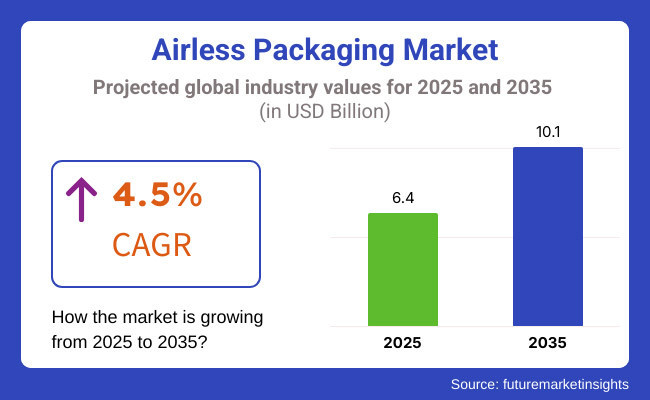

The global airless packaging market is estimated to be worth USD 6.4 billion in 2025 and is projected to reach USD 10.1 billion by 2035, expanding at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035.

This growth is driven primarily by increasing applications across the beauty, personal care, and pharmaceutical sectors, as well as technological advancements in pumping mechanisms and barrier materials. The expansion of e-commerce channels, especially in beauty and healthcare products, further accelerates market demand, as reported by Future Market Insights

Airless packaging technology plays a critical role in preserving sensitive formulations by protecting them from oxidation, contamination, and spoilage. This ability extends the shelf life of products and reduces the need for preservatives, making it particularly attractive in the personal care industry.

The growing consumer preference for higher-end, natural, and organic beauty products, especially in emerging markets has created new growth avenues within the airless packaging segment. Sustainability remains a key market driver. Increased consumer awareness about eco-friendly and recyclable packaging is compelling manufacturers to innovate.

The shift towards greener airless packaging aligns with global sustainability initiatives, pushing companies to explore biodegradable materials and efficient designs that minimize waste. This trend has gained momentum alongside tighter regulations targeting packaging sustainability worldwide.

Aptar Beauty and Pinard Beauty Pack have announced the launch of their latest innovation, Future Airless PET®. This groundbreaking product represents a significant step forward in the world of packaging, offering a fully recyclable, omnichannel, and high-capacity airless packaging solution.

The driving force behind this development is the combination of Aptar’s Future PE pump and Pinard’s patented Airless PET bottle-in-bottle technology.This collaborative effort combines the expertise of both companies in airless dispensing systems and plastic bottles, resulting in a modern packaging solution catering to personal cleansing, body care, hair care, and sun care products.

Madalina Dragan, Marketing Director Personal Care EMEA at Aptar Beauty, underlined the shared values that led to this partnership. She emphasized, “This partnership was born from shared values: the drive to innovate, the demand for high performance, and the pursuit of sustainability. Both companies have a track record in product excellence and hold the EcoVadis Platinum Medal, so there was a strong synergy in our collaboration. Future Airless PET reflects our strengths and our values.”

Paulo Coelho, Plant Director at Pinard, expressed the importance of having a reliable and sustainably designed pump, saying, “When our first airless PET prototype was released, we quickly realized that this innovation would benefit from a reliable and sustainably designed pump, in order to offer a complete, robust, and successful airless solution. With Aptar and its Future pump, we found the ideal partner to meet market expectations by providing an end-to-end, eco-designed solution.”

Pharmaceutical applications also contribute substantially to market growth. Airless packaging enables precision dosing and maintains longer stability of liquid drugs, which improves patient compliance and reduces contamination risks. This technology is increasingly adopted for sensitive formulations such as vaccines and biologics, supporting its broader use in the healthcare industry.

Technological progress continues to redefine the market. Developments in advanced pumping systems improve dose accuracy and user experience. Enhanced barrier materials, including multilayer laminates and coatings, offer superior protection against moisture and oxygen ingress, ensuring product integrity.

The integration of smart packaging solutions, including sensors and tracking, is also emerging to meet evolving consumer and regulatory demands. The growth of e-commerce platforms such as Worten.com has created direct-to-consumer channels that favour airless packaging due to its convenience, product protection, and premium appeal. As online beauty and health sales rise, packaging solutions that maintain product efficacy during transit and use gain competitive importance.

Regionally, North America and Europe currently hold substantial market shares due to advanced manufacturing and regulatory frameworks encouraging sustainable packaging. However, Asia-Pacific is expected to register the fastest growth, supported by rising disposable incomes, rapid urbanization, and increasing adoption of premium beauty and pharmaceutical products.

The airless packaging market is poised for sustained growth, driven by technological innovation, increasing demand for sustainable and protective packaging, and expanding applications in personal care and pharmaceuticals. Manufacturers who prioritize sustainability and consumer convenience are best positioned to capitalize on this evolving market landscape.

The beauty segment is expected to lead the airless packaging market, commanding approximately 68% market share by 2025. Growth is fueled by increasing demand for premium, high-performance packaging solutions that preserve product integrity and extend shelf life.

Airless packaging prevents oxidation and contamination, enabling brands to formulate preservative-free skincare, haircare, and cosmetic products with enhanced biological activity. Over 65% of premium beauty brands have adopted airless packaging to meet consumer preferences for luxury, aesthetics, and functionality.

Key players like L’Oréal, Estée Lauder, and Shiseido invest heavily in recyclable materials, refillable dispensers, and biodegradable components to comply with global sustainability mandates. The segment also benefits from innovations such as RFID-enabled authentication, digital expiry tracking, and dosage-adjustable multi-chamber systems, providing superior consumer experience and brand transparency. Despite challenges including higher production costs and limited recyclability of some materials, advances in mono-material designs and AI-driven packaging optimization promise sustained expansion.

The healthcare segment is projected to capture roughly 32% market share by 2025 in the airless packaging market. This growth is driven by rising demand for packaging that ensures pharmaceutical and nutraceutical product stability, particularly for preservative-free topical, ophthalmic, and dermatological formulations.

Over 50% of recent pharmaceutical packaging innovations involve airless dispensing technologies, highlighting their growing importance in patient safety and regulatory compliance. Advanced solutions like one-way valve systems, vacuum-sealed dispensers, and aseptic filling enable sterile, tamper-evident packaging compliant with stringent healthcare regulations.

Innovations including child-resistant pumps, metered-dose dispensers, and anti-counterfeit features further enhance safety and efficacy. Although adoption has been gradual due to regulatory and cost barriers, emerging trends such as biodegradable materials, IoT-enabled packaging, and smart medication tracking systems are expanding market reach. Pharmaceutical companies like Pfizer and Johnson & Johnson actively invest in these technologies to meet evolving healthcare demands globally.

High Manufacturing Costs and Material Sustainability Concerns

Key players are focused on developing innovative airless packaging solutions to meet the demand for cost-effective designs, as overall packaging options have been impacted due to the rigid and high cost of advanced packaging technologies along with a growing need for sustainable lower-cost materials.

Airless packaging systems designed to keep products free from oxidation and contamination are advancements that combine special materials like multilayer barrier film and piston-based dispensers and require a high degree of engineering for a perfect seal.

Production is more complex, and so costs more to manufacture than traditional packaging alternatives. As a result, this type of packaging is less accessible for smaller brands and for unfashionable, cost-sensitive industries that still use a lot of conventional packaging.

Last, sustainability now ground to a halt as most airless packaging systems continue to rely on plastics such as polypropylene and polyethylene, contributing to environmental waste. Though recyclability is growing, the multilayer structure of airless containers often makes it challenging to separate and recycle.

Regulatory pressures, driven by things like more stringent environmental legislation, the corporate push for sustainability, and consumer demand, have led a lot of manufacturers to try to create more eco-friendly alternatives, but switching to biodegradable or entirely recyclable materials without sacrificing quality or performance is still a primary challenge that must be overcome.

Going forward, businesses need to embrace more economically-friendly manufacturing processes that are not only affordable but also incorporate features like lightweight packaging designs and material optimization. Developing mono-material airless packaging to improve recycling, as well as using post-consumer recycled (PCR) plastics or bio-based resins, will not only help brands meet changing sustainability regulations and consumer preferences.

Increasing Demand for Premium & Eco-Conscious Packaging Solutions

The increasing demand for sustainable packaging solutions and premium airless packaging offers a lucrative opportunity for the growth of airless packaging market. Focusing on convenience, hygiene and product life, airless dispensers hold significant appeal in the areas of personal care, pharmaceuticals and premium cosmetics. Airless packaging has been a boon for the beauty and skincare industry, which relies on active ingredients like retinol, vitamin C and organic ingredients that are degraded by air.

Sustainability-minded innovations 100% refillable airless packaging systems, biodegradable dispenser materials are gaining momentum.Companies that create circular economy packaging models meaning containers aren’t single-use and are able to be reused or recycled easily will reap the reward of regulatory incentives as well as rising demand among environmentally-friendly consumers. There are also new frontiers for airless packaging in food, nutraceutical and medical products that will continually increase the market.

As smart packaging technologies continue to expand, brands can improve customer interaction, safety, and security through airless packs or airless containers with embedded digital tracking or anti-counterfeit technology. Long-term success can be achieved in the growing airless packaging landscape through investment in sustainable input resources, reusable filling and processing practices, and automation-based manufacturing techniques.

The USA airless packaging market shows a growing trend in demand for high-grade cosmetics, skincare, and pharmaceutical products that need contamination-free packaging solutions. Investments in research and development are being driven by the transition toward sustainable and recyclable airless packaging materials.

Major brands in cosmetics and personal care are incorporating airless dispensers to maximize product viability and restrict waste. Government support for sustainable packaging and investments in bioplastics and new airless refillable packaging technologies should continue to drive growth in this space. Moreover, the growth of e-commerce is driving the demand for durable, leak-proof airless packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The Disposable Packaging Market in the UK is being fuelled by increasing consumer demand for sustainable packaging solutions, especially in the beauty and pharmaceutical sectors. Government initiatives to minimize plastic waste and use recyclable packaging materials are driving a shift towards eco-friendly airless dispensers.

Big name personal care brands are working to meet consumer desire for less waste with refillable airless packaging. Further, the increasing inclination towards high-end skincare products in the UK is driving innovations in airless dispensing technology that improve product preservation and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

Germany, France & Italy are potential growth drivers for European airless packaging market owing to booming cosmetics, pharmaceuticals & food industries. The European Union’s Directives on Single Use Plastics and sustainability targets are propelling manufacturers to develop airless packaging options that are biodegradable or recyclable.

The cosmetic and skincare luxury’s markets in France and Italy are driving the usage of airless dispensers, and Germany’s pharmaceutical industry is adopting airless packaging for medical-grade formulations. It further augments the market, due to the innovations in the field of the material science - such as bio-based polymers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

In cosmetics and skincare, growth in airless packaging in Japan is credited to developments in precision packaging technologies. The country’s emphasis on high-quality, hygienic, and minimal-waste packaging complements the rising use of airless dispensing systems.

To prolong product shelf lives and offer accurate dispensing mechanisms, Japanese beauty brands are melding airless packaging into their products. In the future, these trends will boost market growth, due to increased research in sustainable packaging solutions, such as paper-based airless pumps.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

As a world-leading market for beauty and skin care, South Korea is becoming an early adopter of airless packaging trends due to the growing penchant for hygiene, travel-friendly, and sustainable solutions. Airless packaging innovations for K-beauty brands also incorporate eco-friendly materials and refillable packaging features to match sustainability trends.

The government’s efforts to mitigate plastic waste also encourage packaging manufacturers to explore biodegradable airless packaging solutions. Furthermore, the growth of South Korea’s pharmaceutical industry is driving the demand for airless packaging in medical and dermatological applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The airless packaging market is moderately consolidated, led by a mix of Tier 1 global manufacturers and Tier 2/3 regional specialists. Tier 1 players such as AptarGroup Inc., Silgan Holdings Inc., and RPC Group (Berry Global) dominate through large-scale manufacturing, proprietary dispensing systems, and long-term contracts with multinational brands. For instance, AptarGroup recently launched its fully recyclable airless system under the “Future” product line, while Silgan continues to invest in R&D for refillable and lightweight packaging formats.

Tier 2 players such as Albea Group, Quadpack Industries, and Lumson S.p.A. focus on premium aesthetics, custom design, and agile production to serve niche cosmetic brands. Asian manufacturers like Yonwoo Co., Ltd. and HCP Packaging supply high-volume skincare packaging, especially across South Korea, China, and Japan.

Tier 3 participants including Raepak Ltd. and Libo Cosmetics are innovating with biodegradable and PCR-based airless solutions. Entry barriers remain high due to the precision engineering and regulatory compliance required in pharma and cosmetics packaging. While the market has seen recent consolidation-like Berry Global’s acquisition of RPC-there’s still room for fragmentation, especially among indie beauty and wellness brands seeking flexible suppliers.

Recent Airless Packaging Industry News

Between 2024 and 2025, the airless packaging market experienced momentum through large-scale mergers and acquisitions in the broader packaging industry. Amcor announced an USD 8.4 billion all-stock merger with Berry Global in November 2024, a strategic move expected to significantly enhance capabilities in the airless packaging market, given both companies’ strong presence in dispensing systems and cosmetic packaging.

In June 2024, Sonoco Products revealed a USD 3.9 billion acquisition of Eviosys, aiming to strengthen its aerosol and rigid metal packaging portfolio-offering potential synergies with airless technologies. Additional consolidation included Mondi’s purchase of Schumacher Packaging assets and the completed merger between WestRock and Smurfit Kappa.

The Airless Packaging Market was valued at approximately USD 6.4 billion in 2025.

The market is projected to reach USD 10.1 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035.

The demand for Airless Packaging Market is expected to be driven by the growing need for extended shelf life in beauty and skincare products, increasing demand for hygienic and contamination-free packaging in healthcare, and rising consumer preference for premium, sustainable, and recyclable packaging solutions.

The top 5 countries contributing to the Airless Packaging Market are the United States, China, Germany, France, and Japan.

The Beauty and Healthcare segment is expected to lead the Airless Packaging market, driven by the increasing adoption of airless dispensing solutions in cosmetics, skincare, pharmaceuticals, and personal care products to ensure product integrity and reduce preservatives.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Dispensing Systems, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Dispensing Systems, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Dispensing Systems, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Dispensing Systems, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Dispensing Systems, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Dispensing Systems, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Dispensing Systems, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Dispensing Systems, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Dispensing Systems, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Dispensing Systems, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Dispensing Systems, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Dispensing Systems, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Dispensing Systems, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Dispensing Systems, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Dispensing Systems, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Dispensing Systems, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Dispensing Systems, 2023 to 2033

Figure 21: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Dispensing Systems, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Dispensing Systems, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Dispensing Systems, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Dispensing Systems, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Dispensing Systems, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Dispensing Systems, 2023 to 2033

Figure 45: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Dispensing Systems, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Dispensing Systems, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Dispensing Systems, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Dispensing Systems, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Dispensing Systems, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Dispensing Systems, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Dispensing Systems, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Dispensing Systems, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Dispensing Systems, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Dispensing Systems, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Dispensing Systems, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Dispensing Systems, 2023 to 2033

Figure 93: Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Europe Market Attractiveness by Dispensing Systems, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Dispensing Systems, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Dispensing Systems, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Dispensing Systems, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Dispensing Systems, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Dispensing Systems, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Dispensing Systems, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Dispensing Systems, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Dispensing Systems, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Dispensing Systems, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Dispensing Systems, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Dispensing Systems, 2023 to 2033

Figure 141: MEA Market Attractiveness by Packaging Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Material, 2023 to 2033

Figure 143: MEA Market Attractiveness by Dispensing Systems, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Airless Packaging Industry

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Airless Bottles Market

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA