The e-commerce packaging market is expanding steadily, driven by the exponential growth of online retailing and the rising demand for durable, cost-effective, and sustainable packaging solutions. Increased parcel volumes across consumer electronics, fashion, and food delivery sectors are reinforcing demand for protective and lightweight packaging formats.

Technological advancements in corrugated and flexible packaging materials have enhanced customization, printability, and strength-to-weight ratios, aligning with evolving brand and logistics requirements. The market is further influenced by sustainability initiatives and regulatory pressures encouraging recyclable and biodegradable materials.

Rapid penetration of e-commerce platforms in emerging economies, supported by improved logistics infrastructure and smartphone adoption, continues to fuel consumption. With the rise of omnichannel retailing and consumer expectations for safe and aesthetic delivery experiences, the e-commerce packaging market is projected to sustain robust growth in the coming years.

| Metric | Value |

|---|---|

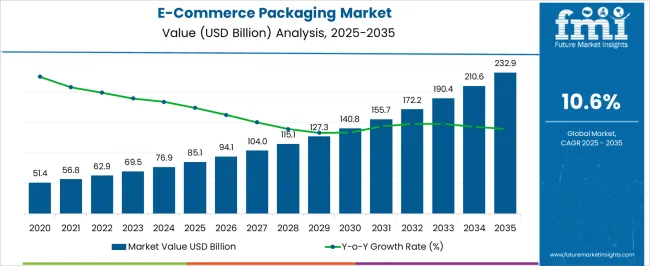

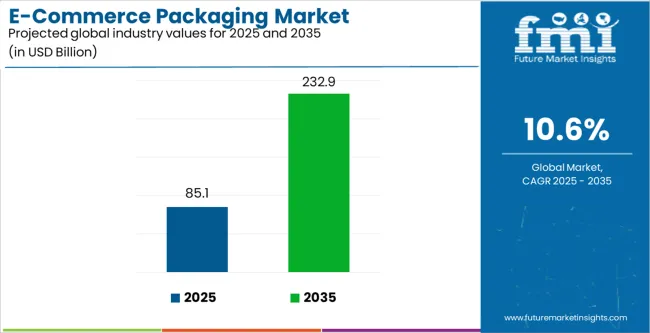

| E-Commerce Packaging Market Estimated Value in (2025 E) | USD 85.1 billion |

| E-Commerce Packaging Market Forecast Value in (2035 F) | USD 232.9 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

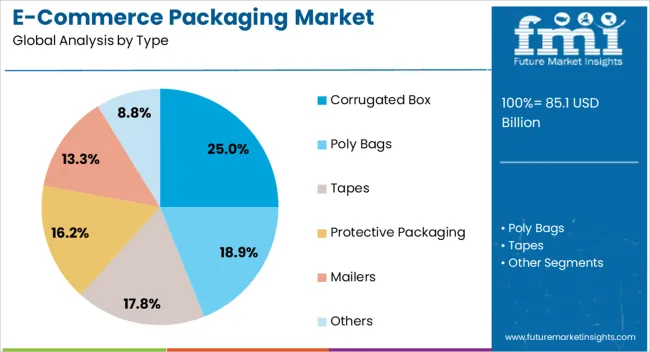

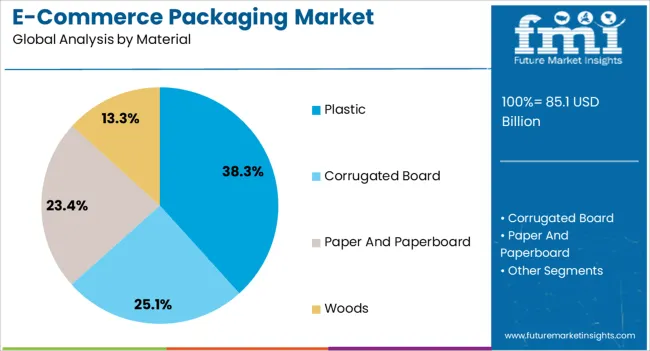

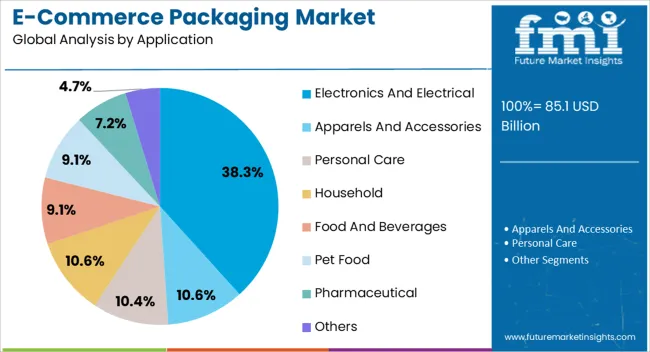

The market is segmented by Type, Material, and Application and region. By Type, the market is divided into Corrugated Box, Poly Bags, Tapes, Protective Packaging, Mailers, and Others. In terms of Material, the market is classified into Plastic, Corrugated Board, Paper And Paperboard, and Woods. Based on Application, the market is segmented into Electronics And Electrical, Apparels And Accessories, Personal Care, Household, Food And Beverages, Pet Food, Pharmaceutical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corrugated box segment leads the type category in the e-commerce packaging market, holding approximately 25.00% share. This segment’s dominance is driven by its superior strength, stackability, and protection capabilities during long-distance shipments.

Corrugated boxes are widely adopted for packaging a variety of products, from electronics to consumer goods, due to their high versatility and cost efficiency. Advances in printing and digital design technologies have enhanced customization, allowing brands to use corrugated boxes as a medium for visual appeal and brand identity.

The recyclability and biodegradability of corrugated materials align with growing sustainability goals, further strengthening market adoption. With the continued expansion of global e-commerce logistics networks and consumer preference for eco-friendly packaging, the corrugated box segment is expected to retain its leadership position over the forecast period.

The plastic segment dominates the material category, accounting for approximately 38.30% share. This leadership is attributed to plastic’s lightweight nature, flexibility, and superior moisture resistance, which make it ideal for protecting products during transportation and storage.

The segment benefits from high demand in flexible packaging formats such as mailers, pouches, and bubble wraps, which offer cost-effective and durable protection. Ongoing innovation in recyclable and bio-based plastics has supported regulatory compliance and improved environmental acceptance.

Additionally, the scalability of plastic manufacturing and its compatibility with automation in packaging lines enhance operational efficiency. With e-commerce shipments requiring varied packaging sizes and durability levels, the plastic segment is anticipated to maintain a strong position as material innovation continues to evolve.

The electronics and electrical segment holds approximately 38.30% share of the application category, driven by the increasing online sales of consumer electronics, appliances, and accessories. This segment benefits from the need for protective, shock-resistant packaging that ensures product safety during transit.

Anti-static and impact-absorbing packaging solutions have gained traction, reducing the risk of damage to sensitive electronic components. Growing consumer reliance on e-commerce channels for high-value electronic products has reinforced demand for advanced packaging formats that balance protection, aesthetics, and cost efficiency.

Manufacturers are focusing on developing customized inserts and tamper-evident solutions to enhance product security. With continuous innovation in sustainable packaging for electronic goods, this segment is projected to remain a major contributor to overall market growth.

From 2020 to 2025, the E-commerce packaging market experienced a CAGR of 11.4% in market value. The widespread adoption of smart packaging technologies, including the prevalence of QR codes and RFID tags, has emerged as a prominent trend in e-commerce packaging market.

These technologies not only furnish consumers with additional product information but also contribute to an elevated and enriched shopping experience overall.

E-commerce packaging is expected to increasingly rely on recyclable materials, biodegradable options, and circular economy practices to address environmental concerns.

The integration of technology into packaging will continue to advance. Smart packaging features will likely become more sophisticated, providing real-time tracking, product authentication, and interactive content for consumers. Projections indicate that the global e-commerce packaging market is expected to experience a CAGR of 10.6% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 11.4% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 10.6% |

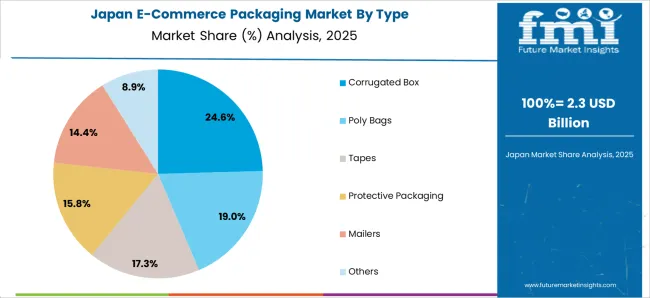

The following table shows the top five countries by revenue, led by South Korea and Japan. Japanese consumers place a high value on the quality of products and their packaging.

E-commerce businesses operating in Japan prioritize packaging solutions that not only protect the products during transit but also reflect a commitment to quality and excellence.

| Countries | The Forecast CAGRs from 2025 to 2035 |

|---|---|

| United States | 10.8% |

| United Kingdom | 11.7% |

| China | 11.3% |

| Japan | 11.8% |

| South Korea | 12.8% |

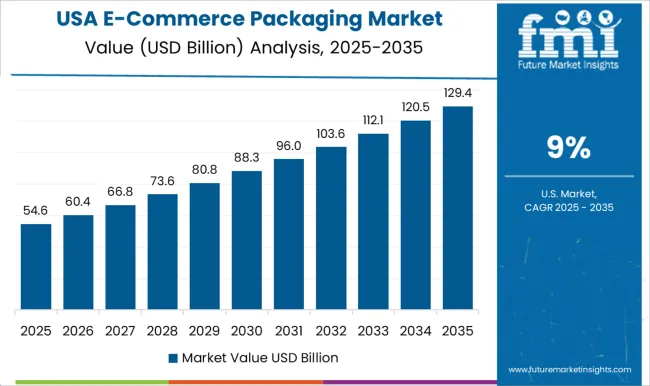

The e-commerce packaging market in the United States is expected to grow with a CAGR of 10.8% from 2025 to 2035. The growth of the market in the country is attributed to a continuous increase in e-commerce adoption, with more consumers turning to online shopping platforms.

Growing emphasis on sustainability in the packaging industry, including e-commerce. Consumers are increasingly conscious of environmental issues, prompting businesses to adopt eco-friendly packaging materials. The demand for sustainable packaging options is likely to influence the market.

The e-commerce packaging market in China is expected to grow with a CAGR of 11.3% from 2025 to 2035. The presence of a large consumer base, increased internet penetration, and a growing middle class drive the market growth in China. The surge in online retail transactions has likely contributed to a parallel growth in the demand for specialized e-commerce packaging.

China is known for its rapid adoption of technology. Innovations in packaging technology, including smart packaging with features such as QR codes, NFC tags, or augmented reality elements, might contribute to the growth of the e-commerce packaging market.

The e-commerce packaging market in the United Kingdom is expected to grow with a CAGR of 11.7% from 2025 to 2035. The surge in e-commerce adoption within the United Kingdom has prompted a notable shift in consumer behavior towards online shopping. This change is driving heightened demand for customized e-commerce packaging solutions that cater specifically to the unique requirements of digital retailers.

The United Kingdom has seen a significant rise in e-commerce adoption, with consumers increasingly turning to online shopping. This trend has likely contributed to an increased demand for specialized e-commerce packaging solutions tailored to the needs of online retailers.

Growing consumer inclination towards online shopping. This surge in online retail activities has likely led to an expanded demand for specialized e-commerce packaging solutions in Japan.

E-commerce packaging in Japan may focus on visually appealing designs, contributing to a positive unboxing experience for customers. Japanese culture often places importance on aesthetics and presentation in packaging. The e-commerce packaging market in Japan is expected to grow with a CAGR of 11.8% from 2025 to 2035.

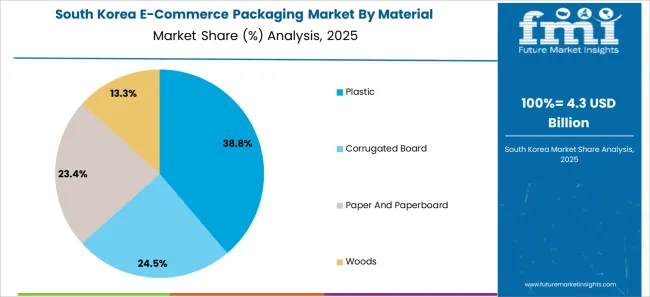

The e-commerce packaging market in South Korea is expected to grow with a CAGR of 12.8% from 2025 to 2035. South Korea has witnessed rapid growth in e-commerce, driven by factors such as increased internet penetration, smartphone usage, and a tech-savvy consumer base. The surge in online shopping has led to a proportional increase in the demand for efficient and tailored e-commerce packaging solutions. The urbanization trend in South Korea, coupled with busy lifestyles, has encouraged more consumers to turn to online platforms for their shopping needs. As a result, the demand for convenient and secure packaging that accommodates various product types has risen significantly.

South Korea engages in significant cross-border e-commerce, contributing to the need for packaging solutions that can withstand international shipping and comply with diverse regulatory requirements.

The below section shows the leading segment. The corrugated box segment is expected to register a CAGR of 10.4% from 2025 to 2035. Based on material, the plastic segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 10.1% from 2025 to 2035.

| Category | CAGR |

|---|---|

| Corrugated Box | 10.4% |

| Plastic | 10.1% |

Based on product, the corrugated box segment is anticipated to thrive at a CAGR of 10.4% from 2025 to 2035. Corrugated boxes can be easily customized to suit various product sizes and shapes. The versatility of corrugated packaging allows for the creation of boxes that fit snugly around the products, providing a protective cushion and reducing the risk of damage during shipping.

Corrugated boxes are generally cost-effective compared to alternative packaging materials. This is particularly important for e-commerce businesses that often operate on thin profit margins and need packaging solutions that offer a balance between affordability and functionality.

The emphasis on sustainability and eco-friendly packaging has led to an increased preference for corrugated boxes. They are made from recyclable materials, and many corrugated boxes themselves are recyclable. This aligns with the growing consumer and industry awareness of environmental concerns.

Based on material, the plastic segment is projected to rise at a 10.1% CAGR through 2035. Plastic materials, such as polyethylene (PE) and polypropylene (PP), are highly versatile and flexible. They can be molded and shaped to accommodate various product sizes and shapes, providing an adaptable packaging solution for the diverse range of products sold in e-commerce.

Plastic packaging is generally lightweight, which contributes to cost savings in shipping. This is particularly important in the e-commerce sector, where shipping costs can significantly impact overall expenses. Lightweight packaging can also reduce the carbon footprint associated with transportation.

Plastic packaging provides a high level of protection against moisture, dust, and other environmental elements. This is crucial for products that may be sensitive to such conditions during transportation and storage.

Companies in the e-commerce packaging sector are engaged in mergers and acquisitions to strengthen their market position, expand their product portfolios, or acquire new technologies.

Such strategic moves aim to enhance competitiveness and capture a larger share of the market. Some companies in the e-commerce packaging market have been actively working on developing and implementing sustainable packaging solutions.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 76.9 billion |

| Projected Market Valuation in 2035 | USD 210 billion |

| Value-based CAGR 2025 to 2035 | 10.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Product, Material, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Amcor Plc.; Berry Global Group, Inc.; CCL Industries; Coveris; Sealed Air; Sonoco Products Company; WINPAK Ltd.; Alpha Packaging; Constantia Flexibles; Mondi; Gerresheimer AG; Silver Spur Corp.; Greif; Transcontinental Inc.; ALPLA |

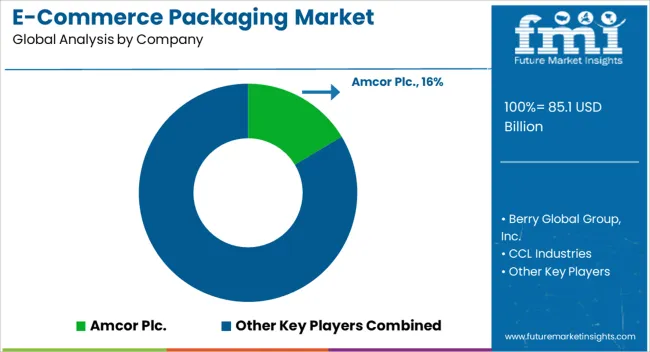

The global e-commerce packaging market is estimated to be valued at USD 85.1 billion in 2025.

The market size for the e-commerce packaging market is projected to reach USD 232.9 billion by 2035.

The e-commerce packaging market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in e-commerce packaging market are corrugated box, poly bags, tapes, protective packaging, mailers and others.

In terms of material, plastic segment to command 38.3% share in the e-commerce packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA