The reusable water bottle market is expanding steadily due to increasing consumer awareness regarding environmental sustainability, rising concerns over single-use plastic pollution, and growing health consciousness. Market dynamics are being influenced by lifestyle shifts toward portable and eco-friendly hydration solutions. Product innovation in terms of design, insulation, and durability has strengthened consumer adoption across diverse age groups and regions.

Regulatory actions promoting waste reduction and circular economy initiatives have further accelerated market penetration. The future outlook indicates consistent demand growth supported by corporate sustainability programs and the rising influence of fitness and outdoor recreation trends.

Manufacturers are focusing on enhancing material quality and integrating aesthetic appeal to cater to evolving consumer preferences Growth rationale is built upon the convergence of sustainability-driven consumer behavior, increased retail availability through organized distribution, and the expanding appeal of reusable products as both practical and lifestyle-oriented choices, positioning the market for long-term, volume-driven expansion across global regions.

| Metric | Value |

|---|---|

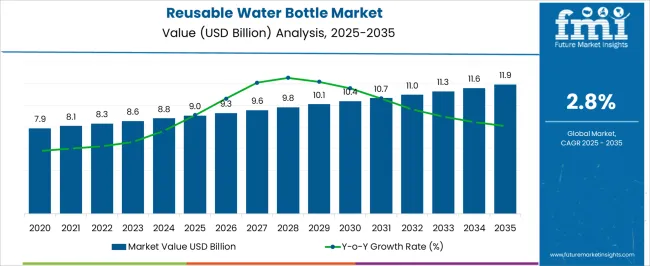

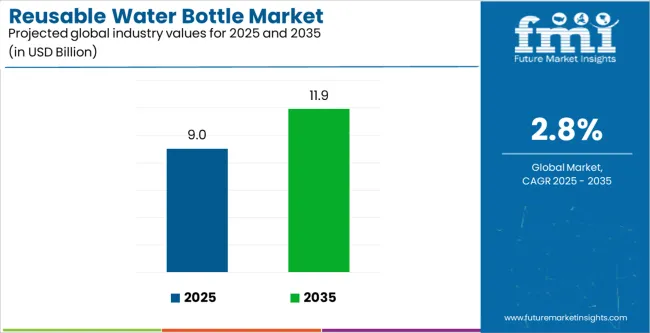

| Reusable Water Bottle Market Estimated Value in (2025 E) | USD 9.0 billion |

| Reusable Water Bottle Market Forecast Value in (2035 F) | USD 11.9 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

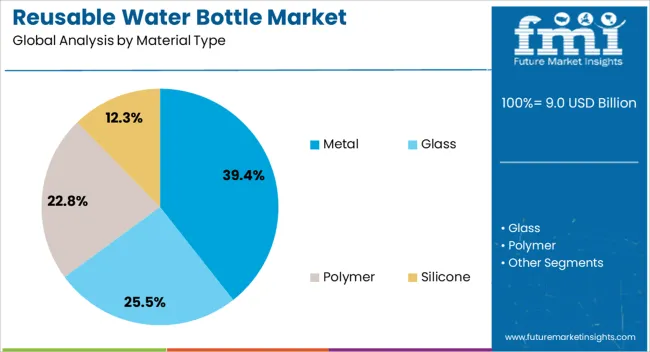

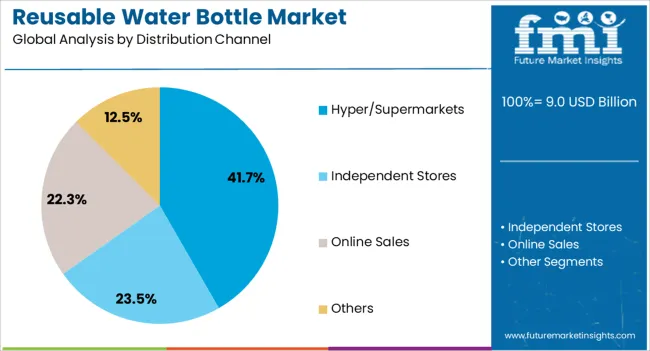

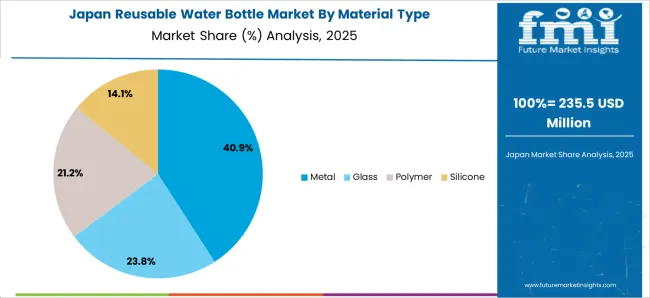

The market is segmented by Material Type, Distribution Channel, and Primary Usage and region. By Material Type, the market is divided into Metal, Glass, Polymer, and Silicone. In terms of Distribution Channel, the market is classified into Hyper/Supermarkets, Independent Stores, Online Sales, and Others.

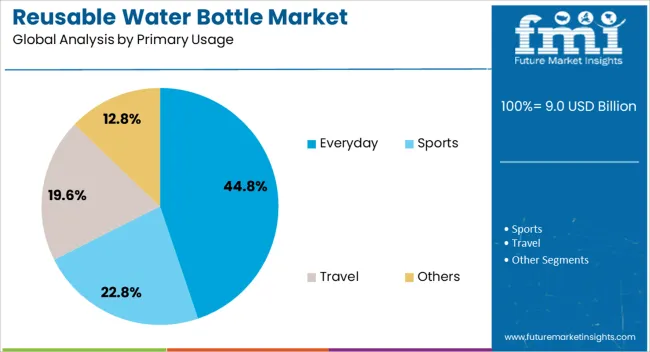

Based on Primary Usage, the market is segmented into Everyday, Sports, Travel, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal segment, accounting for 39.40% of the material type category, has maintained leadership due to its superior durability, temperature retention, and safety profile. Demand has been reinforced by the growing consumer shift toward BPA-free and long-lasting alternatives.

Stainless steel bottles have gained preference for their resistance to odor, corrosion, and environmental impact. Manufacturers have leveraged advanced fabrication and coating technologies to enhance insulation performance and reduce weight, improving user convenience.

The segment’s growth has been further supported by the premium positioning of metal bottles in the retail landscape and their association with sustainable and healthy living Expanding availability across both online and offline channels and increasing adoption among corporate and sports consumers are expected to sustain segment dominance and support long-term profitability.

The hyper/supermarkets segment, holding 41.70% of the distribution channel category, has emerged as the leading retail platform due to its extensive reach, product variety, and accessibility to diverse consumer demographics. Organized retail environments have provided manufacturers with effective visibility and shelf space advantages.

Promotional campaigns and bundled offers have strengthened consumer engagement and encouraged impulse purchases. The dominance of hyper/supermarkets has also been supported by the ability to physically compare materials, sizes, and designs, enhancing purchase confidence.

Retail expansion in urban and semi-urban areas and the integration of sustainability-focused product sections have further reinforced sales momentum Continued investment in retail infrastructure and product placement strategies is expected to maintain this channel’s leadership within the global reusable water bottle market.

The everyday usage segment, representing 44.80% of the primary usage category, has remained dominant due to widespread adoption for daily hydration needs at home, work, and during commuting. Consumers are increasingly opting for reusable bottles as a convenient, cost-effective, and eco-friendly alternative to disposable options.

The segment’s share has been sustained by functional versatility and design innovation catering to portability and ease of cleaning. Branding efforts emphasizing health benefits, personal expression, and environmental responsibility have further strengthened market penetration.

Demand stability has been reinforced by regular replacement cycles and expanding product customization options With consumer behavior continuing to align with sustainable consumption patterns, the everyday usage segment is expected to maintain its leading position, supporting steady market expansion across both developed and emerging regions.

| Historical CAGR | 2.2% |

|---|---|

| Forecast CAGR | 2.8% |

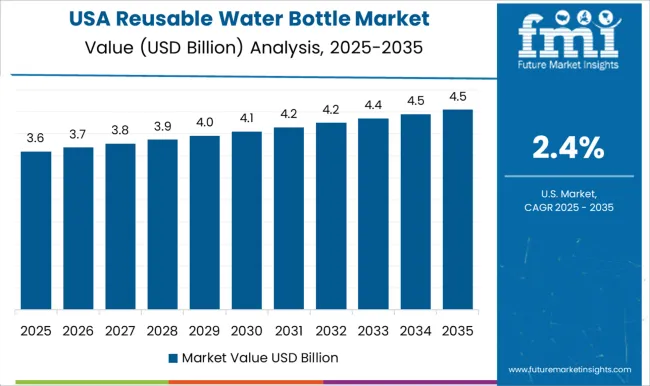

The historical performance of the reusable water bottle market reflects a notable CAGR of 2.2%, indicating moderate growth over the specified period. However, the forecasted CAGR of 2.8% suggests a slight increase in growth rates in the coming years. Several factors contribute to this shift in growth trajectory.

One factor influencing the historical CAGR of 2.2% could be the growing awareness of environmental sustainability and the associated increase in demand for eco-friendly alternatives to single-use plastics.

Consumers are becoming more conscious of the environmental impact of their choices, leading to the gradual adoption of reusable water bottles. Additionally, government initiatives promoting sustainability and reducing plastic waste may have played a role in driving market growth.

The forecasted increase in CAGR to 2.8% could be attributed to several factors. As environmental concerns continue to escalate, there is a heightened emphasis on reducing plastic waste and embracing reusable alternatives.

This growing awareness is expected to drive higher demand for reusable water bottles in the future. Furthermore, advancements in bottle design and material technology, such as lightweight and durable materials, may enhance the appeal of reusable bottles, attracting more consumers to make the switch.

Corporate Sustainability Initiatives

Many companies are implementing corporate social responsibility programs focused on reducing single-use plastics, which include providing employees with reusable water bottles. This corporate shift towards sustainability is boosting the adoption of reusable bottles in workplaces.

Fashion and Personalization

The trend towards personalized and stylish reusable water bottles, featuring unique designs, customizable options, and trendy materials, is attracting consumers looking for functional yet fashionable hydration accessories.

Rise of Specialty Markets

Emerging markets for specialized reusable water bottles, such as bottles designed for outdoor activities like hiking and camping, sports-specific bottles for athletes, and kid-friendly bottles with spill-proof features, are diversifying product offerings and meeting niche consumer needs.

Corporate Sustainability Programs

Corporations and organizations are implementing corporate sustainability programs that promote the use of reusable water bottles among employees and customers, contributing to the overall growth of the market.

This section provides detailed insights into specific segments in the reusable water bottle industry.

| Top Material | Metal |

|---|---|

| Market Share in 2025 | 33.1% |

Metal bottles are projected to maintain their dominance with a significant market share of 33.1% in 2025. Their continued popularity can be attributed to several factors:

| Dominating End Use | Institutional Use |

|---|---|

| Market Share in 2025 | 43.2% |

The institutional use segment is predicted to be the industry leader in 2025, holding an estimated market share of 43.2%. This significant share can be explained by:

The section analyzes the reusable water bottle market across key countries, including the United States, United Kingdom, China, India, and Japan. The analysis delves into the specific factors driving the demand for reusable water bottles in these countries.

| Countries | CAGR |

|---|---|

| United States | 1.7% |

| United Kingdom | 1.5% |

| China | 4.7% |

| India | 6.5% |

| Japan | 2.6% |

The reusable water bottle industry in the United States is anticipated to rise at a CAGR of 1.7% through 2035.

The reusable water bottle industry in the United Kingdom is projected to rise at a CAGR of 1.5% through 2035.

China’s reusable water bottle industry is likely to witness expansion at a CAGR of 4.7% through 2035.

India's reusable water bottle industry is projected to rise at a CAGR of 6.5% through 2035.

Japan's reusable water bottle market is expected to rise at a 2.6% CAGR through 2035.

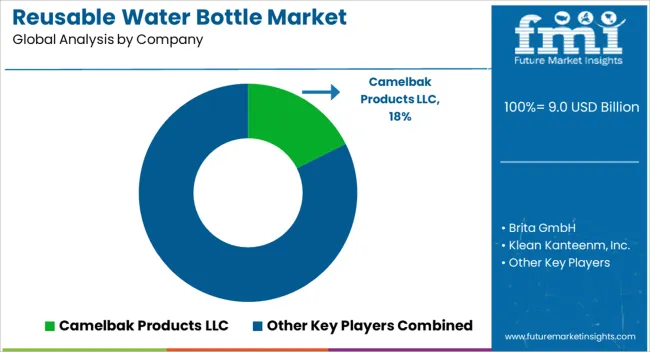

Established brands with strong brand recognition and distribution networks hold a significant market share. However, new entrants are emerging, offering innovative designs, sustainable materials, and niche functionalities. This compels established brands to adapt and innovate to retain their market position.

Consumers are increasingly prioritizing eco-friendly products. Manufacturers are responding by using recycled materials, offering end-of-life recycling programs, and adopting sustainable production practices. This focus on sustainability is becoming a key differentiator in the competitive industry.

Catering to specific needs and preferences through targeted marketing and product development is crucial. This could involve offering water bottles designed for athletes, professionals, or children or providing customization options like personalized engravings or unique designs.

Recent Developments in the Reusable Water Bottle Industry

The global reusable water bottle market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the reusable water bottle market is projected to reach USD 11.9 billion by 2035.

The reusable water bottle market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in reusable water bottle market are metal, glass, polymer and silicone.

In terms of distribution channel, hyper/supermarkets segment to command 41.7% share in the reusable water bottle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Water Purifier Bottle Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Bottle Market Size & Growth 2024 to 2034

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Electric Water Bottle Market

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Collapsible Water Bottle Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Collapsible Water Bottle Companies

Biodegradable water bottles Market

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA