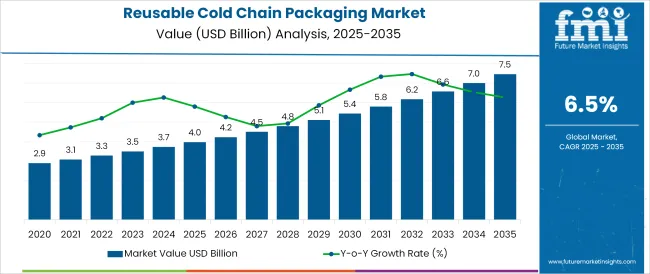

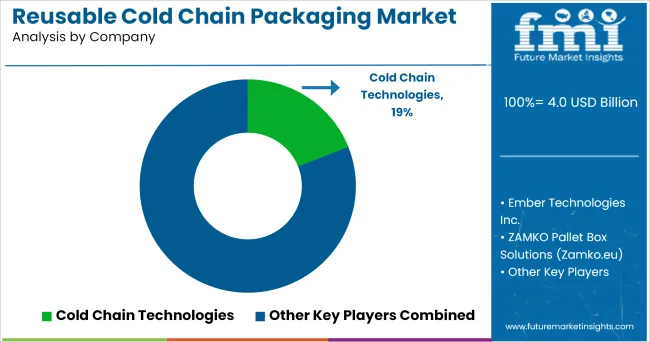

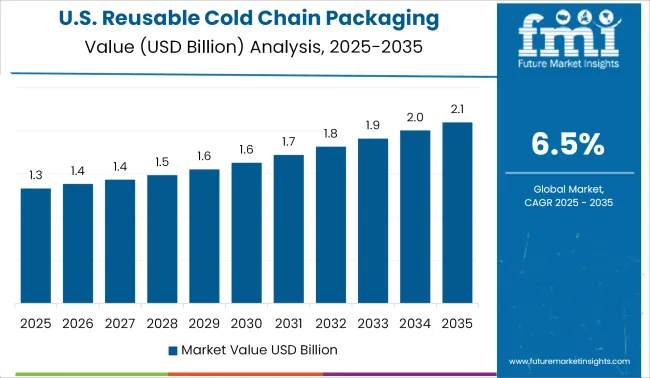

The Reusable Cold Chain Packaging Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The reusable cold chain packaging market is witnessing accelerated growth, supported by rising demand for temperature-sensitive logistics in food, pharmaceuticals, and biotechnology sectors. Increasing regulatory emphasis on food safety and drug integrity is reinforcing the adoption of reusable solutions that ensure consistent thermal protection across the supply chain.

Innovations in phase-change materials, vacuum-insulated panels, and RFID-enabled tracking are enabling greater durability, compliance, and traceability. In parallel, global sustainability goals are driving businesses to transition from single-use polystyrene and gel packs to reusable systems that reduce waste and optimize lifecycle costs.

Cold chain networks are expanding rapidly across emerging economies, where e-commerce and direct to consumer delivery models are further boosting the need for durable and returnable packaging. As operational efficiency and ESG compliance become critical to brand reputation and bottom-line performance, reusable cold chain systems are set to play a central role in long-term logistics strategies.

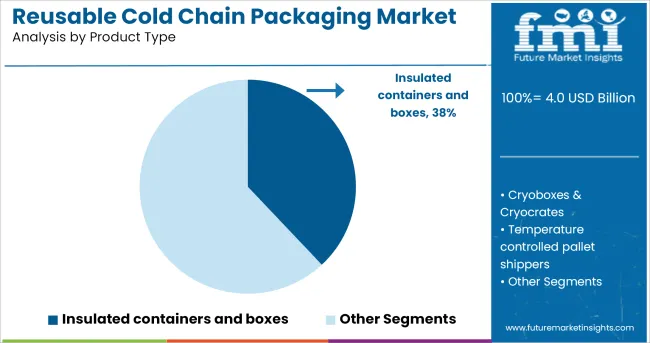

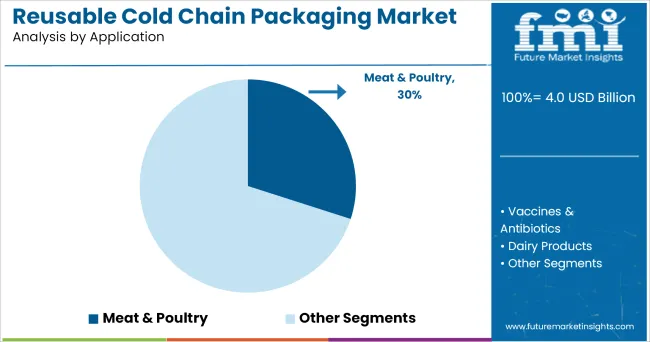

The market is segmented by Product Type, Application, and End-Use and region. By Product Type, the market is divided into Insulated containers and boxes, Cryoboxes & Cryocrates, Temperature controlled pallet shippers, and Others (cold packs, etc.). In terms of Application, the market is classified into Meat & Poultry, Vaccines & Antibiotics, Dairy Products, Bakery & Confectionary, and Others (cosmetics, other perishables, etc.).

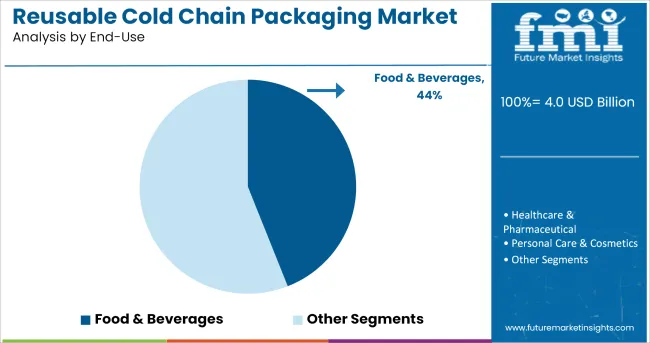

Based on End-Use, the market is segmented into Food & Beverages, Healthcare & Pharmaceutical, Personal Care & Cosmetics, and Others (agriculture, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insulated containers and boxes are projected to hold 38.0% of the reusable cold chain packaging market revenue in 2025, positioning them as the leading product type. Their dominance has been driven by superior insulation properties, modular stacking designs, and robust reusability over extended lifecycles.

These products have been preferred for their ability to maintain precise temperature ranges across various transit durations, supporting compliance with cold chain protocols. The adoption of advanced materials such as polyurethane, vacuum-insulated panels, and recyclable polymers has enhanced performance while reducing total system weight and carbon footprint.

Additionally, their compatibility with palletized shipping and automation systems has made them the container of choice in high-volume cold storage and distribution environments. The long-term cost advantage and growing availability of pooling and reverse logistics networks have further solidified their position as the cornerstone of cold chain transport solutions.

The meat and poultry segment is anticipated to account for 30.0% of the reusable cold chain packaging market revenue in 2025, establishing it as the top application area. This leadership is attributed to the strict temperature control requirements and perishability of protein-based products, which necessitate reliable and compliant packaging solutions.

Regulatory guidelines governing pathogen control, shelf-life extension, and hygiene have driven investment in reusable systems that support repeatable sterilization and reduced cross-contamination risks. Reusable containers with tamper-evident closures, high insulation efficiency, and easy-to-clean surfaces have become critical for meat processors, distributors, and retailers.

Additionally, the growing global trade of fresh and frozen meat products has intensified the need for packaging solutions that offer temperature stability, damage resistance, and cost-efficient reuse over long distances. The segment's share has been reinforced by cold chain infrastructure upgrades and export-oriented meat production hubs across North America, Europe, and Asia-Pacific.

The food and beverages segment is projected to contribute 44.0% of revenue in the reusable cold chain packaging market by 2025, making it the leading end-use vertical. This is being driven by the sector’s increasing reliance on extended shelf-life logistics and temperature-controlled fulfilment for perishable goods.

The expansion of meal-kit services, grocery e-commerce, and specialty food distribution has prompted food brands and retailers to adopt reusable packaging for its thermal reliability, brand visibility, and cost advantages over time. Furthermore, rising sustainability expectations among consumers and regulatory agencies are encouraging companies to phase out disposable packaging in favour of durable alternatives.

The food and beverages sector has been at the forefront of implementing closed-loop logistics systems, leveraging reusable containers to reduce waste, lower transport costs, and improve cold chain integrity. This combination of regulatory pressure, operational efficiency, and consumer-driven sustainability goals continues to underpin the segment’s dominance.

Reusable cold chain packaging is a packaging box or a crate that is used to consistently maintain the temperature of the packaging and shipping goods from manufacture to the final destination. These boxes are commonly used for the transportation of temperature-sensitive products like pharmaceutical vaccines, cosmetics, etc. for which even a minor temperature variance can lead to reduced efficacy of the substance.

The demand for high-quality goods and products to deliver quickly at a competitive price is preferred by the consumers as well as manufacturers. Different levels of cold chain protection are also available for different products to meet the specific needs of manufacturers. The reusable cold chain packaging can be used again with high compliance, efficiency, and cost.

The reusable cold chain packaging helps the consumers to save time, money with efficient temperature controlling by keeping the product quality fresh. The reusable cold chain packaging containers are robust and durable and also have a sustainability profile for reuse.

The reusable cold chain packaging with the customizations in the box sizes and temperature regulations. The customized protective packaging is not only gaining demand in pharmaceuticals especially for biologics & biologicals but also the food segment.

As the demand for fresh products is rising, the demand for customized cold chain packaging is also increasing. The evaporative cooling technology in the reusable cold chain packaging is also preferred and is creating a demand over the traditional cold chain packaging. Therefore, innovations and customizations are the recent trends that are setting the reusable cold chain packaging market in high demand.

The reusable cold chain packaging does not require additional gel coolants and also they weigh much less as compared to the traditional cold chain packaging. The reusable cold chain packaging has larger dimensions compared to the traditional cold chain packaging boxes which are useful in bringing down the packaging costs given the amount of cargo shipped per batch in the containers or boxes.

Also, the reusable cold chain packaging is manufactured with the use of sustainable materials for reuse which eventually results in environmental preservation while reducing the carbon footprint.

The manufacturing of reusable cold chain packaging requires machinery or equipment which is costly and can withhold the market especially for the new entrants operating the reusable cold chain packaging market.

Also, the increase in the freight costs depending upon the framed regulations and the product being exported can be a restraining factor to the reusable cold chain packaging market.

The following global key players such as

Key Asian players manufacturing reusable cold chain packaging

The manufacturers involved in the manufacturing of reusable cold chain packaging are involved in investing the capital in the new technology of the reusable cold chain packaging solutions to expand the business on the global level. Also, the leading packaging distributors and providers are involved in partnering with the top manufacturers involved in manufacturing reusable cold chain packaging to expand their services.

Majority of the clinical labs, diagnostics centre and research laboratories are looking forward for the efficient and effective storage and transportation of the thermosensitive materials and products for the testing. Therefore, reusable cold chain packaging not only enhance the preservation of the thermosensitive products but also they can be reused again for the transportation of the entire batch of the thermosensitive biological products or fluids.

The majority of the key players manufacturing reusable cold chain packaging have their presence in the USA which is the key factor driving the growth of the reusable cold chain packaging market share. Adding to this, also the changing technologies in the packaging industry by emphasizing research & development activities leading to extended product protection and conservation is acting as a boon towards the growth of the reusable cold chain packaging market.

The global reusable cold chain packaging market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the reusable cold chain packaging market is projected to reach USD 7.5 billion by 2035.

The reusable cold chain packaging market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in reusable cold chain packaging market are insulated containers and boxes, cryoboxes & cryocrates, temperature controlled pallet shippers and others (cold packs, etc.).

In terms of application, meat & poultry segment to command 30.0% share in the reusable cold chain packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Reusable Box Market Forecast and Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Industry Share Analysis for Reusable Wine Bags Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA