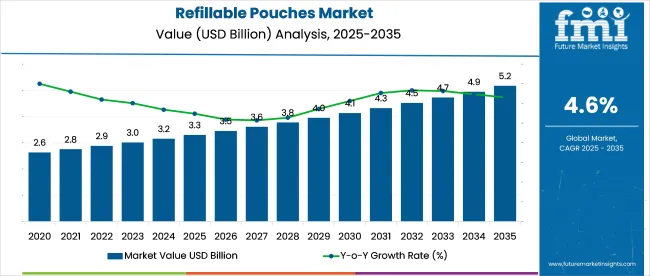

The global refillable pouches market is valued at USD 3.3 billion in 2025 and is likely to reach USD 5.2 billion by 2035, growing at a CAGR of 4.6%.

| Attribute | Value |

|---|---|

| Market Size (2025) | USD 3.3 billion |

| Market Size (2035) | USD 5.2 billion |

| CAGR (2025 to 2035) | 4.6% |

Refillable pouches are gaining visibility across personal care, home care, and food packaging due to their low material usage and compatibility with refill models. Formats range from stand-up packs with spouts to collapsible bags designed for repeat use.

Film structures are shifting toward mono-material and PE-based laminates to support recyclability. Retailers and converters are expanding SKUs, adding fitment systems, and using digital print to enable short runs for subscription packs, seasonal offers, and co-branded editions.

As of 2025, refillable pouches account for an estimated 4.2% share of the global flexible packaging market, valued at over USD 280 billion. Within the plastic packaging market (USD 450+ billion), their share stands at around 1.5%, limited by their narrower scope. In consumer packaging, which spans over USD 2 trillion, refillable pouches contribute under 0.5% but are expanding through food, personal care, and pet product formats.

Within the reusable and refillable packaging segment, projected at USD 50-60 billion, refillable pouches represent about 8-10%, due to increasing demand for refill stations and bulk packaging. In personal and home care packaging, they hold a 3.6% share, led by liquid soap, shampoo, and cleaning gel formats commonly using zipper or spout pouches.

Sierra Liggett, Division Manager at PAC Worldwide, refers to refill pouches as a strategic inflection point in packaging, where performance and environmental responsibility can align. She emphasizes that the company has developed film technologies that guarantee zero leakage, addressing a core functional requirement for liquid and semi-liquid products.

At the same time, these pouches reduce shipping weight by 66%, directly supporting efforts to lower transport-related emissions and material usage. Liggett positions this as proof that functional compromise is not a prerequisite for reducing packaging waste, reinforcing PAC Worldwide’s commitment to practical solutions in packaging design and supply chain optimization.

Brand refill strategies and circular design policies are influencing pouch format choices, particularly in personal care and household cleaning sectors. Zipper-based closures and standalone refillable structures show measurable conversion rates in established retail markets. Compatibility with automated lines and closure integrity are key parameters for packaging suppliers.

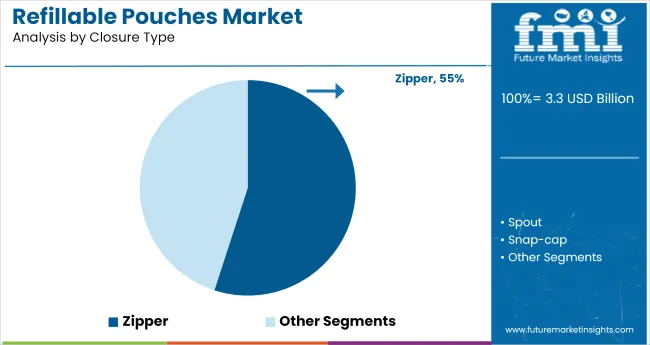

Zipper closures dominate with a 55% share, serving personal care, food, and home cleaning applications where repeated access is essential. Zippers tested for >10 open-close cycles retain 95% sealing integrity, which drives customer retention in refill SKUs. Manufacturers such as Glenroy, Constantia Flexibles, and ProAmpac offer custom zipper formats, including tamper-evident variants.

Pouches in this segment commonly use PE or PET substrates with reclosable linear zippers fused under 180-200°C seal temperatures. Line speeds remain unaffected, achieving 50-65 pouches/min on multi-lane vertical form-fill-seal (VFFS) lines. Formats are suited for retail pack sizes ranging from 150 mL to 2 L.

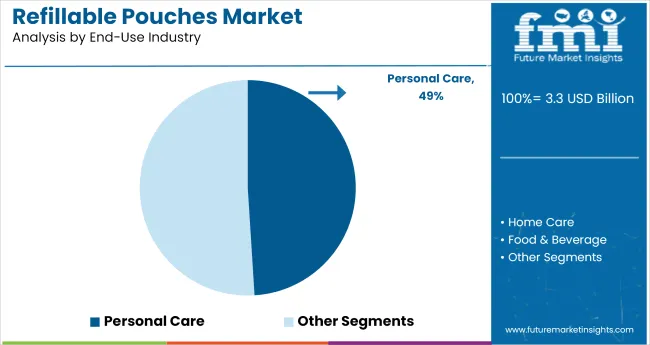

Personal care applications account for 49% of refill pouch demand, driven by shower gels, shampoos, facial cleansers, and lotions. Usage in refill stations and subscription refill models has accelerated pouch volume in 250-400 mL range.

Brands such as L’Oréal, Unilever, and Procter & Gamble deploy refillable pouches across up to 12 product variants per brand line. Key considerations include chemical compatibility (pH 4-9), surface print adhesion under humidity, and material flexibility for viscous fluids. Refill packs must resist up to 3N tear strength to endure repeated squeezes or shelf load.

Reusable standalone pouches are gaining adoption among mid-scale personal and household brands due to ease of brand differentiation and lower per-use cost. Unlike single-use variants, these pouches are designed for 5-10 refill cycles, typically made from 125-150-micron multi-layer laminates. Companies like S-Pack, RefillMyBottle, and Lageen Tubes offer ergonomic designs with spout or wide-mouth zipper closures.

Reusability protocols validate pouch tensile strength retention up to 80% after five uses, while valves and caps are engineered for twist resistance above 1.5 Nm. This format also supports barcode-based refill tracking systems through retail point-of-sale.

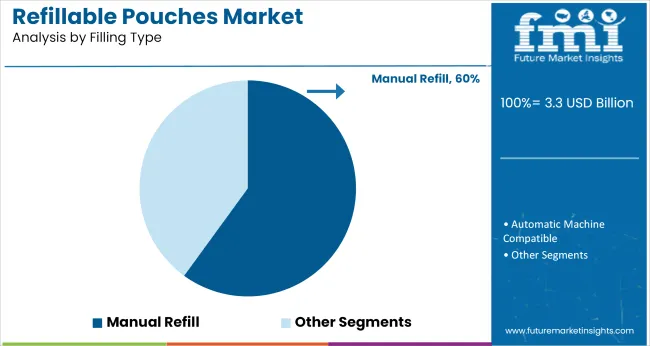

Manual refill pouches continue to dominate small and medium enterprise (SME) manufacturing setups, accounting for over 60% of the filling-type segment. These pouches are produced in batches of 5,000-15,000 units, often using basic impulse sealing equipment.

Key players like ePac, Aptar, and PakFactory supply manual-friendly formats with self-standing gussets and tamper-proof zipper or snap caps. Sealing widths typically range from 6-12 mm, with opening torque adjusted to 0.8-1.1 Nm for user convenience. Manual fill time averages 15-25 seconds/pouch, depending on viscosity and neck diameter.

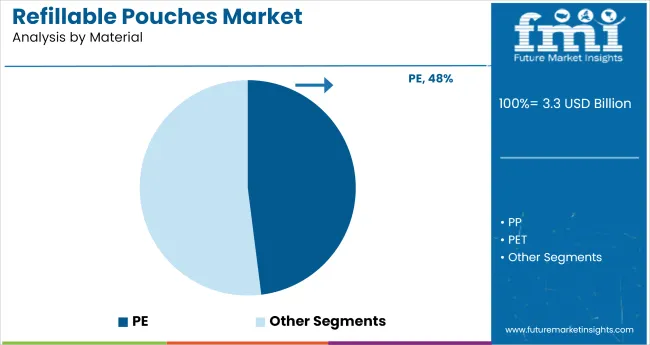

PE remains the dominant pouch material at an estimated 48% share, due to heat seal compatibility, impact strength, and increasing availability of mono-material variants. High-performance PE films are tailored with puncture resistance levels above 1.5 N/mm and show minimal delamination under high-humidity storage.

Firms such as Amcor, Sealed Air, and Coveris supply recyclable PE structures compatible with zippers and pour spouts. These films also allow downgauging up to 20% without compromising form stability. Extrusion temperature settings for PE films are optimized at 210-240°C during pouch forming.

Refillable pouch supply chains adjusted through shorter inventory cycles, modular filling systems, and leaner order volumes. Use-case expansion across food, personal care, and pet products gained traction through functional trials. Rising resin and freight costs compressed margins, prompting shifts toward mono-material formats, subscription pricing, and streamlined sourcing to manage profitability.

Inventory Rationalization & Refill Cycle Optimization

Personal care and household brands trimmed pouch inventory durations to ease warehouse congestion and recover tied-up capital. Average holding time in Western European facilities fell from 74 to 52 days in H1 2025 following a broader uptake of demand-linked replenishment software among mid-tier fillers.

In Japan, refill variants are now cleared from shelves 1.8× faster than rigid-plastic formats across supermarkets. Retailers in the UK widened shelf space for refill stations by 22%, driven by SKU-level turn rate data.

Modular pouch-filling units installed by third-party manufacturers in South Korea lowered minimum order sizes by 19%, supporting quicker replenishment cycles. Stock-out incidents across top-volume refill lines dropped 13% as supply chains adjusted to leaner inventory structures.

Format Validation Across Personal Care and Food Segments

A 2024 user trial led by Technion Israel Institute found that multilayer PE pouches retained 94% functional integrity after five refill rounds when used for toiletries. In France, yogurt producers piloting hybrid pouches combining HDPE and aluminum reported a 31% increase in redemption among loyalty-card users.

Australian brands selling frozen soups registered 17% growth in refill-pack units in Q1 2025 over the prior-year period, with demand supported by freezer-compatible closure features. USA pet food suppliers ran market tests using barrier pouches fitted with resealable spouts for wet formats.

Surveyed households reported 63% preference over cans due to ease of resealing and portioning. Market entry across food, hygiene, and pet care shows format adaptability under varied storage and usage conditions.

Margin Strain from Resin Volatility and Packaging Complexity

Suppliers experienced pressure on gross margins through early 2025 amid elevated input costs and material-specific sourcing constraints. LDPE benchmarks climbed 14% year-on-year by April, while tie-layer adhesives became 9% costlier across key Asian regions. These shifts compressed converter-level margins from 19.5% to 13.2% as pricing lags limited downstream recovery.

Freight rates for Asia-Europe shipments pushed logistics overheads upward, particularly for volume-intensive light packaging. Some converters adopted mono-material structures with thinner films, trimming material costs by 11% while accepting shorter ambient shelf life. Others introduced fixed-price refill bundles to stabilize per-unit revenues. Margin recovery efforts remain dependent on format standardization, flexible sourcing contracts, and packaging line reconfiguration.

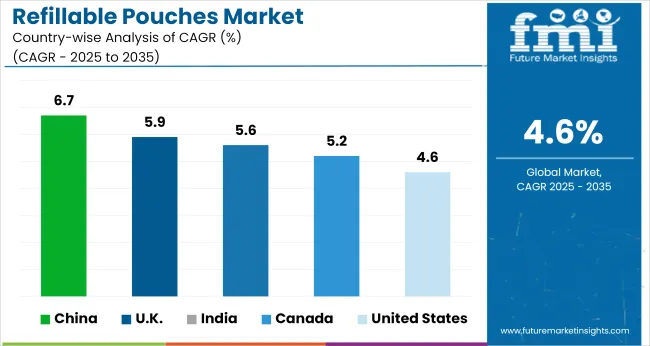

| Countries | CAGR |

|---|---|

| China | 6.7% |

| UK | 5.9% |

| India | 5.6% |

| Canada | 5.2% |

| United States | 4.6% |

Global demand for refillable pouches is projected to grow at a 4.6% CAGR from 2025 to 2035. Among the five profiled countries out of 40 covered, China (BRICS) leads with a 6.7% CAGR, followed by the United Kingdom (OECD) at 5.9%, India (BRICS) at 5.6%, Canada (OECD) at 5.2%, and the United States (OECD) at 4.6%.

These rates translate to growth premiums of +46% for China, +28% for the UK, +22% for India, and +13% for Canada, while the USA aligns exactly with the global average. Expansion in China and India is tied to rising refillable formats in personal care and home-cleaning categories.

In the UK and Canada, demand reflects scaling interest in zero-waste retail and brand-led circular packaging programs. The USA market remains steady, with adoption supported by targeted retail partnerships rather than broad policy shifts.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

In the USA, refillable pouch adoption has seen a gradual but steady expansion, with the market expected to register a compound annual growth rate (CAGR) of 4.6% between 2025 and 2035. Demand is forecasted to reach 288,000 metric tons by 2035, supported by refill formats gaining traction across household cleaning and baby care segments.

Co-packers are beginning to invest in automation lines that accommodate refillable flexible packaging, responding to brand commitments aimed at material reduction. Shifts in packaging laws and changes in extended producer responsibility (EPR) regulations are also influencing procurement and contract packaging dynamics in the country.

The refillable pouch market in Canada is projected to expand at a CAGR of 5.2% through 2035, with demand likely to surpass 92,000 metric tons by the end of the forecast period. Growth is being supported by private-label brands introducing refill SKUs in hand soaps, shampoos, and kitchen essentials.

Consumer packaged goods (CPG) manufacturers in Québec and Ontario are leading the shift with locally sourced pouch laminates and in-house pouch-filling lines. Retailers are also partnering with specialty packaging suppliers to trial refill stations in urban centers.

The UK refillable pouch market is forecasted to grow at a CAGR of 5.9% from 2025 to 2035, with demand expected to reach 118,000 metric tons by the end of the period. Growth in refillable packaging is driven by a mix of corporate mandates, policy incentives, and shifting consumer preferences.

The bulk of refillable pouch usage is seen in body washes, pet shampoos, and refill concentrates. Retail-linked pilots, particularly those launched by high-street pharmacy chains, have reported conversion rates above initial benchmarks.

China’s refillable pouch market is set to grow at a CAGR of 6.7% between 2025 and 2035, with projected demand reaching 624,000 metric tons by 2035. The market is supported by a blend of e-commerce-first product strategies and high-volume usage in refill categories like dishwashing liquids and concentrated fabric softeners.

Chinese packaging converters are scaling up production lines for high-speed form-fill-seal (FFS) machines tailored to refill pouch formats. Local brands are also introducing refill pouches in B2B cleaning products distributed to hotels and institutional buyers.

The refillable pouch industry in India is forecasted to grow at a CAGR of 5.6% from 2025 to 2035, reaching 421,000 metric tons in annual demand by the end of the forecast window. FMCG majors are rolling out refill pouches in mid-size pack formats (400 ml to 1.5 liters), targeting rural and tier-2 markets with affordability as a key lever.

Converter capacity expansion in states like Gujarat and Maharashtra is pushing down unit costs for co-packers. With growing adoption in products like edible oils, handwash, and floor cleaners, refill pouches are becoming standard across multi-use liquid formats.

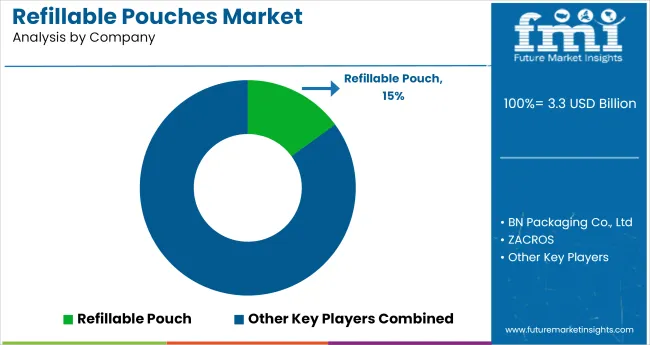

The refillable pouch market is dominated by established manufacturers like BN Packaging and ZACROS, which compete through specialized designs and faster production cycles. KDWPACK and Impak Corporation target sectors need extended shelf-life solutions with high-barrier materials and precision engineering.

Distributors such as TricorBraun and SunDance USA maintain strong positions by offering value-added services like prototyping and supply chain management. Newer players like EastMoon and Flexible Pack gain traction with modular systems and regional cost advantages, appealing to budget-sensitive buyers.

High capital requirements for filling technology and strict packaging regulations create barriers, but agile firms overcome these by focusing on niche applications and optimized pouch formats. Larger companies like Coveris and FlexPouches invest in R&D and vertical integration to stay ahead, while smaller competitors succeed through targeted innovation.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.3 billion |

| Projected Market Size (2035) | USD 5.2 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Closure Types (Segment 1) | Zipper, Spout, Snap-cap, Magnetic |

| Structure Variants (Segment 2) | Single-use Refill Pouch, Rigid-Compatible Pouch, Reusable-Standalone Pouch |

| Materials Used (Segment 3) | PE, PP, PET, Bio-based Plastic, Paper Laminates |

| Filling Types (Segment 4) | Manual Refill, Automatic Machine Compatible |

| End-Use Industries (Segment 5) | Personal Care, Home Care, Food & Beverage, Industrial Fluids, Cosmetics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, China, Japan, South Korea, India, Brazil, Australia |

| Key Companies Profiled | BN Packaging Co., Ltd, ZACROS, KDWPACK, Impak Corporation, Flexible Pouches, TricorBraun, SunDance USA, Flexible Pack, Coveris, EastMoon |

| Additional Attributes | Dollar sales measured across closure type and filling compatibility, share by refill formats in personal care and household categories, increasing demand from liquid food and beauty formulations, adoption in e-commerce and bulk-packaged refills, regional manufacturing clusters in East Asia and Western Europe supporting private label adoption, pouch customization trends driven by refill station models and retail brand circularity programs. |

Zipper, Spout, Snap-cap, Magnetic

Single-use Refill Pouch, Rigid-Compatible Pouch, Reusable-Standalone Pouch

PE, PP, PET, Bio-based Plastic, Paper Laminates

Manual Refill, Automatic Machine Compatible

Personal Care, Home Care, Food & Beverage, Industrial Fluids, Cosmetics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa

The market is projected to reach USD 5.2 billion by 2035, up from USD 3.3 billion in 2025.

Zipper closures hold the largest share at 55% in 2025.

Personal care products account for 49% of total demand in 2025.

China is expected to grow at the fastest pace with a CAGR of 6.7%.

PE-based films lead with a 48% share in pouch material usage.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refillable Deodorants Market Growth, Trends and Forecast from 2025 to 2035

Prefillable Inhalers Market Size and Share Forecast Outlook 2025 to 2035

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Mini Refillable Perfume Bottles Market Size and Share Forecast Outlook 2025 to 2035

Peel Pouches Market

Industry Share & Competitive Positioning in Spout Pouches

Spout Pouches Market Growth, Trends, Forecast 2024-2034

Travel Pouches Market Size and Share Forecast Outlook 2025 to 2035

Slider Pouches Market Size and Share Forecast Outlook 2025 to 2035

2 Seal Pouches Market Size and Share Forecast Outlook 2025 to 2035

Bio PE Pouches Market Trends - Growth & Demand Forecast 2025 to 2035

Market Share Insights for Slider Pouches Providers

Key Players & Market Share in 2 Seal Pouch Industry

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Contour Pouches Market

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Self-Seal Pouches Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA