The diaphragm pumps market is projected to expand from USD 5,807.7 million in 2025 to USD 10,799.8 million by 2035, reflecting a CAGR of 6.4% over the forecast period. Growth is expected to be supported by increased demand across industries where precise, leak-free fluid transfer is critical-particularly in pharmaceuticals, water treatment, chemicals, oil & gas, food & beverage, and power generation.

In May 2025, ARO introduced the EXP Series 3-inch non-metallic air-operated diaphragm pump at the ChemTech conference. This pump was designed to handle aggressive chemicals and was equipped with an electronic interface enabling stroke monitoring, solenoid-driven cycle-rate adjustments, and leak detection. A maximum flow rate of 1,079 L/min was supported using PTFE diaphragms, which were selected for their extended service life in corrosive environments.

Earlier, in April 2025, enhancements to Graco’s QUANTM electric double diaphragm pump were unveiled. The unit was integrated with a 480 V input and XTREME TORQUE motor, allowing reductions in both size and weight while preserving operational reliability. “Engineers, plant operators, and C-level leaders require verifiable performance data before they make a change on their lines,” stated Matthew Bergman, Global Product Manager at Graco, highlighting the product’s alignment with expectations for energy efficiency and precision control.

In January 2025, KNF launched its FM 50 OEM liquid diaphragm pump series, tailored for metering tasks in medical diagnostics, inkjet printing, and food-grade dosing. The pumps delivered flow rates of 100–500 ml/min at ±2% accuracy, with control offered via voltage or PWM signals.

Growth has been further reinforced by industry-wide adoption of electronically controlled diaphragm pumps with PTFE or EPDM linings to comply with hygiene and chemical resistance standards. Integration into PLC and SCADA systems has enabled remote operation, cycle tracking, and automated batching.

With continued prioritization of contamination control and regulatory compliance, diaphragm pumps are expected to see widespread adoption. Modular construction, enhanced digital interfaces, and electrified drive systems will likely define the next phase of innovation through 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5,807.7 million |

| Industry Value (2035F) | USD 10,799.8 million |

| CAGR (2025 to 2035) | 6.4% |

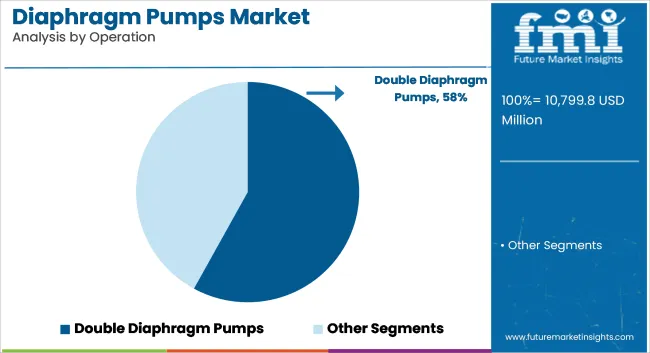

Double diaphragm pumps accounted for 58% of the global market share in 2025 and are projected to grow at a CAGR of 6.7% through 2035. Their adoption was driven by superior performance in handling corrosive, abrasive, and high-solid content fluids across demanding applications.

In 2025, double diaphragm pumps were widely used in chemical transfer, sludge removal, and slurry movement within wastewater, petrochemical, and construction industries. Their ability to operate in dry conditions, self-prime, and deliver consistent flow rates under variable pressure made them suitable for unsteady process conditions.

Manufacturers prioritized diaphragm material advancements (PTFE, EPDM) and air valve innovations to reduce downtime and improve cycle life. Modular pump configurations and ease of disassembly supported maintenance efficiency in field operations, reinforcing usage in both portable and fixed installations across global industrial settings.

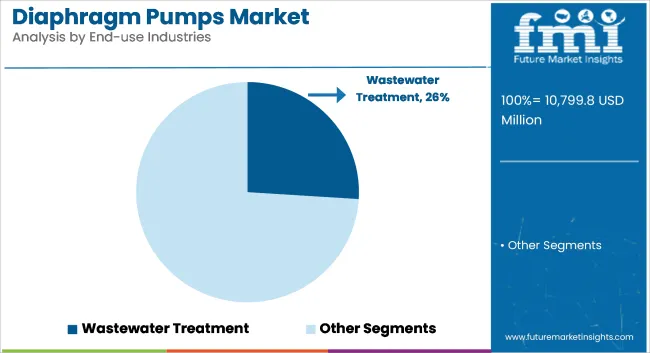

The wastewater treatment industry held 26% of the global diaphragm pump market by end-use in 2025 and is forecast to grow at a CAGR of 6.6% through 2035. Diaphragm pumps were essential in this sector for dosing flocculants, polymers, and chemicals, as well as transferring sludge and slurry in treatment processes.

In 2025, municipal and industrial wastewater facilities adopted air-operated and electric diaphragm pumps due to their clog-resistant performance, ease of maintenance, and capability to handle varying fluid viscosities. Pump configurations were adapted for decentralized treatment units, centralized plants, and mobile filtration systems.

Demand was particularly strong in Asia-Pacific, the Middle East, and parts of Eastern Europe where expanding urban infrastructure and stricter effluent regulations drove investment in new treatment capacities. Manufacturers introduced energy-efficient models with improved flow control and leak-proof designs, supporting compliance with environmental standards and operational reliability across utility installations.

Challenges

High Initial Costs: A Barrier for Widespread Diaphragm Pump Adoption

Diaphragm pumps are esteemed for their efficacy and low operational costs, but high initial investment has become a hurdle, particularly for small and medium enterprises (SMEs) to address. As opposed to traditional pumps, diaphragm pumps need special materials and skilled engineers which increases their initial costs considerably.

Moreover, the wear and tear of the parts and the need to change the diaphragm just add more expenses to the long term, this discourages the budgetary constraints of the buyers. Even if these pumps are of higher durability and chemical resistance, the financial burden that clients see is most of the time the factor driving them to opt for cost-effective choices.

Nevertheless, with technology advancement not only the pump durability but also the number of times maintenance is needed will decrease making the cost-benefit of diaphragms more positive thus lead to their acceptance in a larger number of sectors.

Raw Material Price Volatility: A Challenge for Pump Manufacturers

The market for diaphragm pumps greatly impacts from the fluctuations in the price of raw materials, especially in the case of stainless steel, rubber, and specialty polymers. The major sources of raw materials that make the pumps long-lasting, resistant to corrosion, and compatible with chemicals are used in them.

However, market volatility caused by supply chain interruptions at a global level, trade policies, and inflation can drastically impact production cost. Sudden spikes in raw material costs result in higher manufacturing costs, which in turn cause higher pump prices and reduced profit margins for the manufacturers.

To counter these issues, manufacturers are resorting to substitute materials, forging strategic alliances with suppliers, and implementing localized production strategies. In addition, they are interested in the development of recycling programs and in the sustainable procurement of raw materials in order to lessen their reliance on volatile markets and to provide improved long term price stability.

Alternative Pump Technologies: Rising Competition in the Market

Introducing new alternatives, diaphragm pumps despite the benefits they bring are in tough competition with other pumping technologies like peristaltic pumps, and centrifugal pumps. The centrifugal pump is popular in high-flow applications because of its constant operation and low maintenance needs while peristaltic pumps excel in the precision of tricky fluid handling.

This auto attack makes the adaptation of diaphragm pump manufacturers a must in the form of innovations like high energy efficiency, new diaphragm materials, and better control systems.

Furthermore, the marketing strategies which are emphasizing the strengths of diaphragm pumps such as capabilities of what to use those pumps with corrosive fluids, solids, and precise dosing techniques must be the postpartum measure to stay in the market. As the industries beget new ones, hybrid technologies and smart automation are possibly the new level for gearbox pumps to meet.

Opportunities

Smart Technologies: Revolutionizing Diaphragm Pump Efficiency

The collaboration of smart sensors, IOT-based remote monitoring, and automation is revolutionizing the function of diaphragm pumps. Smart technologies make possible the real-time tracking of the performance, programming of maintenance predictively, and self-optimizing, that is, avoiding downtime and operational costs.

IOT-enabled pumps are giving out information about energy consumption, and flow rates, while providing the time needed for wear-and-tear analysis that allows for a timely schedule of preventive maintenance. This of course will decrease unexpected failures and will enlarge the lifespan of the pumps.

Furthermore, AI-embedded diagnostics assist in optimum pump functionality which can lead to a peak output of the pump with minimal consumption of power. Under industries focusing on digital transformation, the emergence for intelligent self-regulating pumping systems will be on the rise, therefore it will cause the technological advancements to be a market expansion driver.

Emerging Markets: Expanding Growth Opportunities for Pump Manufacturers

The swift industrialization of new markets in Africa, Latin America, and Southeast Asia offers a golden opportunity for diaphragm pump makers. These areas are witnessing the biggest boost in water treatment, agriculture, chemical processing, and mining industries all of which need efficient fluid handling systems.

Government initiatives like the clean water supply campaign, industrial automation program, and agricultural modernization plan would further mean increased demand for the advanced pumping solutions. The birth of new manufacturing hubs and the upswing of foreign investments in such economies would, in addition, pave the way for pump makers to get into regional partnerships, production units, and the like.

By giving solutions with a better-cost ratio, durability, and energy saving, ozone pump manufacturers can get a better share of the profit of these rapidly growing untapped markets.

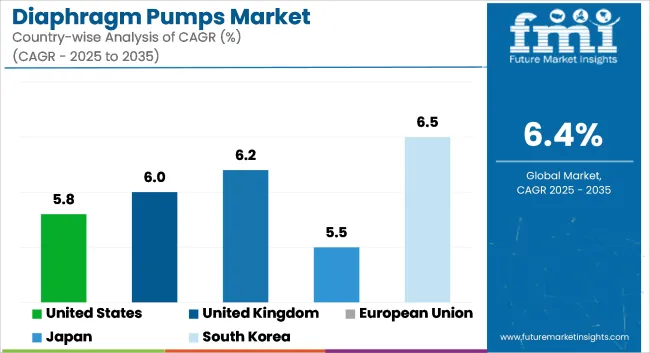

The market in the United States is experiencing continuous growth which is mainly driven by the development of diaphragm pumps in industries such as water treatment, chemical processing, and oil and gas. The country is undertaking various initiatives such as infrastructure improvement, sustainable environmental practices, and industrial efficiency that are creating the need for modern pumping techniques.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The UK diaphragm pumps market is showing a slight but steady increase, promoted by the promotion of industrial automation, stricter environmental rules, and broader sustainability initiatives. The market is now in a good position to gain from the implementation of clean energy and water management measures.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

Diaphragm pump form a major and good market in the European Union which is attributed to the increase sewer environmental laws, technological development, and industrial automation. The region is moving towards energy-efficient and sustainable solutions to face the long-term climate and emissions reduction target.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.2% |

The expansion of Japan's market is attributed to fast technological strides, an undeterred emphasis on high-quality manufacturing, and the increasing requirement for precision machining in industrial processes. The realm of locating smart and energy-efficient diaphragm pumps has been conquered by the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The diaphragm pumps market in South Korea is prospering strongly with the backing of its flourishing semiconductor, electronics, and clean energy industries. The country’s emphasis laid on innovation and sustainability is heightening the asking for latest pumping technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

The diaphragm pumps market is a highly competitive and rapidly evolving sector driven by the demand for efficient fluid transfer solutions across multiple industries, including chemicals, water treatment, pharmaceuticals, and oil & gas. Increasing investments in wastewater management, rising demand for hygienic pumping solutions in food & beverage applications, and advancements in pump technology contribute to the market's growth.

Key global players include IDEX Corporation, Ingersoll Rand, Flowserve Corporation, Grundfos Holding A/S, and Yamada Corporation, with regional contributors playing significant roles in local markets. The market is experiencing trends such as technological advancements in energy-efficient pumps, adoption of smart pump technologies, and a growing emphasis on sustainable and leak-free pumping solutions.

The diaphragm pumps market is set for steady growth, driven by technological advancements and increasing demand from industries requiring precision fluid transfer solutions. Companies focusing on innovation, energy efficiency, and sustainability will likely dominate the competitive landscape.

DEX Corporation

IDEX Corporation is a leading provider of specialized diaphragm pumps for industrial and sanitary markets. The company focuses on precision-engineered solutions, ensuring high performance and sustainability.

IDEX has recently made significant advancements in energy-efficient pump designs, contributing to cost savings and environmental benefits. Additionally, their integration of Internet of Things (IoT) technology enhances pump monitoring and control, further elevating the company's commitment to innovation and operational efficiency.

Ingersoll Rand

Ingersoll Rand is a key player in air-operated diaphragm pumps, serving a wide range of applications. The company focuses on developing high-efficiency, low-maintenance pumping technologies that improve operational reliability.

Ingersoll Rand is also expanding its presence in the water treatment and energy sectors, positioning itself as a leading provider of innovative solutions to meet growing global demands for sustainable and efficient pumping systems in these industries.

Flowserve Corporation

Flowserve Corporation specializes in high-performance diaphragm pumps with exceptional chemical resistance, designed to handle demanding environments. With a strong customer base in the pharmaceutical and chemical industries, Flowserve provides reliable and durable pumping solutions to ensure safe and efficient operations.

The company is focused on enhancing its global supply chain capabilities to meet the increasing demand for its products. By investing in innovation and expanding its network, Flowserve aims to strengthen its position in the global market while ensuring high-quality service and maintaining operational efficiency for customers across various sectors.

Grundfos Holding

Grundfos Holding A/S is at the forefront of innovation in smart, energy-efficient pumping solutions. A leader in sustainable water management and industrial automation, the company focuses on providing environmentally friendly and cost-effective systems.

Grundfos is actively developing IoT-based monitoring systems to optimize pump performance, enabling real-time data collection for enhanced efficiency and maintenance. This commitment to innovation positions Grundfos as a key player in advancing sustainable technologies for water and industrial applications worldwide.

In terms of Mechanism, the industry is divided into Air Operated Diaphragm Pumps, Electrically Operated Diaphragm Pumps

In terms of Application, the industry is divided into Dewatering Diaphragm Pumps, Filter Press, Fluid Transfer, Metering and Dispensing

In terms of End User, the industry is divided into Single Diaphragm Pumps, Double Diaphragm Pumps

In terms of End-use Industries, the industry is divided into Construction Industry, Wastewater Treatment, Chemicals and Petrochemicals Industry, Pharmaceutical Industry, Food and Beverage Industry, Printing and Packaging industry, Paper and Pulp Industry

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Diaphragm Pumps Market is projected to reach USD 5,807.7 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.4% over the assessment period.

By 2035, the Diaphragm Pumps Market is expected to reach USD 10,799.8 million.

The electrically operated segment lies expected to hold a significant share due to increasing urbanization, driving the Diaphragm Pumps Market.

Major companies operating in the Diaphragm Pumps Market IDEX Corporation, Ingersoll Rand, Flowserve Corporation, Grundfos Holding A/S, Yamada Corporation.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 8: Global Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 16: North America Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 20: Latin America Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 25: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 28: Western Europe Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 29: Western Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 32: Western Europe Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 33: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 36: Eastern Europe Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 37: Eastern Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 40: Eastern Europe Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 41: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 44: South Asia and Pacific Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 45: South Asia and Pacific Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 48: South Asia and Pacific Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 52: East Asia Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 53: East Asia Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 56: East Asia Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 57: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Value (US$ Million) Forecast by Mechanism, 2018 to 2033

Table 60: Middle East and Africa Volume (Units) Forecast by Mechanism, 2018 to 2033

Table 61: Middle East and Africa Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 64: Middle East and Africa Volume (Units) Forecast by End Use Industries, 2018 to 2033

Figure 1: Global Value (US$ Million) by Mechanism, 2023 to 2033

Figure 2: Global Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 10: Global Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 18: Global Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 21: Global Attractiveness by Mechanism, 2023 to 2033

Figure 22: Global Attractiveness by Application, 2023 to 2033

Figure 23: Global Attractiveness by End Use Industries, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Mechanism, 2023 to 2033

Figure 26: North America Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 34: North America Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 42: North America Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 45: North America Attractiveness by Mechanism, 2023 to 2033

Figure 46: North America Attractiveness by Application, 2023 to 2033

Figure 47: North America Attractiveness by End Use Industries, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Mechanism, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 58: Latin America Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 66: Latin America Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 69: Latin America Attractiveness by Mechanism, 2023 to 2033

Figure 70: Latin America Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Attractiveness by End Use Industries, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Value (US$ Million) by Mechanism, 2023 to 2033

Figure 74: Western Europe Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 76: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 82: Western Europe Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 83: Western Europe Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 84: Western Europe Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 85: Western Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 90: Western Europe Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 91: Western Europe Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 92: Western Europe Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 93: Western Europe Attractiveness by Mechanism, 2023 to 2033

Figure 94: Western Europe Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Attractiveness by End Use Industries, 2023 to 2033

Figure 96: Western Europe Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Value (US$ Million) by Mechanism, 2023 to 2033

Figure 98: Eastern Europe Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 100: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 106: Eastern Europe Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 107: Eastern Europe Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 108: Eastern Europe Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 109: Eastern Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 114: Eastern Europe Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 115: Eastern Europe Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 116: Eastern Europe Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Mechanism, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by End Use Industries, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Value (US$ Million) by Mechanism, 2023 to 2033

Figure 122: South Asia and Pacific Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 124: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 130: South Asia and Pacific Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 131: South Asia and Pacific Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 132: South Asia and Pacific Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 133: South Asia and Pacific Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 138: South Asia and Pacific Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 139: South Asia and Pacific Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 140: South Asia and Pacific Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 141: South Asia and Pacific Attractiveness by Mechanism, 2023 to 2033

Figure 142: South Asia and Pacific Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Attractiveness by End Use Industries, 2023 to 2033

Figure 144: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Value (US$ Million) by Mechanism, 2023 to 2033

Figure 146: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 148: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 154: East Asia Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 155: East Asia Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 156: East Asia Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 157: East Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 162: East Asia Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 163: East Asia Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 164: East Asia Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 165: East Asia Attractiveness by Mechanism, 2023 to 2033

Figure 166: East Asia Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Attractiveness by End Use Industries, 2023 to 2033

Figure 168: East Asia Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ Million) by Mechanism, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ Million) Analysis by Mechanism, 2018 to 2033

Figure 178: Middle East and Africa Volume (Units) Analysis by Mechanism, 2018 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Mechanism, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Mechanism, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 186: Middle East and Africa Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Mechanism, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by End Use Industries, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA