The 2 Seal Pouches Market is estimated to be valued at USD 19.7 billion in 2025 and is projected to reach USD 34.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The 2 seal pouches market is witnessing consistent growth due to rising demand for flexible durable, and cost-effective packaging across food, pharmaceutical, and personal care industries. Manufacturers are favouring pouch formats that reduce material usage, enhance shelf appeal, and offer superior barrier protection. Increased adoption of lightweight and re sealable packaging in retail and e-commerce channels is further accelerating market momentum.

Regulatory pressures for extended shelf life and tamper-evident packaging, especially in food and healthcare sectors, have influenced advancements in seal integrity and lamination technologies. Additionally, the growing emphasis on sustainability has pushed suppliers to adopt recyclable and mono-material pouches without compromising on performance.

The rise in on-the-go consumption patterns and portion-controlled packaging has further intensified the demand for pouches with moderate carrying capacities and secure sealing mechanisms. Future growth will likely be driven by innovations in compostable films smart packaging integration, and high-speed pouching lines optimized for various product viscosities and formats.

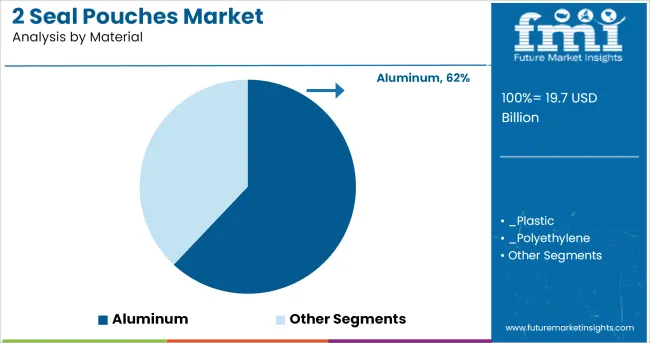

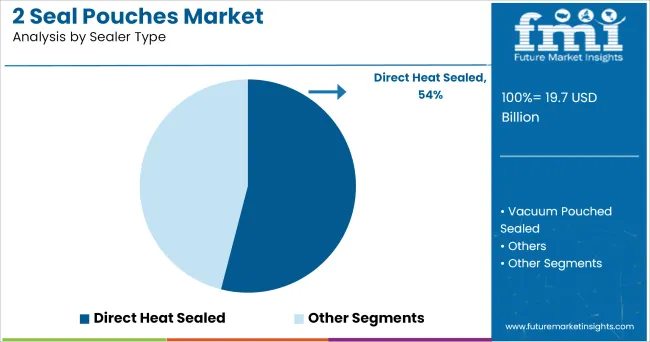

The market is segmented by Material, Sealer Type, Carrying Capacity, and End Use Industries and region. By Material, the market is divided into Aluminum, Plastic, Polyethylene, Polypropylene, Polyvinyl Chloride, Others, and Others (paper etc.). In terms of Sealer Type, the market is classified into Direct Heat Sealed, Vacuum Pouched Sealed, and Others.

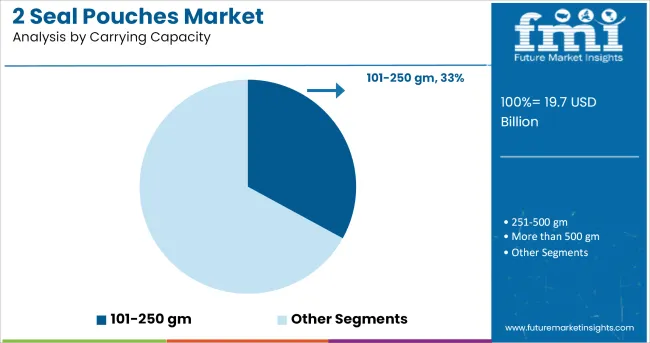

Based on Carrying Capacity, the market is segmented into 101-250 gm, 251-500 gm, More than 500 gm, and Up to 100 gm. By End Use Industries, the market is divided into Food & Beverage, Pharmaceuticals & Healthcare, Cosmetic & Personal Care, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Aluminium is projected to account for 62.0% of the total revenue in 2025 under the material category, establishing it as the dominant substrate used in 2 seal pouch manufacturing. This leadership is attributed to aluminium’s superior barrier properties against moisture, oxygen UV light, and contaminants, which makes it a preferred material for high-sensitivity applications such as pharmaceuticals, specialty foods, and nutraceuticals.

Its high thermal stability and compatibility with direct heat sealing processes have further supported widespread adoption in automated filling lines. Aluminium’s ability to extend shelf life and preserve aroma, flavour, and nutritional value has reinforced its preference across global packaging stakeholders.

While recyclability concerns remain, the material’s unmatched protection and light weight continue to outweigh alternative options in performance-sensitive environments, ensuring its leading role in the market.

In the sealing technology category, direct heat sealing is expected to command 54.0% of total revenue in 2025, marking it as the primary sealing method for 2 seal pouches. This prominence stems from the reliability, strength, and simplicity of the sealing process, which involves applying heat and pressure directly to seal the pouch.

The method is particularly effective for thick films and laminated materials like aluminium, ensuring consistent seal integrity across variable production conditions. Direct heat sealing is also favoured for its low maintenance, cost-efficiency, and suitability in high-volume pouching lines, especially in food and pharma manufacturing.

Additionally, it allows for easy integration with both vertical and horizontal form-fill-seal machines, supporting large-scale adoption. As product safety, leak prevention, and shelf-life extension remain critical packaging goals, direct heat sealing continues to be the preferred choice for manufacturers aiming for durable, tamper evident packaging.

The 101-50 gm sub segment is projected to hold 33.0% of the market revenue in 2025 under the carrying capacity category, maintaining its leadership in pouch size preference. This dominance is being driven by its compatibility with single-use or short-term consumption needs, particularly in the food, nutraceutical, and personal care industries. The segment provides an optimal balance between volume and portability, meeting the increasing consumer demand for convenience, portion control, and reduced waste.

Manufacturers have been adopting this capacity range due to its efficiency in material usage, lower transportation cost, and faster throughput in automated filling lines. Retailers and D2C brands are favouring this size for merchandising versatility and ease of display.

Additionally, the mid-range format aligns well with e-commerce packaging strategies and consumer buying behaviour reinforcing its strong position across diverse application areas in the flexible packaging landscape.

2 seal pouches will see an astronomical increase in sales throughout the forecast period due to increasing demand for packed food and beverages. 2 seal pouches help to protect the contents of the package for a longer time duration.

2 seal pouches product sales are highly based on the aesthetics of the product packaging, due to which there is a competition between key players to provide premium packaging solutions to attract consumers. Furthermore, fluid medicines used in IV drips are largely dependent on 2 seal pouches for transport and logistical storekeeping which raise its sales in healthcare and pharmaceutical sectors.

Major competitors are spending a huge chunk of capital on research and development for developing innovative, attractive and airtight 2 seal pouches packaging solutions. These factors will contribute to the rise of 2 seal pouches demand in future years.

Extensive consumption of packed food across the globe will drive the market growth for the 2 seal pouches. On average western countries, consume millions of packed food products each day, which creates the astonishing demand for 2 seal pouches in the market.

Working-class members of society are largely dependent on packed foods due to their hectic lifestyle than their peers of different age cycles. Increasing dependency on liquid medicines in surgical & day-to-day operations in hospitals has led to a growing demand for 2 seal pouches because of their high wear and tear-resistant properties, which will significantly raise the sales of 2 seal pouches in near future.

Opportunities have come down for 2 seal pouches market players as it is widely seen that customers are more adamant towards purchasing user-friendly products. 2 seal pouches that have zip locking mechanisms are proved to be an effective solution against degradation of product quality. Moreover, the rising usage of liquid makeup in show business has propelled the demand for 2 seal pouches.

All these opportunities will provide an abrupt increase in the financial profitability of 2 seal pouches manufacturers.

The forthcoming trend of replacing traditional plastic bottles used for IV drips in the healthcare sector with 2 seal pouches alternative will prove to be instrumental for sales of the target market. This transition has decreased the dependence on non-recyclable plastic bottles which was earlier used in hospitals.

This change has also decreased the carbon footprint generation of the market. This recent trend will highly increase the demand for 2 seal pouches in the forecast period.

Generation of large piles of pharmaceutical waste in addition to the waste generated from food and beverage packs that are thrown into the dustbin without any segregation on basis of material will directly restrict 2 seal pouches market growth.

However, spreading awareness among the general public and making them understand the importance of recycling and sustainability will decrease the carbon footprint of the market, which in turn increase the revenue generation for the 2 seal pouches market

Global Players

APAC Players

The key competitors implement various strategies such as product launch, merger & acquisition, expansion, innovation and others to survive and compete in the market:

For instance, in 2024, Guangdong Danqing Printing Co., Ltd introduced a new product named food grade kraft paper bag stand up pouch which is sealed 2 ways and provides the barrier protection against rancidity of food products caused by UV light, moisture, and oxygen.

India is projected to be the largest growing country in the 2 seal pouches market in terms of volume and value. India is one of the largest countries by population, it prominently holds a significant consumer share of the food & beverage industry. Furthermore, 2 sealed packed food has gained attraction in the Indian market.

This product has the fastest-growing adaption in the healthcare sector and has distinguished itself in the market. Moreover, new sustainability laws set by the government of India is emphasizing on providing a healthy stance to decrease the carbon footprint generation of the country.

To comply with the government regulations manufactures are setting up plants, collection centres for recycling and providing sustainable packaging solutions. All these factors will prove to be monumental and increase India's market share in the 2 seal pouches market during the forecast period.

The global 2 seal pouches market is estimated to be valued at USD 19.7 billion in 2025.

The market size for the 2 seal pouches market is projected to reach USD 34.0 billion by 2035.

The 2 seal pouches market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in 2 seal pouches market are aluminum, plastic, polyethylene, polypropylene, polyvinyl chloride, others and others (paper etc.).

In terms of sealer type, direct heat sealed segment to command 54.0% share in the 2 seal pouches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

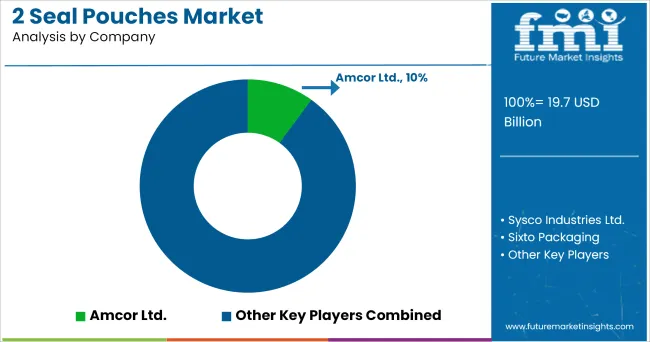

Key Players & Market Share in 2 Seal Pouch Industry

2-(4-(Bromomethyl)phenyl)propionic Acid (BMPPA) Market Forecast and Outlook 2025 to 2035

2-tert-Butylcyclohexanol Market Forecast and Outlook 2025 to 2035

2-Fluorobenzotrifluoride Market Forecast and Outlook 2025 to 2035

2-Methoxynaphthalene-1-Boronic Acid Market Forecast and Outlook 2025 to 2035

20MnCr5 Steel Market Size and Share Forecast Outlook 2025 to 2035

2-Ethoxy Propene Market Size and Share Forecast Outlook 2025 to 2035

2-in-1 Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

2-Ethyl-3,4-ethylenedioxythiophene Market Size and Share Forecast Outlook 2025 to 2035

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

2-Methylfuran Market Size and Share Forecast Outlook 2025 to 2035

2 Loop FIBC Bags Market Size and Share Forecast Outlook 2025 to 2035

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

2-Hexyldecanol Market Size and Share Forecast Outlook 2025 to 2035

2-EthylHexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

2 Piece Cans Market Size and Share Forecast Outlook 2025 to 2035

2-ethylhexanol (2-EH) Market Growth - Trends & Forecast 2025 to 2035

2D Bar Code Marketing Market Analysis by Technology, Code Types, Applications, and Region Through 2035

Breaking Down Market Share in 2 Loop FIBC Bags

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA