The metal straw market is expanding steadily due to rising environmental awareness, regulatory restrictions on single-use plastics, and increasing consumer inclination toward sustainable alternatives. Market growth is being driven by the hospitality and foodservice sectors, which are integrating eco-friendly practices into daily operations. Manufacturers are focusing on product durability, design variety, and safety compliance to meet consumer expectations and global sustainability standards.

Technological improvements in metal forming and surface finishing are enhancing product quality and usability. In addition, online and offline retail penetration is supporting greater product accessibility across both developed and emerging economies. The future outlook remains positive as consumer behavior continues to shift toward reusable lifestyle products and governments strengthen environmental policies.

Continuous brand promotion, along with product diversification across materials and sizes, is expected to reinforce long-term growth The overall market is being shaped by an alignment of environmental responsibility, regulatory compliance, and commercial adoption, positioning metal straws as a mainstream sustainable solution in global markets.

| Metric | Value |

|---|---|

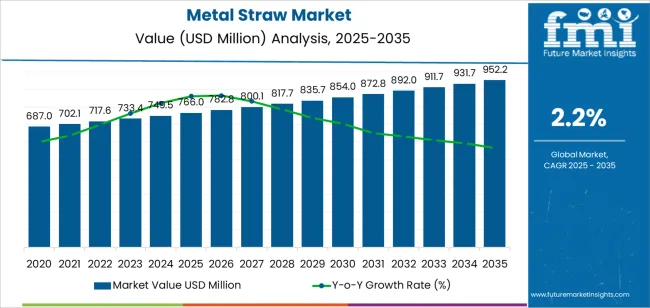

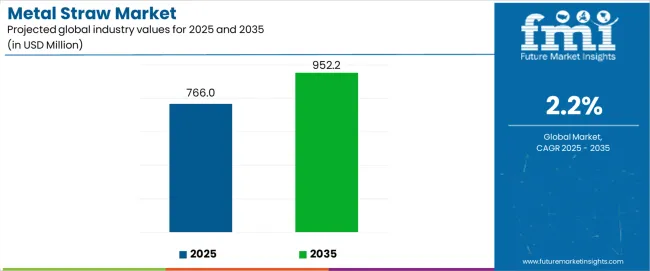

| Metal Straw Market Estimated Value in (2025 E) | USD 766.0 million |

| Metal Straw Market Forecast Value in (2035 F) | USD 952.2 million |

| Forecast CAGR (2025 to 2035) | 2.2% |

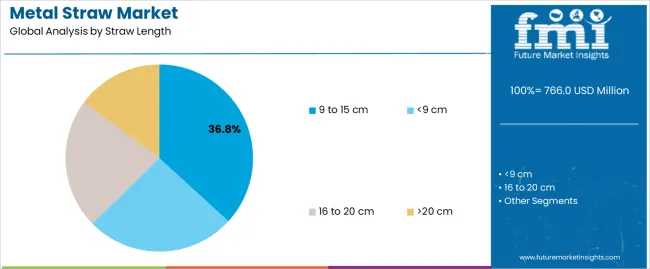

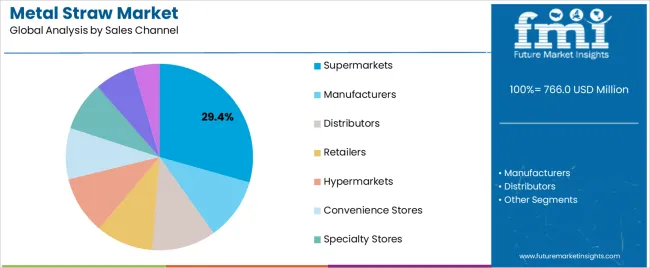

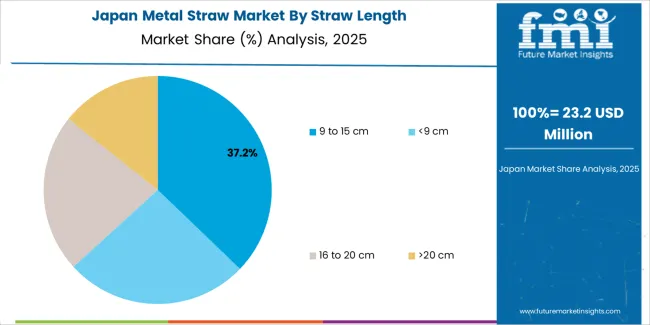

The market is segmented by Straw Length, Sales Channel, and End User and region. By Straw Length, the market is divided into 9 to 15 cm, <9 cm, 16 to 20 cm, and >20 cm. In terms of Sales Channel, the market is classified into Supermarkets, Manufacturers, Distributors, Retailers, Hypermarkets, Convenience Stores, Specialty Stores, Discount Stores & Warehouse/Wholesale Clubs, and E-retail.

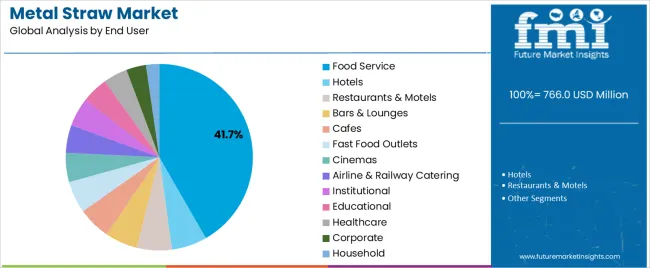

Based on End User, the market is segmented into Food Service, Hotels, Restaurants & Motels, Bars & Lounges, Cafes, Fast Food Outlets, Cinemas, Airline & Railway Catering, Institutional, Educational, Healthcare, Corporate, and Household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 9 to 15 cm segment, accounting for 36.80% of the straw length category, has emerged as the leading range due to its versatility and compatibility with various beverage types and container sizes. Its adoption has been supported by strong demand from cafes, restaurants, and households seeking reusable solutions for standard drinkware.

The compact size ensures convenience, easy storage, and suitability for both hot and cold beverages, reinforcing its functional appeal. Manufacturers have focused on producing straws in this length range using stainless steel and aluminum alloys that provide durability and hygiene benefits.

Demand consistency is further sustained by affordable pricing and availability through both online and offline retail networks Continuous innovation in design, including collapsible and color-coated variants, is expected to strengthen market share and maintain leadership of this segment throughout the forecast period.

The supermarkets segment, holding 29.40% of the sales channel category, dominates distribution due to strong product visibility, consumer trust, and effective in-store promotions. Supermarkets provide direct access to a wide range of sustainable household products, enabling consumers to compare quality and pricing before purchase.

This segment benefits from established retail infrastructure and partnerships with eco-friendly brands, ensuring consistent product availability. Impulse buying behavior and increasing inclusion of metal straws in sustainability-focused product displays have further strengthened market penetration.

Retailers are enhancing consumer engagement through promotional campaigns emphasizing environmental benefits and long-term cost savings As global retail chains expand their sustainable product offerings, supermarket distribution is expected to maintain its leadership position, supported by a growing base of environmentally conscious consumers.

The food service segment, representing 41.70% of the end user category, has remained the dominant contributor due to rapid adoption of sustainable utensils across cafes, restaurants, and quick-service outlets. Market growth is being propelled by government mandates on plastic reduction and brand-level sustainability commitments.

The segment’s strong performance is linked to bulk procurement practices and the rising preference for eco-friendly customer experiences. Metal straws have become a key branding tool for environmentally responsible establishments, enhancing corporate image and customer loyalty.

Continuous innovation in product design and packaging tailored to the hospitality sector has improved usability and maintenance convenience As the global foodservice industry expands and sustainability certifications become integral to business operations, this segment is expected to sustain its leading share and drive the overall growth of the metal straw market.

Rising Emphasis on Hygiene and Safety Boosts Sales of Metal Straws

Easy-to-clean and maintain items are in high demand among customers as concerns about safety and hygiene continue to rise. Manufacturers of metal straws are addressing customer needs by providing dishwasher-safe and sanitary choices that guarantee the highest standards of safety and cleanliness.

Businesses can improve product attractiveness, establish customer trust, and reduce perceived dangers associated with reusable items by prioritizing features that satisfy consumer concerns about safety and cleanliness.

Proliferation of Social Media Platforms Act as a Pivotal Growth Catalyst

Social media platforms are becoming effective tools for influencing consumers' attitudes, tastes, and decisions. Influencers and celebrities are powerful figures who shape the behavior of their followers and are essential in setting trends and consumer preferences.

Metal straw manufacturers take advantage of influencers' wide audience and active participation by using social media channels to highlight endorsements and advocacy for metal straws. This helps to increase brand awareness, boost demand, and reinforce brand messages.

Businesses Aim to Capture Luxury and Premium Audiences

The rise of luxury and premium collections aimed at affluent clients is an important catalyst in the metal straw industry. These elegant metal straws have customizing options, elaborate patterns, and high-quality materials. This trend targets consumers looking for high-end, environmentally friendly lifestyle options by leveraging the convergence of sustainability and luxury.

Businesses can penetrate a niche market, charge higher prices, and uphold the notion that luxury and sustainability coexist by providing premium metal straw collections. This trend allows companies to portray themselves as purveyors of upscale, eco-friendly items and corresponds with the rising demand for sustainable luxury goods.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Segment | 9 to 15 cm (Straw Length) |

|---|---|

| Value Share (2025) | 44.9% |

Based on straw length, the 9 to 15 cm segment holds 44.9% of metal straw market shares in 2025.

| Segment | Food Service (End User) |

|---|---|

| Value Share (2025) | 82.4% |

Based on end user, the food service segment holds 82.4% of metal straw market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

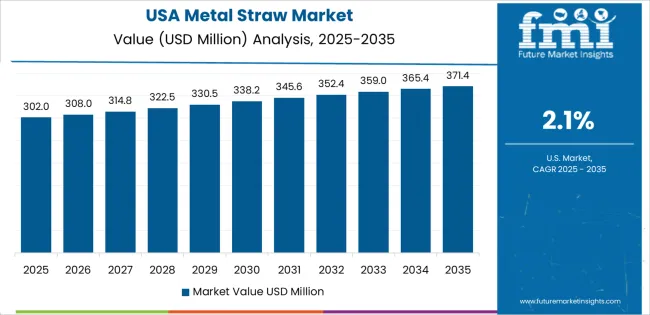

| United States | 0.6% |

| Germany | 0.7% |

| Japan | 1.1% |

| China | 4.0% |

| India | 4.9% |

The demand for metal straws in the United States is anticipated to rise at a 0.6% CAGR through 2035.

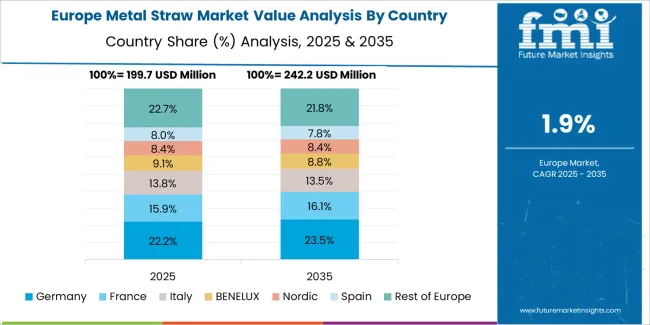

The sales of metal straws in Germany are predicted to increase at a 0.7% CAGR through 2035.

Metal straw market growth in Japan is estimated at a 1.1% CAGR through 2035.

Metal straw demand in China is projected to amplify at a 4.0% CAGR through 2035.

Metal straw sales in India are anticipated to rise at a 4.9% CAGR through 2035.

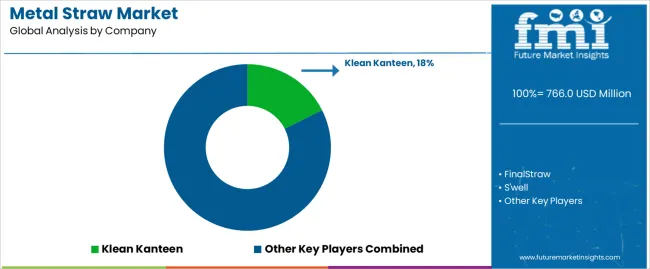

The metal straw market is competitive, with many companies contending for market dominance in the fast-increasing sustainable goods sector. Established companies like Klean Kanteen, S'well, and FinalStraw use their worldwide reach and brand familiarity to exert dominance.

These businesses frequently use extensive marketing techniques, highlighting the environmental friendliness of their metal straws and the lifestyle and prestige connected with their products.

In parallel, many specialized companies and startups, such as Ecostraw, Buluh Straws, and Hummingbird Glass Straws, add to the competitive dynamism.

Recent Development

In January 2025, MiiR introduced the All Day Straw Cup, the latest addition to their drinkware portfolio. This revolutionary stainless steel cup has a design-forward aesthetic and demonstrates the brand's dedication to responsible production.

The global metal straw market is estimated to be valued at USD 766.0 million in 2025.

The market size for the metal straw market is projected to reach USD 952.2 million by 2035.

The metal straw market is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in metal straw market are 9 to 15 cm, <9 cm, 16 to 20 cm and >20 cm.

In terms of sales channel, supermarkets segment to command 29.4% share in the metal straw market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Metal Wheel Chock Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA