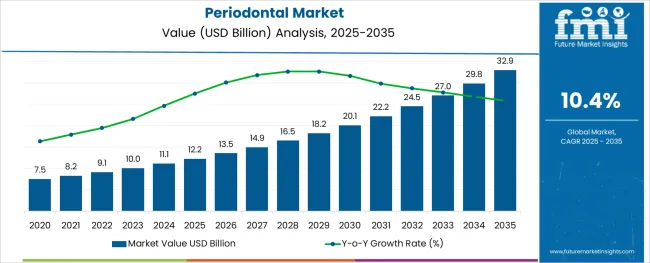

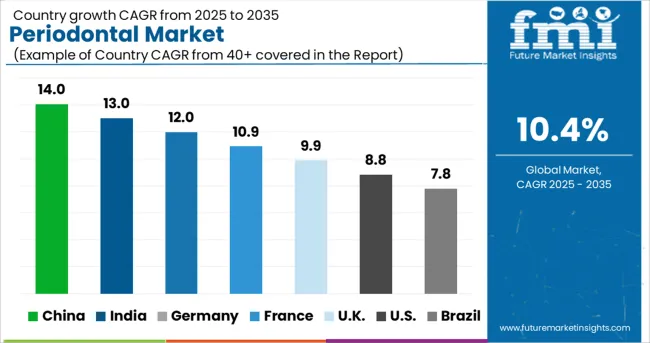

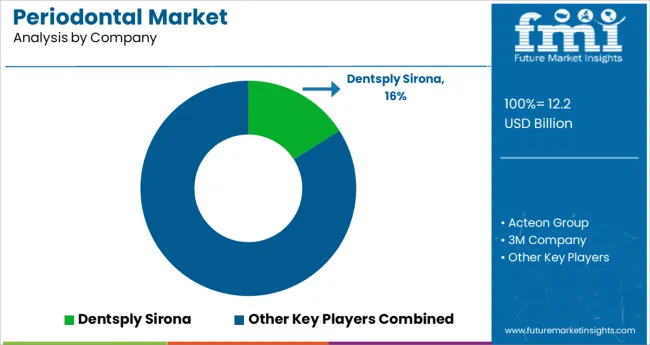

The Periodontal Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 32.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

The periodontal market is undergoing consistent expansion, influenced by growing awareness around oral hygiene, the rising global prevalence of periodontitis, and the demand for preventive as well as restorative dental care. Increasing access to dental services, particularly in urban and semi-urban areas, along with technological integration in diagnostics and treatment delivery, is transforming patient outcomes and practice efficiency.

Advances in ultrasonic scaling, regenerative materials, and minimally invasive surgical tools are supporting a clinical shift toward less traumatic procedures with faster recovery. Regulatory support for dental coverage, combined with educational outreach by dental associations, is fostering earlier diagnosis and long-term patient retention strategies.

In the coming years, opportunities are expected to be driven by the aging population, the increasing linkage between periodontal and systemic health, and growing investments in dental infrastructure, particularly in developing economies.

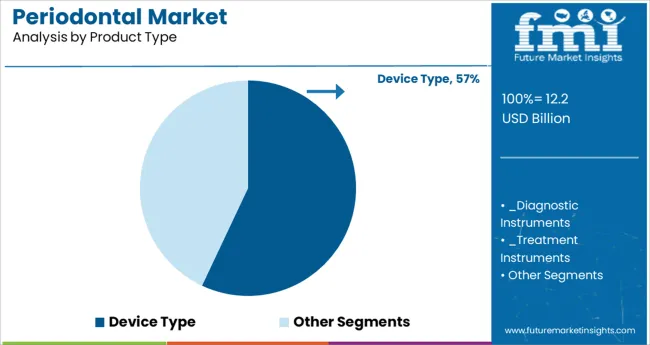

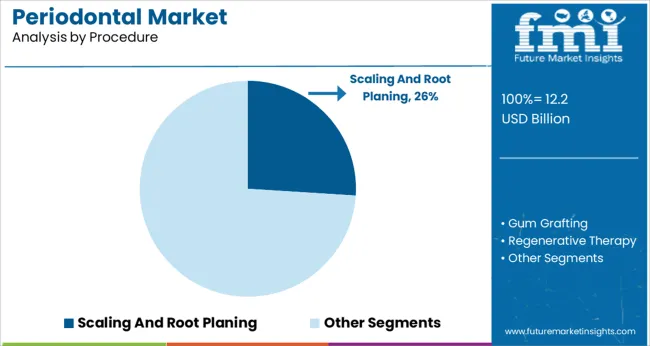

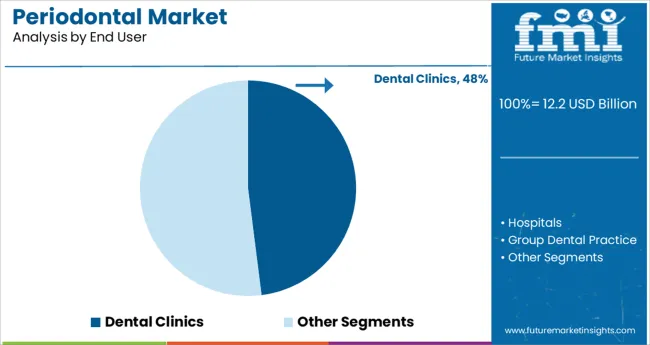

The market is segmented by Product Type, Procedure, and End User and region. By Product Type, the market is divided into Device Type and Drug Type. In terms of Procedure, the market is classified into Scaling And Root Planing, Gum Grafting, Regenerative Therapy, Dental Crown Lengthening, Periodontal Pocket Procedures, Single Tooth Dental Implants, and Multiple Tooth Dental Implants. Based on End User, the market is segmented into Dental Clinics, Hospitals, Group Dental Practice, and Ambulatory Surgical Centers. By End User, the market is divided into Dental Clinics, Hospitals, Group Dental Practice, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Procedure, and End User and region. By Product Type, the market is divided into Device Type and Drug Type. In terms of Procedure, the market is classified into Scaling And Root Planing, Gum Grafting, Regenerative Therapy, Dental Crown Lengthening, Periodontal Pocket Procedures, Single Tooth Dental Implants, and Multiple Tooth Dental Implants. Based on End User, the market is segmented into Dental Clinics, Hospitals, Group Dental Practice, and Ambulatory Surgical Centers. By End User, the market is divided into Dental Clinics, Hospitals, Group Dental Practice, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Device type is projected to dominate the product type category, holding a 57.0% revenue share in the periodontal market by 2025. This leadership is being driven by the critical role of specialized devices such as ultrasonic scalers, laser systems, and curettes in both surgical and non-surgical periodontal procedures.

Technological advancements that enhance precision, reduce patient discomfort, and improve clinical outcomes have led to the widespread adoption of devices over pharmaceutical-based treatment alone. The ability of advanced periodontal devices to support real-time feedback, tissue preservation, and customized patient care protocols has made them indispensable in modern dental practices.

Additionally, greater availability of compact, cost-effective, and multi-functional devices has enabled broader penetration across small to mid-sized dental clinics and emerging markets.

Scaling and root planing is expected to account for 26.0% of the revenue share in the periodontal market by 2025, establishing it as a leading procedure. This non-surgical treatment approach remains the gold standard for managing early to moderate periodontal disease, offering effective biofilm removal and inflammation control. Adoption is being supported by clinical guidelines that prioritize conservative therapy before surgical intervention, particularly in cases of chronic periodontitis.

The demand for scaling and root planing has also grown with the rise in preventive care models and patient demand for less invasive, low-recovery treatments. Advances in ultrasonic scaling technologies and subgingival instrumentation have further improved clinical efficacy and patient comfort, reinforcing the segment’s prominence.

Insurance coverage and inclusion in routine dental care protocols have also contributed to its continued utilization as a first-line periodontal treatment.

Dental clinics are projected to hold the largest end-user share in the periodontal market, accounting for 48.0% of revenue by 2025. This dominance is attributed to the widespread availability of periodontal treatments in standalone and chain dental clinics, which serve as the primary point of care for most patients.

Clinics are often equipped with specialized tools and trained personnel, enabling them to provide both preventive and advanced periodontal services. The increasing number of private dental practices, combined with strategic investments in infrastructure, has contributed to segment growth. Patient preference for personalized, one-on-one care, shorter wait times, and affordable services is also favoring dental clinics over hospital-based dentistry.

Furthermore, clinics are rapidly adopting digital workflow systems, enhancing treatment planning and patient engagement, which further positions them as the preferred choice for periodontal care delivery.

The market value of the periodontal market was approximately 24.2% of the overall USD 11.1 billion of the global dental market in 2024.

The sale of the periodontal market expanded at a CAGR of 8.8% from 2020 to 2024. According to the WHO, age is the primary risk factor for the development of dental diseases and the risk for dental disorders increases with age, particularly for people aged >50 years. Hence, the rising geriatric population is one of the major drivers of the periodontal market.

As per the findings from WHO, the percentage of the population of people who are 60 years of age and above would nearly double in a time span of 35 years. It would increase from 12% to 22% between 2020 and 2050. This would positively impact the growth of the periodontal market.

Other than this, technological advancements can be considered a recognizable driver for this market. The shift from invasive techniques used for a root canal, crown troughing, implant recovery, gingivoplasty, and many more dental procedures towards advanced laser techniques such as diode lasers and CO2 lasers is also expected to contribute to the acceleration of the growth of this market, owing to the prevention of the oral infections. When it comes to periodontal disease diagnosis, 3D digital X-ray imaging is quite commonly used.

Thus, owing to the forenamed factors, the global periodontal market is expected to grow at a CAGR rate value of 10.4 % during the forecast period from 2025 to 2035.

The market is set to have an assertive outlook, owing to the increased regulatory approvals for the products used in the periodontal market. Regulatory bodies like FDA regulate the approval of the medical devices being launched in the USA market.

Apart from this, drug approval is also governed by the FDA so that, it can be proved that the new drug is safe and effective for the patients. The introduction of novel products aligns with the entry of new and improved technology in the market, which ensures the enhancement and launch of new products in the market. This helps bring in new technology that eases treatment procedures and provides improved results to patients. This can be considered an opportunistic factor for the manufacturers operating within the periodontal market.

The cost linked with dental treatments and diagnostic procedures is quite high. The cost of treating periodontal disease can range from USD 1,700 to USD 8,000, depending on the severity level of the disease. These high costs along with the low reimbursement rate for dental procedures are the factors that can hamper the growth of the periodontal market.

Apart from this, the shortage of dental professionals in developing countries can be a major restraining factor for this market. As per a research article published by NCBI in 2024, a shortfall of dentists and specialists in South Africa is predicted till 2035. It was reported that in an ideal scenario, there would be a shortage of 853 dentists and specialists in 2020, 1655 in 2025, and 2267 in 2035.

The mentioned factors collectively propose an adverse effect on the developmental growth of the periodontal market.

The USA dominates the North American region with a total market share of about 92.8% in 2024, and a similar trend is expected over the forecast period.

In the USA, October has been celebrated as National Dental Hygiene Month since 2009 as per the American Dental Hygienists’ Association. This has been initiated to increase awareness about oral heath so that, the general public can be aware of the risks that they can be prone to if they do not follow good oral habits. This would further increase the adoption of effective procedures for the treatment and diagnosis of periodontal diseases. Hence, the sales of periodontal treatment product including both drugs and devices in the USA is quite high and is anticipated to grow moving forward.

The presence of multiple manufacturers like Dentsply Sirona, AMD Lasers, Inc., BIOLASE, Inc., Karl Schumacher, and others is quite high in the USA market and this has boosted the availability of products in the USA periodontal market.

United Kingdom is set to exhibit a CAGR growth rate of nearly 11.0% in the European periodontal market during the forecast period. In 2024, the United Kingdom held the highest market share of about 24.9% of 2024 the Europe periodontal market.

As per recent data from the Department of Health and Social Care, almost half of the adults in the United Kingdom get affected by irreversible periodontitis. This points to the high prevalence of periodontal diseases in the United Kingdom, hence, the periodontal market in the United Kingdom is quite lucrative.

India held approximately 45.2% market share in the South Asia periodontal market in 2024. It is projected to display growth at a lucrative CAGR rate of 11.1% during the forecast period.

The use of tobacco is very common in a country like India. As per a recent publication from the National Center for Biotechnology Information in 2024, the most significant risk factor for periodontal disease is tobacco smoking, since it worsens the condition and raises the risk of periodontal surgery. By inducing microvascular dysfunction, tobacco use harms the vasculature and is known to have a deleterious impact on periodontal health.

As per the Global Adult Tobacco Survey India, 2020 to 17, nearly 29% of all adults who are 15 years old and above are tobacco users. This data has been highlighted by the WHO as well. This scenario has contributed to the propelling growth of the periodontal market in India.

The device segment in the product category of the periodontal market is expected to present high growth at a CAGR rate of 11.3% by the end of the forecast period, with a projected market share of about 84.8% in the global market in 2035. Since the usage of either diagnostic, treatment or surgical instruments is more compared to the consumption of drugs in the periodontology field of dentistry, the device segment is significantly dominant in the product category.

Scaling and root planning accounted for a revenue share of 36.1% in 2024 and are expected to display gradual growth over the forecast period. Scaling and root planing procedures are counted as non-surgical therapies for removing the infection above or below the gum line. Depending on the severity of the infection, the number of sessions is decided for scaling and root planning.

Dental Clinics held the highest market share of 57.4% during the year 2024. The increasing number of clinics specific to the field of dentistry is a major factor due to which dental clinics have been estimated to account for more than half of the share of the end-user segment in the forecast period as well.

To strengthen their presence around the globe and improve their business strategies, the key players are involved in various product launches, expansions, collaborations, and mergers and acquisitions. These are the top key promotional strategies adopted by the key players in the periodontal market.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe, South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, The United Kingdom, Germany, Italy, France, Spain, Russia, BENELUX, Nordic Countries, India, Malaysia, Thailand, Indonesia, China, Japan, South Korea, Australia, New Zealand, Turkey, GCC, and South Africa |

| Key Market Segments Covered | Product, Procedures, End User, and Region |

| Key Companies Profiled | Dentsply Sirona; 3M Company; Danaher Corporation (Sybron Dental ; Specialties Inc./Kerr Corporation); Medtronic; Pfizer Inc.; Novartis AG; ASA Dental S.p.A.; Steris-Hu-Friedy; Carl Martin GmBH; Deppeler SA; AMD Lasers, Inc.; Biolase, Inc.; Straumann AG; Planmeca Oy; Karl Schumacher; GC Corporation; OraVu®; Micron Dental; DENTAURUM GmbH & Co. KG |

The global periodontal market is estimated to be valued at USD 12.2 billion in 2025.

It is projected to reach USD 32.9 billion by 2035.

The market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types are device type, _diagnostic instruments, _treatment instruments, _surgical instruments, drug type, _systemic antibiotics and _local antibiotics.

scaling and root planing segment is expected to dominate with a 26.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA