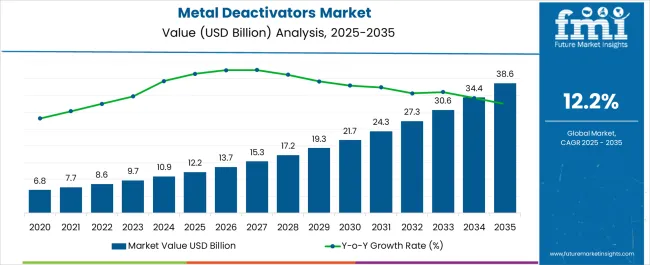

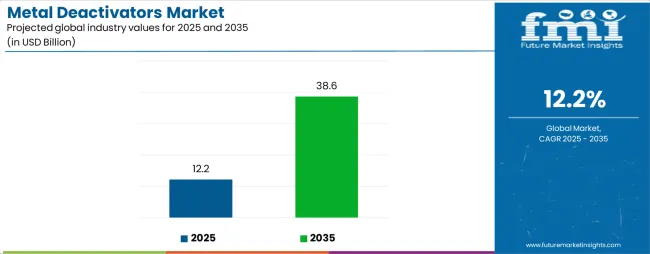

The Metal Deactivators Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 38.6 billion by 2035, registering a compound annual growth rate (CAGR) of 12.2% over the forecast period.

| Metric | Value |

|---|---|

| Metal Deactivators Market Estimated Value in (2025 E) | USD 12.2 billion |

| Metal Deactivators Market Forecast Value in (2035 F) | USD 38.6 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The Metal Deactivators market is experiencing steady growth, driven by increasing industrial demand for corrosion and oxidation inhibitors in lubricants, fuels, and specialty chemicals. The market is being propelled by the need to enhance the longevity and performance of metals exposed to harsh operating conditions, including high temperatures, moisture, and reactive chemicals. Metal deactivators are critical in preventing the degradation of machinery components and fuel systems, thereby reducing maintenance costs and operational downtime.

Growth is further supported by rising automotive production, industrialization, and demand for high-performance lubricants and oils in emerging and developed economies. Advances in chemical formulation, including synergistic blends and environmentally compliant solutions, are enhancing the efficiency of metal deactivators across various applications.

Increasing awareness among manufacturers regarding the benefits of metal deactivators in extending equipment life and improving reliability is shaping market dynamics As industries continue to focus on operational efficiency, sustainability, and regulatory compliance, the market is expected to witness robust growth, with opportunities arising from innovations in oil-based and environmentally friendly deactivation technologies.

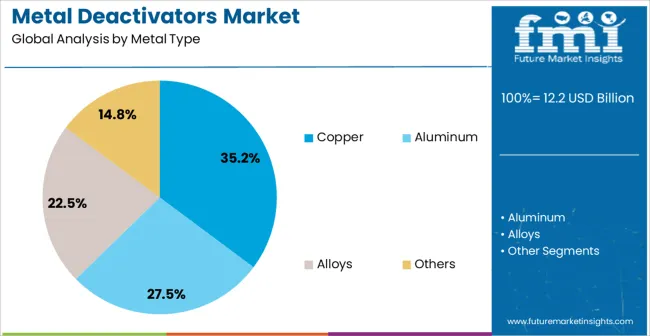

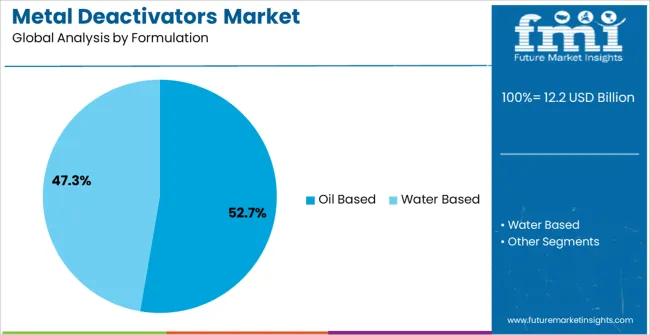

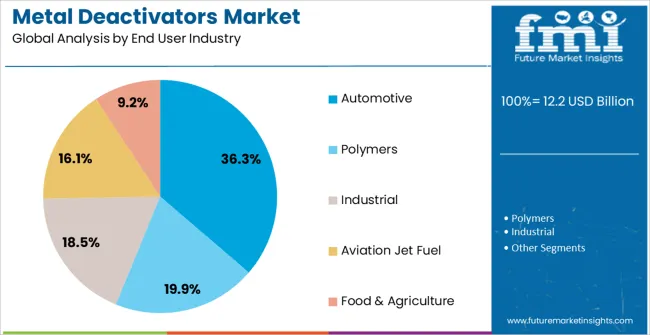

The metal deactivators market is segmented by metal type, formulation, end user industry, and geographic regions. By metal type, metal deactivators market is divided into Copper, Aluminum, Alloys, and Others. In terms of formulation, metal deactivators market is classified into Oil Based and Water Based. Based on end user industry, metal deactivators market is segmented into Automotive, Polymers, Industrial, Aviation Jet Fuel, and Food & Agriculture. Regionally, the metal deactivators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The copper segment is projected to hold 35.2% of the market revenue in 2025, establishing it as the leading metal type. Its dominance is being driven by the widespread use of copper in automotive engines, electrical equipment, and industrial machinery, where corrosion and oxidation risks are significant. Copper surfaces are highly susceptible to chemical attack and the formation of copper oxides, which can degrade performance and increase maintenance requirements.

Metal deactivators specifically designed for copper effectively prevent reactivity with sulfur, oxygen, and other aggressive compounds, enhancing system reliability and equipment longevity. Advancements in chemical formulations that improve compatibility with various lubricants and fuels have further strengthened adoption.

The segment’s growth is supported by increasing automotive production, rising demand for electrical components, and industrial machinery expansion globally As manufacturers and end users prioritize efficiency, durability, and reduced downtime, copper-targeted metal deactivators are expected to maintain their leading market position.

The oil-based formulation segment is expected to account for 52.7% of the market revenue in 2025, making it the largest formulation category. Growth in this segment is being driven by the extensive use of oil-based lubricants in automotive engines, industrial machinery, and turbines, where metal surfaces are exposed to high temperatures and reactive chemicals. Oil-based metal deactivators provide superior solubility, stability, and uniform distribution, enabling effective protection against corrosion and oxidation.

Their compatibility with conventional and synthetic oils, along with ease of incorporation into existing lubricant systems, supports widespread adoption. Technological advancements in additive chemistry have enhanced performance under extreme operating conditions while reducing environmental impact.

Manufacturers increasingly prefer oil-based formulations due to their reliability, cost-effectiveness, and ability to improve equipment life As industrial and automotive sectors continue to expand, and regulatory standards for fuel and lubricant quality evolve, oil-based metal deactivators are expected to remain the leading formulation segment, driving overall market growth.

The automotive end-use industry segment is projected to hold 36.3% of the market revenue in 2025, positioning it as the leading sector. Growth in this segment is being driven by the increasing production of vehicles globally and the rising demand for high-performance engines and lubricants. Metal deactivators are essential in automotive applications to prevent corrosion and oxidation in engines, fuel systems, and other critical components, ensuring reliability, efficiency, and longevity.

The ability of these additives to enhance the performance of oil-based formulations under high temperature and pressure conditions has reinforced their adoption in the automotive sector. Regulatory requirements for emissions reduction, fuel efficiency, and engine durability further support the use of metal deactivators.

The growing emphasis on electric vehicles with hybrid systems and advanced combustion engines is creating additional demand for specialized metal protection solutions As automotive manufacturers continue to prioritize operational efficiency, regulatory compliance, and sustainability, the sector is expected to remain the largest contributor to metal deactivator market revenue.

Metal deactivators are oil and fuel additives used as highly efficient solution to stabilize fluids by disabling the non-ferrous metal-ions. Metal deactivators reduces the negative effects in the lubricants such as corrosion and staining which is occurs mainly due to the oxidation process. To avoid this oxidation and metal contamination, special additives namely antioxidants are being used.

However, cost of antioxidant chemicals is very high. Hence, for the reduction of the cost and usage of antioxidants, a very small quantity of metal deactivators are used. Selection of metal deactivators is also an important part, it is based on a number of factors including the metal to be protected, the base stock used, frequency of the application, length of time it needs to be effective and any additional properties needed for the application.

The metal deactivator market is a very niche segment as compared to other additives; owing to its treat rate and its minute applications but this industry has direct applications in many major industries such as automotive and metal working industry.

Metal deactivators have high usage in end users including polymers, automotive, aviation, and food & agriculture owing to their leading applications in metal working fluids, aviation fuels, jet fuels, engine oils, refineries, food packaging, gear oils and others. Where, metal working and refineries are one of the key applications for metal deactivators in industrial sector.

Additionally, one of the most critical application of metal deactivators is that, it is used where plastics are in direct interaction with the metal surfaces like cable and wire insulations and molded parts having metal inserts.

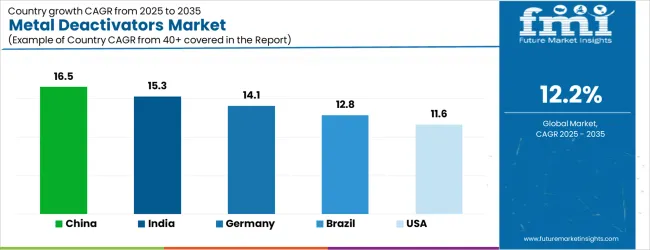

| Country | CAGR |

|---|---|

| China | 16.5% |

| India | 15.3% |

| Germany | 14.1% |

| Brazil | 12.8% |

| USA | 11.6% |

| UK | 10.4% |

| Japan | 9.2% |

The Metal Deactivators Market is expected to register a CAGR of 12.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.5%, followed by India at 15.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 9.2%, yet still underscores a broadly positive trajectory for the global Metal Deactivators Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.1%. The USA Metal Deactivators Market is estimated to be valued at USD 4.3 billion in 2025 and is anticipated to reach a valuation of USD 4.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 550.4 million and USD 311.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.2 Billion |

| Metal Type | Copper, Aluminum, Alloys, and Others |

| Formulation | Oil Based and Water Based |

| End User Industry | Automotive, Polymers, Industrial, Aviation Jet Fuel, and Food & Agriculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

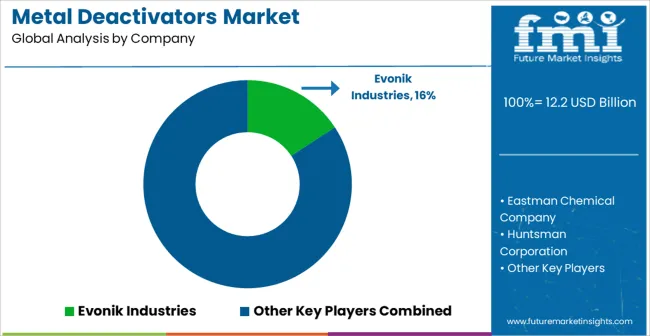

| Key Companies Profiled | Evonik Industries, Eastman Chemical Company, Huntsman Corporation, BASF, Rhodia, Lanxess, Quaker Chemical Corporation, Clariant, Univar Solutions, Milliken Company, Stepan Company, and Solvay |

The global metal deactivators market is estimated to be valued at USD 12.2 billion in 2025.

The market size for the metal deactivators market is projected to reach USD 38.6 billion by 2035.

The metal deactivators market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in metal deactivators market are copper, aluminum, alloys and others.

In terms of formulation, oil based segment to command 52.7% share in the metal deactivators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA