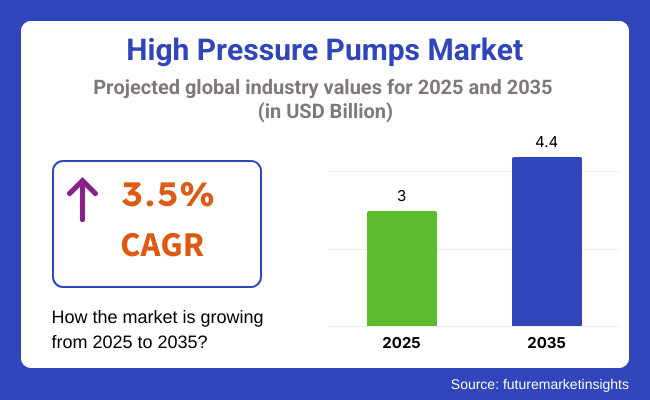

The high pressure pumps market is estimated at USD 3.0 billion in 2025 and is projected to reach USD 4.4 billion by 2035, expanding at a CAGR of 3.5%. China remains the most lucrative market due to its large-scale infrastructure projects and industrial base, while India is expected to witness the fastest growth at a CAGR of 3.7%, driven by manufacturing expansion and government-backed infrastructure schemes.

The market’s growth is propelled by rising demand in oil & gas, power generation, wastewater treatment, and renewable energy sectors. Dynamic pumps dominate usage due to their balance between energy efficiency and output pressure. Government investments in desalination, hydrogen production, and urban sanitation projects are creating new opportunities.

However, raw material price fluctuations and regulatory compliance costs are restraining rapid adoption, particularly among SMEs. Trends such as AI-based predictive maintenance, IoT-integrated monitoring, and green pump systems are transforming the competitive landscape.

Between 2025 and 2035, high pressure pumps will play a vital role in enabling sustainable industrialization. As sectors such as chemical processing, geothermal energy, and smart manufacturing expand, demand for modular, corrosion-resistant, and high-efficiency pump systems will rise. Companies will likely prioritize partnerships with automation players, regional OEMs, and utilities to enable system-wide modernization and long-term service contracts.

Between 2025 and 2035, the market is also expected to benefit from growing investment in green hydrogen and biofuel projects, where high pressure pumps are critical for handling pressurized fluids in electrolyzers and conversion systems. The transition toward cleaner energy sources will open new application areas beyond conventional use cases.

Additionally, as aging industrial infrastructure is modernized across developed economies, there will be a surge in demand for retrofitted pump systems that offer digital integration and energy savings. Emerging markets will also present strong opportunities for first-time installations, especially where industrial water demand and energy security remain strategic concerns.

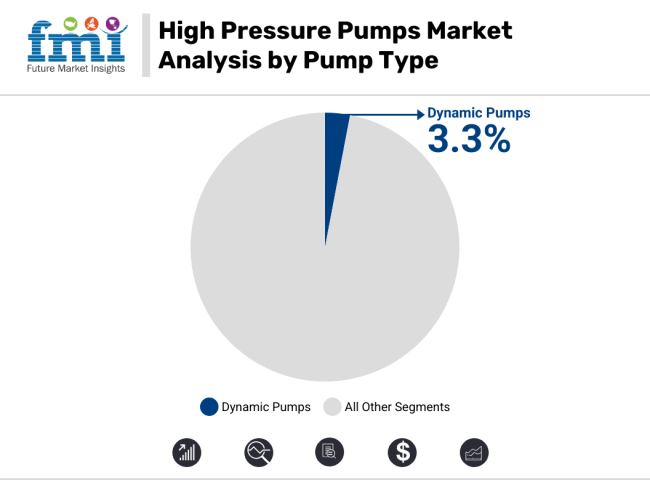

Dynamic pumps are expected to remain the dominant product category through 2035, driven by their efficiency in high-flow industrial processes like metalworking, wastewater management, and thermal power generation. These pumps are preferred in sectors demanding continuous operation and variable load handling. The dynamic segment is projected to register a CAGR of 3.3% during the forecast period.

Positive displacement pumps, on the other hand, are gaining steady traction in precision-heavy industries such as chemicals, pharmaceuticals, and food processing. Their ability to handle viscous fluids and maintain flow consistency under high pressure makes them suitable for controlled, high-accuracy applications. However, adoption is comparatively slower due to higher upfront costs and maintenance complexity.

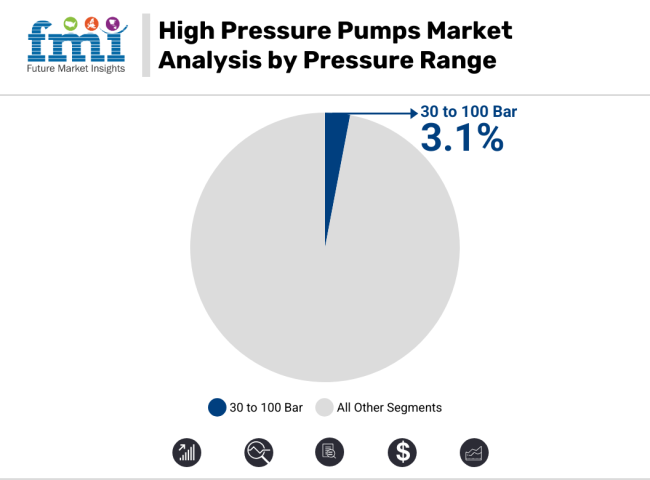

The 30 to 100 bar segment will remain the largest pressure range category, driven by wide applicability in industrial cleaning, municipal water treatment, and mid-pressure manufacturing operations. It offers the best balance between pressure, energy efficiency, and cost, especially for moderate industrial duties.

The 101 to 500 bar range is also gaining traction in sectors like hydrostatic testing and industrial coatings. Above 500 bar pumps are niche but crucial in ultra-high-pressure applications like oilfield drilling, mining, and specialty cleaning systems. While volumes are lower, margins are higher in this segment due to specialized design requirements.

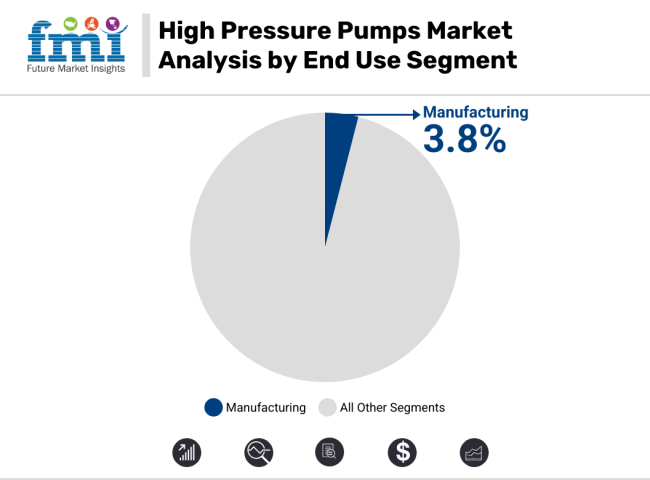

The manufacturing segment is projected to be the fastest-growing end-use category, expanding at a CAGR of 3.8% between 2025 and 2035. Demand is surging across automotive, steel, food processing, and electronics sectors, where high pressure pumps are used for hydraulic systems, cutting, cleaning, and sanitization.

Oil & gas remains the largest segment in 2025 due to legacy demand in exploration, enhanced oil recovery, and refining. However, growth is comparatively slower owing to energy transitions. Power generation and chemicals & pharmaceuticals will maintain stable demand, with a focus on energy-efficient systems and regulatory compliance.

Future Market Insights (FMI) conducted an extensive survey and a series of expert interviews with key stakeholders in the high-pressure pumps industry to develop a deeper understanding of existing trends, challenges, and future opportunities.

Participants included manufacturers, industry experts, end-users from sectors such as oil & gas, water treatment, and manufacturing, as well as regulatory authorities.

The survey also indicated that there was a growing demand for energy-efficient and environmentally friendly pumping solutions. End customers demand pumps that comply with high environmental requirements and contribute toward sustainability goals. Manufacturers responded to this trend by committing to develop greener products that align with customer fluid handling requirements.

Stakeholders further complained about problems such as fluctuations in raw material costs, as well as high entry barriers for the latest generation of high-pressure pumps.

These factors could potentially hinder the adoption rate, particularly in small and medium-sized enterprises.

On the other side, stakeholders were optimistic, expecting evergreen segment growth in the future due to industrial growth and technological advancements.

| Countries | Regulation & Impact on High-Pressure Pumps Landscape |

|---|---|

| European Union | Pressure Equipment Directive (PED) 2014/68/EU - Sets standards for the design and fabrication of pressure equipment, including high-pressure pumps, ensuring safety and free product placement within the EU. Compliance is mandatory for manufacturers targeting the European sector. |

| United Kingdom | Boiler Upgrade Scheme - Provides grants to homeowners for installing environmentally friendly heat pumps, supporting the UK’s broader goal of reducing greenhouse gas emissions by 81% by 2035. While heat pumps contribute to this target by lowering emissions in residential heating, the reduction figure applies to the UK’s overall carbon reduction strategy across all sectors. |

| Germany | Subsidy reductions for heat pumps have led to a decline in heat pump installations, which may indirectly affect demand for related pumping systems in heating and industrial applications. However, high-pressure pumps are primarily used in industrial processes, water treatment, and energy applications rather than domestic heating systems. |

| France | Pressure Equipment Directive (PED) Compliance - France adheres to the European Union's PED 2014/68/EU, which sets standards for the design and fabrication of pressure equipment, including high-pressure pumps. Compliance ensures safety and facilitates free industrial placement within the EU. |

| South Korea | Korean High-Pressure Gas Safety Control Act - This law regulates the production, storage, and transportation of high-pressure gases and equipment. Manufacturers must obtain certification to ensure safety standards are met, impacting the design and operation of high-pressure pumps. |

| India | Gas Cylinder Rules, 2016 - Governed by the Petroleum and Explosives Safety Organization (PESO), these rules regulate the manufacture, storage, and transportation of high-pressure gas cylinders. Compliance is mandatory for manufacturers and influences the design and testing of high-pressure pumps. |

| China | Regulations on Safety Supervision of Special Equipment - Overseen by the State Administration for Market Regulation (SAMR), these regulations cover boilers, pressure vessels, and other special equipment, including high-pressure pumps. Manufacturers must adhere to stringent safety and quality standards. |

| Japan | High Pressure Gas Safety Law - This law ensures public safety by regulating the production, storage, sale, transportation, and consumption of high-pressure gases, along with the production and handling of containers for such gases. Compliance is mandatory for manufacturers and importers of high-pressure pumps. |

The high-pressure pumps research report comprehensively covers the competitive and vendor landscape of the high-pressure pumps landscape.

As a strategy to remain competitive, top manufacturers are concentrating on the cost-effective production of high-quality products.

Many companies are using economies of scale to provide competitive pricing while also ensuring customization to meet varied industry requirements.

Furthermore, Hi-tech advancements are reflected in smart mapping and smart interfacing, firms in the segment are increasingly investing in IoT set-enabled smart pumps, automation, and energy-efficient designs for performance improvement, maintenance cost reduction, and building sustainability.

To fuel growth, these industry leaders are engaging in strategic collaborations, acquisitions, and mergers to broaden their global footprint and product offerings. Integration with real-time monitoring and predictive maintenance software through partnership with industrial automation firms and AI software houses is now commonplace.

Another crucial strategy is tapping into developing segments, like Asia-Pacific, Latin America, and the Middle East, where industrialization and infrastructure are growing rapidly.

In addition, manufacturers are aligning with regulatory compliance trends by developing green, low-emission, and high-efficiency pump systems that will remain competitive in the long term and adhere to advanced environmental regulations in the future.

The year 2024 saw several notable mergers, acquisitions and regulatory changes in India's corporate landscape. In a notable deal, Tata Group integrated Air India and Vistara to create a single full-service carrier, consolidating its aviation assets and creating a single full-service airline.

In media, Reliance's Western Asia merger of USD 8.5 billion with Disney India seemed a move to mobilise high-end content and distribution mechanisms to potentially form a dominant media enterprise, pending regulatory approvals. There was also a rush to the capital segments, with several companies, including Hyundai Motor India. Swiggy, NTPC Green, Ola Electric, and Bajaj Housing Finance making their debut, a sign of strong investor appetite across sectors.

The Competition Commission of India (CCI) issued deal value thresholds warranting mandatory merger approval for M&A Transactions above USD 250 million. CCI also amended the rules of 'Green Channel', under which the automatic approval criteria will now be stricter, further scrutinising the mergers of big contestants to fight with unfair competition.

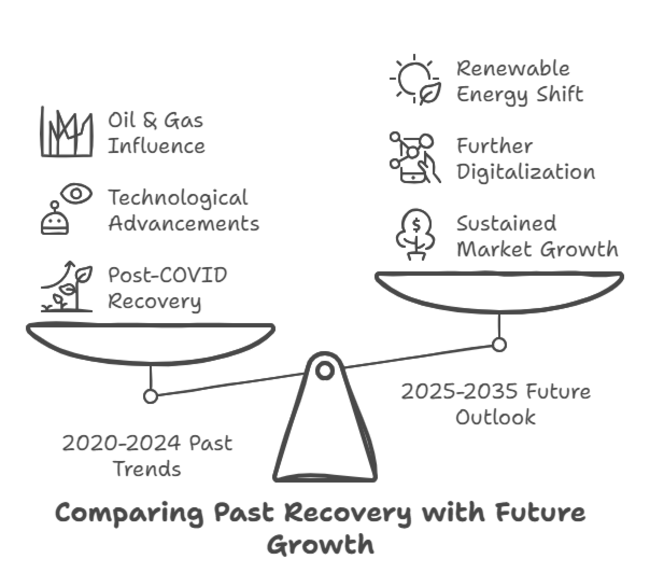

Macroeconomic factors are a significant driver that impacts the global pump demand and hence the global high-pressure pump landscape as well, including industrial development, energy demand, infrastructural development, and sustainability initiatives. The industry grew moderately from 2020 to 2024 due to industrial recovery post-pandemic, increased investments in wastewater treatment, and rising oil & gas exploration. Nonetheless, disruption and inflation pressures in supply chains have added questions to a mix of high raw material costs and production delays.

Demand for high-pressure pumps will be driven by steady industrial expansion, urbanization, and the transition toward sustainable energy in 2025 and beyond. The increasing adoption of hydrogen as an energy carrier, particularly in storage, transportation, and fuel cell applications, will drive demand for high-pressure pumps. Government policies promoting clean energy as well as stricter environmental regulations will drive industries toward energy-efficient pump technologies.

Investment cycles are likely to be influenced by economic volatility, geopolitical risks, and fluctuating oil prices. But as automation grows, digital monitoring solutions make it possible to see everything from afar in real time, and AI-driven predictive maintenance cuts down on downtime, high-pressure pumps will become an important part of Industry.

The high-pressure pumps landscape in the United States is expected to reach a value of approximately USD 808.0 million by 2035 and is expected to develop at an approximate CAGR of 3.6% through 2025 to 2035.

The growth of this industry is mainly due to the strong presence of industries like oil & gas, chemical processing, and manufacturing. Strong infrastructure development and technological innovations are driving the demand for high-pressure pumps in the USA.

Moreover, the trend towards energy conservation and compliance with environmental legislation drives industries to employ highly efficient pumping solutions, thus driving segment growth. However, industry saturation and stringent regulatory frameworks may complicate rapid expansion.

The high-pressure pump market in the United Kingdom is expected to reach USD 157.8 million by 2035. Over the assessment period, sales of high pressure pumps in the United Kingdom are projected to climb at 3.4% CAGR. In the UK, the high-pressure pump segment is driven by an increasing emphasis on renewable energy and wastewater treatment facilities.

The gradual recovery of the manufacturing sector and the government’s infrastructure initiatives likely drove growth within the industry.

But the pace of expansion could be weighed down by economic uncertainties and Brexit-related trade dynamics. The UK government has agreed to a legally binding commitment to reduce carbon emissions and improve energy efficiency, which is an opportunity for high-pressure pump manufacturers through the introduction of new innovative, green products.

The France high pressure pumps industry size is estimated to reach USD 250.7 million by 2035. The high-pressure pump industry in France is expected to grow at a compound annual growth rate (CAGR) of approximately 3.3% between 2025 and 2035.

Water treatment, chemical, and pharmaceutical industries have been boosting the demand for high-pressure pumps in the country due to such strong chemical and pharmaceutical industries, along with evolving water treatment and energy industries.

The rise of government initiatives, such as sustainable development and industrial modernization, also supports the growth of the landscape. On the other hand, economic uncertainty and strict environmental laws could create obstacles.

Germany high pressure pumps industry value is anticipated to total USD 340.9 million by 2035. From 2025 to 2035, the segment for high-pressure pumps will continue to see a CAGR of around 3.5% in Germany.

The demand for high-pressure pumps is further bolstered by the nation's long-established automotive and manufacturing sectors.

Germany's emphasis on industrial automation and energy-efficient solutions is well matched to the adoption of innovative pumping solutions.

This also contributes to the growth of the sector, along with the shift to sustainable energy sources and the upgrading of infrastructure.

Italy high pressure pumps industry value is anticipated to total USD 210.8 million by 2035. From 2025 to 2035, the high-pressure pumps segment in Italy is forecast to witness a CAGR of about 3.2% in the next 10 years.

Industries such as manufacturing, food processing, and textiles, among others, supplement the demand landscape for high-pressure pumps in the country.

Italy's focus on modernization of industrial equipment and greater energy efficiency also plays into industrial growth.

Nonetheless, the pace of growth may vary due to economic uncertainties and regional disparities.

Sustainable practices are coupled with technological advancements, providing further opportunities for segment players to offer new and innovative product solutions.

The South Korea high pressure pumps industry size is estimated to reach USD 211.2 million by 2035. The forecast period indicates a CAGR of 3.5% for the South Korea high-pressure pumps sector.

Rapid industrialization, technological advancements, and strong industries in sectors such as electronics, automotive, and shipbuilding fuel the demand for high-pressure pumps.

Government initiatives that promote infrastructure development and energy efficiency also aid the industry.

Nonetheless, factors like uncertainty in the global economy and competition from other countries in the region can potentially affect growth over time and force a focus on creating opportunities in new sectors.

The Japan’s High-Pressure Pumps market is expected to reach USD 382.5 million and is anticipated to grow at a compound annual growth rate (CAGR) of 3.4% during the forecast period from 2025 to 2035.

The automotive sector, the evolution in power generation, and the greater acceptance of technological and innovative practices are driving the country's need for high-pressure pumps. Japan's energy-efficient approach to sustainable practices is fuelling the growth of advanced pumping systems.

But the aging population and stagnant economy could constrain industrial growth and also lead to a shift in economic priorities, which may impact the demand for high-pressure pumps. Labor shortages, meanwhile, might speed up automation, increasing demand for advanced energy-efficient pumping solutions.

The high-pressure pumps sector in China was valued at USD 425.7 million in 2025 and is projected to reach a revised size of USD 600.4 million in 2035, growing at a CAGR of 3.7% over the analysis period 2025 to 2035.

Rapid industrialization, urbanization, and infrastructure development in the country are the major factors contributing to the demand for high-pressure pumps.

China plays a major role in manufacturing, chemical processing, and energy, which are considered the three primary areas of industry growth.

Government programs that stress protecting the environment and using energy efficiently also encourage the use of more advanced pumping solutions. Yet environmental issues and regulatory pressures may affect the dynamics.

The total market size of Australia and New Zealand in 2035 is likely to be USD 180.5 million in Australia and New Zealand. Further, government initiatives towards inclusive infrastructure development and sustainable water management are anticipated to support the growth of this segment.

Yet, potential economic volatility and environmental policies could disrupt that growth path. The focus on technological innovation and energy savings provides scope for segment players to present innovative solutions.

India is anticipated to register a compound annual growth rate (CAGR) of 3.7% during the forecast period. Industry valuation in India is set to reach around USD 310 million in 2025 and USD 440.0 million by 2035.

India's high pressure pumps segment is expanding based on increasing demand across industries such as manufacturing, oil & gas, power generation, and water treatment.

Policies by the government like the "Make in India" program together with infrastructure programs Smart Cities Mission, AMRUT: Atal Mission for Rejuvenation and Urban Transformation are driving the segment.

But oil & gas remains a critical contributor with new refineries coming up and the exploration required that involves high-pressure pumps for drilling and transporting.

Sustained industrialization and growing investment in manufacturing, power generation, and oil & gas are creating strong growth opportunities in emerging economies such as India, China, and South Korea.

These organizations need to establish localized manufacturing bases and regional distribution channels to reduce costs and enhance access to the sector.

They can establish alliances with regional OEMs and EPC companies that can facilitate better industry penetration and faster adoption.

IoT-powered high-pressure pumps are significantly transforming the pharmaceutical, wastewater utility, and industrial automation industries.

Firms must install AI-driven diagnostics, predictive maintenance, and cloud-enabled monitoring systems with intelligent pumping solutions. Performance optimization with connectivity to software providers will create customers with enhanced efficiency and cost savings.

Mergers, acquisitions, and strategic alliances are all the most important things to growth as companies buy niche pump manufacturers to expand and enrich their product lines.

Joint ventures with oilfield service providers and infrastructure developers can create opportunities for long-term contracts, as they need dependable suppliers.

Dynamic and Positive Displacement

30 to 100 Bar, 101 to 500 Bar, and Above 500 Bar

Oil & Gas, Manufacturing, Chemicals & Pharmaceuticals, Power Generation, and Other End Uses

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa

Growing industrial applications of pumps, recent developments in fluid handling technology, and an increasing demand for energy-efficient solutions are driving the demand for pumps in various segments.

These pumps are extensively used in the oil & gas, manufacturing, power generation, chemicals, and water treatment sectors for efficient operation.

Industries are required to move towards compliant and sustainable pumping solutions due to stringent energy efficiency norms, environmental policies and safety standards.

Pump technology is being transformed and operational costs are being lowered with IoT enabled smart pumps, AI powered predictive maintenance and energy efficiency designs.

The Asia-Pacific, North America, and Europe are seeing the most impressive growth due to rapid industrialization, infrastructure development, and advances in technology.

Table 1: Global Value (US$ Million/Billion) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Pressure, 2018 to 2033

Table 7: Global Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 8: Global Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 10: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Pressure, 2018 to 2033

Table 15: North America Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 16: North America Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 20: Latin America Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Pressure, 2018 to 2033

Table 23: Latin America Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 26: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 28: Western Europe Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 30: Western Europe Volume (Units) Forecast by Pressure, 2018 to 2033

Table 31: Western Europe Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 38: Eastern Europe Volume (Units) Forecast by Pressure, 2018 to 2033

Table 39: Eastern Europe Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 46: South Asia and Pacific Volume (Units) Forecast by Pressure, 2018 to 2033

Table 47: South Asia and Pacific Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: East Asia Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 50: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 52: East Asia Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 54: East Asia Volume (Units) Forecast by Pressure, 2018 to 2033

Table 55: East Asia Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 56: East Asia Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Value (US$ Million/Billion) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Value (US$ Million/Billion) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Value (US$ Million/Billion) Forecast by Pressure, 2018 to 2033

Table 62: Middle East and Africa Volume (Units) Forecast by Pressure, 2018 to 2033

Table 63: Middle East and Africa Value (US$ Million/Billion) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 2: Global Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 3: Global Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 4: Global Value (US$ Million/Billion) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million/Billion) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 10: Global Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 14: Global Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 17: Global Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 18: Global Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Attractiveness by Type, 2023 to 2033

Figure 22: Global Attractiveness by Pressure, 2023 to 2033

Figure 23: Global Attractiveness by End Use, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 26: North America Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 27: North America Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 28: North America Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 34: North America Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 38: North America Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 41: North America Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 42: North America Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Attractiveness by Type, 2023 to 2033

Figure 46: North America Attractiveness by Pressure, 2023 to 2033

Figure 47: North America Attractiveness by End Use, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 50: Latin America Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 51: Latin America Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 52: Latin America Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 58: Latin America Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 62: Latin America Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 65: Latin America Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Attractiveness by Pressure, 2023 to 2033

Figure 71: Latin America Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 74: Western Europe Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 75: Western Europe Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 76: Western Europe Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 77: Western Europe Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 86: Western Europe Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 87: Western Europe Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 88: Western Europe Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 89: Western Europe Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Attractiveness by Pressure, 2023 to 2033

Figure 95: Western Europe Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 98: Eastern Europe Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 99: Eastern Europe Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 100: Eastern Europe Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 101: Eastern Europe Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 110: Eastern Europe Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 111: Eastern Europe Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 112: Eastern Europe Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 113: Eastern Europe Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Pressure, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 123: South Asia and Pacific Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 134: South Asia and Pacific Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 135: South Asia and Pacific Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 136: South Asia and Pacific Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 137: South Asia and Pacific Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Attractiveness by Pressure, 2023 to 2033

Figure 143: South Asia and Pacific Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 146: East Asia Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 147: East Asia Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 148: East Asia Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 149: East Asia Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 150: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 154: East Asia Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 158: East Asia Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 159: East Asia Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 160: East Asia Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 161: East Asia Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Volume (Units) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Attractiveness by Pressure, 2023 to 2033

Figure 167: East Asia Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ Million/Billion) by Type, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ Million/Billion) by Pressure, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ Million/Billion) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ Million/Billion) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ Million/Billion) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ Million/Billion) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ Million/Billion) Analysis by Pressure, 2018 to 2033

Figure 182: Middle East and Africa Volume (Units) Analysis by Pressure, 2018 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Pressure, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Pressure, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ Million/Billion) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Volume (Units) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Pressure, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA