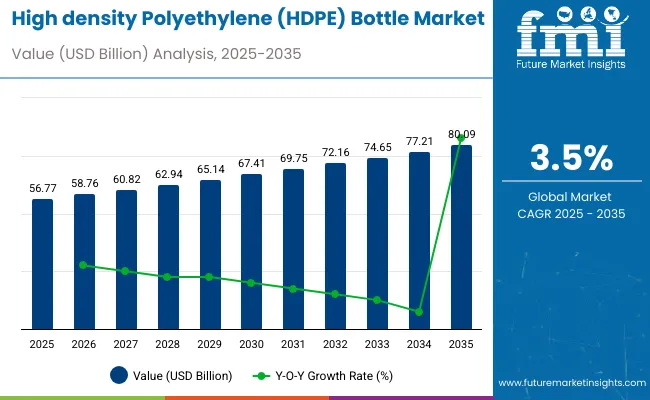

The global high density polyethylene (HDPE) bottle market is anticipated to experience steady growth, with its value expected to rise from approximately USD 56.77 billion in 2025 to USD 80.09 billion by 2035, representing a CAGR of 3.5%.

This upward trend is largely driven by growing demand across various sectors, including food and beverages, pharmaceuticals, and household products, for packaging solutions that are durable, lightweight, and resistant to chemicals. HDPE bottles are increasingly preferred because they offer exceptional strength, impact resistance, and the ability to maintain the integrity and safety of the products they contain.

The versatility of HDPE bottles makes them suitable for packaging a wide array of items such as cleaning agents, personal care products, and beverages. Their cost-effectiveness compared to alternative materials further bolsters their popularity, making them a staple in the packaging industry worldwide. Moreover, as consumers and manufacturers alike become more conscious of product safety and environmental impact, HDPE’s recyclability and relatively low environmental footprint are strengthening its market position.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 56.77 billion |

| Industry Value (2035F) | USD 80.09 billion |

| CAGR (2025 to 2035) | 3.5% |

Recently, Incoplas launched a revolutionary range of lightweight HDPE bottles based on Total’s dedicated ISBM resin SB 1359. These bottles, available in symmetrical and asymmetrical designs up to 5 liters, featured significantly reduced weight compared to traditional HDPE extrusion blow-molded solutions without compromising mechanical performance.

The collaboration combined Total’s advanced HDPE ISBM technology with Incoplas’ processing expertise. Elke Berges, marketing manager at Rigid Packaging, noted that the SB 1359 resin enabled easier and more stable processing on ISBM machines, broadening application possibilities.

Despite the positive outlook, the HDPE bottle market does face several challenges. Fluctuating raw material prices, particularly for petroleum-based feedstocks, can impact manufacturing costs and profit margins. Additionally, increasing regulatory pressure aimed at reducing plastic waste and promoting sustainability is prompting manufacturers to reassess their packaging strategies. Governments worldwide are introducing stringent policies to curb single-use plastics, which may restrict the usage of traditional HDPE bottles if alternatives are not adopted.

To address these challenges, the industry is witnessing ongoing advancements in recycling technologies, which enable more efficient reuse of HDPE materials. Innovations in sustainable packaging alternatives, including the incorporation of bio-based HDPE and post-consumer recycled content, are also gaining traction. Additionally, there is a noticeable shift toward lightweight packaging solutions, which help reduce material consumption and lower transportation-related carbon emissions.

The HDPE bottle market is subject to various government regulations aimed at ensuring product safety, environmental protection, and compliance with food and beverage standards. These regulations cover the entire lifecycle of HDPE bottles, from raw material sourcing and manufacturing to usage and disposal.

The global trade of HDPE bottles is driven by growing demand across food and beverage, pharmaceuticals, and personal care industries. Production is concentrated in countries with strong petrochemical and plastics manufacturing sectors, while imports are significant in regions with high consumption but limited local production capabilities. Trade flows are influenced by cost competitiveness, quality standards, and environmental regulations promoting recyclable packaging.

The below table presents the expected CAGR for the global high density polyethylene (HDPE) bottle market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.5% |

| H2 (2024 to 2034) | 3.0% |

| H1 (2025 to 2035) | 4.5% |

| H2 (2025 to 2035) | 5.0% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 2.5%, followed by a slightly higher growth rate of 3.0% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.5% in the first half and remain relatively moderate at 5.0% in the second half. In the first half (H1) the market witnessed a decrease of 50 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

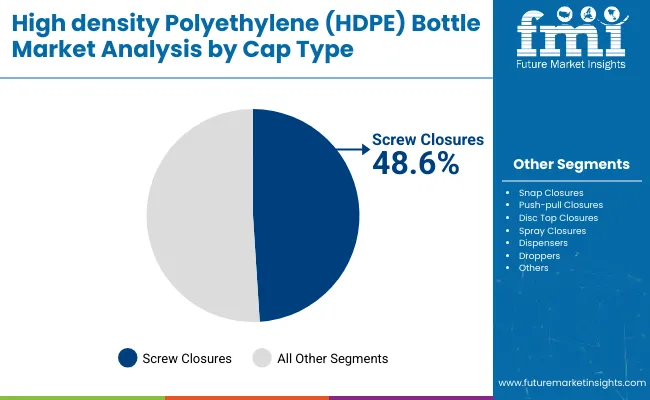

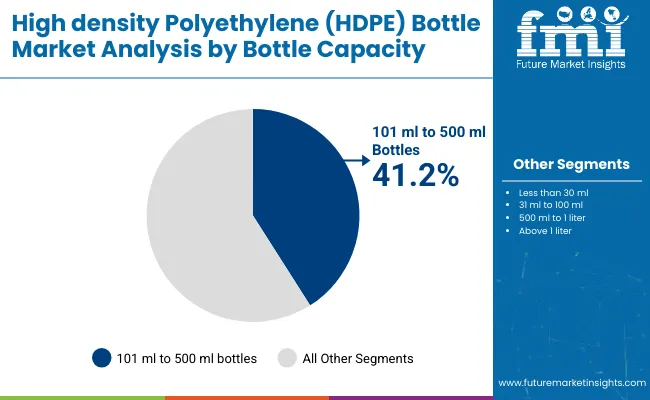

The HDPE bottle market is experiencing steady growth driven by rising demand for secure closures and versatile packaging capacities across industries. Key investment areas include screw closures-favored for their leak-proof design and safety features-and mid-size bottles ranging from 101 ml to 500 ml, which offer broad usability in food, pharmaceutical, and personal care sectors. These segments are aligned with evolving consumer preferences for convenience, safety, and sustainability.

Screw closures are projected to dominate the HDPE bottle cap market, holding 48.6% market share by 2025. Their success stems from reliable sealing, reusability, and convenience-attributes essential in applications such as beverages, liquid pharmaceuticals, syrups, lotions, and dairy products.

These closures protect product integrity by preventing leaks and contamination, enhancing user experience across personal care, homecare, and food industries. Additionally, child-resistant variants are gaining market share, particularly in the pharmaceutical and chemical sectors where tamper-proof packaging is a regulatory necessity. This growth is reinforced by sustainability trends, as companies seek lightweight, recyclable, and biodegradable screw closures to meet environmental goals

Notable players like Berry Global, Silgan Holdings, and Closure Systems International are investing in eco-friendly innovations, including ergonomic, consumer-centric designs. These advancements are not only enhancing usability but also reducing plastic waste. The convergence of safety, sustainability, and consumer convenience continues to cement screw closures as the leading cap solution in HDPE packaging.

The 101 ml to 500 ml capacity range is expected to lead the HDPE bottle market by volume in 2025, accounting for 41.2% market share. This mid-size bracket strikes a balance between portability and sufficient storage, making it highly adaptable across industries. It is extensively used for packaging shampoos, conditioners, lotions, juices, liquid soaps, and over-the-counter medications, especially in urban and travel-friendly formats.

Within this range, bottles sized between 250 ml and 350 ml are particularly in demand, especially in the personal care and homecare segments. Rising consumer inclination toward single-use, lightweight, and recyclable packaging is encouraging manufacturers to adopt minimalistic and customizable HDPE designs.

Brands like Amcor, Alpla, and RPC Group are leading innovation in this space, offering sustainable, functional solutions that align with both branding needs and environmental regulations. With increasing demand for convenient and eco-conscious products, the 101 ml to 500 ml segment is positioned to remain the dominant format in HDPE bottle packaging well into the future.

Packaging that is secure and tamper proof is a need created by consumer and regulatory requirements on product integrity and security. HDPE bottles are widely used, partly because of the strength of the material and the ability to add a tamper-evident and child-resistant closure. Such characteristics are critical requirements in personal care, food & beverage, and household chemicals where the ingress of product contamination or unauthorized access is considered seriously threatening.

Tamper-proof seals, breakable caps, and child-safe lids ensure consumer confidence while fulfilling strict safety norms. Manufacturers are also embedding authentication features like serialized barcodes and holographic labels into HDPE packaging as counterfeit products grow.

As there is increasing demand for cold and chilled storage and transportation, HDPE bottles have become an excellent and preferred packaging material for sensitive products. The product's value can be protected from exposure to moisture, oxygen, and UV light due to its exceptional barrier properties.

Food & beverage, chemicals, and healthcare industries widely use HDPE bottles to store perishable and sensitive liquids in pristine condition. Light and impact-resistant, HDPE bottles offer low-cost and effective cold chain packaging solutions, which reduces product spoilage and enhances shelf life. This is one of the primary factors driving the market.

This is yet another significant challenge to the HDPE bottle market with increasing global concern over environmental sustainability and reduction of plastic wastes. With continued damage to ecosystems, especially marine waters, due to environmental pollution through plastics, governments have been enforcing strict policies regarding the use of plastics.

In many countries, single-use plastics are banned or restricted, and the force grows for companies to adopt more environmentally friendly packaging alternatives. Currently, the regulations require the use of recyclable or biodegradable material, hence making manufacturers spend on sustainable innovations.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Recycling Innovations | Investment in recycled HDPE and biodegradable materials has to be pursued with an increasingly stringent set of regulations around plastic waste as against the goal and environmental considerations around circular economies. |

| Lightweight & Durable Design | Lightweight innovations in HDPE bottles lead to less usage of material yet increasing durability, decreased transportation cost, and better sustainability. |

| Barrier Coating & Protection Technologies | Advances in the coatings for barrier improvement for HDPE bottles allow greater protection from moisture, oxygen, and UVs for better preservation of contents- food, pharmaceuticals, or chemicals with more extended shelf lives. |

| Automation & Smart Manufacturing | Increased global demand has made efficiency improvement, cost-cutting, and uniform product quality the focus areas through investments in automated blow molding and high-speed production lines. |

| Customization & Branding Innovations | Increasing demand for unique shapes, colors, and custom labeling will also spur market growth with investment in digital printing, embossed designs, and premium finishes. |

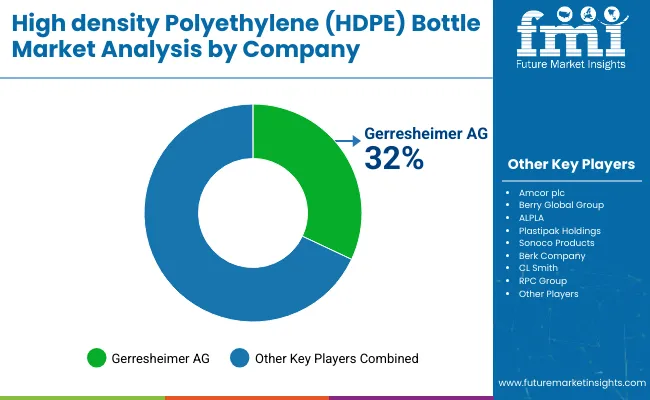

Tier 1 companies comprise market leaders capturing significant market share in high density polyethylene (HDPE) bottle market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Amcor plc, Berry Global Group Inc., Gerresheimer AG and APLPA.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge.

These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 Plastipak Holdings, Inc., Sonoco Products Company, Berk Company LLC, CL Smith, RPC Group Plc, Graham Packaging, Nampac Limited, and ALPLA Werke Alwin Lehner GmbH & Co. KG.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

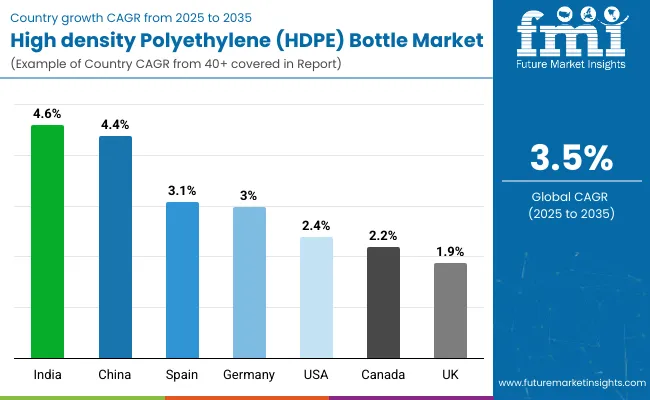

The section below covers the future forecast for the high Density polyethylene (HDPE) bottle market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 2.4% through 2035. In Europe, Spain is projected to witness a CAGR of 3.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.4% |

| Germany | 3.0% |

| China | 4.4% |

| UK | 1.9% |

| Spain | 3.1% |

| India | 4.6% |

| Canada | 2.2% |

Food and beverage packaging dominate the market for HDPE in the USA, since demand for safe, lightweight and durable packaging keeps it in greater usage. HDPE is used for milk jugs, juice bottles and other food containers because of its properties of moisture resistance, strength and recyclability, and this factor is also attributed to the growing consumption of packaged and processed foods. In addition, the sustainability trends have made brands opt for environmentally friendly and recyclable materials.

One of the main growth drivers for the HDPE bottle market in Germany is the automobile industry, since most manufacturers now make use of light and tough plastics for the packaging of automotive fluids, lubricants, and coolant. The preferred chemical resistance and impact strength characteristics of HDPE bottles and recyclability of HDPE make them suitable for storage of engine oils, brake fluids, and cleaning solutions.

Germany is one of the leaders globally in the production of automobiles and electric vehicles. As a result, demand for high-performance sustainable packaging continues to rise to fit the industrial drive for efficiency, cost-effectiveness, and environmental sustainability.

The key players of the HDPE bottle market focus on product innovation, sustainability, and the increasing market presence. Companies introduce light-weighted impact-resistant recyclable HDPE bottles with advanced barrier properties that will enhance product protection. Further, mergers and acquisitions with the local manufacturers and suppliers have aided firms to expand their global networks of distribution.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2024) | USD 54.85 billion |

| Current Total Market Size (2025) | USD 56.77 billion |

| Projected Market Size (2035) | USD 80.09 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD Billion for value |

| Cap Types Analyzed (Segment 1) | Screw Closures, Snap Closures, Push-Pull Closures, Disc Top Closures, Spray Closures, Dispensers, Droppers |

| Bottle Capacities Assessed (Segment 2) | Less than 30 ml, 31 ml to 100 ml, 101 ml to 500 ml, 500 ml to 1 liter, Above 1 liter |

| Visibility Types Analyzed (Segment 3) | Translucent, Opaque |

| Neck Types Assessed (Segment 4) | Narrow-Mouth Bottles, Wide-Mouth Bottles |

| End-Users Covered (Segment 5) | Food & Beverages, Chemical, Pharmaceuticals, Personal Care & Cosmetics, Homecare & Toiletries |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Brazil, South Korea, GCC Countries |

| Key Players Influencing the Market | Gerresheimer AG, Amcor plc, Berry Global Group, ALPLA, Plastipak Holdings, Sonoco Products, Berk Company, CL Smith, RPC Group, Graham Packaging, Nampac Limited, ALPLA Werke Alwin Lehner GmbH |

| Additional Attributes | Dollar sales by bottle capacity and cap type, screw closures dominant with 48.6% share, 101-500 ml bottles lead with 41.2% share, demand for leak-proof & versatile formats |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of cap type, the industry is segmented into screw closure, snap closures, push-pull closures, disc top closures, spray closures, dispensers, and droppers.

In terms of bottle capacity, the industry is segmented into less than 30 ml, 31 ml to 100 ml, 101 ml to 500 ml, 500 ml to 1 liter, and above 1 liter.

In terms of visibility, the industry is segmented into translucent and opaque bottles.

In terms of neck type, the industry is segmented into narrow-mouth bottles and wide-mouth bottles.

Food & Beverages, Chemical, Pharmaceuticals, Personal Care & Cosmetics, Homecare & Toiletries.

Key regions covered include North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The global high density polyethylene (HDPE) bottle industry is projected to witness CAGR of 3.5% between 2025 and 2035.

The global high density polyethylene (HDPE) bottle industry stood at USD 54.85 billion in 2024.

Global high density polyethylene (HDPE) bottle industry is anticipated to reach USD 80.09 billion by 2035 end.

East Asia is set to record a CAGR of 6.24% in assessment period.

The key players operating in the global High Density Polyethylene (HDPE) Bottle industry include Amcor plc, Berry Global Group, Inc., Gerresheimer AG and APLPA.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Density Polyethylene HDPE Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in High-Density Polyethylene Bottle Market

High Density Polyethylene Film Market

Light Density Polyethylene (LDPE) Bottles Market Growth Trends Forecast 2025 to 2035

High Density Interconnect Market Size and Share Forecast Outlook 2025 to 2035

High density Fiberboard (HDF) Market Size and Share Forecast Outlook 2025 to 2035

High Density (HD) Cell Banking Market Size and Share Forecast Outlook 2025 to 2035

High-Density Racks (>100Kw) Market Growth - Trends & Forecast 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Demand for High-Density Racks (100Kw) in Japan Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ultra-High Molecular Weight Polyethylene Manufacturers

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA