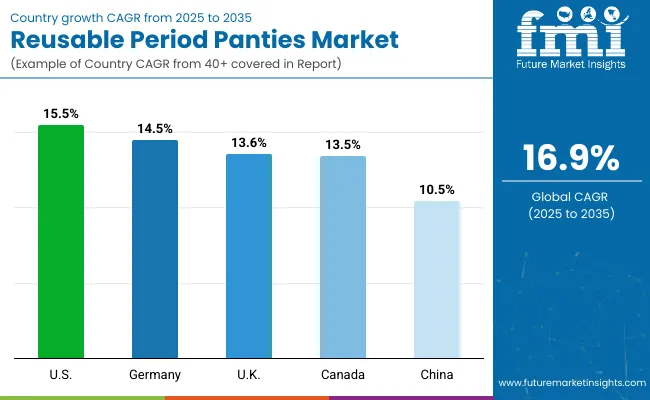

The reusable period panties market is projected to generate USD 180.4 million in revenue in 2025 and is anticipated to reach USD 859.7 million by 2035, registering a compound annual growth rate (CAGR) of 16.9% over the forecast period.

The increasing awareness of sustainability, coupled with the growing demand for eco-friendly and comfortable menstrual products, is driving the significant growth of this market. Reusable period panties, made from absorbent, washable fabrics, offer an alternative to traditional disposable sanitary products and are gaining popularity among environmentally conscious consumers.

A major driver of the market’s growth is the increasing focus on reducing waste and plastic pollution. Consumers are increasingly seeking sustainable alternatives to single-use products, and reusable period panties fit this need by offering a product that can be reused for several years. Additionally, the growing trend towards self-care and health-conscious choices is propelling the demand for menstrual products that provide comfort, convenience, and leak protection while being gentle on the skin.

Recent developments in the market focus on innovations in fabric technology and design, which improve the effectiveness and comfort of reusable period panties. Companies are integrating moisture-wicking, odor-neutralizing, and antimicrobial properties into their products to enhance performance.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 180.4 million |

| Market Size in 2035 | USD 859.7 million |

| CAGR (2025 to 2035) | 16.9% |

On September 16, 2024, Modibodi unveiled its Renaissance Collection, a premium line of period-proof lingerie. Crafted from recycled Klauber lace, the collection offers thongs, midi-briefs, and high-waisted briefs in Bordeaux Red, Riviera Blue, and Noir Black. Each piece provides leak-proof protection suitable for light to heavy flow, starting at £21.99. This was officially announced in the company's press release.

As awareness of environmental issues and sustainable choices continues to grow, the reusable period panties market is expected to see rapid expansion, offering a convenient and eco-friendly solution for menstrual care.

Per capita spending on reusable period panties is increasing globally as consumers seek sustainable and comfortable alternatives to traditional menstrual products. Growing awareness of environmental impact, health benefits, and rising acceptance of reusable menstrual solutions are driving demand across diverse markets.

Developed Countries

In regions like North America, Western Europe, and Australia, per capita spending is relatively high. Consumers prioritize eco-friendly products and are willing to invest in premium, durable period panties. Strong retail presence, e-commerce availability, and health-conscious marketing campaigns support consistent spending. Brands like Thinx, Knix, and Modibodi lead the market with innovative designs and material technologies.

Emerging Markets

In countries such as India, Brazil, and parts of Southeast Asia, per capita spending is growing steadily but remains lower than in developed markets. Increased awareness of menstrual health, rising female workforce participation, and improving affordability are key factors. Educational initiatives and rising e-commerce penetration are expanding access to reusable period panties, fostering gradual market growth.

The adoption and progress of the circular economy vary significantly across regions, influenced by government policies, industrial practices, consumer awareness, and infrastructure development. The circular economy aims to reduce waste, promote recycling, and encourage sustainable resource use across sectors.

Europe

Europe is a global leader in circular economy initiatives, driven by comprehensive policies like the European Green Deal and the Circular Economy Action Plan. The European Union has established ambitious targets for waste reduction, recycling rates, and sustainable product design. Countries such as the Netherlands, Germany, and Sweden have advanced recycling systems, circular business models, and strong public-private collaborations.

North America

In North America, particularly in the United States and Canada, circular economy efforts are growing steadily. While federal policies are evolving, several states and cities have implemented strong regulations on waste management and extended producer responsibility. Corporate sustainability initiatives and consumer demand for eco-friendly products are driving circular practices, especially in sectors like packaging, electronics, and textiles.

Asia-Pacific

The Asia-Pacific region shows diverse progress in circular economy adoption. Countries like Japan and South Korea have well-established recycling infrastructure and regulatory frameworks promoting circularity. China has launched national strategies targeting resource efficiency and pollution reduction, integrating circular economy principles into industrial policies. Emerging economies such as India and Southeast Asian nations are gradually adopting circular models amid increasing urbanization and waste challenges.

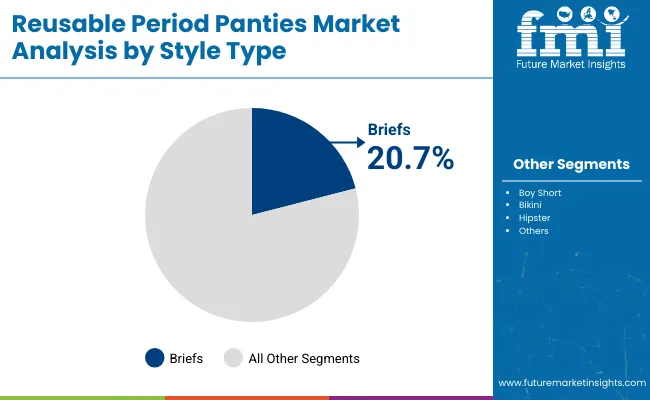

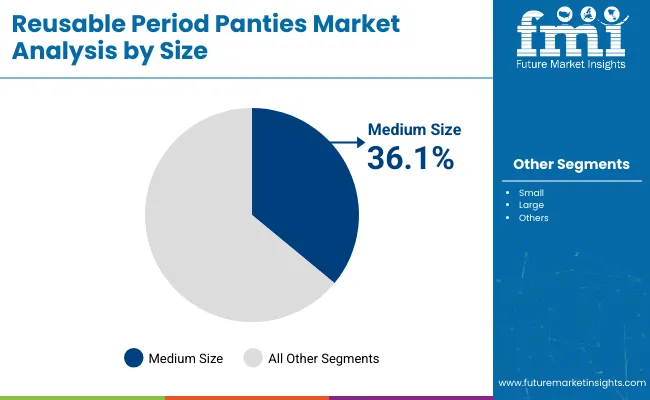

The global reusable period panties market is poised for steady growth between 2025 and 2035. In 2025, briefs are projected to hold 20.7% of the style segment, while medium size is expected to capture 36.1% of the size segment. Key players include Thinx, Modibodi, and Saalt.

The briefs segment is projected to account for 20.7% of the style type market share in 2025. This style offers full coverage, making it a preferred option for overnight protection and heavy flow days. The combination of comfort, reliability, and classic design appeals across age groups. Brands such as Thinx and Modibodi offer briefs designed with multilayer absorption technology, moisture-wicking fabrics, and antimicrobial layers.

Increasing consumer interest in reusable menstrual products is further driving demand for briefs, especially among eco-conscious users. Briefs also cater to those transitioning from disposable products, providing a familiar silhouette with sustainable advantages. As users seek comfort-focused, leak-proof options, the briefs segment is expected to maintain steady growth.

The medium size segment is expected to capture 36.1% of the size-based market share in 2025. Medium sizing aligns well with a broad consumer base, fitting individuals across varied age and body types. It is often considered the default or “standard” offering in most brands’ size ranges.

Companies like Saalt and Knix target this segment with inclusive fit options and stretchable fabrics for better adaptability. Medium sizes also tend to dominate trial purchases or multipack offers, further boosting their share. With most manufacturers optimizing designs around medium dimensions, this size sees higher inventory levels and faster turnover. Its universal fit and popularity among first-time buyers make it a strategic growth area for brands.

In the past few years, many social agencies are organizations have undertaken awareness initiatives. To promote the usage of female hygiene products in rural and underdeveloped cities and towns across the globe.

For instance, UNICEF is actively undertaking campaigns to promote awareness regarding female hygiene. As per the statistics, nearly 1.8 billion women experience their menstrual cycle every month across the world. Although, millions of these individuals are unable to manage their menstrual cycle. Due to a lack of awareness and inadequate availability of menstrual hygiene products.

The efforts undertaken by agencies like UNICEF are expected to play a key role in raising awareness of good menstrual hygiene. Thereby escalating the demand for reusable period panties in the forthcoming years.

Demand in the United States is anticipated to account for a 20.1% share of the reusable period panties industry. The North American reusable period panties market is likely to hold around 24.3% of the global industry.

Consumers are seeking menstrual hygiene products that provide comfort, control leakage, and are sustainable. Manufacturers are also offering subscription-based models via online channels to make the shopping experience more seamless. Such developments are expected to augment the growth in the market over the assessment period.

In 2022, total sales in the United Kingdom market accounted for 24.8% of the Europe reusable period panties market. The demand for reusable period panties in the United Kingdom is projected to increase at a 13.6% CAGR during the forecast period. Increasing awareness regarding alternative menstrual hygiene products, along with the wide availability of such products across online and offline channels boosts the market.

According to FMI, India accounted for over 36.1% of the South Asia reusable period panties industry in 2022. Sales in the Indian market are projected to record a 25.5% CAGR over the forecast period. Increasing awareness regarding feminine hygiene driven by government initiatives is likely to propel the demand in India.

In terms of demographic, a surging preference for comfortable menstrual hygiene products among teens and tweens is anticipated. Therefore, manufacturers are launching innovative products to cater to the growing demand.

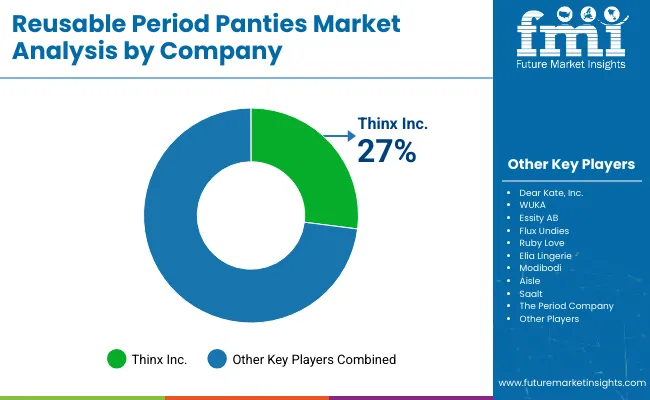

The reusable period panties market is highly competitive, driven by growing demand for sustainable and comfortable menstrual products. Leading brands like Thinx, Modibodi, and Knix dominate the market with innovative leak-proof technologies and strong brand identities.

Mid-sized players such as Saalt and Ruby Love cater to niche segments like teens and comfort-focused users. Emerging and regional brands are also gaining ground by emphasizing eco-friendly materials, ethical production, and inclusive designs. Overall, the market is shaped by innovation, sustainability, and expanding consumer awareness.

The reusable period panties industry is highly competitive, with players competing based on product innovation, quality, price, and marketing strategies. Leading players in the global market are adopting various strategies such as mergers, acquisitions, and collaborations to expand their global footprint. They are also investing in research and development activities. To improve their product portfolios to offer products suitable for different demographics.

Thinx Inc.

Thinx Inc. is a leading player in the reusable period panties market, offering a range of products for different flow levels. The company has a strong online presence and has expanded its product portfolio to include reusable tampons and pads.

Ruby Love LLC

Ruby Love LLC is another leading player in the reusable period panties industry. The company is known for its patented technology that provides leak-proof protection. It offers a variety of products for different menstrual needs and has a strong customer base in North America.

WUKA Wear Ltd.

WUKA Wear Ltd. is a United Kingdom-based company that specializes in eco-friendly and sustainable menstrual hygiene products. The company offers a range of reusable period panties and has won several awards for its innovative products.

Lunapads International Products Ltd.

Lunapads International Products Ltd. is a Canadian company that offers a variety of reusable menstrual products, including period panties. The company is known for its commitment to sustainability and social responsibility.

Modibodi Pty Ltd.

Modibodi Pty Ltd. is an Australian company that offers a range of reusable period panties for different flow levels. The company has a strong focus on innovation and sustainability and has won several awards for its products.

| Expansion Strategy | Description |

|---|---|

| Product Diversification | Expanding product line by introducing new products such as period-proof swimwear, activewear, or otder menstrual products. |

| International Expansion | Entering new international markets by partnering witd local retailers or distributors or establishing a direct-to-consumer model. |

| Sustainability Initiatives | Emphasizing eco-friendliness and sustainability by using recycled materials. Reducing waste during production, or implementing green packaging. |

| Collaborations and Partnerships | Collaborating witd influencers, social media personalities, or otder brands to increase brand awareness and reach new audiences. |

| Online Marketing Strategies | Enhancing online presence tdrough social media advertising, influencer marketing, search engine optimization, and email marketing. |

| Innovation and Technology | Incorporating innovative technology, such as moisture-wicking fabrics or odor-neutralizing technology, to differentiate from competitors and enhance product performance. |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 180.4 million |

| Projected Market Size (2035) | USD 859.7 million |

| CAGR (2025 to 2035) | 16.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for dollar sales |

| Style Types Analyzed (Segment 1) | Boy Short, Bikini, Brief, Hipster, Others |

| Sizes Analyzed (Segment 2) | Small, Medium, Large |

| Absorbency Levels Analyzed (Segment 3) | Heavy/Super Absorbency, Medium Absorbency, Light Absorbency, Super Light Absorbency |

| Price Ranges Analyzed (Segment 4) | Mass/Economic, Mid Range, Premium |

| Sales Channels Analyzed (Segment 5) | Modern Trade, Convenience Stores, Departmental Stores, Specialty Stores, Mono Brand Stores, Online Retailers, Drug Stores, Other Sales Channel |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Reusable Period Panties Market | Dear Kate, Inc., WUKA, Essity AB, Flux Undies, THINX Inc., Ruby Love, Elia Lingerie, Modibodi, Aisle, Saalt, The Period Company |

| Additional Attributes | dollar sales, CAGR trends, style type distribution, size preferences, absorbency level demand, price range segmentation, competitor dollar sales & market share, regional growth patterns |

This market is estimated to be worth USD 859.7 million by 2035.

Growing demand for eco-friendly and sustainable menstrual products.

The United Kingdom's strict waste rules boost the market demand.

Increasing adoption of reusable period panties among young generations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Reusable Box Market Forecast and Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Industry Share Analysis for Reusable Wine Bags Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA