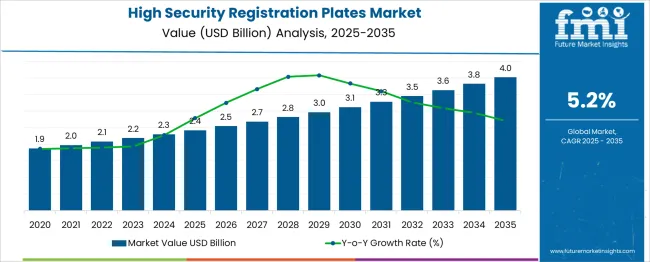

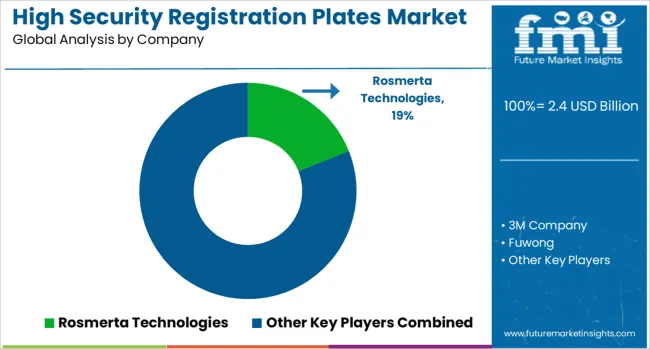

The High Security Registration Plates Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Market growth curve shape analysis indicates a steady, linear progression rather than sharp spikes or volatility, signifying consistent demand driven by regulatory mandates and increased vehicle registrations worldwide. From 2025 to 2030, the market expands from USD 2.4 billion to USD 3.1 billion, adding USD 0.7 billion, accounting for 44% of total incremental growth, as governments intensify enforcement of tamper-proof and traceable plate standards to curb vehicle-related crimes. This phase demonstrates gradual year-on-year increments of about 4.5%–5%, supported by large-scale compliance programs in emerging economies.

Between 2030 and 2035, the market grows from USD 3.1 billion to USD 4.0 billion, contributing USD 0.9 billion, or 56% of growth, signaling slightly higher momentum as smart and RFID-enabled plates gain traction to support vehicle tracking and toll automation initiatives. Players focusing on laser etching, embedded holograms, and chip-based authentication technologies will strengthen their competitive position as digitalization in transportation security accelerates, shaping a predictable yet opportunity-rich growth curve for the industry.

| Metric | Value |

|---|---|

| High Security Registration Plates Market Estimated Value in (2025 E) | USD 2.4 billion |

| High Security Registration Plates Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The HSRP market occupies a specialized yet high-value niche across multiple related sectors. Within the broader automotive parts & accessories market, HSRPs contribute a modest 2–3%, since overall automotive accessory spending is dominated by structural and electronic components. In contrast, within the vehicle identification & registration systems market, HSRPs represent a substantial 15–20%, as they are key components in registered vehicle tracking, digital records, and regulatory compliance. Their role is also critical in the vehicle security & anti-counterfeit solutions market, where they account for about 10–12% of offerings designed to prevent forgery, theft, and unauthorized use.

Among all license plate types, high-security variants make up approximately 25–30% of the license plate and number plate manufacturing market, due to mandates requiring tamper-resistant materials and unique identifiers in many jurisdictions. Finally, as part of government and law enforcement vehicle compliance systems, HSRPs account for 5–7%, supporting initiatives around mandatory registration, enforcement, and fleet authentication. Regulatory mandates especially in regions like the EU, India, and North America alongside rising vehicle ownership and heightened security concerns, are driving adoption. Though still a fraction of some large parent markets, HSRPs hold outsized importance where legal enforcement, traceability, and security are priorities.

The high security registration plates (HSRP) market is being shaped by regulatory mandates, vehicle traceability initiatives, and the integration of smart identification technologies. Rising government enforcement for tamper-proof license plate systems has created momentum for widespread adoption across both private and commercial vehicle categories.

Integration with centralized vehicle databases and support from traffic safety policies have strengthened the compliance ecosystem, particularly in emerging economies. Improved manufacturing standards and advances in security printing, laser branding, and embedded chip technologies have expanded functional reliability and adoption readiness.

Over the forecast period, market growth is expected to be further supported by rising vehicle sales, public-private partnerships, and digital vehicle registration infrastructure enhancements across key automotive hubs.

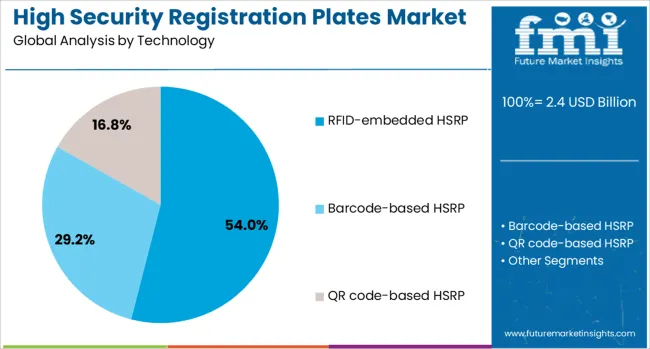

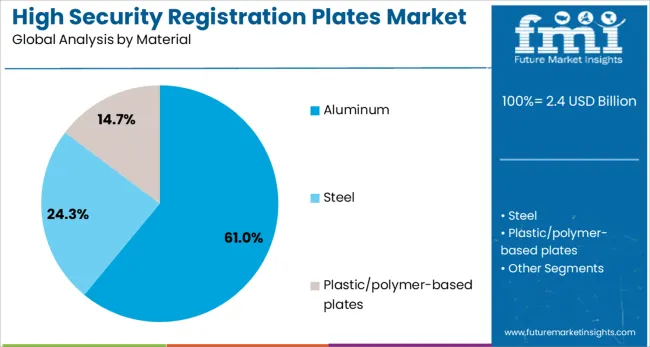

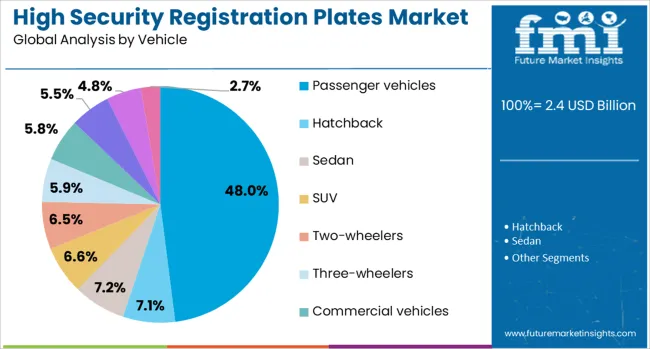

The high security registration plates market is segmented by technology, material, vehicle, distribution channel, end use, and geographic regions. The high security registration plates market is divided into RFID-embedded HSRP, Barcode-based HSRP, and QR code-based HSRP. The high security registration plates market is classified by material into Aluminum, Steel, and Plastic/polymer-based plates. The high security registration plates market is segmented into Passenger vehicles, Hatchback, Sedan, SUV, Two-wheelers, Three-wheelers, Commercial vehicles, Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), and Heavy Commercial Vehicles (HCV).

The distribution channel of the high security registration plates market is segmented into OEM and Aftermarket. The end use of the high security registration plates market is segmented into Government and law enforcement agencies, Private vehicle owners, and Fleet operators. Regionally, the high security registration plates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

RFID-embedded HSRPs are projected to account for 54.00% of the market revenue in 2025, making them the leading technology segment. This dominance is driven by the increasing reliance on RFID-based identification systems that offer real-time data transmission, faster vehicle verification, and enhanced anti-theft capabilities.

Mandatory government guidelines in several countries have accelerated deployment in newly registered vehicles. The compatibility of RFID-enabled plates with tolling systems, smart parking, and law enforcement applications has positioned them as a foundational layer in intelligent transport infrastructure.

Their passive design, low power requirements, and minimal maintenance contribute further to operational efficiency and lifecycle cost benefits.

Aluminum is expected to lead the material segment with a 61.00% revenue share in 2025. Its prevalence is being attributed to its high strength-to-weight ratio, resistance to environmental degradation, and suitability for high-precision embossing and laser branding processes.

The material's recyclability and extended durability align with governmental sustainability benchmarks and automotive OEM quality standards. Moreover, aluminum’s ability to retain structural integrity under harsh conditions ensures consistent performance in both standard and high-usage fleet vehicles.

These properties have led to widespread preference across HSRP manufacturers and enforcement bodies alike.

Passenger vehicles are anticipated to represent 48.00% of the market by revenue in 2025, marking them as the dominant vehicle segment. The surge in personal vehicle ownership, combined with regulatory enforcement for HSRP installation in new and existing vehicles, has led to increased deployment.

Urban regions with dense passenger vehicle populations have seen rapid implementation due to centralized monitoring programs and rising concerns over vehicle cloning and fraud. Government-subsidized compliance drives and mandatory retrofitting timelines have further expanded the adoption footprint within this category.

As digitization in vehicle registration and road surveillance scales, passenger vehicles are expected to remain the primary contributor to HSRP demand.

High Security Registration Plates (HSRP) are standardized vehicle license plates featuring security elements such as laser-etched codes, hot-stamped chromium holograms, and non-removable snap locks to prevent tampering and counterfeiting. These plates ensure traceability and compliance with regional transportation regulations.

Government mandates, digitization of vehicle records, and rising emphasis on road safety and theft prevention have reinforced growth. Manufacturers are adopting advanced embossing technologies, reflective films, and automated production processes to deliver tamper-proof solutions. Expansion in vehicle registrations and enforcement of uniform security norms continue to drive market adoption globally.

Adoption of HSRPs has been driven by strict government regulations aimed at standardizing vehicle identification and reducing theft. Mandates for secure registration systems in both new and existing vehicles have accelerated implementation in several regions. Increased emphasis on traffic management, automated toll collection, and road safety monitoring has reinforced the demand for secure plates integrated with unique identification features. Expansion of vehicle fleets and rising sales in emerging economies have created a significant growth opportunity for compliant solutions. Integration of HSRPs into smart transport systems has further contributed to their widespread deployment across various vehicle categories.

Market growth has been hindered by operational challenges in large-scale implementation, particularly in regions with high vehicle density and fragmented regulatory oversight. Delays in government tender processes and inconsistencies in compliance enforcement have slowed adoption. High upfront costs for plate manufacturing, embossing equipment, and holographic materials have imposed financial constraints on vendors. Limited consumer awareness and reluctance to replace existing plates with HSRPs have also affected market penetration. The presence of counterfeit and substandard plates in certain markets adds to security risks, creating challenges for authorities and genuine manufacturers striving to maintain compliance and quality standards.

Significant opportunities exist in integrating HSRPs with advanced features such as embedded QR codes and RFID tags for real-time vehicle tracking and automated tolling. Partnerships with transport authorities for digitalized registration systems can provide long-term revenue streams for vendors. Emerging markets implementing stricter traffic regulations present avenues for rapid adoption, particularly in Asia-Pacific and Latin America. Expansion in aftermarket retrofitting programs for existing vehicles further boosts demand. Opportunities also lie in offering plate personalization within regulatory frameworks, supporting premium segments while maintaining security compliance. Development of centralized manufacturing and distribution hubs can improve operational efficiency for large-scale rollouts.

Current trends highlight the adoption of automated plate production systems that enhance precision and scalability in high-volume manufacturing. Advanced tamper-proof features, including self-destructive snap locks and chromium-based holographic elements, are becoming standard in premium compliance plates. RFID-enabled HSRPs are gaining prominence for seamless toll collection and vehicle monitoring. Integration with smart city infrastructure and vehicle databases is being prioritized to improve enforcement and road safety. Vendors are exploring lightweight, durable plate materials to reduce wear and tear over time. Consolidation among key players through strategic partnerships and government-approved manufacturing licenses continues to shape competitive dynamics in this sector.

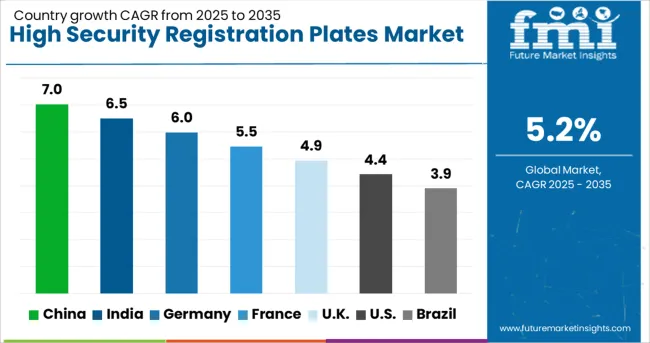

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The high security registration plates (HSRP) market is projected to grow at a CAGR of 5.2% through 2035, supported by government mandates, vehicle security initiatives, and rising adoption of anti-counterfeiting technologies. China leads with a CAGR of 7.0%, driven by strict compliance norms and advanced manufacturing processes. India follows at 6.5%, benefiting from nationwide HSRP mandates for all vehicle categories. Germany records 6.0%, leveraging its advanced automotive ecosystem and demand for high-tech security solutions. The United Kingdom posts 4.9%, supported by technology integration in vehicle identification systems, while the United States grows at 4.4%, driven by standardization efforts and premium vehicle adoption. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to grow at a CAGR of 7.0% through 2035, supported by strict regulatory frameworks mandating the use of tamper-proof plates for all new and existing vehicles. Rapid urbanization and rising vehicle ownership are creating high-volume demand for secure and standardized identification systems. Chinese manufacturers are leveraging automated production technologies for hot-stamped and laser-etched plates, ensuring compliance with government quality benchmarks. Integration of embedded RFID chips and QR codes is accelerating, improving law enforcement and toll collection efficiency. Partnerships between local suppliers and global security solution providers are enabling technology transfer for advanced plate designs. Strong government initiatives targeting road safety and counterfeit prevention further reinforce market adoption.

India is projected to grow at a CAGR of 6.5% through 2035, supported by the implementation of government directives mandating HSRPs for all vehicles, including retrofitting for existing fleets. Expanding vehicle ownership, coupled with initiatives to curb vehicle theft and cloning, is driving market penetration. Manufacturers are scaling production capacities to meet growing demand for embossed aluminum plates with laser-etched details and chromium-based holograms. State-level partnerships with approved vendors ensure compliance and quality assurance across regional markets. Integration of RFID tags within HSRPs facilitates vehicle tracking for toll collection, traffic monitoring, and law enforcement purposes. Growth in e-commerce-based plate distribution channels and online booking systems for HSRP installations further accelerates adoption in urban and semi-urban regions.

Germany is expected to expand at a CAGR of 6.0% through 2035, driven by stringent automotive security standards and advanced vehicle identification systems. High-security plates in Germany are designed with laser-etched codes, tamper-proof fasteners, and durable reflective materials to prevent counterfeiting. The demand for RFID-enabled solutions is increasing for integration with smart traffic management systems and automated tolling infrastructure. German manufacturers are adopting robotic stamping and laser-marking technologies for precision and scalability. Additionally, integration with digital vehicle registries supports real-time verification and enforcement, reducing fraud risks. Partnerships between automotive OEMs, registration authorities, and technology firms are boosting innovation in plate durability, corrosion resistance, and advanced authentication features.

The United Kingdom is projected to achieve a CAGR of 4.9% through 2035, supported by regulatory adoption of high-security plates for new and imported vehicles. Demand for plates with built-in holograms, laser engravings, and tamper-evident features is growing among premium vehicle segments and fleet operators. Technology upgrades are emphasizing RFID-enabled HSRPs to enhance road monitoring and vehicle compliance systems. Domestic suppliers are collaborating with global security firms to develop plates compatible with emerging smart infrastructure. Automated production lines and advanced printing technologies ensure quality consistency in high-volume plate manufacturing. With the rising integration of connected mobility systems, HSRPs are expected to become a critical component for smart transportation frameworks.

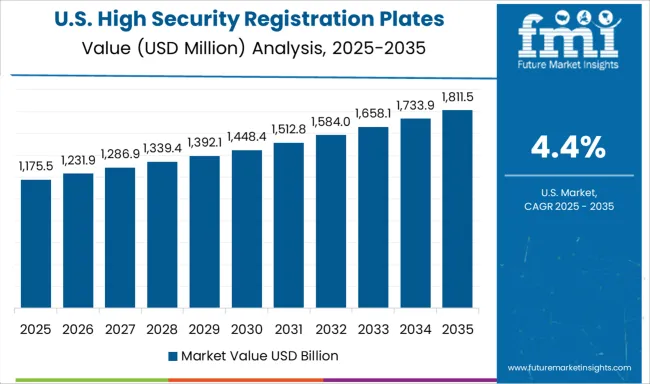

The United States is expected to post a CAGR of 4.4% through 2035, driven by federal and state initiatives promoting standardization of vehicle identification systems. High-security plates with laser-engraved serials, barcodes, and anti-cloning features are gaining traction to combat fraud and vehicle theft. The integration of RFID chips within license plates supports automated tolling, traffic monitoring, and connected vehicle applications. Leading manufacturers are investing in durable materials and advanced coating technologies to extend plate life under diverse climatic conditions. Collaborations between plate producers, automotive OEMs, and IoT solution providers are strengthening the adoption of smart identification solutions across major states.

The high security registration plates (HSRP) market is dominated by specialized manufacturers and technology providers delivering tamper-proof, standardized plates that comply with government regulations. Rosmerta Technologies leads the Indian market with a strong presence in vehicle registration projects supported by government mandates for HSRP implementation. 3M Company offers advanced reflective sheeting and security features integrated into license plate manufacturing for global markets, ensuring durability and anti-counterfeit protection. Utsch Group and JH Toennjes are major European players providing turnkey license plate production systems with embedded security technologies like laser branding and holographic elements.

SAMAR’T and Jepson serve the European and Latin American markets with premium-quality plates featuring barcodes, RFID chips, and tamper-proof seals. UTAL specializes in automated production technologies for aluminum and composite-based plates, while Fuwong caters to emerging markets with cost-effective solutions combined with compliance-driven features. Shimnit India has a strong foothold in South Asia, focusing on government partnerships for large-scale HSRP rollouts. Competitive differentiation revolves around advanced security features, material longevity, compliance with ISO and national regulations, and integration with vehicle registration databases for traceability. Barriers to entry include high compliance costs, precision manufacturing requirements, and the need for government approvals. Strategic priorities include expanding RFID-enabled plate offerings for smart mobility systems, improving anti-tampering technologies, and forming long-term contracts with transportation authorities to secure recurring demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Technology | RFID-embedded HSRP, Barcode-based HSRP, and QR code-based HSRP |

| Material | Aluminum, Steel, and Plastic/polymer-based plates |

| Vehicle | Passenger vehicles, Hatchback, Sedan, SUV, Two-wheelers, Three-wheelers, Commercial vehicles, Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), and Heavy Commercial Vehicles (HCV) |

| Distribution Channel | OEM and Aftermarket |

| End Use | Government and law enforcement agencies, Private vehicle owners, and Fleet operators |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rosmerta Technologies, 3M Company, Fuwong, Hills Numberplates, Jepson, JH Toennjes, SAMAR’T, Shimnit India, UTAL, and Utsch Group |

| Additional Attributes | Dollar sales by plate material (aluminum, polymer-based) and end-use segments (passenger vehicles, commercial vehicles, two-wheelers). Demand dynamics are driven by government mandates for standardized vehicle identification and enhanced road safety measures. Regional trends indicate Asia-Pacific leading adoption due to regulatory enforcement, while Europe focuses on advanced HSRP solutions with RFID integration for intelligent transport systems. Innovation trends include development of plates with QR codes for digital verification, tamper-proof laser etching, and embedded microchips to support electronic toll collection and automated vehicle tracking. |

The global high security registration plates market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the high security registration plates market is projected to reach USD 4.0 billion by 2035.

The high security registration plates market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in high security registration plates market are rfid-embedded hsrp, barcode-based hsrp and qr code-based hsrp.

In terms of material, aluminum segment to command 61.0% share in the high security registration plates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

Demand for High Security Wedge Barricades in UK Size and Share Forecast Outlook 2025 to 2035

High Tibial Osteotomy (HTO) Plates Market Growth – Trends & Outlook 2025-2035

China High Tibial Osteotomy (HTO) Plates Market Insights – Size, Trends & Forecast 2025-2035

India High Tibial Osteotomy (HTO) Plates Market Insights – Trends, Demand & Forecast 2025-2035

Japan High Tibial Osteotomy (HTO) Plates Market Analysis – Demand, Trends & Forecast 2025-2035

Canada High Tibial Osteotomy (HTO) Plates Market Report – Trends, Demand & Forecast 2025-2035

United States High Tibial Osteotomy (HTO) Plates Market Insights – Growth, Share & Forecast 2025-2035

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA