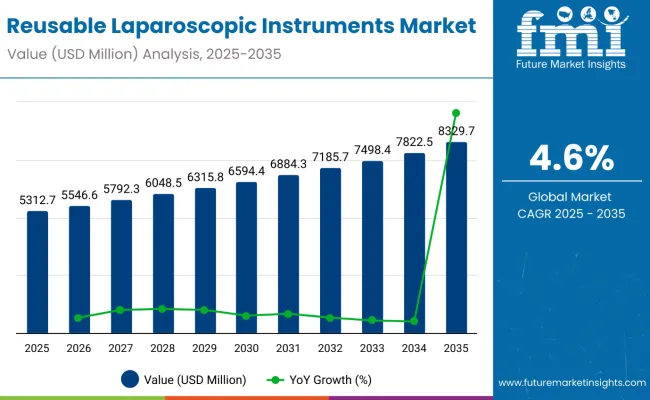

In the coming years, the reusable laparoscopic instruments product market is expected to reach USD 5,312.7 million by 2025. It is expected to steadily grow at a CAGR of 4.6% to reach USD 8,329.7 million by 2035. In 2024, reusable laparoscopic instruments have generated roughly USD 5,079.0 million in revenues.

Laparoscopic instruments are used for carrying out very small incisions compared to open procedures and are never utilized for single procedures. Some examples of reusable laparoscopic instruments include scissors, graspers, trocars, and forceps, which give precision during operations such as laparoscopic cholecystectomy procedures, inguinal hernia repair, etc.

The first and foremost is their cost-effectiveness. The increase in the use of laparoscopic instruments owing to the rising popularity of minimally invasive procedures is another major factor contributing to the growth of the market. Additionally, an increase in the number of healthcare facilities and an increase in the adoption of reusable laparoscopic instruments due to technological advancements further anticipate market growth.

Increasing demand for minimally invasive surgery has greatly favored the growth of the reusable laparoscopic device market. From the very beginning, the demand for shorter recovery time, smaller cuts, and more comfort for patients has encouraged laparoscopic procedures to become extensively used.

High-definition imaging and 3D/4D visualization systems increased precision and safety in laparoscopic surgeries, making its operation more efficacious and appealing to surgeons. Increasing cost-effectiveness, together with the hospitals' effort to discard medical waste, would further promote the use of reusable instruments.

The ongoing push for minimally invasive techniques, advancements in sterilization technology, and a growing global health market are expected to keep contributing to the growth of reusable laparoscopic devices, especially in developing countries, for the next few years.

The rising prevalence of chronic and lifestyle-related diseases, such as cancer and polycystic ovary syndrome (PCOS), is significantly impacting healthcare systems worldwide. As more patients require surgical interventions for diagnosis and treatment, there is a growing demand for efficient, cost-effective, and sustainable surgical tools. This has led to increased adoption of reusable laparoscopic instruments, which offer long-term economic and environmental benefits. These instruments are becoming essential in minimally invasive procedures, supporting improved patient outcomes and reducing surgical waste.

Reusable laparoscopic instruments are classified as medical devices and are regulated under stringent health and safety frameworks across global markets. These regulations cover design, manufacturing, sterilization, and reprocessing requirements to ensure safe repeated use in surgical settings. Certification and compliance standards are essential for market access, particularly in healthcare systems that prioritize patient safety and infection control.

The use of laparoscopic techniques has greatly increased in North America owing to the constant growth of the demand for minimally invasive procedures, which include benefits such as faster recovery, less scarring, and pain relief.

The second factor has been increased concern primarily regarding the cost of care. Reusable instruments, expensive as they are in initial installation, yield great returns by being sterilizable and reusable many times, resulting in that reduced cost over many years that appeals strongly to healthcare providers challenged to decrease expenditure.

Reusable instruments reduce the use of disposable instruments and hence are in consonance with these goals. Developments in sustainable practices and waste reduction in hospitals are gaining emphasis in North America.

The advancement of sterilization procedure technology ensures on the development of the reuse of instruments as having safe and hygienic for reuse. In addition, robotic surgery as well as imaging techniques now being with greater use enhance the sophistication and accuracy of laparoscopic procedures, thus demanding higher quality and more consistent instruments.

Finally, increasing conditions, like obesity, and diseases of the gastrointestinal system, lay a great demand for laparoscopic surgery and have significantly contributed to the accruing demand for reusable laparoscopic instruments in North America.

With strict adherence to environmental compliance and sustainability, it becomes possible to reuse devices. The ambulatory and operating facilities are minimizing their medical waste by using reusable laparoscopic instruments, reducing dependence on single-use instruments.

Cost-effectiveness can also be added to the scenario. Although reusable instruments tend to be expensive during purchase, their repetitive sterilization and use make countries involved with public health budgets save phenomenally over time.

Innovations in sterilization are happening within the production of better and larger quality instruments in developing hygiene and security purposes thus increasing business growth opportunity in Europe.

These reasons have induced an ever-increasing need in Europe for public medicine to procure such apparatus within its framework in the face of ever-increasing levels of laparoscopic surgery applied against such afflictions as obesity and pathologies within the abdominal cavity. All listed here urge development towards European applications for reusable laparoscope instruments.

Reusable devices became quite necessary in line with the efforts of improving surgical care without putting the burden of excess costs within the region.

A growing issue that has been a basis for this force is sustainability and being an environmental steward. Waste reduction is a growing concern on the agenda of most Asia Pacific nations, and having reusable instruments makes waste of disposable equipment less, thus a sustainable choice of less medical waste.

Advances, too, in sterilization technologies and better construction of instruments have improved the safety and reliability of reusable laparoscopic instruments. The increasing presence of these instruments in developing markets and government initiatives aimed at increasing healthcare access are further factors that boost their demand in the region.

Infection Risk Associated with Reusable Laparoscopic Instruments hinders its Adoption in the Market.

The reusable laparoscopic instruments market is disadvantaged by several impediments to its bulk implementation. Smaller hospitals or surgical facilities might find the initial high cost, acquisition, and maintenance of the instruments a prohibitive factor.

Regulatory bodies like the FDA and EMA set stringent guidelines concerning reprocessing protocols, which increases the workload incurred by health facilities and thus compliance costs. The fact that disposable laparoscopy instruments do not require sterilization makes their entry into the market much easier. Finally, sterilization is complex and requires highly skilled personnel, becoming an added challenge for healthcare facilities.

Increase in Focus of Hospitals towards Adopting Cost-effective Options Attribute to the Growth of the Market Players

Increasing demand for reusable laparoscopic instruments owing to the higher emphasis put on cost-effectiveness and sustainability in the healthcare sector significantly contributes to the growth of the market. Improvements in advanced sterilization technologies, such as automated reprocessing systems and UV-based processes, are ensuring safety with more extended life expectancy of the devices.

The advent of robotic-assisted surgery converging with AI-powered tools is throwing up new windows of opportunity, creating a need for high-precision reusable instruments. In addition, the implementation processes encouraged by government policies for sustainable healthcare and the demand for circular economy in medical manufacturing have acted as the rear gear for reusable instruments to become more cost-effective and appealing throughout the healthcare sector.

Introducing new sterilization methods like plasma sterilization, hydrogen peroxide vapor systems, and UV-based sterilization enhances the safety and durability of reusable laparoscopic instruments. These enhancements reduce infection risks, improve reprocessing efficiencies, and comply with international healthcare regulations. In addition, several policies and regulatory standards put down by the FDA and EMA for governing the sterilization and reprocessing of reusable instruments are further anticipating the market's growth.

An emphasis on the standardization of sterilization techniques has put pressure on manufacturers to produce more robust and less hazardous instruments. Environmental regulations seeking to promote the green use of medical devices have also started to trend in hospital-surgery center purchasing decisions.

Surgical procedures focus increasingly on being environmentally Friendly. This alone propels the disposal of previously used laparoscopic tools to preserve better lives for the environment. Health care institutions are adopting other sustainability measures to help mitigate drug devastation and reduce costs in due course. The adoption of eco-friendly sterilization mechanisms and reusable surgical kits probably promotes minimized environmental impacts and maximizes economic benefits in the long run. Increasingly Popularity of Hybrid Laparoscopic Technique-Growth in demand for ultra-modern reusable instruments compatible with robotic platforms that mix traditional laparoscopy and robotic-assisted surgery.

Reusable laparoscopic instruments are currently gaining cutting-edge advancements in the medical arena due to various factors influencing the surgical environment. However, the rising demand for minimally invasive surgeries is prime among these factors. Such procedures tend to enhance recovery time, cause less invasive incisions and subject patients to lower discomfort levels post-surgery. The trend towards less invasive methods has increased demand for high-quality reusable instruments.

The other strong driving factor is cost-effectiveness in healthcare. Even though reusable laparoscopic instruments are more expensive to purchase, their long-term worth becomes evident because they can be reused several times instead of disposables. The cost-effectiveness aspect of such devices is highly favorable for hospitals and surgical facilities, especially in cost-sensitive areas.

Instrumentation technology, as well as sterilization equipment improvements, are transforming these phenomena. Advanced sterilization technologies also assure healthcare practitioners that these instruments are safe and reliable, even for repeated use. Not only this but with the resulting increase in demand for intricate laparoscopic procedures, strong and accurate instruments become a necessity.

In the future, the continuous increased application of minimally invasive procedures, further developments in medical technologies, and global sustainability awareness will lead to more and more use of reusable instruments for laparoscopic surgeries so that they are part and parcel of contemporary practice in health care.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with sterilization and patient safety regulations for reusable instruments. |

| Technological Advancements | Introduction of high-quality stainless steel and modular designs for extended usability. |

| Consumer Demand | Increased demand due to cost savings and sustainability concerns. |

| Market Growth Drivers | Expansion of laparoscopic procedures across multiple medical specialties. |

| Sustainability | Growing awareness of medical waste reduction through reusable alternatives. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental and sustainability regulations promoting reusable over disposable instruments. |

| Technological Advancements | Integration of AI-assisted tools and sensor-enabled instruments for enhanced precision and safety. |

| Consumer Demand | Higher adoption of advanced ergonomic and customizable reusable instruments. |

| Market Growth Drivers | Surge in minimally invasive robotic-assisted surgeries requiring high-precision reusable tools. |

| Sustainability | Industry-wide shift toward fully sustainable manufacturing and sterilization practices. |

The need for reusable laparoscopic instruments in the United States has been historically continuous owing to developed healthcare systems and a general trend towards minimally invasive surgeries. The apparent choice of hospitals and surgery centers toward reusable instruments is based on long-term lower costs and less waste under a growing overall push for economical healthcare.

The aging population, coupled with the ongoing demand for obesity, cancer, and gastrointestinal surgeries, is still supporting the market further. Technological advancements have ensured that these instruments have the highest precision and safety with the use of efficient sterilizing methods and robotic surgery for their production.

As the healthcare world looks more favorably on sustainability, the growth potential for reusable laparoscopic instruments has become a huge opportunity for the near future.

Market Growth Factors

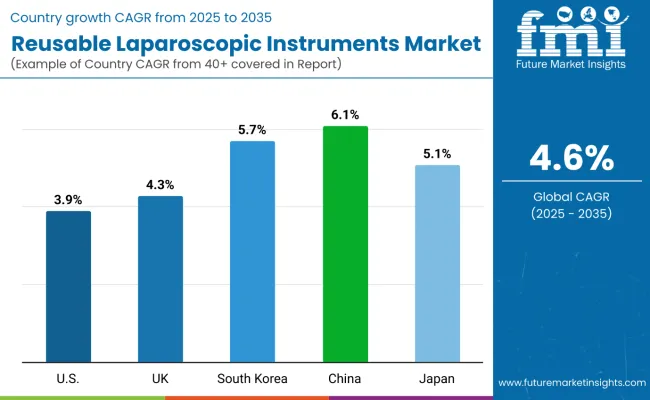

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

Market Outlook

The increasing stress on minimizing medical waste and instituting green policies makes it easy for reusable devices to become the go-to choice. With improvements in sterilization technology, healthcare practitioners are able to safely reuse such instruments.

The demand for reusable laparoscopic equipment will continue increasing with the increasing popularity of minimally invasive operations while employing cost-effective and green strategies in the UK's healthcare sector.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Market Outlook

Reusable laparoscopic instruments are also becoming the focus of Korea's health discourse as the country seeks to provide the highest quality healthcare and next-generation medical technologies. As demand for minimally invasive surgical procedures rises, hospitals are looking for economically viable options that do not compromise on quality.

There is a need for reusable instruments, and with that, the government of South Korea needs to support sterilization advancement and equipment development. A growing interest in environmental sustainability engenders healthcare professionals' acceptance of reusable instruments. The ever-increasing growth of South Korea's medical tourism sector will boost the uptake of reusable laparoscopic instruments, thereby enhancing market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

In China, reusable laparoscopic instruments are progressively generating viable enterprises as the country's health care remains on course for further development. The increased volume of surgeries with an accelerated penetration from an aging cohort demands surgical tools that are ever more sophisticated and cost-effective.

The public hospitals recognize the long-term savings to be derived with reusables, using less operational funds in the future. Investment by the Chinese government into sterilization technology's health infrastructure makes reusable equipment safer.

Further, as sustainability gains momentum in the nation, the expansion of reusable laparoscopic instruments will become even more intense. As health care continues to advance, the Chinese market for the equipment will prove to be prosperous in the near future.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

The innovative healthcare policies and programs will introduce reusable laparoscopic instruments into Japan's overall strategy for cost-effective and quality healthcare. The aging population and increasing numbers of laparoscopic surgery patients make a very strong case for minimally invasive procedures employing novel devices with potential uses as far as economic matters are concerned.

Japan's sustainability agenda would favor overall development in minimizing waste and cost with reusable laparoscopic instruments. Japanese healthcare practitioners use reusable ones in their investments in high-tech sterilization technology to ensure the safe re-use of the instruments used.

With Japan's strong commitments to green activities and its high standards, the market for reusable laparoscopic instruments will continue to thrive, with cost-saving and eco-friendly concerns driving demand.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

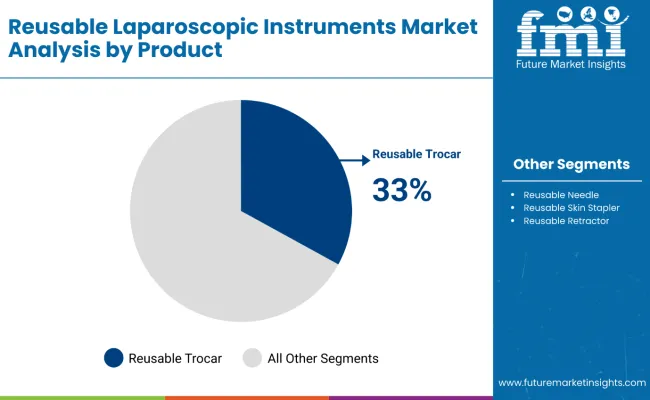

Reusable trocars are widely used in laparoscopic surgeries due to their cost-effectiveness, durability, and environmental benefits. Unlike single-use trocars, reusable versions can be sterilized and used multiple times, significantly reducing long-term surgical costs for hospitals and clinics.

They are made from high-quality materials that withstand repeated sterilization without compromising performance. Additionally, reusable trocars help reduce medical waste, aligning with global efforts toward sustainable healthcare practices.

Their reliability and lower total ownership cost make them a preferred choice in both public and private healthcare settings.

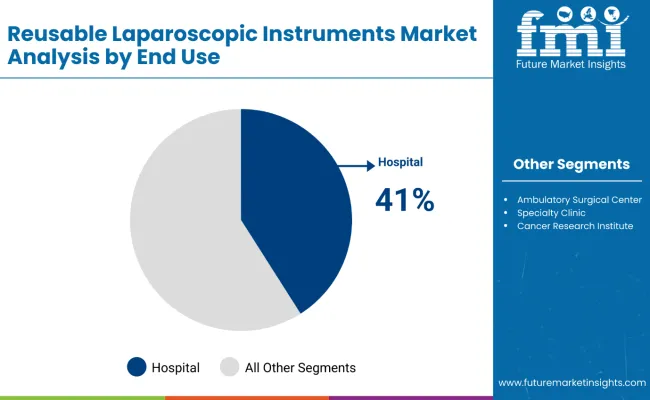

Reusable laparoscopic instruments are widely used in hospitals due to their cost-efficiency, durability, and sustainability. They can be sterilized and reused multiple times, significantly lowering the overall cost of surgical procedures compared to disposable instruments.

Hospitals also benefit from consistent performance and reliability, as these instruments are made from high-quality materials designed for repeated use. Additionally, they support environmental goals by reducing medical waste. This combination of economic and ecological advantages makes them a preferred choice for many healthcare facilities.

The reusable laparoscopic instruments market is growing at an accelerated rate, with global and local players alike pushing innovations and developments. Hospitals are starting to use these instruments as the patient load is increasing, with a growing demand for sophisticated and minimally invasive interventions.

The manufacturers are working towards designing high-quality and durable instruments that not only support good patient outcomes but also assist with the overall cost of health care. The technology behind the laparoscopic instruments is being developed both by established brands and new companies.

With healthcare systems holding onto cost-effectiveness and sustainability, reusable instruments' future is bright and has turned into a game-changer for surgery. This transformation is changing the way surgeons approach minimally invasive procedures, and it is obvious that further market growth is impending.

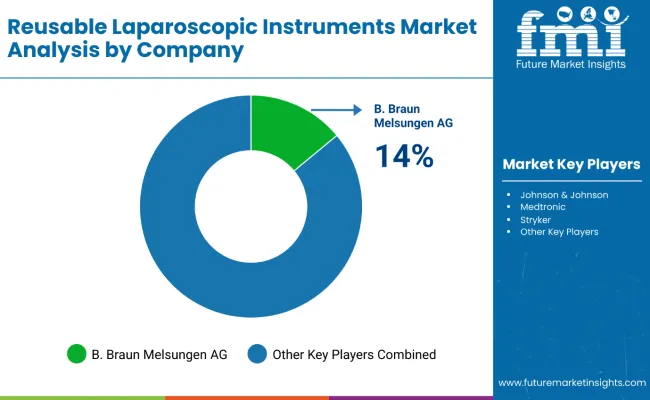

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| B. Braun Melsungen AG | 14.0% |

| Johnson & Johnson | 10.1% |

| Medtronic | 8.1% |

| Stryker | 7.3% |

| Other Companies | 60.4% |

| Company Name | Medtronic |

|---|---|

| Year | 2025 |

| Key Company Developments and Activities | Market leader offering advanced modular and ergonomic laparoscopic instruments for various minimally invasive procedures. |

| Company Name | B. Braun Melsungen AG |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Provides high-quality reusable laparoscopic instruments with a focus on durability and surgeon comfort. |

| Company Name | Johnson & Johnson (Ethicon) |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Specializes in precision-engineered laparoscopic tools designed for efficiency and patient safety. |

| Company Name | Karl Storz SE & Co. KG |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Develops innovative endoscopic and laparoscopic surgical instruments with enhanced visualization capabilities. |

| Company Name | Olympus Corporation |

|---|---|

| Year | 2024 |

| Key Company Developments and Activities | Offers a broad range of reusable laparoscopic devices integrated with advanced imaging and energy-based technologies. |

Medtronic

A surgical instrument market leader, Medtronic manufactures cutting-edge reusable laparoscopic solutions that maximize precision and efficiency.

B. Braun Melsungen AG

The quality of high standard and ergonomic designs allows the surgical instruments produced by B. Braun of global repute to be reused in various specialties.

Johnson & Johnson (Ethicon)

Ethicon, the leader in minimally invasive surgery, strives to develop next-generation laparoscopic instruments which improve patient outcomes and the art of surgery.

Karl Storz SE & Co. KG

With precision optics and engineering, Karl Storz has produced top-quality reusable laparoscopic instruments and thus remains the world leader in endoscopy.

Olympus Corporation

One of the leading innovators in medical imaging, Olympus integrates sophisticated visualization technologies into its reusable laparoscopic instruments.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. They include:

These companies focus on expanding the reach of reusable laparoscopic solutions, offering competitive pricing and cutting-edge innovations to meet diverse surgical needs.

The overall market size for reusable laparoscopic instruments market was USD 5,312.7 million in 2025.

The reusable laparoscopic instruments market is expected to reach USD 8,329.7 million in 2035.

Increase in number of people undergoing minimally invasive surgeries anticipates the growth of the market.

The top key players that drives the development of reusable laparoscopic instruments market are B. Braun Melsungen AG, Johnson & Johnson, Medtronic, Stryker and Medline Industries

Reusable Trocars segment by product is expected to dominate the market during the forecast period.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Surgery

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Region

Table 06: North America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 11: Latin America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 16: Europe Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 18: Europe Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 21: South Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 24: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 26: East Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 31: Oceania Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 34: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 35: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 36: Middle East and Africa Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 38: Middle East and Africa Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 39: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Surgery

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Figure 01: Global Market Volume (Units), 2012 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Pricing Analysis per unit (US$), in 2022

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2012 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, By Surgery

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, By Surgery

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, By Surgery

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, By End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, By End User

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, By End User

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 20: North America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 21: North America Market Value (US$ Million) Forecast, 2023-2033

Figure 22: North America Market Value Share, by Product (2023 E)

Figure 23: North America Market Value Share, By Surgery (2023 E)

Figure 24: North America Market Value Share, By End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: USA Market Value Proportion Analysis, 2022

Figure 31: Global Vs. USA Growth Comparison

Figure 32: USA Market Share Analysis (%) by Product, 2022 & 2033

Figure 33: USA Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 34: USA Market Share Analysis (%) By End User, 2022 & 2033

Figure 35: Canada Market Value Proportion Analysis, 2022

Figure 36: Global Vs. Canada. Growth Comparison

Figure 37: Canada Market Share Analysis (%) by Product, 2022 & 2033

Figure 38: Canada Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 39: Canada Market Share Analysis (%) By End User, 2022 & 2033

Figure 40: Latin America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 41: Latin America Market Value (US$ Million) Forecast, 2023-2033

Figure 42: Latin America Market Value Share, by Product (2023 E)

Figure 43: Latin America Market Value Share, By Surgery (2023 E)

Figure 44: Latin America Market Value Share, By End User (2023 E)

Figure 45: Latin America Market Value Share, by Country (2023 E)

Figure 46: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Mexico Market Value Proportion Analysis, 2022

Figure 51: Global Vs Mexico Growth Comparison

Figure 52: Mexico Market Share Analysis (%) by Product, 2022 & 2033

Figure 53: Mexico Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 54: Mexico Market Share Analysis (%) By End User, 2022 & 2033

Figure 55: Brazil Market Value Proportion Analysis, 2022

Figure 56: Global Vs. Brazil. Growth Comparison

Figure 57: Brazil Market Share Analysis (%) by Product, 2022 & 2033

Figure 58: Brazil Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 59: Brazil Market Share Analysis (%) By End User, 2022 & 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Global Vs Argentina Growth Comparison

Figure 62: Argentina Market Share Analysis (%) by Product, 2022 & 2033

Figure 63: Argentina Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 64: Argentina Market Share Analysis (%) By End User, 2022 & 2033

Figure 65: Europe Market Value (US$ Million) Analysis, 2012 to 2022

Figure 66: Europe Market Value (US$ Million) Forecast, 2023-2033

Figure 67: Europe Market Value Share, by Product (2023 E)

Figure 68: Europe Market Value Share, By Surgery (2023 E)

Figure 69: Europe Market Value Share, By End User (2023 E)

Figure 70: Europe Market Value Share, by Country (2023 E)

Figure 71: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 73: Europe Market Attractiveness Analysis By End User, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 75: UK Market Value Proportion Analysis, 2022

Figure 76: Global Vs. UK Growth Comparison

Figure 77: UK Market Share Analysis (%) by Product, 2022 & 2033

Figure 78: UK Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 79: UK Market Share Analysis (%) By End User, 2022 & 2033

Figure 80: Germany Market Value Proportion Analysis, 2022

Figure 81: Global Vs. Germany Growth Comparison

Figure 82: Germany Market Share Analysis (%) by Product, 2022 & 2033

Figure 83: Germany Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 84: Germany Market Share Analysis (%) By End User, 2022 & 2033

Figure 85: Italy Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Italy Growth Comparison

Figure 87: Italy Market Share Analysis (%) by Product, 2022 & 2033

Figure 88: Italy Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 89: Italy Market Share Analysis (%) By End User, 2022 & 2033

Figure 90: France Market Value Proportion Analysis, 2022

Figure 91: Global Vs France Growth Comparison

Figure 92: France Market Share Analysis (%) by Product, 2022 & 2033

Figure 93: France Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 94: France Market Share Analysis (%) By End User, 2022 & 2033

Figure 95: Spain Market Value Proportion Analysis, 2022

Figure 96: Global Vs Spain Growth Comparison

Figure 97: Spain Market Share Analysis (%) by Product, 2022 & 2033

Figure 98: Spain Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 99: Spain Market Share Analysis (%) By End User, 2022 & 2033

Figure 100: Russia Market Value Proportion Analysis, 2022

Figure 101: Global Vs Russia Growth Comparison

Figure 102: Russia Market Share Analysis (%) by Product, 2022 & 2033

Figure 103: Russia Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 104: Russia Market Share Analysis (%) By End User, 2022 & 2033

Figure 105: BENELUX Market Value Proportion Analysis, 2022

Figure 106: Global Vs BENELUX Growth Comparison

Figure 107: BENELUX Market Share Analysis (%) by Product, 2022 & 2033

Figure 108: BENELUX Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 109: BENELUX Market Share Analysis (%) By End User, 2022 & 2033

Figure 110: East Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 111: East Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 112: East Asia Market Value Share, by Product (2023 E)

Figure 113: East Asia Market Value Share, By Surgery (2023 E)

Figure 114: East Asia Market Value Share, By End User (2023 E)

Figure 115: East Asia Market Value Share, by Country (2023 E)

Figure 116: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: China Market Value Proportion Analysis, 2022

Figure 121: Global Vs. China Growth Comparison

Figure 122: China Market Share Analysis (%) by Product, 2022 & 2033

Figure 123: China Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 124: China Market Share Analysis (%) By End User, 2022 & 2033

Figure 125: Japan Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Japan Growth Comparison

Figure 127: Japan Market Share Analysis (%) by Product, 2022 & 2033

Figure 128: Japan Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 129: Japan Market Share Analysis (%) By End User, 2022 & 2033

Figure 130: South Korea Market Value Proportion Analysis, 2022

Figure 131: Global Vs South Korea Growth Comparison

Figure 132: South Korea Market Share Analysis (%) by Product, 2022 & 2033

Figure 133: South Korea Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 134: South Korea Market Share Analysis (%) By End User, 2022 & 2033

Figure 135: South Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 136: South Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 137: South Asia Market Value Share, by Product (2023 E)

Figure 138: South Asia Market Value Share, By Surgery (2023 E)

Figure 139: South Asia Market Value Share, By End User (2023 E)

Figure 140: South Asia Market Value Share, by Country (2023 E)

Figure 141: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 142: South Asia Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 143: South Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: India Market Value Proportion Analysis, 2022

Figure 146: Global Vs. India Growth Comparison

Figure 147: India Market Share Analysis (%) by Product, 2022 & 2033

Figure 148: India Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 149: India Market Share Analysis (%) By End User, 2022 & 2033

Figure 150: Indonesia Market Value Proportion Analysis, 2022

Figure 151: Global Vs. Indonesia Growth Comparison

Figure 152: Indonesia Market Share Analysis (%) by Product, 2022 & 2033

Figure 153: Indonesia Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 154: Indonesia Market Share Analysis (%) By End User, 2022 & 2033

Figure 155: Malaysia Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Malaysia Growth Comparison

Figure 157: Malaysia Market Share Analysis (%) by Product, 2022 & 2033

Figure 158: Malaysia Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 159: Malaysia Market Share Analysis (%) By End User, 2022 & 2033

Figure 160: Thailand Market Value Proportion Analysis, 2022

Figure 161: Global Vs. Thailand Growth Comparison

Figure 162: Thailand Market Share Analysis (%) by Product, 2022 & 2033

Figure 163: Thailand Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 164: Thailand Market Share Analysis (%) By End User, 2022 & 2033

Figure 165: Oceania Market Value (US$ Million) Analysis, 2012 to 2022

Figure 166: Oceania Market Value (US$ Million) Forecast, 2023-2033

Figure 167: Oceania Market Value Share, by Product (2023 E)

Figure 168: Oceania Market Value Share, By Surgery (2023 E)

Figure 169: Oceania Market Value Share, By End User (2023 E)

Figure 170: Oceania Market Value Share, by Country (2023 E)

Figure 171: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 172: Oceania Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 173: Oceania Market Attractiveness Analysis By End User, 2023 to 2033

Figure 174: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: Australia Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Australia Growth Comparison

Figure 177: Australia Market Share Analysis (%) by Product, 2022 & 2033

Figure 178: Australia Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 179: Australia Market Share Analysis (%) By End User, 2022 & 2033

Figure 180: New Zealand Market Value Proportion Analysis, 2022

Figure 181: Global Vs New Zealand Growth Comparison

Figure 182: New Zealand Market Share Analysis (%) by Product, 2022 & 2033

Figure 183: New Zealand Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 184: New Zealand Market Share Analysis (%) By End User, 2022 & 2033

Figure 185: Middle East & Africa Market Value (US$ Million) Analysis, 2012 to 2022

Figure 186: Middle East & Africa Market Value (US$ Million) Forecast, 2023-2033

Figure 187: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 188: Middle East & Africa Market Value Share, By Surgery (2023 E)

Figure 189: Middle East & Africa Market Value Share, By End User (2023 E)

Figure 190: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 191: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness Analysis By Surgery, 2023 to 2033

Figure 193: Middle East & Africa Market Attractiveness Analysis By End User, 2023 to 2033

Figure 194: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison

Figure 197: GCC Countries Market Share Analysis (%) by Product, 2022 & 2033

Figure 198: GCC Countries Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 199: GCC Countries Market Share Analysis (%) By End User, 2022 & 2033

Figure 200: Türkiye Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Türkiye Growth Comparison

Figure 202: Türkiye Market Share Analysis (%) by Product, 2022 & 2033

Figure 203: Türkiye Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 204: Türkiye Market Share Analysis (%) By End User, 2022 & 2033

Figure 205: South Africa Market Value Proportion Analysis, 2022

Figure 206: Global Vs. South Africa Growth Comparison

Figure 207: South Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 208: South Africa Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 209: South Africa Market Share Analysis (%) By End User, 2022 & 2033

Figure 210: Northern Africa Market Value Proportion Analysis, 2022

Figure 211: Global Vs Northern Africa Growth Comparison

Figure 212: Northern Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 213: Northern Africa Market Share Analysis (%) By Surgery, 2022 & 2033

Figure 214: Northern Africa Market Share Analysis (%) By End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Reusable Box Market Forecast and Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Industry Share Analysis for Reusable Wine Bags Companies

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA