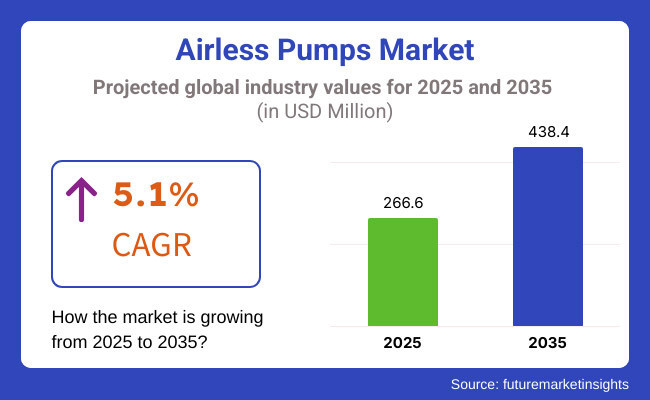

The airless pumps market is expected to rise from USD 266.6 million in 2025 to USD 438.4 million by 2035. This growth, driven by a CAGR of 5.1% during the forecast period, is primarily fuelled by the increased adoption of airless dispensing technologies in the skincare, pharmaceutical, and cosmetic sectors. These systems eliminate dip tubes, preventing air contact and contamination, which is essential for maintaining the efficacy of sensitive formulations.

In the cosmetics and personal care industry, demand for airless packaging is being driven by the growing preference for organic, preservative-free formulations. These products are often sensitive to oxidation and require protection from external exposure. Airless pumps provide that barrier, ensuring product longevity.

In a 2024 press release, Aptar Pharma announces that the recent approval by the National Medical Products Administration (NMPA) in China of Sinomune Pharmaceutical’s metronidazole gel for the treatment of papulopustular rosacea uses Aptar Pharma’s Mezzo+ CS Airless dispensing solution for dermal drug delivery. This approval marks the first Aptar Pharma Airless+ drug delivery system used for an approved drug product in China and re-confirms Aptar Pharma’s expertise in developing and supporting innovative drug delivery solutions worldwide.

“With this approval, we are happy to be expanding the reach of our proven Airless+ drug delivery technology to the China market,” said Dr. Stefan Hellbardt, Vice President Business Development and Scientific Affairs, Consumer Healthcare at Aptar Pharma. He also added “Aptar Pharma’s proven Airless+ technology not only provides better protection for drug contents, but also gives patients a more convenient user experience.”

Xin Yao, China President and Vice President & General Manager of Aptar Pharma, NEA, commented, “We are pleased that our Aptar Pharma Airless+ technology is now available to patients in China who suffer from papulopustular rosacea

In pharmaceuticals, particularly in dermatology and specialty drugs, airless pumps are being utilized for their hygienic, metered dispensing features. With a growing focus on patient safety and regulatory compliance, pharmaceutical companies are increasingly replacing traditional packaging with airless systems that reduce contamination risks and improve dose accuracy. Applications in topical treatments and ophthalmic drugs are gaining traction, supported by rising awareness around pharmaceutical packaging innovations.

Environmental sustainability also plays a central role in the market’s evolution. As regulations push for greener solutions, packaging manufacturers are responding with recyclable and refillable airless pump options. In 2024, Beauty Packaging Manufacturer Quadpack Touts Mono-material Ultra Solo and highlighted “We are aiming for greater recyclability in our product development,” explains Quadpack Category Specialist Alejandra Isern, “and nothing is easier to recycle than a mono-material pack.

Ultra Solo is also our first airless solution in PE, expanding the range of materials in our airless portfolio”. Material innovation, precise molding technologies, and enhanced pump mechanics are also improving product aesthetics and performance, positioning airless pumps as a preferred solution in both premium and mass-market segments.

The airless pump technology is being transformed by consumer safety expectations, sustainable packaging mandates, and pharmaceutical compliance needs. This positions the market for long-term growth, with innovation and sustainability at the forefront of its trajectory through 2035.

The skincare application segment is projected to dominate the global airless pump market, accounting for approximately 47.8% of the total share by 2025. This strong demand is driven by the increasing need to preserve the integrity of active skincare ingredients such as vitamin C, peptides, and retinoids, which are highly sensitive to air and microbial contamination. Airless dispensing technology provides a hermetically sealed environment that prevents oxidation and extends shelf life, making it the preferred choice among skincare manufacturers.

As consumers continue to prioritize product hygiene, precision in dosage, and luxurious user experience, airless pumps are gaining traction in a variety of skincare categories including moisturizers, anti-aging serums, sunscreens, and clinical-grade formulations. In addition, the growth of personalized beauty routines and high-performance cosmetic treatments has led to a surge in demand for custom-designed airless packaging with features such as double-chamber compartments, refillable options, and vacuum-based dispensing.

The integration of smart packaging elements, such as usage trackers and digitally interactive features, is also further driving the adoption of airless pumps in the skincare space. These innovations, supported by collaborations between global brands and technology-focused startups, have positioned skincare as the most dynamic application area in the airless pump market.

In terms of material type, plastic continues to hold the dominant position in the global airless pump landscape, with an estimated market share of 78.4% in 2025. Plastic’s widespread adoption is primarily attributed to its versatility, cost efficiency, and suitability for high-volume manufacturing. Materials such as polypropylene, polyethylene, and PET are commonly used in airless pump production due to their lightweight nature, barrier properties, and compatibility with a broad range of product viscosities.

These materials also allow for flexible design configurations, which are essential in delivering user-centric packaging formats across both mass and premium skincare segments. While environmental concerns have led to growing scrutiny of plastic usage, the category is undergoing transformation through the introduction of more sustainable variants, including post-consumer recycled plastics, biodegradable alternatives, and mono-material constructions that enhance recyclability.

Furthermore, the use of plastic enables seamless integration with automated filling equipment and supports the development of innovative, sustainable dispensing formats. As global brands commit to circular packaging goals, plastic airless pumps are being re-engineered to balance performance with sustainability, ensuring their continued dominance in the market.

High Production Costs and Material Compatibility Issues

The high production costs, especially for high-end and sustainable packaging solutions, is one of the key restraining forces in the airless pumps market. In contrast, airless pump systems must be designed to ensure airtight sealing, precise dosing, and interchangeable product formulations.

These might be multi-layer barriers, piston-based dispensers, ultra-vacuum seals, etc., all of which makes them expensive to manufacture and expensive compared to a standard pump or squeeze dispenser. For small and mid-sized brand owners, this poses a huge problem because (a) airless is not really affordable and (b) they’ll have to spend time and budget on their packaging for products that don’t need it.

Another obstacle is material incompatibility, a problem most notably seen in the pharmaceutical and cosmetics industry, where product stability is paramount. Certain formulations respond with plastic or metal vessel parts, particularly when possessing volatile or reactive substances, causing degradation or loss of efficacy.

Sure, manufacturers have begun dabbling in both chemically-resistance and even eco-friendly materials but the widespread adoption, without sacrificing performance, remains a tall order.

By investing in cost-efficient production, automation, and material innovation, companies can reduce these challenges. This includes developing mono-material airless pumps that can be more simply recycled and reduce the number of components, which can help drive down costs.

Also, to increase the compatibility of materials they will ensure better compatibility between packaging manufacturers and product formulators, leading to much broader adoption across the industry.

Rising Demand for Precision Dispensing and Sustainable Solutions

The growing consumer demand for precision dispensing, product preservation and hygienic packaging is further driving the demand for airless pumps and its applications in industries from skincare to pharmaceuticals and nutraceuticals that use airless pumps to protect their active ingredients from damaging oxidation, contamination and degradation.

Unlike traditional pumps that let in air after each use, airless systems create a vacuum seal that traps product fresh and maintains its consistency. Another path for growth lies in sustainability-driven innovation. Under pressure from both regulatory bodies and consumers to embrace sustainable packaging, brands are looking for alternatives to traditional plastic-based airless pumps.

Solution: Refillable airless systems, biodegradable dispenser components, and PCR (post-consumer recycled) plastics other companies are looking into using aluminium-based airless pumps and bio-resin materials that are both durable and possibly recyclable.

Another factor that enhances the market potential is the diversification of airless pump applications beyond cosmetics and pharmaceuticals-into food, automotive lubricants, and household products. Metered dispensing, touchless pump systems, IoT-integrated smart pumps are some of the innovations that can enhance the user experience and help packaging manufacturers create new revenue streams.

Growth in this demand is driven by the growing need for upscale skincare, cosmetics and pharmaceutical products which require accurate and contamination-free packaging. Sustainable airless pump manufacturing is being promoted by the tendency toward environmentally-friendly and reusable packaging solutions.

Moreover, the extensive rise in the adoption of airless pumps in the food & beverage sector for use in sauces and condiments also provide lucrative opportunities for the market to grow. This, in turn, is spurring the market growth in USA such as innovations in technology such as controlled dosage mechanism smart dispensers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

In the UK, the increasing awareness regarding sustainable packaging for personal care, cosmetics, and pharmaceuticals will, in turn, effectuate the airless pumps market. Another key factor for the growing demand for refillable and biodegradable airless pumps is government mandates to reduce plastic waste.

Airless dispensing solutions are being used by a number of leading beauty and skincare brands in the UK to extend the life of products, making it easier for consumers to benefit from their use. Growth in market is further expected as innovations in material like bio-based plastics improve.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

With a sound presence of luxury cosmetics, skincare and the pharmaceuticals industry, Germany, France and Italy commands the chunk of market in the airless pumps across EU. Single-wall packaging airless pumps that are recyclable and reusable are being used by manufacturers driven by EU's harsh regulations on single-use plastics and sustainability movement.

And France is setting the stage for airless dispenser innovation for luxury beauty, while Germany is increasing the uptake of airless pumps within the pharmaceutical sector that demand precise dosage control. According to a data bank report published by Laboratory, the demand for sustainability dispensing solutions in food and beverage packaging is growing rapidly, which will contribute to the growth of sustainable dispensing solutions market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

The growth of Japan's airless pumps market has been aided by advances in precision dispensing in cosmetics, skincare and medical use. Furthermore, the Japanese beauty companies emphasize the nature of quality products with innovative packaging solutions that have resulted in the growth of airless pumps to allow shelf-life longevity of a product along with providing controlled dispensing.

Meanwhile, the country’s growing interest in sustainable materials is pushing manufacturers to explore refillable airless pump options. The rising reliance of the pharmaceutical industry on sterile and airless dispensing solutions further facilitates the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Notably, the country’s K-beauty scene is among the largest influencers in the global marketplace, and the airless pumps segment is developing progressively in the region.

Demand for airless pump solutions for travel-able beauty and skincare brands is also on the rise, with airless designs that are biodegradable and refillable part of an official push for sustainable packaging now gaining interest. In addition, in South Korea, the pharmaceutical and food sectors are increasingly implementing airless pumps, further bolstering market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The increasing demand for an accurate, clean, and sustainable dispensing for cosmetics, personal care, pharmaceuticals, and food packaging are the key factors fuelling the growth of the airless pumps market.

Revolutionary for cosmetics, plastic-free pumps and dispensers, new dispensing technologies for dosage control, premium refillable pump and dispenser solutions. New plastic-free and eco-materials are being developed for brands along with superior pump technology to deliver a better consumer experience and reduce product waste.

AptarGroup, Inc. (20-24%)

AptarGroup dominates the airless pumps market, offering high-performance, eco-friendly dispensing systems for personal care, beauty, and pharmaceutical applications.

Silgan Dispensing Systems (14-18%)

Silgan provides innovative and recyclable airless pump solutions designed for precision dosing and extended product shelf life.

Albea Group (10-14%)

Albea leads in sustainable packaging, integrating PCR materials and lightweight airless pumps for personal care and cosmetics.

Quadpack Industries (8-12%)

Quadpack specializes in high-end airless pump solutions with custom designs for luxury skincare and fragrance brands.

Lumson S.p.A (5-9%)

Lumson focuses on elegant and protective airless pump systems, ensuring product integrity with stylish and functional packaging.

Other Key Players (35-45% Combined)

Several global manufacturers contribute to the airless pumps market with specialized and sustainable solutions across industries. These include:

The Airless Pumps Market was valued at approximately USD 266.6 million in 2025.

The market is projected to reach USD 438.4 million by 2035, growing at a compound annual growth rate (CAGR) of 5.1% from 2025 to 2035.

The demand for Airless Pumps Market is expected to be driven by the rising demand for preservative-free skincare products, increasing use in pharmaceutical packaging for precision dosing, and the shift toward sustainable, refillable, and hygienic dispensing solutions in cosmetics and healthcare.

The top 5 countries contributing to the Airless Pumps Market are the United States, China, Germany, France, and Japan.

The Skincare and Pharmaceutical Applications segment is expected to lead the Airless Pumps market, driven by the growing preference for airless dispensing technology in premium skincare, medical formulations, and sensitive liquid-based products requiring extended shelf life and contamination-free delivery.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Pump Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Pump Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Pump Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Pump Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Pump Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Pump Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Material, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Airless Pumps Market Share

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Packaging Market Growth - Demand & Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Market Share Breakdown of Airless Packaging Industry

Airless Bottles Market

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA