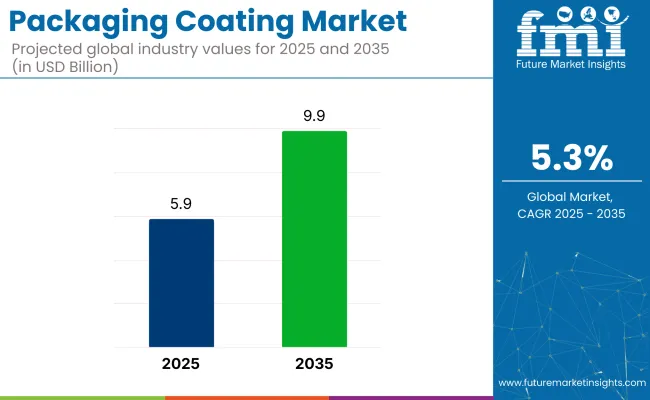

The packaging coating market is projected to grow from USD 5.9 billion in 2025 to USD 9.9 billion by 2035, at a CAGR of 5.3% during the forecast period. This expansion is attributed to the increasing demand for high-performance and sustainable coating solutions across various packaging applications, particularly in the automotive, food and beverage, and industrial sectors.

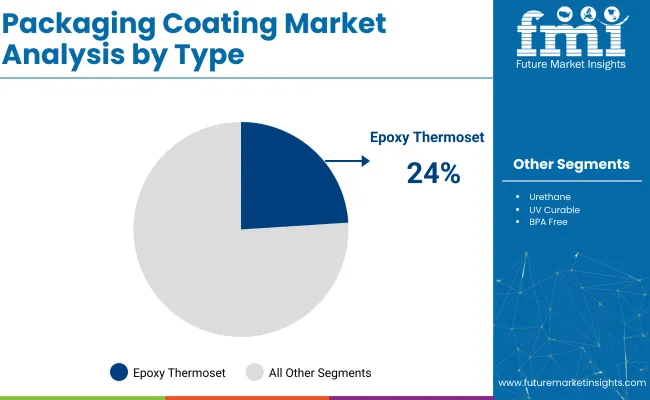

Epoxy Thermoset coatings, known for superior adhesion and chemical resistance, are anticipated to hold approximately 24% share in 2025, driven by their suitability for metal packaging and industrial applications requiring durability and protection.

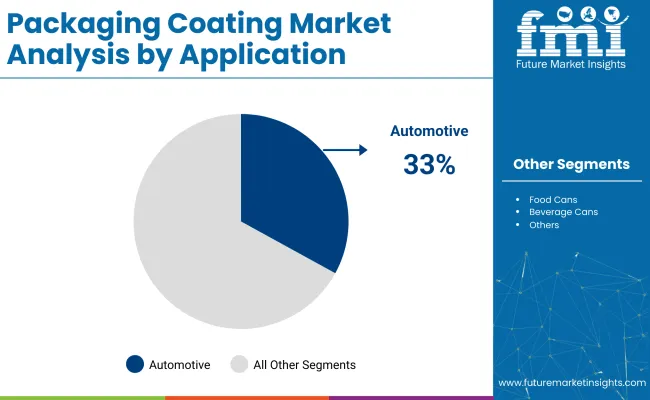

The automotive segment is expected to continue its industry leadership, capturing around 33% share in 2025, supported by the growing emphasis on corrosion-resistant and lightweight automotive packaging materials. As the global automotive industry accelerates toward electrification and lightweighting, demand for specialized packaging coatings that ensure product safety and longevity is increasing.

In an official press release dated August 29, 2024, published by MarketScreener and Yahoo Finance, Maarten Heijbroek, CEO of Stahl Group, stated, “I am very excited to welcome Weilburger Graphics to the Stahl Group. This is another important step on our strategic journey. It will enhance our position in the European industry with its innovative portfolio in growth industries like food and beverages, cosmetics and pharmaceuticals, unique expertise, state-of-the-art manufacturing facilities and a distinct focus on sustainability.” This statement highlights the industry's shift toward innovation, sustainability, and consolidation in packaging coatings.

While North America and Europe remain dominant in the automotive and food packaging industries due to their well-established sectors, the Asia Pacific region is witnessing a rapid adoption of eco-friendly coating technologies, spurred by growing manufacturing output and stricter environmental regulations. The industry outlook remains positive, supported by the transition to low-VOC, water-based coatings aligned with global sustainability trends.

Epoxy thermoset types, automotive applications, and food and beverage end-use are projected to dominate the industry in 2025, driven by durability, industrial versatility, and stringent packaging standards.

Epoxy thermoset is projected to dominate the product type segment with a 24% share in 2025 due to its exceptional durability, chemical resistance, and mechanical strength. This material is widely used in critical applications such as electronics encapsulation, automotive structural parts, and construction adhesives, where heat resistance and adhesion are vital.

The automotive sector is expected to lead the application segment with a 33% share in 2025, fueled by increasing demand for lightweight, high-strength materials for vehicle parts, coatings, and adhesives. Epoxy thermosets are widely utilized in automotive electrical components, structural reinforcements, and exterior coatings due to their excellent heat resistance and mechanical stability.

The food & beverage sector is projected to dominate the end-use segment with a 23% share in 2025, owing to its stringent safety requirements for packaging and processing materials.

The industry is evolving due to growing demand for sustainable barrier solutions and expansion in flexible and e-commerce packaging sectors. Companies are innovating with eco-friendly coatings and advanced application technologies to meet changing consumer preferences and regulatory standards.

Sustainable Barrier Innovation Driving Market Transformation

Sustainability mandates and brand commitments are driving innovation in packaging for barrier coatings. Bio-based and recyclable coatings are being introduced to replace PFAS and metal-in-glass lines. Start-ups and major players are collaborating to develop water-based and biodegradable options that are compatible with existing packaging operations. For example, lignin-based coatings can be developed to waterproof paper cups while maintaining recyclability. The demand for eco-friendly liners is increasing across various food, beverage, and pharmaceutical applications. These barrier innovations protect product integrity and align with the goals of a circular economy.

Flexible and E-commerce Packaging Expansion Fueling Market Growth

Growth in e-commerce and flexible packaging is amplifying demand for advanced coatings that ensure durability and aesthetics. Flexible containers require food-safe, high-barrier coatings to protect their contents during transit and storage. The integration of digital printing is increasing the need for coatings that enhance gloss, scratch resistance, and ink adhesion. Packaging for snacks, beverages, and personal care products now features multi-layer coatings that protect against moisture, oxygen, and UV radiation. Asia-Pacific leads in flexible coating adoption, while North America focuses on sustainable materials.

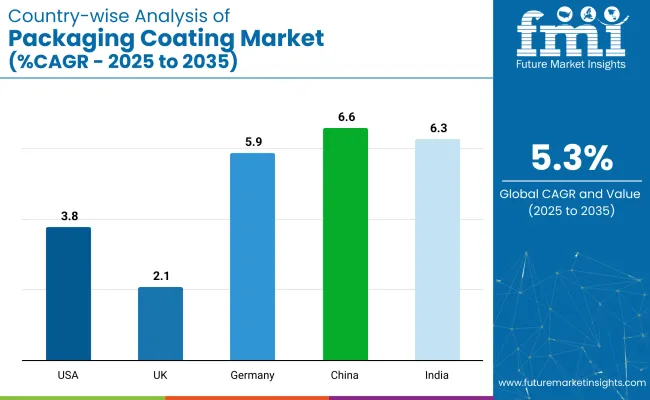

The global packaging coating industry identifies transformative trends across key economies. Packaging coating producers operating in growth-centric regions can devise strategies based on consumption patterns, regulatory shifts, sustainability preferences, and technological adoption.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 3.8% |

| United Kingdom | 2.1% |

| Germany | 5.9% |

| China | 6.6% |

| India | 6.3% |

The United States industry is witnessing stable expansion at a projected CAGR of 3.8% between 2025 and 2035. This growth is attributed to stringent environmental regulations driving demand for low-VOC and sustainable coatings.

The industry in the United Kingdom is expected to grow at a slower CAGR of 2.1% during the forecast period. Regulatory frameworks that encourage the use of recyclable and compostable materials influence coating innovations.

The German industry is expected to grow at a CAGR of 5.9%, driven by its robust industrial base and increasing environmental awareness. The nation’s leadership in automotive, food processing, and machinery exports necessitates advanced packaging coatings with superior durability and resistance features.

China commands the fastest CAGR of 6.6% in the industry, underpinned by rapid urbanization and industrialization.

India is emerging as a major growth hub in the packaging coating sector at a CAGR of 6.3%. This expansion is fueled by rising consumer demand for packaged food, pharmaceuticals, and personal care products.

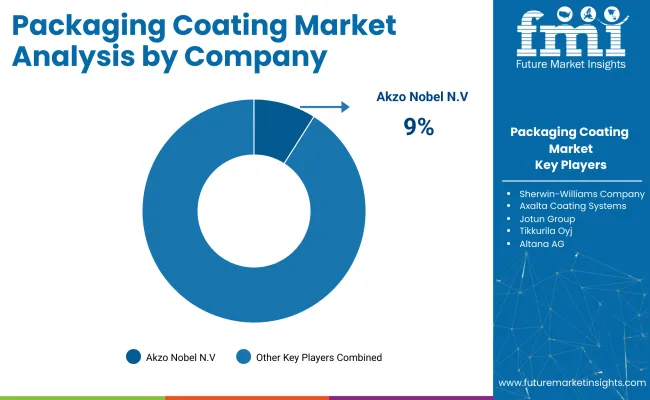

Key companies such as Akzo Nobel N.V., PPG Industries, and Sherwin-Williams lead the industry with broad product portfolios, advanced coating technologies, and strong global presence across food, beverage, and industrial packaging sectors. Other key players such as Axalta Coating Systems, RPM International, and Kansai Paint focus on regional industries with tailored, high-performance coatings. Emerging players, including Jotun Group, Tikkurila Oyj, and Altana AG, serve niche applications, leveraging sustainable formulations and competitive pricing to meet local packaging industry demands.

Recent Packaging Coating Market News

BASF SE has officially initiated the divestment process of its coatings business, aiming for a valuation of approximately €6 billion (USD 6.81 billion). The company has reached out to potential buyers, including a joint interest from Carlyle Group and Sherwin-Williams, as well as leading private equity firms such as CVC Capital and Blackstone. This strategic move, confirmed by a BASF spokesperson, aligns with the company’s portfolio optimization efforts and is being actively explored during the second quarter of 2025, as reported by Reuters and Bloomberg.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.9 billion |

| Projected Market Size (2035) | USD 9.9 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Types Analyzed (Segment 1) | Epoxy Thermoset, Urethane, UV Curable, BPA Free, Soft Touch UV Curable and Urethane |

| Applications Analyzed (Segment 2) | Food Cans, Beverage Cans, Caps and Closures, Aerosols and Tubes, Industrial Packaging, Promotional Packaging, Specialty Packaging |

| End Uses Analyzed (Segment 3) | Food and Beverages, Cosmetics, Pharmaceuticals, Consumer Electronics, Automotive Components |

| Regions Covered | North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Packaging Coating Market | Akzo Nobel N.V., PPG Industries, Inc., Sherwin-Williams Company, Axalta Coating Systems, RPM International Inc., Kansai Paint Co., Ltd., Jotun Group, Tikkurila Oyj, Nippon Paint Holdings Co., Ltd., Altana AG |

| Additional Attributes | Dollar sales, share by coating type and application, growing demand in food and beverage packaging, advancements in BPA-free and UV curable coatings, regional packaging industry trends |

By type, the industry is segmented into epoxy thermoset, urethane, UV curable, BPA free, and soft touch UV curable and urethane.

By application, the industry is segmented into food cans, beverage cans, caps and closures, aerosols and tubes, industrial packaging, promotional packaging, and specialty packaging.

By end-use, the industry is divided into food and beverages, cosmetics, pharmaceuticals, consumer electronics, and automotive components.

By region, the industry is segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East & Africa.

The industry is valued at USD 5.9 billion in 2025.

The industry is expected to reach USD 9.9 billion by 2035, growing at a CAGR of 5.3%.

Key players include Akzo Nobel N.V., PPG Industries, Sherwin-Williams, Axalta Coating Systems, RPM International, Kansai Paint, Jotun, Tikkurila, Nippon Paint Holdings, and Altana AG.

Demand is fueled by food, beverage, pharmaceutical, and consumer goods sectors requiring barrier protection and aesthetic finishes.

Growth is driven by sustainability initiatives, lightweight substrates, UV-curable coatings, and increasing regulatory compliance for food safety.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanocrystal Packaging Coating Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA