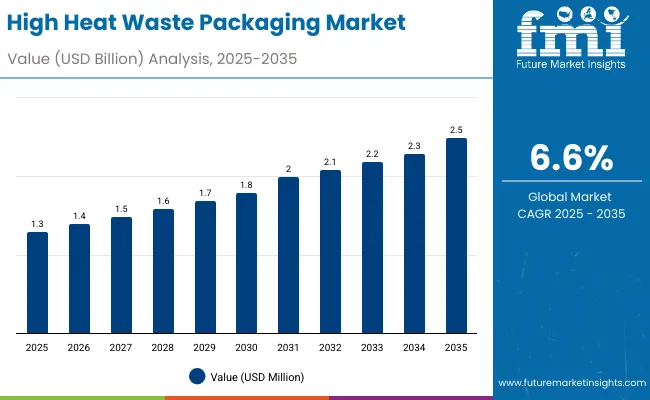

The high heat waste packaging market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, advancing at a CAGR of 6.6%. Growth is supported by industrial waste management regulations and rising demand for thermally stable packaging solutions. PP-based materials dominate due to cost efficiency and high temperature resistance.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.5 billion through adoption in industrial and medical waste containment. From 2030 to 2035, another USD 0.7 billion will come from construction, metal, and chemical waste applications. Asia-Pacific leads expansion, driven by waste disposal infrastructure development.

From 2020 to 2024, the high heat waste packaging market grew as industries adopted thermally stable containment solutions for hazardous and industrial waste. Metal, chemical, and medical sectors drove demand for PP and aluminum-based liners. Strict regulations for thermal disposal and incineration waste handling accelerated product innovation.

By 2035, the market will reach USD 2.5 billion, growing at 6.6% CAGR. Polypropylene will remain dominant, supported by rising industrial processing waste. Bags and liners will lead usage, while Asia-Pacific will be the fastest-growing region due to modernization of industrial waste management systems.

The market is expanding as global industries face stricter regulations on high-temperature waste containment and disposal. Rising chemical, metal, and medical waste volumes require packaging that withstands extreme temperatures and corrosive conditions.

Manufacturers adopt PP and PET materials for their resilience and cost efficiency. Adoption of multilayer laminates and foil composites ensures protection during transport and incineration. Industrialization and waste segregation standards strengthen global demand.

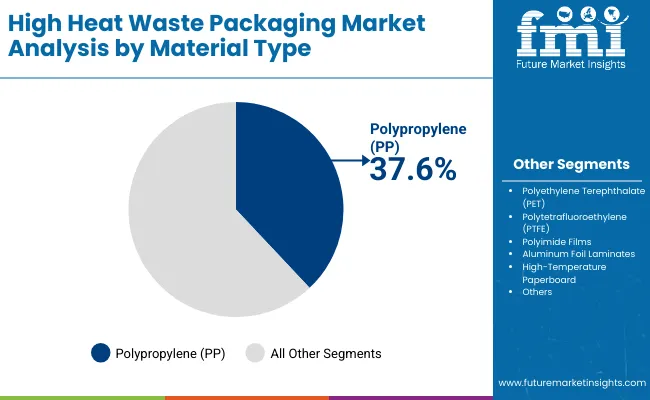

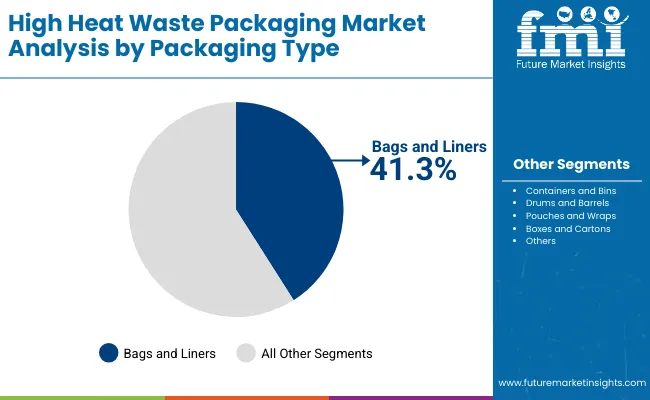

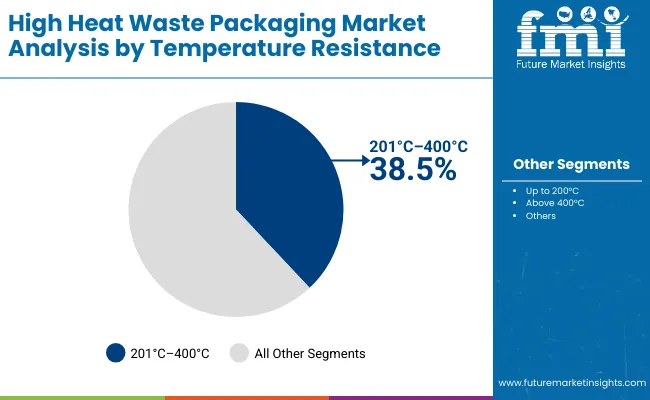

The market is segmented by material, packaging type, temperature resistance, application, end-use industry, and region. Materials include PP, PET, PTFE, polyimide films, aluminum laminates, and heat-resistant paperboard. Packaging types include bags, containers, drums, pouches, and boxes. Temperature resistance spans up to 200°C, 201-400°C, and above 400°C. End-use industries include manufacturing, healthcare, foodservice, construction, and chemical processing.

Polypropylene will hold 37.6% share in 2025, driven by its superior thermal endurance and affordability. It is widely used in waste liners and containers across industrial and healthcare sectors.

Future growth will stem from composite PP films with higher structural stability, enhancing usability in hazardous waste applications.

Bags and liners will account for 41.3% share in 2025, valued for containment efficiency and ease of handling. These are used across construction, medical, and foodservice sectors.

Advancements in multilayer coatings and automated sealing technologies will ensure continued dominance through 2035.

This segment will hold 38.5% share in 2025, suitable for industrial and chemical waste handling. These materials resist deformation and maintain barrier properties under extreme conditions.

R&D in higher thermal stability and recyclable coatings will further strengthen growth.

Industrial waste handling will represent 36.9% share in 2025, reflecting large-scale use in metal, chemical, and construction waste management.

Future adoption will expand in process industries emphasizing compliant disposal practices.

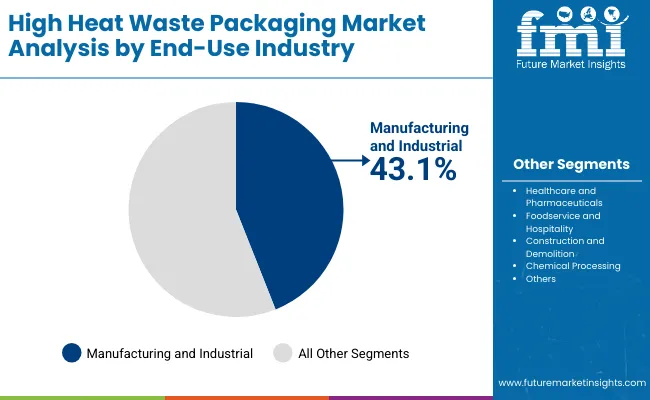

The manufacturing and industrial segment will account for 43.1% share in 2025, driven by thermal treatment of by-products and hazardous waste.

By 2035, stricter government compliance and automation in waste segregation will reinforce leadership.

Growth is driven by regulatory frameworks promoting safe thermal waste disposal and industrial expansion. PP and PET packaging ensure integrity under extreme temperatures.

High costs of advanced laminates and non-recyclability of multilayer composites restrict adoption. Infrastructure gaps in emerging economies also limit deployment.

Growing demand for recyclable heat-resistant films and expansion of waste-to-energy plants create significant opportunities.

Key trends include biodegradable high-temperature laminates, sensor-based containment monitoring, and enhanced incineration safety packaging. Innovation in PP blends strengthens sustainability.

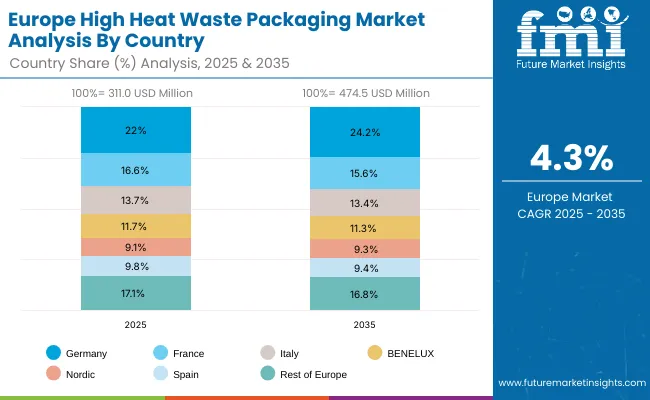

The global high heat waste packaging market is expanding rapidly as stricter waste management regulations and industrial safety standards take effect. Asia-Pacific leads adoption, supported by accelerating industrialization and government-led waste processing initiatives. Europe emphasizes recyclability and thermal stability in materials, while North America invests in advanced containment systems for hazardous and healthcare waste. Increasing sustainability goals and innovations in heat-resistant films are driving the next phase of market maturity.

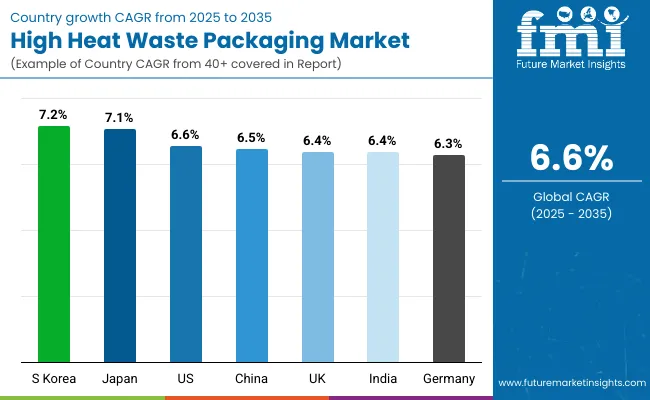

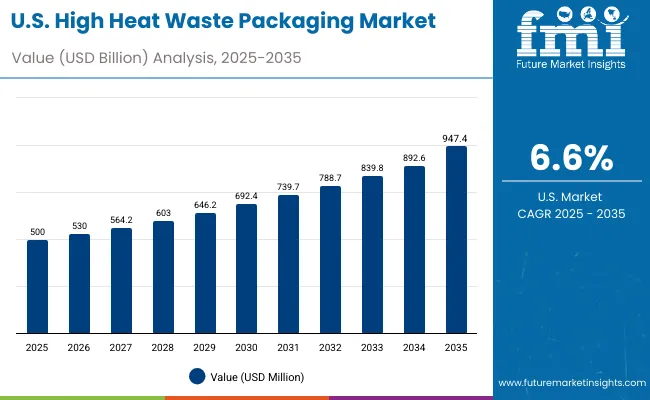

The USA market will grow at a CAGR of 6.6% from 2025 to 2035, driven by compliance requirements in hazardous and medical waste packaging. Healthcare waste management protocols are fueling demand for durable, heat-resistant containment systems. Industrial sectors are also adopting multi-layer thermal packaging to ensure safe disposal and transportation of chemical residues. Strict federal waste management policies and ongoing sustainability initiatives are reinforcing market expansion across key states.

Germany will expand at a CAGR of 6.3%, propelled by stringent EU waste treatment regulations and advanced recycling infrastructure. Industries are increasingly using high heat-resistant packaging to handle thermal and chemical waste safely. Research initiatives focused on bio-based, recyclable films are gaining traction. German manufacturers are also developing advanced containment solutions that meet EU sustainability goals while ensuring compliance in industrial and environmental protection sectors.

The UK market will grow at a CAGR of 6.4%, supported by strong construction, industrial, and healthcare waste management activity. Regulatory frameworks promoting zero landfill and circular economy principles are driving adoption. Local waste processors are investing in recyclable, high-heat packaging solutions to ensure compliance and safety. Innovation in reusable thermal barriers and biodegradable composites is further expanding the scope of sustainable waste containment.

China will grow at a CAGR of 6.5%, driven by industrialization, urbanization, and metal waste handling demands. The government’s push for green waste management is stimulating large-scale use of thermal packaging systems. Local manufacturers are developing affordable, heat-resistant bags and containers for industrial waste containment. Continuous innovation in material science and recycling systems is strengthening China’s leadership in waste packaging modernization.

India will grow at a CAGR of 6.4%, driven by modernization of waste processing facilities and environmental compliance measures. Demand for heat-resistant packaging is rising in food, chemical, and pharmaceutical waste sectors. SMEs are adopting cost-effective solutions to comply with tightening national waste disposal standards. Public-private partnerships are improving infrastructure, enabling broader adoption of thermal-resistant packaging materials across industrial clusters.

Japan will grow at a CAGR of 7.1%, led by advancements in smart waste management and recycling technologies. Adoption of automated waste segregation and heat-tolerant containment systems is increasing. The healthcare and biotechnology industries are deploying specialized packaging for high-risk waste. Rising consumer and corporate focus on sustainability is promoting the use of eco-engineered, high-temperature packaging materials across Japan’s urban and industrial sectors.

South Korea will lead with a CAGR of 7.2%, emphasizing industrial safety, recyclable packaging films, and automation. The country’s strong focus on waste reduction and recycling efficiency is driving demand for innovative heat-resistant materials. Manufacturers are investing in R&D for advanced polymers that can withstand high thermal exposure. Integration of smart monitoring systems within industrial waste management processes further supports market growth.

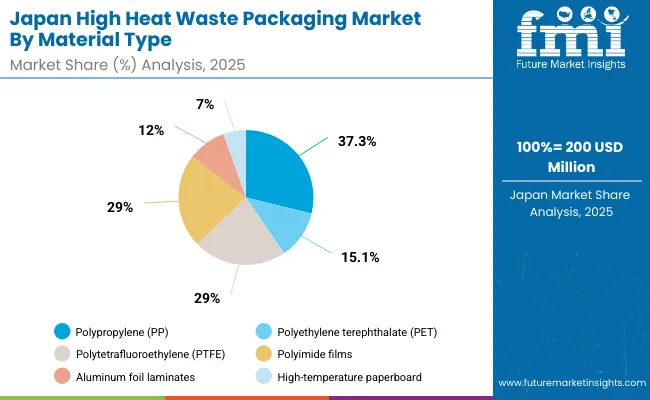

Japan’s high heat waste packaging market, valued at USD 200 million in 2025, is led by polypropylene (PP) with a 37.3% share due to its strong heat deflection and cost efficiency in industrial waste applications. Polyethylene terephthalate (PET) follows at 15.1%, offering high dimensional stability for incineration packaging. Polytetrafluoroethylene (PTFE) and polyimide films collectively represent nearly 29%, supporting chemical waste handling under extreme temperatures. Aluminum foil laminates at 12.0% are preferred for radiation-resistant packaging. High-temperature paperboard holds 7.0%, serving specialized waste streams. Government mandates for safer waste transportation and advancements in polymer science drive Japan’s thermal packaging growth.

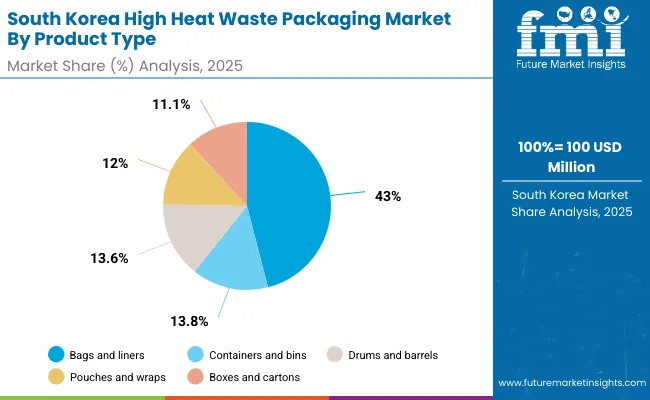

South Korea’s high heat waste packaging market, estimated at USD 100 million in 2025, is dominated by bags and liners with a 43.0% share, owing to their widespread adoption in hazardous and medical waste management. Containers and bins hold 13.8%, suitable for structured storage and easy handling. Drums and barrels, with 13.6%, are favored for chemical-resistant containment. Pouches and wraps account for 12%, addressing smaller-scale waste segments. Boxes and cartons at 11.1% serve regulated incineration transport. Growth is sustained by industrial waste management reforms, safety-focused packaging standards, and increasing deployment of thermally stable multilayer films across South Korea’s waste treatment ecosystem.

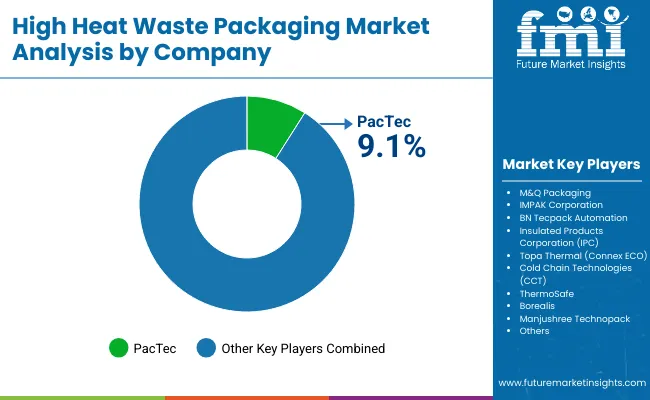

The market is moderately fragmented, featuring key players PacTec, M&Q Packaging, IMPAK Corporation, BN Tecaplast, Insulated Products Corporation, Topa Thermal, Cold Chain Technologies, ThermoSafe Brands, Borealis, and Manjushree Technopack. These firms focus on thermal endurance, barrier coatings, and recyclable materials.

PacTec and M&Q Packaging lead with industrial-grade solutions, while IMPAK Corporation and BN Tecaplast emphasize multi-layer polymer containment. Borealis and ThermoSafe pioneer R&D in recyclable, heat-resistant materials. Competition revolves around durability, temperature performance, and regulatory compliance.

Key Developments of High Heat Waste Packaging Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Material | PP, PET, PTFE, Polyimide Films, Foil Laminates, Paperboard |

| By Packaging Type | Bags, Containers, Drums, Pouches, Boxes |

| By Temperature Resistance | Up to 200°C, 201-400°C, Above 400°C |

| By Application | Industrial, Medical, Foodservice, Chemical, Construction Waste |

| By End-Use Industry | Manufacturing, Healthcare, Foodservice, Construction, Chemical Processing |

| Key Companies Profiled | PacTec, M&Q Packaging, IMPAK Corporation, BN Tecaplast, Insulated Products Corporation, Topa Thermal, Cold Chain Technologies, ThermoSafe Brands, Borealis, Manjushree Technopack |

| Additional Attributes | Growth driven by industrial waste regulations, heat-resistant material innovations, and recycling initiatives. |

The market will be valued at USD 1.3 billion in 2025.

The market will reach USD 2.5 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Polypropylene will lead with a 37.6% share in 2025.

Bags and liners will dominate with a 41.3% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Heat Glass Reinforced Polyamide 66 Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat To Power Market Size and Share Forecast Outlook 2025 to 2035

Packaging Waste Recycling Market Growth and Insights 2025 to 2035

Heat Shrink Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of High Barrier Packaging Films for Pharmaceuticals

Market Share Breakdown of High Barrier Packaging Films Suppliers

Heat Sealable Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Heat Exchanger Market

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

APAC Waste Heat Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

Packaging Machine Heaters Market Growth – Trends & Forecast 2025 to 2035

High-End Performance Packaging Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA