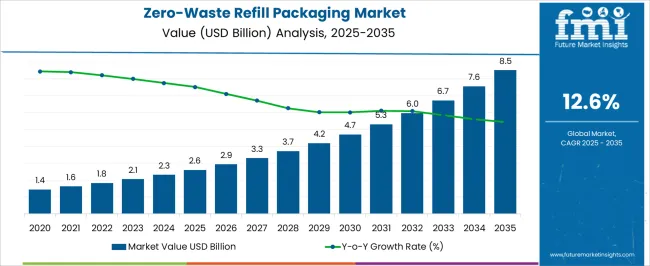

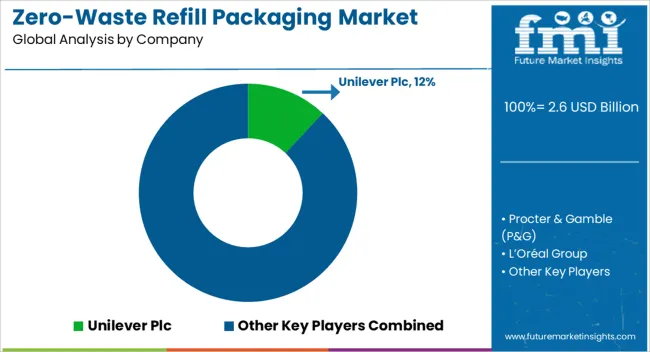

The zero-waste refill packaging market is valued at USD 2.6 billion in 2025 and is set to reach USD 8.4 billion by 2035, resulting in a total increase of USD 5.8 billion over the forecast decade. This represents a 223.1% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 12.6%. Over ten years, the market grows by a 3.2 multiple.

In the first five years (2025 to 2030), the market progresses from USD 2.6 billion to USD 5.0 billion, contributing USD 2.4 billion, or 41.4% of total decade growth. This phase is shaped by rising consumer awareness of plastic waste reduction and corporate sustainability commitments. Regulatory pressure on single-use packaging across developed markets accelerates adoption.

In the second half (2030 to 2035), the market grows from USD 5.0 billion to USD 8.4 billion, adding USD 3.4 billion, or 58.6% of the total growth. This acceleration is supported by mainstream retail adoption, improved refill infrastructure, and cost parity with traditional packaging. Expansion into emerging markets and development of advanced refill technologies strengthen market penetration, positioning zero-waste refill packaging as a standard retail offering.

| Metric | Value |

|---|---|

| Zero-Waste Refill Packaging Market Estimated Value in (2025E) | USD 2.6 Billion |

| Zero-Waste Refill Packaging Market Forecast Value in (2035F) | USD 8.4 Billion |

| Forecast CAGR (2025 to 2035) | 12.6% |

From 2020 to 2024, the zero-waste refill packaging market expanded from USD 0.7 billion to USD 2.2 billion, driven by increasing consumer demand for sustainable packaging solutions and corporate zero-waste initiatives. Nearly 60% of growth came from personal care and home cleaning product categories where refill formats gained mainstream acceptance. Leading companies such as Unilever, P&G, and L'Oréal emphasized lightweight pouches, concentrate formulations, and retail partnership expansion. Competitive focus remained on packaging innovation, supply chain optimization, and consumer education programs, while smart refill technologies and IoT integration stayed secondary initiatives. Direct-to-consumer refill subscriptions contributed approximately 25% of total market value during this period.

By 2035, the zero-waste refill packaging market will reach USD 8.4 billion, growing at a CAGR of 12.6%, with automated refill stations and digital tracking systems representing over 35% of market value. Competition will intensify as brands introduce smart dispensing solutions, biodegradable refill materials, and circular economy business models. Established players are expanding through hybrid retail-digital platforms combining traditional refill formats with subscription services and personalized packaging solutions. Emerging refill technology providers are gaining market share with modular dispensing systems, concentrated formula innovations, and partnership-based distribution networks, meeting evolving consumer preferences for convenience and environmental responsibility.

The increasing consumer awareness of plastic waste and environmental impact is driving growth in the zero-waste refill packaging market. These solutions significantly reduce packaging waste by allowing consumers to reuse containers while purchasing product refills. Growing corporate sustainability commitments and regulatory pressure on single-use plastics further support market expansion.

Refill packaging systems featuring lightweight pouches, concentrated formulations, and modular designs are gaining traction for their ability to reduce material usage by up to 80% compared to traditional packaging. Their compatibility with existing retail infrastructure and consumer convenience makes them increasingly attractive. Cost savings for both manufacturers and consumers, combined with improved brand loyalty through sustainable practices, strengthen adoption across multiple product categories.

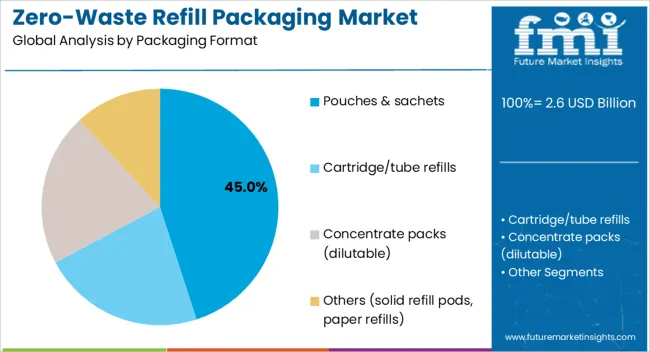

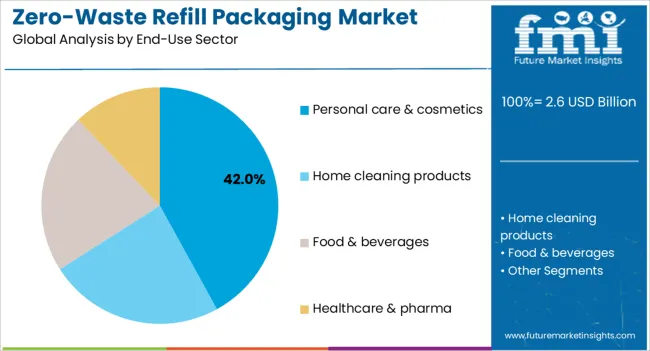

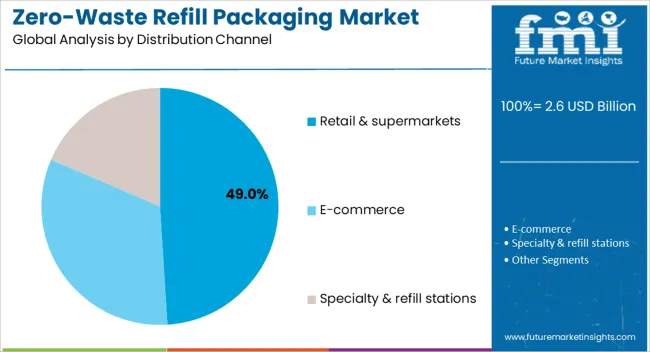

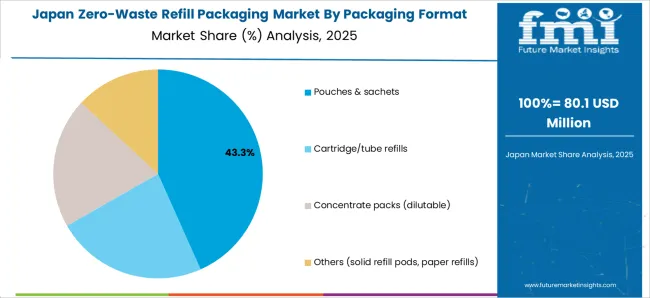

The market is segmented by packaging format, end-use sector, distribution channel, and region. Packaging format segmentation includes pouches & sachets, cartridge/tube refills, concentrate packs (dilutable), and others including solid refill pods and paper refills, each offering different sustainability benefits and consumer convenience levels. End-use sector covers personal care & cosmetics, home cleaning products, food & beverages, and healthcare & pharma, supporting diverse consumer needs and usage patterns. Distribution channel segmentation includes retail & supermarkets, e-commerce, and specialty & refill stations, enabling multiple touchpoints for consumer access. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Pouches and sachets are projected to account for 45.0% of the zero-waste refill packaging market in 2025, driven by their lightweight design and significant material reduction compared to rigid containers. These flexible formats use up to 85% less packaging material than traditional bottles while maintaining product integrity and shelf life. Their compact size enables efficient shipping and storage across retail networks.

Growing adoption is supported by consumer familiarity with pouch formats and ease of use in home refilling applications. Advances in barrier film technology enhance product protection while maintaining recyclability. The format's versatility across liquid and powder products, combined with cost-effective manufacturing, reinforces its market leadership position across multiple product categories.

Personal care and cosmetics applications are forecast to hold 42.0% of the market in 2025, supported by strong consumer demand for sustainable beauty products and brand differentiation through environmental initiatives. Categories including shampoo, body wash, skincare, and makeup products drive significant adoption of refill formats. Premium positioning of sustainable beauty products enhances consumer willingness to pay for refillable options.

Adoption is reinforced by brand loyalty benefits and repeat purchase patterns in personal care categories. Refill formats enable product customization and seasonal variations while maintaining packaging consistency. Growing influence of environmental consciousness in beauty purchasing decisions, particularly among younger demographics, continues to expand this segment's market share.

Retail and supermarket channels are expected to represent 49.0% of distribution in 2025, leveraging existing store infrastructure and consumer shopping habits. Major retail chains are establishing dedicated refill sections and partnering with brands to offer in-store refilling stations. This channel benefits from immediate product availability and consumer ability to examine refill options before purchase.

The segment's growth is supported by retailer sustainability initiatives and consumer preference for integrated shopping experiences. Store-based refill stations reduce shipping costs and packaging waste while providing consumer education opportunities. Retail partnerships enable brand exposure and trial of new refill products, supporting market expansion through established consumer touchpoints.

The zero-waste refill packaging market is expanding as consumers increasingly prioritize environmental sustainability and waste reduction in purchasing decisions. Rising regulatory pressure on single-use plastics and corporate zero-waste commitments drive industry adoption. Growing awareness of plastic pollution and circular economy principles support market growth. However, higher upfront costs, consumer behavior changes, and infrastructure requirements present adoption challenges. Innovations in refill station technology, concentrate formulations, and digital tracking systems are reshaping market opportunities.

Zero-waste refill packaging addresses growing consumer concern about plastic waste and environmental impact by reducing packaging material usage by up to 80% compared to traditional formats. Cost savings for both manufacturers and consumers create economic incentives, with refill products typically priced 20-30% lower than new packaged equivalents. Regulatory initiatives targeting single-use plastics and extended producer responsibility programs accelerate corporate adoption. Brand differentiation through sustainability credentials enhances customer loyalty and premium positioning opportunities. These converging factors create strong market momentum across developed and emerging economies.

Market expansion faces challenges from significant upfront investment requirements for refill station infrastructure and specialized packaging equipment. Consumer behavior change requires education and convenience improvements to overcome established purchasing patterns. Supply chain complexity increases with dual packaging systems and inventory management for both original and refill products. Quality control concerns and product contamination risks in refill systems require enhanced safety protocols. Limited availability in rural markets and smaller retail outlets restricts market penetration, confining growth primarily to urban areas and major retail chains.

Key trends include development of automated refill stations with digital payment systems and product tracking capabilities. Concentrate formulations reduce shipping costs and packaging requirements while maintaining product efficacy. Subscription-based refill services integrate e-commerce convenience with sustainability benefits. Biodegradable and compostable refill packaging materials align with circular economy principles. Partnership models between brands, retailers, and technology providers create integrated refill ecosystems. These innovations position zero-waste refill packaging as a comprehensive solution combining environmental benefits with consumer convenience and business efficiency.

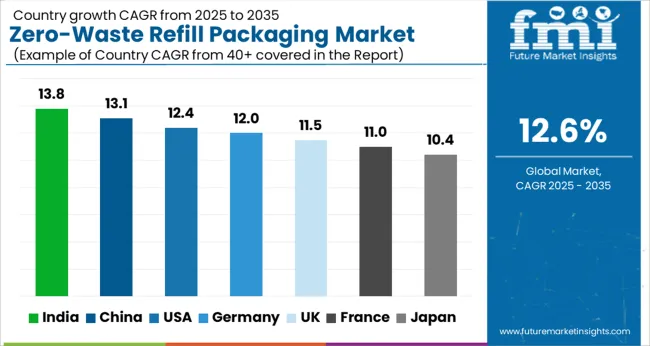

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 13.80% |

| China | 13.10% |

| USA | 12.40% |

| Germany | 12.00% |

| UK | 11.50% |

| France | 11.00% |

| Japan | 10.40% |

The global zero-waste refill packaging market is experiencing rapid growth, driven by environmental regulations, consumer sustainability awareness, and corporate zero-waste initiatives. Asia-Pacific emerges as the fastest-growing region, with India and China leading adoption through urban retail expansion and government support for waste reduction. Developed markets including the United States, Germany, and United Kingdom focus on infrastructure development, regulatory compliance, and mainstream retail integration, supporting comprehensive refill ecosystems across multiple product categories and distribution channels.

The USA market for zero-waste refill packaging is projected to grow at a CAGR of 12.4% from 2025 to 2035, driven by corporate sustainability commitments and consumer demand for environmentally responsible products. Major retailers are establishing refill stations and partnering with leading brands to offer comprehensive refill options across personal care, home cleaning, and food categories. E-commerce platforms are expanding refill subscription services, providing convenience and cost savings to environmentally conscious consumers.

Growth is supported by state-level plastic reduction initiatives and extended producer responsibility programs encouraging refillable packaging adoption. Consumer willingness to pay premium prices for sustainable products creates favorable market conditions, while brand loyalty benefits from refill programs enhance long-term customer relationships.

Germany's zero-waste refill packaging market is expected to grow at a CAGR of 12.0%, supported by stringent EU packaging regulations and strong consumer environmental consciousness. Supermarket chains are implementing comprehensive refill aisles and automated dispensing systems across personal care and household product categories. Government incentives for circular economy initiatives encourage innovation in refill packaging technologies and business models.

The market benefits from established recycling infrastructure and consumer familiarity with sustainable packaging practices. Premium positioning of refill products aligns with quality expectations, while cost savings and environmental benefits drive adoption across demographic segments. Technology integration in retail environments enhances consumer experience and operational efficiency.

The UK market for zero-waste refill packaging is forecast to grow at a CAGR of 11.5%, driven by retailer-led sustainability initiatives and increasing consumer environmental awareness. Major supermarket chains are expanding refill sections and partnering with brands to offer comprehensive zero-waste solutions. Government plastic reduction targets and extended producer responsibility regulations create regulatory support for refill packaging adoption.

Consumer campaigns and education programs increase awareness of environmental benefits and cost savings from refill products. Premium retail positioning and quality assurance measures address consumer concerns about product integrity. Integration with existing loyalty programs enhances customer engagement and repeat purchases through refill offerings.

China's market for zero-waste refill packaging is projected to grow at a CAGR of 13.1%, fueled by urban retail expansion and government focus on plastic waste reduction. Major cities are implementing refill station networks in supermarkets and convenience stores, supporting consumer access to sustainable packaging options. E-commerce platforms are launching refill subscription services, leveraging digital payment systems and delivery infrastructure.

Government initiatives targeting single-use plastics create regulatory momentum for refill packaging adoption. Consumer awareness of environmental issues drives demand for sustainable products, while cost savings appeal to price-conscious demographics. Technology integration enables sophisticated refill systems with quality monitoring and inventory management capabilities.

Indian zero-waste refill packaging market is forecast to record the fastest growth at a CAGR of 13.8%, supported by FMCG companies piloting refill programs and government support for zero-waste retail initiatives. Urban areas are experiencing rapid adoption of refill stations in supermarkets and specialty stores, while e-commerce platforms expand refill product offerings. Consumer price sensitivity makes cost-effective refill options particularly attractive in the Indian market.

Government waste reduction policies and plastic ban initiatives create regulatory support for sustainable packaging alternatives. Growing middle-class environmental awareness drives demand for eco-friendly products, while corporate sustainability commitments accelerate refill program development. Technology adoption enables efficient refill systems adapted to local market conditions and consumer preferences.

France's market for zero-waste refill packaging is expected to grow at a CAGR of 11.0%, driven by legislation mandating reusable and refillable formats in supermarkets and strong consumer support for environmental initiatives. Retail chains are implementing comprehensive refill systems across personal care, cleaning, and food categories. Government incentives for circular economy businesses encourage innovation in refill packaging technologies and distribution models.

Consumer acceptance of refill products is high due to environmental consciousness and quality assurance measures. Premium positioning maintains product integrity perceptions while cost savings provide additional consumer benefits. Technology integration in retail environments improves operational efficiency and consumer experience through automated dispensing and inventory management systems.

Japan's market for zero-waste refill packaging is projected to grow at a CAGR of 10.4%, supported by technology-enabled refill systems in personal care and household product categories. Innovation in automated dispensing technology and quality control systems addresses consumer expectations for convenience and product integrity. Corporate sustainability initiatives drive adoption across major FMCG companies and retail chains.

Consumer acceptance is supported by quality assurance measures and integration with existing retail loyalty programs. Technology sophistication enables advanced refill systems with inventory tracking and product customization capabilities. Premium positioning aligns with quality expectations while environmental benefits appeal to environmentally conscious demographics.

The zero-waste refill packaging market is moderately consolidated, with consumer goods giants, sustainable packaging innovators, and retail partners competing across personal care, home cleaning, and food & beverage applications. Global leaders such as Unilever Plc, Procter & Gamble, and L'Oréal Group hold notable market share, driven by comprehensive refill programs, lightweight packaging innovations, and retail partnership expansion. Their strategies increasingly emphasize circular economy business models, digital integration, and consumer education initiatives.

Established players including Henkel AG, The Body Shop International, and Nestlé SA are supporting market development through specialized refill product lines, sustainable packaging materials, and technology-enabled dispensing solutions. These companies focus on premium positioning, brand loyalty programs, and environmental credential development, offering comprehensive sustainability platforms that integrate refill options with broader corporate responsibility initiatives.

Regional and specialty providers such as Kao Corporation, SC Johnson, Colgate-Palmolive, and Ecover (Method) focus on category-specific solutions and niche market development. Their strengths include innovative concentrate formulations, biodegradable packaging materials, and partnership-based distribution models, enabling market penetration through specialized retail channels and consumer segments prioritizing environmental sustainability and product quality.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 billion |

| Packaging Format | Pouches & Sachets, cartridge/tube refills, concentrate packs (dilutable), and others |

| End-use Sector | Personal Care & Cosmetics, home cleaning products, food & beverages, and healthcare & pharma |

| Distribution Channel | Retail & supermarkets, e-commerce, and specialty & refill stations |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Unilever Plc, Procter & Gamble (P&G); L’Oréal Group; Henkel AG; The Body Shop International; Nestlé SA; Kao Corporation; SC Johnson; Colgate-Palmolive; Ecover (Method). |

| Additional Attributes | Dollar sales by packaging format, end use sector, and distribution channel, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging startups, buyer preferences for sustainable versus conventional materials, integration with AI-driven design and digital manufacturing platforms, innovations in multi-material packaging capabilities and closed-loop recycling systems, and adoption of smart packaging solutions with embedded sensors, QR codes, and interactive features for enhanced consumer engagement. |

The global zero-waste refill packaging market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the zero-waste refill packaging market is projected to reach USD 8.5 billion by 2035.

The zero-waste refill packaging market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in zero-waste refill packaging market are pouches & sachets, cartridge/tube refills, concentrate packs (dilutable) and others (solid refill pods, paper refills).

In terms of end-use sector, personal care & cosmetics segment to command 42.0% share in the zero-waste refill packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

Refillable Pouches Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Refillable Deodorants Market Growth, Trends and Forecast from 2025 to 2035

Prefillable Inhalers Market Size and Share Forecast Outlook 2025 to 2035

Global Prefilled Formalin Vials Market Trends – Size, Share & Growth 2025 to 2035

Prefilled Syringe Drug Molecule Market Analysis - Size, Share, and Forecast 2025 to 2035

Mini Refillable Perfume Bottles Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dry Powder Refilling Machine Market

Ophthalmic Prefilled Injectables Market Size and Share Forecast Outlook 2025 to 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA