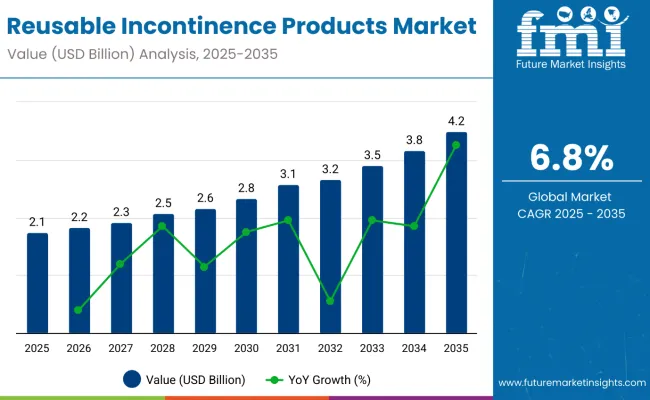

The reusable incontinence products market is valued at USD 2.1 billion in 2025 and is expected witness approximately USD 4.2 billion by 2035. This notable growth reflects a significant CAGR of 6.8% over the forecast period. Increasing demand for sustainable personal care products and the rising need for long-term cost-saving hygiene solutions are significantly influencing the market’s expansion.

The shift away from disposable incontinence products is being observed globally as environmentally conscious consumers and healthcare providers are focusing on reusable, washable, and long-lasting alternatives to reduce waste generation and disposal-related challenges.

The market is evolving in response to changing consumer preferences and demographic factors. A key driver remains the aging global population, particularly in developed countries where longevity is rising and the number of elderly individuals requiring continence management solutions is growing.

Alongside this demographic shift, there is increasing awareness about adult incontinence issues, reducing the social stigma associated with these products and encouraging consumers to seek more comfortable, skin-friendly, and discreet reusable solutions. Furthermore, the economic advantage of reusable products, which offer savings over single-use alternatives in the long run, is an additional motivating factor for both individual buyers and healthcare institutions managing patients with chronic conditions.

Another significant growth catalyst is the innovation in absorbent textile technologies. Industry leaders such as TENA, Depend, and Abena are investing heavily in developing next-generation fabrics that enhance moisture-wicking, odor control, and overall product durability.

These technological improvements are increasing the functional appeal of reusable incontinence products, positioning them as not only environmentally sustainable but also highly effective for daily use. The demand for high-performance, reusable solutions in home care settings and outpatient facilities is rising, as caregivers and patients prioritize ease of use, product reliability, and cost efficiency in managing incontinence needs over extended periods. Manufacturers are heavily investing in research and development to launch innovative products.

Reusable incontinence products are subject to regulatory oversight to ensure safety, hygiene, and effectiveness for users. These products are often classified as medical devices or hygiene products depending on the region, requiring compliance with relevant regulations such as FDA clearance in the United States or the Medical Device Regulation (EU MDR 2017/745) in the European Union. Strict standards governing material safety, biocompatibility, and quality management help protect consumers from adverse reactions and ensure consistent product performance.

Per capita spending on reusable incontinence products is gradually increasing worldwide, driven by growing awareness of sustainable and cost-effective alternatives to disposable products. Rising healthcare costs and environmental concerns encourage consumers and care facilities to adopt reusable options, especially in developed regions.

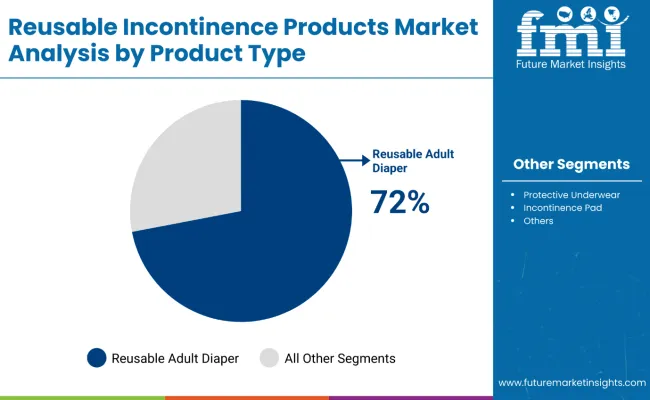

The reusable incontinence products market is segmented by product type into reusable adult diapers, protective underwear, incontinence pads, bed pads & underpad, and others (washable chair pads, waterproof mattress protectors, and reusable swim).

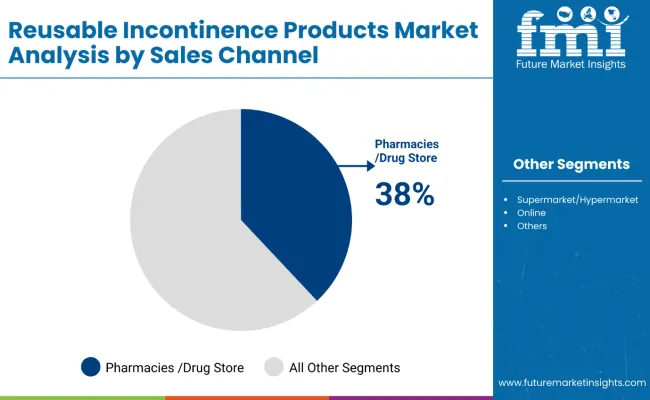

Based on sales channel, the market includes supermarkets/hypermarkets, convenience stores, pharmacies/drug stores, online, and others (specialty medical stores and bulk procurement by healthcare institutions). Geographically, the market is categorized into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The reusable adult diapers segment holds the dominant position in the reusable incontinence products market, accounting for approximately 72% of the total market share. This segment continues to witness strong growth driven by the rising elderly population, especially in developed regions such as North America and Europe, where aging-related incontinence issues are prevalent.

The preference for reusable adult diapers is attributed to their high absorbency capacity, superior comfort, and economic advantages over disposable alternatives. These products are also designed with improved fabric technologies that ensure skin protection, odor control, and moisture-wicking properties, making them suitable for prolonged use in both home and institutional care settings.

Manufacturers such as TENA, Depend, and Abena are heavily investing in product innovation to enhance user comfort and discretion. These diapers are becoming more form-fitting, breathable, and environmentally friendly, aligning with consumer preferences for sustainable and cost-effective hygiene solutions.

Additionally, the stigma surrounding incontinence is gradually diminishing, resulting in a greater willingness among consumers to invest in high-quality reusable products. The segment also benefits from a growing trend of home-based healthcare, as caregivers prefer these reusable solutions due to their durability, long-term savings, and ease of maintenance compared to single-use disposable products.

| Product Type | Share(2025) |

|---|---|

| Reusable Adult Diapers | 72% |

The pharmacies/drug stores segment holds the largest share in the reusable incontinence products market, accounting for approximately 38% of the total market value. This dominance is primarily due to the trust and convenience that consumers associate with purchasing healthcare and hygiene products from specialized outlets.

Pharmacies and drug stores offer a wide range of product choices, including various sizes, absorbency levels, and brands, allowing customers to make informed selections based on their specific needs. Moreover, the presence of trained pharmacists in these stores provides an added advantage, as they can offer guidance and recommendations for suitable products, especially for elderly or first-time buyers.

The availability of products in supermarkets/hypermarkets is also significant, as these large retail chains provide easy access to reusable incontinence items for daily shoppers. However, these outlets often lack the personalized consultation services found in pharmacies. Convenience stores cater to emergency or quick purchases but typically have a limited selection compared to pharmacies or supermarkets.

Meanwhile, the online segment is experiencing rapid growth, fueled by the rising trend of e-commerce, especially among caregivers and patients who prefer the privacy, home delivery, and subscription models offered by digital platforms. The “others” category includes specialty health stores, direct sales channels, and institutional suppliers catering to hospitals, care homes, and rehabilitation centers that procure bulk reusable incontinence products

| Sales Channel | Share(2025) |

|---|---|

| Pharmacies /Drug Stores | 38% |

One of the crucial challenges in the applicable incontinence products request is the need for lesser consumer mindfulness and education. Numerous independences remain reluctant to switch from disposable to applicable products due to enterprises about hygiene, conservation, and original costs.

Also, artistic spots girding incontinence issues may help open conversations and product relinquishment. Companies must invest in mindfulness juggernauts, product demonstrations, and educational enterprise to drive request penetration.

The adding focus on sustainability and advancements in spongy fabric technologies present significant openings for request growth. Inventions similar as humidity- wicking fabrics, antimicrobial coatings, and flawless leak- evidence designs are enhancing product effectiveness and stoner comfort.

Brands that integrate smart technology, similar as detector- enabled incontinence wear and tear, will further revise the request. Also, growing Eco-conscious consumer gets is fueling demand for applicable, biodegradable, and immorally produced hygiene results.

| Country | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| Germany | 84.1 |

| United Kingdom | 68.3 |

| Japan | 125.1 |

| Country | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 15.20 |

| China | 8.30 |

| Germany | 13.10 |

| United Kingdom | 12.50 |

| Japan | 11.40 |

The USA request for applicable incontinence products is expanding due to an growing population and adding mindfulness of sustainable healthcare results. Consumers seek cost-effective and environmentally friendly druthers to disposable products, leading to advanced relinquishment rates.

Healthcare professionals laboriously recommend applicable options, while e-commerce platforms enhance availability, making it easier for consumers to explore and buy custom- fit, high- absorbency results

China’s request benefits from growing consumer education and affordability, leading to increased relinquishment of applicable incontinence products. Original brands dominate the geography, offering cost-effective, durable, a deco-friendly options that cater to a different client base. Rising health mindfulness and government-led sustainability enterprise further support request growth. With a large growing population, demand is anticipated to rise steadily in the coming times.

Germany sees strong demand for eco-friendly, washable incontinence products driven by a well- established healthcare system and environmentally conscious consumers. Apothecaries and online retailers play a pivotal part in icing wide availability allowing druggies to find high- quality, medical- grade results. Germany’s emphasis on sustainability and decoration healthcare products positions it as a leading request in Europe.

The UK request is growing due to advanced relinquishment of discreet, ultra-absorbent applicable incontinence products. Elderly care installations and home care services drive demand, prioritizing comfort and long- term cost savings. Also, direct- to- consumer brands and online platforms give customized results, appealing to individualities seeking discreet, swish, and comfortable options.

Japan leverages advanced fabric technology and a growing population to boost demand for high- absorbency, applicable druthers. The country’s focus on invention, comfort, and ultra-thin yet largely spongy accoutrements makes applicable incontinence products a favoured choice. Medical institutions and watch installations play a crucial part in promoting long- term, cost-effective results, buttressing Japan’s position as a technologically advanced request.

Reusable incontinence products market is growing due to growing awareness of eco-friendly healthcare solutions, growing incidence of urinary incontinence, and need for cost-effective alternatives to disposable products. A survey of 250 respondents, including incontinence patients, caregivers, and healthcare providers, presents a report on the key market trends and consumer behaviour.

Convenience, absorbency, and long-term saving are the biggest purchase drivers, with 72% of customers choosing reusable incontinence products to cut costs and save in the future. Among the 50+ age group, 65% welcome products with better absorbency and gentle skin material, and 38% among the younger age group utilize reusable products for their concern about the environment.

Fashion fit and fabric development are significant forces behind purchasing behaviour, where 58% of the sample have cotton products in mind as an ideal solution they find to be breathable and 42% opting for moisture-wicking synthetics for peak dryness. Products that adjust like washable briefs and absorbency pads that are reusable and leak-proof are gaining traction among consumers looking for discreet protection.

Price and brand reputation are strong purchasing drivers. While 49% of the respondents have faith in well-established brands such as TENA, Conni, and Wear ever, 45% of them explore new green brands offering sustainable and hypoallergenic products. High price sensitivity prevails, as 68% of the customers prefer reusable ones costing less than USD 50, while 32% prefer long-lasting, expensive ones.

Online shopping and subscription services lead the distribution process with 57% of the subjects purchasing reusable incontinence items online for ease and discreet shipping. Yet, 43% would rather buy from pharmacies and medical supply outlets for improved product evaluation. Increased acceptance of subscription services with ongoing shipments of reusable incontinence items is also picking up speed among care givers and chronic condition patients.

With greater awareness of eco-alternatives, cost-effectiveness, and comfort-centric designs, the market for reusable incontinence products will further grow. Manufacturers can leverage this by developing sustainable materials, innovation in absorbency technology, and enhancing direct-to-consumer online selling platforms to address changing consumer demands.

The USA applicable incontinence products request is witnessing steady growth, driven by an growing population, adding mindfulness of sustainable healthcare products, and advancements in spongy fabric technology. Major players include Tranquillity, Depend, and TENA.

Market Growth Factors

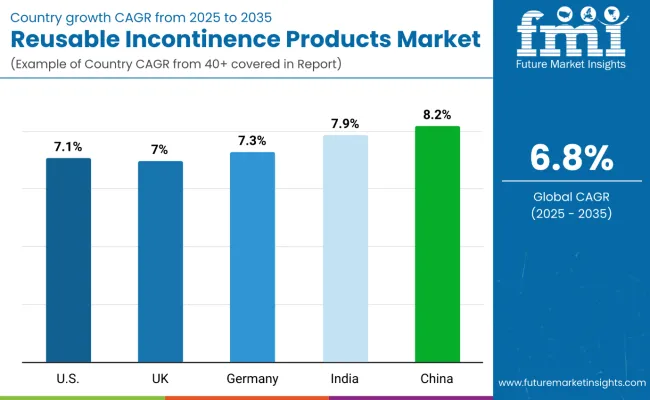

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

The UK applicable incontinence products request is expanding due to rising senior care requirements, government enterprise promoting sustainability in healthcare, and growing relinquishment of washable defensive wear and tear. Leading brands include Confitex, iD Direct, and Washable prodigies.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Germany’s applicable incontinence products request is growing, with consumers fastening on high- quality, dermatologist- tested, and skin-friendly accoutrements. Crucial players include Seni, Hartmann Group, and Abena.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s applicable incontinence products request is witnessing rapid-fire growth, fuelled by adding senior care requirements, rising healthcare mindfulness, and affordability- driven demand for long- continuing results. Major brands include musketeers, Kara- In, and quality.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.9% |

China’s applicable incontinence products request is expanding significantly, driven by adding disposable inflows, rising demand for sustainable healthcare results, and rapid-fire growth in senior care services. crucial players include YUYUE, TENA China, and Cortex.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

The applicable incontinence products request is witnessing steady growth, driven by an growing population, rising mindfulness of sustainable healthcare results, and adding consumer preference for cost-effective, long- term druthers to disposable products. Inventions in spongy technology, door control, and skin-friendly accoutrements enhance product performance and stoner comfort.

Crucial players concentrate on developing washable undergarments, applicable pads, and leak- evidence missions with humidity- wicking fabrics. E-commerce and direct- to- consumer deals channels are expanding request availability, while healthcare providers and apothecaries continue to play a significant part in product distribution.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.1 billion |

| Projected Market Size (2035) | USD 4.2 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion |

| By Product Type | Reusable Adult Diapers, Protective Underwear, Incontinence Pads, Bed Pads & Underpads |

| By Absorbency Level | Light, Moderate, Heavy, and Overnight. |

| By Sales Channel | Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, and Specialty Stores |

| By End-User | Men, Women, and Elderly Population |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA). |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

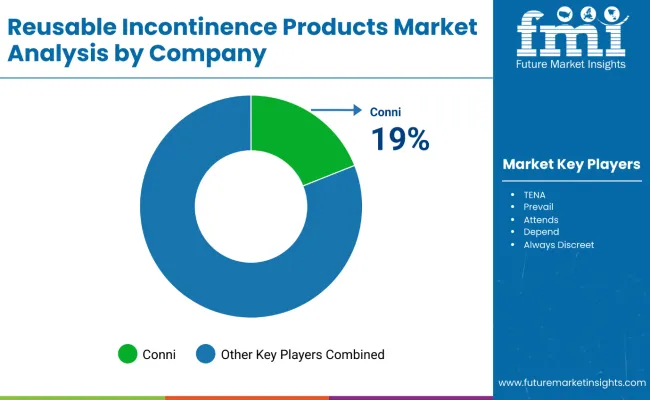

| Key Players | TENA (Essity AB), Prevail (First Quality), Attends (Attindas Hygiene), Tranquility (Principle Business Enterprises), Conni, Depend (Kimberly-Clark), Always Discreet (P&G), and NorthShore Care Supply |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

Reusable Adult Diapers, Protective Underwear, Incontinence Pads, Bed Pads & Underpads, and Others.

Light, Moderate, Heavy, and Overnight.

Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Specialty Stores, and Others.

Men, Women, and Elderly Population.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Reusable Incontinence Products industry is projected to witness a CAGR of 6.8% between 2025 and 2035.

The Reusable Incontinence Products industry stood at USD 1.3 billion in 2024.

The Reusable Incontinence Products industry is anticipated to reach USD 4.2 billion by 2035 end.

Europe is set to record the highest CAGR of 7.5% in the assessment period.

The key players operating in the Reusable Incontinence Products industry include TENA, Prevail, Attends, Tranquility, Conni, and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product , 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product , 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Product , 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 52: Asia Pacific Market Volume (Units) Forecast by Product , 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 54: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: Asia Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Product , 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 66: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: MEA Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 70: MEA Market Volume (Units) Forecast by Size, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product , 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product , 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product , 2023 to 2033

Figure 32: Global Market Attractiveness by End User, 2023 to 2033

Figure 33: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 34: Global Market Attractiveness by Size, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product , 2023 to 2033

Figure 38: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product , 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product , 2023 to 2033

Figure 68: North America Market Attractiveness by End User, 2023 to 2033

Figure 69: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 70: North America Market Attractiveness by Size, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product , 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product , 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product , 2023 to 2033

Figure 104: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product , 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 120: Europe Market Volume (Units) Analysis by Product , 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 124: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 128: Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 132: Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product , 2023 to 2033

Figure 140: Europe Market Attractiveness by End User, 2023 to 2033

Figure 141: Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 142: Europe Market Attractiveness by Size, 2023 to 2033

Figure 143: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product , 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 156: Asia Pacific Market Volume (Units) Analysis by Product , 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product , 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Size, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product , 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Size, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 192: MEA Market Volume (Units) Analysis by Product , 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 196: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 200: MEA Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 204: MEA Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product , 2023 to 2033

Figure 212: MEA Market Attractiveness by End User, 2023 to 2033

Figure 213: MEA Market Attractiveness by Price Range, 2023 to 2033

Figure 214: MEA Market Attractiveness by Size, 2023 to 2033

Figure 215: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Reusable Box Market Forecast and Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Industry Share Analysis for Reusable Wine Bags Companies

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Reusable Water Bottle Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA