibility with robotic material handling.

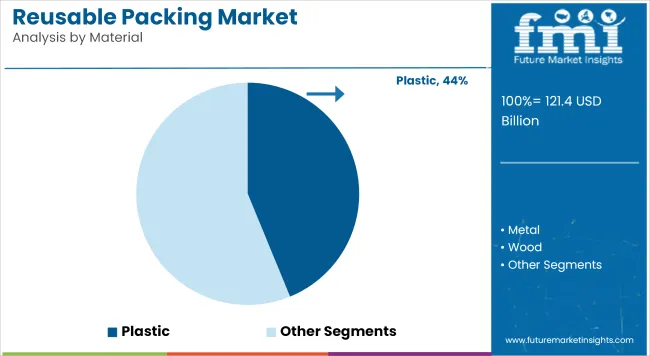

The market is segmented based on material, product type, end-use industry, distribution channel, and region. By material, the market includes plastic, metal, wood, glass, foam, textile/fabric, and composite materials. In terms of product type, the market is categorized into pallets, crates, dunnage, intermediate bulk containers (IBC), boxes, drums & barrels, reusable bags & sacks, and trays & racks.

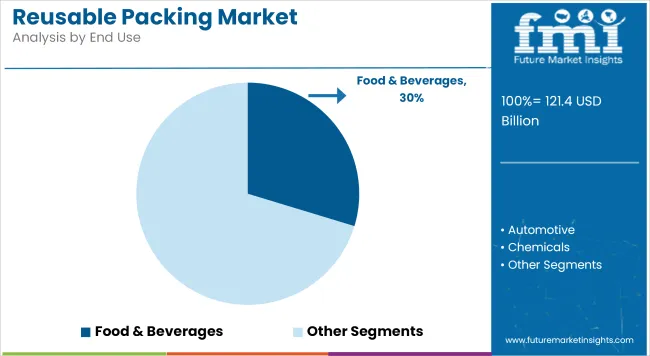

By end-use industry, the market comprises food & beverages, automotive, chemicals, building & construction, pharmaceuticals, logistics & transportation, consumer durables, retail & e-commerce, and agriculture.

Based on distribution channel, the market is segmented into direct-to-business (B2B), third-party logistics providers (3PLs), and reusable packaging pools (e.g., CHEP, IFCO). Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Plastic has been estimated to account for 43.8% of the global reusable packaging market in 2025, due to its combination of durability, low weight, and mold ability. High-density polyethylene (HDPE), polypropylene (PP), and PET have been predominantly used for crates, pallets, bins, and containers.

These materials have enabled long service life and easy cleaning, making them ideal for circular supply chains. Plastic packaging has been designed to withstand repeated handling and stacking stress. The use of plastic in reusable formats has reduced single-use waste and improved handling efficiency across logistics hubs and warehouses.

Interlocking features, RFID tagging compatibility, and weather resistance have added to their appeal. Design innovations such as foldable totes and collapsible crates have been deployed to save reverse logistics costs. Food-safe plastic containers have ensured hygienic transport for perishables and beverages.

Plastic reusable packaging has been preferred across both automated and manual loading operations. Standardized footprints and stack ability have facilitated integration into conveyor and shelving systems. Due to its recyclability, post-consumer and post-industrial plastic content has been increasingly adopted in manufacturing.

Sustainability certifications have been applied to plastic-based systems to support brand goals. With advancements in material blends and reinforcements, impact-resistant and antimicrobial plastics are being introduced for sensitive applications.

The shift to circular packaging models in retail and B2B supply chains has further accelerated adoption. Plastic's reusability has aligned with cost-saving goals and ESG compliance strategies. As a result, plastic is expected to remain the dominant material type in the reusable packaging segment.

The food & beverages sector has been projected to hold 29.7% of the reusable packaging market share in 2025, owing to high-volume product movement, perishability, and hygiene requirements. Reusable crates, bins, and pallets have been widely employed for produce, bakery items, meat, dairy, and bottled beverages.

Returnable packaging has ensured product safety, temperature control, and contamination prevention across cold chains. Compliance with food-grade standards has been consistently met through washable and sanitized systems.

Retail grocers, food processors, and beverage bottlers have adopted reusable packaging to reduce plastic waste and streamline backhaul logistics. Closed-loop systems have enabled consistent crate rotation, especially for short-distance and regional supply chains. The adoption of barcoded and RFID-enabled containers has enhanced traceability. Ease of stacking and handling has reduced labor costs and product damage.

With the rise in online grocery and meal kit delivery, reusable totes and bins have gained importance in warehouse-to-doorstep models. Reusable beverage crates and racks have been used to transport water, soda, and beer efficiently across distribution centers and retail shelves.

Return programs and deposit systems have supported crate recovery in urban and rural zones. These systems have been optimized for temperature control and operational sustainability. Going forward, regulatory policies targeting single-use packaging are expected to further promote reusable formats across the F&B value chain.

Innovation in modular, insulated, and tamper-evident packaging designs is being prioritized. Regional co-ops and retailer partnerships have supported shared container pools. As consumption volumes and sustainability expectations increase, the food and beverage sector is set to lead reusable packaging demand globally.

High Initial Costs and Reverse Logistics Complexity

High setup cost of durable containers, tracking equipment, and cleaning facilities is limiting market growth. The major challenges include the complication in terms of reverse logistics in the metropolitan last-mile and global shipping as collection of reusable packaging entails logistical, operational and environmental expenses. Moreover, the lack of standardisation in packaging formats and conflictual regulatory guidelines on reuse versus recyclability can result in confusion amongst consumers and corporations alike.

Sustainability Mandates, Circular Economy Momentum, and Smart Tracking Technologies

Growing pressure to eliminate single-use plastics and achieve corporate ESG objectives is driving the transition to reusable packaging systems throughout retail, foodservice, logistics, e-commerce, and industrial applications. Improvements in intelligent RFID/NFC tracking, collapsible pack design, antimicrobial protection and blockchain-traceability are improving system performance.

Public-private partnerships are paving the way to adoption at scale with city-wide reuse models and subscription-return logistics. The rise of conscious consumers, especially Gen Z and Millennials also is driving demand for reuse-based business models.

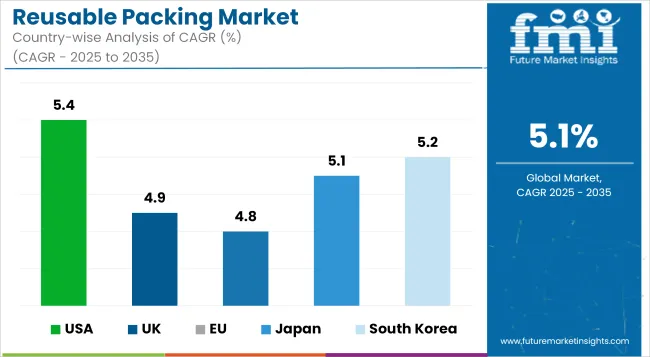

The United States reusable packing market is booming at a robust pace, supported by increasing sustainability pledges made by big box retailers, logistics companies, and food delivery services. Corporate-Companion: Eliminating harmful single-use plastics through durable, reusable containers and totes to reduce environmental impact and meet ESG expectations.

Audiences are growing especially in e-commerce, where reusable shipping boxes, insulated delivery bags and collapsible crates are being adopted to reduce packaging waste. Startups with closed-loop packaging systems for online orders are also becoming popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

Environmental directives banning single-use packaging and a growing consumer base that back affordable eco-friendly substitutes drive the steady momentum of UK's Reusable Packing industry. Supermarkets, restaurant chains and fashion retailers are testing reusable packaging schemes including returnable delivery boxes and refill pouches.

Government support for circular economy initiatives and investments in reuse infrastructure (such as reverse logistics and washing centers) are driving adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

Underpinned by an ambitious framework of sustainability legislation, the EU reusable packing market is consistently growing; the EU packaging waste directive, a cornerstone agreement currently under discussion, as well as the EU circular economy action plan, opened a pathway towards a circular economy, which facilitates in-depth development of the EU reusable packing market.

Germany, France, and the Netherlands are widely recognized leaders in reusable packaging systems, featuring widely used systems in beverage, foodservice, and retail logistics. Disposable bags, cups and containers are being replaced with reusable plastic crates, pallets, kegs and containers in B2B supply chains, while reuse platforms that directly touch the consumer are sprouting up across the grocery and meal-kit delivery industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.8% |

The Japan market for reusable packing remains in upward trajectory, aided by the countries deep-rooted culture of cleanliness, efficiency and waste management. Reusable containers used in retail, food delivery, and electronics logistics are on the rise to curb packaging waste in a densely populated society.

As a result, some retailers and logistics companies are developing new stackable, space-saving, RFID-enabled reusable containers that allow for better traceability and turnaround efficiency. Reusable packaging standards are part of public-private partnerships among industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The South Korean reusable packing market is quickly gaining momentum, propelled by a combination of increasing environmental consciousness, urban density, and strict government regulations on plastic waste. To help minimize waste, e-commerce behemoths and food delivery services are working towards reusable packaging systems to boost their corporate image and live up to national zero-waste targets.

Reusable insulated bags, containers for takeout, and sturdy transport crates are becoming more commonplace. South Korea’s advances in smart logistics and automation are also aiding the scaling of returnable packaging systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The reusable packing market is growing rapidly as corporations and consumers alike are focusing on sustainability, circular economy efforts, and waste reduction. Across e-commerce, food & beverage, retail, industrial shipping, and logistics, reusable packing solutions are becoming the e-qual to single-use packaging, durable, returnable, and cost-efficient. The key growth drivers include corporate ESG initiatives, a regulatory ban on single-use plastics, and rising consumer awareness regarding sustainable consumption.

Other Key Players

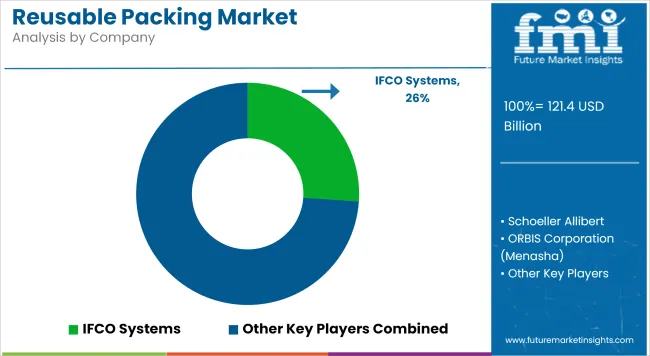

The overall market size for reusable packing market was USD 121.4 billion in 2025.

The reusable packing market is expected to reach USD 199.6 billion in 2035.

Growing emphasis on environmental sustainability, increasing regulations on single-use plastics, and rising demand from logistics and retail sectors for cost-effective, durable packaging will drive market growth.

The top 5 countries which drives the development of reusable packing market are USA, European Union, Japan, South Korea and UK.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Reusable Box Market Forecast and Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Industry Share Analysis for Reusable Wine Bags Companies

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA