The packaging additives market is growing tremendously owing to the demands for better packaging performance, sustainability & shelf life from various industries including food and beverage, pharmaceuticals, personal care, and industrial goods.

These additives improve the performance of packaging materials by imparting barrier properties, UV resistance, antimicrobial protection, and anti-fogging. The next decade will witness huge growth in the market owing to advancements in biodegradable and recyclable packaging technologies alongside a growing focus on eco-friendly solutions.

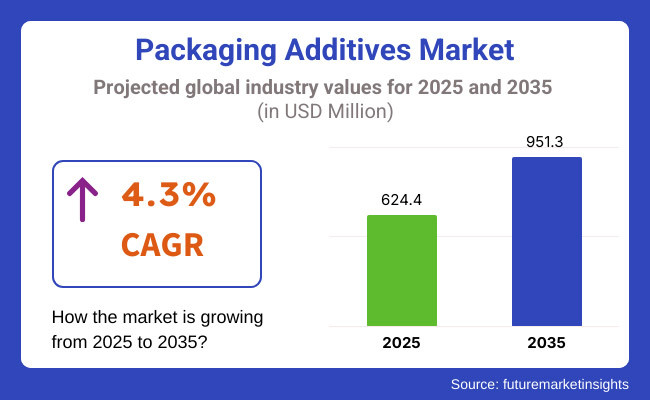

The estimated market size of packaging additives is expected to reach an estimated value of USD 624.4 Million by 2025 and grow at a CAGR of 4.3% from 2025 and reach USD 951.3 Million by 2035.

This growth is fueled by increasing regulatory requirements for sustainable packaging, rising consumer awareness about food safety, and technological advancements in high-performance polymer additives. Also, sustainability initiatives, which encourage the use of bio-based and compostable packaging materials, are promoting the uptake of this market.

Besides, developments in high-barrier coatings and improved scavenging of oxygen, together with the automation of packaging material production, are creating developments in the market. The fast-growing e-commerce and food delivery service sectors, along with the rising investments in AI-driven quality control systems, are contributing even more to market growth.

Moreover, the incorporation of smart packaging features with RFID tracking, tamper evident characteristics, and IoT-enabled monitoring will deepen the visibility of the supply chain and enhance product safety.

Asia-Pacific is expected to dominate the packaging additives market, driven by rapid industrialization, growing food and pharmaceutical sectors, and increasing regulatory focus on sustainable packaging. Countries such as China, India, and Japan are witnessing high demand for packaging additives in food packaging, healthcare, and personal care applications.

The region’s market growth is further supported by innovations in bio-based additives, cost-effective production techniques, and automation in packaging material processing. Additionally, government policies promoting single-use plastic reduction and extended producer responsibility (EPR) programs are encouraging manufacturers to invest in eco-friendly packaging additives.

The increasing presence of global packaging firms and food manufacturers in Asia-Pacific is also boosting local production capabilities. Furthermore, research and development in antimicrobial coatings and moisture-resistant additives are expected to create new growth opportunities in the region.

However, North America is still an important market for packaging additives due to the strong demand that is received from the food & beverage, pharmaceutical, and personal care industries. The United States and Canada are also harnessing technological advancements in the areas of active packaging, oxygen scavengers, and around-tamper-evident solutions. Further, increased investment in automation and the AI-powered defect detection will improve efficiency and reduce production material waste in the industry.

Regulatory policies aimed at reducing plastic waste and encouraging circular economy practices are expected to stimulate demand trends in compostable and recyclable additives. The market has also been greatly influenced by rising investments in the research and development of bio-based antimicrobials, moisture-barrier coatings, and smart packaging systems.

Rising demand in FMCG and food service, besides healthcare, is a pull factor for product innovation in sustainable packaging. Most of the companies based in North America are keen on integrating smart labeling and freshness indicators into packaging to enhance consumer engagement and safety in products. Innovations in strong yet lightweight packaging additives with better recyclability are expected to change the scenario of the market in the next few years.

Europe remains a significant market for packaging additives, notwithstanding all these factors, due to increased stringency of environmental regulations, the adoption of circular economy practices, and growing consumer demand for biodegradable alternatives. The technologically advanced countries in Europe, like Germany, France, and the UK, adopt fiber-based coatings, low-carbon production processes, and plastic-free barrier additives.

Also, investments in next-generation polymer research are contributing to the increased efficiency of packaging additives. The rapid establishment of closed-loop recycling systems for mixed flexible packaging waste also plays a significant role in driving progress towards sustainable solutions.

A string of stringent policies promoting plastic-free packaging such as the extended producer responsibility (EPR) and sustainable material innovation is fast evolving to transform the future of the market. In addition, increasing consumers' awareness and demand for premium, resealable and fully recyclable versatile packaging solutions are expected to contribute to the long-term growth of the market.

The region is also witnessing increasing collaboration between food manufacturers, personal care brands, and sustainability-focused organizations to create next-generation solutions for packaging additives. Moreover, research institutions across Europe are investing in AI-driven production optimization, moisture-resistant coatings, and biodegradable packaging films, among other things. These advances are likely to enhance overall efficiency and, thus, adoption across multiple industries.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on improving recyclability and reducing plastic waste. |

| Material and Formulation Innovations | Development of lightweight, high-barrier functional coatings. |

| Industry Adoption | Widely used in food service, e-commerce, and pharmaceutical packaging. |

| Market Competition | Dominated by traditional packaging manufacturers. |

| Market Growth Drivers | Growth driven by demand for lightweight, resealable packaging additives. |

| Sustainability and Environmental Impact | Early-stage adoption of recyclable and lightweight additives. |

| Integration of AI and Process Optimization | Limited AI use in defect detection and packaging optimization. |

| Advancements in Packaging Technology | Basic improvements in sealing and moisture resistance. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating fully recyclable and compostable packaging additives. |

| Material and Formulation Innovations | Expansion of AI-driven, biodegradable, and tamper-proof packaging additive technologies. |

| Industry Adoption | Increased adoption in premium food packaging, active packaging, and high-barrier medical packaging. |

| Market Competition | Rise of sustainability-focused startups and AI-driven packaging firms. |

| Market Growth Drivers | Market expansion fueled by automation, AI integration, and plastic-free fiber-based packaging technologies. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable, reusable, and fiber-based packaging solutions. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated packaging manufacturing, and real-time defect tracking. |

| Advancements in Packaging Technology | Development of smart packaging additives with QR codes, RFID-enabled tracking, and IoT-connected freshness monitoring. |

The USA largely prevails in the market for packaging additives owing to the growing demand for advanced packaging types that increase the shelf life, improve sustainability, and augment the function of the products. Eco-friendly packaging along with the stringent FDA regulations and growing consumer awareness about food safety are driving innovations in biodegradable, antimicrobial, and oxygen-scavenging additives production.

Thus, manufacturers are investing in nanotechnology, smart packaging coatings, and moisture-resistant solutions to improve packaging while reducing adverse environmental effects. Besides these, there is bringing the method of UV stabilizers, barrier coatings, and anti-fog additives through the booming e-commerce market, thus demanding durable and lightweight packaging materials.

Companies now include AI-driven quality control, active packaging technologies, and bio-based additives to comply with regulatory requirements and consumer preferences for sustainable packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The UK packaging additives market is rapidly growing as businesses focus on sustainability, regulatory standards, and advanced packaging functionalities. Various governmental policies for plastic reduction, extended producer responsibility (EPR), and circular economy missions are increasing the adoption of biodegradable, recyclable, and food-safe packaging additives.

Companies are working on antimicrobial coatings, oxygen barrier films, and lightweight fillers to further improve their durability and efficiency in regard to packaging materials. There has been an increasing demand for specialty additives to create high-barrier, flexible, and active packaging solutions for the food, pharmaceutical, and personal care industries.

In addition, advances in water-based coatings, solvent-free adhesives, and UV-stabilizers are making packaging materials more sustainable and cost-effective. Companies are also looking into digital-printing technologies and intelligent packaging innovations to improve branding and enhance transparency in the supply chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

Japan's market for packaging additives is growing steadily mainly due to the demand for high-performance, food-safe, and technologically advanced packaging materials. Strict government protocols regarding food safety, recyclability, and material waste are compelling companies to adopt nontoxic, biodegradable, and moisture-resistant additives for packaging.

Manufacturers are investing in active packaging technologies such as oxygen scavengers, antimicrobial agents, and temperature-sensitive coatings to enhance food preservation and extend shelf life. Besides, innovations like nano-coatings, bio-based barrier layers, and high transparence films are creating more demand in premium packaging applications.

Companies are applying AI techniques to quality control, smart labeling solutions, and digital authentication systems, which could improve product security and traceability. The increasing adoption of sustainable packaging solutions within Japan's food, electronics, and pharmaceutical sectors is further propelling investments in advanced technologies for packaging additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The market for packaging additives in South Korea is emerging rapidly owing to increasing consumer awareness, initiatives from the government concerning sustainability, and development in functional packaging. Demand for eco-friendly, high-barrier antimicrobial packaging materials is generating the need for developing next-generation additives with improved performance and sustainability in their formulations.

Government regulations that promote the reduction of plastic waste and biodegradable alternatives are also driving investments in the sector, as are regulations on energy-efficient production processes. Moving towards integrating an AI-based material testing, water-based coatings, and ultra-thin barrier films further enhance the performance of packaging systems.

The increase in intelligent packaging solutions, such as QR-coded tracking systems and smart freshness indicators, raises the demands for new innovative packaging additives. Moreover, new research on bio-based plasticizers, solvent-free stabilizers, and thermal-resistant coatings has helped companies develop good sustainable packaging solutions that are much more efficient in terms of application in different industries, such as food, healthcare, and consumer goods, among others.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Disinfectant additives, oxygen scavengers, and UV stabilizers are all major market-driving segments as industries are in constant search for better shelf life, protection, and improved durability of materials. Most manufacturers today are concerned with developing additives that are more non-toxic, biodegradable, and safe for use in the food industry to get their products aligned with the standards that keep changing in the industry.

Such steps are also embraced by these companies in terms of investment in high-barrier coatings, moisture-resistant films, and solvent-free alternatives for increment in sustainability in packaging applications.

Antimicrobial packaging additives still reign supreme, with prioritization for hygiene, product safety, and extended shelf life for perishable goods. These companies are designing next-generation antimicrobial coatings, nano-based inhibitors, and biopolymer-infused films capable of preventing bacterial growth and preserving freshness.

Besides, plant-based antimicrobial agents and other bioactive compounds offer added support to sustainability efforts. Additionally, the market is further aided by the advancements of smart packaging technologies with real-time microbial detection and active indicators of freshness.

Promising growth for the oxygen scavenger packaging additives market will be further driven by the demand for high-performance materials resistant to oxygen for food, pharmaceuticals, and electronics. Manufacturers are focusing on developing polymeric oxygen absorbents, iron-based scavengers, and reactive barrier coatings to mitigate oxidation, spoilage, and degradation. Furthermore, with the developments of MAP and active packaging technologies, innovations within this domain are gaining traction.

New developments in intelligent packaging solutions featuring digital freshness indicator and embedded oxygen sensor will have a positive influence in motivating the adoption of high-value packaging applications.

The UV stabilizer packaging additives sector is growing immensely as manufacturers are experimenting with UV-resistant coatings, photostabilizers, and advanced light-blocking packaging technologies. Companies are looking toward solvent-free UV inhibitors, nano-coatings, and high-transparency stabilizers to extend the life and performance of packaging.

Research into bio-based UV stabilizers, water-based FDA-compliant formulations, and thermal-resistant coatings is another innovation driver. Growing demand for weather-resistant, fade-proof, and high-clarity packaging solutions across the food, cosmetics, and consumer goods industries is further favoring the adoption of UV stabilizers.

Investigation into the field of AI for the conduct of materials testing and enzyme-based barrier enhancements, as well as intelligent packaging functionalities, is improving how packaging additives can be used more efficiently. AI-powered supply chain optimization can increasingly leverage the performance flow of capital while reducing material waste in additive manufacturing processes.

Thus, the demand for packaging solutions will continue to drive the market for packaging additives, since these requirements speak about the high performance (cost-efficient) as well as being environmentally friendly packaging. Innovations in materials science, smart packaging technologies, and bio-based additives will be the focus of the evolution of this field, where packaging additives are vital components for all consumer and industrial applications in the future.

Even as an alternative avenue of packaging enhancement, the packaging additives market structurally cuts across areas that require high performance, endurance, and sustainability features in packaging solutions. Packaging additive products find application in the fields of food & beverage, pharmaceuticals, personal care, and industry packaging, mainly due to enhanced durability and barrier properties as well as longer shelf life.

Adoption of different packaging additives across flexible packaging, rigid containerization shapes and bio-based materials has encouraged penetration development in this market. More than 70% of packaging manufacturers used additive solutions since they could modify mechanical properties, enhance properties for UV resistance, provide antimicrobial protection, and help in recyclability.

Packaging additives are expected to maintain a promising demand growth in commercial and industrial applications owing to the unique characteristics of moisture resistance, high-barrier capabilities, and compatibility with automated manufacturing systems.

Advanced manufacturing processes such as biodegradable coatings, oxygen scavengers, and artificial intelligence-enhanced quality control have opened up new avenues of development in specialized markets such as antimicrobial packaging, smart food wraps, and high-barrier multilayer films.

Material engineering innovation has driven compostable packaging additives, solvent-free barrier coatings, and smart packaging enhancers, making packaging additives more appealing to different industries. Improvements in regulatory compliance and sustainability initiatives also spur the adoption of food-safe bio-based and low VOC additives that ensure compliance with global food safety and environmental standards.

The market has witnessed a remarkable increase due to the introduction of AI-prompted production monitoring, automating the additive blending procedure into a lightweight performance-oriented packaging solution that is in line with global sustainability trends and waste reduction initiatives.

Besides, benefits will accrue from adding smart packaging technologies, such as RFID-enabled freshness monitoring and tamper-proof coatings, thereby adding efficacy and attractiveness to packaging additive solutions.

Packaging additives hold a significant share of the market in food & beverage and pharmaceutical segments as businesses seek durable, cost-effective, and environmentally friendly packaging solutions. The growing demand for high-barrier, lightweight, and bio-compatible packaging additives contributes to the sustained growth of the market.

With its essential role in food wrapping, beverage cartons, and flexible films, the food & beverage industry remains a key driver of the packaging additives market. These solutions offer superior barrier protection, antimicrobial functionality, and compliance with food safety regulations, making them superior to untreated packaging materials.

Market trends indicate a shift toward bio-based and edible packaging additives, where innovative coating technologies enhance product safety and extend shelf life. Studies show that over 75% of food packaging companies prefer packaging additives due to their ability to maintain product integrity and support global sustainability initiatives.

The adoption of packaging additives in pharmaceuticals, frozen foods, and eco-friendly consumer goods has further expanded market opportunities. As businesses focus on improving packaging sustainability and reducing plastic waste, AI-driven material optimization, high-barrier biodegradable coatings, and moisture-resistant paper-based packaging additives are becoming increasingly popular.

Despite advantages such as improved shelf stability and enhanced barrier properties, the market faces challenges such as fluctuating raw material costs, regulatory compliance with food safety standards, and recyclability concerns. However, developments in AI-powered additive formulations, solvent-free coatings, and bio-based antimicrobial solutions are driving innovations that enhance product efficiency and sustainability.

The personal care and industrial packaging sectors have become major end-users of advanced packaging additives due to the increasing need for tamper-proof, high-barrier, and eco-friendly packaging materials. Packaging additives are preferred for their ability to optimize product safety, enhance durability, and comply with global environmental standards.

An increasing number of personal care brands, e-commerce packaging providers, and industrial chemical manufacturers are incorporating high-performance packaging additives into their packaging strategies, offering enhanced product protection, reduced packaging waste, and compliance with international safety regulations. Research suggests that more than 65% of sustainable packaging manufacturers prioritize high-quality packaging additives for improved efficiency and environmental impact reduction.

While packaging additives offer advantages such as extended product shelf life and improved recyclability, challenges such as compatibility with certain materials, regulatory restrictions on chemical additives, and high production costs for specialty coatings persist.

However, ongoing advancements in AI-driven material innovation, biodegradable barrier coatings, and tamper-proof packaging technologies are addressing these challenges, ensuring continued market expansion.

The packaging additives market is influenced by rising demand in food & beverage, pharmaceuticals, personal care, and industrial applications. The market is witnessing innovation through new material developments, such as bio-based coatings, antimicrobial films, and AI-powered additive formulation optimization, addressing concerns about efficiency, sustainability, and regulatory compliance. Additionally, advancements in automated additive blending and AI-driven quality control are further shaping industry trends.

The rising preference for high-barrier, food-safe, and compostable packaging additives is also contributing to market growth. Furthermore, increased investments in smart packaging integration and circular economy initiatives are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid additive solutions that integrate high-barrier properties with intelligent freshness monitoring for enhanced usability. Additionally, collaborations between packaging manufacturers and additive solution providers are driving the development of customized packaging additives tailored to diverse industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 12-16% |

| Dow Inc. | 8-12% |

| Clariant AG | 6-10% |

| Evonik Industries AG | 4-8% |

| Ampacet Corporation | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops high-performance, food-safe packaging additives with bio-based and sustainable properties. |

| Dow Inc. | Specializes in lightweight, high-barrier packaging additives with recyclable and compostable features. |

| Clariant AG | Produces AI-driven, high-performance additive formulations optimized for food, pharmaceutical, and industrial packaging. |

| Evonik Industries AG | Expands its product line with antimicrobial and moisture-resistant packaging additives for extended shelf life. |

| Ampacet Corporation | Focuses on innovative, eco-friendly packaging additive solutions with AI-powered quality control. |

Key Company Insights

BASF SE (12-16%)

BASF leads in high-performance packaging additives, emphasizing sustainability and innovation in bio-based and food-safe formulations.

Dow Inc. (8-12%)

Dow is a dominant player, offering lightweight, high-barrier packaging additives with recyclable and compostable properties.

Clariant AG (6-10%)

Clariant enhances its portfolio with AI-driven, high-performance additive formulations optimized for various packaging applications.

Evonik Industries AG (4-8%)

Evonik strengthens its market presence with antimicrobial and moisture-resistant packaging additives for extended shelf life.

Ampacet Corporation (3-7%)

Ampacet focuses on innovative, eco-friendly packaging additive solutions with AI-powered quality control.

Other Key Players (45-55% Combined)

Several specialty packaging additive manufacturers contribute to the expanding market. These include:

The overall market size for the Packaging Additives Market was USD 624.4 Million in 2025.

The Packaging Additives Market is expected to reach USD 951.3 Billion in 2035.

The market will be driven by increasing demand from food & beverage, pharmaceutical, and personal care industries. Innovations in bio-based coatings, AI-powered material optimization, and improvements in antimicrobial and high-barrier packaging additives will further propel market expansion.

Key challenges include regulatory compliance with food safety standards, the complexity of additive recycling, and fluctuating raw material costs. However, advancements in solvent-free coatings, AI-driven defect detection, and biodegradable barrier additives are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to stringent environmental regulations, increased investment in sustainable packaging technologies, and high consumer demand for eco-friendly packaging. Meanwhile, Asia-Pacific is experiencing rapid growth driven by expanding manufacturing industries, urbanization, and increased adoption of flexible packaging solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Substrate Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Substrate Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 37: North America Market Attractiveness by Substrate Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Substrate Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Substrate Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Substrate Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Substrate Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Substrate Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Packaging Type, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Substrate Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Substrate Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Substrate Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Substrate Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Substrate Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Packaging Type, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA