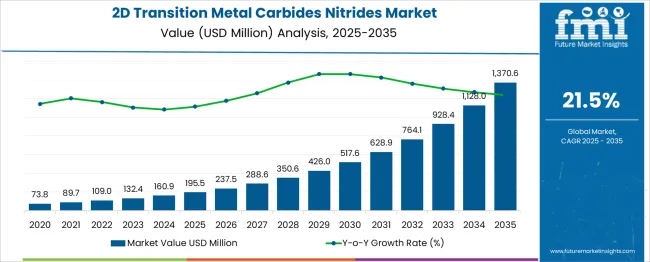

The 2D transition metal carbides nitrides market is set to grow from USD 195.5 million in 2025 to USD 1,370.6 million by 2035, with a CAGR of 21.5%. A 10-year growth comparison reveals rapid acceleration over the forecast period. Between 2025 and 2030, the market grows from USD 195.5 million to USD 350.6 million, contributing USD 155.1 million in growth, with a CAGR of 12.4%. This early-stage growth is driven by increasing demand for 2D transition metal carbides and nitrides in a variety of high-performance applications, including energy storage, electronics, and advanced coatings. The growth is fueled by innovations in material science, particularly in the fields of catalysis and supercapacitors, where these materials offer superior performance. From 2030 to 2035, the market expands from USD 350.6 million to USD 1,370.6 million, contributing USD 1,020 million in growth, with a CAGR of 31.4%. This period represents a phase of sharp acceleration, driven by increasing adoption in next-generation technologies, such as quantum computing, advanced sensors, and high-efficiency energy solutions. The market experiences strong momentum due to technological breakthroughs, further scaling of production processes, and rising industrial demand for materials with high electrical conductivity, thermal stability, and mechanical strength.

| Metric | Value |

|---|---|

| 2D Transition Metal Carbides Nitrides Market Estimated Value in (2025 E) | USD 195.5 million |

| 2D Transition Metal Carbides Nitrides Market Forecast Value in (2035 F) | USD 1370.6 million |

| Forecast CAGR (2025 to 2035) | 21.5% |

The 2D Transition Metal Carbides Nitrides market is advancing steadily as the demand for high-performance materials in energy storage, electromagnetic shielding, and catalysis increases. Adoption is being driven by the unique electrical, thermal, and mechanical properties of these materials, enabling breakthroughs across batteries, supercapacitors, and sensors.

Industry dynamics reflect growing utilization of MXenes due to their tunable surface chemistry and superior conductivity compared to conventional alternatives. Future outlook remains positive as research and commercialization efforts continue to bridge laboratory innovation with scalable manufacturing.

Significant opportunities are expected to emerge through collaborations between material producers and end-use industries, while ongoing advancements in synthesis techniques and surface functionalization are paving the way for broader application. Environmental considerations and performance-driven design in advanced devices are reinforcing their market trajectory and supporting long-term growth prospects.

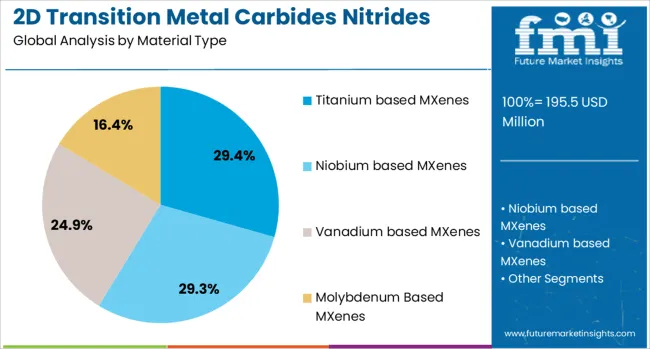

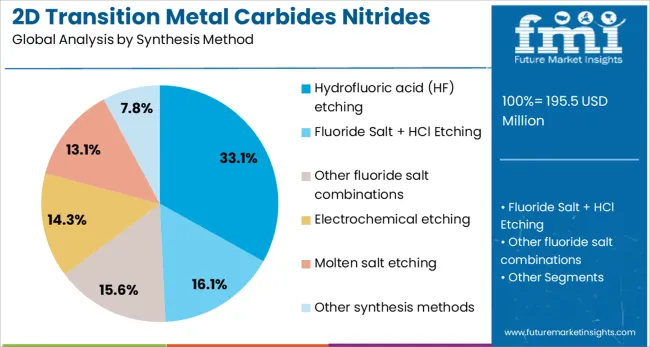

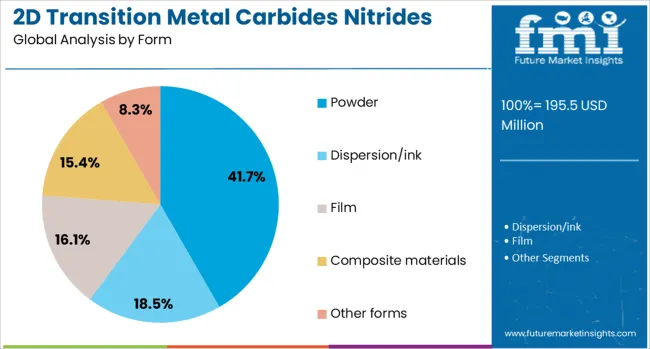

The 2D transition metal carbides nitrides market is segmented by material type, synthesis method, form, application, end-use industry, and region. By material type, the market is divided into titanium-based MXenes, niobium-based MXenes, vanadium-based MXenes, molybdenum-based MXenes, tantalum-based MXenes, and other MXene types. In terms of synthesis method, it is classified into hydrofluoric acid (HF) etching, fluoride salt + HCl etching, other fluoride salt combinations, electrochemical etching, molten salt etching, and other synthesis methods. Based on form, the market is segmented into powder, dispersion/ink, film, composite materials, and other forms. By application, it is categorized into energy storage, electronics and optoelectronics, sensors and biosensors, environmental remediation, biomedical applications, composites and coatings, and other applications. By end-use industry, the market is segmented into electronics and semiconductors, energy and power, healthcare and pharmaceuticals, automotive and transportation, environmental and water treatment, aerospace and defense, research and academia, and other end-use industries. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

When segmented by material type the titanium based MXenes segment is projected to hold 29.4% of the total market revenue in 2025 maintaining its position as the leading material category. This leadership has been supported by the relatively mature synthesis protocols and superior electrochemical properties of titanium based MXenes which have enabled their widespread adoption in energy storage and sensing applications.

Their balanced combination of conductivity, surface area, and structural stability has facilitated extensive research and early-stage commercialization. Additionally titanium based MXenes have demonstrated higher compatibility with surface modifications and intercalation chemistries enhancing their versatility for diverse end uses.

These advantages have reinforced their preference among developers seeking a reliable and scalable MXene material contributing to their continued prominence in the market.

In terms of synthesis method the hydrofluoric acid etching segment is forecast to account for 33.1% of the market revenue in 2025 establishing itself as the dominant synthesis technique. This position has been driven by its effectiveness in selectively removing the A layers from MAX phases to produce high-quality MXene sheets with minimal defects.

The simplicity and accessibility of the HF etching method have supported its widespread adoption in both research and pilot-scale production. Moreover its ability to produce MXenes with desirable surface terminations critical for tuning material properties has strengthened its appeal despite safety and environmental challenges associated with HF handling.

The proven reliability of this method and its compatibility with a variety of MAX phase precursors have underpinned its leading share as other alternative synthesis routes remain under optimization.

When segmented by form the powder segment is projected to capture 41.7% of the market revenue in 2025 retaining its leadership as the most preferred form. This dominance has been reinforced by the powder form’s ease of handling, storage, and integration into downstream processes such as ink formulation, coating, and composite fabrication.

The versatility of MXene powders in being dispersed, processed, or directly incorporated into devices has made them the material form of choice for manufacturers and researchers alike. Furthermore powder MXenes have shown better stability during transport and storage compared to suspensions which has enhanced their commercial viability.

Their adaptability to a broad range of applications and compatibility with scalable processing techniques have strengthened their position as the primary form fueling their sustained growth in the market.

The 2D transition metal carbides nitrides market is expanding due to the increasing demand for advanced materials with unique properties such as high strength, conductivity, and thermal stability. These materials, known as MXenes, have found applications in fields like energy storage, electronics, and coatings. Their ability to withstand extreme conditions, along with their conductivity and mechanical properties, make them ideal for use in batteries, supercapacitors, and other electronic devices. While challenges like scalability, production costs, and limited commercialization exist, the market offers opportunities through innovation and increased demand in high-performance sectors.

The 2D transition metal carbides nitrides market is driven by the increasing demand for high-performance materials in energy storage systems and electronics. MXenes, a class of materials that includes 2D transition metal carbides and nitrides, have gained attention due to their exceptional properties such as high electrical conductivity, mechanical strength, and thermal stability. These characteristics make them ideal candidates for use in energy storage applications like lithium-ion batteries, supercapacitors, and fuel cells, where high energy density and rapid charge/discharge rates are critical. The growing adoption of MXenes in advanced electronic devices, sensors, and coatings is further contributing to the growth of the market. Their potential in catalysis and environmental applications is driving further interest in the material.

The primary challenges in the 2D transition metal carbides nitrides market are the high production costs and scalability issues. Producing MXenes requires specialized techniques such as selective etching, which can be costly and time-consuming. These production processes make the commercial-scale manufacturing of MXenes challenging, limiting their widespread adoption. Moreover, as demand for MXenes grows, there is a need to scale up production while maintaining the quality and performance of the material. The high costs associated with raw materials, along with the complexity of processing and fabrication, pose significant barriers to making MXenes more accessible for broader industrial applications. Overcoming these challenges requires advances in manufacturing techniques and cost reduction strategies.

The 2D transition metal carbides nitrides market presents significant opportunities for growth, especially in the development of advanced energy storage solutions. MXenes' high conductivity and mechanical properties make them ideal candidates for next-generation batteries, supercapacitors, and other energy storage devices that require high performance and energy density. As the demand for energy-efficient solutions increases globally, there is growing interest in materials that can support the transition to cleaner, more sustainable energy systems. Beyond energy storage, MXenes are also being explored for use in sensors, electromagnetic shielding, and water purification, further expanding their potential applications. As research progresses and production techniques improve, the market for MXenes is expected to grow, particularly in energy and electronics.

A significant trend in the 2D transition metal carbides nitrides market is the ongoing research and innovation in material properties and applications. Scientists and engineers are continually working on enhancing the performance of MXenes, particularly in areas like energy storage, where the material’s high surface area and conductivity can be leveraged to improve battery performance. In addition, the exploration of new applications in fields such as environmental remediation, catalysis, and electromagnetic interference shielding is expanding the utility of MXenes. Research into developing more cost-effective and scalable production methods is also a key trend, which could drive the commercialization of these materials in a wider range of industries. This trend toward innovation and expanding applications positions MXenes as a key material in the future of advanced materials science.

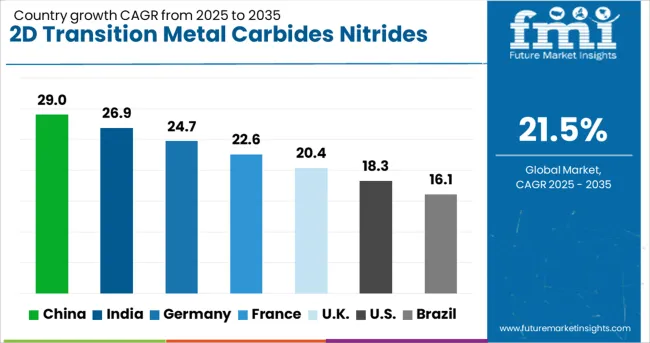

| Country | CAGR |

|---|---|

| China | 29.0% |

| India | 26.9% |

| Germany | 24.7% |

| France | 22.6% |

| UK | 20.4% |

| USA | 18.3% |

| Brazil | 16.1% |

The 2D transition metal carbides nitrides market is projected to grow at a global CAGR of 21.5% from 2025 to 2035. China leads with a CAGR of 29.0%, followed by India at 26.9%, and Germany at 24.7%. The United Kingdom shows 20.4% growth. China and India, both part of the BRICS group, exhibit rapid growth driven by the increasing demand for advanced materials in industries such as electronics, energy, and manufacturing. In OECD nations like Germany and the UK, steady growth is fueled by innovation and increasing applications of 2D materials in nanotechnology, electronics, and energy storage. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 29.0% through 2035, driven by rapid advancements in electronics, energy storage, and nanotechnology. As China continues to emerge as a leader in technology and manufacturing, the demand for advanced materials like 2D transition metal carbides nitrides is expected to rise. The country’s focus on research and development in energy-efficient technologies, coupled with government support for high-tech industries, will continue to drive the adoption of 2D materials. Moreover, China’s growing participation in the global supply chain for electronics and semiconductors further boosts market growth.

India is projected to grow at a CAGR of 26.9% through 2035, with increasing demand for advanced materials driven by the country's industrial growth and technological advancements. The demand for 2D transition metal carbides nitrides in India is accelerating as industries like electronics, energy storage, and manufacturing continue to expand. The Indian government’s initiatives to support innovation and the rising focus on renewable energy further contribute to the market growth. With an increase in nanotechnology applications and advancements in materials science, India’s market for these materials is expected to grow significantly in the coming years.

Germany is projected to grow at a CAGR of 24.7% through 2035, driven by increasing applications of 2D materials in high-performance industries such as electronics, energy storage, and nanotechnology. Germany’s advanced manufacturing sector and strong focus on research and innovation in material sciences make it a key player in the market. The adoption of 2D transition metal carbides nitrides in applications such as semiconductors, battery technologies, and renewable energy solutions is accelerating. The German government’s push toward green technologies and energy-efficient solutions also contributes to the growing demand for these advanced materials.

The United Kingdom is projected to grow at a CAGR of 20% through 2035, supported by increasing demand for advanced materials in high-tech industries. The UK is witnessing significant advancements in nanotechnology, energy storage, and electronics, all of which are driving the demand for 2D transition metal carbides nitrides. The country’s continued focus on technologies, along with growing investment in research and development, is expected to accelerate the adoption of these materials in various sectors. As the UK integrates more efficient and high-performance materials into its industries, demand for 2D transition metal carbides nitrides will continue to rise.

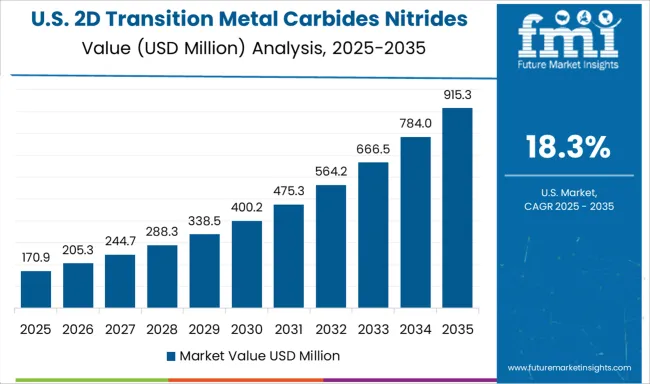

The United States is projected to grow at a CAGR of 18.3% through 2035, with significant demand for 2D transition metal carbides nitrides driven by the increasing adoption of these materials in high-performance applications. The growing need for advanced materials in electronics, energy storage, and nanotechnology is accelerating market demand. The USA government’s continued investment in R&D for renewable energy solutions and next-generation technologies is fueling the growth of the 2D material market. The USA also plays a pivotal role in the global supply chain for advanced materials, contributing to the global market’s expansion.

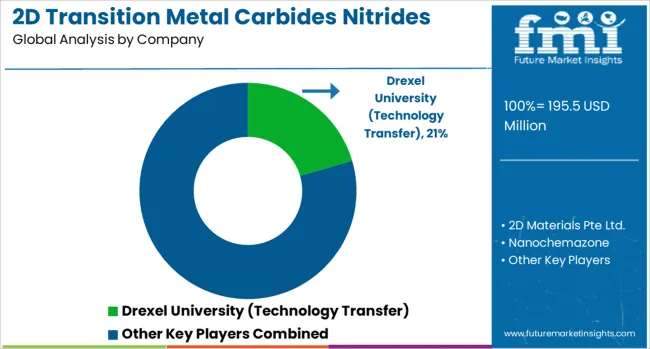

The 2D transition metal carbides and nitrides market is shaped by the combined efforts of leading companies and academic institutions driving the development and commercialization of advanced materials for electronics, energy storage, and catalysis. Drexel University (Technology Transfer) remains pivotal in advancing research and commercialization of MXenes for diverse technology and manufacturing applications. Commercial players such as 2D Materials Pte Ltd. and Nanochemazone specialize in high-quality MXenes for energy storage, sensors, and electronic devices, while ACS Material, LLC and Alfa Chemistry supply a wide portfolio of functional 2D materials tailored to meet growing demand across electronics, batteries, and nanotechnology.

Broader participation is observed from chemical giants and niche suppliers. American Elements and Merck KGaA serve both academic and industrial research with specialized 2D materials, whereas Ossila Ltd. and Nanografi Nano Technology focus on delivering products that support electronics, optoelectronics, and photonic device innovation. Sky Spring Nanomaterials, Inc. and Cheap Tubes Inc. emphasize competitive pricing and industrial-scale applications, ensuring accessibility of high-quality nanomaterials to a wider set of industries. Competitive differentiation is largely determined by product quality, production scalability, and R&D capabilities, while barriers to entry include high synthesis costs, technical expertise, and regulatory compliance. Strategic priorities for established players revolve around advancing synthesis methods, enhancing material performance, and expanding production capacity to cater to the rising demand in industrial-scale applications.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Material Type | Titanium based MXenes, Niobium based MXenes, Vanadium based MXenes, Molybdenum Based MXenes, Tantalum Based MXenes, and Other MXene types |

| Synthesis Method | Hydrofluoric acid (HF) etching, Fluoride Salt + HCl Etching, Other fluoride salt combinations, Electrochemical etching, Molten salt etching, and Other synthesis methods |

| Form | Powder, Dispersion/ink, Film, Composite materials, and Other forms |

| Application | Energy storage, Electronics & optoelectronics, Sensors & biosensors, Environmental remediation, Biomedical applications, Composites & coatings, and Other applications |

| End Use Industry | Electronics & semiconductors, Energy & power, Healthcare & pharmaceuticals, Automotive & transportation, Environmental & water treatment, Aerospace & defense, Research & academia, and Other end use industries |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Drexel University (Technology Transfer), 2D Materials Pte Ltd., Nanochemazone, ACS Material, LLC, Alfa Chemistry, American Elements, Sigma-Aldrich (Merck KGaA), Ossila Ltd., Nanografi Nano Technology, SkySpring Nanomaterials, Inc., and Cheap Tubes Inc. |

| Additional Attributes | Dollar sales by material type (MXenes, transition metal carbides, transition metal nitrides) and end-use segments (energy storage, catalysis, electronics, sensors, coatings). Demand dynamics are driven by increasing applications of 2D materials in energy storage devices, the growing demand for efficient catalysts, and advancements in electronics and photonics. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by ongoing research and development activities, as well as increasing industrial demand for high-performance materials. Innovation trends focus on developing scalable and cost-effective synthesis methods, enhancing material performance, and expanding the application of 2D materials in various high-tech industries. |

The global 2D transition metal carbides nitrides market is estimated to be valued at USD 195.5 million in 2025.

The market size for the 2D transition metal carbides nitrides market is projected to reach USD 1,370.6 million by 2035.

The 2D transition metal carbides nitrides market is expected to grow at a 21.5% CAGR between 2025 and 2035.

The key product types in 2D transition metal carbides nitrides market are titanium based mxenes, _tic, _tic, _ticn, _other titanium based mxenes , niobium based mxenes, _nbc, _nbc, _other niobium based mxenes, vanadium based mxenes, _vc, _vc, _other vanadium based mxenes, molybdenum based mxenes, _moc, _other molybdenum based mxenes, tantalum based mxenes, _tac, _other tantalum based mxenes and other mxene types.

In terms of synthesis method, hydrofluoric acid (hf) etching segment to command 33.1% share in the 2D transition metal carbides nitrides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA