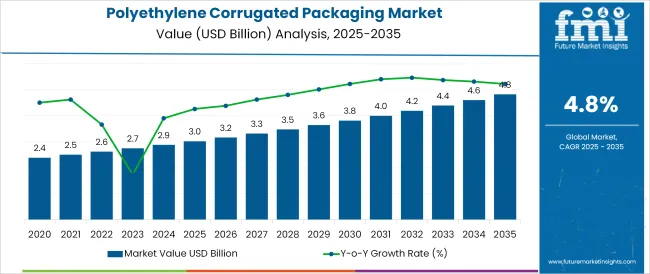

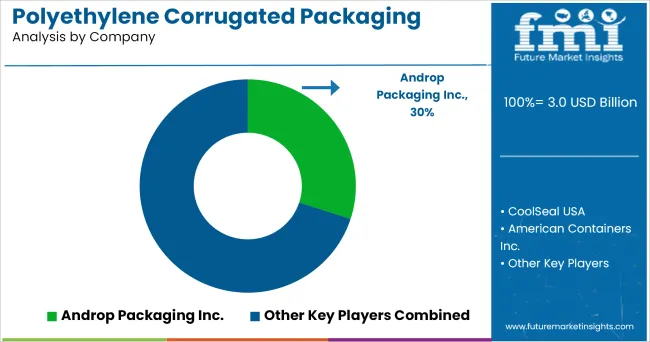

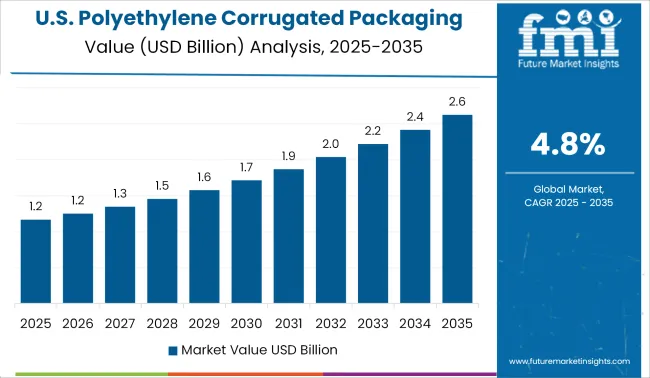

The Polyethylene Corrugated Packaging Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The polyethylene corrugated packaging market is experiencing consistent growth, underpinned by rising demand for impact-resistant, lightweight, and moisture-resistant packaging solutions across a wide range of industrial and commercial applications. The combination of polyethylene’s barrier properties with corrugated strength is enabling enhanced performance in transit packaging, especially for sectors requiring hygienic and temperature-sensitive solutions.

Increased penetration in cold chain logistics and the demand for cost-effective, reusable secondary packaging are further driving market adoption. Manufacturers are aligning with regulatory and sustainability expectations by developing recyclable and food-safe variants. Innovations in polymer reinforcement and flute design are enabling better load handling, stack ability, and printability qualities essential for branding and logistics.

The market is also benefiting from demand surges in organized retail, processed food, and industrial electronics packaging. As businesses optimize packaging for operational efficiency and sustainability, polyethylene corrugated formats are expected to remain at the forefront of secondary packaging innovation.

The market is segmented by Flute Type, Board Type, and End Use and region. By Flute Type, the market is divided into B Flute, A Flute, F Flute, E Flute, and C Flute. In terms of Board Type, the market is classified into Single Wall, Double Wall, and Triple Wall. Based on End Use, the market is segmented into Food & Beverages, Agriculture, Healthcare and Pharmaceutical, Electrical and Electronics, Automotive, and Logistics and Transportation.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

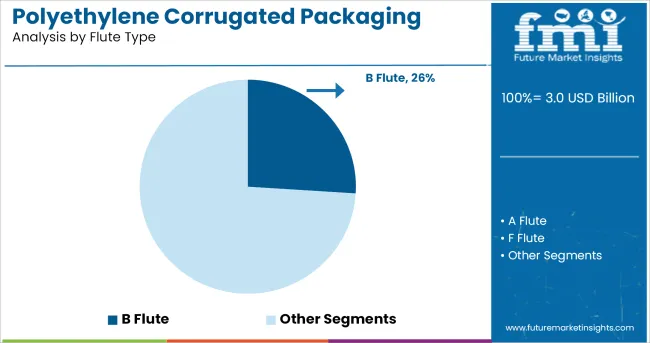

The B flute sub segment is projected to hold 26.0% of revenue within the flute type category in 2025, making it a key contributor to market volume. This dominance is attributed to its superior crush resistance and smoother surface, making it highly effective for die cut designs and graphics printing in point-of-sale packaging.

Its medium wall thickness offers a practical balance between rigidity and cushioning, suitable for a wide range of lightweight to medium weight goods. B flute has become particularly favored in food, beverage, and personal care segments where both product protection and shelf appeal are critical.

Moreover, manufacturers are increasingly incorporating B flute profiles in polyethylene-coated corrugated designs to ensure product safety during transport while retaining recyclability. These characteristics have helped establish its continued relevance in both structural and visual performance standards.

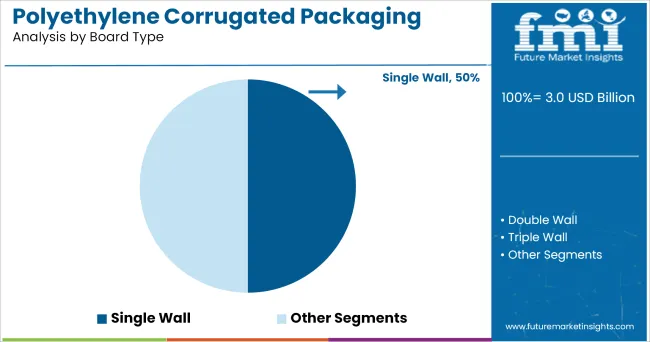

The single wall board type is anticipated to account for 50.0% of the total revenue in 2025 within the board type segment, maintaining its position as the preferred configuration. This leadership is driven by its lightweight nature, ease of handling, and cost-effectiveness, which align well with packaging needs in high-volume, fast-moving consumer goods.

Single wall constructions are capable of supporting a variety of flute profiles while maintaining packaging efficiency in terms of space and material usage. The adoption of polyethylene coated single wall boards has expanded due to their moisture resistance and compatibility with automated filling and stacking systems.

Furthermore, logistics and distribution companies are favoring single wall formats for secondary packaging that meets protection and sustainability benchmarks. As supply chains seek packaging solutions that reduce damage rates and optimize transportation economics, single wall polyethylene corrugated formats continue to hold the highest share.

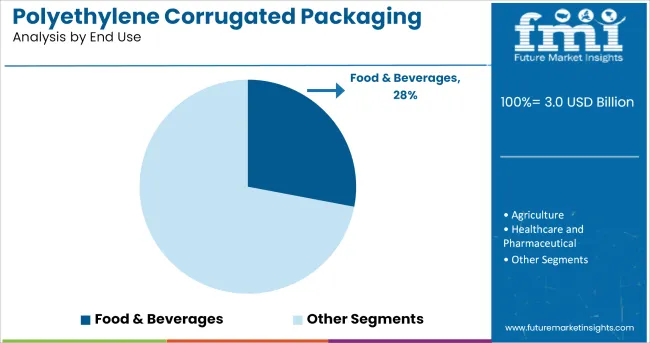

The food and beverages sector is forecast to account for 28.0% of the overall polyethylene corrugated packaging market revenue in 2025, establishing it as the largest end-use segment. This leadership has been driven by heightened demand for hygienic, moisture-resistant, and structurally stable packaging solutions that comply with food safety standards.

Polyethylene corrugated packaging offers critical advantages for perishables, processed foods, and beverages through its barrier properties and load-bearing capability. The segment has further benefited from growth in e-commerce grocery, cold chain distribution, and meal kit services, all of which require resilient and reliable transport packaging.

The use of food-grade coatings and resistance to contaminants has made these solutions suitable for direct and indirect food contact. With rising focus on packaging efficiency and waste reduction in the F&B industry, polyethylene corrugated formats continue to be adopted for their reusability, customizability, and cost-to-performance ratio.

Packaging is the most essential and fundamental requirement for transporting products to the customers. Safe and secure packaging keeps the products safe and protects them from moisture, temperature, and external atmospheric conditions. Polyethylene corrugated packaging is suitable for packaging purposes.

Polyethylene corrugated boxes are widely used in various products packaging. The boxes made of polyethylene corrugated packaging is safe and suitable for transporting high-value products like electricals, electronics, glass, smartphones, pharmaceuticals, cosmetics, and food & beverages.

The polyethylene corrugated packaging products are resistant to oil, chemicals, acid, water, and attack by microorganisms. Polyethylene corrugated packaging is growing due to the rising demand for pre-packaged and ready-to-eat food products. Therefore, polyethylene corrugated packaging is expecting significant growth due to remarkable growth in food and beverage industry.

Polyethylene corrugated packaging is a cost-effective and widely used packaging solution for various products and applications. The PE corrugated packaging provides high barrier protection against moisture, water vapour, environmental influences, and contamination.

The boxes or cartons made using PE corrugated sheets are lightweight and flexible. They are foldable, versatile, and reusable. Polyethylene corrugated packaging is resilient packaging for shipping, transporting, and storing products.

The rapid urbanization in developing countries, changing consumer’s preference for packaged food, and rise in quick-service restaurants for safe, secure, and timely delivery of the products propel the growth of polyethylene corrugated packaging.

The increase in the consumption of ready-to-eat and processed food products, online food ordering, and rapidly changing lifestyles pushes the global food market, which drives the growth of the polyethylene corrugated packaging market share.

In packaging and shipping, RFID or radio frequency identification offers protection against theft and fraud. It helps the supplier track the product, damage, loss, slow delivery, and real-time cargo movements. The polyethylene corrugated packaging with use of RFID technology increases accuracy, improves efficiency, and supports accelerating the delivery speed.

The RFID technology tracks the location, contents, information and provides complete accountability. The growing customer’s preference for fast, safe and reliable packaging solution enables the polyethylene corrugated packaging to opt for RFID technology.

Additionally, the rising consumer trend to use sustainable and environment friendly packaging as recyclable and reusable products could also bolster the demand for polyethylene corrugated packaging.

Key players such as

are actively involved in polyethylene corrugated packaging market for different applications. Key Asian players such as Plastech Co., Ltd, Shree Ganesh Packaging, LLC, Shish Industries Limited, Yamakoh, Co., Ltd., Dynapac Co., Ltd, and others are actively involved in polyethylene corrugated packaging market for different applications.

The manufacturers involved in manufacturing polyethylene corrugated packaging adopt various strategies such as product launch, and sustainability to serve the increasing demand for the polyethylene corrugated packaging market.

In May 2024 Minnesota Diversified Industries reusable corrugated box is (RSC) regular-slotted container produced which is more sustainable and cost-effective. It reduces the cost related to box break down, erection, storing and disposing of box packaging.

The polyethylene corrugated packaging provides ideal protection against severe climatic conditions. It is not influenced by external conditions, water, chemicals and protect the products from moisture, UV, dust and contamination.

The increasing takeaway food and online food orders have created ample scope for polyethylene corrugated packaging in USA. The USA people are more conscious about health and hygiene and more concerned about the packaging food and consumer products.

The polyethylene corrugated packaging helps in storing, carrying, and packing various food products and safely maintains the freshness and durability. Therefore, the growing demand for processed, packaged readymade food order and takeaway parcels will generate significant demand for polyethylene corrugated packaging in the USA.

The global polyethylene corrugated packaging market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the polyethylene corrugated packaging market is projected to reach USD 4.8 billion by 2035.

The polyethylene corrugated packaging market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in polyethylene corrugated packaging market are b flute, a flute, f flute, e flute and c flute.

In terms of board type, single wall segment to command 50.0% share in the polyethylene corrugated packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Polyethylene Pipe Market Growth – Trends & Forecast 2024-2034

Polyethylene Market Growth – Trends & Forecast 2024-2034

Polyethylene furanoate Market

Polyethylene Orthopaedic Insert Market

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bio-Polyethylene Terephthalate for Packaging Market

Recycled Polyethylene Terephthalate (rPET) Packaging Market Growth and Trends 2025 to 2035

Renewable Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Metallocene Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Chlorinated Polyethylene Resins and Elastomers (CPE) Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA