The rapid growth of the global antimicrobial nanocoatings market between 2025 and 2035 will be fuelled by the increasing demand for surface hygiene, awareness about pathogen transmission, and advancements in nanomaterial engineering technology.

These coatings prevent the growth of microbes, decrease contamination, and increase material life in the healthcare, transportation, electronics, and construction industries. Their nanoscale properties give them strong adherence, long-lasting efficacy and broad-spectrum antimicrobial activity, making them perfect for high-touch and delicate settings.

Practically all nanocoating films have proven to be sufficiently durable and suitable for various substrates, including polymers, metals, ceramics, and textiles, which has enabled metals such as silver, copper, zinc oxide, titanium dioxide, and derivatives of graphene to be identified as the most promising nanocoatings with active antimicrobial activity.

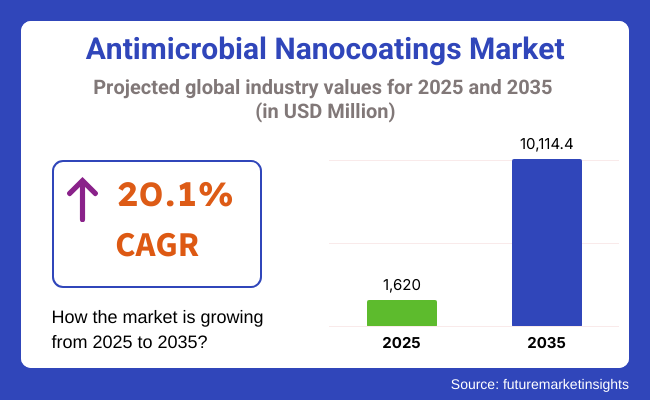

Increased emphasis on infection control, particularly regarding public infrastructure and medical facilities, further drives demand. The antimicrobial nanocoatings market is projected to account for over USD 1,620 Million in 2025 and approximately USD 10,114.4 Million by 2035, growing at a CAGR of 20.1%.

Antimicrobial Nano-coatings Market is driven by the rising demand for long-lasting surface disinfection and microbial resistance owing to increasing avoidance over the transmission of pathogens across the globe across several sectors including healthcare, consumer electronics, packaging, and architecture. These nanoscale coatings prevent bacterial and viral colonization by damaging cell membranes, and subsequently inhibit pathogen reproduction.

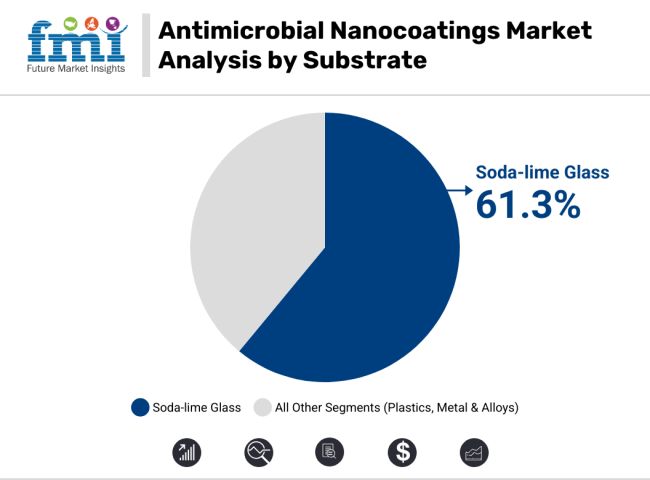

Within the plethora of substrates and media types, the soda-lime glass surfaces and added nano-silver coatings have become the most common and serve multiple applications in terms of protecting a touch-screen, hygiene of public interface, and/or sterilization of a medical device for global market share. These segments enable large-scale integration at key touchpoints without sacrificing transparency, durability, or optical clarity.

With public health safety or infection control being the new design imperative, manufacturers are turning to antimicrobial nanocoatings to assist with infection control and to extend the lifecycle of the product while increasing the time between maintenance activity.

Nano-silver coatings gain traction due to high antimicrobial efficacy, longevity, and regulatory acceptance

Items employed in the production of antimicrobial nanocoatings are derived from nano-silver owing to its excellent biocidal characteristics, broad-spectrum activity, and versatility with diverse substrates. Silver nanoparticles damage microbial membranes and block enzyme activity, making them highly effective at low concentrations against bacteria, viruses, and fungi.

Nano-silver is conventionally preferred among industries as it helps in long-term antimicrobial action, stability against UV exposure and thermal resilience, making it possible to incorporate into hospital surface materials, consumer electronics, packaging films, and HVAC (heating, ventilation, and air conditioning) systems. It also plays nice with polymers and glass, enabling clear, scratch-resistant coatings for commercial and clinical applications.

When used within prescribed limits, nano-silver is recognized as a safe and effective antimicrobial agent by regulatory bodies in the USA, EU, and Asia-Pacific. Such worldwide acceptance accelerated product approvals and integration into high-touch applications like elevator buttons, smartphone screens and surgical tools.

Nano-gold and organic nanoparticles provide specific advantages in terms of sensitivity or bio-compatibility, such as they are not broadly used since nano-silver is the leader for its ready-to-use, established technology and scalable production processes.

Soda-lime glass drives market use through touch interface protection, sterilizable surfaces, and public-use deployment

Soda-lime glass is the predominant substrate for antimicrobial nanocoatings through its extensive implementation in architectural glazing, medical devices, public transport interfaces, and consumer electronics. Its smooth, non-porous nature allows uniform spreading of all coat application as much of the antimicrobial effect is realise before the coating realises its long-term anied surface protection.

Husk has a transparent, fingerprint-resistant surface that prevents microbial deposit formation in high-contaminating places such as hospitals, airports, elevators, and retail checkout screens, and it does so by manufacturers coating soda-lime glass with nano-silver. These surfaces are resistant to abrasion, hold optical clarity and endure repeated disinfection, perfect for modern hygiene-oriented design.

Its high affordability and recyclability also make soda-lime glass ideal for large-area applications like touchscreen kiosks, partitions, and smart appliances. It adds value to the product and meets infection control standards for healthcare and hospitality when used with antimicrobial nanocoatings.

Although borosilicate and quartz glass possess superior heat and chemical stability, soda-lime glass prevails thanks to widespread availability (both global supply and cost structure) and compatibility with high-throughput coating processes.

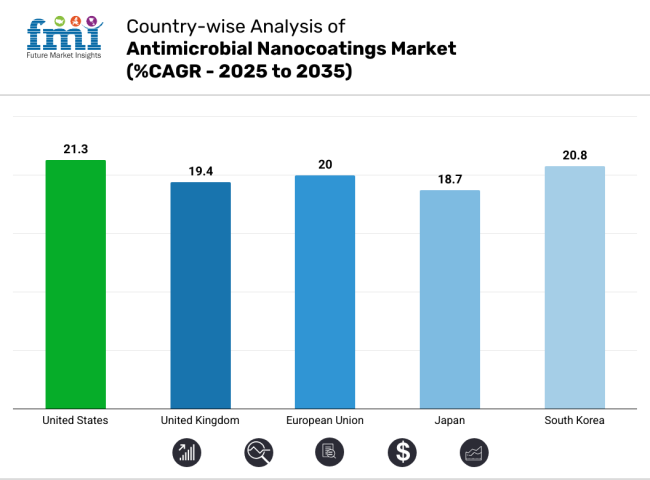

The Immunodiagnostics Market report aims to help stakeholders in the market to gain a competitive advantage. The United States ranks first in adoption, largely due to infection control mandates, strong research and development in nanotechnology, and the early commercialization of silver- and copper-based coatings. Post-pandemic the integrated system in public transport, smart electronics, HVAC system is on the rise.

The antimicrobial nanocoatings market in North America is being driven by investment in the surface protection of hospitals and public health systems, as well as stringent environmental regulations and the growing need for low-VOC and biocompatible coatings. Germany, the UK, and the Netherlands are using antimicrobial coatings in high-traffic public areas, in medical devices, and in construction materials.

Asia-Pacific, driven mainly by growth in healthcare systems, construction and government sanitation programs in China, India and Southeast Asia, is the fastest-growing region. In residential appliances, automotive interiors, and smart consumer electronics, adoption is exploding. So, we live with this kind of thing, and now more is coming, because Japan and South Korea are the two leaders, using antimicrobial duty nanocoatings to attach to the end of your wearables, air purifiers, and even the optical displays.

Safety validation, cost concerns, and regulatory ambiguity limit market acceleration.

Even with potent antimicrobial mechanisms, many nanocoating materials encounter regulatory indecision about both safety with humans and environmental access. For instance, silver nanoparticles, raise concerns about bioaccumulation and chronic toxicity. The process to obtain permission from regulatory institutions, e.g. EPA, REACH, FDA, may be lengthy and expensive, which serves as a barrier to enter the market for entrepreneurs and small-scale innovators.

Moreover, nanomaterials and precision application technologies are expensive, which result in a considerable cost factor for mass adoption especially in such low-margin industries as textiles and packaging. The establishment of performance benchmarks is missing, consumer awareness is still limited and it poses a challenge in terms of trust and scalability. In developing countries where the regulatory infrastructure for nanotech is nascent, these barriers are particularly acute.

Multifunctional surfaces, healthcare coatings, and electronics drive future demand.

Because of this, the market has a lot of opportunities for multifunctional coatings that exhibit antimicrobial action with an anti-scratch, anti-fingerprint, any UV-resistance or self-cleaning properties. Antimicrobial coatings are being used on general-purpose furniture, touchscreens, IV poles, surgical instruments, and other items at hospitals, eldercare facilities, and diagnostic labs to reduce outbreaks of hospital-acquired infections (HAIs).

Nanocoatings are proving to be a major differentiator in consumer electronics, including smartphones, laptops, headphones and wearables. Their incorporation in optical lenses, screens, and casings of electronic devices will improve hygiene and antimicrobial protection without compromising transparency and tactile performance. As investments in nanomedicine [AN1] and smart surfaces increase, the market for antimicrobial coatings will expand beyond just environmental applications to next-gen biosensors, implantable devices, and wound care materials.

The COVID-19 pandemic, which arose between 2020 and 2024, gave rise to the health trend of antimicrobial surfaces in public and personal spaces. Similarly, emergency innovations enlisted nanocoatings on ATMs, elevators, public transport poles, and school furniture. But the span also highlighted deficits in studies of toxicity and regulatory clarity. Interest in the short-term drove variable product quality and misinformation about efficacy which dampened post-pandemic momentum.

In the 2025 to 2035 era, the commercial market will transition to industry- and application-validated, versatile nanocoatings. Adoption will broaden into high-traffic settings, implantable medical devices, and consumer gadgets. Beyond recyclability and non-toxic formulations, manufacturers will be focusing more on life-cycle analysis to maximize sustainability goals. Performance will benefit from an AI-guided design of nanomaterial, 3D printing, and smart coating diagnostics that add precision, reliability, and traceability.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emergency use approvals and mixed safety guidelines |

| Consumer Trends | Focus on hygiene and virus-free surfaces |

| Industry Adoption | High in healthcare and transport |

| Supply Chain and Sourcing | Limited nanomaterial sourcing and high R&D costs |

| Market Competition | Dominated by chemical giants and specialty coatings firms |

| Market Growth Drivers | Pandemic-driven demand, R&D investment |

| Sustainability and Impact | Focus on antimicrobial efficacy |

| Smart Technology Integration | Minimal integration with existing surfaces |

| Sensorial Innovation | Transparent, thin, and odorless coatings |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized frameworks, green certifications, and premarket toxicity testing |

| Consumer Trends | Long-term demand for durable, safe, and eco-smart coatings |

| Industry Adoption | Expansion in electronics, med-tech, construction, and packaging |

| Supply Chain and Sourcing | Emergence of bio-synthesized nanomaterials and localized production hubs |

| Market Competition | Entry of nanotech startups, biotech firms, and healthcare-focused innovators |

| Market Growth Drivers | Sustainable smart coatings, HAIs prevention, and electronics hygiene |

| Sustainability and Impact | Shift to non-toxic, biodegradable, and recyclable nanocoatings |

| Smart Technology Integration | Coatings with diagnostic feedback, performance sensors, and AI design |

| Sensorial Innovation | Responsive coatings with color change, thermal regulation, and haptic features |

The antimicrobial nanocoatings market in the USA is expanding quickly as a result of a rising requirement in high-touch public surfaces, food packaging, and medical devices. Hospitals are using silver and copper-based nanocoatings as a way to help tackle hospital-acquired infections (HAIs), and electronics and kitchen appliance manufacturers are implementing antimicrobial finishes.

Innovations in graphene oxide and zinc oxide nanocoatings are emerging from R&D hubs in California and Massachusetts. Antimicrobial coatings are also being applied in HVAC systems, wall panels, and elevators in the construction sector. Clear guidance from the EPA is allowing nanotech-based antimicrobial agents to be commercialized faster.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 21.3% |

Antimicrobial nanocoatings are being adopted in the public transport, school and healthcare infrastructure across the UK Local councils and hospitals are already installing permanent coatings for door handles, handrails and restrooms. British schools in London and Manchester are working with private companies to create nano-silver and bio-founded antimicrobial agents.

Growing demand for antimicrobial coatings in food-grade applications and cleanroom environments also bolsters growth. Meanwhile the government is promoting safer formulations via aligning post-Brexit chemical regulation and offering R&D tax credits for sustainable nanotech applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 19.4% |

The European Union (EU) countries are fiercely pushing the application of antimicrobial nanocoatings in building materials, transport systems and medical textiles. Germany, France and Sweden are leading adoption coming off of stricter public health and hygiene regulators. Common coatings for decreasing microbial load on hospital surfaces and reusable gear include silver nanoparticles, TiO₂, and chitosan.

The EU is backing alternatives on the nanocoating front that are eco-safe, non-toxic and biodegradable through its Horizon Europe program. Demand for antimicrobial packaging applications is also growing in the food and beverage industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 20.0% |

Japan: Demand from the electronics, medical equipment, and hygiene-sensitive packaging sectors is driving the growth of antimicrobial nanocoatings market in Japan. From high precision optical and semiconductor components with titanium dioxide and zinc oxide nanocoatings.

Preventing infection in hospitals and elderly care homes in Tokyo and Osaka through the use of antimicrobial floor and wall coatings Government funding supports R&D in UV activated Nanocoatings, Anti-Viral Surface technologies. There’s also demand in wearable electronics and in public hygiene infrastructure such as ATMs and elevator buttons.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 18.7% |

Consumer electronics, home appliances and healthcare devices are rapidly integrating antimicrobial nanocoatings in South Korea. Companies in Seoul have added silver and copper nanoparticle coatings to mobile devices, air purifiers and refrigerators. Hospitals are installing nanocoated fixtures and antimicrobial curtains to reduce infection risks.

Research experiment conducted by several academic institutions are ongoing on hybrid nanocoatings that offer antimicrobial, anti-smudge, and self-cleaning properties. Government investments in nanomaterial startups and export-friendly quality standards are making South Korea a regional leader in antimicrobial nanocoating innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 20.8% |

Antimicrobial Nanocoatings Market is growing rapidly, particularly in healthcare, food packaging, electronics, construction and textiles, as they can inhibit microbial growth on surfaces. With the potential for antimicrobial protection to become a key issue for many, the need for long-lasting, non-leaching and broad-spectrum antimicrobial protection is increasing as we face the emerging threat of antimicrobial resistance (AMR).

Advanced surface adhesion, durability and biocompatibility are being engineered into nanocoatings using silver, copper, zinc oxide and quaternary ammonium compounds. The regulatory focus on safety, green nanomaterials, and indoor air quality also drives research on such alternative solutions as water-based and bio-derived nanocoatings.

Key Company & Antimicrobial Nanocoatings Market Solutions

| Company Name | Key Offerings/Activities |

|---|---|

| Bio-Gate AG | In 2024, launched silver-based nanocoatings for orthopedic implants in 2025, expanded into dental and surgical instruments with multi-metal nanoparticle blends. |

| DSM Biomedical | In 2024, developed zwitterionic nanocoatings for catheters and stents in 2025, introduced bioresorbable antimicrobial coatings for wound dressings. |

| Hydromer Inc. | In 2024, enhanced hydrophilic silver nanocoatings for diagnostic devices in 2025, rolled out anti-fouling nanosurfaces for hospital touchpoints. |

| Buhler AG | In 2024, released nanostructured antimicrobial films for food packaging in 2025, co-developed antimicrobial architectural coatings with paint manufacturers. |

| P2i Ltd. | In 2024, introduced plasma-based waterproof antimicrobial coatings for wearables in 2025, scaled application to smartphones and touchscreens. |

Key Market Insights

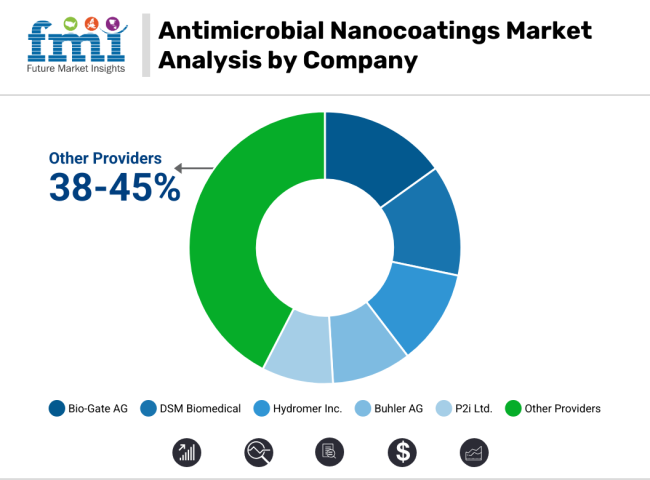

Bio-Gate AG (13-16%)

Bio-Gate, a leader in silver-based nanocoating solutions for the medical device and surgical tools segments. In 2024, it introduced orthopedic implant coatings that combine silver ions with nano-silica for continuous, long-term slow release protection.

In 2025,Bio-Gate followed this development with a wide-spectrum multi-metal blend capable of targeting not only biofilms on surfaces of all kind, including dental instruments and surgical steel, but also biofilm conversion processes within the body while maintaining biocompatibility across the board. The company’s coatings are CE-certified and supported by clinical studies showing reduced rates of infections in high-risk applications.

DSM Biomedical (11-14%)

DSM Biomedical is developing non-toxic, implant-grade nanocoatings. In 2024, it created zwitterionic (charge-balanced) coatings to repel biofilms and microbial adhesion associated with catheters and cardiovascular devices. In 2025, biodegradable antimicrobial nanocoatings (BZ-M1) based on polymeric matrices ([poly(lactide-co-glycolide)]-doped ZnO NPs) were developed by DSM for the treatment of damaged biological tissues.

DSM is also working with academic institutions to improve host-compatibility and reduce chronic inflammation, which has made them a supplier of choice for next-generation implantable and topical devices.

Hydromer Inc. (9-12%)

Hydromer specializes in hydrophilic and lubricious nanocoatings with antimicrobial enhancements. In 2024, it updated its silver-based coatings to increase adherence to plastics used in diagnostic and point-of-care tools. In 2025, Hydromer introduced anti-fouling nanosurfaces for door handles, railings, and other hospital contact points. The company provides custom formulation services to meet specific substrate and sterility needs, making it a preferred partner for OEMs in the diagnostic device and medical furniture markets.

Buhler AG (7-10%)

Buhler is translating its nanotechnology expertise into protective food packaging and building surface solutions. In 2024, it launched nanocoated films for perishable food wrappers with antimicrobial agents designed to extend shelf life.

In 2025, it partnered with architectural paint manufacturers to create interior wall coatings with long-acting antimicrobial action suitable for schools and healthcare facilities. Buhler’s coatings emphasize non-migration and food safety compliance, making them ideal for regulated packaging environments.

P2i Ltd. (6-9%)

P2i applies its expertise in plasma coating to wearable and electronic devices. In 2024, it introduced waterproof antimicrobial nanocoatings for fitness trackers and smartwatches. By 2025, the company scaled its vapor deposition platform to apply ultra-thin antimicrobial layers to smartphone screens and public-use touch displays.

P2i’s non-leaching antimicrobial coatings offer durable, invisible protection without impacting device functionality. Its edge lies in combining hydrophobicity and microbial resistance in a single nanolayer.

Other Key Players (38-45% Combined)

Numerous emerging players, university spin-offs, and green-tech startups are advancing the antimicrobial nanocoatings field with niche and sustainable solutions. These include:

The overall market size for the antimicrobial nanocoatings market was USD 1,620 Million in 2025.

The antimicrobial nanocoatings market is expected to reach USD 10,114.4 Million in 2035.

The demand for antimicrobial nanocoatings is rising due to increasing concerns about infection control, growing applications in healthcare and consumer products, and the effectiveness of nano-silver materials in pathogen resistance. The expanding use of soda-lime glass substrates in medical devices and public touch surfaces is further driving market growth.

The top 5 countries driving the development of the antimicrobial nanocoatings market are the USA, Germany, China, Japan, and South Korea.

Nano-silver materials and soda-lime glass substrates are expected to command a significant share over the assessment period.

Table 01: Global Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 02: Global Market Size Volume (KT) and Value (US$ Million) Forecast By Material Type, 2017 to 2032

Table 03: Global Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 04: Global Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Table 05: Global Market Size Volume (KT) and Value (US$ Million) Forecast By Region, 2017 to 2032

Table 06: North America Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2017 to 2032

Table 07: North America Market Size Volume (KT) and Value (US$ Million) Forecast By Material Type, 2017 to 2032

Table 08: North America Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 09: North America Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 10: North America Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Table 11: Latin America Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2017 to 2032

Table 12: Latin America Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 13: Latin America Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 14: Latin America Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 15: Latin America Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Table 16: Europe Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2017 to 2032

Table 17: Europe Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 18: Europe Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 19: Europe Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 20: Europe Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Table 21: East Asia Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2017 to 2032

Table 22: East Asia Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 23: East Asia Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 24: East Asia Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 25: East Asia Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Table 26: South Asia Pacific Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2017 to 2032

Table 27: South Asia Pacific Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 28: SAP Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 29: South Asia Pacific Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 30: South Asia Pacific Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Table 31: MEA Market Size Volume (KT) and Value (US$ Million) Forecast By Country, 2017 to 2032

Table 32: MEA Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 33: MEA Market Size Volume (KT) and Value (US$ Million) Forecast By Substrate, 2017 to 2032

Table 34: MEA Market Size Volume (KT) Forecast By End-Use Industry, 2017 to 2032

Table 35: MEA Market Size Value (US$ Million) Forecast By End-Use Industry, 2017 to 2032

Figure 01: Global Market Historical Volume (KT), 2017 to 2021

Figure 02: Global Market Current and Forecast Volume (KT), 2022 to 2032

Figure 03: Global Market Historical Value (US$ Million), 2017 to 2021

Figure 04: Global Market Current and Forecast Value (US$ Million), 2022 to 2032

Figure 05: Global Market Incremental $ Opportunity (US$ Million), 2022 to 2032

Figure 06: Global Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 07: Global Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 08: Global Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 09: Global Market Absolute $ Opportunity by Plastics Segment, 2017 to 2032

Figure 10: Global Market Absolute $ Opportunity by Glass Segment, 2017 to 2032

Figure 11: Global Market Absolute $ Opportunity by Metal & Alloy Segment, 2017 to 2032

Figure 12: Global Market Absolute $ Opportunity by Others Segment, 2017 to 2032

Figure 13: Global Market Share and BPS Analysis By Material Type– 2022 & 2032

Figure 14: Global Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 15: Global Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 16: Global Market Absolute $ Opportunity by Nano-silver Segment, 2017 to 2032

Figure 17: Global Market Absolute $ Opportunity by Nano-gold Segment, 2017 to 2032

Figure 18: Global Market Absolute $ Opportunity by Metal Halides Segment, 2017 to 2032

Figure 19: Global Market Absolute $ Opportunity by Organic Nanoparticles Segment, 2017 to 2032

Figure 20: Global Market Absolute $ Opportunity by Nanocomposites Segment, 2017 to 2032

Figure 21: Global Market Absolute $ Opportunity by Metal Nono hybrids Segment, 2017 to 2032

Figure 22: Global Market Absolute $ Opportunity by Others Segment, 2017 to 2032

Figure 23: Global Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 24: Global Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 25: Global Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Figure 26: Global Market Absolute $ Opportunity by Automotive Segment, 2017 to 2032

Figure 27: Global Market Absolute $ Opportunity by Building & Construction Segment, 2017 to 2032

Figure 28: Global Market Absolute $ Opportunity by Consumer Goods Segment, 2017 to 2032

Figure 29: Global Market Absolute $ Opportunity by Food & Beverages Segment, 2017 to 2032

Figure 30: Global Market Absolute $ Opportunity by Medical & Healthcare Segment, 2017 to 2032

Figure 31: Global Market Absolute $ Opportunity by Packaging Segment, 2017 to 2032

Figure 32: Global Market Absolute $ Opportunity by Textile Segment, 2017 to 2032

Figure 33: Global Market Absolute $ Opportunity by Others Segment, 2017 to 2032

Figure 34: Global Market Share and BPS Analysis By Region– 2022 & 2032

Figure 35: Global Market Y-o-Y Growth Projections By Region, 2022 to 2032

Figure 36: Global Market Attractiveness Analysis By Region, 2022 to 2032

Figure 37: Global Market Absolute $ Opportunity by North America Segment, 2017 to 2032

Figure 38: Global Market Absolute $ Opportunity by Latin America Segment, 2017 to 2032

Figure 39: Global Market Absolute $ Opportunity by Europe Segment, 2017 to 2032

Figure 40: Global Market Absolute $ Opportunity by East Asia Segment, 2017 to 2032

Figure 41: Global Market Absolute $ Opportunity by South Asia Pacific Segment, 2017 to 2032

Figure 42: Global Market Absolute $ Opportunity by Segment, 2017 to 2032

Figure 43: North America Market Share and BPS Analysis By Country– 2022 & 2032

Figure 44: North America Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 45: North America Market Attractiveness Projections By Country, 2022 to 2032

Figure 46: North America Market Share and BPS Analysis By Material Type– 2022 & 2032

Figure 47: North America Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 48: North America Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 49: North America Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 50: North America Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 51: North America Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 52: North America Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 53: North America Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 54: North America Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Figure 55: Latin America Market Share and BPS Analysis By Country– 2022 & 2032

Figure 56: Latin America Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 57: Latin America Market Attractiveness Projections By Country, 2022 to 2032

Figure 58: Latin America Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 59: Latin America Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 60: Latin America Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 61: Latin America Market Share and BPS Analysis By Material Type– 2022 & 2032

Figure 62: Latin America Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 63: Latin America Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 64: Latin America Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 65: Latin America Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 66: Latin America Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Figure 67: Europe Market Share and BPS Analysis By Country– 2022 & 2032

Figure 68: Europe Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 69: Europe Market Attractiveness Projections By Country, 2022 to 2032

Figure 70: Europe Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 71: Europe Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 72: Europe Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 73: Europe Market Share and BPS Analysis By Material Type – 2022 & 2032

Figure 74: Europe Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 75: Europe Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 76: Europe Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 77: Europe Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 78: Europe Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Figure 79: East Asia Market Share and BPS Analysis By Country– 2022 & 2032

Figure 80: East Asia Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 81: East Asia Market Attractiveness Projections By Country, 2022 to 2032

Figure 82: East Asia Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 83: East Asia Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 84: East Asia Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 85: East Asia Market Share and BPS Analysis By Material Type – 2022 & 2032

Figure 86: East Asia Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 87: East Asia Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 88: East Asia Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 89: East Asia Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 90: East Asia Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Figure 91: South Asia Pacific Market Share and BPS Analysis By Country– 2022 & 2032

Figure 92: South Asia Pacific Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 93: South Asia Pacific Market Attractiveness Projections By Country, 2022 to 2032

Figure 94: South Asia Pacific Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 95: South Asia Pacific Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 96: South Asia Pacific Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 96: SAP Market Share and BPS Analysis By Material Type – 2022 & 2032

Figure 98: SAP Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 99: SAP Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 100: South Asia Pacific Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 101: South Asia Pacific Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 102: South Asia Pacific Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Figure 103: MEA Market Share and BPS Analysis By Country– 2022 & 2032

Figure 104: MEA Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 105: MEA Market Attractiveness Projections By Country, 2022 to 2032

Figure 106: MEA Market Share and BPS Analysis By Substrate– 2022 & 2032

Figure 107: MEA Market Y-o-Y Growth Projections By Substrate, 2022 to 2032

Figure 108: MEA Market Attractiveness Analysis By Substrate, 2022 to 2032

Figure 109: MEA Market Share and BPS Analysis By Material Type – 2022 & 2032

Figure 110: MEA Market Y-o-Y Growth Projections By Material Type, 2022 to 2032

Figure 111: MEA Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 112: MEA Market Share and BPS Analysis By End-Use Industry– 2022 & 2032

Figure 113: MEA Market Y-o-Y Growth Projections By End-Use Industry, 2022 to 2032

Figure 114: MEA Market Attractiveness Analysis By End-Use Industry, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Susceptibility Testing Market Growth – Industry Forecast 2025-2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Antimicrobial Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA