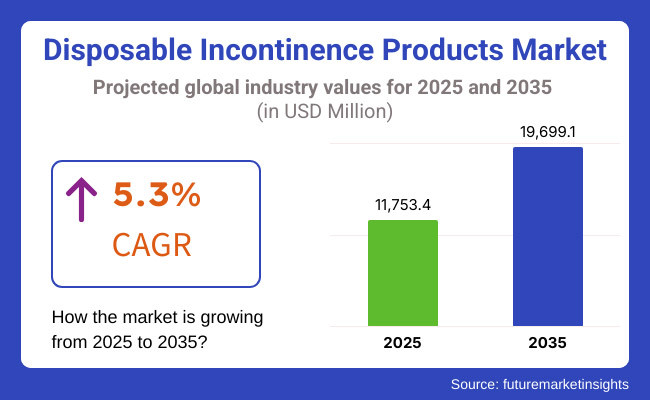

The disposable incontinence products market is expected to reach USD 11,753.4 million by 2025 and is expected to steadily grow at a CAGR of 5.3% to reach USD 19,699.1 million by 2035. In 2024, the disposable incontinence products market generated roughly USD 11,161.8 million in revenues.

The disposable incontinence articles including adult diapers, pads, liners, underpads, disposable protective underwear, and several more comfort-ensuring hygiene systems for people who suffer from the loss of bladder or bowel control.

The increased consumption of disposable incontinence products is mainly observed in countries with older people, such as Japan, Germany, and the USA. An increase in the consumption of disposable products for incontinence is through sales channels such as e-commerce. Growing awareness of incontinence care issues, improvements in comfort and absorption technology of existing products, changes in social aspects, reducing stigmas, government subsidy programs of elder care assistance, and increasing healthcare spending significantly contribute to the growth of the market.

Between 2020 and 2024, the increase in the elderly population raises the demand for products internationally, more so in developed countries like Japan, Germany, and the United States, as the common age-related conditions of urinary incontinence and mobility impairments are on the rise.

Health organizations carried out more awareness campaigns, which contributed to less stigma associated with open discussion and use of the product. Further, during this pandemic time, online shopping trends saw increased accessibility for aged or mobility-restricted consumers. Also, with the new technology types toward product advancement in terms of higher absorbency, skin-friendliness, and stealth design, the growth of the market is further accelerated.

The increasing incidence of urinary and fecal incontinence occurring in the elderly as an age-related factor anticipates the growth of the market in North America. The rising awareness and de-stigmatization with regard to incontinence encourage freer use of the product. Increased healthcare expenditure in a country like the USA and Canada makes incontinence management products more available. Increased incidence of chronic illnesses such as diabetes and obesity, and neurological disorders also augurs well for demand. This, along with online convenience, better absorbency technology, and the introduction of discreet and skin-friendly designs, makes the product attractive. Increased female workforce participation in terms of postpartum incontinence is also fuelling uptake in conjunction with the growing homecare market.

The changes involving all disposable incontinence products within Europe for the lifestyle needs have been attributed to the changes in population demographics by older people. Growing health awareness programs and government-funded healthcare schemes for the elderly are also major contributors. On top of that, there are advances in product technology that enhance, attractive, better absorbency, odor management, and discreet fit. The other factors responsible for increasing demand are rising prevalence rates of chronic diseases such as diabetes, obesity, and neurological diseases. Social attitudes related to incontinence, high demand for home healthcare services, and increased availability via retail outlets and online channels will increase accessibility and stimulate broader use across the region.

Increased urbanization, along with advancements in healthcare infrastructure and rising disposable incomes, mean larger numbers of consumers are being able to afford high-quality incontinence products. The expansion of online shopping platforms in the region has also increased availability, especially in far-flung areas. In addition, innovations in product designs in terms of thinner, skin-friendliness and super absorbency attract both older users as well as, the younger ones who require it for postpartum or medically related aspects.

Challenges

Rising Environmental Awareness in Regions such as Europe and North America are Increasing Scrutiny On Product Disposability, Hindering Market Adoption.

Disposal incontinence products primarily consist of man-made materials, superabsorbent polymers (SAP), polyethylene films, and nonwoven fabrics, all of which end up as plastic wastes. Growing environmental concerns and government pressure from nations like Europe and North America have yet added to the scrutiny of producers about the disposal and environmental footprint of their products. Consumers today are greening as well, seeking biodegradable or sustainably sourced products. The trade-off between performance, comfort, and being green is not a simple task, as biodegradable products tend to be less absorptive and less durable compared to their conventional counterparts. Similarly, waste infrastructures in developing countries are not suitably designed to manage waste from significant incontinence products.

Opportunities

Expanding Home Healthcare Market Poses New Opportunities in the Market

Home healthcare and health consciousness bring bright prospects for disposable incontinence products. Older persons stay at home owing to their aging population, increasing the demand for high-performance and easy-to-use incontinence products that cover an even bigger market opportunity. Home healthcare, in particular, grew tremendously in the Asia Pacific region with urbanization and consequently increased disposable incomes and greater access to healthcare. Meanwhile, the adoption of telehealth and digital health platforms further enhances product knowledge and makes it easier for consumers to access medical counsel and guidance regarding products. Manufacturers can bank on this trend through the manufacture of thinner, odor-absorbing, highly absorbent, yet unobtrusive products for home use, tying up with healthcare professionals, pharmacies, and online platforms to boost distribution and product education, thus generating very strong growth opportunities.

Growing Focus on Product Innovation Surges the Growth of the Market

Companies are working on absorbency, breathability, and skin-friendly surfaces, particularly for long-term users. Dual-core technology, which combines retaining a large volume of liquid with comfort in contact with a dry surface, is gaining further popularity. Materials for controlling odors and hypoallergenic materials are emerging as part of the standard. Companies are investing in designs that allow for thinner and less noticeable products to be worn discreetly under clothing by active adults wanting to lead a normal life despite incontinence. Such developments, besides consumer satisfaction, also increase the attractiveness of products for all ages, creating opportunities for the industry to draw in new users and retain existing ones looking for performance and comfort solutions.

Increasing Penetration in Emerging Markets Anticipates the Growth of the Market

With an increase in health awareness, improvement in the standard of living, and an increase in the elderly population, the disposable incontinence products market is booming in emerging markets. Countries in the Asia-Pacific, Latin American, and Middle East regions are witnessing an increased presence of products in pharmacies, supermarkets, and online stores. Meanwhile, nations like India, China, and Brazil also have incontinence management included in their elderly care schemes by governments and health bodies. As consumers understand that the social taboo regarding incontinence is declining, they will have more confidence in approaching health professionals and purchasing quality disposables with less privacy.

Preferential Shift Toward Sustainable and Eco-Friendly Products is an Ongoing Trend in the Market

growing trend in the disposable incontinence products industry toward largely sustainable alternatives. Increasingly, with environmental consciousness rising among consumers, more so at such countries in Europe and North America, organizations have begun manufacturing products that collapse into biodegradable plant-based fibers or recycled parts. Some brands are looking at reduced packaging waste and credible certifications to back their sustainable practices. This trend continues to have the backing of regulatory bodies promoting sustainable manufacturing and responsible disposal. While companies balance performance and eco-friendliness, those who succeed are bound to gain competitive superiority with employers of ethical purchasing preference.

Development of Personalized Solutions is an Emerging Trend in the Market

Manufacturers are offering customized-fit solutions to meet the unique needs of consumers, such as gender-specific designs for light, moderate, or severe incontinence and skin-sensitive versions for users with dermatological ailments. Smart incontinence products with sensors for tracking wetness levels and notifying caregivers or users' phones are the second emerging trend in development. Most of these technological solutions will provide extra convenience to bedridden patients or those with cognitive impairment. Businesses have hence improved their user experience beyond conventional absorbents into digital health technology. Through personalization and intelligent integration, transitions into the industry are anticipated, particularly in homes for the aged and home healthcare.

The disposable incontinence product market increased between 2020 and 2024, with the crutch of an ever-increasing population of the elderly coupled with greater awareness and concerns provided by the COVID-19 pandemic that demanded home healthcare and hygiene. Product innovation between 2020 and 2024 focused primarily on comfort and absorbency while maintaining discretion. From 2025 to 2035, development will take off with advances such as smart monitoring and a compelling drive for sustainability in materials. The other engine behind this adoption will be the increased availability of healthcare services within emerging economies and the growth of online retail channels. Social perceptions toward incontinence are changing, while more government programs in elderly care will also reinforce demand in the future.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory interest was directed toward product safety, skin tolerance, and absorbency functionality. Regulators such as the FDA (USA), EMA (Europe), and TGA (Australia) highlighted requirements with respect to leak prevention, hygiene, and chemical safety of materials in disposable incontinence products. |

| Technological Advancements | Ultra-thin absorbent cores, dual-layer technology, odor control materials, and breathable fabrics maximizing comfort and performance were among the technological innovations of this era. Intelligent features such as wetness sensors started appearing in high-end products |

| Consumer Demand | The rising demand resulted from the rapidly growing populations of older households being more informed about incontinence and widely adopting this product during COVID-19, hence reaping benefits from home care. Slowly, the social stigma associated with urinary incontinence also faded, particularly in the developing markets. |

| Market Growth Drivers | Driving forces included a growing aged population, increasing access to health care, improved installment government programs for older people, and innovative products. Another good example would be e-commerce channels that support acceptance, especially subscription-based buying. |

| Sustainability | The industry would be likely to face growing criticism on account of plastic waste and non-biodegradable materials. Companies began making investments in plant-based materials, minimum plastic packaging, and carbon-neutral manufacturing. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | By 2035, stricter laws governing carbon footprint, biodegradability, and green materials. International regulation may improve your access to the market. |

| Technological Advancements | For comfort and sustainability, intelligent sensors should be widely adopted; skin-friendly innovations, and biodegradable superabsorbents have gained importance by 2035. |

| Consumer Demand | The young cohort and green-conscious consumers create demand; telemedicine will lend visibility to referral products from health care. |

| Market Growth Drivers | Emerging economies, green product launches, custom-fit solutions to fit diverse user requirements would be the market growth drivers. |

| Sustainability | Full biodegradability, carbon-neutral production, and eco certifications will be key differentiators for market leadership by 2035. |

Increasing incontinence cases due to such population factors combined with increasing consumer demand for discreet and comfortable products as real estate for e-commerce grows will foster the industry growth.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The increased number of older individuals in Germany, awareness about managing incontinence, and favorable reimbursement schemes are driving the need for disposable incontinence products. Further product innovation, for example, through the use of green and skin-friendly materials, is expected to sustain the growth of this market in Germany, especially in the domains of home healthcare and geriatric care.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.6% |

Market Outlook

The increasing elderly population in India is gaining the market in disposable incontinence products; increasing awareness among people about proper healthcare and improvement in dealing with personal hygiene products is further strengthening this. Category change and urbanization are opening up new lifestyle changes in tier 2 and tier 3 towns to form a strong part of the market in the near future.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.2% |

With the coming of the fast-life population aging, along with the promotion of old age care through government intervention, the market for disposable incontinence products soars in China. Their affordability and domestic manufacturing improvements make the products more available. Premiumization trends toward finer comfort and better absorption are also gaining grounds for long-term growth in the market.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.7% |

Japan has disposable incontinence products since it is in the fastest-aging society in the world. Trends influencing the industry include advances toward odor control and improved fit and gender segmentation.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The adult Diapers segment dominates the disposable incontinence products market due to its higher absorbency for severe incontinence cases.

Adult Diapers are the key segments in the market for disposable incontinence products, which is due to the exceptionally high absorbency and comfort they offer when used in patients suffering from severe conditions of incontinence, especially bedridden or immobile elderly patients. These products are usually sought after in hospitals, nursing homes, and long-term care settings where longer use and the best leakage protection are required. Awareness and advocacy for products, coupled with strong reimbursement policies, particularly in developed market countries, have also made them popular. These attractive products are extensively appealing to caregivers looking after patients with limited mobility.

The disposable Protective Underwear segment is growing rapidly due to Increasing Demand for Discreet, Comfortable, and Easy-to-use Solutions.

The Disposable Protective Underwear category is growing really fast, with the rapidly emerging extra demand for such discreet, very comfortable, and easy-to-use products for active adult men and women with mildly to moderate incontinence. Growing consumer awareness, coupled with various product advancements that include breathable fabrics and odor control technology, makes consumers demand these products. Additionally, broader retail presence, particularly through e-commerce websites, increases sales.

Hospitals Segment Dominates the Disposable Incontinence Products Market due to High Patient Turnover.

Hospitals purchase in bulk high-absorbency incontinence products that are durable for maintaining the hygiene of patients and prevention of infection. Besides, since reimbursement policy throughout most nations favors hospitals to provide quality incontinence products as part of routine care, hospitals become major consumers as aging patients and urologically troubled clients are being increasingly admitted. Equally, with the assurance of reliable medical suppliers, on-demand clinically tested brand-based disposable incontinence products only further fortifies the monopolistic market share of hospitals.

E-commerce segment holds a significant share of the disposable incontinence products market due to its access to a wide product range.

With privacy, convenience, and a wide array of product offerings, e-commerce must attract the largest disposable incontinence products market share. Retailers prefer online purchases as a way of avoiding the stigma attached to purchasing incontinence products. E-commerce websites offer ample product information, reviews, offers, and subscription plans, thereby instilling confidence in the consumer and promoting repeat purchases.

Innovations revolve around ultra-absorbent core, skin-friendly fabric, and biodegradable material to entice consumers on comfort and green credentials. The requirements for smart sensors for real-time monitoring are also much sought after. Companies seek collaboration with geriatric care centers and home health organizations in order to increase their reach. The next success factor is regulatory clearances, the presence of reimbursement opportunities for such products, and any differentiation of products on parameters like odor control, gender-specific design, and superior fit. Also, emerging markets offer a great deal of opportunity for growth, thereby fueling further competition and innovation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Essity AB | 33.6% to 38.5% |

| Kimberly-Clark Corporation | 20.4% to 22.6% |

| The Proctor & Gamble Company | 15.1% to 17.2% |

| Activ Medical Disposable | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

Key Company Developments and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Essity AB | Essity AB is one of the main players in the disposable incontinence product segment, along with TENA, its most recognizable brand. It is an eco-conscious company that innovates on environmentally friendly materials and carbon-neutral products. |

| Kimberly-Clark Corporation | Kimberly-Clark distinguishes itself with the Depend and Poise brands, known for maximum-absorbency urinary leakage management products that are life-friendly to users' skin. "Fit" technology and very gender-driven designs drew the company's focus on innovation |

| The Procter Gamble Company | With a discreet line of incontinence products, P&G applies its broad consumer healthcare experience to ads, search, and coproduction to present the thinnest, odor-reduced, and most comfortable products from its research. |

| Activ Medical Disposable | Activ Medical Disposable's primary focus is on providing cost-effective incontinence-absorbing disposable-centric solutions to institutional buyers with an independent focus on nursing homes and hospitals. |

The overall market size for disposable incontinence products market was USD 11,753.4 million in 2025.

The disposable incontinence products market is expected to reach USD 19,699.1 million in 2035.

Growing ageing population suffering from incontinence problem anticipates the growth of the disposable incontinence products market.

The top key players that drives the development of disposable incontinence products market are Essity AB, Kimberly-Clark Corporation, The Proctor & Gamble Company, Activ Medical Disposable and Medline Industries, Inc.

Adult diapers segment by product is expected to dominate the market during the forecast period.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Region

Table 02A: Global Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 02B: Global Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 06: North America Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 12: Latin America Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 13: Latin America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 14: Latin America Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 16: Latin America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 18: Europe Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 20: Europe Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 21: Europe Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 23: Europe Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 24: South Asia Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 26: South Asia Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 27: South Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 28: South Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 30: East Asia Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 31: East Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 32: East Asia Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 33: East Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 34: East Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 35: East Asia Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 36: Oceania Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Oceania Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 38: Oceania Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 39: Oceania Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 40: Oceania Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 41: Oceania Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Table 42: Middle East & Africa Market Value (US$ Million) Analysis 2014 to 2022 and Forecast 2023 to 2033, by Country

Table 43: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Product

Table 44: Middle East & Africa Market Volume (Units) Analysis and Forecast 2014 to 2033, by Product

Table 45: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Incontinence Type

Table 46: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by Material

Table 47: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2014 to 2033, by By Distribution Channel

Figure 1: Global Market Volume (Units), 2014 to 2022

Figure 2: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2022 to 2033

Figure 3: Disposable Incontinence Products, Pricing Analysis per unit (US$), in 2022

Figure 4: Disposable Incontinence Products, Pricing Forecast per unit (US$), in 2033

Figure 5: Global Market Value (US$ Million) Analysis, 2014 to 2022

Figure 6: Global Market Forecast & Y-o-Y Growth(%) Analysis, 2023 to 2033

Figure 7: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 8: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 9: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Incontinence

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Incontinence

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Incontinence

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Material

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Material

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Material

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by By Distribution Channel

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by By Distribution Channel

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by By Distribution Channel

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Region

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 23: North America Market Value (US$ Million) Analysis, 2014 to 2022

Figure 24: North America Market Value (US$ Million) Forecast, 2022 to 2032

Figure 25: North America Market Value Share, by Product (2023 E)

Figure 26: North America Market Value Share, by Incontinence (2023 E)

Figure 27: North America Market Value Share, by Material (2023 E)

Figure 28: North America Market Value Share, by By Distribution Channel (2023 E)

Figure 29: North America Market Value Share, by Country (2023 E)

Figure 30: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 31: North America Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 32: North America Market Attractiveness Analysis by Material, 2023 to 2033

Figure 33: North America Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 35: USA Market Value Proportion Analysis, 2022

Figure 36: Global Vs. USA Growth Comparison, 2023 to 2033

Figure 37: USA Market Share Analysis (%) by Product, 2022 & 2033

Figure 38: USA Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 39: USA Market Share Analysis (%) by Material, 2022 & 2033

Figure 40: USA Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 41: Canada Market Value Proportion Analysis, 2022

Figure 42: Global Vs. Canada. Growth Comparison, 2023 to 2033

Figure 43: Canada Market Share Analysis (%) by Product, 2022 & 2033

Figure 44: Canada Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 45: Canada Market Share Analysis (%) by Material, 2022 & 2033

Figure 46: Canada Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 47: Latin America Market Value (US$ Million) Analysis, 2014 to 2022

Figure 48: Latin America Market Value (US$ Million) Forecast, 2022 to 2032

Figure 49: Latin America Market Value Share, by Product (2023 E)

Figure 50: Latin America Market Value Share, by Incontinence (2023 E)

Figure 51: Latin America Market Value Share, by Material (2023 E)

Figure 52: Latin America Market Value Share, by By Distribution Channel (2023 E)

Figure 53: Latin America Market Value Share, by Country (2023 E)

Figure 54: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 55: Latin America Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 56: Latin America Market Attractiveness Analysis by Material, 2023 to 2033

Figure 57: Latin America Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 58: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 59: Mexico Market Value Proportion Analysis, 2022

Figure 60: Global Vs Mexico Growth Comparison, 2023 to 2033

Figure 61: Mexico Market Share Analysis (%) by Product, 2022 & 2033

Figure 62: Mexico Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 63: Mexico Market Share Analysis (%) by Material, 2022 & 2033

Figure 64: Mexico Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 65: Brazil Market Value Proportion Analysis, 2022

Figure 66: Global Vs. Brazil. Growth Comparison, 2023 to 2033

Figure 67: Brazil Market Share Analysis (%) by Product, 2022 & 2033

Figure 68: Brazil Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 69: Brazil Market Share Analysis (%) by Material, 2022 & 2033

Figure 70: Brazil Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 71: Argentina Market Value Proportion Analysis, 2022

Figure 72: Global Vs Argentina Growth Comparison, 2023 to 2033

Figure 73: Argentina Market Share Analysis (%) by Product, 2022 & 2033

Figure 74: Argentina Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 75: Argentina Market Share Analysis (%) by Material, 2022 & 2033

Figure 76: Argentina Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 77: Europe Market Value (US$ Million) Analysis, 2014 to 2022

Figure 78: Europe Market Value (US$ Million) Forecast, 2022 to 2032

Figure 79: Europe Market Value Share, by Product (2023 E)

Figure 80: Europe Market Value Share, by Incontinence (2023 E)

Figure 81: Europe Market Value Share, by Material (2023 E)

Figure 82: Europe Market Value Share, by By Distribution Channel (2023 E)

Figure 83: Europe Market Value Share, by Country (2023 E)

Figure 84: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 85: Europe Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 86: Europe Market Attractiveness Analysis by Material, 2023 to 2033

Figure 87: Europe Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 88: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 89: UK Market Value Proportion Analysis, 2022

Figure 90: Global Vs. UK Growth Comparison, 2023 to 2033

Figure 91: UK Market Share Analysis (%) by Product, 2022 & 2033

Figure 92: UK Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 93: UK Market Share Analysis (%) by Material, 2022 & 2033

Figure 94: UK Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 95: Germany Market Value Proportion Analysis, 2022

Figure 96: Global Vs. Germany Growth Comparison, 2023 to 2033

Figure 97: Germany Market Share Analysis (%) by Product, 2022 & 2033

Figure 98: Germany Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 99: Germany Market Share Analysis (%) by Material, 2022 & 2033

Figure 100: Germany Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 101: Italy Market Value Proportion Analysis, 2022

Figure 102: Global Vs. Italy Growth Comparison, 2023 to 2033

Figure 103: Italy Market Share Analysis (%) by Product, 2022 & 2033

Figure 104: Italy Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 105: Italy Market Share Analysis (%) by Material, 2022 & 2033

Figure 106: Italy Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 107: France Market Value Proportion Analysis, 2022

Figure 108: Global Vs France Growth Comparison, 2023 to 2033

Figure 109: France Market Share Analysis (%) by Product, 2022 & 2033

Figure 110: France Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 111: France Market Share Analysis (%) by Material, 2022 & 2033

Figure 112: France Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 113: Spain Market Value Proportion Analysis, 2022

Figure 114: Global Vs Spain Growth Comparison, 2023 to 2033

Figure 115: Spain Market Share Analysis (%) by Product, 2022 & 2033

Figure 116: Spain Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 117: Spain Market Share Analysis (%) by Material, 2022 & 2033

Figure 118: Spain Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 119: Russia Market Value Proportion Analysis, 2022

Figure 120: Global Vs Russia Growth Comparison, 2023 to 2033

Figure 121: Russia Market Share Analysis (%) by Product, 2022 & 2033

Figure 122: Russia Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 123: Russia Market Share Analysis (%) by Material, 2022 & 2033

Figure 124: Russia Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 125: BENELUX Market Value Proportion Analysis, 2022

Figure 126: Global Vs BENELUX Growth Comparison, 2023 to 2033

Figure 127: BENELUX Market Share Analysis (%) by Product, 2022 & 2033

Figure 128: BENELUX Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 129: BENELUX Market Share Analysis (%) by Material, 2022 & 2033

Figure 130: BENELUX Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 131: Nordic Market Value Proportion Analysis, 2022

Figure 132: Global Vs Nordic Growth Comparison, 2023 to 2033

Figure 133: Nordic Market Share Analysis (%) by Product, 2022 & 2033

Figure 134: Nordic Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 135: Nordic Market Share Analysis (%) by Material, 2022 & 2033

Figure 136: Nordic Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 137: East Asia Market Value (US$ Million) Analysis, 2014 to 2022

Figure 138: East Asia Market Value (US$ Million) Forecast, 2022 to 2032

Figure 139: East Asia Market Value Share, by Product (2023 E)

Figure 140: East Asia Market Value Share, by Incontinence (2023 E)

Figure 141: East Asia Market Value Share, by Material (2023 E)

Figure 142: East Asia Market Value Share, by By Distribution Channel (2023 E)

Figure 143: East Asia Market Value Share, by Country (2023 E)

Figure 144: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 145: East Asia Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 146: East Asia Market Attractiveness Analysis by Material, 2023 to 2033

Figure 147: East Asia Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 149: China Market Value Proportion Analysis, 2022

Figure 150: Global Vs. China Growth Comparison, 2023 to 2033

Figure 151: China Market Share Analysis (%) by Product, 2022 & 2033

Figure 152: China Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 153: China Market Share Analysis (%) by Material, 2022 & 2033

Figure 154: China Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 155: Japan Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Japan Growth Comparison, 2023 to 2033

Figure 157: Japan Market Share Analysis (%) by Product, 2022 & 2033

Figure 158: Japan Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 159: Japan Market Share Analysis (%) by Material, 2022 & 2033

Figure 160: Japan Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 161: South Korea Market Value Proportion Analysis, 2022

Figure 162: Global Vs South Korea Growth Comparison, 2023 to 2033

Figure 163: South Korea Market Share Analysis (%) by Product, 2022 & 2033

Figure 164: South Korea Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 165: South Korea Market Share Analysis (%) by Material, 2022 & 2033

Figure 166: South Korea Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 167: South Asia Market Value (US$ Million) Analysis, 2014 to 2022

Figure 168: South Asia Market Value (US$ Million) Forecast, 2022 to 2032

Figure 169: South Asia Market Value Share, by Product (2023 E)

Figure 170: South Asia Market Value Share, by Incontinence (2023 E)

Figure 171: South Asia Market Value Share, by Material (2023 E)

Figure 172: South Asia Market Value Share, by By Distribution Channel (2023 E)

Figure 173: South Asia Market Value Share, by Country (2023 E)

Figure 174: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 175: South Asia Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 176: South Asia Market Attractiveness Analysis by Material, 2023 to 2033

Figure 177: South Asia Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 178: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 179: India Market Value Proportion Analysis, 2022

Figure 180: Global Vs. India Growth Comparison, 2023 to 2033

Figure 181: India Market Share Analysis (%) by Product, 2022 & 2033

Figure 182: India Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 183: India Market Share Analysis (%) by Material, 2022 & 2033

Figure 184: India Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 185: Indonesia Market Value Proportion Analysis, 2022

Figure 186: Global Vs. Indonesia Growth Comparison, 2023 to 2033

Figure 187: Indonesia Market Share Analysis (%) by Product, 2022 & 2033

Figure 188: Indonesia Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 189: Indonesia Market Share Analysis (%) by Material, 2022 & 2033

Figure 190: Indonesia Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 191: Malaysia Market Value Proportion Analysis, 2022

Figure 192: Global Vs. Malaysia Growth Comparison, 2023 to 2033

Figure 193: Malaysia Market Share Analysis (%) by Product, 2022 & 2033

Figure 194: Malaysia Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 195: Malaysia Market Share Analysis (%) by Material, 2022 & 2033

Figure 196: Malaysia Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 197: Thailand Market Value Proportion Analysis, 2022

Figure 198: Global Vs. Thailand Growth Comparison, 2023 to 2033

Figure 199: Thailand Market Share Analysis (%) by Product, 2022 & 2033

Figure 200: Thailand Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 201: Thailand Market Share Analysis (%) by Material, 2022 & 2033

Figure 202: Thailand Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 203: Oceania Market Value (US$ Million) Analysis, 2014 to 2022

Figure 204: Oceania Market Value (US$ Million) Forecast, 2022 to 2032

Figure 205: Oceania Market Value Share, by Product (2023 E)

Figure 206: Oceania Market Value Share, by Incontinence (2023 E)

Figure 207: Oceania Market Value Share, by Material (2023 E)

Figure 208: Oceania Market Value Share, by By Distribution Channel (2023 E)

Figure 209: Oceania Market Value Share, by Country (2023 E)

Figure 210: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 211: Oceania Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 212: Oceania Market Attractiveness Analysis by Material, 2023 to 2033

Figure 213: Oceania Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 214: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 215: Australia Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Australia Growth Comparison, 2023 to 2033

Figure 217: Australia Market Share Analysis (%) by Product, 2022 & 2033

Figure 218: Australia Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 219: Australia Market Share Analysis (%) by Material, 2022 & 2033

Figure 220: Australia Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 221: New Zealand Market Value Proportion Analysis, 2022

Figure 222: Global Vs New Zealand Growth Comparison, 2023 to 2033

Figure 223: New Zealand Market Share Analysis (%) by Product, 2022 & 2033

Figure 224: New Zealand Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 225: New Zealand Market Share Analysis (%) by Material, 2022 & 2033

Figure 226: New Zealand Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 227: Middle East & Africa Market Value (US$ Million) Analysis, 2014 to 2022

Figure 228: Middle East & Africa Market Value (US$ Million) Forecast, 2022 to 2032

Figure 229: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 230: Middle East & Africa Market Value Share, by Incontinence (2023 E)

Figure 231: Middle East & Africa Market Value Share, by Material (2023 E)

Figure 232: Middle East & Africa Market Value Share, by By Distribution Channel (2023 E)

Figure 233: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 234: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 235: Middle East & Africa Market Attractiveness Analysis by Incontinence, 2023 to 2033

Figure 236: Middle East & Africa Market Attractiveness Analysis by Material, 2023 to 2033

Figure 237: Middle East & Africa Market Attractiveness Analysis by By Distribution Channel, 2023 to 2033

Figure 238: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 239: GCC Countries Market Value Proportion Analysis, 2022

Figure 240: Global Vs GCC Countries Growth Comparison, 2023 to 2033

Figure 241: GCC Countries Market Share Analysis (%) by Product, 2022 & 2033

Figure 242: GCC Countries Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 243: GCC Countries Market Share Analysis (%) by Material, 2022 & 2033

Figure 244: GCC Countries Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 245: Türkiye Market Value Proportion Analysis, 2022

Figure 246: Global Vs. Türkiye Growth Comparison, 2023 to 2033

Figure 247: Türkiye Market Share Analysis (%) by Product, 2022 & 2033

Figure 248: Türkiye Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 249: Türkiye Market Share Analysis (%) by Material, 2022 & 2033

Figure 250: Türkiye Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 251: South Africa Market Value Proportion Analysis, 2022

Figure 252: Global Vs. South Africa Growth Comparison, 2023 to 2033

Figure 253: South Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 254: South Africa Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 255: South Africa Market Share Analysis (%) by Material, 2022 & 2033

Figure 256: South Africa Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Figure 257: Northern Africa Market Value Proportion Analysis, 2022

Figure 258: Global Vs Northern Africa Growth Comparison, 2023 to 2033

Figure 259: Northern Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 260: Northern Africa Market Share Analysis (%) by Incontinence, 2022 & 2033

Figure 261: Northern Africa Market Share Analysis (%) by Material, 2022 & 2033

Figure 262: Northern Africa Market Share Analysis (%) by By Distribution Channel, 2022 & 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Incontinence Care Products Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Incontinence Skincare Products Market Analysis by Product Type, Price, End-User, Sales Channel and Region 2025 to 2035

Adult Incontinence Products Market

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA