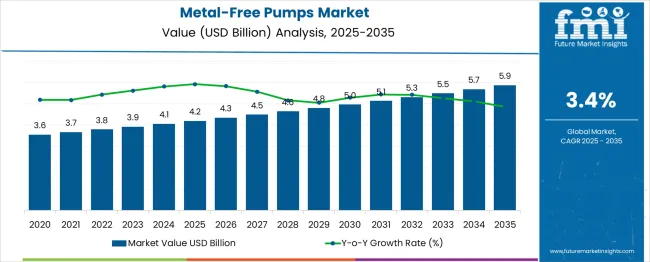

Between 2025 and 2035, the global metal-free pumps market is projected to expand steadily from USD 4.2 billion to USD 5.9 billion, reflecting a CAGR of 3.4%. Year-on-year, the market is expected to grow by approximately USD 0.14 to 0.19 billion, with the pace of growth gradually increasing due to compounding effects.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.2 billion |

| Industry Value (2035F) | USD 5.9 billion |

| CAGR (2025 to 2035) | 3.4% |

This stable progression highlights steady demand for non-metallic pump solutions, especially in sectors such as chemicals, pharmaceuticals, and food processing, where corrosion resistance and contamination prevention are critical. Regulatory pressure and the growing emphasis on operational safety are also reinforcing adoption. The predictable growth pattern indicates a mature, resilient market with strong potential for long-term investment in specialized pump technologies designed for harsh or sensitive environments.

The industry holds a specialized but growing share within its parent industries. In the global industrial pumps market (USD 65 billion), metal-free variants account for 8-12%, gaining traction in corrosive fluid handling. The chemical processing industry represents 25-30% of demand, driven by need for corrosion-resistant solutions.

In pharmaceuticals/biotech (USD15 billion pump market), their share reaches 20-25% due to strict contamination standards. Water/wastewater treatment contributes 15-20% adoption for ultrapure and chemical dosing applications. The food/beverage sector shows 10-15% penetration, prioritizing hygienic polymer pumps. With a CAGR of 7.2% (2023-2030), growth is fueled by stricter regulations (FDA, EPA) and material innovation, though high costs (30-50% premium over metal pumps) limit wider adoption in price-sensitive markets.

Ben Ashe, CEO of MDM Pumps, highlighted the company’s commitment to innovation, stating, “Our passion for rigorous R&D in non-metallic centrifugal pumps has yielded disruptive technology that delivers unparalleled corrosion resistance and efficiency in the most aggressive fluid handling environments.”

This statement, featured in MDM’s July 2025 news update and podcast, reflects the company’s focus on redefining reliability standards across industries such as aquaculture, chemical processing, and environmental services. MDM’s non-metallic pump designs are engineered for high-corrosion applications, offering long service life and reduced maintenance.

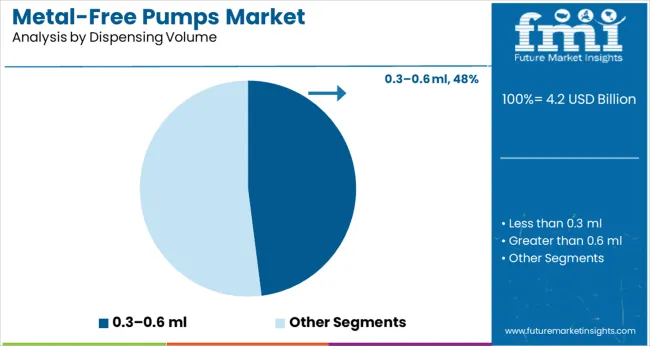

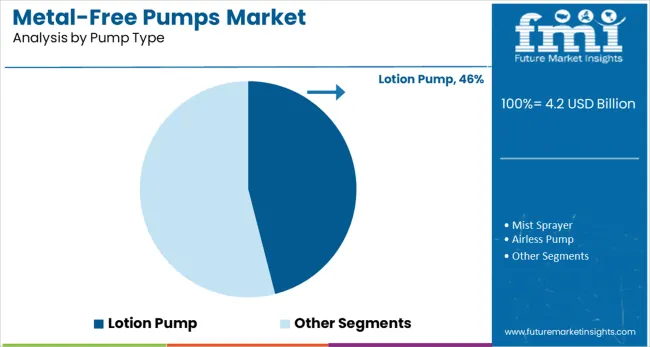

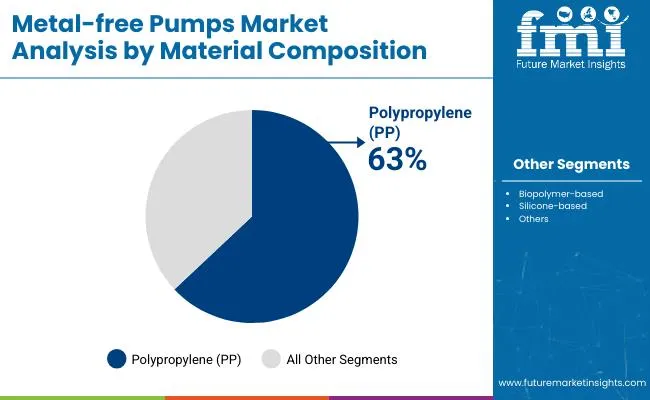

The industry is driven by rising demand for safe, non-reactive dispensing solutions in cosmetics and pharmaceuticals. Polypropylene leads material usage with 63% share, while mid-volume (0.3-0.6 ml) and lotion pumps dominate dispensing formats.

Polypropylene (PP) will remain the dominant material in metal-free pumps, accounting for 63% of the material composition in 2025. Known for its chemical resistance and moldability, PP is preferred for personal care and pharmaceutical liquids that require non-reactive containers.

Manufacturers like Aptar Group, Silgan Dispensing, and Albea use injection-molded PP for mist sprayers and airless pumps, ensuring compatibility with clean-label formulations. Its lightweight nature supports transport cost reduction, especially for global beauty exports.

Dispensing volumes between 0.3 and 0.6 ml represent the largest share at 48%, driven by rising consumer demand for controlled, single-press dosing in cosmetics and nutraceuticals. Ideal for serums, gels, and lotions, this category balances product economy with user convenience.

Brands such as L'Oréal, Neutrogena, and Aveeno heavily rely on this pump range for skin and hair treatment products. The segment also benefits from growth in refillable pump packaging for luxury beauty.

Lotion pumps will continue to dominate pump type segmentation, holding a 46% share in 2025, due to their versatility across skincare, pharma, and homecare. Companies like Raepak, Frapak, and Bona Pharma offer lotion pumps with up-lock or down-lock mechanisms, supporting leak-proof packaging and clean dispensing. Their ability to handle higher viscosity products makes them ideal for creams, moisturizers, and hair masks, especially in refillable and recyclable formats.

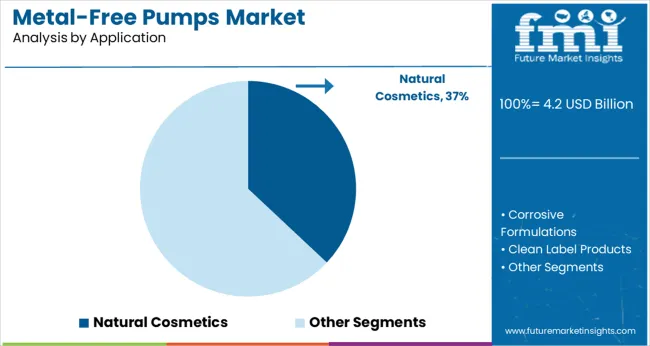

Natural cosmetics will drive substantial growth, accounting for 37% of metal-free pump applications in 2025. The segment favors metal-free systems to avoid contamination risks and support clean-label positioning. Firms like The Ordinary, Drunk Elephant, and Herbivore Botanicals use airless and PP-based pumps to preserve preservative-free formulas. These pumps enable oxygen exclusion and consistent output without metal springs or components that could degrade organic formulations.

Cosmetics will dominate the end-use landscape, making up 41% of total demand for metal-free pumps in 2025. The push for green, visually aesthetic, and non-contaminating pumps is highest in skincare and haircare.

Leading cosmetic groups such as Estée Lauder, Shiseido, and Unilever are transitioning toward recyclable pumps in glass and biopolymer containers. The growth of DTC beauty brands has also increased demand for tamper-evident and dose-specific dispensing.

The industry is expanding as chemical resistance, contamination control, and compliance needs increase across pharmaceuticals, semiconductors, and food processing. With fluoropolymer demand rising 7.8% in 2024, pump sales climbed in high-purity applications, while shifts in solvent handling standards and supply chain sourcing patterns continued to influence equipment upgrades.

High-Purity Demands Shaping Procurement Across Critical SectorsMetal-free pump units saw a 10.3% increase in shipments across pharmaceutical and specialty chemical verticals in 2024. Perfluoroalkoxy (PFA) and PTFE-based pump bodies accounted for 71.6% of units deployed in corrosive fluid environments. Cleanroom manufacturing zones drove a 13.9% rise in demand for non-metallic diaphragm pumps to meet strict extractables limits. Semiconductor fabs in Taiwan and South Korea expanded installation of contact-free drive systems to minimize particle generation during slurry transfer.

Regulatory Shifts and Solvent Handling Requirements Expanding AdoptionHazardous materials standards under REACH and TSCA prompted accelerated replacement cycles for metal-containing pump assemblies, especially in pesticide formulation and industrial coatings. End users reported a 17.4% drop in leak incidents after switching to metal-free magnetic drive pumps in high-risk processes.

In the food sector, resin-compliant models with FDA certification gained share, driven by stricter sanitization validation. Chemical manufacturers using ketones, acids, and caustics increased their metal-free pump installations by 11.2% compared to the prior year.

Cost Management and Materials Availability Influencing Buyer StrategyVirgin fluoropolymer resin prices rose 6.5% YoY in Q1 2025, affecting unit pricing in North America and parts of Europe. Some OEMs began offering hybrid polymer-composite casings to reduce dependence on PTFE supply volatility. Buyers in cost-sensitive regions, particularly Southeast Asia, shifted toward modular pump architectures to defer full system replacement. Distributors reported a 14.6% increase in small-volume orders, suggesting more fragmented procurement driven by project-based rather than fleetwide upgrades.

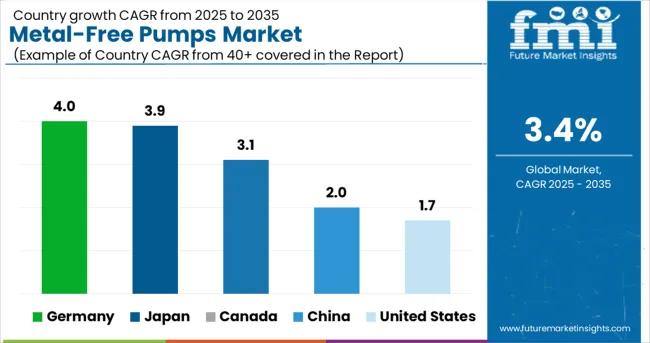

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.0% |

| Japan | 3.9% |

| Canada | 3.1% |

| China | 2.0% |

| United States | 1.7% |

The global industry is projected to expand at a CAGR of 3.4% between 2025 and 2035. Germany (OECD) leads among the profiled nations with a growth rate of 4.0%, surpassing the global average by 0.6 percentage points. Japan (OECD) closely follows at 3.9%, up 0.5% from the global baseline. Canada (OECD) stands at 3.1%, slightly under the global figure by 0.3%.

In contrast, China (BRICS) and the United States (OECD) register slower growth at 2.0% and 1.7% respectively, reflecting a divergence of 1.4% and 1.7% below the global CAGR. These differences reflect varying industrial upgrade cycles, environmental regulatory pressures, and regional preferences in pump material selection.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The United States is projected to grow at 1.7% CAGR through 2035, indicating a mature and moderately saturated demand landscape. From 2020 to 2024, uptake remained steady in pharmaceutical and industrial fluid-handling segments, though price-sensitive OEMs prioritized reconditioned units. High regulatory compliance costs have slowed procurement cycles, particularly in chemical and biotech applications. Demand has remained most consistent for air-operated diaphragm variants used in high-purity applications, where non-metal contact surfaces are mandated.

Canada is expected to grow at 3.1% CAGR over the forecast period, outperforming the US by a notable margin. This growth is underpinned by environmental upgrades in wastewater treatment and food-grade chemical handling. From 2020 to 2024, federal subsidies encouraged clean plant retrofits using non-metal pump solutions. In agri-processing facilities across Ontario and British Columbia, fully plastic diaphragm pump systems have replaced traditional stainless steel units due to corrosion risks and higher maintenance costs.

The metal-free pumps industryis set to expand at 4.0% CAGR, the highest among developed economies. From 2020 to 2024, demand grew in semiconductor and chemical coating applications, particularly in Saxony and Baden-Württemberg. OEMs are favoring perfluoropolymer-lined pumps for high-purity and abrasive fluid handling.

China is projected to grow at 2.0% CAGR, driven by industrial diversification and local manufacturing scale. Between 2020 and 2024, demand remained strongest in textile chemical dosing and agricultural fluid handling.

Larger installations in Tier 2 cities are switching to plastic centrifugal and peristaltic pumps due to better cost-performance ratios. Local manufacturers are investing in polypropylene-based pump variants to meet export specifications, particularly for Southeast Asia and Africa.

The metal-free pump industry in Japan is expected to grow at 3.9% CAGR, supported by long-term capital replacement cycles and process optimization in high-precision industries. From 2020 to 2024, cleanroom automation and semiconductor facilities increased demand for diaphragm and bellows pumps constructed entirely from fluoropolymers.

Quality compliance and energy efficiency goals continue to steer OEMs toward metal-free options. Compact plastic pump systems are also being introduced in laboratory automation and specialty chemical setups.

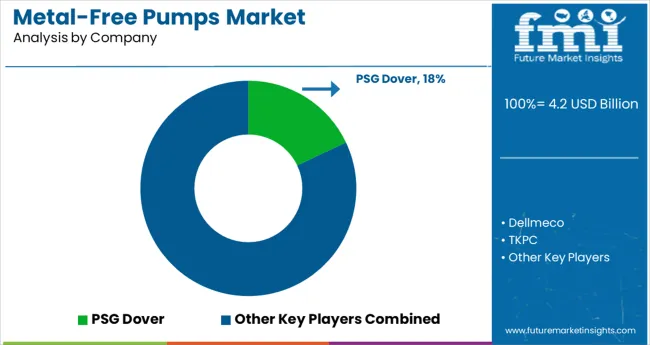

The sector is led by PSG Dover, leveraging its broad product range and global supply chain to serve chemical and industrial clients. Almatec competes with specialized air-operated diaphragm pumps for corrosive fluid handling.

Mid-sized players like Aptar and CAPARDINI focus on precision pumps for pharmaceuticals and cosmetics, using reinforced polymers to replace traditional metals. New entrants such as Dellmeco and TKPC target cost-sensitive markets with simplified designs, though material certification hurdles limit their expansion.

Barriers include high R&D costs for chemical-resistant composites and stringent FDA/EPA approvals favoring incumbents. PlastoMatic and Maxis circumvent these challenges through regional partnerships and modular pump designs, while Fti Air and YTS compete via rapid prototyping for niche industrial applications. Customer loyalty to proven brands further restricts market entry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.2 billion |

| Projected Market Size (2035) | USD 5.9 billion |

| CAGR (2025 to 2035) | 3.4% |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion (revenue) |

| Segmentation - Material Composition | All-Plastic (PP, PE), Biopolymer-based, Silicone-based |

| Segmentation - Dispensing Volume | Less than 0.3 ml, 0.3-0.6 ml, Greater than 0.6 ml |

| Segmentation - Pump Type | Lotion Pump, Mist Sprayer, Airless Pump |

| Segmentation - Application | Corrosive Formulations, Natural Cosmetics, Clean Label Products |

| Segmentation - End-Use Industry | Skincare, Haircare, Pharmaceuticals, Food Products (e.g., sauces, gels) |

| Regional/Country Coverage | North America (USA, Canada), Europe (Germany, UK, France, Italy, Spain), Asia-Pacific (China, Japan, South Korea, India, ASEAN), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (GCC Countries, South Africa, Egypt) |

| Leading Companies Profiled | PSG Dover, Dellmeco, TKPC, Almatec, Aptar, CAPARDONI, PlastoMatic, Fti Air, Maxis, YTS |

| Additional Attributes | Dollar sales by pump type and end-use, increasing demand for airless and mist sprayers in premium cosmetics, growing interest in biopolymer pumps for sustainable branding, rise in clean-label and corrosion-sensitive formulations driving adoption across skincare and pharma sectors |

The industry is projected to reach USD 5.9 billion by 2035, growing at a 3.4% CAGR.

Polypropylene (PP) leads the material segment with a 63% market share in 2025.

41% of demand in 2025 is expected to come from cosmetic packaging applications.

0.3–0.6 ml pumps lead with a 48% share due to their use in skincare and nutraceuticals.

PSG Dover is the top player with an 18% global market share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Diaphragm Pumps Market Growth - Trends & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA