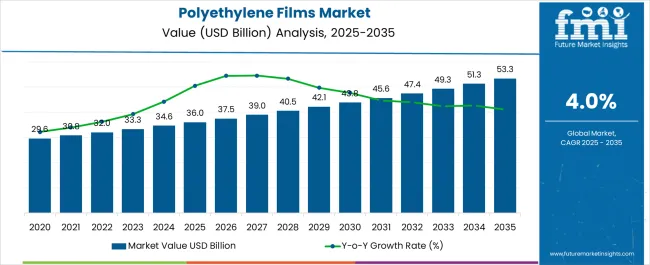

The polyethylene films market is estimated to be valued at USD 36.0 billion in 2025 and is projected to reach USD 53.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

The market demonstrates steady expansion driven by packaging industry demand, agricultural applications, and construction material requirements that necessitate flexible barrier solutions with specific permeability characteristics, mechanical strength, and environmental resistance properties. Food packaging operations implement polyethylene films for fresh produce protection, frozen food barriers, and flexible packaging systems that maintain product freshness while providing moisture control and contamination prevention throughout distribution channels. The material's versatility enables applications spanning from lightweight grocery bags to heavy-duty industrial liners requiring varying thickness specifications and additive formulations tailored to specific performance requirements.

Food packaging applications represent the dominant consumption segment where polyethylene films provide cost-effective barrier properties for bread wrapping, meat packaging, and produce bags requiring moisture retention and oxygen transmission control that extends shelf life while maintaining visual appeal. Manufacturing facilities specify film grades with controlled slip characteristics, heat seal properties, and optical clarity that accommodate high-speed packaging equipment while providing consumer appeal through product visibility. Quality control protocols emphasize consistency in film thickness, mechanical properties, and barrier performance that ensure reliable package integrity throughout automated filling and sealing operations.

Agricultural markets demonstrate significant adoption of polyethylene films for greenhouse covering, mulch applications, and crop protection systems where controlled permeability and ultraviolet radiation resistance enable crop production optimization while reducing water consumption and pesticide requirements. Greenhouse operators utilize specialized films with light transmission characteristics and thermal properties that optimize growing conditions while providing weather protection and insect exclusion. Mulch film applications require biodegradable formulations and soil-friendly additives that eliminate disposal concerns while providing weed suppression and moisture conservation benefits.

Technology advancement trajectories concentrate on barrier enhancement technologies and multi-layer film structures that provide superior protection characteristics while enabling material thickness reduction and cost optimization. Blown film extrusion improvements enable better gauge control and optical properties while reducing energy consumption during production processes. Metallization and coating technologies enhance barrier properties for applications requiring extended shelf life and protection against light, oxygen, and moisture transmission.

Innovation development concentrates on nanotechnology applications and smart film technologies that provide enhanced barrier properties, antimicrobial characteristics, and sensing capabilities for food packaging and medical applications. Nano-clay reinforcement improves mechanical properties while reducing material usage requirements. Active packaging features incorporate oxygen scavengers and moisture control systems within film structures to extend product shelf life beyond traditional passive barrier protection.

| Metric | Value |

|---|---|

| Polyethylene Films Market Estimated Value in (2025E) | USD 36.0 billion |

| Polyethylene Films Market Forecast Value in (2035F) | USD 53.3 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The polyethylene films market is experiencing strong growth supported by the rising demand for flexible packaging, agricultural applications, and industrial wrapping solutions. The material’s versatility, durability, and cost effectiveness are driving its widespread adoption across multiple sectors.

Increasing emphasis on sustainable packaging and recyclability has also contributed to the growth of polyethylene films, particularly in consumer goods and food packaging industries. Advances in extrusion technologies and film processing have enhanced barrier properties, printability, and customization, further strengthening market penetration.

Regulatory initiatives promoting eco friendly plastics and circular economy practices are shaping future growth strategies. The outlook remains positive as packaging converters and manufacturers increasingly focus on lightweight, durable, and recyclable solutions that meet both consumer preferences and regulatory standards.

The low density polyethylene films segment is expected to account for 41.70% of the total market revenue by 2025 within the material category, establishing it as the leading segment. Its dominance is attributed to superior flexibility, toughness, and sealability that make it highly suitable for packaging and industrial applications.

LDPE films are widely adopted in food packaging, consumer goods, and agricultural uses due to their lightweight nature and moisture resistance. Additionally, advancements in film processing technologies and recyclability initiatives are strengthening demand for LDPE films across multiple sectors.

These qualities continue to reinforce its strong position within the material segment of the polyethylene films market.

The less than 50 microns segment is projected to hold 38.60% of market revenue by 2025 within the thickness category, making it the dominant segment. This growth is driven by increasing adoption in flexible packaging, retail carry bags, and disposable applications where lightweight and cost effective solutions are essential.

The segment benefits from reduced material usage, lower production costs, and ease of recyclability, aligning with sustainability initiatives. Furthermore, growing demand for single use packaging alternatives in emerging markets has reinforced its adoption.

Its balance of strength, thinness, and affordability has positioned it as the preferred thickness category in the polyethylene films market.

The bags and pouches segment is estimated to contribute 44.20% of the total revenue by 2025 within the application category, positioning it as the leading segment. The increasing demand for packaged food, consumer goods, and e commerce shipments has accelerated the adoption of polyethylene based bags and pouches.

Their durability, lightweight nature, and ability to preserve product integrity have driven widespread use across retail and industrial packaging. Additionally, innovations in printing and customization are enhancing branding opportunities for manufacturers, further fueling growth.

With expanding urbanization and lifestyle changes favoring convenience packaging, bags and pouches remain the most significant application area in the polyethylene films market.

The global polyethylene films market has anticipated a CAGR of 2.6% during the historic period with a market value of USD 36 billion in 2025.

The polymerization of ethylene forms polyethylene, which is a strong, lightweight, and water-resistant polymer. With a variety of uses ranging from shopping bags to the packaging industry, polyethylene films are the most widely used films worldwide.

In comparison to other types of packaging films, polyethylene films have a significantly greater strength to weight ratio, making them a better choice. Additionally, the lightweight nature of polyethylene films contributes to a reduction in overall weight. Polyethylene films are suitable for the demanding market requirements because of their ability and compatibility with other barrier layers. The packaged product is sealed by polyethylene films from moisture, oxygen, dust, and bacteria. Additionally, colored polyethylene films aid in shielding the packaged item from sunlight. It is advantageous for both users and manufacturers to be able to print out information on polyethylene films. The polyethylene films provide a number of benefits that boost the product's aesthetic appeal by means of a variety of shades, patterns, and designs. Overall, the market for polyethylene films is expected to increase significantly between 2025 and 2035.

The rising demand for eco-friendly packaging is driving the sales of PE films, as manufacturers and consumers alike look for more sustainable options. PE's recyclability, lightweight, durability, barrier properties, and regulatory support make it an attractive option for eco-friendly packaging. PE is a recyclable material and can be used to produce eco-friendly bags and packaging products. The increasing demand for environmentally friendly packaging is driving the sales of PE films.

Governments around the world are imposing regulations to reduce the use of single-use plastic bags and promote the use of eco-friendly packaging. This is creating a positive impact on the sales of PE films, as more manufacturers are switching to eco-friendly packaging materials such as PE. Consumers are becoming more aware of the environmental impact of packaging and are demanding more eco-friendly options. This is driving the demand for PE-based packaging, which is seen as a more sustainable option compared to other types of packaging materials.

It is necessary to increase crop production and improve raw food quality due to the increasing population and food consumption. Due to their minimum ecological footprint, the use of packaging films such as polyethylene films in agriculture is increasing rapidly.

The increasing demand for healthy nutrients and increasing focus on technology for agriculture is driving the inclusion of polyethylene films. By using packaging films in agriculture, crops can be grown with minimum water supply or in deserted areas. Packaging films including polyethylene films act as barriers against the use of pesticides and insects by keeping crops in enclosed systems.

In the greenhouse process, polyethylene films create ideal atmospheric conditions for growing plants. These help to protect plants from harmful UV rays and maintain the internal temperature, which is favorable for increasing the production of organic products. The polyethylene films are also used in the form of tunnels and mulch, depending on the type of plant. Thus, they offer rewarding growth opportunities to polyethylene films manufacturers by targeting the innovation-driven agricultural industry.

The bio polyethylene film segment is projected to register a CAGR of 4.6% during the forecast period. The bio polyethylene film is a type of polyethylene film that is made from renewable resources, such as sugarcane, instead of fossil fuels. This has made it an increasingly popular choice among consumers and manufacturers who are seeking to reduce their carbon footprint and offer more environmentally friendly packaging products. This has led to an increase in demand for these films, especially from companies looking to reduce their environmental impact.

Bio PE films have similar properties to traditional PE films, such as high tensile strength, tear resistance, and flexibility. This means that they can be used in a variety of applications, including bags & pouches, liners & lidding films, sachets & stick packs, and others. The companies look to reduce their environmental impact and improve their bottom line, the demand for bio-PE films is likely to grow.

The bags & pouches segment is projected to hold around 48% of the market value share by the end of 2035. Polyethylene bags & pouches are in high demand for various applications, including food & beverage, healthcare, cosmetics & personal care, and others. The increasing demand for these applications drives the production of PE bags & pouches. PE bags & pouches can be manufactured in a variety of shapes, sizes, and thicknesses, making them suitable for a wide range of applications. They are moisture-resistant, which helps to protect the contents from damage or spoilage. Polyethylene bags & pouches are lightweight and compact, making them easy to transport and store. PE bags & pouches offer a combination of cost-effectiveness & environmental sustainability, which makes them an attractive option for manufacturers and consumers.

The food & beverage industry that is expected to drive substantial growth for the polyethylene (PE) films market. PE films are widely used in the packaging of various food & beverage products, such as fresh produce, processed foods, snacks, and confectionery, due to their excellent moisture and vapor barrier properties, as well as their transparency and durability. The growing demand for flexible and convenient food packaging, driven by the growth of the fast-moving consumer goods (FMCG) industry, is expected to drive demand for PE films. Additionally, the increasing demand for sustainable packaging solutions, as well as the growing use of PE films in the packaging of perishable food products is also expected to drive growth in the PE films market for food packaging. The food & beverage segment is anticipated to grow 1.7 times the current market value during 2025 to 2035.

| Country | USA |

|---|---|

| Market Share (2025) | 20.0% |

| Market Share (2035) | 17.0% |

| BPS Analysis | -300 |

| Country | China |

|---|---|

| Market Share (2025) | 16.2% |

| Market Share (2035) | 19.5% |

| BPS Analysis | +320 |

| Country | India |

|---|---|

| Market Share (2025) | 6.9% |

| Market Share (2035) | 8.7% |

| BPS Analysis | +180 |

| Country | Japan |

|---|---|

| Market Share (2025) | 5.8% |

| Market Share (2035) | 5.4% |

| BPS Analysis | -40 |

| Country | Germany |

|---|---|

| Market Share (2025) | 4.4% |

| Market Share (2035) | 4.2% |

| BPS Analysis | -20 |

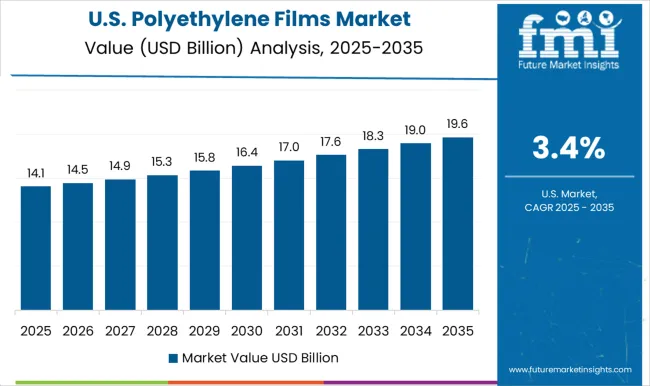

The USA is expected to hold around 84% of the North American polyethylene films market by the end of 2025. The USA flexible packaging market is thriving and expanding, according to the Flexible Packaging Association (FPA). The food (retail and institutional) market, which accounts for roughly 52% of exports, is the largest market for flexible packaging in the United States. The expanding flexible packaging adoption along with growing food sector in the USA fuel the demand for polyethylene films.

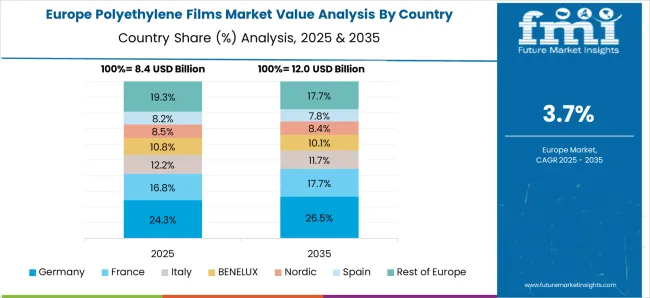

The German market for polyethylene films is projected to grow 1.6 the current market value during the forecast period. According to the Germany Trade and Invest (GTAI), the food and beverage industry is the fourth-largest industry in Germany. Besides this, Germany is the third-largest importer and exporter of food and agriculture products. On the back of these factors, the demand for flexible packaging including polyethylene films is anticipated to bolster in Germany.

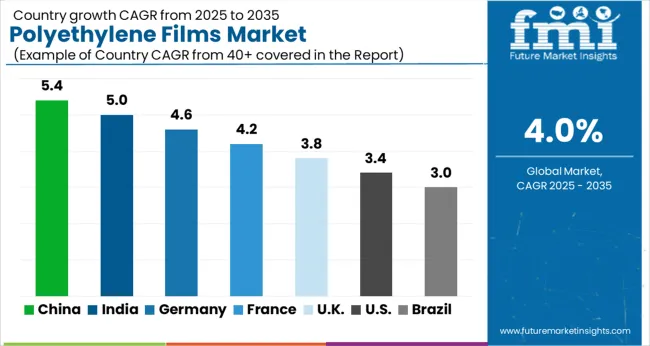

India's polyethylene films market is anticipated to expand at a CAGR of 5.7% during 2025 to 2035 due to the increasing consumption of flexible plastic packaging in India. According to the Federation of Indian Chambers of Commerce & Industry, it is confirmed that the per capita consumption of plastic in 2020 was around 12 kgs and reached around 20 kgs by the end of 2025. The increasing preference for plastic among the consumer is projected to augment the sales of plastic flexible packaging including polyethylene films.

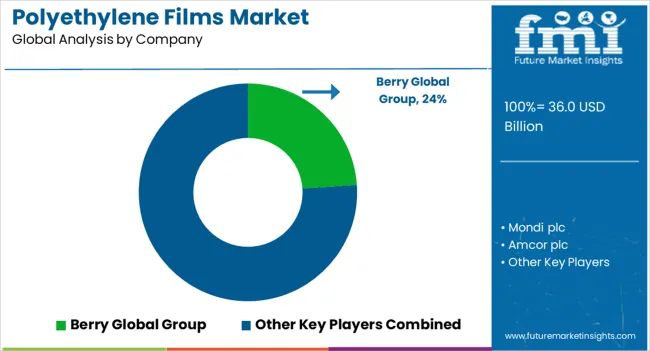

The polyethylene films market includes major global manufacturers competing on material performance, processing quality, and product range. Berry Global Group Inc. leads with LDPE, LLDPE, and HDPE films for food packaging, stretch wrap, and industrial applications. Its focus on lightweight and high-clarity films strengthens its global position. Mondi plc and Amcor plc supply mono-material polyethylene films used in flexible food and healthcare packaging. Both companies emphasize production efficiency and advanced extrusion control.

Sealed Air Corporation produces high-barrier polyethylene films that improve food protection and extend product shelf life. Huhtamäki Oyj and Winpak Ltd. specialize in multilayer polyethylene films offering heat resistance, mechanical strength, and high sealing reliability for food and pharmaceutical use. ProAmpac LLC develops polyethylene films with advanced printing, lamination, and surface treatment options suited to retail and consumer packaging.

PolymerShapes LLC and Nitto Denko Corporation manufacture polyethylene films for technical and industrial applications, including insulation, protective layering, and component shielding. Sphere Group, Glenroy Inc., and Plastissimo Film Co. Ltd. supply polyethylene films for packaging and agriculture, focusing on flexibility and production scale. Schur Flexibles Holding GesmbH and Armando Alvarez Group operate large extrusion facilities producing films for industrial wrapping and silage protection. Trioplast Industries and Superfilm Packaging Industries provide heavy-duty polyethylene films for industrial, agricultural, and commercial applications.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.0% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Thickness, Application, End Use, Region |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan Countries; Baltic Countries; Middle East & Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia & New Zealand |

| Key Companies Profiled | Berry Global Group Inc.; Mondi plc; Amcor plc; Sealed Air Corporation; Huhtamäki Oyj; Winpak Ltd.; ProAmpac LLC; PolymerShapes LLC; Nitto Denko Corporation; Sphere Group; Glenroy Inc.; Plastissimo Film Co. Ltd.; Schur Flexibles Holding GesmbH; Armando Alvarez Group; Trioplast Industries; Superfilm Packaging Industries |

| Customization & Pricing | Available upon Request |

The global polyethylene films market is estimated to be valued at USD 36.0 billion in 2025.

The market size for the polyethylene films market is projected to reach USD 53.3 billion by 2035.

The polyethylene films market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in polyethylene films market are low density polyethylene films (ldpe), linear low density polyethylene films (lldpe), medium density polyethylene films (mdpe), high density polyethylene films (hdpe) and bio polyethylene films.

In terms of thickness, less than 50 microns segment to command 38.6% share in the polyethylene films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Polyethylene Pipe Market Growth – Trends & Forecast 2024-2034

Polyethylene Market Growth – Trends & Forecast 2024-2034

Polyethylene furanoate Market

Polyethylene Orthopaedic Insert Market

Bio-Polyethylene Terephthalate for Packaging Market

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Metallocene Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA