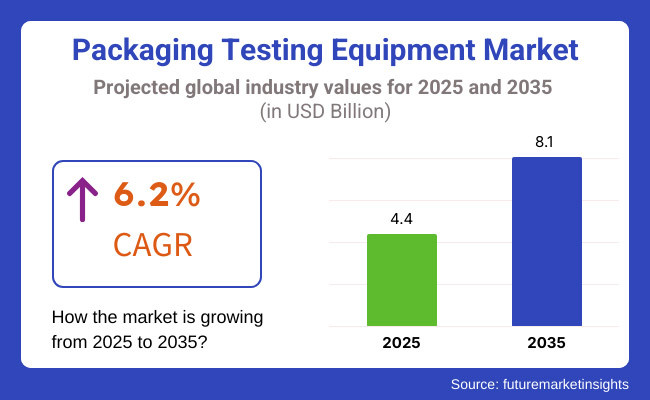

The global packaging testing equipment market is expected to increase from USD 4.4 billion in 2025 to USD 8.1 billion by 2035, expanding at a CAGR of 6.2%. This growth is being driven by manufacturers across sectors such as food and beverage, pharmaceuticals, and consumer goods who are investing in advanced testing technologies to meet higher safety, durability, and sustainability standards.

New regulatory frameworks are forcing companies to ensure that packaging materials are leak-proof, compressively strong, and maintain barrier properties throughout the supply chain. As packaging becomes more central to consumer satisfaction and brand protection, the reliance on automated and AI-enabled testing systems is growing sharply.

Technological shifts in packaging validation are also contributing to this transformation. Real-time monitoring through IoT devices, robotic systems for material fatigue testing, and the adoption of machine learning algorithms for predictive maintenance are redefining quality control benchmarks. In 2024, Amcor Chief Sustainability Officer David Clark added, “Amcor is committed to leading the packaging industry toward a circular society.

We are ramping up our efforts in advocating for consistent and effective regulations, encouraging infrastructure development, and educating both customers and consumers. We can all contribute to a more sustainable future.” Companies like AMETEK MOCON, Presto Stantest, and Labthink are also actively expanding their portfolios to include non-destructive testing solutions and high-speed digital inspection tools that adapt to new packaging substrates such as compostable films and recycled polymers.

This surge is further fueled by e-commerce, where the protection of products through rigorous packaging standards is essential. Returns due to damaged products remain a concern in digital retail, pushing logistics players to adopt rigorous drop, vibration, and pressure testing mechanisms. According to a 2024 analysis reported by Future Market Insights, demand for advanced testing equipment is particularly strong in the Asia-Pacific region, where rapid urbanization and manufacturing activity are driving the need for localized quality assurance systems.

Regulatory enforcement is also tightening, especially in pharmaceutical packaging, where sterility and tamper-evidence are non-negotiable. As companies align their packaging goals with circular economy principles, testing equipment manufacturers are being compelled to create machines that can simulate the life cycle of biodegradable and recyclable packaging under real-world conditions. These changes are setting a new precedent for packaging compliance across the global supply chain.

The microbiological testing segment is projected to account for approximately 23.7% of the global packaging testing equipment market by 2025, supported by the increased demand for contamination control and shelf-life extension technologies across food and pharmaceutical packaging lines.

As the risk of microbial contamination continues to pose regulatory and reputational challenges for manufacturers, the adoption of automated microbial detection systems and real-time sterility testing platforms has been expanding significantly. Non-invasive testing technologies that utilize optical sensors and biosensors are also being incorporated into next-generation microbiological test equipment, improving efficiency while maintaining package integrity.

Simultaneously, the integration of smart packaging technologies-such as freshness indicators, antimicrobial surface treatments, and time-temperature sensors-is further boosting the market for microbiological testing systems. These innovations are particularly being adopted in cold chain and perishable goods logistics, where microbial stability is a key concern. Manufacturers are now leveraging these high-performance tools to meet stringent safety standards, avoid recalls, and build consumer trust. This shift is expected to drive robust market expansion for microbiological testing equipment throughout the forecast period.

The food & beverage and pharmaceutical sectors are expected to collectively account for more than 58.2% of the packaging testing equipment market by 2025, underscoring their central role in adopting advanced quality assurance solutions.

Regulatory compliance, rising consumer expectations for safety, and the need to minimize contamination and spoilage have led companies in these industries to prioritize high-precision and automated testing systems. AI-integrated platforms that offer predictive analytics, real-time defect detection, and packaging integrity evaluation are being implemented at scale to improve throughput and reduce human error in testing operations.

In the pharmaceutical sector, where compliance with standards such as FDA’s 21 CFR Part 11 and EU GMP Annex 1 is essential, the use of automated leak detection, seal strength testing, and particulate analysis has become routine.

Meanwhile, in food and beverage processing lines, rapid microbiological screening, burst testing, and vacuum decay methods are used to verify barrier properties, shelf-life claims, and structural integrity of packaging. With sustainability also emerging as a key concern, equipment that enables testing of eco-friendly materials without compromising safety is gaining preference. These market drivers are expected to sustain long-term growth in packaging testing equipment demand across these critical industries.

Challenges

Opportunities

The USA dominates the packaging testing equipment market due to the increasing demand for high-quality, durable, and compliant packaging solutions across industries such as food & beverages, pharmaceuticals, consumer goods, and e-commerce. Strict FDA and ASTM regulations for packaging integrity, combined with growing consumer expectations for product safety and sustainability, are driving investments in advanced testing equipment. Companies are focusing on AI-powered defect detection, automated material testing, and non-destructive testing methods to enhance packaging quality and compliance.

Additionally, the rise of smart packaging and intelligent labeling is pushing manufacturers to develop real-time monitoring and digital quality control solutions. Businesses are also integrating IoT-enabled sensors, robotic testing systems, and cloud-based data analytics to improve accuracy and efficiency in packaging testing processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

UK Packaging Testing Equipments Market is steadily increasing as most of the industries are becoming more concerned with sustainability, regulatory compliance, and efficient packaging. Initiatives such as increased producer responsibility (EPR), plastic taxes, and regulations in circular economies encourage companies to have more innovative approaches to packaging by improving testing.

Consequently, the increasing consumer demand for impact-resistant, moisture-proof, and recyclable materials has increased the use of mechanical strength testers, permeability analyzers, and environmental simulation chambers.

Investments are currently being made in high-speed automated testing solutions, non-invasive inspection systems, and digital traceability technologies to ensure compliance and sustainability of packaging. Advancements in smart packaging solutions such as RFID-based authentication and real-time condition monitoring are also pushing further investments in packaging testing equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

The Japanese packaging testing equipment market is expanding and gaining momentum on account of its rigorous quality control practices, dynamic manufacturing ecosystem, and focus on precision-oriented packaging solutions. Advanced packaging testing equipment is sold in increasing numbers owing to the requirements and trends demanding lighter, stronger, and greener packaging materials coming from the electronics, pharmaceuticals, and food packaging industries.

Corporations are now investing in AI material analysis, high-precision drop testers, and automated sealing integrity testers to ensure compliance with the stringent safety and performance standards of Japan. The emergence of smart packaging and IoT-based quality control systems encourages businesses to incorporate real-time monitoring, predictive analytics, and AI-powered defect detection in their packaging testing processes.

The increased focus on sustainability has also led to rising investments in testing technologies related to biodegradable packaging materials, recyclability assessments, and ecob-labeling verifications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's packaging testing equipment market is witnessing rapid growth due to rising regulatory scrutiny, technological advancement, and e-commerce development. The characteristics of highly durable and temperature-resistant covers with tamper-proof capabilities are encouraging significant investments in advanced mechanical testing methods, barrier property analysis, and accelerated aging tests. Initiatives from the government in the area of eco-friendly packaging and reduced plastic wastes encourage extended product shelf life while creating more demand for the latest testing equipment.

In addition, businesses today are integrating AI-based automation, IoT-based data collection, and blockchain-based tracking into their packaging quality control systems. The increasing popularity of smart packaging solutions such as QR-coded traceability and interactive consumer engagement is another driving force that is encouraging investments into emerging packaging testing methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The packaging testing equipment market is influenced by rising demand in food & beverage, pharmaceuticals, personal care, and industrial applications. The market is witnessing innovation through new testing technologies, such as AI-powered defect detection, automated leak testing, and material stress analyzers, addressing concerns about efficiency, sustainability, and regulatory compliance. Additionally, advancements in non-destructive testing and automated quality control systems are further shaping industry trends.

The rising preference for sustainable, high-speed, and AI-integrated packaging testing equipment is also contributing to market growth. Furthermore, increased investments in smart packaging validation and regulatory compliance initiatives are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid testing solutions that integrate high-precision analytics with AI-based predictive defect prevention for enhanced usability. Additionally, collaborations between packaging manufacturers and testing equipment providers are driving the development of customized quality assurance solutions tailored to diverse industry needs.

Other Key Players (45-55% Combined)

Several specialty packaging testing equipment manufacturers contribute to the expanding market. These include:

The overall market size for the Packaging Testing Equipment Market was USD 4.4 Billion in 2025.

The Packaging Testing Equipment Market is expected to reach USD 8.1 Billion in 2035.

The market will be driven by increasing demand from food & beverage, pharmaceutical, and personal care industries. Innovations in AI-powered defect detection, non-destructive testing, and automated quality control systems will further propel market expansion.

Key challenges include high initial investment costs, regulatory compliance with evolving packaging standards, and the complexity of automated testing integration. However, advancements in predictive maintenance, smart packaging analytics, and real-time integrity testing are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to stringent food safety regulations, increased automation in packaging quality control, and high adoption of smart packaging solutions. Meanwhile, Asia-Pacific is experiencing rapid growth driven by rising industrialization, increasing exports, and demand for high-precision quality assurance solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Content, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Content, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Content, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Content, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Content, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Content, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Content, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Content, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Content, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Content, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Testing Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Testing Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Content, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Content, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Content, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Content, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Content, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Content, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Content, 2023 to 2033

Figure 21: Global Market Attractiveness by Testing Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Content, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Content, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Content, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Content, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Content, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Content, 2023 to 2033

Figure 45: North America Market Attractiveness by Testing Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Content, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Content, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Content, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Content, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Content, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Content, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Testing Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Content, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Content, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Content, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Content, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Content, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Content, 2023 to 2033

Figure 93: Europe Market Attractiveness by Testing Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Europe Market Attractiveness by Content, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Content, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Content, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Content, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Content, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Content, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Testing Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Content, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Testing Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Content, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Testing Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Testing Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Testing Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Testing Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Content, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Content, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Content, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Content, 2023 to 2033

Figure 141: MEA Market Attractiveness by Testing Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Material, 2023 to 2033

Figure 143: MEA Market Attractiveness by Content, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Packaging Testing Services Industry

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Food Packaging Equipment Market

Skin Packaging Equipment Market

Mortar Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA