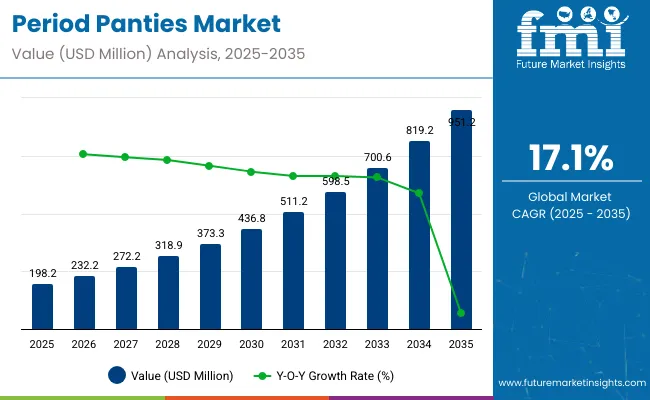

As per newly released data by Future Market Insights (FMI), the period panties market is estimated at USD 198.2 million in 2025 and is projected to reach USD 951.2 million by 2035, at a CAGR of 17.1% from 2025 to 2035. Share of period panties market in its parent market (feminine hygiene products market is 15%-20%.)

| Attribute | Details |

|---|---|

| Historical Period Panties Market Size 2024 | USD 169.7 million |

| Estimated Period Panties Market Size 2025 | USD 198.2 million |

| Projected Period Panties (2035) Market Size | USD 951.2 million |

| Value CAGR (2025 to 2035) | 17.1% |

Governments around the world are increasingly recognizing the importance of menstrual hygiene management and taking active steps to improve access to menstrual products and education. These initiatives aim to reduce stigma, promote health, and support gender equality by ensuring that menstrual needs are met in schools, public institutions, and vulnerable communities.

The above table presents the expected CAGR for the global period panties market industry over several semi-annual periods from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 14.3%, followed by a slightly higher growth rate of 19.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 14.3% (2024 to 2034) |

| H2 | 19.5% (2024 to 2034) |

| H1 | 18.3% (2025 to 2035) |

| H2 | 15.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 18.3% in the first half and remain relatively low at 15.9% in the second half. In the first half (H1) the sector witnessed an increase of 183 BPS while in the second half (H2), the industry witnessed a decrease of 159 BPS.

The global period panties market has shown a considerable growth rate of 15.7% from 2020 to 2024 due to some factors like increased awareness of hygienic menstrual products, increased awareness of environmental-friendly products, and a shift towards using reusable menstrual products. Consumers at this time wanted period panties as they were comfortable, washable, and a cheaper way of handling menstruation. Other related developments such as fabric technology helped to develop the market in as much as they developed the work of the product.

Also, it is necessary to note that stable growth of the Internet expansion, e-commerce, and presence in social networks contributed to the distribution of information, primarily for the younger generation. To this end, brands began to use this trend as a way of offering a wide variety of styles, sizes, and absorbencies of the product. New brand creation, higher investment, and new product launches by new as well as existing players also helped the Period Panties market to achieve better market penetration in all the regional markets.

As to the outlook till the period 2025 to 2035, it is expected that the market is going to maintain the strong growth trend with the forecasted growth rate of 17.1% till 2035, this is due to the constant innovations in the design of the product and in the materials used in making the luxury watches. In this case, such aspects as the use of antimicrobial fabrics, biodegradable products, and better comfort and fitting could be some of the stimuli of reason that may attract a larger and larger populace.

Further, as cost, convenience, and information about environmental impacts continue to reduce and become part of many consumer decision-making, the shift to environmentally sustainable menstrual products will continue.

The market is also in the process of expanding in emerging economies, as there the market awareness will be better, the distribution network will be improved and the per capita income will be higher which will in turn fuel the market for growth. In conclusion, the period panties market has significant prospects for development in the next ten years due to the increase in the usage of new technologies in production, the changing perception of society toward the product, and market expansion.

The period panties market is anticipated to witness strong growth in the forthcoming period with the increased environmental consciousness, the shift towards a sustainable lifestyle, and female labor force participation. Women are getting more educated and empowered.

There is, therefore, a bigger consciousness about the implications on the environment and health of conventional menstrual products like pads and tampons, which are usually heavily laden with chemicals, and contribute in a big way to plastic waste. It is, therefore, that alternatives like period panties are moving to the forefront.

Moreover, the market is becoming increasingly available to new designs and materials developed, with the manufacturing community catering to more comfort, functionality, and aesthetic appeal for period panties. Brands on their part are very active in campaigns as well as educational initiatives to make people conscious of period panties, which underscore long-term cost-effectiveness and environmental gain.

For example, the waste reduction from disposable menstrual products is one focus these brands have now geared into with period panties, hence making them an environmentally-friendly solution. This strategic positioning will help overall market growth in the coming years, with consumer inclination towards products that fit into their sustainable values.

Drivers for the surge in demand for period panties are expected to be the growing consumer preference for comfort and sustainable products. With enhanced social values, the modern consumer, notably a young woman, becomes more and more attentive to each menstrual product: it should work not only effectively but also harmoniously with her health and sustainability. Period panties seem to be filling this niche perfectly, offering a reusable, comfortable, and discreet solution for menstrual management.

The other important factor that is changing is the shift toward using organic and natural products. People are becoming more aware of the potential health dangers of exposure to certain chemicals and allergens in traditional menstruation products. This is increasingly the case for menstrual products made of organic and natural materials.

In response to this, manufacturers design organic period panties from such sustainable materials as organic cotton that do not contain synthetic dyes and hard chemicals. With the incorporation of fabric technologies, period panties can be designed to have maximum absorbency, odor control, and moisture-wicking qualities.

At the same time, they should offer alternatives to users of traditional products. These are not only innovations meant to attract new clientele but also innovations that will make even content consumers keep spending on quality period panties.

Rising health and environmental concerns expected to boost sales in the USA

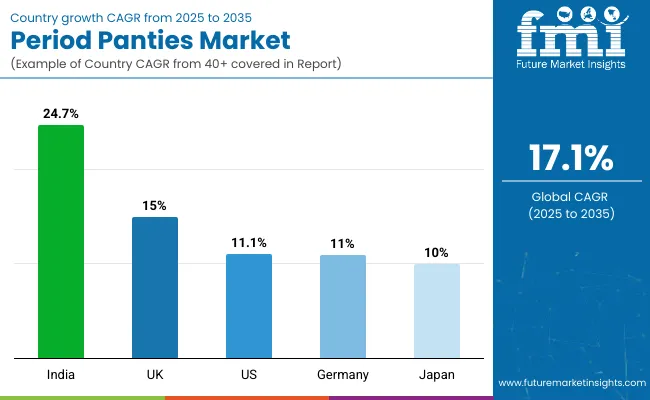

The opportunities in the USA market are expected to facilitate the growth of the period panties market at a robust CAGR of 11.1% which can be attributed to the growth in the awareness of sustainable menstrual products, growth in environmental consciousness, and high demand for comfortable and effective, eco-friendly menstrual products.

With consumers in America becoming sensitive when it comes to the environment, people are now going for items that have little impact on the environment. These two values also fit perfectly with period panties because they are reusable, thus making them an environmentally friendly product as compared to disposable menstrual products.

Furthermore, flexibility and comfort delivered by period panties as consumer products are other factors that have aided their acceptance in the USA market. Consumers, especially female ones, are now in search of feminine pads that effectively regulate menstrual flow in addition to offering maximum comfort and lightweight with minimized visibility. This has resulted in increased demand for modern products occasioned by the period panties which are fashionable and technologically developed.

Moreover, the leading production companies in the United States are always adapting to create more products that will accommodate the new needs of the population. They are creating period panties with functionalities like antimicrobial, higher absorption rate, and quick moisture control to adequately address the market needs for functionality and comfort.

The market is also experiencing a more personalized type of product, where companies produce as many different styles, colors, and sizes as possible to attract customers of different ages, sexes, and races. Therefore, period panties are now considered part of menstrual care for many women in the United States and contribute to market expansion.

Brands focusing on awareness and accessibility to drive growth

The period panties market in India is projected to grow at a robust CAGR of about 24.7% during the forecast period. This is due to the growth in the knowledge of women for proper menstrual products, growth of the incomes per capita, and the marketing strategies that have been initiated to help the female clientele gain more insight into using the products.

There is a cultural change observed in the Indian market in what concerns the consumption of menstrual products due to a change of mentality regarding people's health and hygiene. In many states across India menstruation is still considered a taboo, mostly because of this there is still poor knowledge and limited access to good sanitary products.

Still, this fact is evolving as brands together with NGOs step up to create massive awareness among females about the essence of contemporary menstrual products and period panties. For instance, Nua, an Indian femtech company at the forefront of this movement has been running a campaign #GoWithYourFlow starring Bollywood actress Deepika Padukone.

Apart from being a commercial campaign that seeks to highlight Nua’s line of menstrual wellness products, the campaign also has the noble intent of undoing the taboo associated with menstruation while encouraging an open conversation on the matters of menstruation.

Such initiatives are also serving to transform perceptions around the country as well as boosting the use of period panties. Also, an increase in disposable income among consumers in India supports more women to buy enhanced quality sanitary niches. Therefore, the exclusivity of period panties which used to be a preserve of a certain class is gradually fading and it can be seen that anyone can afford it.

Such an increase in accessibility, when people are informed about the minimal impact of period panties on the environment and the benefits they can have on people's health, are the main factors that can result in the rapid growth of the period panties market in India in the following years.

Focus on menstrual hygiene and awareness campaigns to boost sales in Africa

There is a favorable market for period panties in Sub-Saharan Africa, although the region faces substantial barriers to MHM. In many African countries, MH is still a concern because of multiple barriers, including limited access to proper menstrual products, limited access to proper sanitation, and social taboos about menstruation.

Nevertheless, owing to the increase in the awareness of menstrual hygiene and the help of NGOs and advocacy groups, the situation is gradually changing. Such organizations as Speak Up Africa and KITAMBAA are currently actively working to increase awareness about MHM and its necessity.

For instance, the "Menstrual Hygiene Management: The "from Taboo to Economic Power" campaign that was recently initiated in Senegal seeks to promote women's and girls' economic and social status by focusing on menstrual status barriers.

The strategic approach of this campaign is to ensure that local communities, religious groups, and key policymakers reign in their thinking to promote better adoption of menstrual hygiene practices. As a result of these campaigns, more people in the region are now embracing the use of period panties as an effective, environmentally friendly solution for managing their periods.

Further, period panties are environmentally-friendly for women and girls who do not have access to disposable menstrual products or have issues with proper waste disposal. Since period panties can be washed and worn again and again, they are thrifty and environmentally friendly compared to disposable products, especially in areas where the latter are inaccessible or prohibitively expensive.

As awareness increases and more women get access to feminine products, the market for period panties in Africa will witness an uptick which would present good business opportunities.

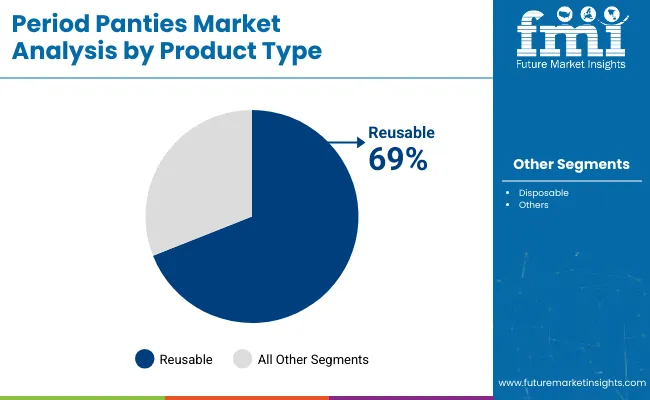

Reusable Panties Expected to Drive Market Sales

Reusable period panties will take a large portion of the share of 69.0% in 2024 within the period panties segment considering they are environmentally friendly, cheap, and quite convenient. Unlike other menstrual products, reusable period panties are eco-friendly as they eliminate the need for period products that can only be used once and then disposed of. These panties are manufactured to be reusable, eliminating the chances of using panties and then disposing of them by throwing them in the bin.

Also, long-term cost savings are known to make their products attractive to smart shoppers willing to pay for cost within the context of value, aftershaves that do not compromise their comfort or efficiency. With the increasing consciousness of sustainability and menstrual health, women are choosing reusable period panties more and more placing the product category in a dominant position. This category is expected to grow with the CAGR of 18.4% from 2025 to 2034

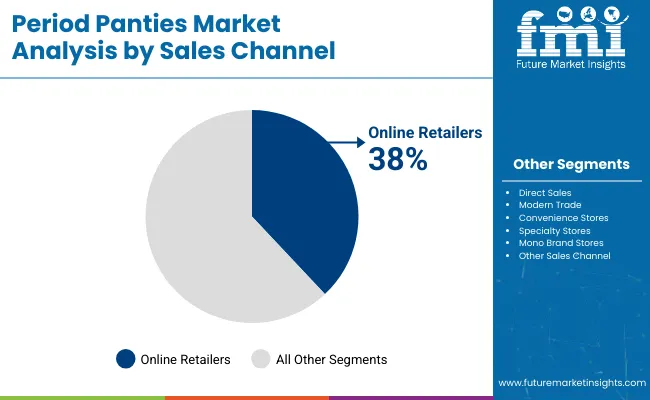

Online Retailing Expected to Increase the Sales

In the period panties market, online retailing is particularly expected to make a significant contribution to sales as a result of the global growth in e-commerce consumption. The advancement in technology where consumers can shop online has made it easy for them to purchase period panties of choosing from a wide range of panties available in the market, comparing the prices of different brands and reading more from customer reviews.

This trend is further supported by the increased access to smartphones and the internet around the world which has assisted women to search and buy these products online.

Furthermore, the new retail channels like online stores tend to provide deals on products, membership on services, as well as anonymity in the delivery services, which are essential for anybody who wants her or his business to be as comfortable as possible. Therefore, the segment of online retail stores is expected to expand at a fast pace to emerge as the most important sales channel for period panties in the forecast period.

Leading players operating globally in the market are focusing on expansion, partnership, development, and new product launches to expand their business globally.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 198.2 million |

| Projected Market Size (2035) | USD 951.2 million |

| CAGR (2025 to 2035) | 17.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Product Type | Reusable, Disposable |

| By Sales Channel: | Direct Sales, Modern Trade, Convenience Stores, Specialty Stores, Mono Brand Stores, Online Retailers, Other Sales Channel |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

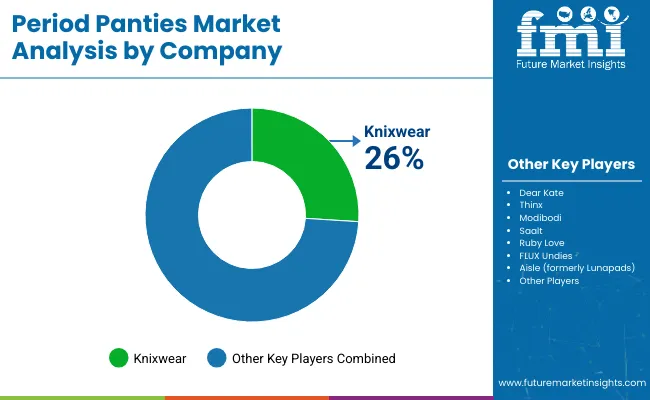

| Key Players | Dear Kate, Thinx, Knixwear, Modibodi, Saalt, Ruby Love, FLUX Undies, Aisle (formerly Lunapads), Dear Kate, Proof |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

The global period panties market reached a valuation of USD 198.2 million in 2025.

The global period panties market grew at a sluggish 15.7% CAGR between 2020 and 2024.

Key trends driving period panties sales include increasing demand for sustainable, eco-friendly menstrual products and advancements in fabric technology that offer enhanced comfort, absorbency, and leak-proof protection.

Leading players operating in the global period panties market are Dear Kate, Thinx, Knixwear Modibodi, Saalt, Ruby Love, FLUX Undies, Aisle (formerly Lunapads), and Dear Kate among others.

The North America period panties market is projected to grow at 10.8% CAGR over the forecast period.

Leading players in the global period panties market are estimated to account for approximately ~15%-25% of the total market share.

The Europe period panties market is anticipated to expand at ~12.4% CAGR over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Period Panties Market Report – Trends, Demand & Outlook 2025-2035

India Period Panties Market Insights – Demand, Growth & Forecast 2025-2035

France Period Panties Market Report – Size, Trends & Outlook 2025-2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Period Patch Market Trends – Demand, Growth & Forecast 2025 to 2035

Periodontal Market Size and Share Forecast Outlook 2025 to 2035

Period Balm Market Trends - Growth & Outlook 2025 to 2035

Period Patch Market Share Analysis

Period Cramp Supplement Market – Growth, Demand & Wellness Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA