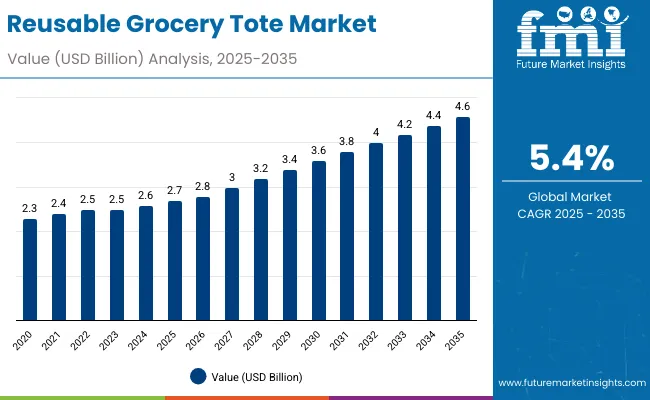

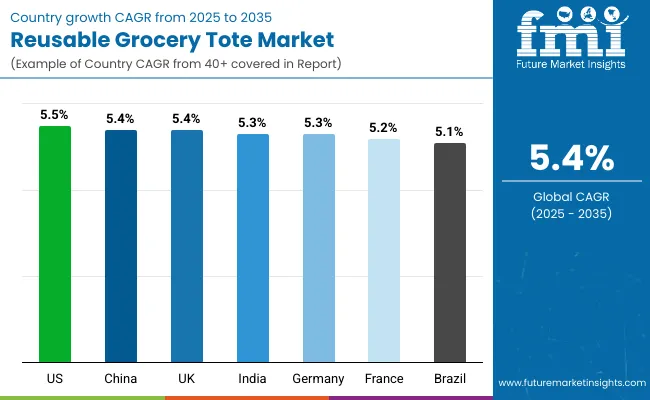

The reusable grocery tote market will expand from USD 2.7 billion in 2025 to USD 4.6 billion by 2035, advancing at a CAGR of 5.4%. This growth is fueled by bans on single-use plastic bags, expansion of eco-friendly retail programs, and rising consumer preference for durable, washable bags. Retailers and governments alike are driving adoption across supermarkets, specialty stores, and online grocery delivery systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.7 billion |

| Industry Value (2035F) | USD 4.6 billion |

| CAGR (2025 to 2035) | 5.4% |

Between 2025 and 2030, the market will add USD 0.8 billion, largely from urban retail growth and consumer awareness campaigns. From 2030 to 2035, growth of USD 1.1 billion will be driven by e-commerce, food delivery platforms, and specialty retailers. Medium-capacity totes, recyclable PP, and stylish canvas designs will anchor demand globally, with Asia-Pacific leading adoption.

From 2020 to 2024, the reusable grocery tote market grew steadily as governments-imposed bans on single-use plastic bags and retailers offered incentives for eco-friendly alternatives. Early adoption centered on non-woven polypropylene and cotton totes, which were promoted by supermarkets and municipalities. Awareness campaigns, alongside branding opportunities for retailers, expanded tote visibility and consumer acceptance.

By 2035, the market will reach USD 4.6 billion at 5.4% CAGR. Non-woven PP and standard totes will dominate, supported by bulk production and affordability. Retail and e-commerce will lead usage as digital grocery shopping grows. Asia-Pacific will drive the highest growth, led by Japan and South Korea, while Europe and North America focus on compliance and premium tote designs.

The reusable grocery tote market is expanding as consumers and retailers shift toward sustainability. Governments worldwide enforce bans on single-use plastics, boosting adoption of durable, recyclable totes. Supermarkets and hypermarkets remain major buyers, encouraging loyalty programs that incentivize tote use.

Fashion-forward designs and customizable branding also drive uptake, making totes lifestyle accessories. E-commerce and online grocery platforms expand demand for reusable bags in last-mile delivery. With circular economy principles gaining momentum and consumers embracing reusability, the market’s long-term growth is secured.

The reusable grocery tote market is segmented by material, bag type, capacity, application, end-use industry, and region. Materials include non-woven polypropylene, cotton, jute, woven polypropylene, recycled PET, and canvas. Bag types cover standard, foldable, insulated, drawstring, and box-style totes. Capacities range from small, medium, to large. Applications span supermarkets, convenience stores, specialty stores, and online grocery delivery. End-use industries include retail and e-commerce, food and beverages, and household products across global regions.

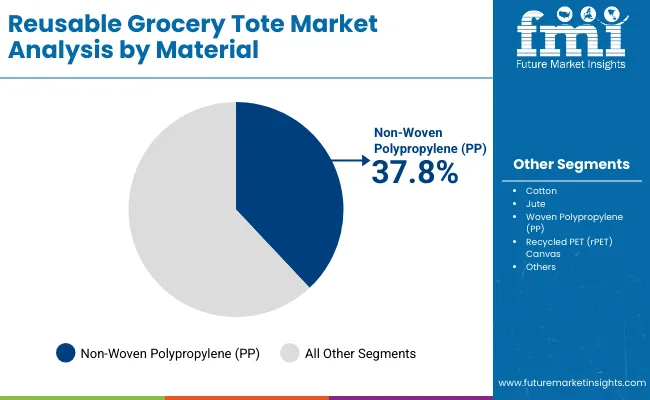

Non-woven polypropylene (PP) will hold 37.8% share in 2025 due to affordability, durability, and ease of branding. Its lightweight yet strong design makes it the top choice for supermarkets and e-commerce platforms. Retailers prefer PP totes for bulk distribution and promotional programs, offering them as alternatives to banned plastic bags.

Future growth will stem from advances in recycled PP, biodegradable coatings, and stylish finishes. Automation in PP tote manufacturing improves scalability, while compliance with eco-label certifications expands acceptance. By 2035, PP totes will continue to dominate as the most widely adopted material globally.

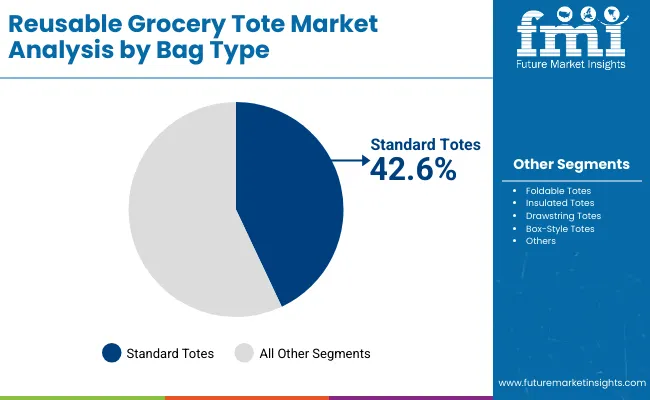

Standard totes will account for 42.6% share in 2025, reflecting their simplicity, practicality, and versatility. These bags are widely distributed by supermarkets and retail chains as primary replacements for single-use plastics. Their durability and capacity make them highly preferred for everyday shopping and bulk grocery trips.

Growth will be supported by increased branding potential, with standard totes serving as mobile advertising tools. Retailers continue to expand loyalty programs that encourage tote reuse, while customization trends enhance consumer appeal. Standard totes will remain the cornerstone of the market through 2035.

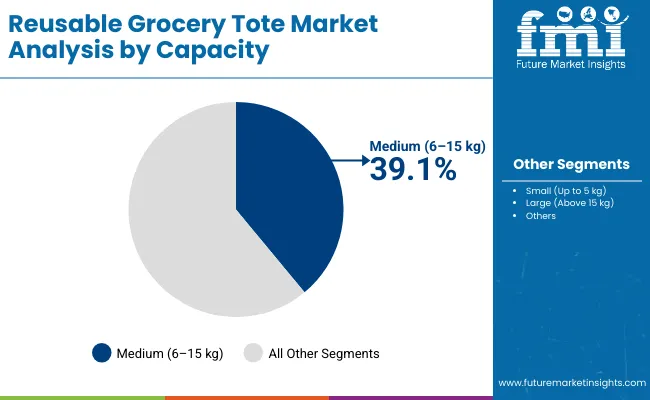

Medium-capacity bags (6-15 kg) will command 39.1% share in 2025, offering the right balance of durability and practicality. Shoppers prefer these totes for their ability to handle typical grocery volumes without being cumbersome. Retailers favor them for promotional campaigns and bulk packaging.

Future expansion will be driven by enhanced ergonomic designs, foldable options, and recycled-content variants. Medium-capacity totes also align with logistics needs for e-commerce platforms, reinforcing their long-term dominance.

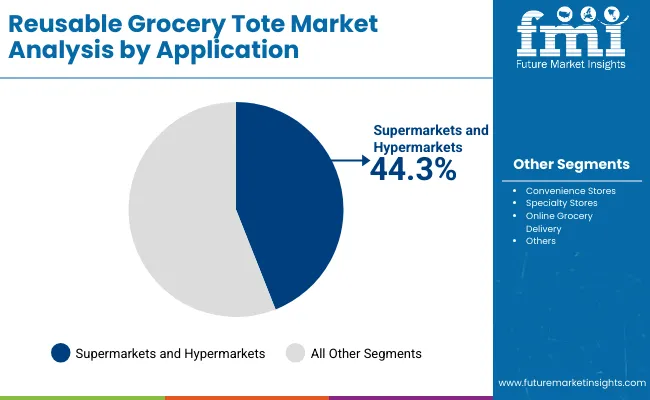

Supermarkets and hypermarkets will account for 44.3% share in 2025, reflecting their central role in tote adoption. Plastic bans and retailer-led sustainability initiatives drive bulk distribution of reusable bags at checkout points. Retailer branding also boosts tote visibility.

Growth will expand as grocery e-commerce integrates reusable totes for delivery. With major retail chains prioritizing sustainability, supermarkets and hypermarkets will remain key to market expansion through 2035.

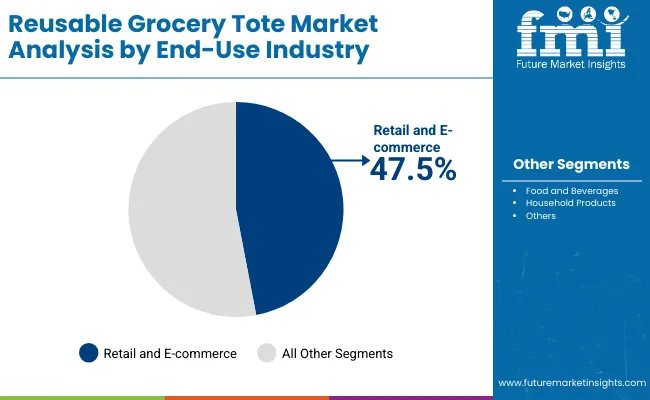

Retail and e-commerce will account for 47.5% share in 2025, the largest end-use industry. Online grocery platforms, fashion retailers, and general merchandise stores adopt totes for sustainable delivery and brand promotion. Their role in last-mile logistics reinforces growth.

By 2035, retail and e-commerce adoption will deepen with customized designs, traceability features, and integration into loyalty programs. The sector’s rapid expansion ensures its continued dominance.

The market is driven by bans on single-use plastic bags, consumer demand for sustainability, and retailer incentives. Tote bags reduce environmental impact while enhancing branding for retailers. Fashionable designs expand their utility beyond groceries, while supermarkets distribute totes at scale. E-commerce integration further strengthens growth, ensuring reusable totes remain central to sustainable retail strategies.

Higher upfront costs compared to plastic bags limit adoption in price-sensitive markets. Durability concerns with repeated use, particularly for low-cost non-woven PP bags, hinder reuse rates. Recycling challenges for mixed-material totes add complexity. Lack of consumer awareness in some regions slows penetration. These restraints create barriers, especially in emerging markets where affordability and education remain issues.

Significant opportunities exist in premium totes, e-commerce logistics, and fashion collaborations. Retailers leverage tote customization for marketing, while brands explore biodegradable cotton, jute, and rPET materials. Partnerships with NGOs and sustainability campaigns enhance adoption. Expansion into online grocery delivery further elevates opportunities, making reusable totes both a retail necessity and a consumer lifestyle product.

Trends include the shift to recycled PET and biodegradable cotton totes, lightweight foldable designs, and smart bag features such as QR codes for promotions. Fashion retailers adopt reusable totes as lifestyle accessories, while e-commerce integrates reusable delivery bags. Certification programs verifying durability and recyclability gain traction. Collectively, these trends reinforce the market’s evolution toward versatile, sustainable solutions.

The market is expanding worldwide as bans on plastics and sustainable retail initiatives converge. Asia-Pacific leads growth, with Japan and South Korea adopting at higher rates. Europe enforces strict circular economy mandates, while North America emphasizes large-scale retail distribution. Latin America and the Middle East show increasing uptake through retail partnerships and food delivery platforms.

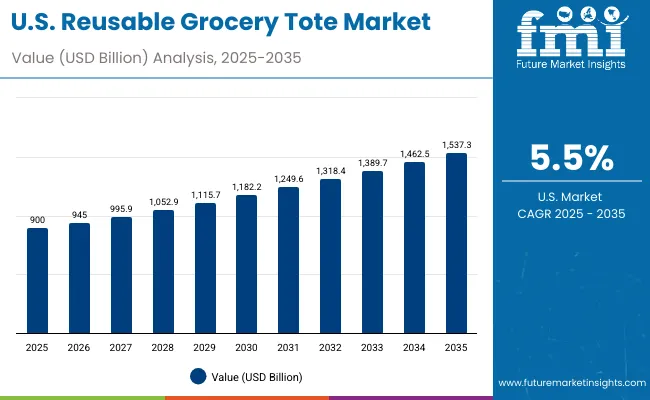

The USA tote bag market is forecast to expand at a CAGR of 5.5%, supported by large supermarket chains and reinforced by state-level plastic bag bans. Growing e-commerce platforms and specialty stores continue to enhance nationwide demand for reusable totes. Retailers also emphasize customized and branded designs, which contribute to visibility and strengthen consumer loyalty, making tote bags not only functional but also important branding tools in a competitive retail environment.

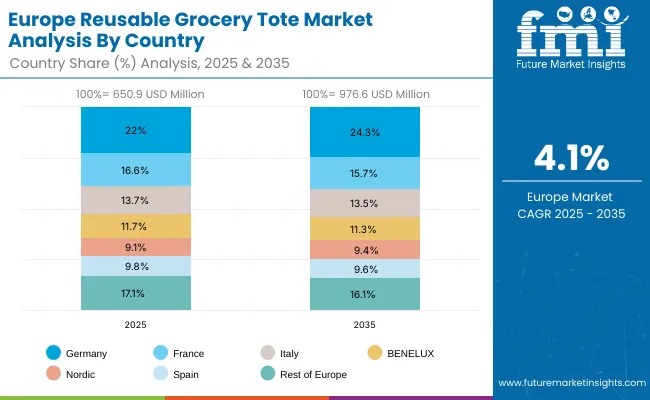

Germany will grow steadily at 5.3% CAGR, underpinned by strict EU packaging regulations and progressive sustainability policies. Grocery retailers play a leading role by distributing reusable totes, framing them as part of broader sustainability commitments. At the same time, fashion retailers are investing in enhancing premium designs that reflect consumer preferences for eco-friendly and stylish products, blending sustainability with high-end aesthetics to strengthen adoption across urban and suburban consumer bases in Germany.

The UK tote bag market is projected to record a 5.4% CAGR, propelled by the established levy on single-use plastic bags. Supermarkets remain at the forefront of adoption, distributing reusable tote bags widely among consumers. Additionally, the surge of online grocery delivery services provides a new momentum, with tote bags integrated into last-mile delivery packaging, further embedding them into consumer routines and supporting sustainable practices across retail and delivery segments nationwide.

China’s tote bag market is expected to expand at 5.4% CAGR, driven primarily by large-scale retail chains and reinforced by government-imposed bans on plastic bags. Online retail platforms such as e-commerce marketplaces are further propelling demand, making tote bags integral to retail packaging. At the supply side, low-cost polypropylene (PP) totes dominate production, ensuring affordability and availability, while aligning with the country’s large-scale distribution requirements and emphasis on replacing disposable plastic packaging solutions.

India’s tote bag market will grow at 5.3% CAGR, supported by nationwide restrictions on plastic usage. Demand is particularly strong in grocery and household retail, where tote bags have become essential because of government mandates. Awareness campaigns led by non-governmental organizations (NGOs) further encourage the shift, creating stronger consumer acceptance of totes as environmentally safe alternatives, while retailers continue to expand distribution and accessibility across urban centers and smaller towns.

Japan’s tote bag market is projected to expand at a 6.0% CAGR, reflecting a strong culture of recycling and environmental awareness. Premium materials such as cotton and recycled PET (rPET) totes dominate, favored for durability and sustainability. Retailers are increasingly emphasizing style and fashion-forward designs, appealing to a consumer base that values quality and aesthetics, reinforcing tote bags as both eco-friendly and lifestyle products, well-aligned with Japan’s recycling mandates and consumer trends.

South Korea is set to lead global tote bag growth at 6.2% CAGR, supported by e-commerce logistics and strong uptake in fashion retail. Consumers show significant interest in foldable and stylish tote bag designs, which combine functionality with aesthetics. Retailers further promote reusable solutions in logistics and delivery, positioning tote bags as essential within Korea’s fast-growing e-commerce market, as well as fashion-conscious consumer culture emphasizing design, convenience, and sustainability together.

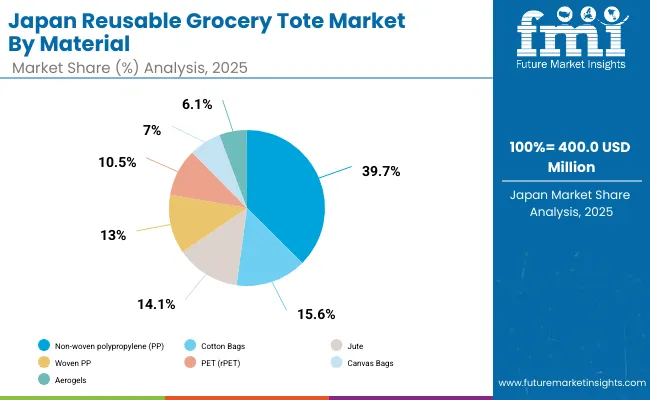

Japan’s reusable grocery tote market, valued at USD 400 million in 2025, is led by non-woven polypropylene (PP) with a 39.7% share, favored for cost-effectiveness and durability. Cotton bags hold 15.6%, supported by eco-conscious buyers seeking natural fibers, while jute accounts for 14.1% with strong adoption in retail promotions. Woven PP contributes 13.0%, offering strength for heavier loads, and recycled PET (rPET) totes at 10.5% reflect the push for circular economy practices. Canvas bags at 7.0% remain niche but preferred for premium, long-lasting applications. Overall, material selection reflects Japan’s balance between affordability, strength, and sustainability in retail packaging solutions.

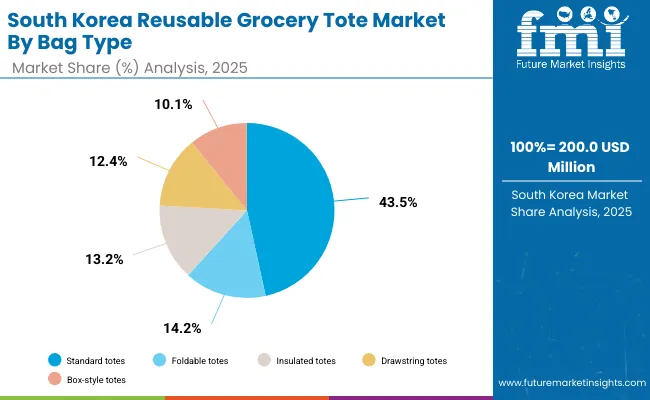

South Korea’s reusable grocery tote market, sized at USD 200 million in 2025, is dominated by standard totes with a 43.5% share, driven by widespread adoption for everyday grocery shopping. Foldable totes represent 14.2%, offering compact convenience for urban consumers, while insulated totes at 13.2% cater to temperature-sensitive food transport. Drawstring totes hold 12.4%, appealing to younger demographics for casual multipurpose use, while box-style totes at 10.1% serve organized packing needs. Market segmentation demonstrates South Korea’s preference for practical, versatile, and stylish options. Growth is further propelled by eco-regulations discouraging single-use plastics, enhancing tote adoption across retail and household use.

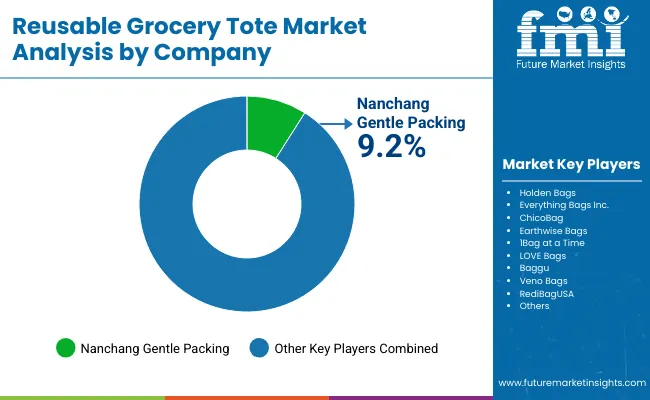

The market is highly fragmented, with global and regional players competing on price, material innovation, and branding. Key companies include Nanchang Gentle Packing, Holden Bags, Everything Bags Inc., ChicoBag, Earthwise Bags, 1Bag at a Time, LOVE Bags, Baggu, Veno Bags, and RediBagUSA.

ChicoBag, Baggu, and Earthwise Bags emphasize sustainability and stylish designs. Nanchang Gentle Packing and Holden Bags lead bulk supply for supermarkets. Regional players like Veno Bags and RediBagUSA focus on customization and affordability. Partnerships with retailers, NGOs, and e-commerce platforms shape competition, while innovation in biodegradable and recycled materials defines leadership.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| By Material | Non-Woven PP, Cotton, Jute, Woven PP, Recycled PET, Canvas |

| By Bag Type | Standard, Foldable, Insulated, Drawstring, Box-Style |

| By Capacity | Small, Medium, Large |

| By Application | Supermarkets, Convenience Stores, Specialty Stores, Online Grocery Delivery |

| By End-Use Industry | Retail & E-commerce, Food & Beverages, Household Products |

| Key Companies Profiled | Nanchang Gentle Packing, Holden Bags, Everything Bags Inc., ChicoBag, Earthwise Bags, 1Bag at a Time, LOVE Bags, Baggu, Veno Bags, RediBagUSA |

| Additional Attributes | Growth driven by plastic bans, e-commerce, and fashion-oriented designs. |

The market will be valued at USD 2.7 billion in 2025.

The market will reach USD 4.6 billion by 2035.

The market will grow at a CAGR of 5.4% during 2025-2035.

Non-woven polypropylene totes will lead with a 37.8% share in 2025.

Retail and e-commerce will anchor demand with a 47.5% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Reusable Box Market Forecast and Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Industry Share Analysis for Reusable Wine Bags Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA