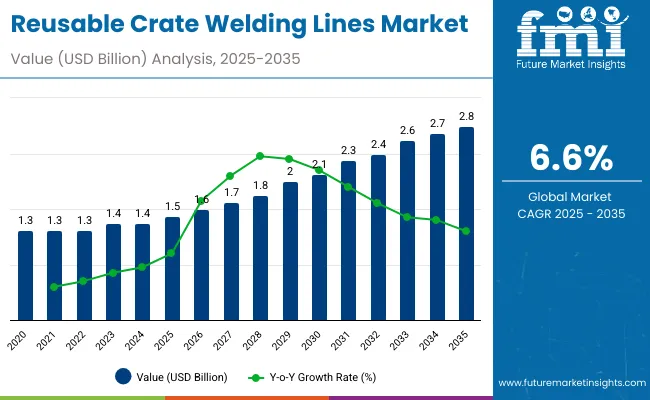

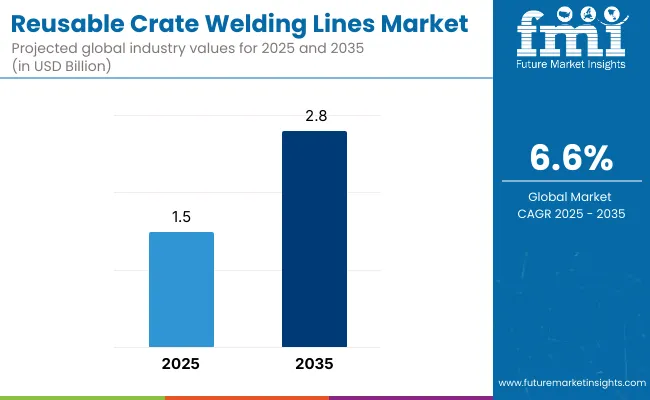

The global reusable crate welding lines market will expand from USD 1.5 billion in 2025 to USD 2.8 billion by 2035, growing at a CAGR of 6.6%. Growth is supported by increasing automation in crate manufacturing and demand for sustainable, durable materials. Ultrasonic welding dominates for its high precision and energy efficiency. Between 2025 and 2030, adoption of fully automatic welding systems will add USD 0.8 billion in market value. By 2035, digital monitoring and robotic integration will further streamline production across logistics and food packaging industries.

Between 2020 and 2024, automation reshaped crate welding systems, integrating robotic precision and AI-based weld inspection. The transition toward reusable crates for logistics and food packaging strengthened sustainability goals. By 2035, the market will reach USD 2.8 billion, driven by ultrasonic and infrared welding advancements. Asia-Pacific’s expansion, fueled by industrial automation and sustainability mandates, will anchor future growth, while Europe continues emphasizing energy-efficient welding technologies.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.5 billion |

| Forecast Value in (2035F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Between 2020 and 2024, automation reshaped crate welding systems, integrating robotic precision and AI-based weld inspection. The transition toward reusable crates for logistics and food packaging strengthened sustainability goals. By 2035, the market will reach USD 2.8 billion, driven by ultrasonic and infrared welding advancements. Asia-Pacific’s expansion, fueled by industrial automation and sustainability mandates, will anchor future growth, while Europe continues emphasizing energy-efficient welding technologies.

Market expansion is driven by global emphasis on circular economy practices and reusable logistics infrastructure. Increasing deployment of polypropylene and recycled materials enhances durability and environmental performance. Automation and robotic control in welding lines reduce defects, optimize productivity, and ensure consistent structural quality across industries such as food processing, warehousing, and automotive component handling.

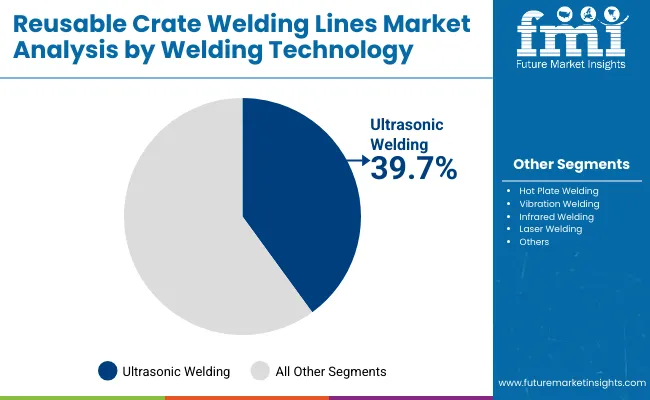

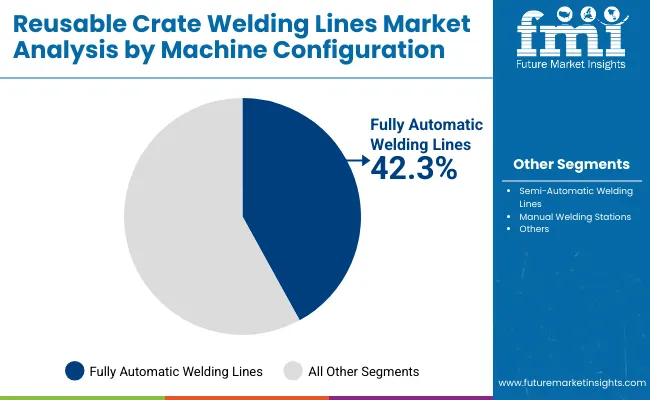

The market is segmented by welding technology, machine configuration, material, application, end-use industry, and region. Welding technology includes ultrasonic welding, hot plate welding, vibration welding, infrared welding, and laser welding, ensuring strong and precise joints for reusable plastic crates. Machine configuration covers fully automatic welding lines, semi-automatic welding lines, and manual welding stations, catering to varied production capacities. Material segmentation includes polypropylene (PP), high-density polyethylene (HDPE), polycarbonate (PC), recycled plastics, and composite polymers, supporting durability and sustainability goals. Applications span food and beverage crates, dairy and agricultural crates, industrial and logistics crates, and automotive component crates, ensuring robust handling solutions. End-use industries include food and beverage processing, agriculture and dairy, industrial manufacturing, logistics and warehousing, and automotive. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Ultrasonic welding is projected to capture 39.7% of the market in 2025, driven by its precision, speed, and minimal energy consumption. The process creates clean, strong joints without adhesives or fasteners, making it ideal for polypropylene crate assembly. Its compatibility with automation supports high-volume manufacturing and uniform quality across production lines.

By 2035, wider implementation of automated frequency control and real-time weld inspection will enhance productivity and consistency. These innovations will reduce rework rates and improve process reliability. As sustainability and cost optimization become central to operations, ultrasonic welding remains the preferred technology for durable crate fabrication.

Fully automatic welding systems are expected to account for 42.3% of the market in 2025, favored for their ability to reduce manual labor and ensure consistent output. These machines incorporate digital programming, robotic handling, and multi-station operations to optimize production flow.

By 2035, integration of AI-enabled sensors and closed-loop feedback systems will revolutionize crate manufacturing efficiency. Automation enhances precision while lowering operational costs, aligning with Industry 4.0 standards. As manufacturers scale operations to meet rising logistics and packaging demands, fully automatic lines dominate investment priorities.

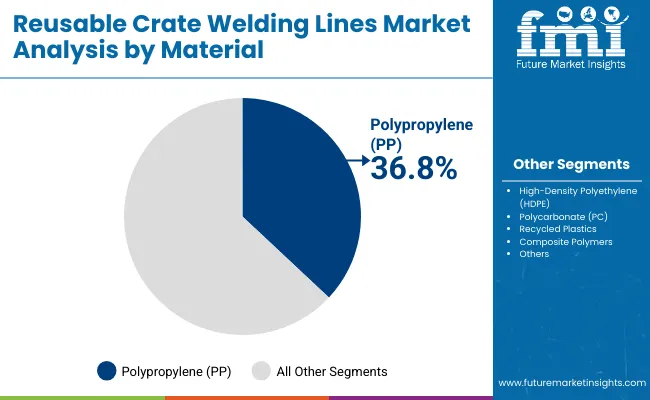

Polypropylene is forecast to represent 36.8% of the market in 2025, valued for its lightweight durability and compatibility with advanced welding processes. Its chemical resistance and impact strength make it ideal for reusable crate applications across food, beverage, and logistics industries.

By 2035, the development of reinforced polypropylene blends will expand its use in heavy-duty and temperature-sensitive transport solutions. The material’s recyclability supports circular packaging goals, ensuring compliance with sustainability regulations. As demand for eco-friendly crates increases, polypropylene remains the material of choice.

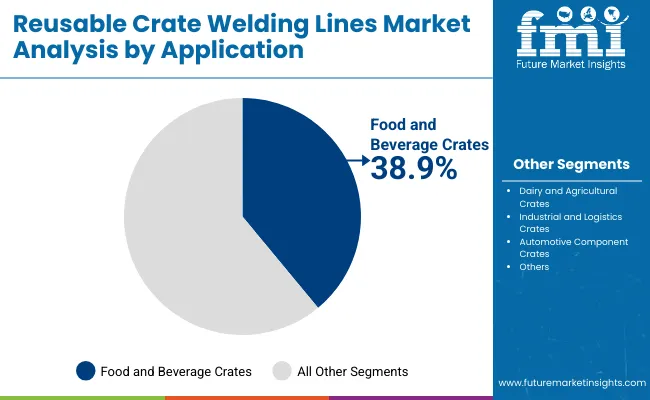

Food and beverage crates are projected to command 38.9% of the market in 2025, supported by the sector’s need for durable, washable, and reusable transport packaging. Ultrasonic welding ensures hygienic sealing, eliminating crevices that can harbor contaminants during repeated use.

By 2035, energy-efficient welding lines and water-resistant materials will further improve cleaning efficiency and lifecycle performance. Beverage producers and retailers continue to invest in reusable crates to cut waste and comply with sustainability mandates. This segment remains the principal driver of growth across global welding line installations.

Rising sustainability targets and efficiency optimization drive adoption of automated welding lines across industrial packaging sectors.

High capital investment and maintenance costs limit small-scale manufacturer entry.

Growing use of recycled materials and AI-assisted welding analytics presents long-term potential for sustainable innovation.

Smart welding controls, modular automation cells, hybrid welding systems, and predictive maintenance integration define upcoming technological directions.

The global reusable crate welding lines market is growing as industries embrace sustainable packaging automation and modular manufacturing systems. Asia-Pacific leads adoption, driven by large-scale industrial automation and robotic welding investments, while North America focuses on enhancing productivity across logistics and food processing sectors. Europe is prioritizing energy efficiency, recyclability, and digitalized production frameworks. The transition toward durable, reusable packaging solutions continues to strengthen global demand for precision-engineered, eco-efficient welding technologies.

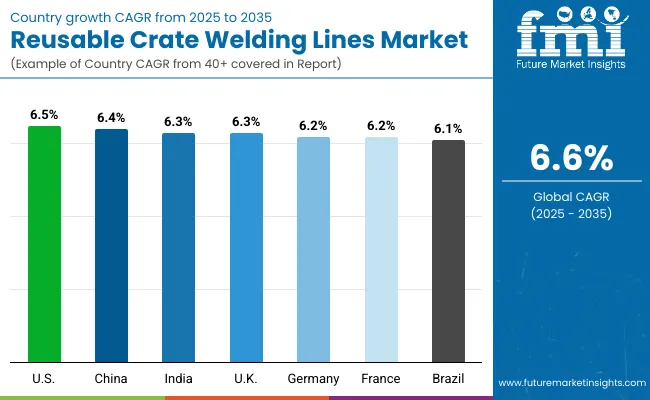

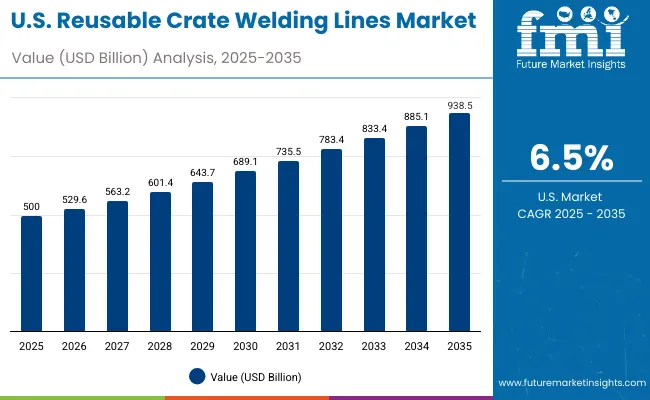

The USA will grow at 6.5% CAGR, supported by modernization of manufacturing and the shift toward sustainable packaging automation. Robotic welding systems are enhancing precision and throughput across logistics and food handling applications. Adoption of energy-efficient welding technologies is aligning with corporate sustainability goals. The USA market is seeing robust investment in digital twin monitoring, ensuring consistent weld quality and reduced downtime across large-scale operations.

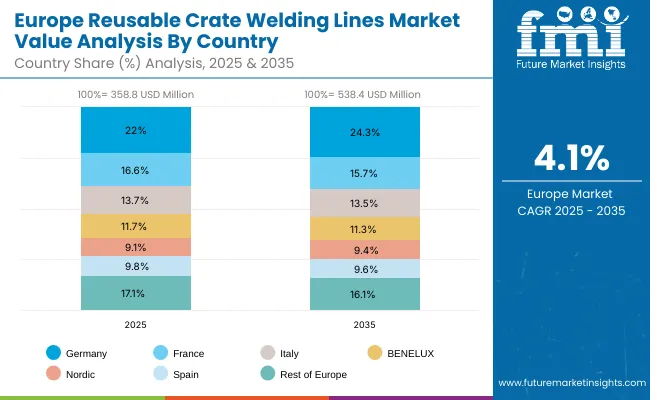

Germany will expand at 6.2% CAGR, focusing on energy-optimized and digitally connected welding systems. Industrial automation in manufacturing and warehousing continues to accelerate adoption. The use of reinforced and durable materials is broadening crate applications across food, chemical, and recycling industries. Strong government policies promoting recyclability and material circularity are driving investment in next-generation crate welding technologies.

The UK will grow at 6.3% CAGR, supported by advanced automation in warehousing and logistics. Manufacturers are increasingly integrating ultrasonic and hybrid welding technologies for precision crate fabrication. Robotics are optimizing labor efficiency and line speed in modular packaging production. Sustainability-focused design standards and post-consumer plastic initiatives are reinforcing innovation and adoption of reusable crate welding systems.

China will grow at 6.4% CAGR, leading production scalability and automation in reusable packaging. Industrial automation programs are expanding capacity and improving weld uniformity across crate manufacturing facilities. Domestic demand from logistics, agriculture, and e-commerce sectors is surging rapidly. The integration of AI-enabled quality control systems is strengthening production reliability and export competitiveness of welded reusable crates.

India will grow at 6.3% CAGR, supported by rising modernization across dairy, agriculture, and logistics sectors. Cost-effective robotic welding systems are expanding accessibility for mid-sized manufacturers. Integration of recycled plastics into crate fabrication is becoming a key sustainability focus. Government infrastructure projects and logistics expansion continue to boost the adoption of reusable and durable crate welding systems.

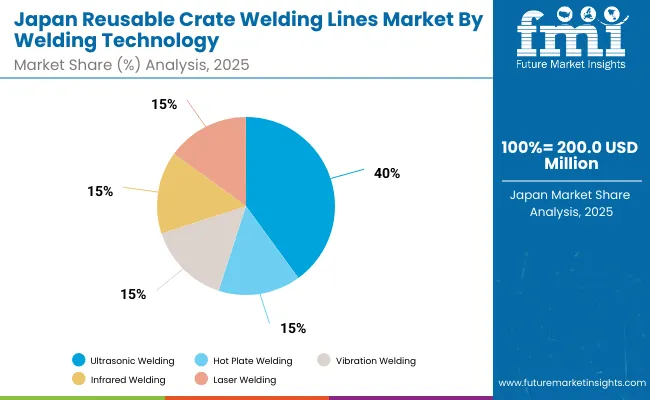

Japan will grow at 6.9% CAGR, driven by compact and high-precision welding technologies tailored for space-efficient production. Robotics and automated control systems are leading innovation in reusable packaging lines. Integration of clean energy welding systems supports carbon reduction initiatives. Smart sensors and adaptive control modules are improving consistency and efficiency in high-value industrial applications.

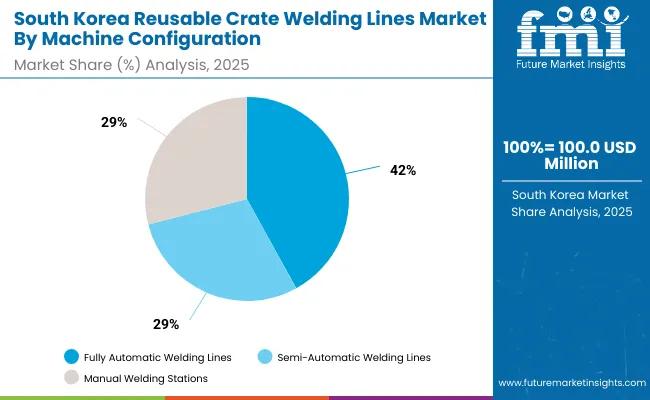

South Korea will lead with 7.0% CAGR, spearheading automation in reusable crate production. AI-driven control systems are improving operational precision, defect detection, and maintenance efficiency. Investments in smart packaging technologies are aligning with the nation’s advanced manufacturing roadmap. Continuous growth in crate exports is solidifying South Korea’s position as a hub for high-tech, sustainable packaging automation.

Japan Reusable Crate Welding Lines Market by WeldingJapan’s reusable crate welding lines market, valued at USD 200.0 million in 2025, is led by ultrasonic welding, accounting for 38.1% share, due to its precision, energy efficiency, and suitability for thermoplastic materials. Hot plate welding follows, enabling strong seals for industrial crates. Vibration and infrared welding methods are gaining adoption for automated systems, enhancing production throughput. Meanwhile, laser welding supports high-speed, minimal-distortion bonding, aligning with Japan’s advanced manufacturing focus and automation-led quality standards.

South Korea Reusable Crate Welding Lines Market by MachineSouth Korea’s reusable crate welding lines market, worth USD 100.0 million in 2025, is dominated by fully automatic welding lines, which hold 43.7% share, driven by increased automation in logistics and packaging. Semi-automatic welding lines offer flexibility for medium-scale facilities optimizing cost and output balance. Manual welding stations continue to serve small manufacturers requiring customization. South Korea’s robust industrial base and adoption of robotic welding technologies strengthen production reliability and operational efficiency in crate assembly.

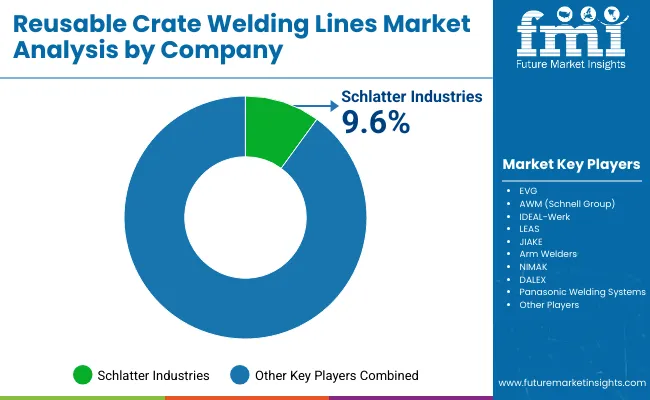

The market is moderately consolidated, featuring Schlatter Industries, EVG, AWM (Schlatter Group), IDEAL-Werk, LEAS, JIAKE, Arm Welding Systems, NIMAK, DALEX, and Panasonic. Schlatter and IDEAL-Werk lead in large-scale automation systems, while Panasonic focuses on compact and energy-efficient welding platforms. Emerging players in Asia integrate AI-driven controllers and multi-material compatibility features to capture mid-tier manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Welding Technology | Ultrasonic, Hot Plate, Vibration, Infrared, Laser |

| By Machine Configuration | Fully Automatic, Semi-Automatic, Manual |

| By Material | PP, HDPE, PC, Recycled, Composite |

| By Application | Food, Dairy, Industrial, Automotive |

| Key Companies Profiled | Schlatter Industries, EVG, AWM (Schlatter Group), IDEAL-Werk, LEAS, JIAKE, Arm Welding Systems, NIMAK, DALEX, Panasonic |

| Additional Attributes | Growth driven by sustainable automation, energy-efficient welding, and circular economy adoption. |

The Reusable Crate Welding Lines Market is valued at USD 1.5 billion in 2025.

The market will reach USD 2.8 billion by 2035.

The market will grow at a CAGR of 6.6%.

Ultrasonic welding leads with 39.7% share in 2025.

Fully automatic welding lines dominate with 42.3% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reusable Box Market Size and Share Forecast Outlook 2025 to 2035

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Industry Share Analysis for Reusable Wine Bags Companies

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Reusable Water Bottle Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA